Gold, Silver, Miners, or BOLD?

Disclaimer: Your capital is at risk. This is not investment advice.

Gold is on the verge of an all-time high, and it’s about time too. Robin Griffiths, who writes the AAA Report for ByteTree, which will be published on Wednesday, reminded me last week that there are tops, double tops and triple tops, but you never see quadruple tops because the price always breaks out. The $2,065 high has been touched three times since 2020, so be prepared.

Peak rates are helpful, but gold doesn’t even need them. A strong decade for the safe haven is inevitable as the money printers get going again. Inflation will prove stubborn, and geopolitics will remain a mess. Under such circumstances, you might have good reason to believe gold is already a crowded trade, but no. The institutions have been selling for the past three years, and the speculators have virtually forgotten it exists. And don’t forget the softer dollar.

Gold and Silver

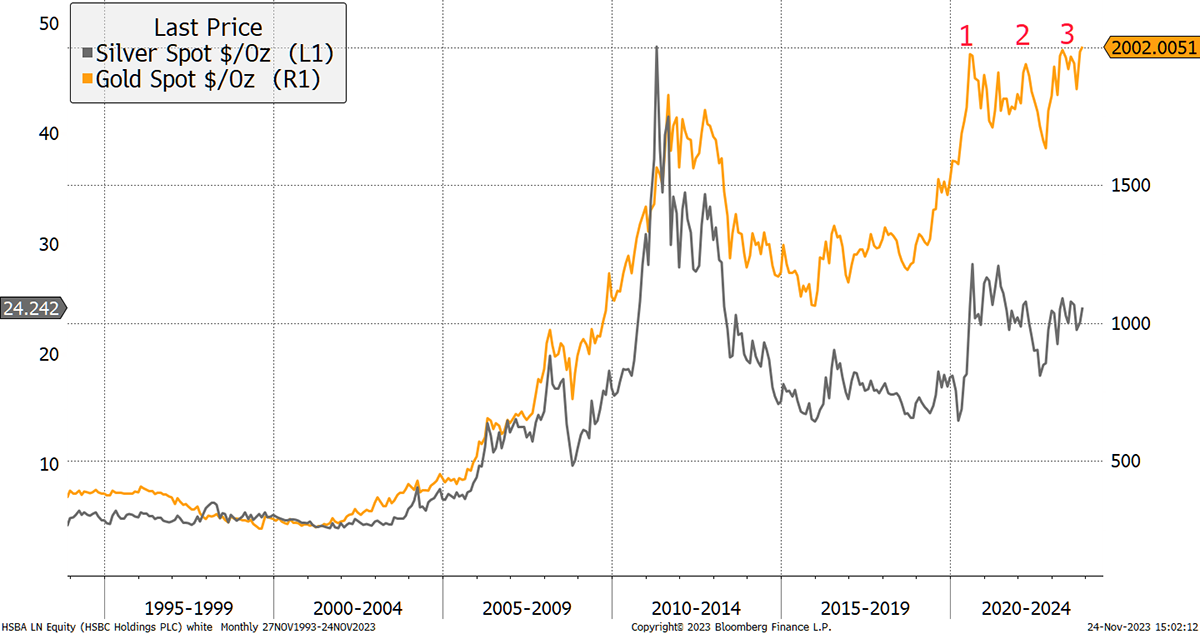

Many turn straight to silver and gold miners, and I sympathise with that view. Silver, like the miners, is leveraged to the gold price, but it is important to remember that the higher returns are always given back when the gold rally turns down. It is often said that silver and the miners are a trade rather than an investment. Don’t forget to sell when it’s over, but right now, they look good, and have done for a while.

Over the last six years, since Bitcoin’s high, silver, gold and the miners have seen the same returns, which would surprise many. Silver gave back most of the 2011 gains, whereas gold held on to the bulk. The gold vs silver vs miners debate never ends. It’s a matter of timing as, if you can call the market, you hold silver and miners on the way up and gold on the way down.

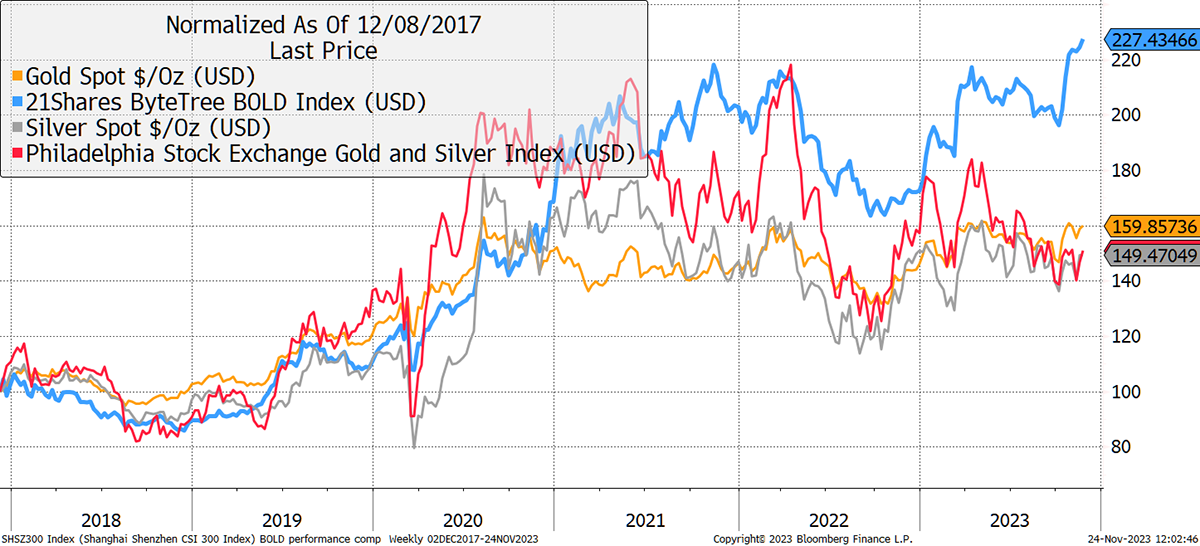

ByteTree created a new alternative, which doesn’t require any thought whatsoever. All you need to do is recognise that if you add a little Bitcoin to your gold, great things happen in ByteTree’s BOLD Index. Consider that BOLD currently trades at an all-time high when neither Bitcoin nor Gold has managed to do that. It all comes down to risk management and monthly rebalancing.

BOLD at an All-Time High

Consider that in 2022, when Bitcoin tumbled, BOLD rebalancing transactions reduced Gold exposure while adding Bitcoin. When the reversal came earlier this year, BOLD was ready with ample exposure to Bitcoin to capitalise on the rally. These rebalancing transactions have led to excess returns of between 5% to 7% per annum over and above buy and hold. Rebalancing Bitcoin and Gold is powerful because they are naturally uncorrelated, as Gold is more aligned with bonds and Bitcoin with equities, hence a lasting risk-on, risk-off pairing. No need for market timing.

Watch out for my monthly update on gold in Atlas Pulse on Wednesday and BOLD on Friday. A double whammy.

A Week at ByteTree

Following the regime change in financial markets, I have been hunting for quality stocks in The Multi-Asset Investor. It is unusual that traditional high-quality stocks, such as Nestle, J&J, and Unilever, have been heading south, ignoring the prospect of peak interest rates. Normally, they’d rally under such conditions as they are highly interest rate sensitive and behave much like bonds. The explanation is simple: they never corrected during the bond collapse and therefore need to cheapen. That made me look for alternatives or “contrarian quality”. I keep finding ideas in healthcare where the correction has been substantial. Finding great companies at low prices is what we do best.

In ByteFolio, there was excitement as Javier Milei became the new president of Argentina. He’s a libertarian economist who understands the economic freedoms of Bitcoin, which means there is one more country likely to join this exclusive club (alongside El Salvador).

Our crypto portfolio hasn’t been this vibrant since it began. It’s altcoin season, and while 99.9% of crypto tokens are indeed complete garbage, there are some hidden gems out there, and that’s our focus. If you are interested in crypto, ByteFolio is a must.

Have a great weekend,

Charlie Morris

Founder, ByteTree