Contrarian Quality

Last week, I highlighted the Quality comeback. The downward pressure on interest rate sensitive investments would ease, and opportunities would arise. In recent issues, I have added low-priced equity exposure via investment trusts and investment companies in Soda, and low-priced quality companies in Whisky.

The regime shift in the Money Map could be a delight, assuming rates remain stable or fall slowly. But it will be very painful if rates and inflation turn down too far and too quickly. Fortunately, this scenario is unlikely because the economy is being propped up by excessive government spending, and it is unrealistic that this is suddenly withdrawn. For what it’s worth, my personal view is that inflation and rates will cool, only to bounce back at a later date.

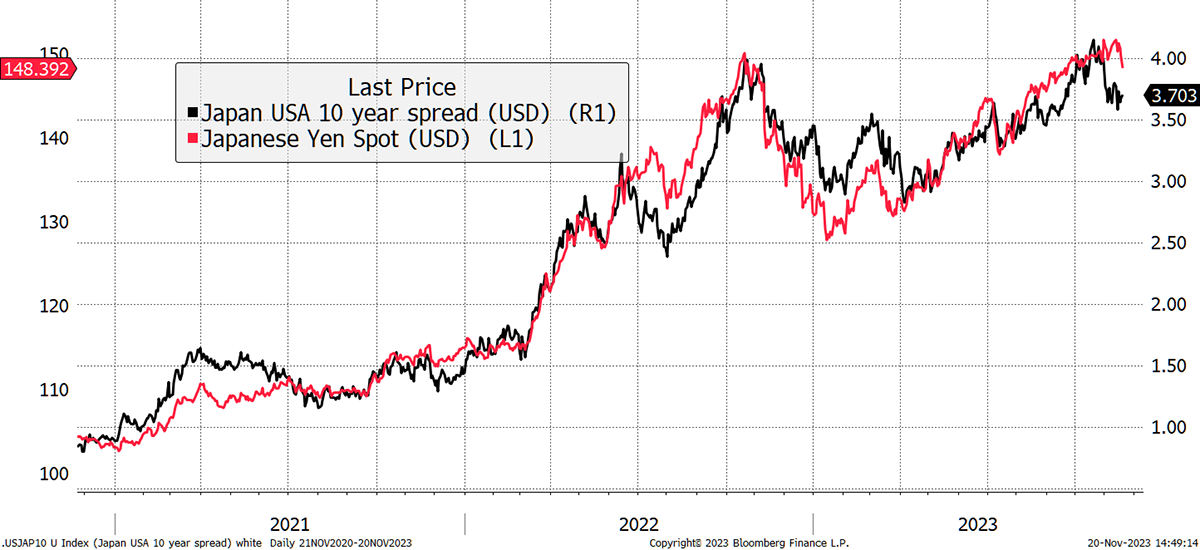

That said, the Yen would love it. I know holding the Yen has been painful, but I sleep better knowing that if things go badly wrong, we have some powerful protection. In black, I show the difference between the US 10-year bond yield and the Japanese 10-year bond yield. It has a tight fit with the Yen and is a reminder of how the Yen could do very well if or when rates collapsed.

The Yen and the Rate Gap

Remember that the Yen falling on this chart means the Yen is rising while the dollar is falling.

Alternatively, the Yen would also surge if Japanese rates rose while US rates didn’t, which makes two positive scenarios for the Yen. The manager of the Capital Gearing Trust (CGT), Peter Spiller, stated why he believes the Yen is attractive holding in their half-year report:

“Since the start of 2021, the Yen has risen from 141 to the pound to 182. Adjusting for relative inflation, it has depreciated by over 30%. We remain convinced of the Yen’s attraction and have a 9% weighting to the currency. This is both on valuation grounds and portfolio composition. On all purchasing power parity (‘PPP’) measures, the Yen appears to be extraordinarily cheap. The portfolio role for the Yen is also important. Japan is the single largest overseas holder of US government bonds. There is a concern, justified in our view, that a change in Japanese monetary policy could result in huge sales of treasuries and repatriation of the proceeds. Were this to happen, rising yields on US government bonds should be accompanied by gains on the Yen.”

In other words, holding the Yen covers some probable scenarios that would destabilise markets. I find it easy to make the case that the Yen is undervalued and a diversifier, but I am relieved that the worst may be behind us. In any event, the Yen is a quality investment on the Money Map.

While bonds have rallied, you might reasonably expect the bond-like stocks to rally as well. They are called bond-like or quality stocks because they are big and liquid, have stable long-term earnings power, and perform best when the market senses we face lower interest rates and inflation ahead. Whether we do or not is another matter, but the market currently believes it.

I want to highlight that recent recommendations have been in areas that offer value because they have fallen in price. The Money Map Regime may well point us towards bond-like stocks, but so many things in recent years have become distorted. I show some of the world’s highest-quality businesses that are not bouncing on lower rates.

Quality Slumps

Why haven’t they bounced on lower rates?

Because they failed to fall, and therefore become cheap, when the bond market collapsed over the past two years. Instead, they were a safe haven, and investors flocked to them to escape the evaporation of market liquidity. Estee Lauder has sold off sharply, but the others have only moved sideways with minor losses. This is certainly a disappointment because I would like to be buying high-quality stocks at low prices. They just aren’t there yet.

The value offered by the market is whatever it happens to be. It is never exactly what we would like, and so successful investors need to compromise.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd