The Comedy of Inflation

Disclaimer: Your capital is at risk. This is not investment advice.

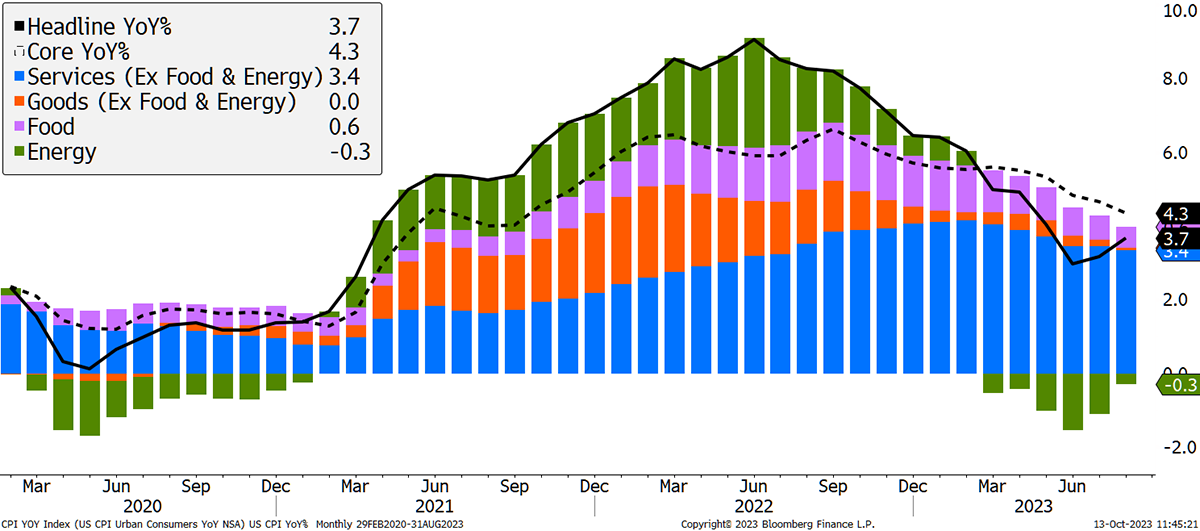

US consumer price inflation rose to 3.7% (core 4.3%) against the Fed’s target of 2%. An American comedian posing as a Nobel Prize-winning economist, Paul Krugman, said that if you exclude food, energy, shelter and used cars, then inflation was below target. The trouble with Krugman’s observation is that nothing that we need should be excluded from the inflation calculation. Life without food, energy and shelter would be miserable. And if you didn’t have those things, you might appreciate a used car.

US CPI is 3.7%

Notice how the black CPI line is about to move above the dotted line. That creates a bullish condition for gold, which I will be writing about next week in Atlas Pulse. When CPI > Core Inflation, then own gold.

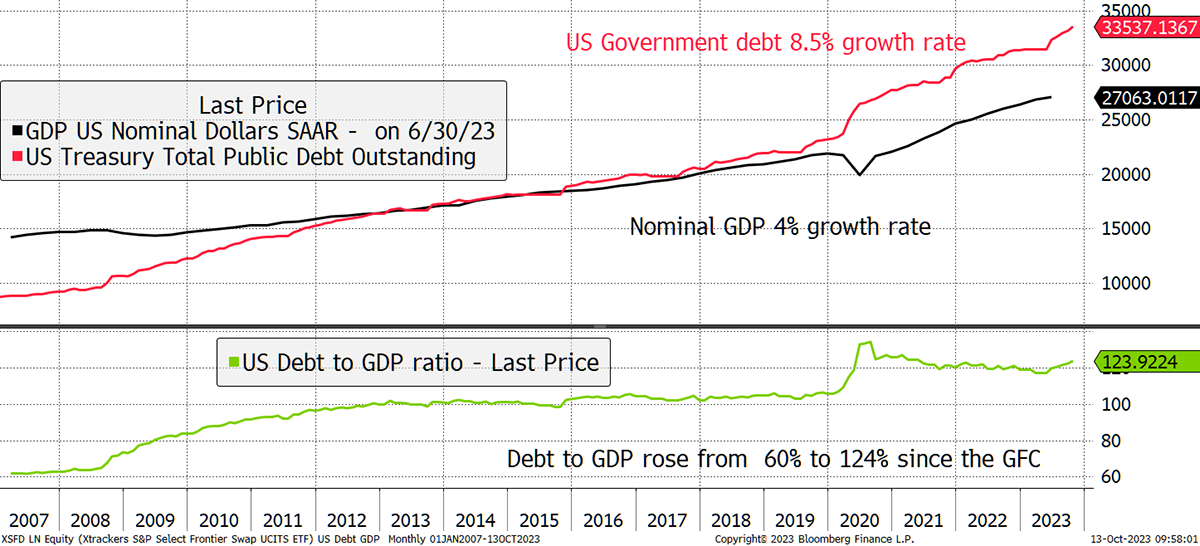

Krugman likes debt and believes America should have much more of it. He believes you can print money without consequences. The trouble with that is you can have too much of a good thing. US debt has grown at 8.5% p.a. since the global financial crisis, whereas nominal GDP has grown at half that rate. The result, debt to GDP, is 124%, which is very high indeed. Does he realise that debt is supposed to be repaid?

US Debt Explodes

Debt probably isn’t repaid, which is fine so long as people believe otherwise. Total US debt is $33.5 trillion ($98k per person), which is up $2 trillion since May this year. If you are wondering why the surge in interest rates hasn’t slowed the economy, that might explain it. The Fed may be tightening, but the government is spending like no tomorrow.

This can only end in tears. We know that because the treasury’s debt auctions are under pressure. Demand for treasuries is waning because there are too many bonds to sell and fewer believers to buy them. As Andrew Hunt put it (H/T The Halkin Letter),

“We have long argued that when the central bank is reassigned to the defence of sovereign credit, it loses the capacity to control inflation.”

Losing control of inflation is what markets fear. When I speak of the US, the rest of the developed world is in a similar boat, some countries better, some much worse. But the US is the daddy to watch because if they are in trouble, we are all in trouble.

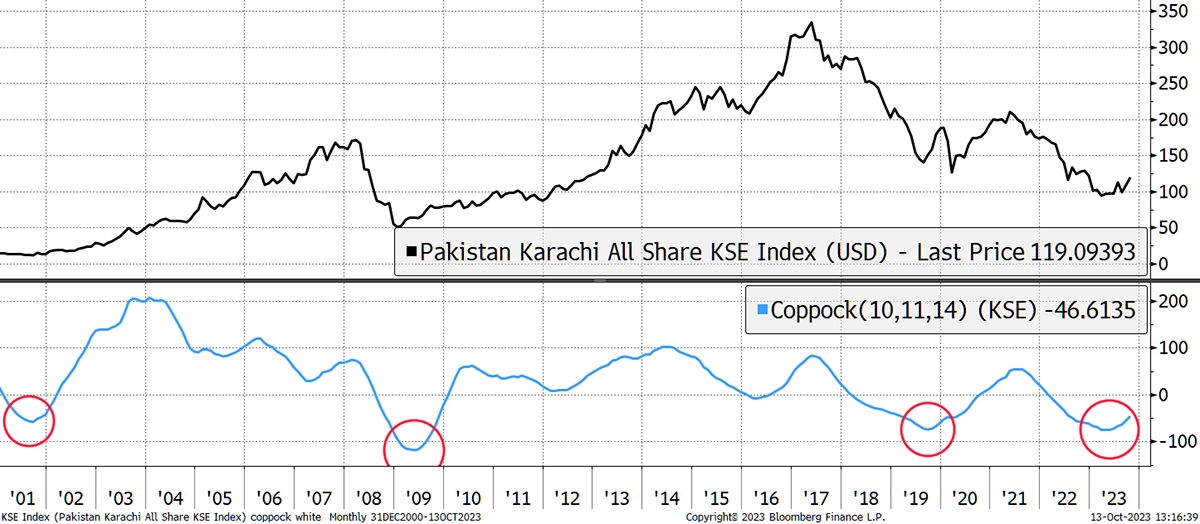

Turkey is a step ahead, as high inflation is alive and well, as it is in Pakistan. I’ll come back to Turkey next week in Atlas Pulse, but Pakistan is fascinating. Inflation is 32% (was 38%), and the stockmarket has been hammered since the peak in 2017. I wrote about it on Tuesday in the Multi-Asset Investor letter. The government is in trouble, but the stockmarket seems in much better health. You can read the piece for the full details, but the bottom line is the Karachi Stock Exchange has just given a Coppock Buy Signal in USD terms. The last three signals returned 1,344%, 557% and 45% respectively. Nice job!

Karachi on the Up

Trades like these are completely different from what we see in normal portfolios and are essential during uncertain times. Those hoping a balanced portfolio full of government bonds and large-cap equities is going to perform over the coming years should prepare to be disappointed. At ByteTree, we are proud to do things differently and take advantage of value, and different asset classes, where we can find it.

A Week at ByteTree

ByteTree Venture, which was launched in September, now has six recommendations, a number which will keep on growing. It was nice to see The Restaurant Group (RTN), owner of Wagamama, receive a bid from Apollo yesterday. The bid came in at 65p, which is the target price, and we took profits. A nice little earner over such a short period of time.

Venture also looked at a European bank and another UK mid-cap. You often hear how UK shares are so cheap, but which ones? ByteTree Venture finds them for you, and it’s not just in the UK. We’re on a mission.

Venture can be accessed via the Morris on Markets and Professional Investor bundles – explore our subscription plans.

ByteTrend Is Live

ByteTrend is live on X, formerly Twitter. It’s a simple way to identify the strong and weak trends in markets. It’s a powerful system, and we’ll be talking much more about it. We have two accounts, one for crypto and one for equity ETFs, commodities and FX. There’s much more to come, but we’ve kept them separate because some see them as chalk and cheese.

Have a great weekend,

Charlie Morris

Founder, ByteTree