The Price of Luxury and Our New Venture

Disclaimer: Your capital is at risk. This is not investment advice.

LVMH (MC) has become Europe’s most valuable company. Last year, they sold €80 billion of luxury goods from 75 different brands, mainly in fashion and clothing. The business of luxury is remarkable because it seems to be one of the few areas outside of software that can make supernormal profits. LVMH brags 68% gross margins, and nearly 20% of sales turn into free cash flow.

Luxury is one of those areas that did well out of lockdown as people treated themselves to something special. Its success also reflects the huge amount of global wealth creation over the past decade. These days, it’s not just the ladies clamouring for brands but the men too. In a perfect storm, the luxury industry has more customers from more countries.

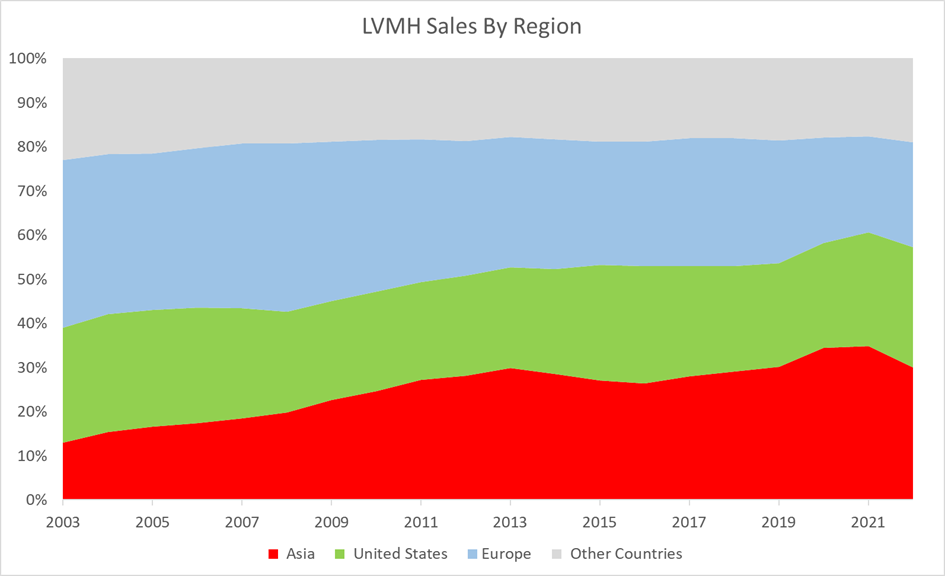

The most important country has been China. LVMH has seen Europe’s share of sales decline from 38% in 2003 to 24%, which probably reflects our place in the world. The US has remained stable, while Asia ex. Japan surged from 13% to 35% by 2021.

We keep hearing about the troubles in China. First, it was an anti-corruption drive, then a housing catastrophe, and now an economic slowdown (or worse). In 2022, LVMH’s Asian sales dropped from 35% to 30%. Then, in the first quarter of 2023, there was an excitable €7.6 billion of sales as the economy reopened, but it was followed by a more subdued €6.8 billion in the second quarter. That happened as sales in other places were the same or higher.

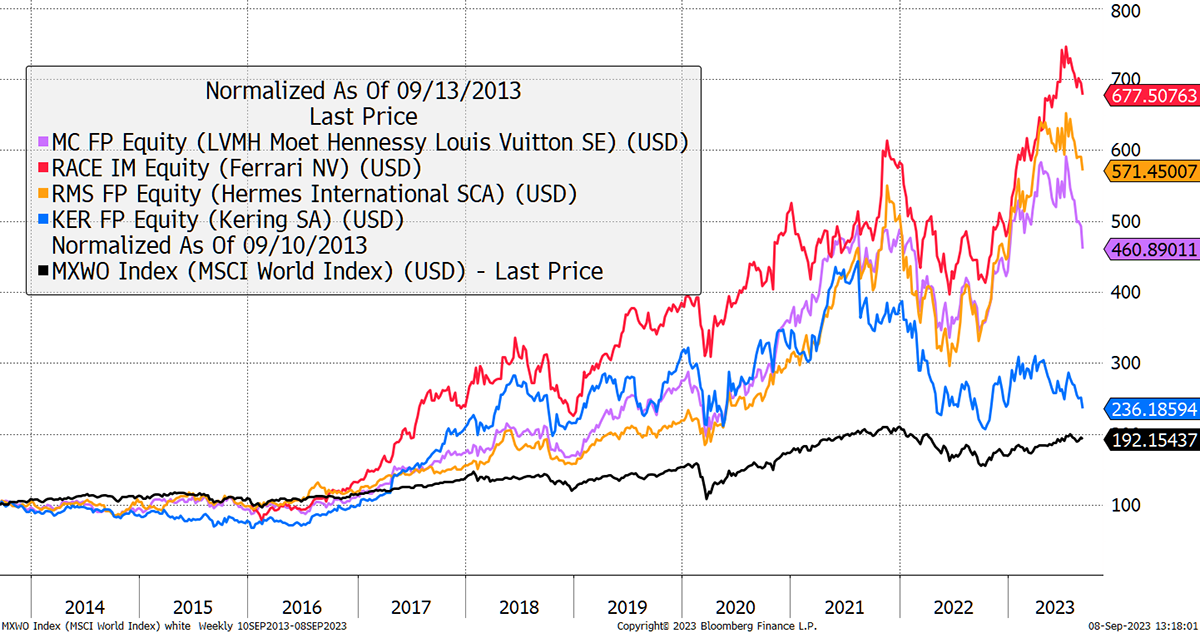

Share prices for luxury stocks are headed south, and the market is telling us to be fearful of a Chinese slowdown. Or does it go further than that?

Luxury Goods Companies

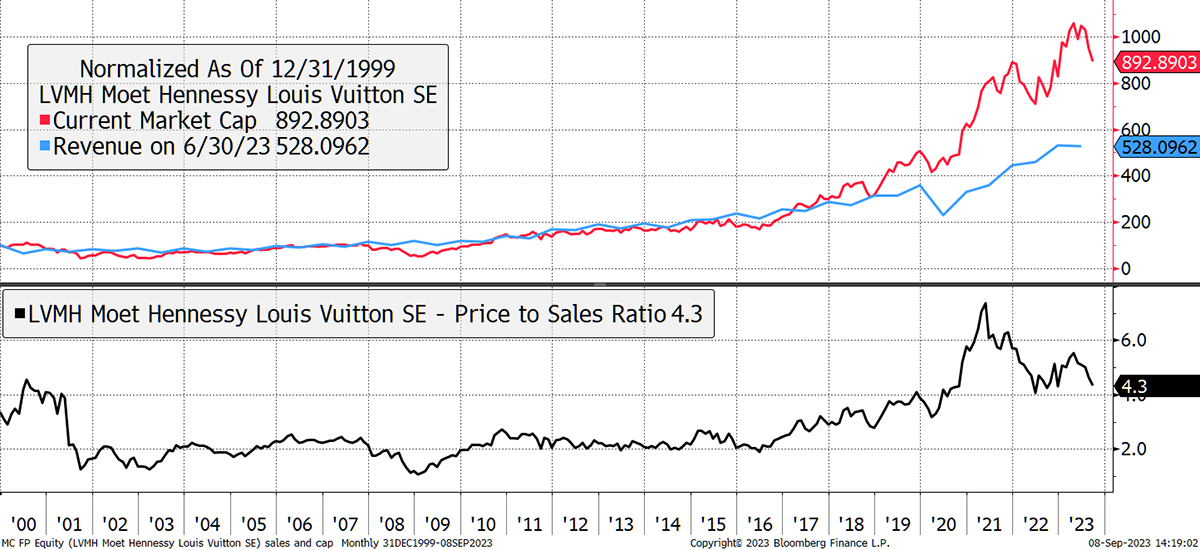

I keep harping on about this simple point in markets where it is assumed that profit margins will remain supernormal forever. Sadly, they never do, and that is the worry. LVMH has grown spectacularly, but as always in these situations, the share price has outgrown the company. LVMH shares trade at 4.3x sales against a 20-year average closer to 2x. That’s the problem.

High Priced Luxury Goods, Higher Priced Luxury Shares

As I said, LVMH is Europe’s most valuable company, and that’s another problem. Valuable companies have the largest exposure to the market indexes, which means if they are highly valued, that is a strong headwind for the index to perform. It feels like the end of an era for these money-making giants. Whether it’s US tech or European luxury, enough is enough.

I believe a new era has begun, and the likes of the S&P 500 and the EuroStoxx will struggle as they have to absorb losses from overvalued large-cap stocks. Rarely has there been a better time to pick up cheap stocks and stay away from the carnage. The equity strategist Russell Napier, made an excellent point. China has been hollowing out profits from Western companies that make stuff. A new cold war is coming, things are changing, and it is time to buy those companies back.

A Week at ByteTree

The highlight of our week was the first idea in Venture. I am delighted as it will give me the opportunity to share some of the higher risk, less liquid, and more controversial ideas that I come across in markets. Before Venture, I would see them and send them straight to the bin. Now, I have an outlet, which is exciting. My maiden stock was not particularly risky, but an excellent business model that is undervalued, mainly because it fails the sniff test.

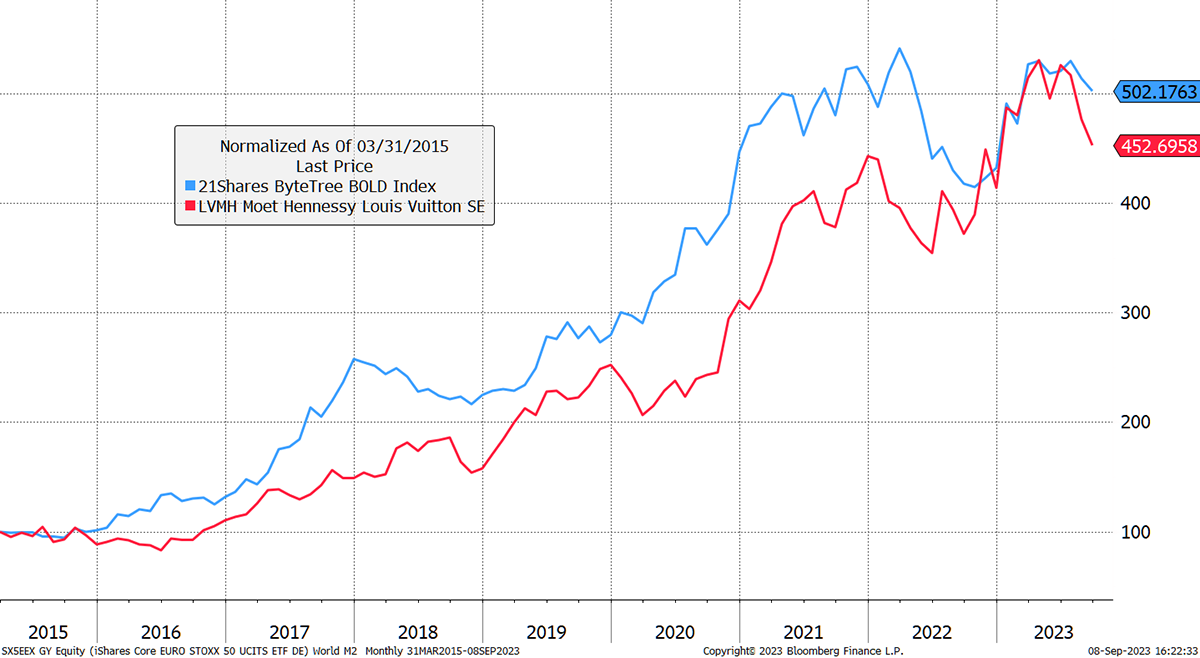

On 31st August, our BOLD Index (Bitcoin and Gold) was rebalanced. Bitcoin’s volatility has fallen to 41% over the past year, which has boosted index exposure to 24.9%, a new record. BOLD continues to surprise, with resilience and low volatility. I wonder how it does versus LVMH? After all, gold is a luxury good. Bitcoin probably is too.

BOLD or Luxury?

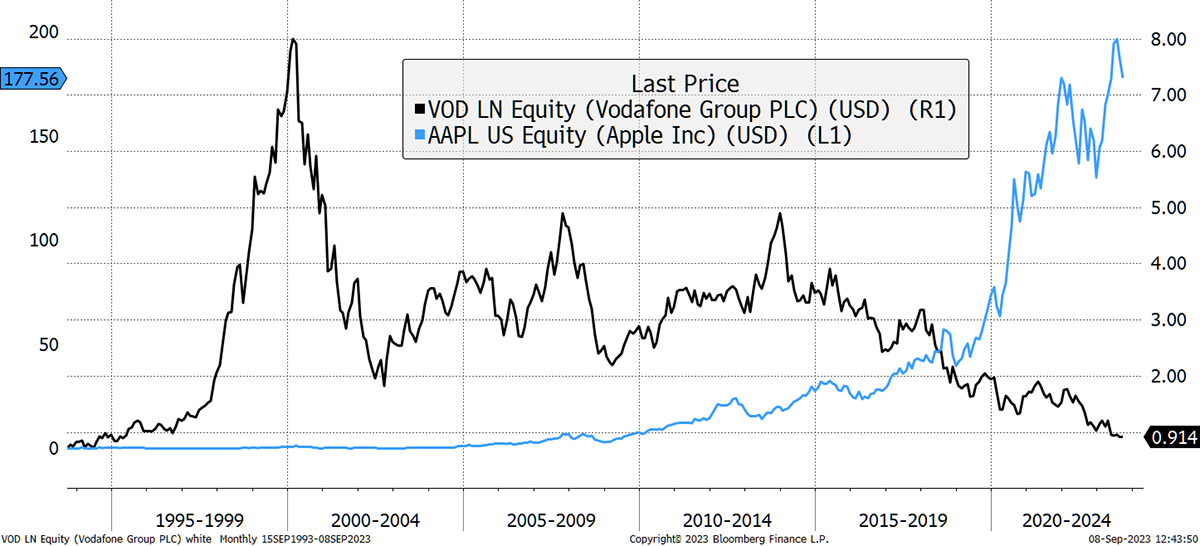

In The Multi-Asset Investor, I looked at highly indebted companies. In particular, the UK housebuilders were indebted leading into 2008, where their share prices collapsed. They were bailed out, and prices soared in the aftermath. I investigated whether a company like Vodafone (VOD), with vast debts, would rally when we start to see rate cuts. It might, but one big difference is that rate cuts are highly unlikely to find their way to zero ever again. More importantly, the housebuilders were growing businesses. I am not sure how VOD will find a way to grow.

In any event, the Americans always seem to do it bigger and better. It took VOD 23 years to destroy $200 billion of shareholder value. Apple (AAPL) managed to do that in just two days.

Vodafone Versus Apple

Have a great weekend,

Charlie Morris

Founder, ByteTree