The Corporate Debt Dynamic

If a company is debt-free and can produce a profit, it’s unusual to go bust, but it is still possible. I have never been a fan of highly indebted companies and have generally steered clear of them for the simple reason they can go bust without notice. Yet the irony is that sometimes the companies that are nearly bust, but not actually bust, can deliver the highest returns as they recover. I am coming round to the idea that as we emerge from this debt crisis, the next great opportunity will once again come from highly indebted companies.

The best-performing stocks of 2009, after the credit crisis, had entered the crisis with too much debt. Their share prices collapsed, and when the system was bailed out, these companies surged. What were the worst-performing stocks of 2009? The well-managed companies that had proved resilient with strong balance sheets and steady cash flow. They did nothing wrong but couldn’t recover as they hadn’t suffered in the first place.

There is clearly a time when indebted companies become interesting, and I am coming around to the idea that they will present a big opportunity at some point when this debt crisis unfolds. I say that because they have performed poorly as rates have risen, and in many cases, prices have fallen well into value territory. It stands to reason that they will perform when rates eventually turn down.

It's a fine balance because some companies that need funding but can’t access the credit markets will fail. In contrast, those with high levels of debt but are still able to tap the credit markets will survive. Credit markets can be brutal.

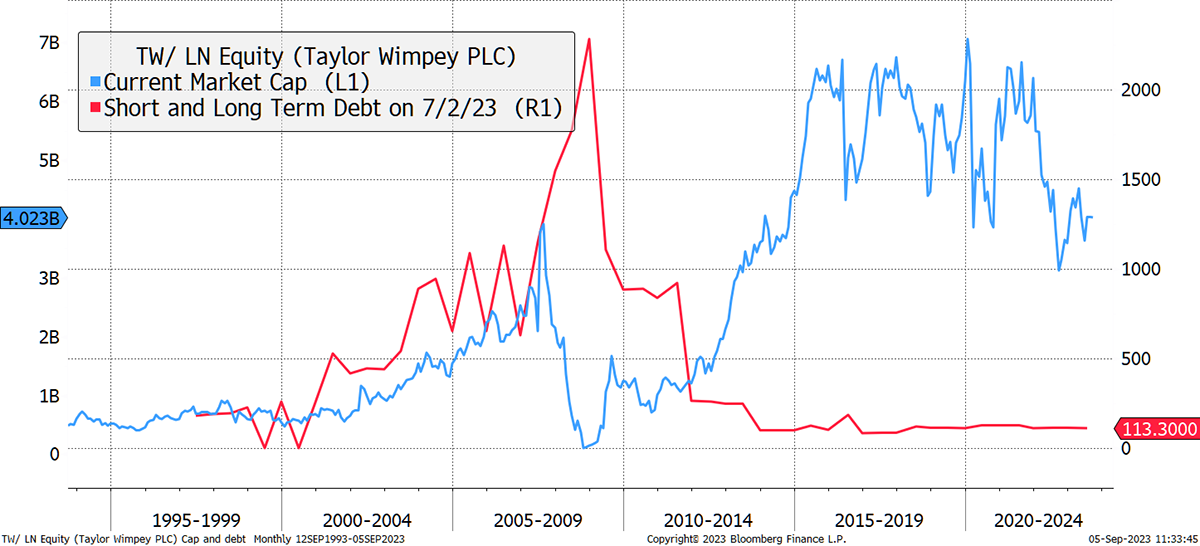

In 2009, the housebuilders were over-indebted and got into trouble. I show Taylor Wimpey (TW), which came close to the brink. By late 2008, the shares were either dirt cheap or the business would soon fold. Luckily, they received funding.

Taylor Wimpey Was Heavily Indebted in 2008

In the aftermath, TW surged because it became clear that they were going to survive. The government rebooted the credit markets, and the shares rallied from under 4p to 200p over the next few years. Thereafter, TW prioritised paying down debt along with the rest of the UK housebuilding sector. Today, most housebuilding companies have low debts or are debt-free.

Those looking for a repeat of 2009’s surge will be disappointed because while the house building sector could face a few lean years, it is not close to going bust because the balance sheets are strong and the companies generate cashflow.

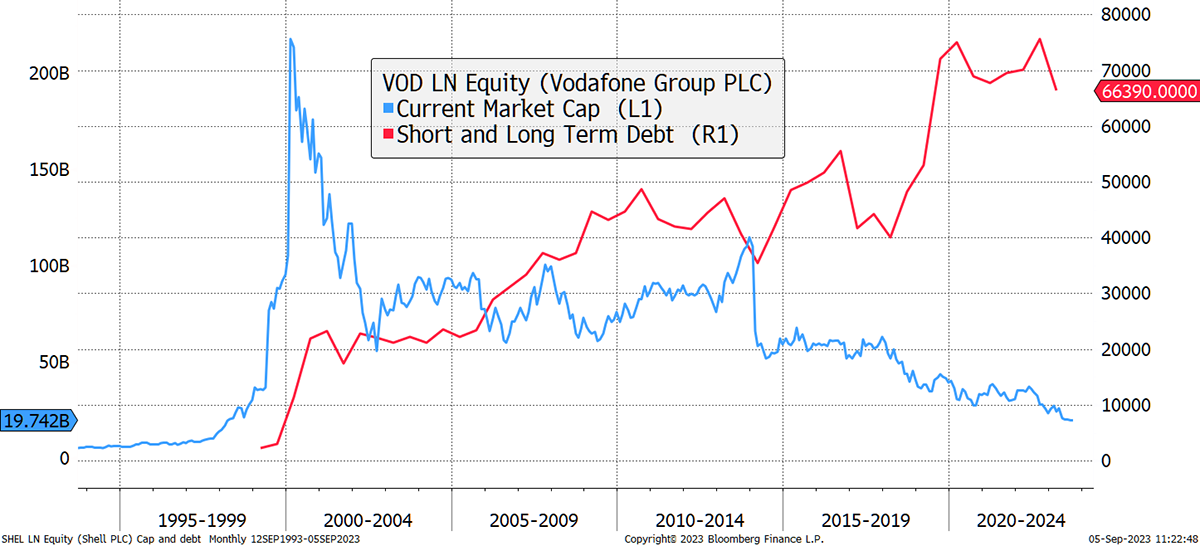

Moving on to one of today’s indebted companies, Vodafone (VOD), it has seen an impressive 23 years of capital destruction. The shares are down 87%, or 44% if you include dividends. Today’s sales are slightly below the levels seen in 2003, which is an embarrassment. Yet management has overseen debt balloon from £2.2 billion in 1999 to £75 billion by 2020, while the market cap is just under £20 billion.

Vodafone’s Growth in Debt

What did they do with this money? Buy back shares. From 2005 to 2014, they blew the lot, and to no avail. But since the buy-backs stopped, the shares carried on falling.

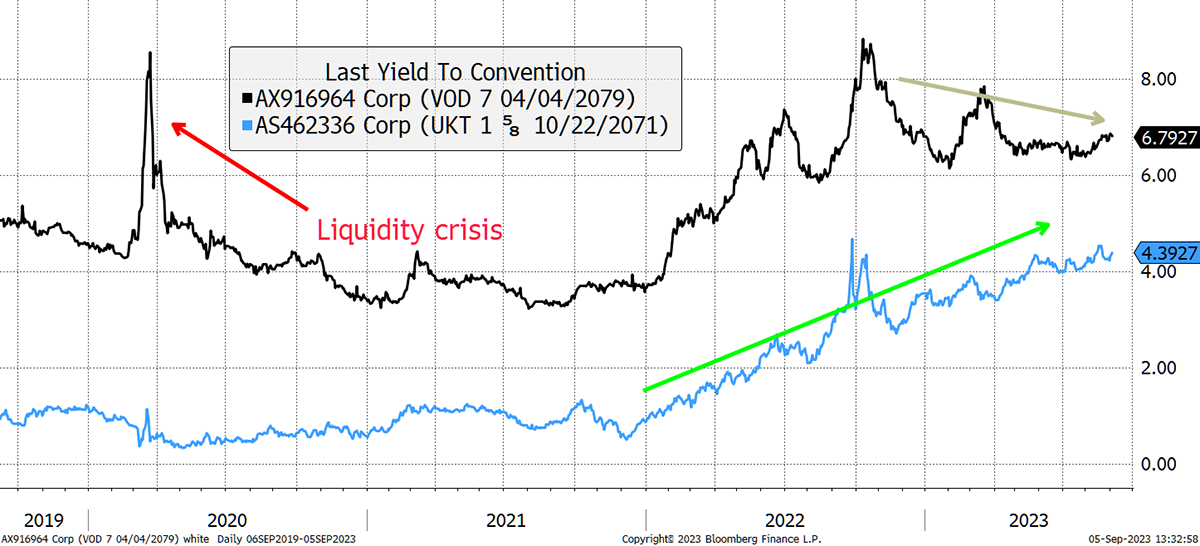

One saving grace is that VOD has successfully lengthened its average debt maturity to 21 years. It has done this by issuing ultra-long dated bonds when rates were very low. One bond expires in 2079. Remarkably, it has only fallen by 15% since 2020, when the equivalent 2071 Gilt is down 63% over the same period. Government bonds are supposed to be safe!

Government vs Corporate Ultra-Long Bond Yield

VOD might be an unimpressive company from an investor’s perspective, but its bonds are deemed to be good quality. The business can’t grow, but at the same time, no one is ditching their mobile phone. This particular bond also pays a 7% annual coupon, which makes the bond much less volatile than the gilt with a 1.625% coupon. That explains much of the VOD bond stability.

Yet in 2020, VOD’s bonds sold off sharply while gilts fell only slightly in a liquidity crisis, which was resolved by massive money printing. Interest rates hadn’t changed, but the credit markets froze over. During such times, government bonds perform best because they remain liquid.

Yet today, the ultra-long gilt keeps on falling (yield rising) while VOD’s bonds seem to be more stable. It is effectively telling us that credit spreads are tightening during this extraordinary era for government debt.

VOD is unquestionably highly indebted, and the shares have fallen to a level that offers good value, but the shares would only be a buy after a credit event, which hasn’t yet happened. The bears insist that when the economy turns down hard, another credit event will come, and indebted companies will feel the heat. But the bulls say that given the extraordinarily buoyant credit conditions in 2020 and 2021, where companies refinanced at low rates, this has been delayed.

But it will come, and I find so many companies that are seemingly low growth, high debt, which will sooner or later feel the pinch. If a new downturn is on the horizon, which I believe may well be the case, this will be a fascinating group to watch. We just have to remember that what happened to the housebuilders can happen to others, especially the likes of VOD.

Action:

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd