The British Pound Flirts with a 6-Year High

Disclaimer: Your capital is at risk. This is not investment advice.

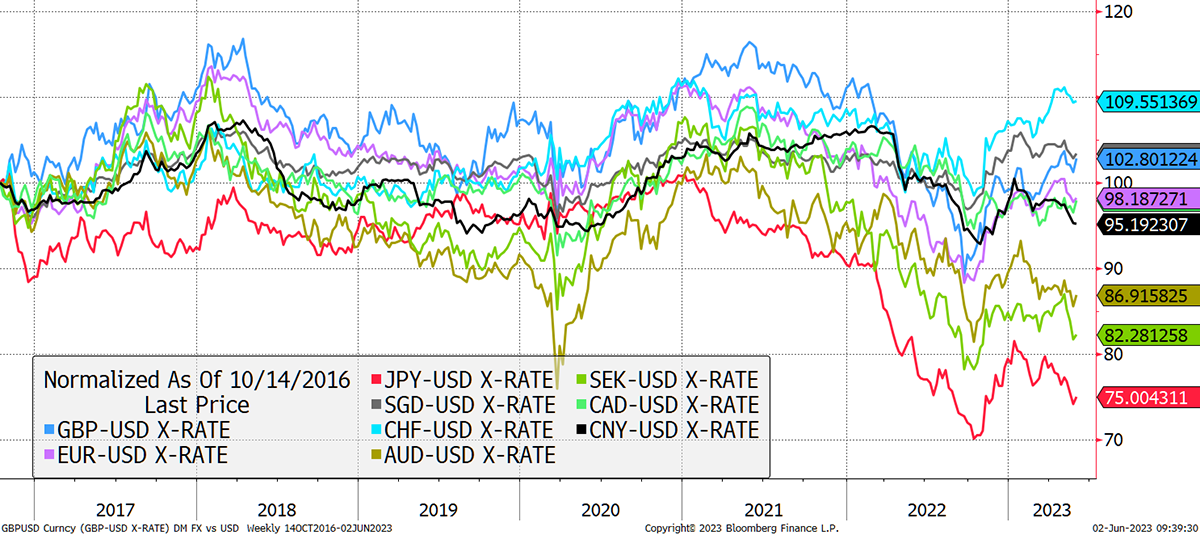

Who’d have thought that the pound, universally ridiculed by the FT’ies (lefties who read the Financial Times), would be on the verge of a 6-year high? Only the Swiss Franc and the Singapore Dollar, both financial safe havens, are ahead of the pound over this post-Brexit period.

Versus Developed Currencies

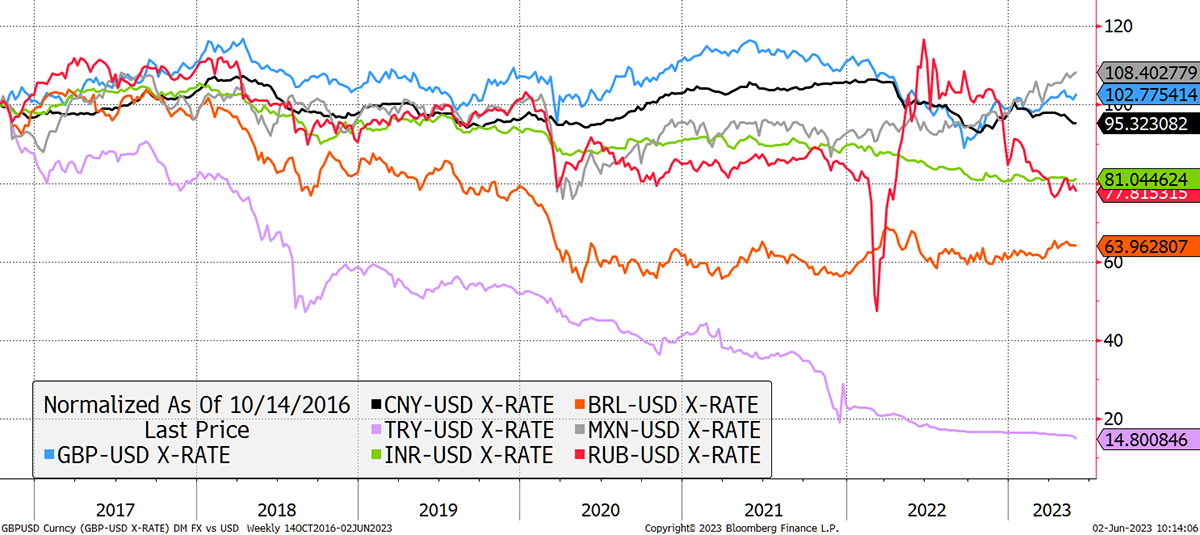

The pound has also been doing well against emerging market currencies, with just the Mexican Peso ahead. With consistently high real interest rates (rates above inflation), the Mex has been a standout performer, even ahead of the Swiss Franc. The Chinese Renminbi has turned down while the Brazilian Real, Russian Ruble and Indian Rupee have been poor stores of value. As for the Turkish Lira, that is what happens when you allow inflation to run away.

Versus Emerging Currencies

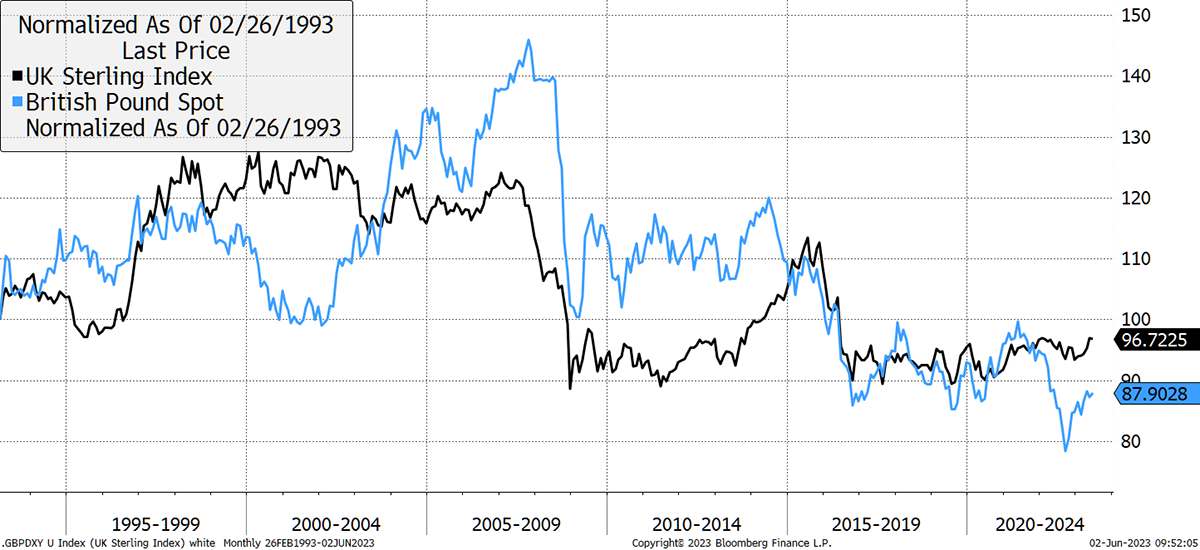

By stripping out the US dollar, we can see how the pound has done against a global FX basket (black line) since the crash out of the European Rate Mechanism (ERM) in 1992. Back then, the UK was on the path of joining the euro. The pound did well for the next 15 years until the credit crisis in 2008. It then surged into 2015 before crashing down but has been stable since. Could it rally again?

The Pound Since Leaving the ERM

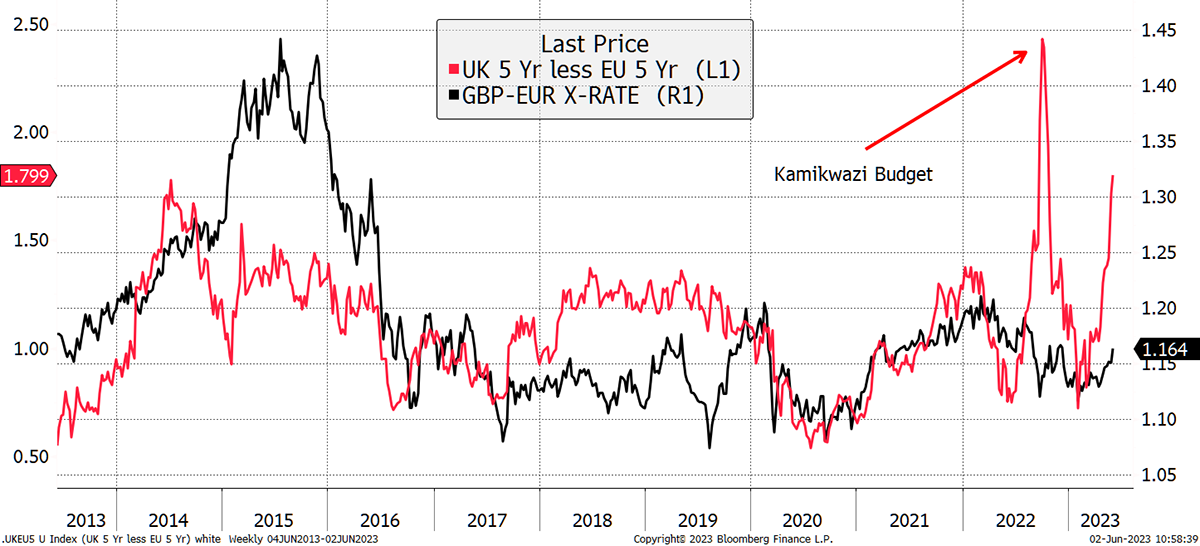

It could, as UK bond yields are among the highest in the developed world, only to be outgunned by New Zealand. Using the pound vs euro as an example, I overlay the difference between the 5-year bond yields for the UK and Germany. The surge last September was unplanned, but this time is different.

Higher Interest Available in the UK

The interest rate gap (using 5-year bonds) has surged again, with the difference this time being that there isn’t a crisis. The last time the rate gap was this wide, £1 bought €1.50. Perhaps this is evidence that we are in a bull market for equities, even though it doesn’t feel that way. Or maybe we never had much of a bear?

The World Index peaked on 4 January 2022. In GBP, it never fell by more than 15%, and today is just 6% lower. In USD, it fell 27% and is now 12% lower. Non-profitable tech stocks and crypto may have taken a bath last year, but large cap equities really didn’t, even though the strength was concentrated in big tech.

Not Much of a Bear in 2022

It is remarkable how the World Index, when measured in GBP, has remained in such a narrow range. The market rallies have coincided with a rising pound, and vice versa. This has materially dampened volatility, as the pound has acted as a counterbalance.

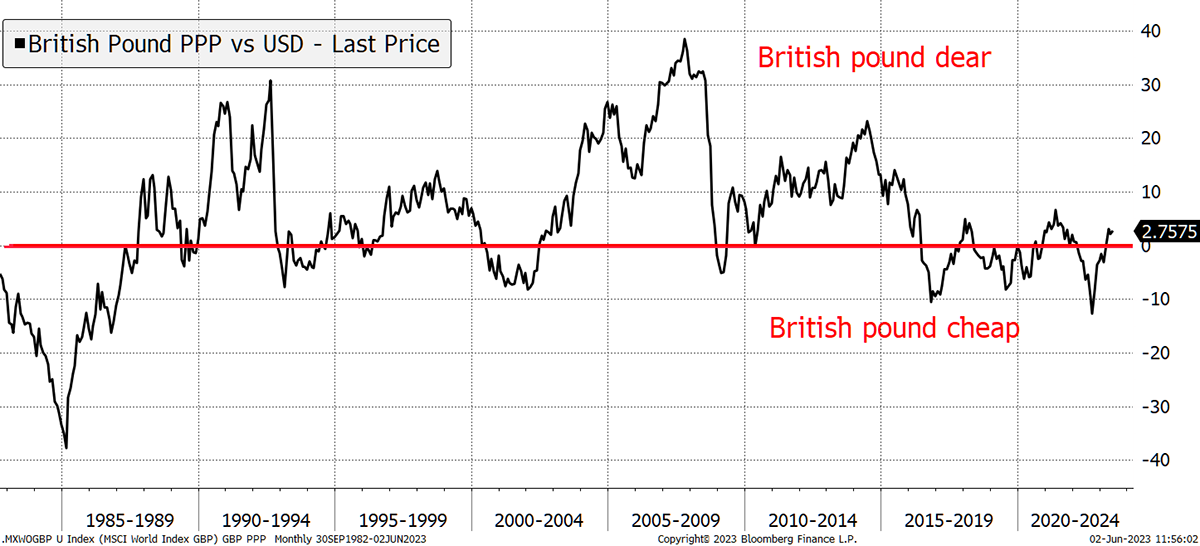

I will round off on that thought. A rising pound is something we have long associated with equity bull markets. The periods when the pound has been overvalued in terms of purchasing power have generally been associated with a buoyant financial market. Today, the pound is just 2% overvalued. Many forget that the sterling crashes when the UK left the ERM, the aftermath of the credit crisis, and Brexit were all born from periods of overvaluation.

The Pound Is Just Above Fair Value

The implication for investors is to recognise that while the pound is rising, that will dampen returns on foreign assets, favouring domestic assets. This will hold true until the pound peaks, at which time overseas assets will have a tailwind. That explains why the two portfolios I run have diverged this year. The lower-risk Soda Portfolio invests internationally, while the higher-risk Whisky Portfolio invests more domestically. Whisky has been off to the races, while Soda has stalled. In the long run, it is probably a good thing to have one of each.

Stories of the pound’s demise are greatly exaggerated.

ByteTree Premium

Other than diversification, another important thing in investments is steering away from trouble. As highlighted in The Multi-Asset Investor, Caution on China is warranted, and this is no longer just political, but economic too. The expected boom following China’s delayed exit from lockdown has proved to be disappointing. Peak exports clash with an impending debt crisis.

In addition to steering away from trouble, it’s also a good idea to find some winners. Robin and Rashpal’s AAA Report didn’t disappoint. It updated the model, but of particular interest was the extraordinary number of seemingly broken relationships in financial markets today. One simple example is the market’s newfound confidence in shrugging off clear signs of economic weakness, which would normally lead to a bear market.

In crypto, it looks more and more like a bull market, but still on the thin side. With the technology sector seemingly accelerating, I have little doubt that there are still fortunes to be made, and the next cycle will not disappoint. Bitcoin is becoming an increasingly credible asset, and mainstream finance still doesn’t own it. That can only lead to a boom over the coming years. In the latest BOLD Index rebalancing (Bitcoin and Gold), I highlighted how Bitcoin volatility continues to fall, thus boosting the weight in the index.

Charlie Erith added to Ethereum in ByteFolio, which seems to be outperforming Bitcoin. Another piece of evidence that we’re in a bull market, perhaps. ByteTree’s on-chain data confirms this!

Have a great weekend,

Charlie Morris

Founder, ByteTree