Vinter ByteTree BOLD1 Index

Disclaimer: Your capital is at risk. This is not investment advice.

Rebalancing Report | June 2023;

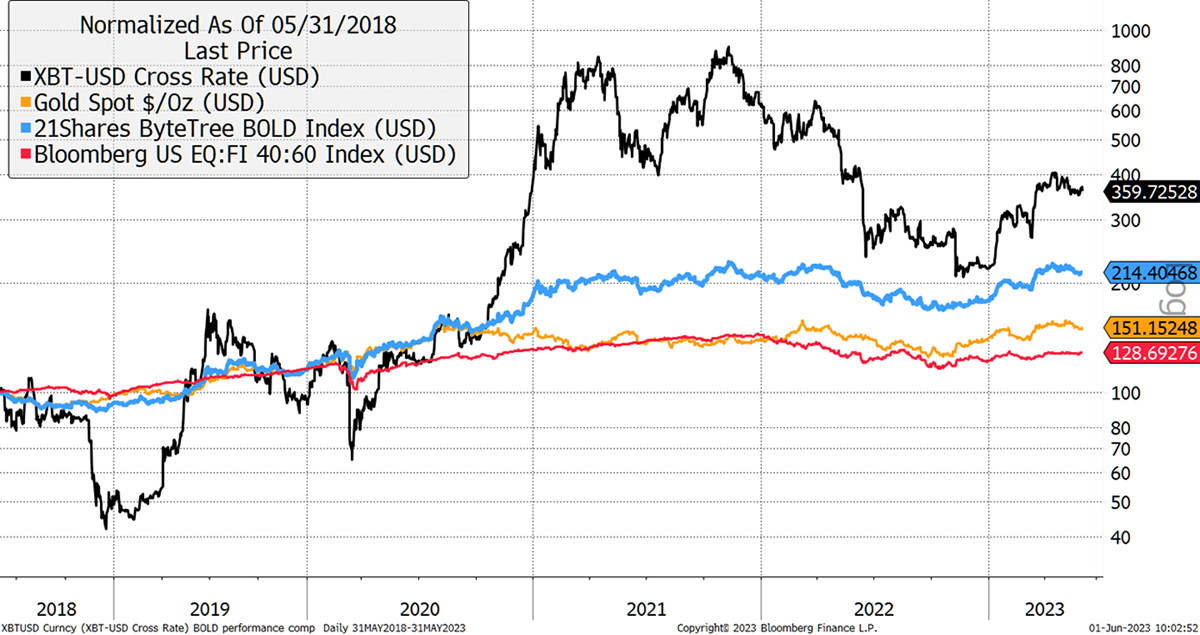

The Vinter ByteTree BOLD1 Index (BOLD1) fell by 2.2% in May, taking the return for the year to 19.5% in USD terms. Over the month, Bitcoin fell by 7.6%, Gold fell by 1.4%, global equities fell by 1.3%, and US Treasuries also fell by 1.8%. It was a negative month across the board as markets continued rate hikes alongside the deadlock over the debt ceiling. Downward pressure on bonds has put downward pressure on general asset prices.

BOLD1, Bitcoin, Gold and a 60:40 Portfolio over Five Years

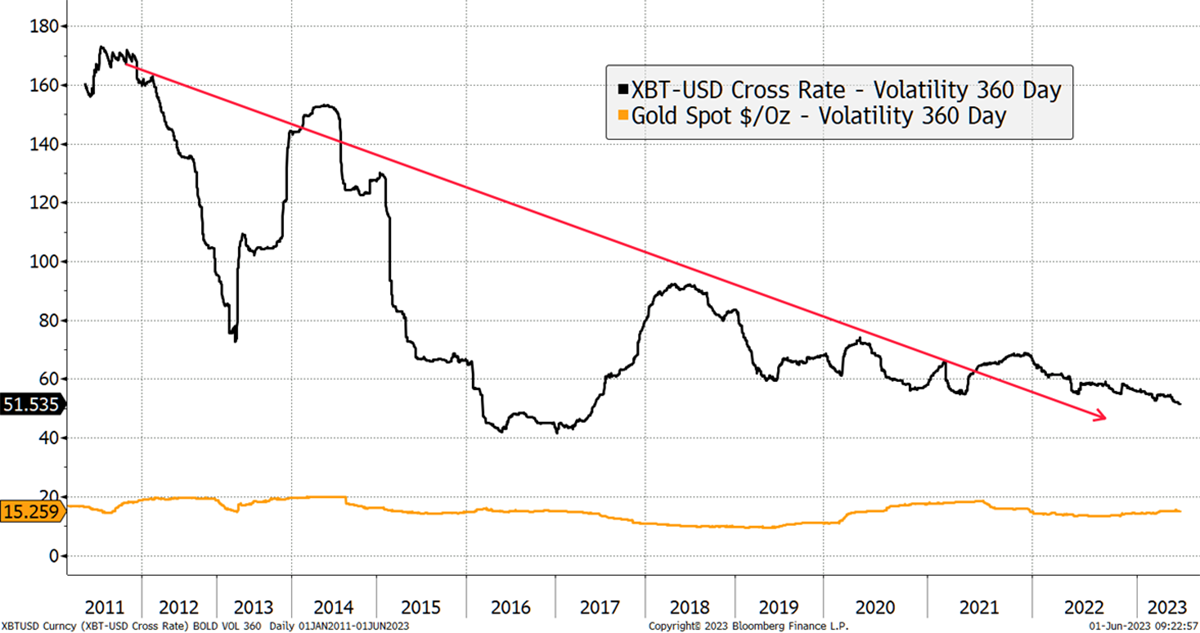

The 360-day volatility for Bitcoin and Gold reached 47.8% and 13.9%, respectively. The downward trend in bitcoin volatility continues.

Bitcoin and Gold Past 360-day Volatility

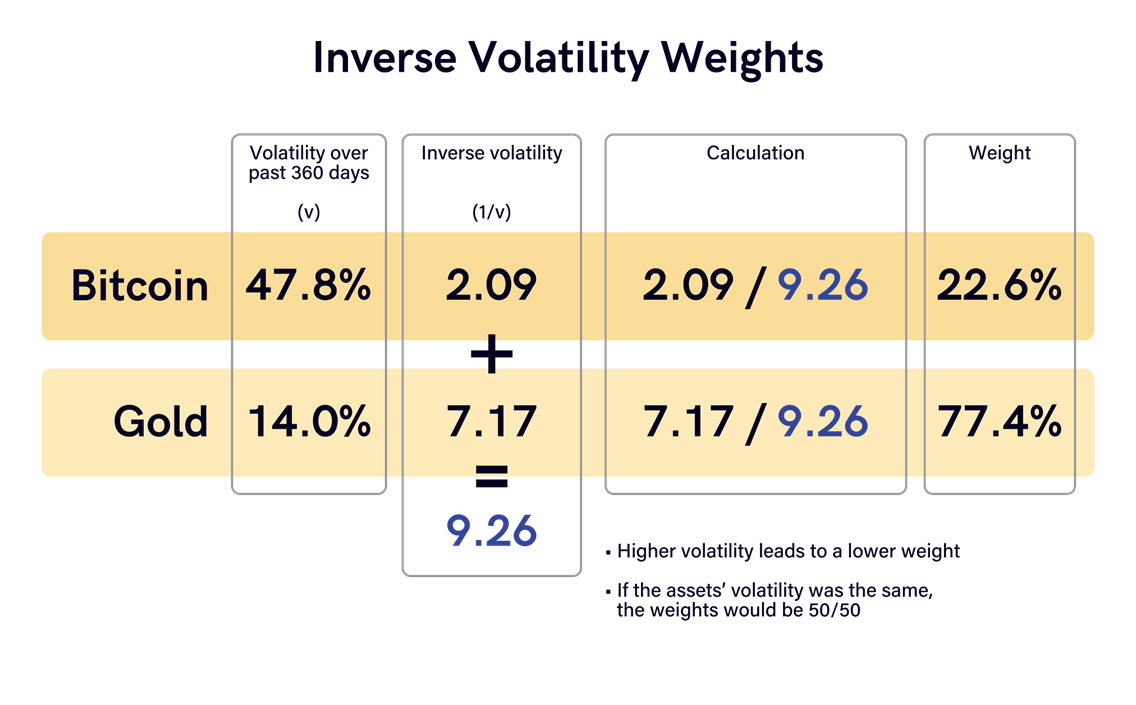

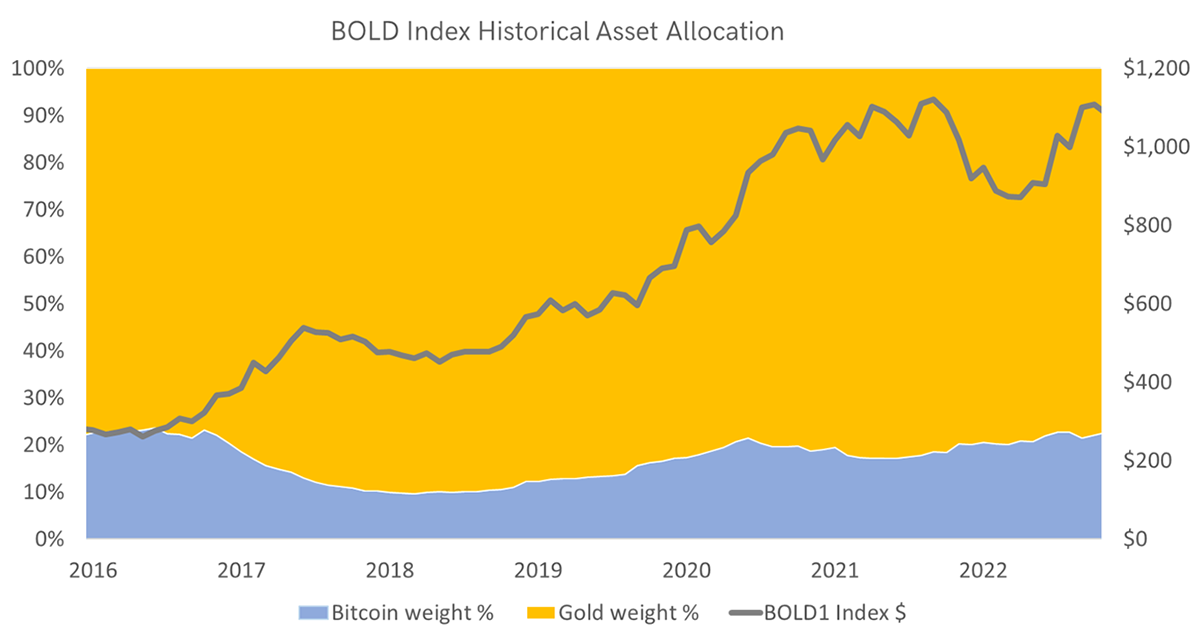

Risk-weighted asset allocation techniques are commonly used in finance to improve risk-adjusted returns. BOLD1 uses the “inverse volatility” methodology, which means the more volatile asset has a lower weight in the basket.

The BOLD1 Index has completed its monthly rebalancing. The new target weights are 22.6% for Bitcoin and 77.4% for Gold. Bitcoin ended May with 22.0% exposure and 78.0% in Gold. As a result, Bitcoin has seen an increase of 0.6% while Gold decreased by 0.6%.

The highest recorded Bitcoin weight in the Index occurred in January 2017 at 23.6%. This followed a period of relatively low volatility which resulted in a price surge in 2017. As the volatility rose by the year-end, Bitcoin’s weight had fallen to 13.0% by the year-end and averaged 10.7% during the 2018 bear market. In contrast, Gold’s volatility remained consistently low.

The BOLD1 Index benefits not only from capital appreciation from rising prices but also from monthly rebalancing transactions and asset allocation. The pursuit of risk weighting is important because it steers the portfolio away from the riskier asset, with more appropriate exposure to the safer asset. By repeatedly rebalancing, there is an additional return from “volatility harvesting”. That is a tried and tested strategy that benefits from buying low and selling high.

Bitcoin and Gold are naturally uncorrelated, and it is rare that both are doing well or badly at the same time. The process of rebalancing means buying the weaker asset and selling the stronger asset. By repeatedly doing this at the end of each month, the BOLD1 Index adds additional value over time, estimated to be in the 5% to 7% range per annum.

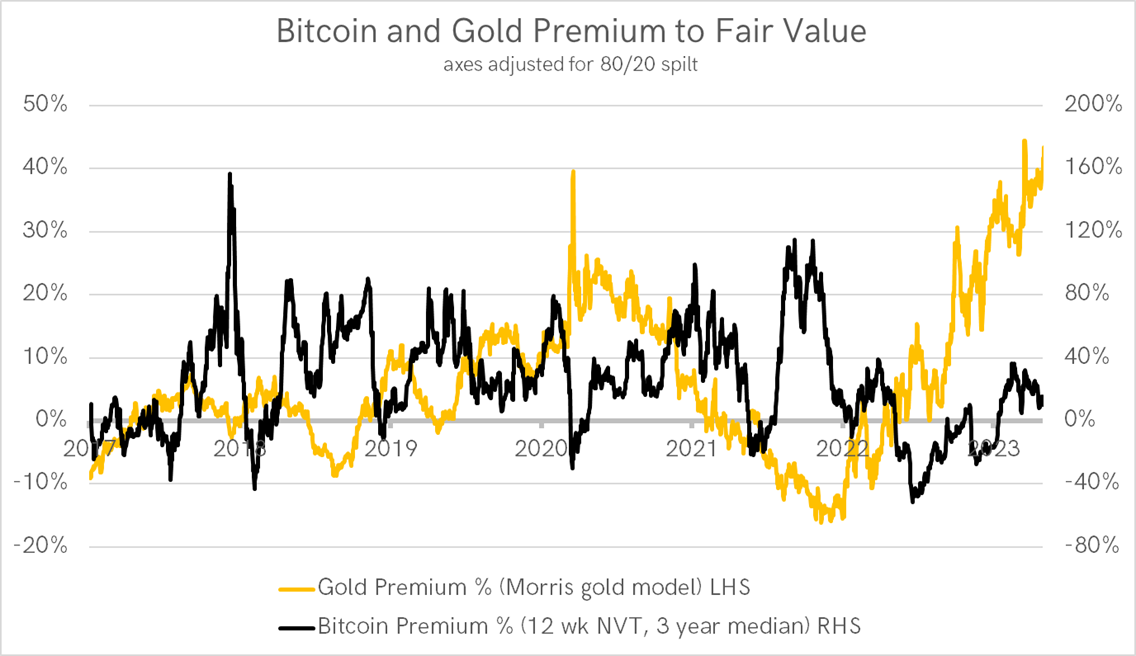

Currently, ByteTree’s models show Gold to be trading at a premium, no doubt for good reason, while Bitcoin trades at fair value. With the Bitcoin halving less than 11 months away and annualized new supply falling below 1%, Bitcoin is likely to benefit. Should the Gold price come under pressure, as it did in 2020, the last time it traded at a premium, BOLD1 is likely to outperform Gold once again. It is unfashionable to suggest that Bitcoin can reduce risk in portfolios, but data suggest it to be true.

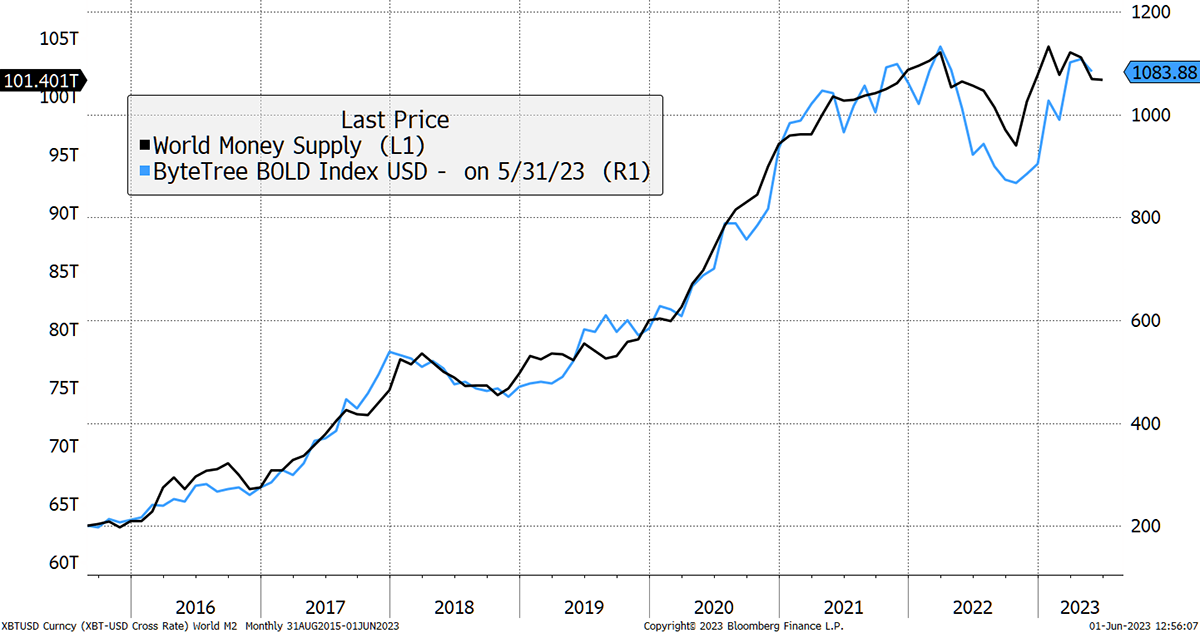

BOLD1 gives investors exposure to the two most liquid alternative assets on a risk-weight basis. This is a highly efficient asset strategy that has mirrored the growth in the global money supply more closely than any other asset combination, with 3.8x returns.

BOLD1 Has Been an Effective Hedge Against Global Monetary Supply Growth

Comments ()