Caution on China

Trade in Soda;

Thankfully, it looks like an agreement will be reached on the US debt ceiling. The good news is that the US government will likely avoid default. Depending on your view, the good or bad news is that that debt can now grow by another $4 trillion over the next two years. On the announcement, bond prices rose slightly (yields fell), but we still can’t be sure if that marks a turn-up for bonds or just short-term relief. When we finally know when peak interest rates are behind us, it will be a very different world for investors. In the meantime, we are still grappling with an economic slowdown in the West and severe weakness in the East. The only boom is in cyberspace.

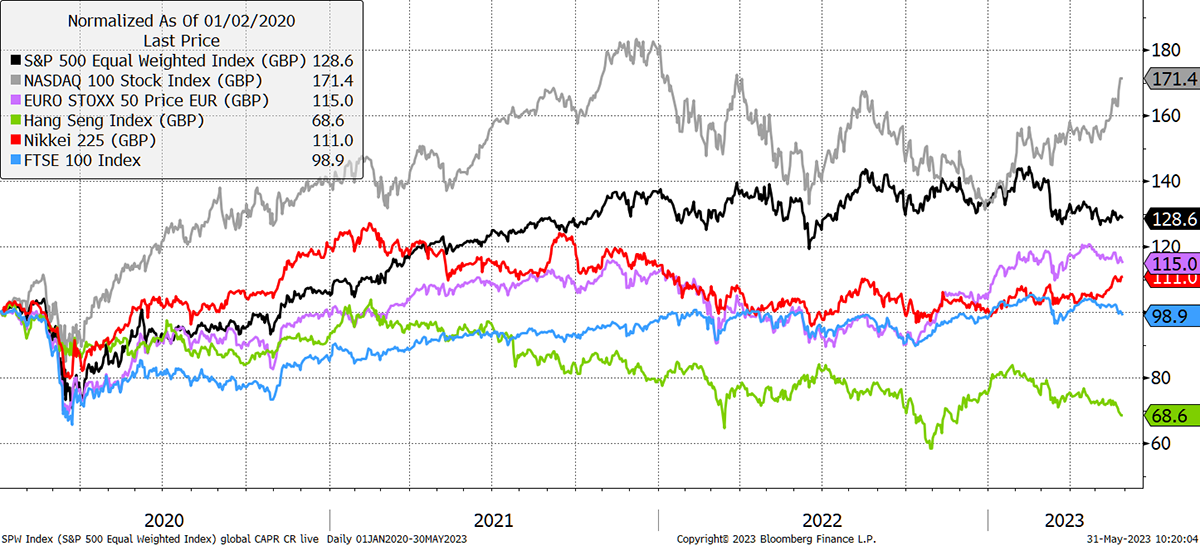

Going back to pre-pandemic times (Jan 2020), stockmarkets (in GBP) reflect this. Hong Kong’s Hang Seng Index has barely ever been in positive territory. The UK, Europe and Japan are much the same, while the technology-heavy NASDAQ has surged and may make an imminent all-time high. It seems cyberspace is the only place to avoid the world’s troubles.

Global Trends Since Pre-Pandemic

The black line is the S&P 500 equally-weighted index, which reduces the tech exposure significantly, making it a better reflection of the broader US economy. This index is still ahead of the rest of the world, but much less so. Furthermore, when you price it in GBP, it has been flat for two years and seems to be losing strength. It is an alternative view of how stockmarkets have been behaving. Currency swings have heavily offset changes in price.

In my short note on Friday, I highlighted how thin market breadth had become. It’s tech and little else that is rewarding investors. This is a cause for concern and is another comparison of the late 1990s, where a divergence appeared between the new and old economies.

As you know, last October and after a brutal year, I suspected things would get better and turned bullish on equities. In some places, they have risen, and in others, they haven’t. I put great faith in Asia and the emerging markets, mainly on value grounds, but that has come under pressure. The only safe haven has been growth because it is deemed to be insulated from the problems in the real world. Whether true or exaggerated, it’s happening.

Sell iShares Emerging Markets Dividend ETF (SEDY) in Soda

I have given the deep-value, emerging markets trade every chance, but anything related to China seems to be imploding. The harsh reality is that emerging market value remains the cheapest allocation on the planet, but unfortunately, it is still getting cheaper.

Something is badly wrong in China, and we best get out of the way. Perhaps relations between the West and the East have structurally changed. I read this morning that just 6% of flights between the USA and China have resumed since reopening. I will embrace emerging market value, and commodities, once again when the global recovery comes. That may take some time.

We still hold emerging market bonds, but these are much lower risk than equities and come from many different issuing nations. China exposure is 3.96% which I can live with for the time being. There is no suggestion that their creditworthiness is in peril. The yield to maturity is now 7.5%.

RHI Magnesita (RHIM) Update

RHIM rallied yesterday on the news that “Rhône Capital L.L.C. intends to acquire, in cash, shares representing 20% of the issued and outstanding share capital in the Company for a price of £28.50 per share. The Board is considering its response to the partial offer, and a further announcement will be made in due course.”

The shares rallied 24% to £25, which is still 10% below the offer price. This is excellent news and a reminder that value stocks generally work out in the end. So far this has only broken even, but this announcement provides a boost and hopefully a floor for the future.

Action:

Sell iShares Emerging Markets Dividend ETF (SEDY) in Soda

Postbox

Once again, there’s a heavy postbag this week. That reflects broad confusion, which comes as no surprise given events. At times like this, pulling rabbits out of hats is difficult, but I can help to explain what is going on and keep you out of trouble. Keep the comments coming, but please bear in mind I very much appreciate short questions that I can publish.

A reader sent an email questioning the relationship between bond yields and growth stocks, with reference to my recent tech recommendations. The question related to the idea that when rates rise, growth stocks should come under pressure because the discount rates rise. My apologies for losing this excellent question. I remember reading it but can’t find it. Computers sometimes do this.

It is true that a higher interest rate raises the discount rate, which puts downward pressure on valuations of financial assets such as bonds and equities. This is generally observed in a low-inflation environment. But higher rates are worse for quality than for growth.

Consider that a conventional bond doesn’t grow, it only repays the 100 it promised to do at redemption. A company like Unilever (ULVR) grows at around 5% and resembles a bond with some growth. Over 10 years, 5% compounds to 63% or 10% over 2 years.

The US 10-year bond has fallen around 25% over the past two years due to rate hikes. Put simply, a company like Unilever will have grown by 10% over two years, and the share price should be down by 25% - 10% = 15%. Obviously, there are other factors, but I hope you get the point.

A growth stock, such as Nvidia (NVDA), has a growth rate of 50% and, as a result, is much more sensitive to growth than interest rates, which barely move the dial. That is why growth outperforms value when rates rise.

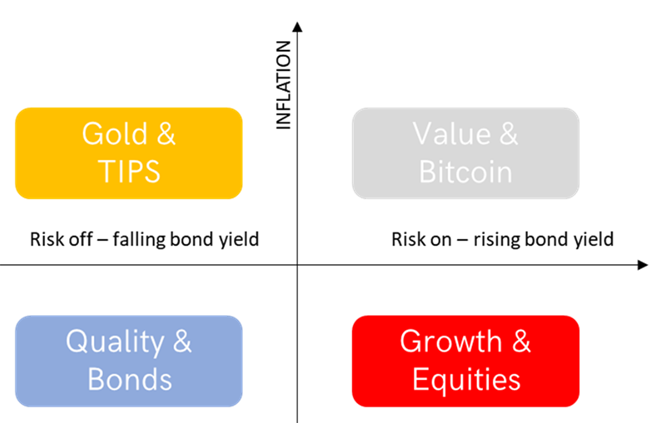

To complicate matters, I will now bring in valuation. If the rate hikes kick off when growth stocks are highly priced, the bubble can burst as sentiment turn negative. However, if valuations are favourable and fundamentals are sound, then growth can shrug off rate hikes and prove to be defensive. We last witnessed this in 2013 during the taper tantrum when gold collapsed by 30%, and tech was resilient.

In 2021, the tech sector was a bubble with extremely high valuations. The largest stocks are still highly valued, but the rest have already experienced a significant bear market. With lower valuations and the arrival of AI, which has led to a structural upgrade to growth, things have improved.

Let’s say tech was growing at 10% per annum and slowing, which was the case late last year. Then AI comes along, and that 10% becomes 12%. The arrival of AI may be big enough to keep the tech train going for another cycle. At least that’s the hype.

In an inflationary environment, it’s different. Unilever and Nvidia make money, which is not of much use in a high-inflation environment because the value of money is falling. Much better to make gold, oil, steel and food, which is what value or cyclical stocks do. Hard stuff from the factories is resistant to inflation because it is real and cannot be inflated.

It’s a complex subject, but I hope you can see that growth expectations can outrank interest rates but other factors such as valuation and growth matter too.

I tend to agree with the poster this week and their comments on Ruffer and CGT. You say they are pretty good at avoiding a bear market but they are down 10% and 7% respectively since I bought them in Feb this year. That’s pretty average at best. If the expectation for them is good shouldn’t we be ‘dollar averaging’ and buying more or at least sell them and re-purchase at a better time? At the moment I’m just watching money disappear with them.

Or alternatively…

On the capital protectors Capital Gearing and Ruffer I have held both since 2017 when I transferred my Stakeholder pension funds into a SIPP six years ago. I have holdings in Capital Gearing (CGT), Ruffer (RICA), and also Personal Assets Trust (PNL). I regard their role as a more than satisfactory for investments that were intended to provide a degree of capital protection to my portfolio. With thanks and best regards.

There’s an old saying that investing is a marathon rather than a sprint, and that is certainly the way absolute return funds operate. Their investment decisions are fundamentally driven with a focus on risk. They do not chase returns or hot themes but want to be on the right side of history. Their long-term records demonstrate that.

They are currently defensive, even more so than usual, which would be better received if the stockmarket was falling rather than drifting. Instead, we have a narrow bull market, and they are being left behind. This year, RICA is down 5.5% NAV and down 8.3% price, while CGT is down 1% NAV and 3.8% price. They will not be happy about this, nor am I. They will be issuing new factsheets in the coming days, and it will be interesting to hear what they have to say, especially RICA. CGT has seen its shares swing from a 2% premium to a 2% discount. That is outside of their control, and buybacks are underway to prevent further widening.

When I started Soda in 2016, I allocated 20% to both RICA and CGT, and they have compounded around 6.2% after fees, in contrast to the FTSE Private Balanced Index of 5.9%. They have outperformed a little but with much less risk. I hold them because they are highly unlikely to lose material amounts of money, as risk is at the heart of their process. For reference, PNL has returned 5.6% per annum.

CGT and RICA have lots going on behind the scenes. CGT holds many small positions, while RICA has a protection strategy. Both allocations are down to 14.6%, as the Soda portfolio has outperformed. That is expected because I am willing, on occasion, to take on more risk. I have considered rebalancing and taking the weights back up to 20% but, in the absence of a wide discount, haven’t done so. Instead, I have tended to add allocations alongside them that I like. Currently, that would include inflation-linked bonds and the yen. Both are currently draining, but at some point, they should perform very well.

Both companies hold a longer-term view that inflation is going to be volatile and average around a higher rate than currently expected. When markets acknowledge this, both funds will perform well again. That said, if I sense there is a change of process or something has fundamentally changed within these organisations, I will not hesitate to sell.

Is CG Real Return at 197.54 price a better entry point than previously recommended at around 202.00.

My conviction has not changed, so lower prices are a good thing. This is a good opportunity to buy CGT.

In the flash note of 17/5 you said sell silver SSLN or alternatively sell PHSP instead. Silver has performed terribly since. Given that we held both should we not have sold both not just one of them? Should we sell the rest now?

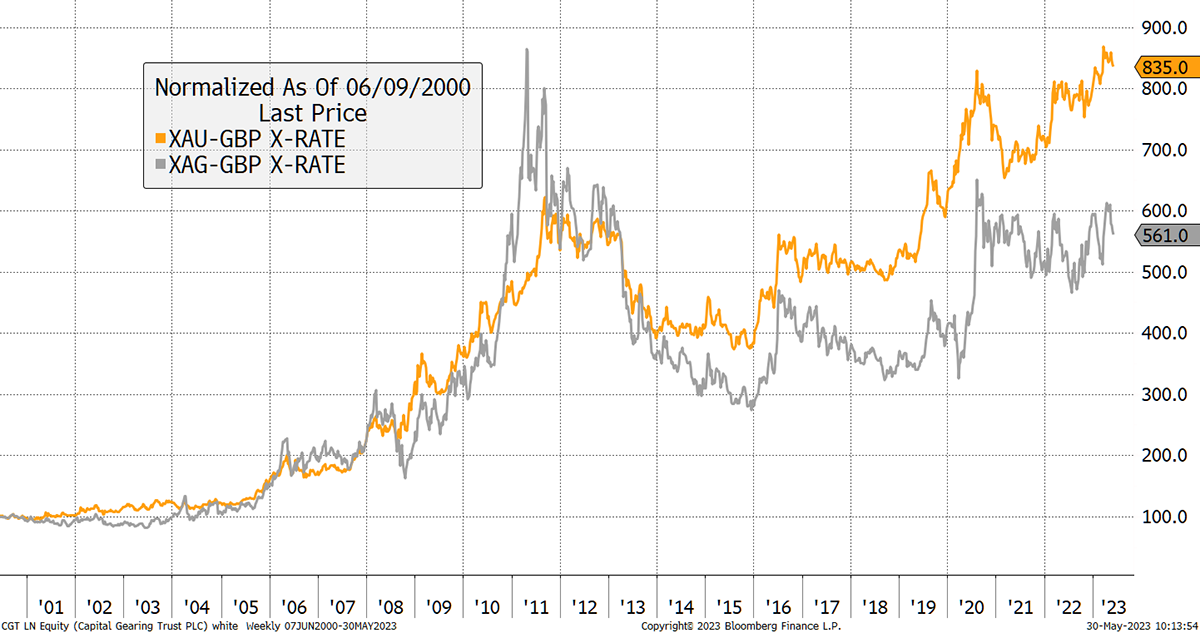

I am bullish on gold and silver over the long term. Over the years, I add when the winds are blowing in the right direction and reduce when the headwinds reappear. Sometimes I get that spot on, such as in late 2018, when I started to add precious metals back in, having been absent or ultra-light. In January 2013, I sold gold for my clients when at HSBC, ahead of the gold crash of 2013. Then I was outright bearish, whereas today, I am not.

I am merely more cautious than a month ago because that is what the market is telling us. The dollar is rising, technology stocks are in charge, and the markets seem to believe the Fed that the battle against inflation is being won (hopeful). Gold and silver are highly correlated, and the reason to hold silver is that you think it will shoot past gold, like it did in 2011. I think that’s likely at some point.

Strong Trends in Gold and Silver

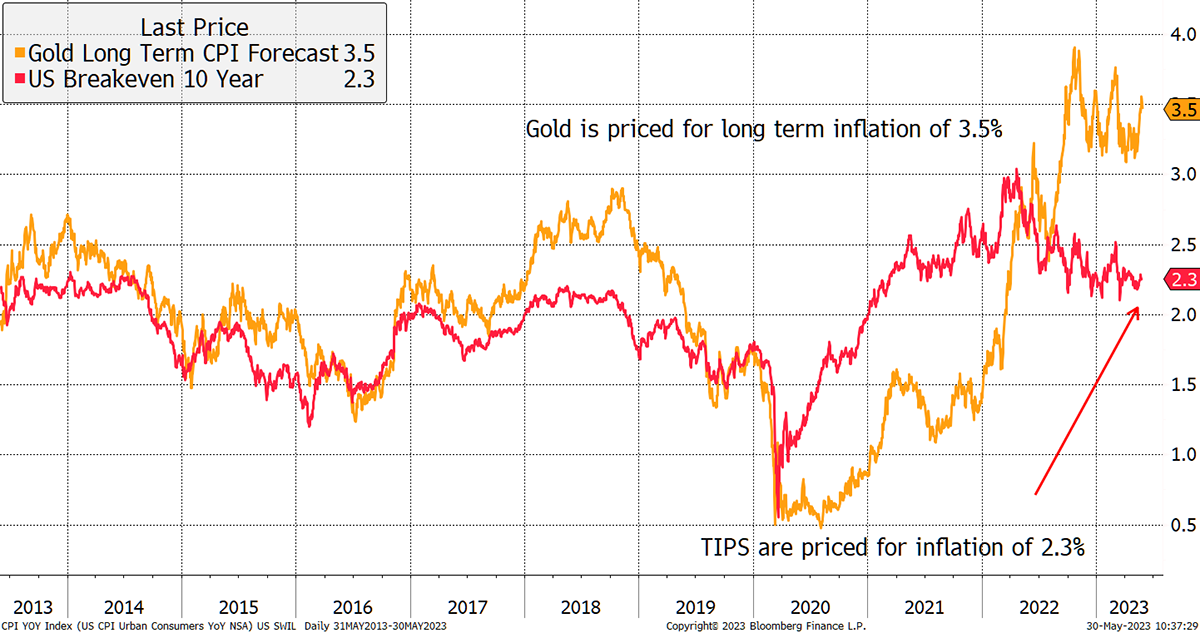

The inflation question is important because it tells us where peak interest rates will settle. If the Fed succeed, then we want to own little or perhaps even no gold. If the Fed fails, there will be a limit on how high interest rates can go without causing a depression. That will force real interest rates lower, and we should have a high allocation to gold and its friends.

Between 2013 and 2019, gold and TIPS were in agreement on what long-term inflation expectations would be. Since 2020, they have disagreed. If gold is right, then the gold bull market will continue, and TIPS will surge.

Gold versus the Bond Market

Can you please tell me your view on the present cash position of the portfolios, especially in Soda (approx. 8%). Given the present poor performance of the markets do you not think the portfolio should be holding more cash as a preparation for any opportunities ahead?

And…

The portfolio is currently heavy in cash which I agree is the correct strategy. The recent headlines have however led me to thinking about the risk of the bank going bust. What's the closest thing to cash without it being cash? If the bank were to go bust, I would lose my cash deposits (less the deposit guarantee scheme) whereas I would keep my other assets.

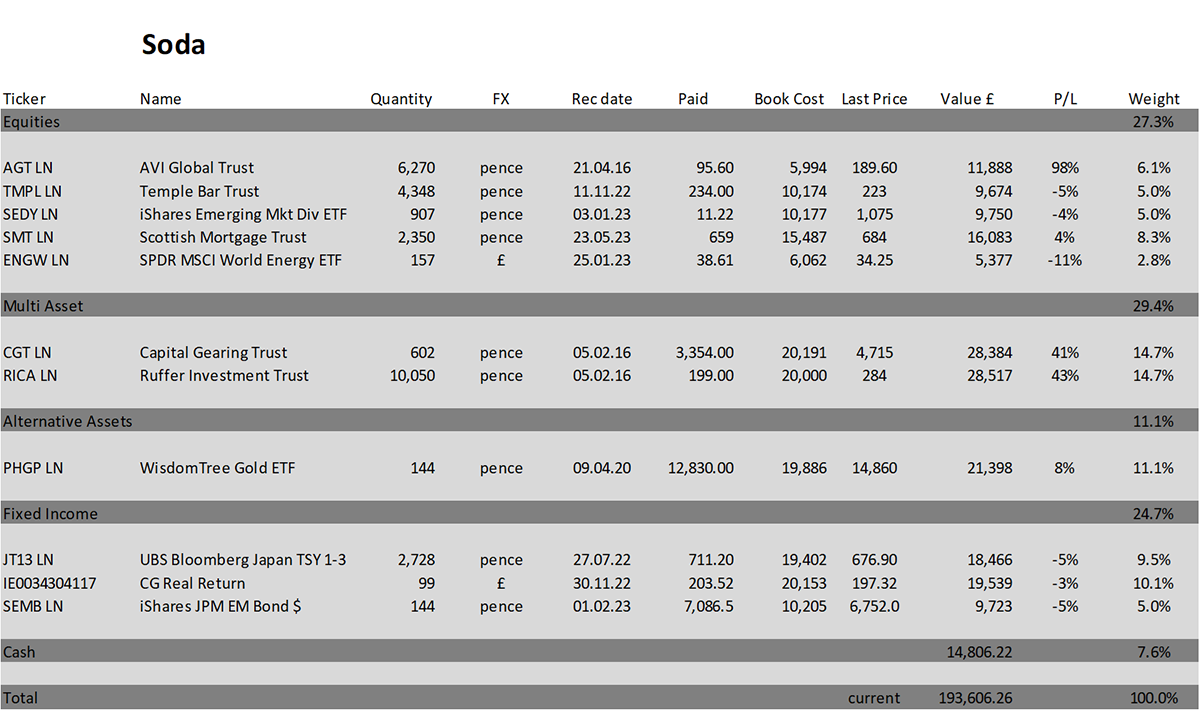

The cash position in Soda is 7.6%. I would boost that to 21.7% by adding the yen (short-dated bonds) and the cash held within other funds. It is already on the high side, and with SEDY sold, now even higher. The portfolios are defensive again.

If you wish to invest your cash into short-dated government bonds:

Invesco US Treasuries 0-1 Year GBP (TIGB)

This invests in ultra-short-dated US Treasuries and hedges the return into GBP, so you have no currency risk. The estimated yield is 2.48% (paid out as income), but the total return (yield to maturity) is estimated to be 5.36%. The fee is 0.1% per annum. This is low risk. This is a good option.

iShares 0-5 Year Gilt ETF (IGLS)

Short-dated gilts are normally low risk, but this fund fell 10% peak to trough over the past two years, making it more realistically low to medium risk. The yield is 0.8% (estimated paid out as income), but the total return (yield to maturity) is 4.6%. The fee is 0.07% per annum.

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 3.3% this year and is up 93.6% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

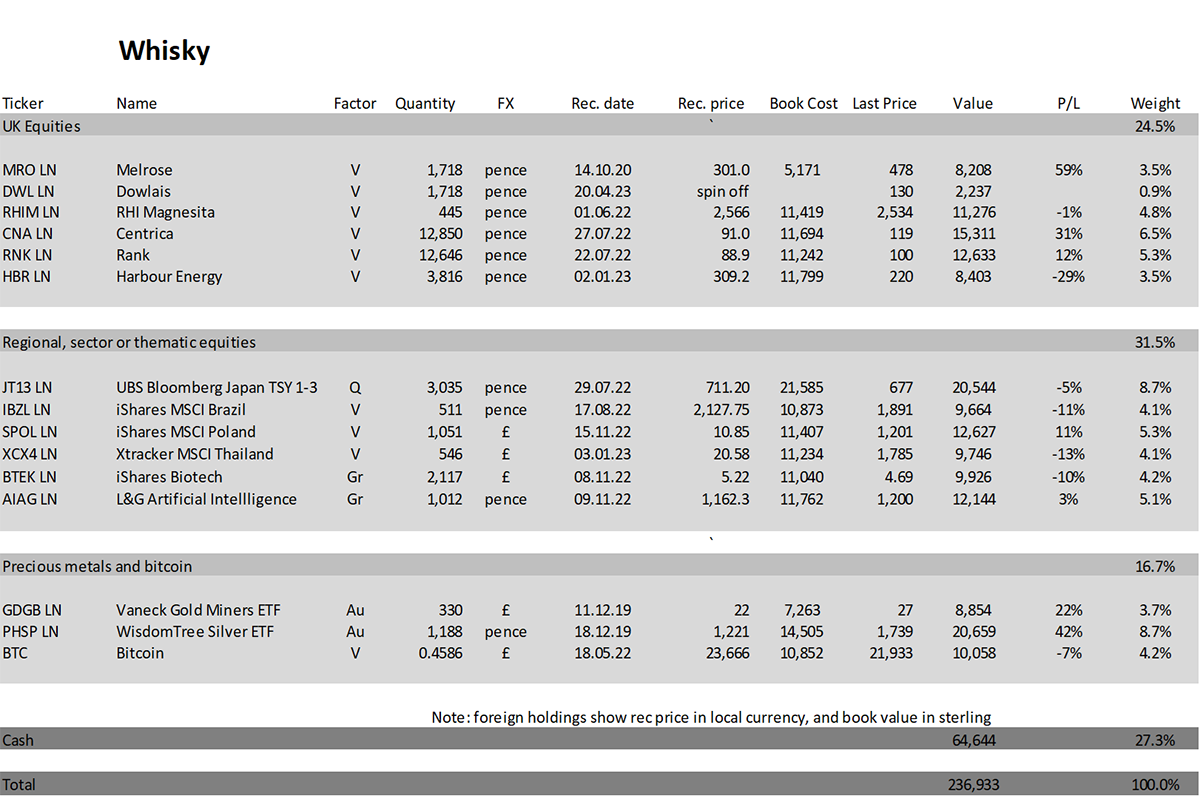

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.1% this year and up 136.9% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

It is nice to see the recently acquired tech trades, SMT and AIAG, get off to a good start. Despite their inclusion, I still see the portfolios as being defensive. We have to make the most of opportunities as they arise.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd