Challenging Times for Bonds and Breadth

Disclaimer: Your capital is at risk. This is not investment advice.

It is rare that the market breadth can be as thin as it is today outside of a bear market. That is, the number of stocks in an uptrend is low, yet the stockmarket is holding up. The only recollection I have over the past 25 years was in 1999, during the greatest technology surge in history. Back then, just like today, bond yields were rising, but most stocks outside of tech were not. That’s logical because higher rates put downward pressure on asset prices. The only way to fight that is with growth.

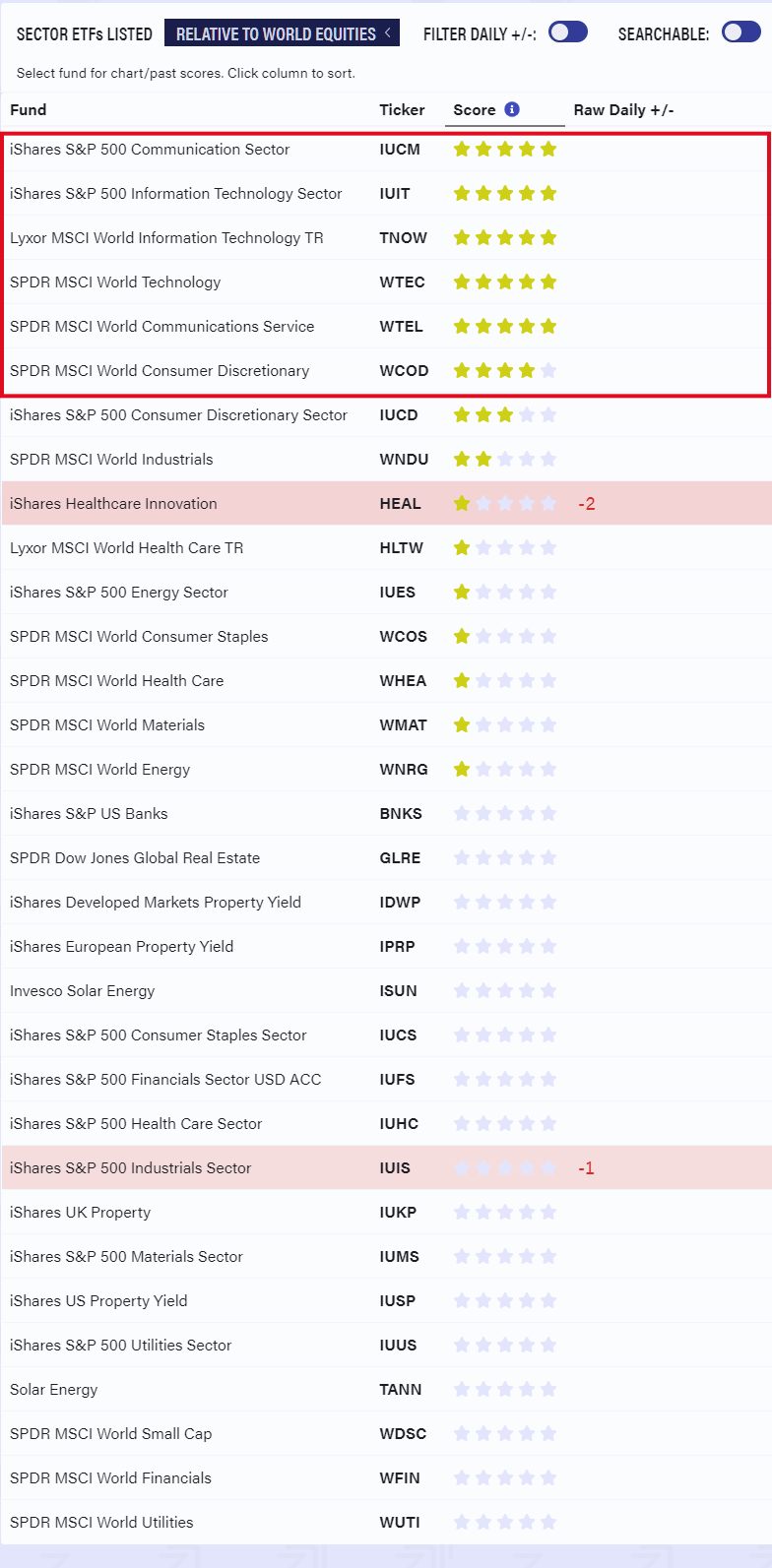

A look at ByteTrend’s sector relative strength model says it all. A 4 or 5-star trend is beating the world index, whereas a 0, 1 or 2-star trend is lagging behind. There are few winners, yet many losers.

Communications, which basically means internet, and technology have strong trends. Consumer discretionary is also holding up, and then, on closer inspection, you realise it is 20% Amazon. Last year’s defensive sectors, such as consumer staples and healthcare, are underperforming alongside utilities, real estate, energy, financials and materials. It’s a thin market.

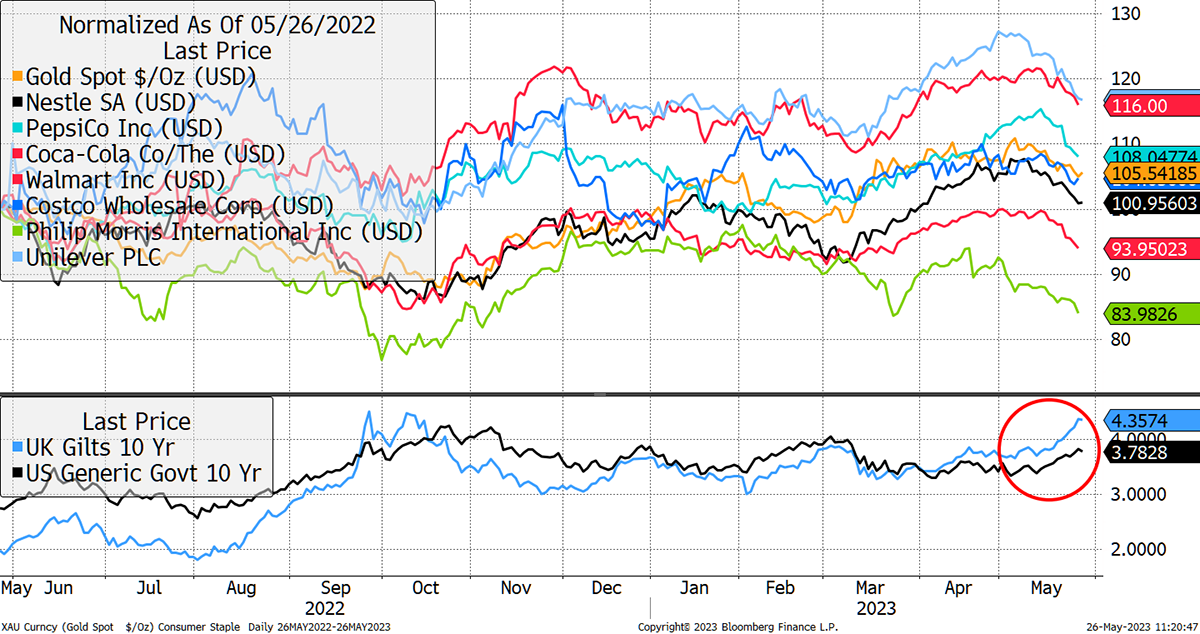

Zooming in on consumer staples, you can see how just as bond yields have risen in the US and the UK (lower chart), the consumer stocks have turned down in unison. As bond yields rise, and so get more attractive, equities have to compete, and in the absence of growth, that means lower prices.

Consumer Staples Are Rate Sensitive

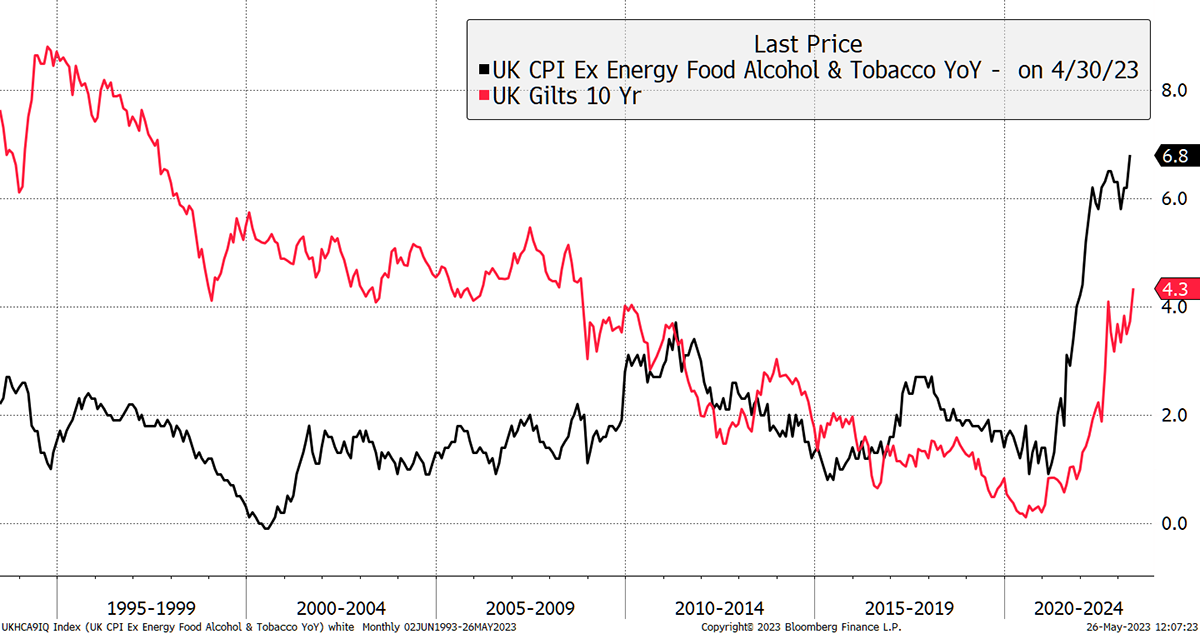

The shock of the week, that caused bond yields to rise, was UK core inflation which rose against expectations. That caused gilt yields to rise back to the levels where the UK government fell last October.

Rising Rates Are Painful for Asset Prices

Perhaps the fight against inflation is harder than we thought. Commodity prices are much lower and continue to come under pressure, but food and wages are proving sticky. It all points to interest rates staying higher for longer, which is not what the stockmarket wants to hear. That is all except for the high-growth sectors.

Then comes artificial intelligence, which has the potential to transform society. You keep hearing how many problems it is able to solve, and how it can do the jobs of coders, authors, songwriters and even actors. Yet it is controversial, and we have little idea of how it will play out. My view is that it will boost productivity, which our economies so badly need.

The market agrees, and while most stocks are under pressure, the chip maker Nvidia (NVDA) rose 25% after announcing spectacular results for the quarter, reflecting a surge in demand. There is a stampede to embrace AI, and it has brought the tech sector back to life.

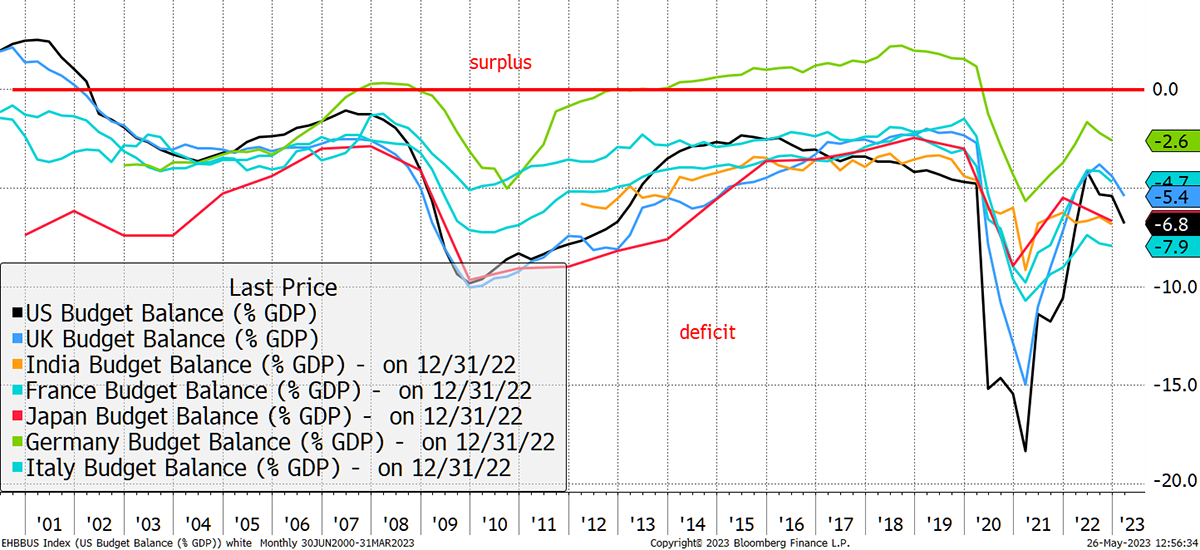

Maybe this is deserved because something needs to change. Governments around the world have structural deficits, even the Germans, and this seemingly has no end in sight.

Structural Deficits

The cost of servicing this ever-increasing debt burden is explosive. Perhaps the hope is that the civil service can be replaced by chatbots, and if we’re lucky, the politicians too.

I was writing about this in The Multi-Asset Investor, along with trouble in China. They, too, seem to be running out of money.

Here at ByteTree, we are interested in AI’s link with the crypto sector. In ByteFolio, Charlie Erith wrote:

“blockchain technology represents the means of maintaining privacy and preserving truth. Bitcoin, in particular, is cited as a way forward because it is genuinely decentralised. It cannot be controlled by a central entity, and thus it becomes of huge value, especially when considered not just as a form of money and store of wealth but as a messaging system.”

The whole point is that AI does the hard work, so we don’t have to. Computers need to interact, and this sits at the heart of blockchain technology. One example came from Token Takeaway, where Ali covered Radix, which has already doubled this year. It competes with Solana, Cardano, NEAR and so on, and has been around since 2021. With a valuation below $1bn and several competitors over 10x that, it’s the sort of thing that interests us.

Have a great weekend, and due to the UK bank holiday Monday, ByteFolio and The Multi-Asset Investor will be published on Tuesday and Wednesday, respectively.

Have a great weekend,

Charlie Morris

Founder, ByteTree