Sovereign Risk

In my last Atlas Pulse, I wrote how the US 10-year yield above 4% was dangerous. When it happened last October, for 18 days, it brought down the UK government. This time, it only managed one day, but the casualty list comprises five banks (if we include First Republic). To avoid panic, the response from the authorities has been swift and much bigger than many realise. The Federal Reserve’s balance sheet grew by $300bn last week, and there’s more. Sometimes, it is right to panic, and they certainly did.

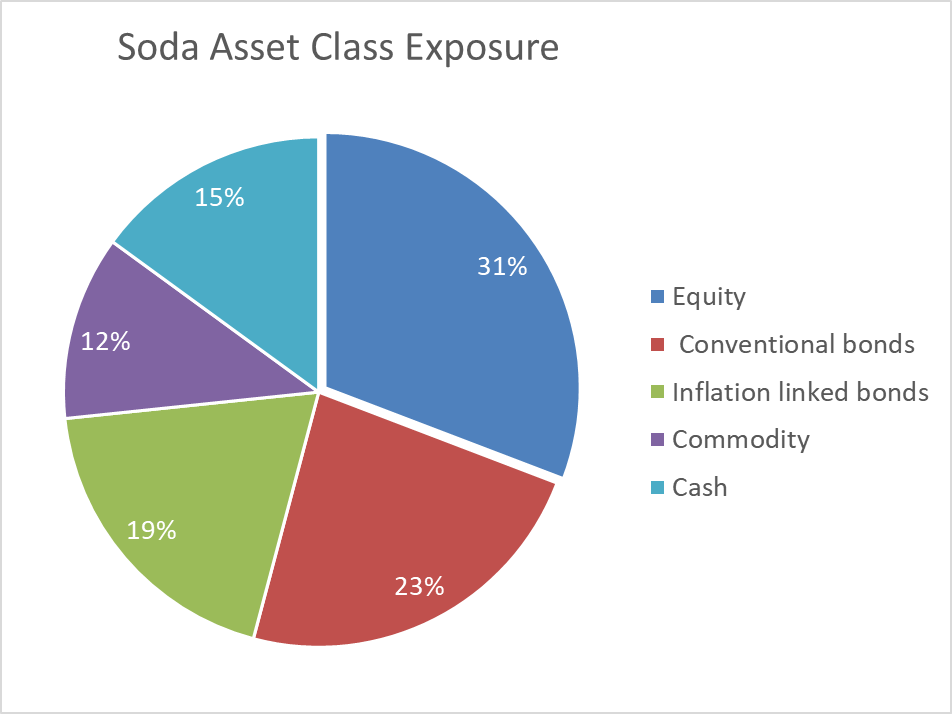

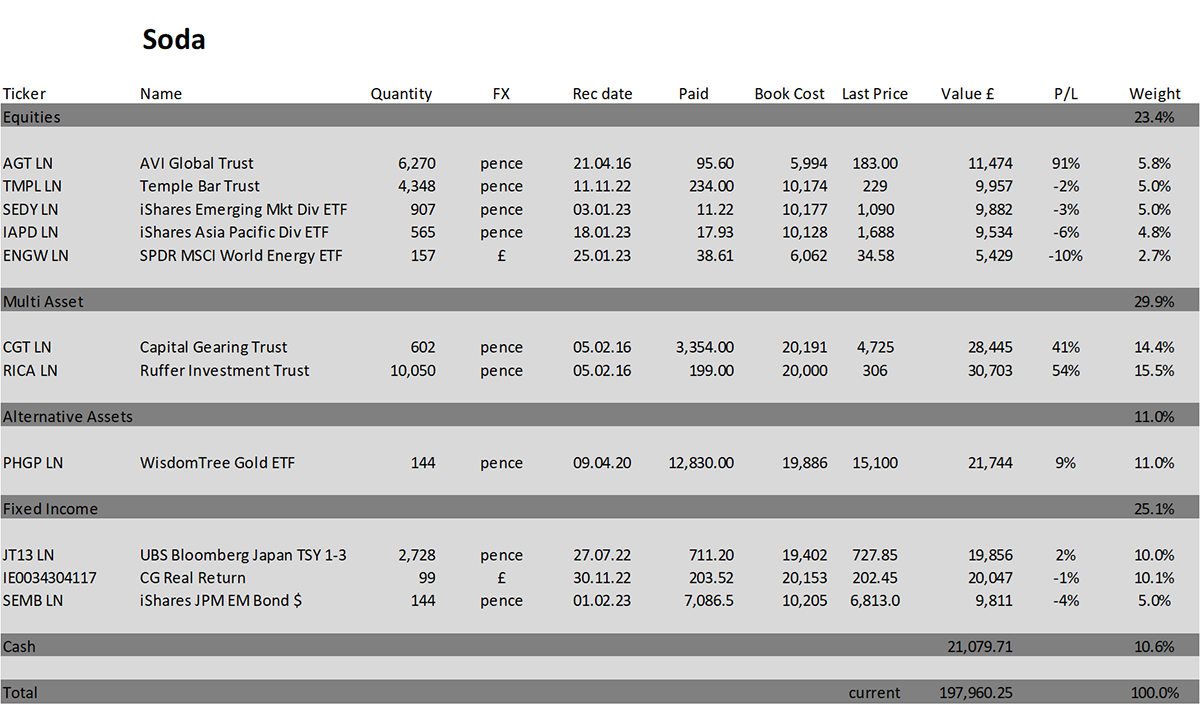

I will talk through my recent flash note, which reduced risk in the Soda portfolio for the third time. But probably of more interest, I increased gold, which I will get to later.

The three trades (UK Property, Europe Dividends, FTSE 100) reduced equity exposure from around 47% in February to 31% today, which is a more defensive stance. We are still higher than where we were before the autumn recovery when equity exposure dropped to around 20%. I don’t much like it being that low, at least not for long, because, in the end, recoveries are inevitable.

It may be that following the interventions by the authorities, the stockmarket doesn’t fall, and it was wrong to sell. But anyone who has witnessed a full-scale banking crisis will always err on the side of caution, which is what I have done.

Asset Allocation Overview

If the stockmarket was to slide over the coming months, having less value at risk makes one hell of a difference. And more importantly, it keeps you whole for when the recovery comes. What use is a recovery if your capital is already lost? These are unstable times in markets, which quite simply means we should be more risk averse than normal.

But be in no doubt, I dislike reducing risk in portfolios, especially since this is the third time in three years. Booms and busts are ever present, but the frequency is becoming alarming. I would much prefer we lived in a more stable world, but we don’t. Part of the solution is to keep the portfolios liquid and boost diversification where opportunities present themselves. If the outlook was clearer, and less risky, I would happily run with 60% equities or higher. Unfortunately, they are not.

Credit Suisse and Switzerland

Last October, in one of my last issues of the Fleet Street Letter before I moved my work over to ByteTree, I mentioned Credit Suisse and the rumours surrounding their business. It was clear they were in trouble, and their cost base was too high. My visit to their offices to promote our BOLD ETF in Lugano, Switzerland, confirmed that. I can tell you it would not have been difficult for them to cut costs. And if they’d bought BOLD in decent size, they’d be buying UBS, not the other way around.

It is not often I feel sorry for a bank, but my heart goes out to UBS because they really didn’t want to end up owning their failed rival. They were arm-twisted into it for the national good. As Mervyn King, former Bank of England governor, said, “most banks are global in life but national in death”. There is a big difference between HSBC buying SVB’s modest UK arm for a quid and $1.1 trillion UBS buying $576 billion Credit Suisse.

These are big numbers, and the Swiss National Bank has lent CHF 50 billion to smooth things over, with the depositors being fully protected, which has prevented panic. Yet all is not well.

The UK and Europeans are up in arms as there is a clear hierarchy in a bankruptcy. The shareholders are supposed to be wiped out first and the bondholders next. The “Cocos”, an instrument that came about following the 2008 financial crisis to provide depositors with an additional layer of capital, were wiped out while the shareholders were paid, albeit a modest sum.

This is not how it is supposed to work, and I am not sure how well this bodes for Switzerland’s long-standing reputation for financial competence.

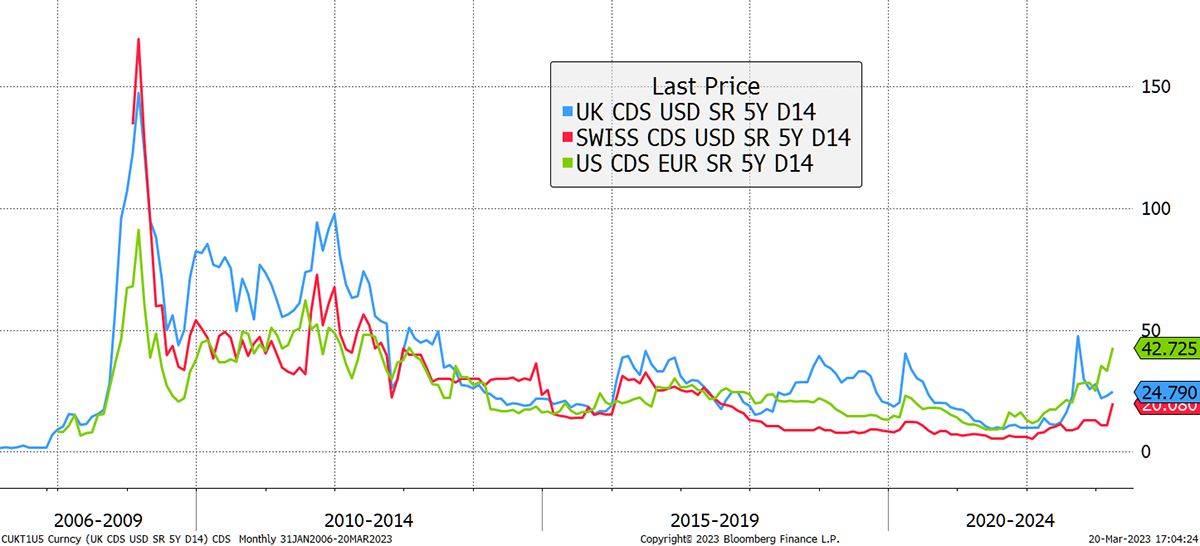

I have revisited sovereign “credit default swaps”, which have been quiet for a while. They basically enable you to buy insurance against a country’s bond default. The cynics say that’s all well and good for small countries, but for large ones, what’s the point? By this, they mean that if a large country goes down, there’ll be no one left to pay the insurance. Too true.

Looking at CDS spreads, and as a result of recent events, Switzerland has become a little riskier.

Sovereign Default Spreads

Source: Bloomberg

In 2006, it cost 0.02% to insure against a UK default. Presumably, the price would have been similar for the US and Switzerland. CDS prices surged in 2008 and remained high until the eurozone crisis passed post-2012. Essentially all the risks that markets worried about were nationalised, which alleviated concerns. For how long can we keep on doing that?

Today, it costs 0.2% to insure a Swiss government bond against default, which is still relatively cheap. For comparison, Germany, Sweden and the Netherlands are a little cheaper, but last year, Swiss CDS traded at 0.07%. The jump is notable.

More startling is the cost of the US CDS. Last year US CDS was 0.1%, which has recently quadrupled to 0.42%. That is the same as South Korea and approaching Spain/Portugal.

US sovereign default risk has overtaken Blighty’s, which is quite a surprise. The reason is not that Uncle Sam has less clout but that they have taken on so many liabilities. According to Bloomberg, the new backstop to protect depositors across all US banks will total $2 trillion of additional exposure.

Is this QE? Or not QE? That is the question. No one seems to be sure, but backstopping the US banking system presumably doesn’t come about for free. The Macro Strategy Partnership say, “it’s temporary, but once initiated, it would presumably come back every time there is a problem. With a real cost to everything, this socialising of all risk would completely divorce price from value or utility, destroying the economy”.

It is a very bad idea.

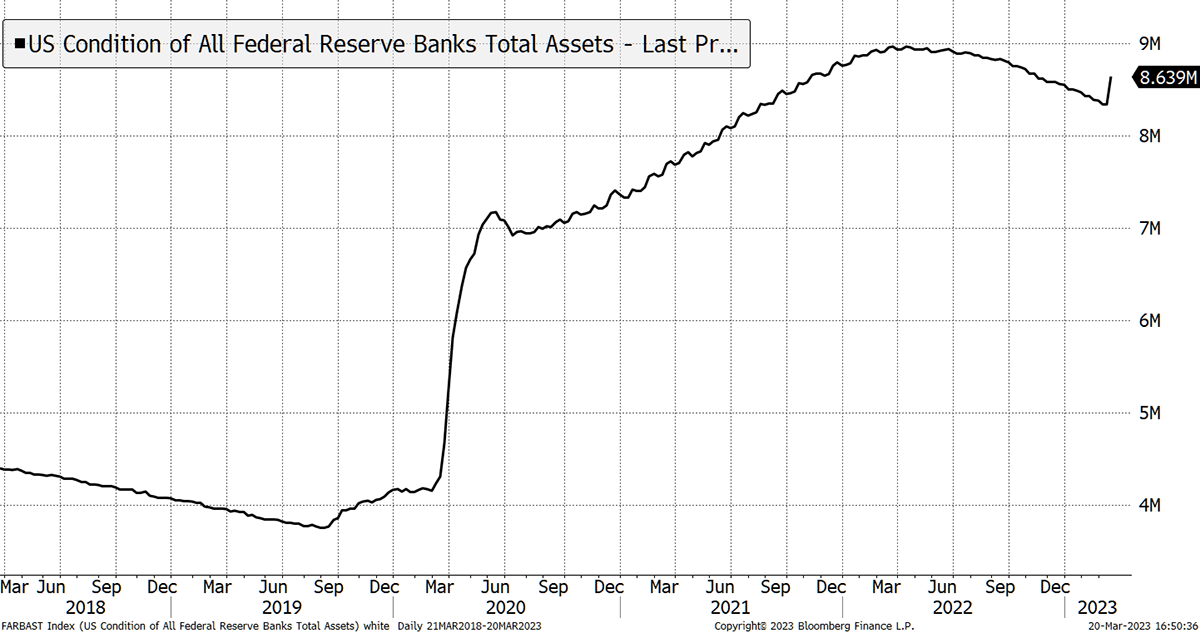

And it has started. We already saw the Fed’s $9 trillion balance sheet jump last week by $300 billion, which has reversed half of all of the quantitative tightening from last year. All that pain, and for what?

Federal Reserve Balance Sheet Expands Again

Source: Bloomberg

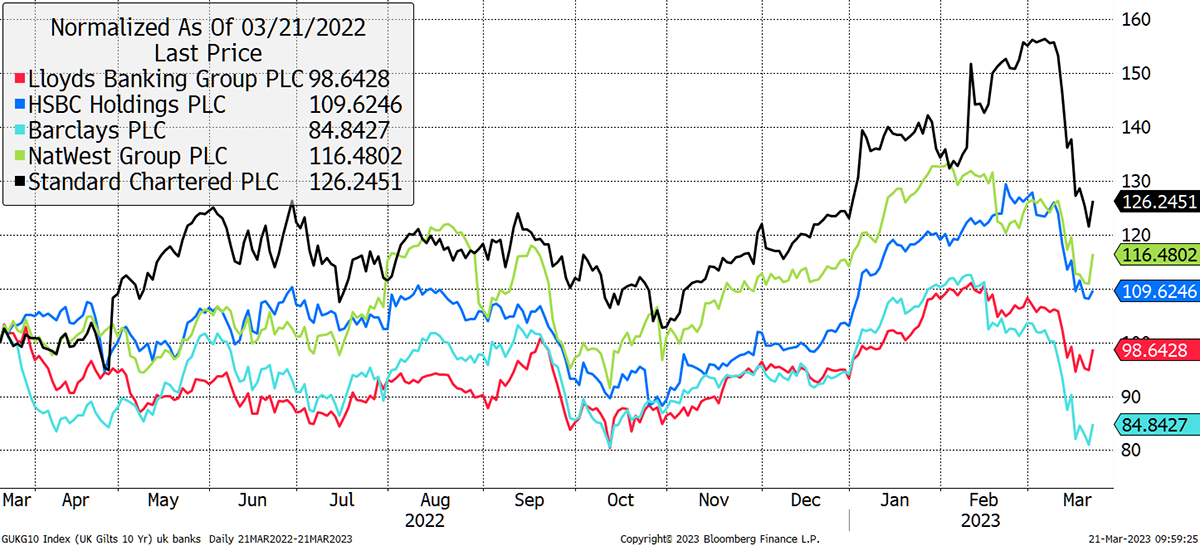

Let’s have a quick look at the banks. Most UK banks are flat or up over the past year. Barclays is down 15%. Lloyds has barely noticed the recent drop.

UK Banks

Source: Bloomberg

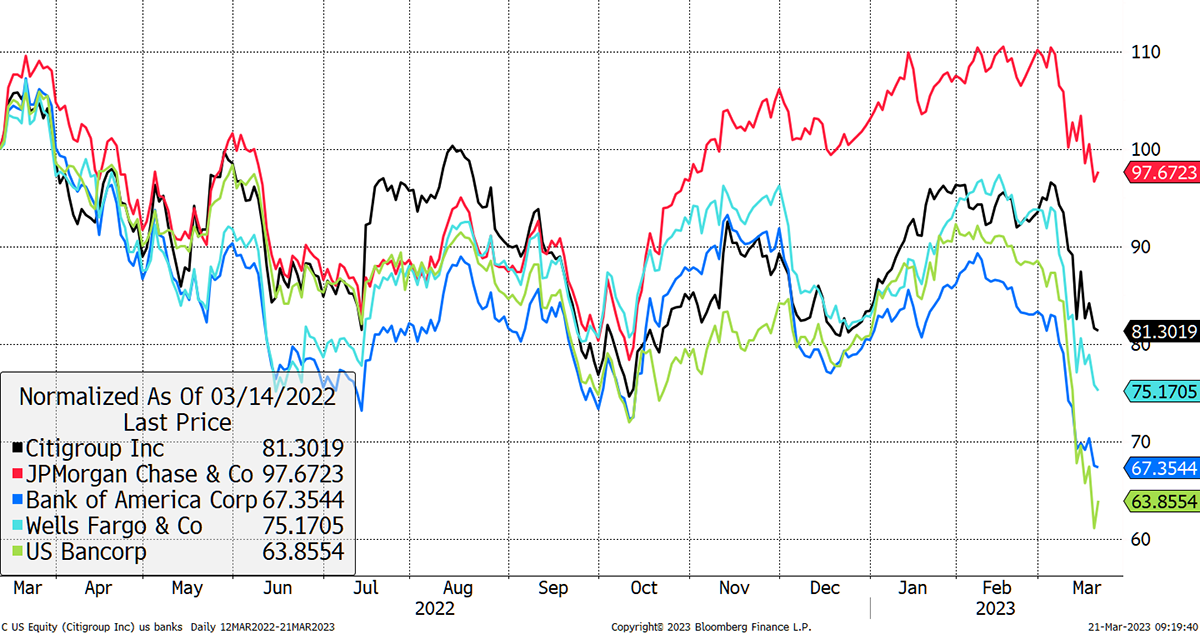

The best-performing US bank, JP Morgan, is down over the past year. US Bancorp is down nearly 40%. The recent drop has been painful.

US Banks

Source: Bloomberg

It might surprise you to see that European banks have fared best over the past year. The majors are all up with Italy’s UniCredit flying. The recent drop hasn’t been that bad.

European Banks

Source: Bloomberg

It is notable how UK and European banks have fared much better than US banks. The bigger problem is over there. With the dollar still soft, the CDS spreads rising, and the weakest banking sector, my increase in gold is starting to make sense.

Why I Increased Gold

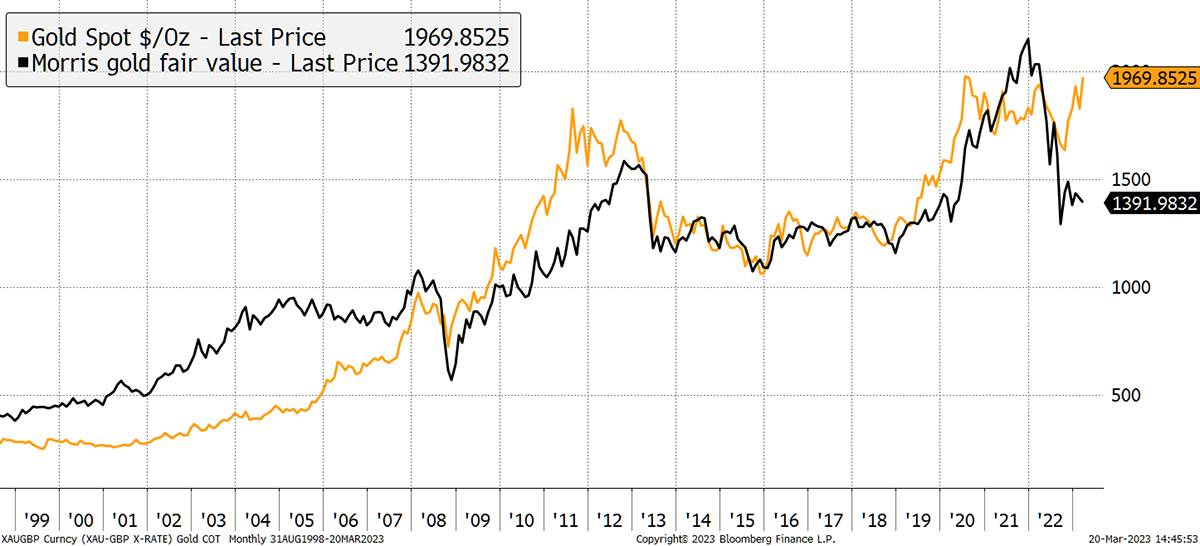

Many gold watchers have made the connection between the gold price and the money supply. It is a simple idea in that gold is finite, and printed money isn’t. If you print more money, the gold price naturally needs to be adjusted higher, as it is inflationary for asset prices.

My gold valuation model, which compares gold to TIPS, has seen the premium expand again. This time, rather than opt for more TIPS, which I continue to believe are undervalued, I opted for more gold. I’ll explain.

Gold Premium to TIPS Expands

Source: Bloomberg

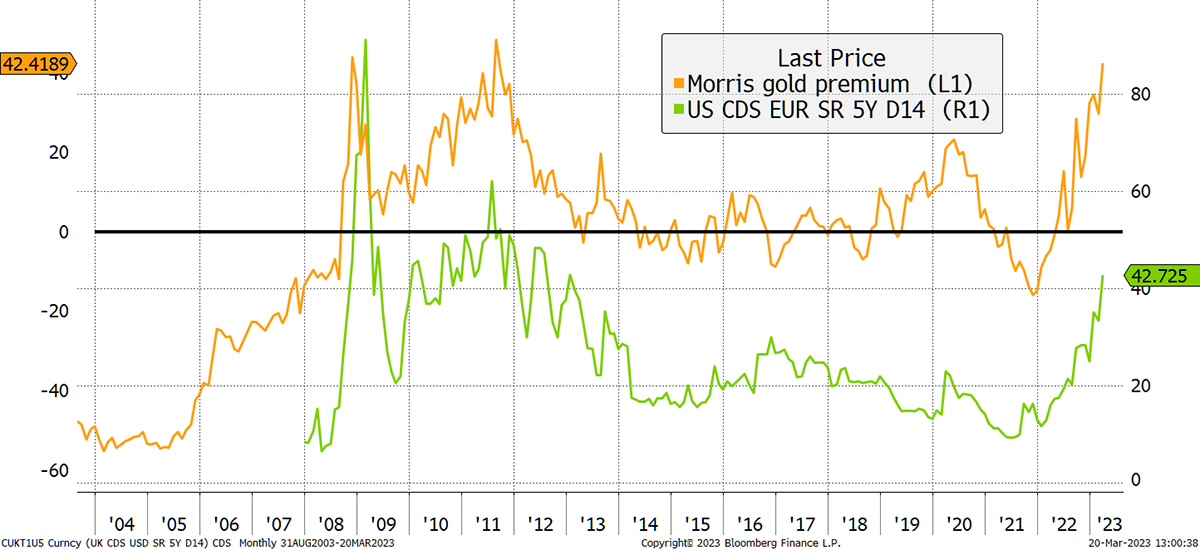

The premium is the gap between my fair value of gold and the value implied by TIPS, currently 42%. In the past, there has been a link with investor fund flows, but last year that broke down, as institutional investors have been avoiding gold for 2½ years, which is remarkable. As I was observing events last week, it struck me that the (dollar) gold premium is once again closely aligned with US sovereign CDS risk; something we haven’t seen for a decade.

The Gold Premium Is Aligned with Sovereign Risk

Source: Bloomberg

The link between gold strength and sovereign credit has been side-lined, but now it’s back. Gold was structurally repriced higher between 2007 and 2011, and it is happening again.

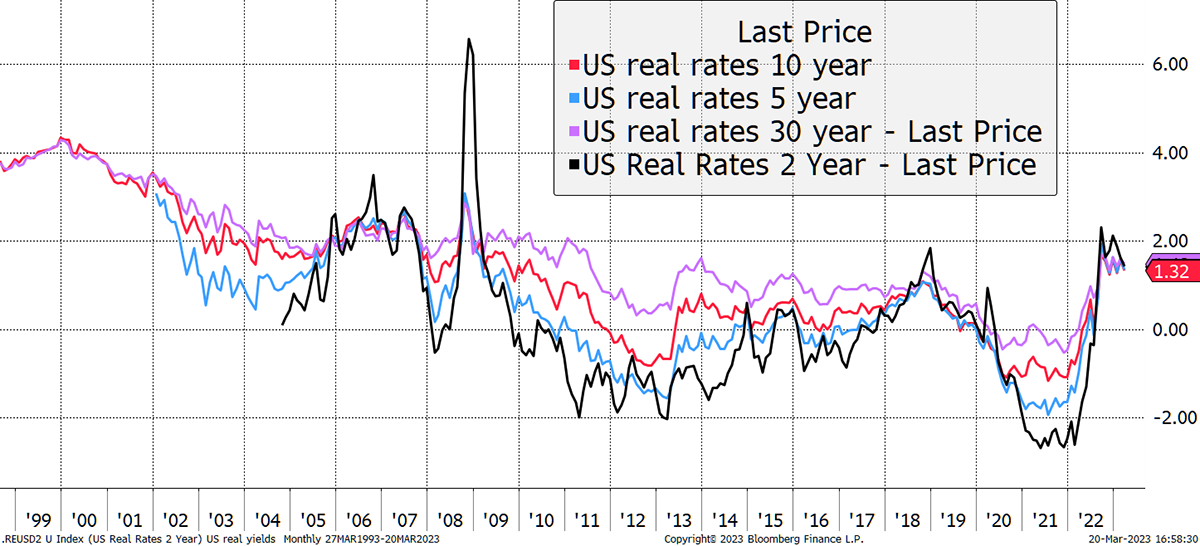

Furthermore, real rates have surged over the past year, and recent events make it ever more likely that they will start to fall again. Those believing gold will be dumped as markets freeze up don’t appreciate that with a soft dollar, and easier money, the environment will be more like 2001/2 than 2008/9. That’s good for gold.

Time to Call the Peak on Real Rates

Source: Bloomberg

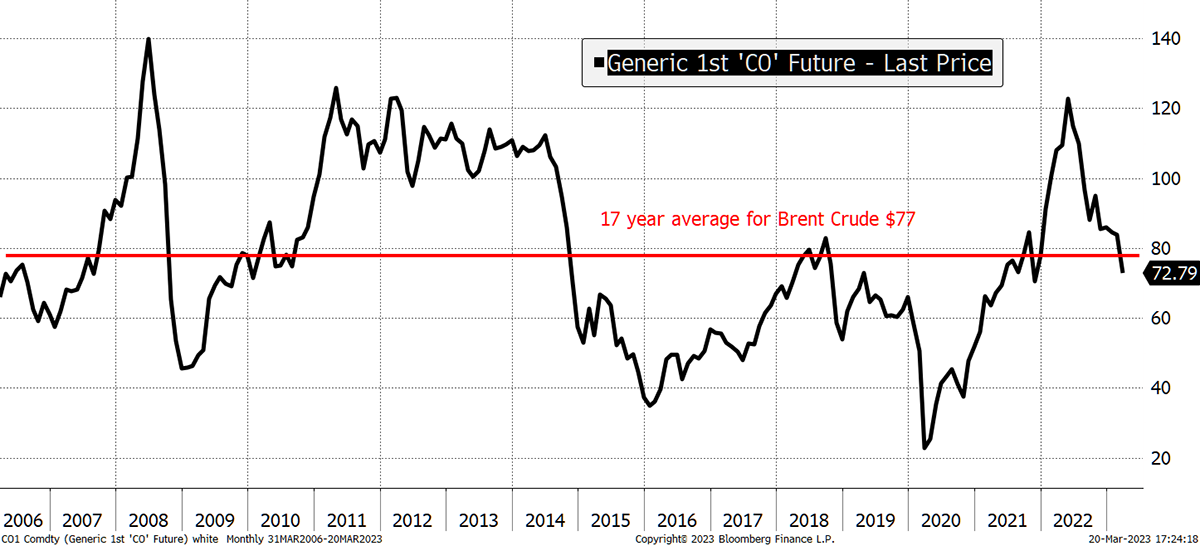

Finally, with so much happening, oil deserves a quick mention. I would highlight the 15-year average is $77. The low in 2008 was $40, in 2016 $30, and in 2020 $20. Do not make the mistake of thinking the next low will be $10.

A Word on Oil

Source: Bloomberg

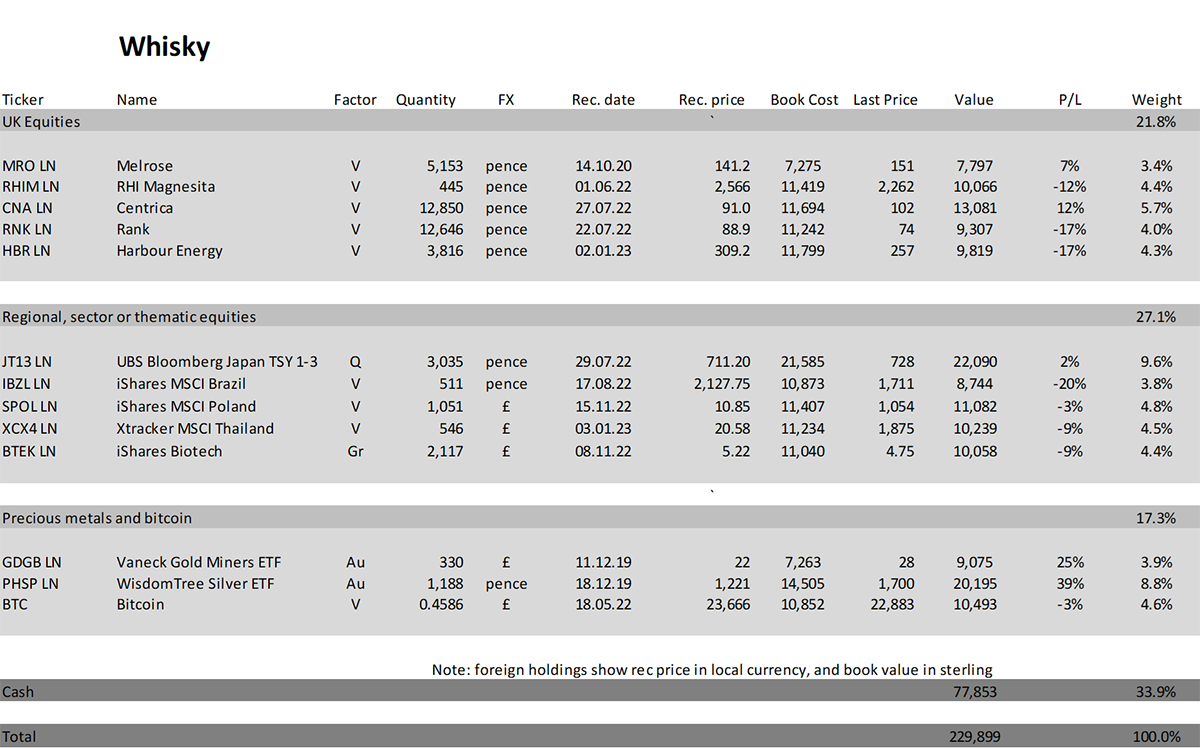

2016 saw US oil production nearly double, and 2020 saw the transport industry shut down. Neither of those will be repeated, so I do not see the downside risk to oil being as bad as in past cycles. Commodity prices will be something to keep a close eye on in the coming months, and I am considering options for Whisky.

Action:

No action

Postbox

What are your views on commercial property, infrastructure and renewables?

No matter how great these things can be over the long term, these are illiquid assets, and when financial markets come under pressure, liquidity is an early casualty. If your assets are unleveraged, you can sit it out and wait for better times, but that wait can be long, depending on the situation. If they are leveraged, consider taking action.

I have followed Soda and Whisky for a number of years, keep up the good work. As part of my portfolio mirrors Soda and Whisky, any differences in the published portfolios are very apparent. I am trying to reconcile the cash in Soda from 7 March to 14 March when iShares Euro Mkts Dividend ETF (IDVY) was sold as I am considerably more down. I would be grateful if whoever puts the portfolio table together could clarify.

That would be me. Well spotted. I booked it in euros by mistake, which has been corrected. It is good to see a small army of readers preventing these errors from lasting more than a few days.

Portfolios

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 1.1% this year and is up 98.0% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 2.9% this year and up 129.9% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

We have de-risked enough, possibly too much, but the chances of markets racing north is minimal. The best thing to do now is to sit tight.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()