When Bond Yields Exceed 4%, UK Governments Fall

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report; Issue 80

In 2020 and 2021, investors opted for TIPS over conventional bonds, yet over the past year, they have moved the other way. The TIPS ETF has fallen from $40bn of assets to $20bn, while the long bond ETF has doubled from $15bn to $30bn. The loud and clear message from this shift is that investors are woefully unprepared for an inflation shock.

Highlights

| Macro | Bond yields above 4% break things |

| Regimes | Bubble in high-quality assets |

| Flows | Investors pile into bonds yet shun TIPS |

| Bitcoin Bull | Network Demand Model says buy |

| Confused? | Buy BOLD |

Bond Yields Above 4% Break Things

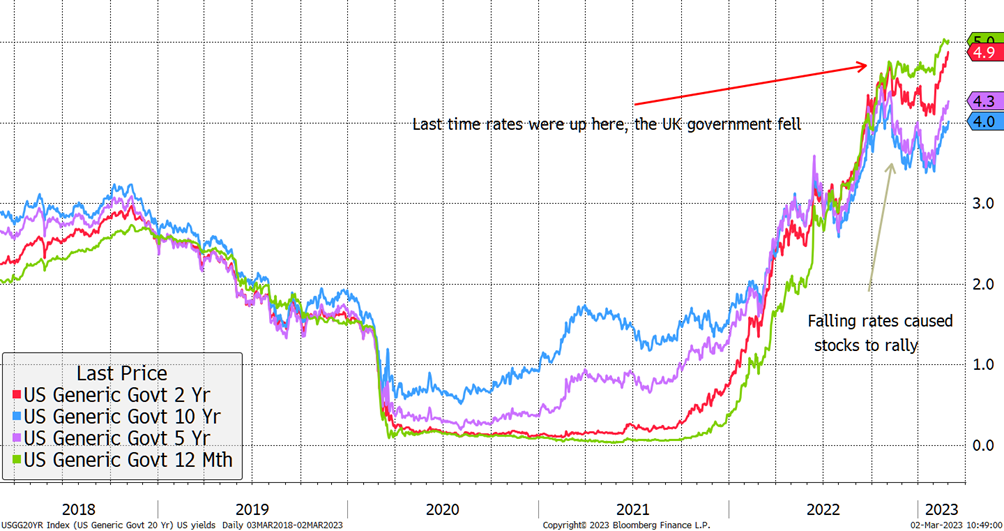

The US 10-year yield has just risen back above 4%. It’s not making the headlines, but this is what it did for 18 painful days last October. In that time, the UK government came crashing down as it tried to introduce policies the bond market couldn’t stomach.

High Bond Yields Will Cause Havoc

Last October, the bond market was in no mood for tax cuts or, more importantly, “pro-growth” policies. This is because pro-growth strategies are associated with “risk on”, which typically results in higher bond yields. If that is confusing, consider that major economic shocks, such as the 2008-crisis, saw bond yields collapse. If busts send yields lower, then booms must send them higher.

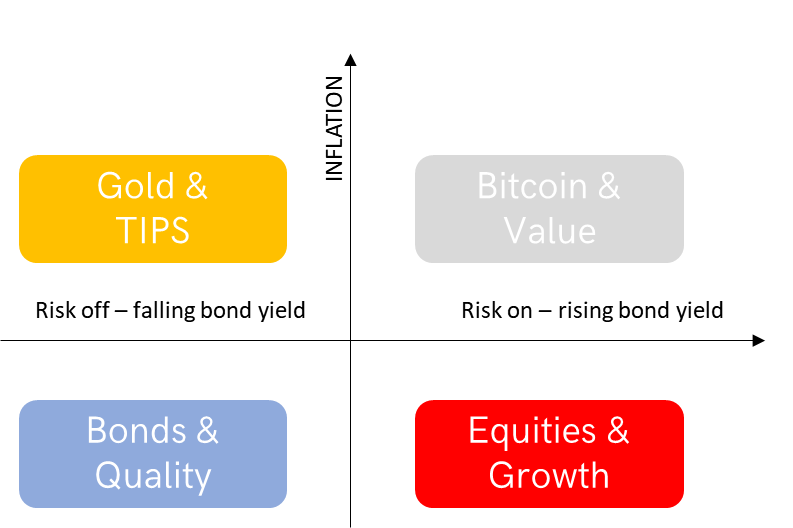

This is shown in my Money Map, which has been my faithful companion in making asset allocation decisions for years. It is a simple idea based around bonds yields and inflation. Basically, gold, TIPS, bitcoin and value are good things to own if you think inflation will rise. And when that happens, bonds, quality, equities (mainstream), and growth will do poorly.

My Money Map

If you think inflation is dead, and a depression is coming, buy bonds and quality. Most people in financial markets seem to think inflation is not a concern and that there will be a soft landing, in which case the blue and red boxes will be the best places to be.

For the record, I disagree with them.

Multi-asset investors should embrace this sort of framework, but most don’t. Instead, they diversify across everything they can find. This approach successfully avoids the worst possible outcomes but can only ever deliver average results.

The Money Map helped me to better understand financial markets and make fewer mistakes. For example, there is no point investing in high-quality companies when inflation and bond yields are rising because the winds and tides are against them. In contrast, choose average to bad stocks in the correct regime, and you’ll be forgiven.

The Money Map also helped us to create the BOLD Index, which blends bitcoin and gold on a risk-weighted basis. It is a highly efficient inflation hedge. More on that later.

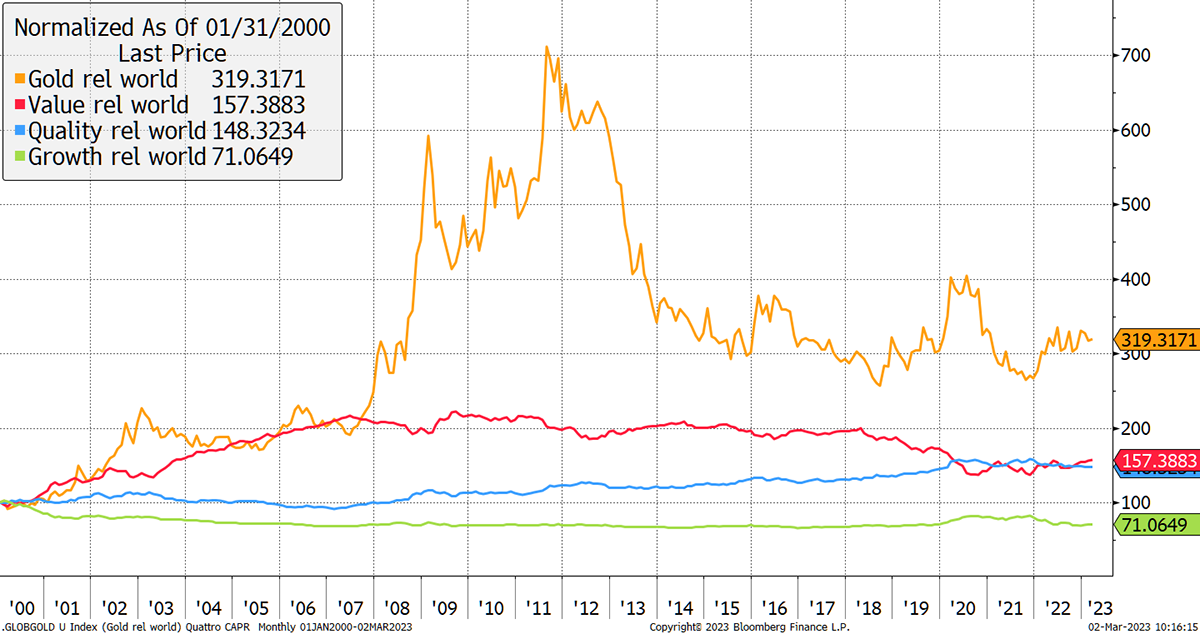

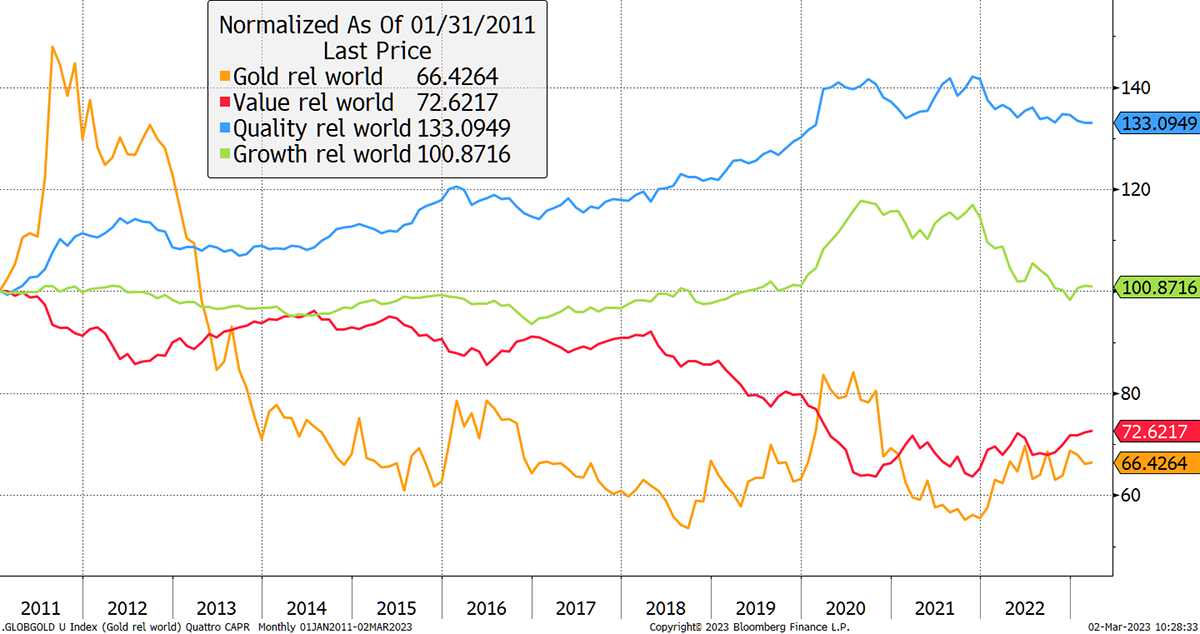

I show the Money Map quadrants against the world index in the 21stcentury. Gold has done very well, which most institutional investors do not seem to acknowledge. Furthermore, it will surprise many that the value and quality quadrants have been similar, with growth lagging behind.

The Money Map in the 21st Century

Sorry, growth was weak?!

Over the past 10 years, growth has been much stronger than value, but after the dotcom crash, it struggled for several years. In showing growth, I have not selectively chosen successful internet stocks, but all growth stocks in the traditional sense, as defined by the MSCI Indices. The FANGS (successful internet stocks) are diluted down by this measure. What perhaps surprises me is how quality has prevailed.

Quality Has Boomed

By quality, we refer to those special companies that make things we really need, such as toothpaste, healthcare, utilities, and branded foods. Their growth is modest but reliable, and investors have found sanctuary in them in the uncertain world of recent years.

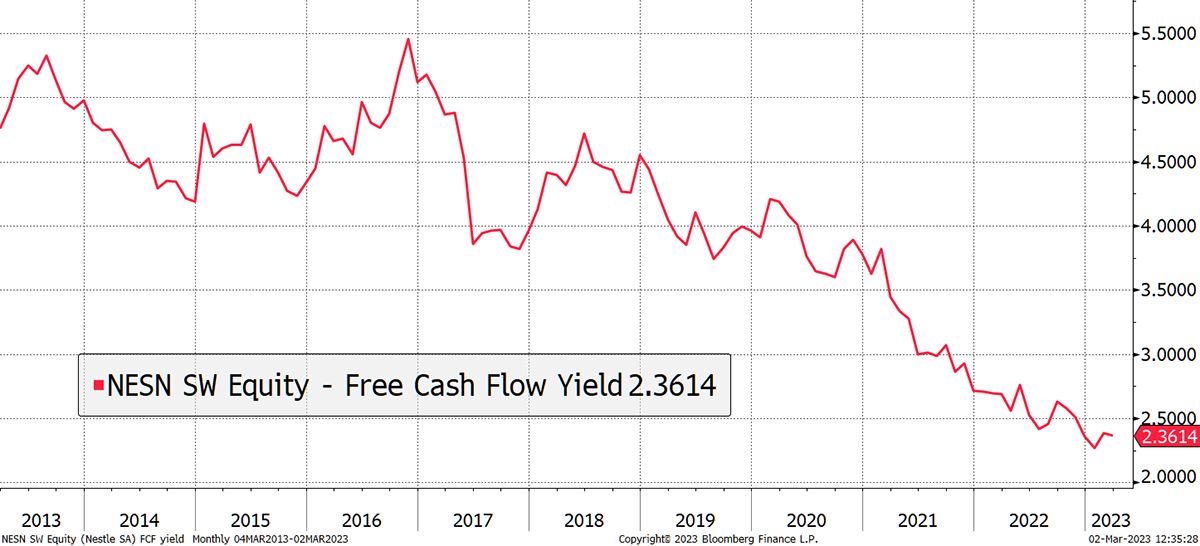

Bubble in High Quality Assets

Switzerland’s Nestle (NESN) is one of the darlings on the global shortlist of high-quality companies. The company is wonderful, it’s just the valuation that is scary. Once upon a time, it offered a 5% free cashflow yield. Today, that is 2.4%. With bonds back above 4%, you have to wonder why investors still buy it.

Nespresso

2022 saw a major correction in tech stocks, yet, remarkably, high-quality stocks got away lightly. I suspect that with yields back above 4%, and likely to remain higher for longer, 2023 will be quality’s annus horribilis.

Some claim these companies have pricing power, but it is not as much as commonly believed, and as a result, they will fail as inflation hedges. We know that because high-quality companies fell hard in the 1974 stock market crash; one that was instigated by a surge in inflation.

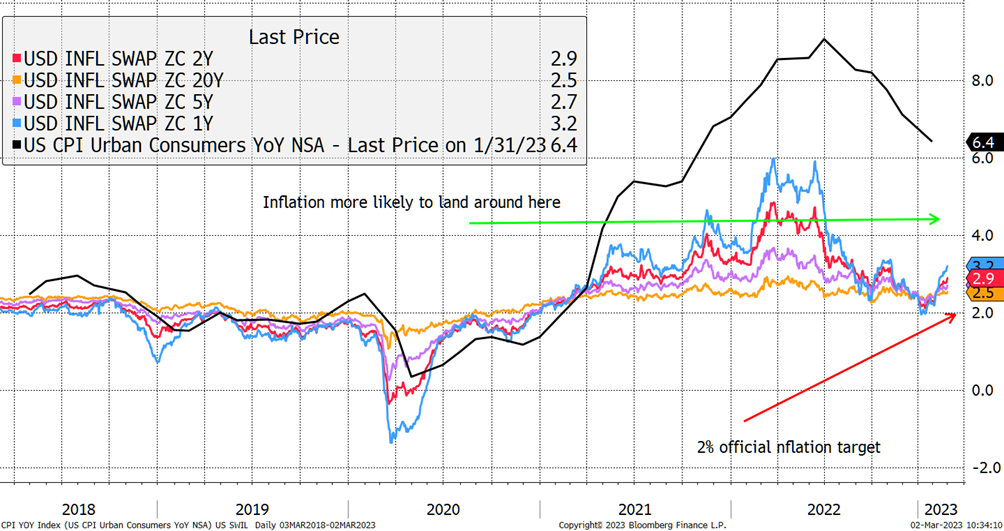

How is Inflation?

The inflation narrative peaked nearly a year ago when two-year expectations touched 6%. They then fell to 2% in short order, which is frankly ridiculous. If inflation was going to be 2% on average over the next two years, it would need to be sub 4% today, at the very least. Given it is still 6.4%, you can see how wrong the market has been, and there is no chance of that 2% target being met. The current gold price implies the 20-year inflation average will be 3.15%, in contrast to TIPS, which see it at 2.55%. I’ll get to this later.

Meet You in the Middle

Gold is right because gold is always right. In recent issues, I have highlighted how TIPS are under-owned by foreign investors because of the sanctions against Russia. If you were in China or India, and had to choose between gold and TIPS, you’d choose gold because it is beyond the reach of the US government.

Investors Buy Bonds and Shun TIPS

I am doubling down. TIPS are not only under-owned by foreign investors but domestic investors too. In 2020 and 2021, US investors briefly opted for TIPS over conventional bonds. But over the past year, they went the other way.

In short, the TIPS ETF fell from $40bn of assets to $20bn, while the long bond ETF doubled from $15bn to $30bn.

The loud and clear message from investors is that they are woefully unprepared for an inflation shock.

Shocks occur when events are unexpected by the majority. If everyone was expecting inflation to linger, they would be better positioned, and the necessary price adjustments would have already happened.

But they are not. Quite the opposite, in fact. They are looking the other way, sure that inflation is irrelevant. If inflation surprises the market, with positioning as it is, it will come as a major shock.

News Flash

According to the BBC: “Pret A Manger will give staff their third pay rise in 12 months, following other firms in boosting wages during a labour shortage. The coffee chain said the rise, to begin in April, amounts to a 19% bump in year-on-year pay for shop staff. Retailers including Tesco have made similar moves…”

While a sandwich shop doesn’t move macroeconomic mountains, it is indicative of what’s going on. Inflation is hotter than their coffee, and stickier than their brownies.

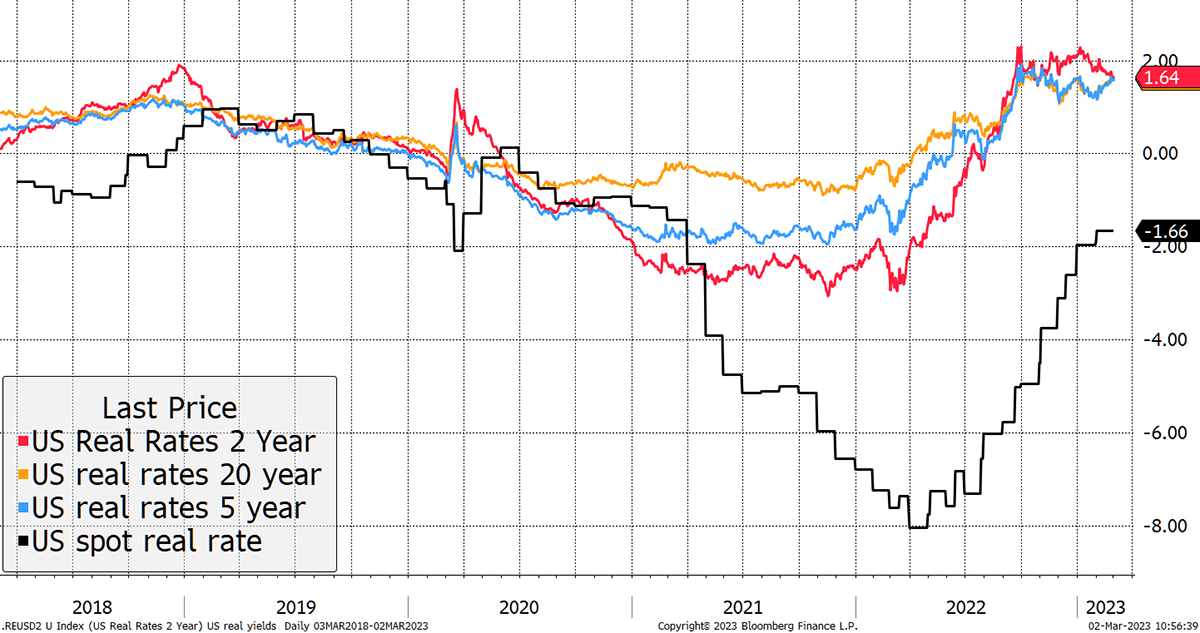

Markets might be waking up to this slowly, but I put it to you that our measures of real interest rates are wrong. Real rates are interest rates less inflation. Forward real rates use forward inflation estimates, which are understated. If that is true, then our estimates for real rates are overstated.

Real Rates Are Lower Than We Think

In the above chart, all measures converge around +1.64%, when the backwards-looking measure (base rates 4.75% less 12-month CPI 6.4%) is -1.66%. This gap is closing, but I have come to realise the black line is the closest to the actual answer we are looking for. And with Pret-busting wage rounds, tight money is a faraway dream.

TIPS vs Gold

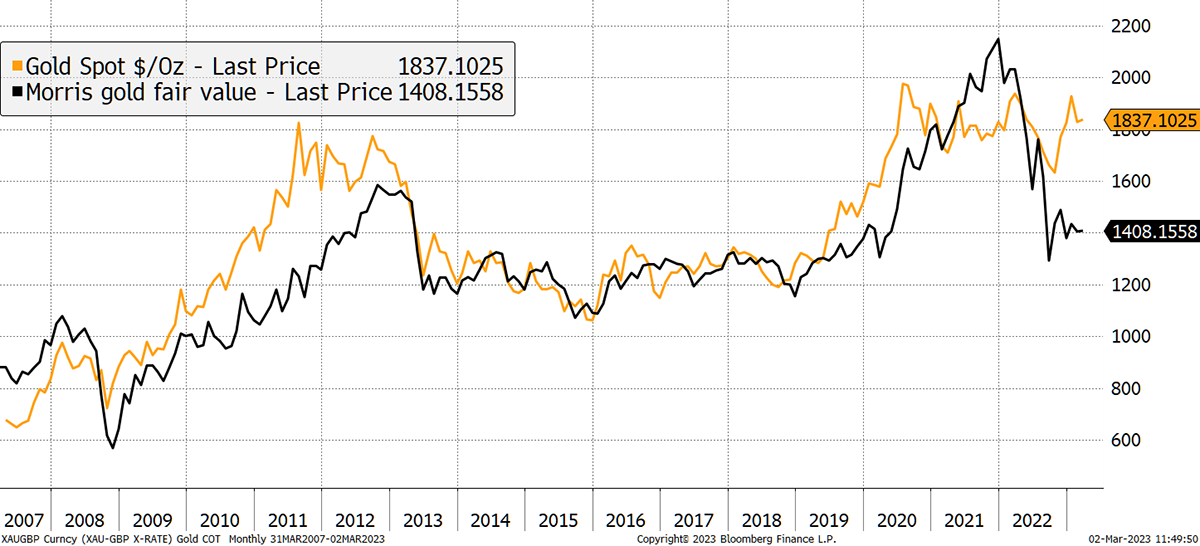

Regular readers will understand that TIPS think gold is worth $1,408, whereas the yellow metal trades at $1,837, as shown below.

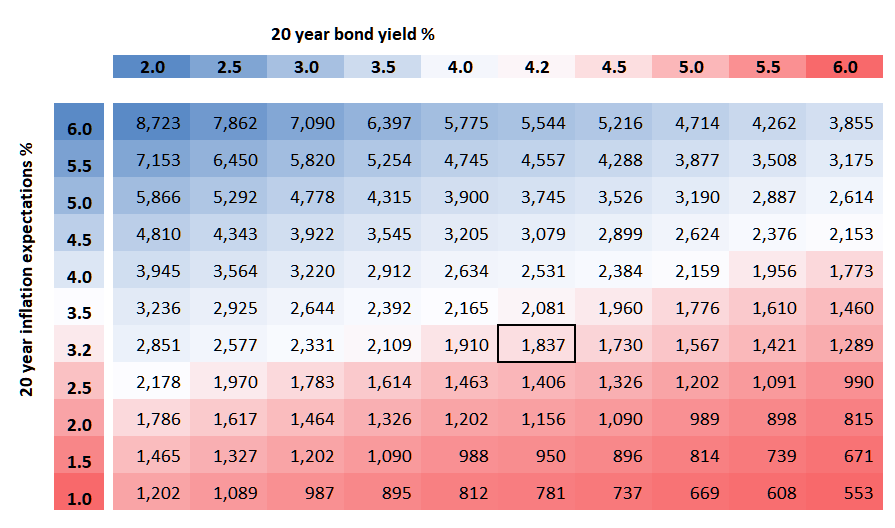

Gold, on the other hand, thinks inflation will be 3.2% over the next 20 years when TIPS see it at 2.55% (which would justify the current gold price). We know that the 20-year yield is 4.2%, so you’d need an inflation expectation of 3.2% to justify today’s $1,837 gold price.

Gold Price Scenarios

My view is that the table will see scenarios shift towards the top right. That is, higher rates combined with higher inflation.

Given the outflows from not only TIPS but gold too, AND the extraordinary inflows into the long bond (while inverted), it is clear that this market is totally mispriced and unprepared for a sustained period of higher inflation.

Buy BOLD

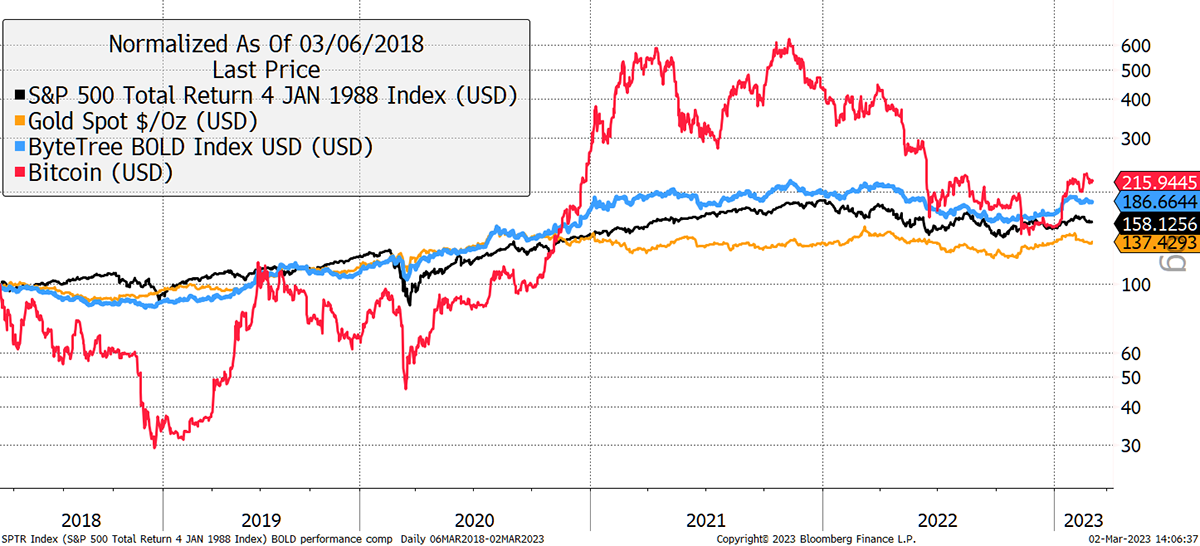

The ByteTree Bitcoin and Gold Index (BOLD) has had a great start to the year. Over five years, BOLD is ahead of the pack. I include the S&P 500 total return index (with dividends), bitcoin and gold.

BOLD is the Champion of Champions

The period covers two devastating bitcoin bear markets and is not flattered by the bitcoin bubble of 2017. Yet still, BOLD beats the S&P 500 in both absolute terms and on a risk-adjusted basis.

This outstanding performance will continue for three reasons:

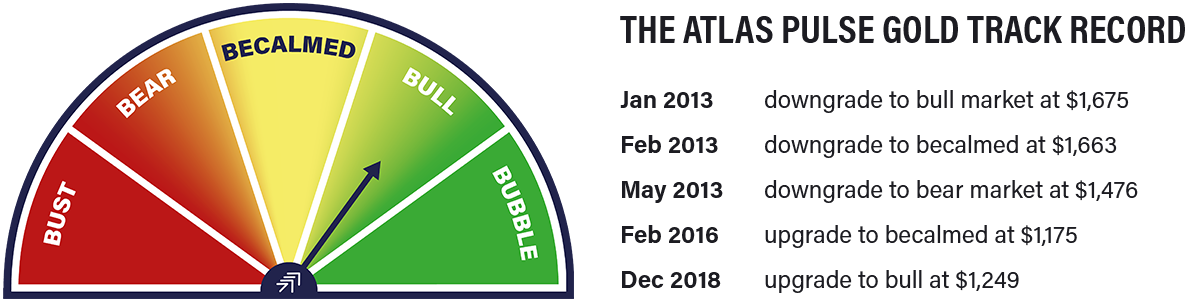

- Gold is in a bull market, albeit with bumps in the road

- Rebalancing uncorrelated assets adds alpha over time (higher returns)

- Bitcoin is great, and a new bull signal has been given

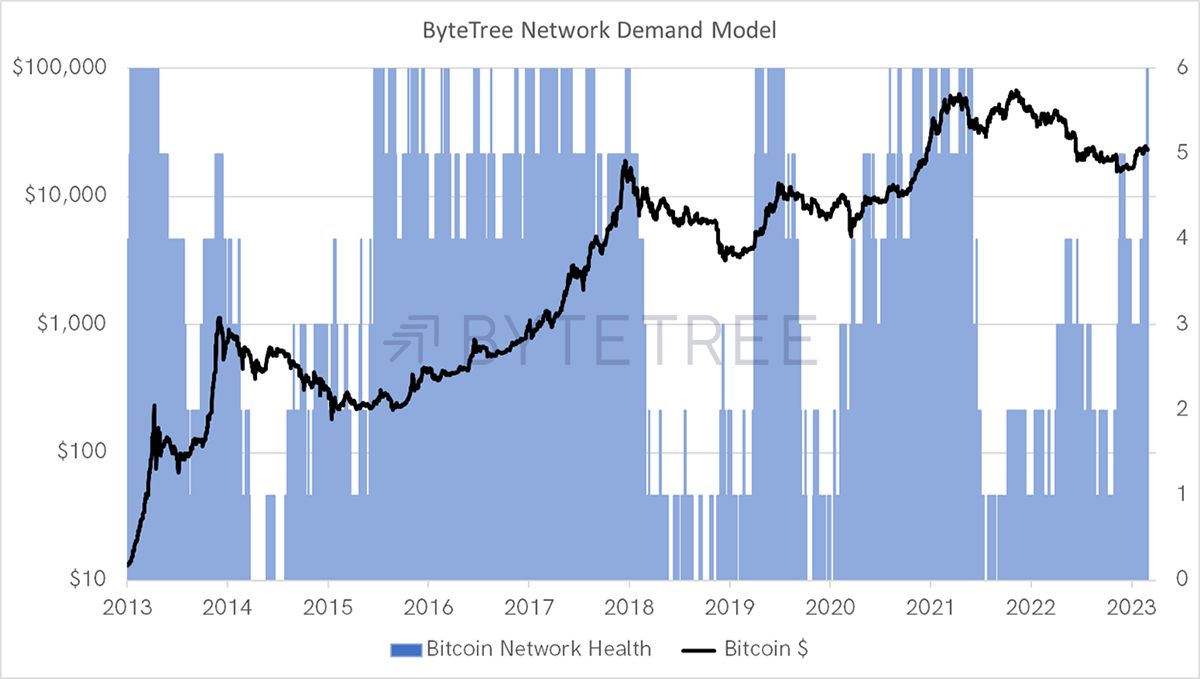

Network Demand Model Says Buy

Our Network Demand Model is a beauty that has been on the right side of history. Last April, it sparked up to 4 stars, but alas, it reversed. It touched 5 stars after the FTX scandal, and now shows 6. It simply means: buy bitcoin.

I first wrote about bitcoin in Atlas Pulse in November 2013. The price was $1,000 and it was very exciting, but I said to expect an 80% crash, which soon came about. Then in 2015, with the price below $300, I was banging the drum, and many Atlas Pulse readers bought bitcoin at that time.

I have repeated that a few times over the years, and it is time to bang the drum again. But with the price above $20,000, you can’t expect the outcomes of the past to be repeated. Against that, it is less risky today, as it is a more mature asset.

BOLD allocates to gold and bitcoin according to past volatility. Over the past 360 days, most of which were in a bear market, we have seen bitcoin volatility decline to 49%. This is remarkable and is below the levels for Tesla, Volvo, Expedia, Rolls Royce and Netflix. At this rate, it’ll be below Nestle by 2030.

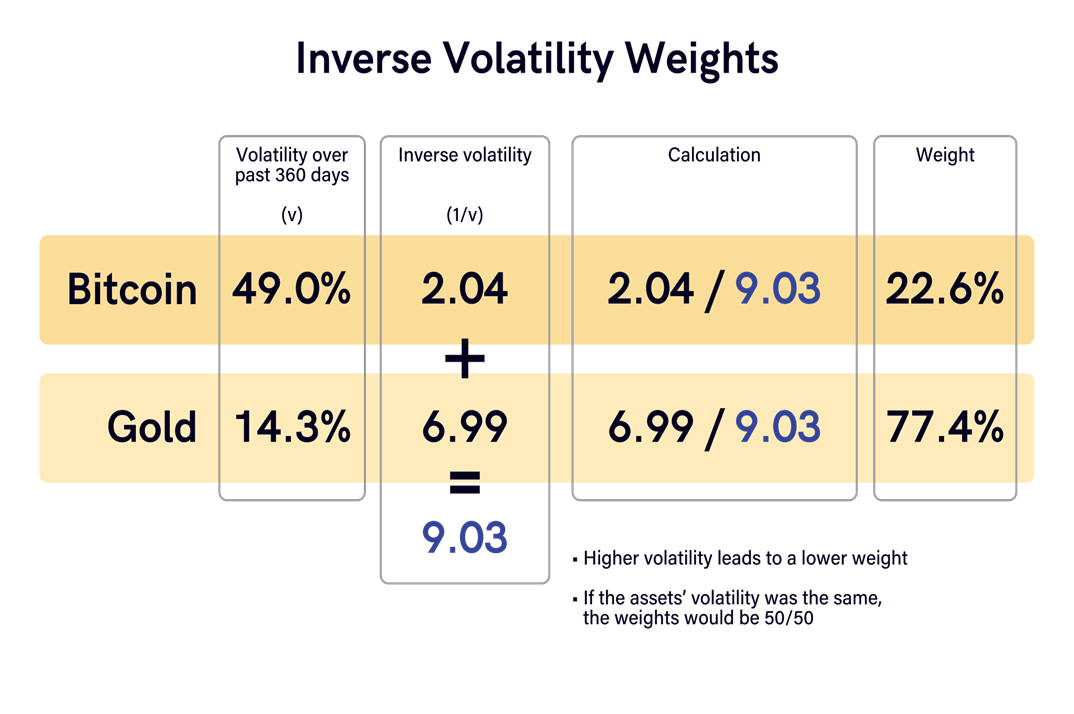

You can see how it works here. In the latest rebalance, bitcoin’s 49% volatility compares to gold’s 14.3%. In order to have the same amount of money in each asset, you’d allocate 50/50. But to have the same amount of risk, you’d allocate 77.4% to gold and 22.6% to bitcoin, as determined by this formula.

That is, having $77.40 invested in gold is about the same risk as having $22.60 in bitcoin. BOLD carries out this exercise each month and the portfolio is rebalanced. Our partner, 21Shares, can be found here.

ByteTree Newsletter

If you don’t already subscribe to our newsletter, you should. As shown above, markets are in a more fragile state than for a generation. Inflation is hard to predict and hard to tame. Asset prices are adjusting to an entirely new paradigm.

The newsletter is a free service which includes a monthly Gold Report as well as weekly updates on the most important developments we see in financial markets. We look forward to seeing you.

Summary

It’s an uncertain world we live in, and the market seems to be mispriced for an inflation shock. They think it will fade away easily, but what if it doesn’t? In the absence of buying gold, bitcoin or better still, BOLD, my suggestion would be to apply for a job at Pret A Manager.