Bottom of the Bitcoin Cycle

Disclaimer: Your capital is at risk. This is not investment advice.

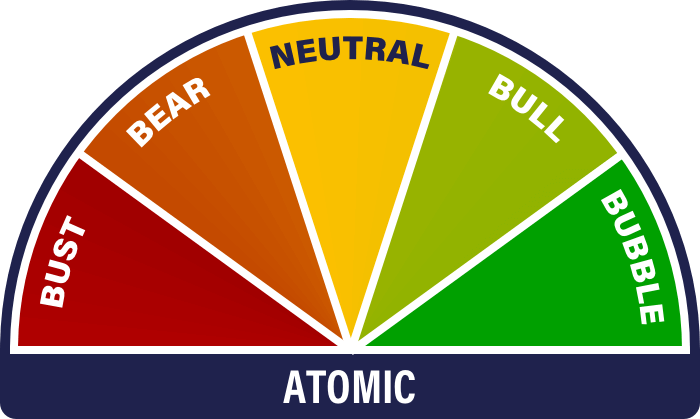

ATOMIC 79

On-chain data analysis combined with corporate news suggests we are at the bottom of the cycle. The technical picture is also constructive. Macro has been a headwind, but that may not last, and there are signs bitcoin is decoupling anyway.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Sloppy, but above obvious support |

| On-chain | Machine says the cycle has turned up |

| Macro | Sticky inflation, but can bitcoin decouple |

| Investment Flows | Big outflow is fund specific |

| Cryptonomy | Silvergate bank collapses, Grayscale sues, Coinbase expands |

Technical

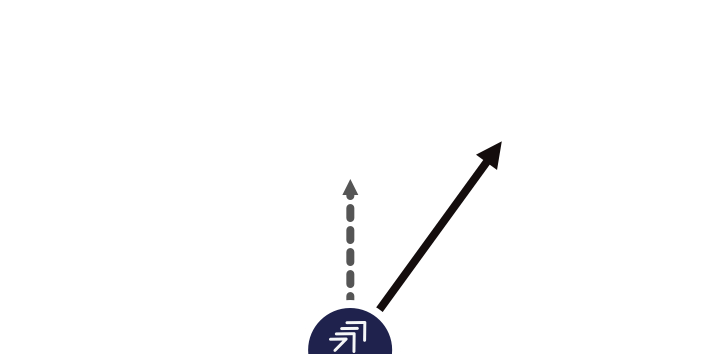

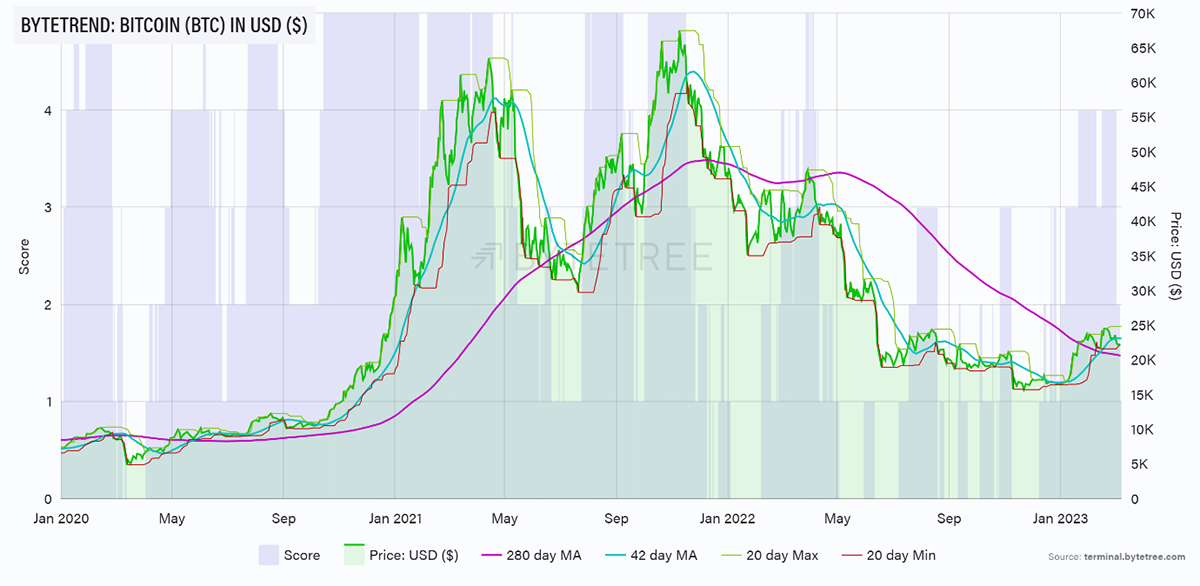

Price action has been sloppy over the last fortnight, with BTC falling to 1-star relative to the USD. When we go back to the start of the bull market in the second quarter of 2021, we see a similar pattern. The May 2021 Golden Cross was followed by two months of sideways price movement, followed by a sharp move higher in August. At this point, we will also be looking at the long-term moving average (280-day) as support. A break below US$20,600 would be unhelpful.

The current technical set-up does nothing to disabuse our view that this is the right territory to accumulate and be patient, but it is fragile and will remain so until we see the 280-day MA sloping upwards. Our internal fair value measure sits at US$21,236. Given the health of the blockchain, as discussed below, that’s a good reference point.

BTC Currently Scores 1-star on ByteTrend in USD

Source: ByteTree

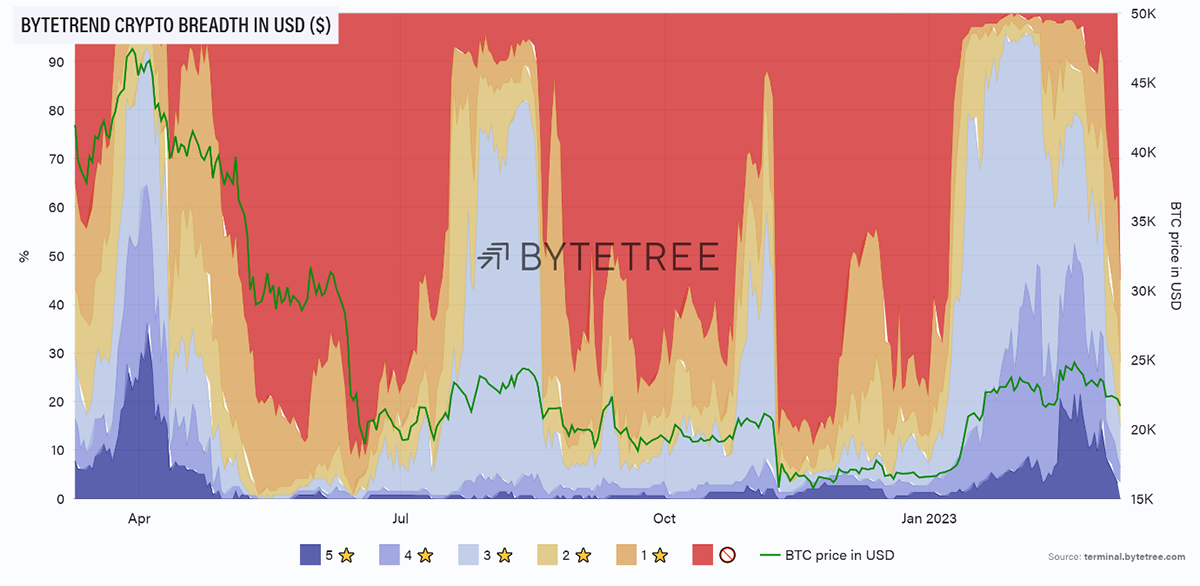

The extent of the deterioration in crypto can be seen in this breadth chart, which shows how much the sector has faded over the last fortnight.

ByteTrend Crypto Breadth in USD

Source: ByteTree

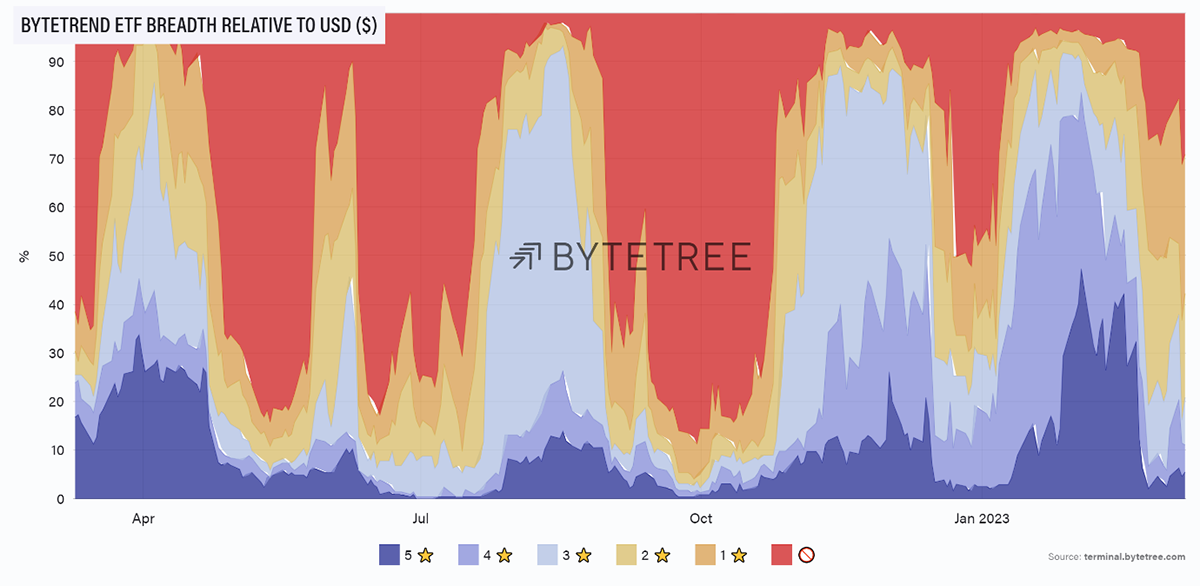

It’s not alone in this regard, as we see from the ByteTrend ETF breadth chart. This demonstrates that for all the negative stories emanating from the sector, this is macro-driven weakness rather than crypto-specific.

ByteTrend ETF Breadth Relative to USD

Source: ByteTree

On-chain

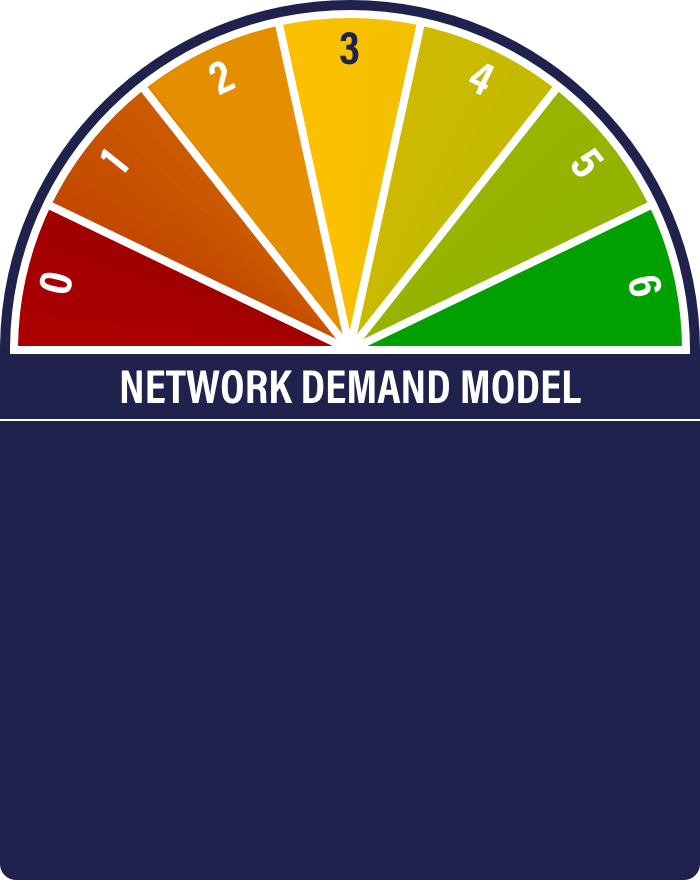

To reinforce the point, the Network Demand Model is now maximum bullish, with a score of 6/6. The Network Demand Model tells us about the momentum of activity on the blockchain, so it’s very positive to see all indicators pointing in the right direction. Don’t forget, this is a committee of signals. We don’t rely on a single one, but when the voting is unanimous, it’s a good sign that the network is in rude health.

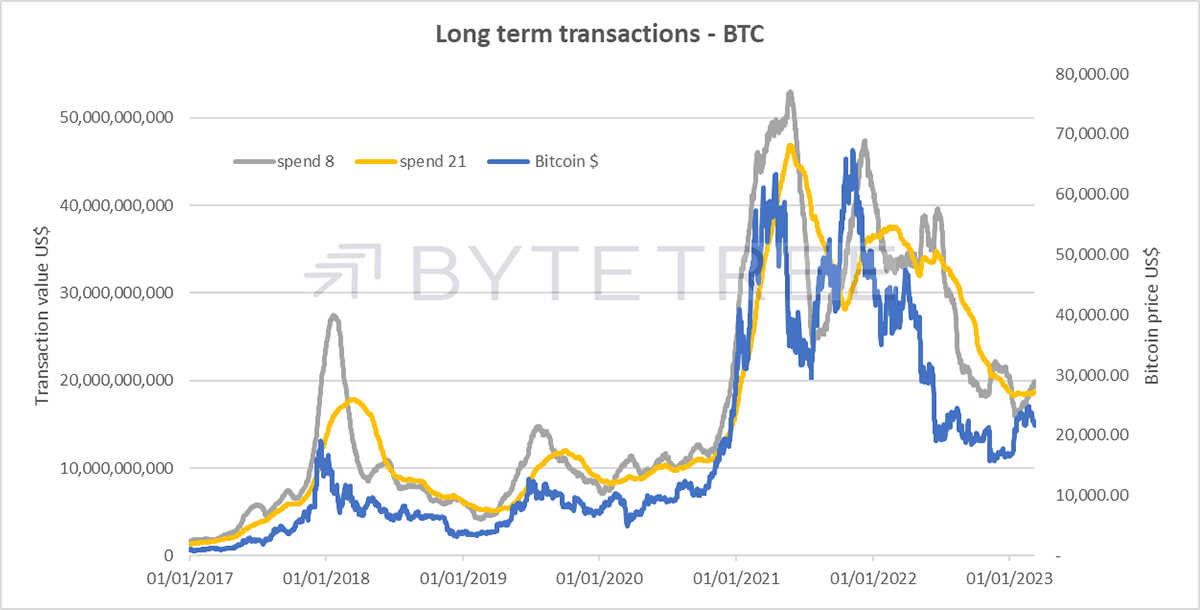

The upturn in the fee signal is particularly significant. This has been driven by the emergence of Ordinals, which is effectively the ability to inscribe a Non Fungible Token (NFT) on the Bitcoin blockchain. It’s an important development because it helps solve an existential problem for bitcoin: a long-term decline in fees would disincentivise miners and, therefore, jeopardise the network’s foundations and security.

It’s also a reminder that because the Bitcoin Network is a technology, it can evolve. In this respect, it should not be thought of as merely digital gold. It has very different properties to gold, most of which - in a digital world - are vastly superior.

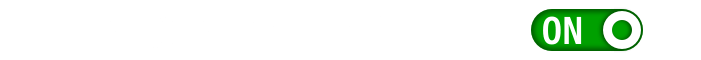

Long-term BTC Transactions

Source: ByteTree

Long-term BTC Fees

Source: ByteTree

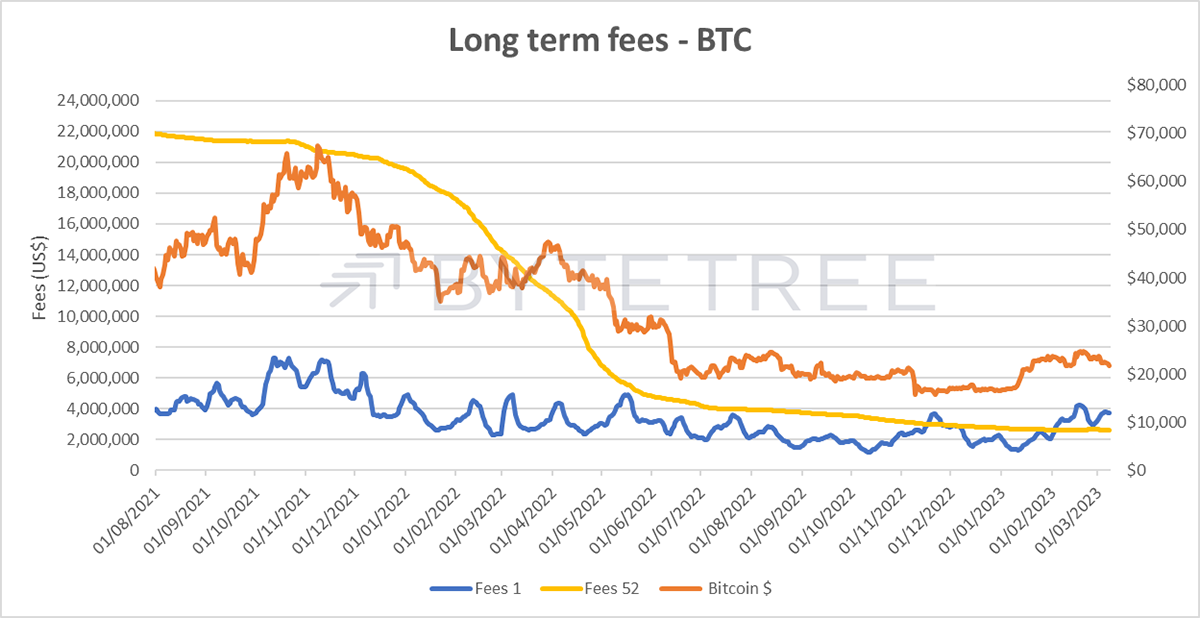

In a similar vein, the transaction count has materially picked up over the fortnight.

BTC On-chain Transaction Count

Source: ByteTree

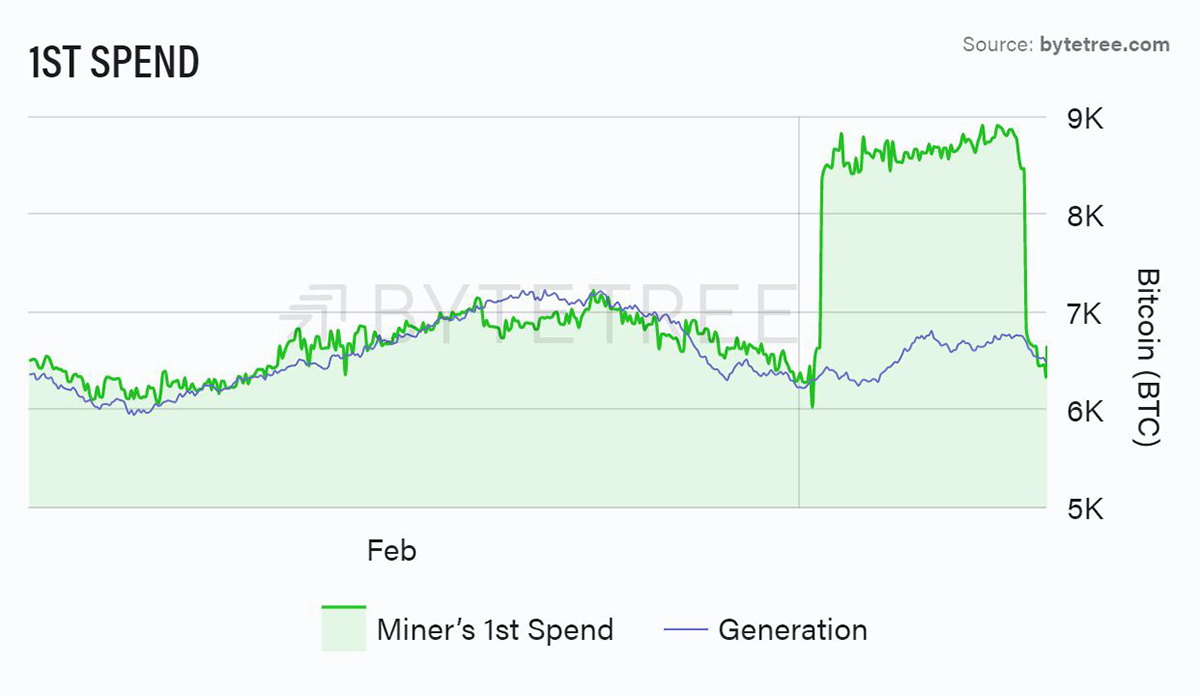

There has been some notable activity in terms of First Spend; 3,061 coins worth around US$70m were moved for the first time on 1 March. There was no price impact, so it’s hard to read too much into it, save that there seems to be healthy demand. It’s small in the scheme of things: remember that 900 new coins are minted each day, worth around US$18.5m at today’s price. Meanwhile, BTC trades just under US$22bn a day.

BTC On-chain Miner First Spend

Source: ByteTree

Macro

As demonstrated earlier, price weakness isn’t restricted to bitcoin and crypto. There are few places across asset classes to hide at the moment. This is because interest rates have been marching higher. A return of over 4% from the US 10-year treasury bill will undoubtedly suck money away from riskier assets. As discussed in both The Multi-Asset Investorand Atlas Pulse recently, it’s all about competition for capital.

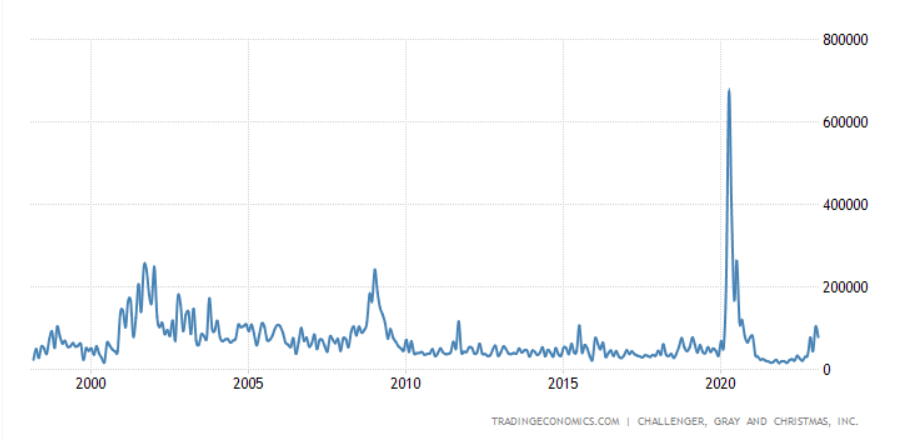

While inflation appears stickier than many expected, it is worth considering that the factors causing that stickiness are the ones that tend to lag rather than lead the business cycle, most obviously wages. We shouldn’t be surprised that wage rises are impacting the data at the moment. But if we assume that higher interest rates will, at some stage, feed through to weaker demand and weaker sales, businesses can only take so much before they are forced to lay off workers.

In this regard, it is interesting to note that US-based employers announced 77.8k job cuts last month, the highest February number since 2009.

United States Challenger Job Cuts

Source: Trading Economics

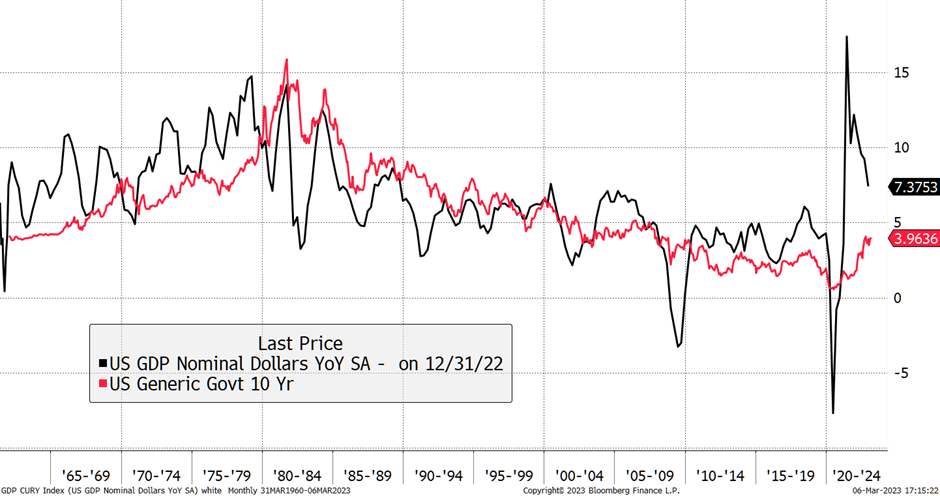

And while wage growth was running at 7.86% YoY in January, it has been trending down since early 2021, in a pattern that closely resembles nominal GDP, perhaps unsurprisingly.

US Wages and Salaries Growth

Source: Trading Economics

US Nominal YoY GDP Growth vs US 10-year Yield

Source: Bloomberg

It is far from a trend, and the counter-argument is that unemployment is still very low and participation rates are rising, albeit from a low base. But the latter could be an older generation being forced back into work now that living costs have risen. And if jobs are about to become scarcer, there will surely be less pressure on wage growth.

Therefore, markets are at a critical juncture. If inflation remains sticky, rates will remain higher for longer, which will apply continued pressure to risk assets. On the other hand, evidence that the battle is won will encourage the doves. ATOMIC favours the latter.

But to what extent will this matter as far as bitcoin is concerned going forwards, anyway? In ATOMIC’s view, not much. As the year progresses, the narrative will more likely centre around adoption, use cases and regulation. Unlike equities, bitcoin doesn’t have a valuation problem.

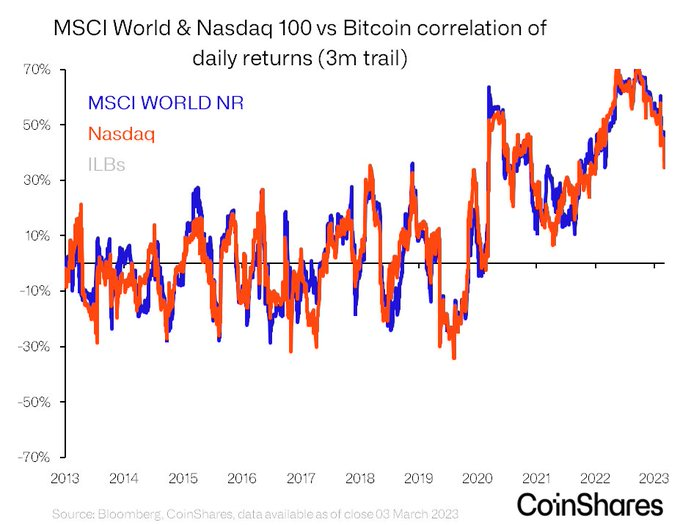

Indeed, this decoupling process already appears to be underway. Firstly, BTC’s long-term volatility (360-day) continues to decline, a sign of a maturing asset. Secondly, its correlation to the Nasdaq has been gradually falling, as shown below.

Source: CoinShares

Investment Flows

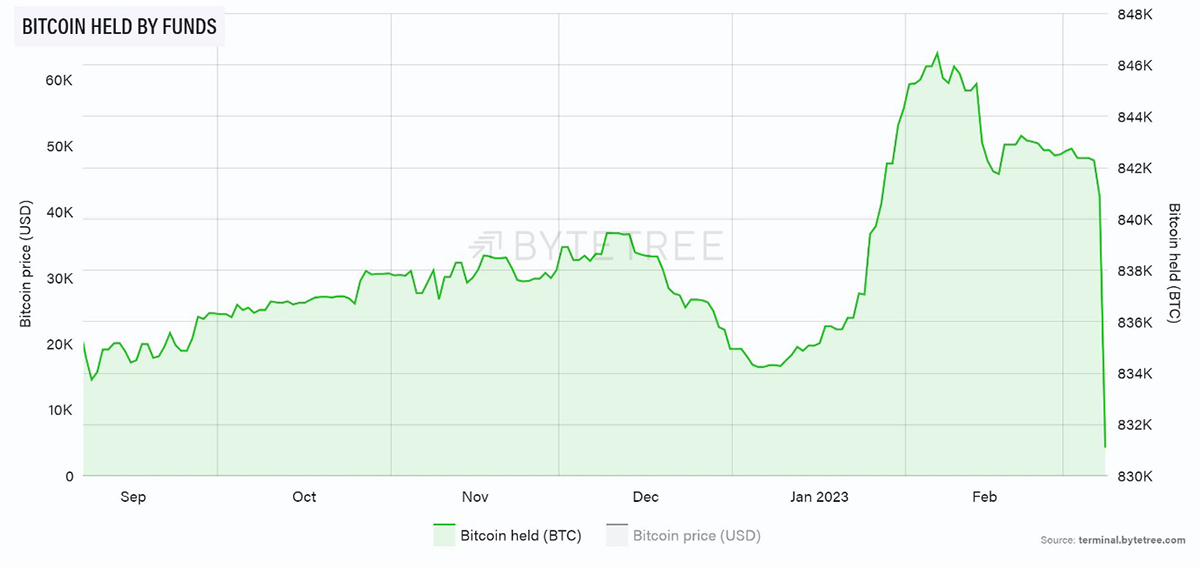

There’s been a nasty, unexplained outflow of 9,855 BTC from the 3iQ CoinShares Bitcoin ETF (BTCQ.U). It’s around 71% of the Fund’s assets. This accounts for 86.2% of the outflows seen in total so far this month, so it can’t be viewed as systemic.

BTC Held by Funds

Source: ByteTree

Interestingly, 400 BTC have moved into BITO, the BTC futures ETF. It’s small but reassuring, especially in the context of the regulatory bashing going on in the US.

Cryptonomy

Silvergate Bank

Silvergate Bank, one of the most prominent US banks supporting the crypto industry, has moved into voluntary liquidation. This appears to be another consequence of the FTX collapse. This development has been well-flagged, not least because major customers like Coinbase have been publicly fleeing from it. The news has been gleefully seized upon by the authorities, who continue to fail to discriminate between institutions surrounding crypto and crypto itself. That said, in the bigger scheme of things, this is a tidying-up exercise. Harsh lessons are being learned, and it is to be hoped that the mistakes of the last cycle will not be repeated in the next. It’s also another demonstration that crypto doesn’t get bailed out by taxpayers; it has to learn the hard way. Long term, that’s a good thing.

Coinbase

In all the uncertainty about regulation and the collapse of Silvergate, barely a day goes past when there isn’t an announcement of a new initiative from Coinbase. Following the announcement in late February that they would be launching their own Layer 2 blockchain (BASE), the company announced the acquisition of One River Digital Asset Management on 3 March. Coinbase is becoming the full-service monster in this space, and this is surely helped by their efforts to stay on the right side of regulation, where they can steer the conversation. The company has skillfully positioned itself as the grown-up in the room. It’s a classic case of industry consolidation. While others flounder, it is hoovering up the best resources and strengthening its market position.

Grayscale

Talking of floundering, the bitcoin asset management’s bete noire, the Grayscale Bitcoin Trust (GBTC), saw its discount to NAV narrow sharply after the first day’s hearing in its court case against the SEC. The case surrounds the SEC’s rejection of GBTC’s application to convert into a spot bitcoin ETF. This is a huge case because the availability of a spot ETF would have a transformational effect on ordinary investors’ ability to hold bitcoin. It would also unlock a serious amount of value because GBTC has been trading at around a 40% discount to NAV.

It’s early days since a judgement isn’t expected until the autumn, but it’s a wonderful opportunity for lawyers to pick apart the illogical stance of the SEC. These are the hard yards for the industry but also the moments when sturdier foundations for the future are being constructed. The SEC will discover that in a free nation, they won’t have it all their own way.

Mt Gox

A number of investors have been worried about a substantial potential overhang from the coins recovered from the Mt Gox collapse in 2014. The number of coins recovered is 137,890, worth around US$3bn, so it’s a decent chunk. While it could be a short-term negative if all dumped on the market in one go, if fed into the market slowly, it would probably have minimal impact given a daily volume transacted of around US$24bn.

The latest news is that the largest creditor has made clear their intention not to sell. Who knows how many others will or will not follow that example, but a believer in bitcoin in 2014 is very likely to be a believer in it now. Unless there are bills to pay, it seems unlikely that this episode has a significant impact, and even if it does, it will be immaterial in the long run.

Summary

The crypto market has deteriorated over the past fortnight, but uncertainty about the macro is largely to blame. Similar weakness can be seen in the ETF market.

Meanwhile, our Network Demand Model sits on full bull, illustrating that the Bitcoin Network is in good health. Industry consolidation continues apace, which is what we want to see at cycle lows. The outlook remains constructive. Eyes on the horizon.

Comments ()