Bitcoin Feeds on Institutional Weakness

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 80;

The last fortnight has seen major cracks appear in the traditional financial architecture. Simultaneously the SEC has continued trying to marmalise the crypto industry. Both these events demonstrate why bitcoin was created. It is no surprise that it continues to move higher.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | BTC moves to full 5-stars on ByteTrend in USD |

| On-chain | Bringing in the fees |

| Macro | Watershed for hard money |

| Investment Flows | BITO sees inflows |

| Cryptonomy | Coinbase puts up a fight |

Technical

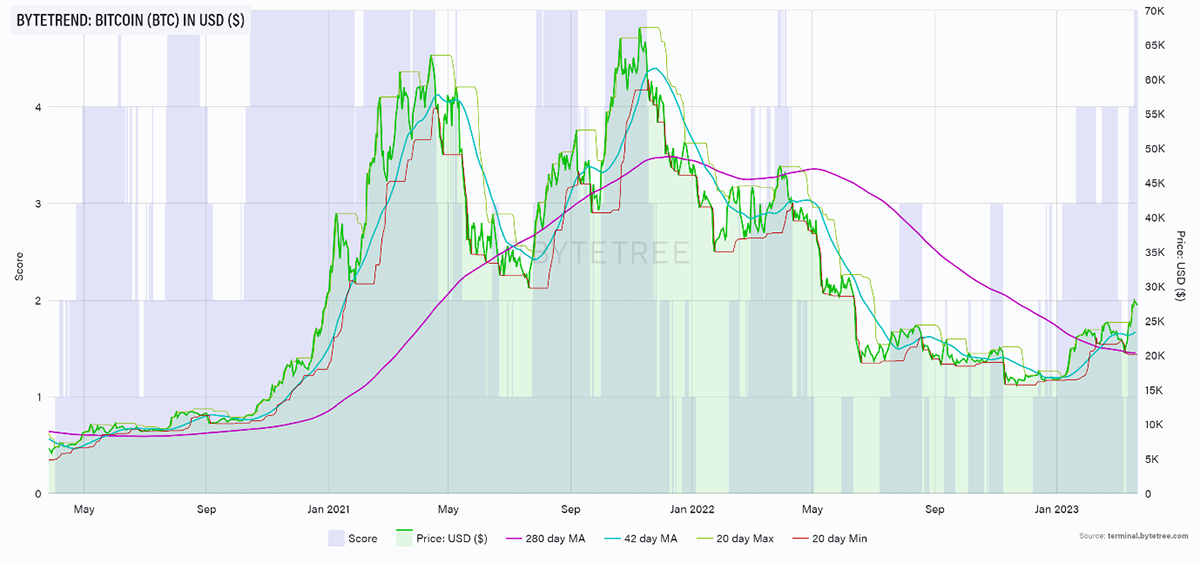

Bitcoin’s long-term moving average has finally changed direction and is sloping upwards. This is the first time in a year and completes the full set of momentum indicators on ByteTrend. This is the first time Bitcoin has been on a 5-star rating since last April.

The one difference now - and it’s significant from a trend-following perspective - is that the short-term trend is above the long-term. This is the “golden cross” we referred to last month and suggests we are in a powerful uptrend.

Source: ByteTree

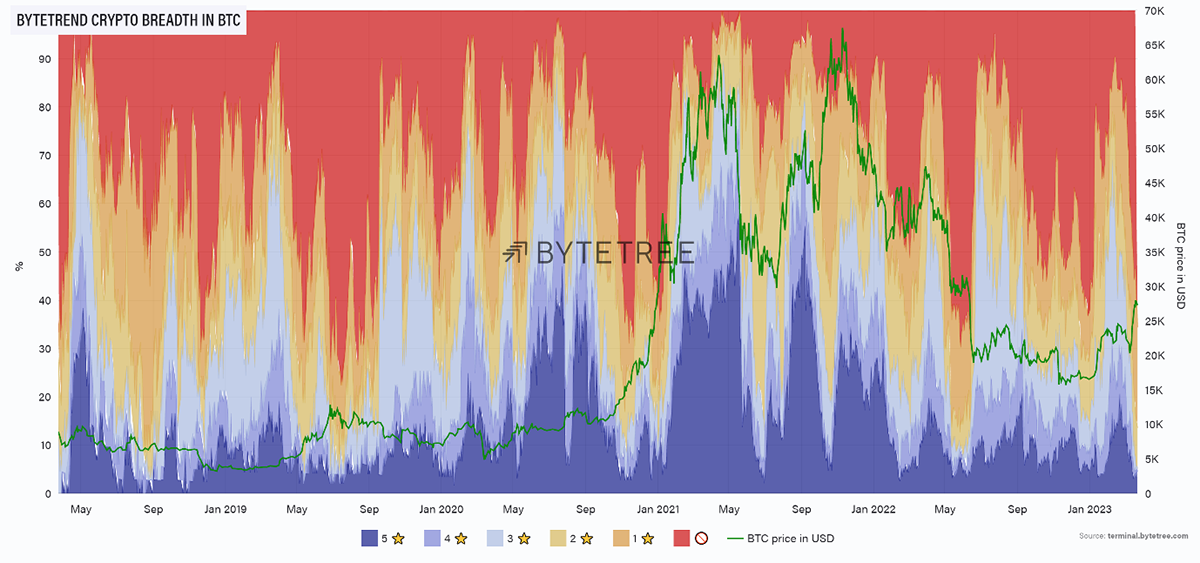

Note also how dominant bitcoin is at the moment. This is reflected in the breadth chart, where you see breadth declining as BTC rises. We saw something similar in the sharp breakout in the fourth quarter of 2020, and it’s striking how long that period of dominance lasted. BTC had basically quadrupled from around US$10k to US$40k before the market started rotating aggressively into alts.

The blow-off top has historically been signalled by rampant speculation on just about anything. We’re far from that at the moment.

Source: ByteTree

On-chain

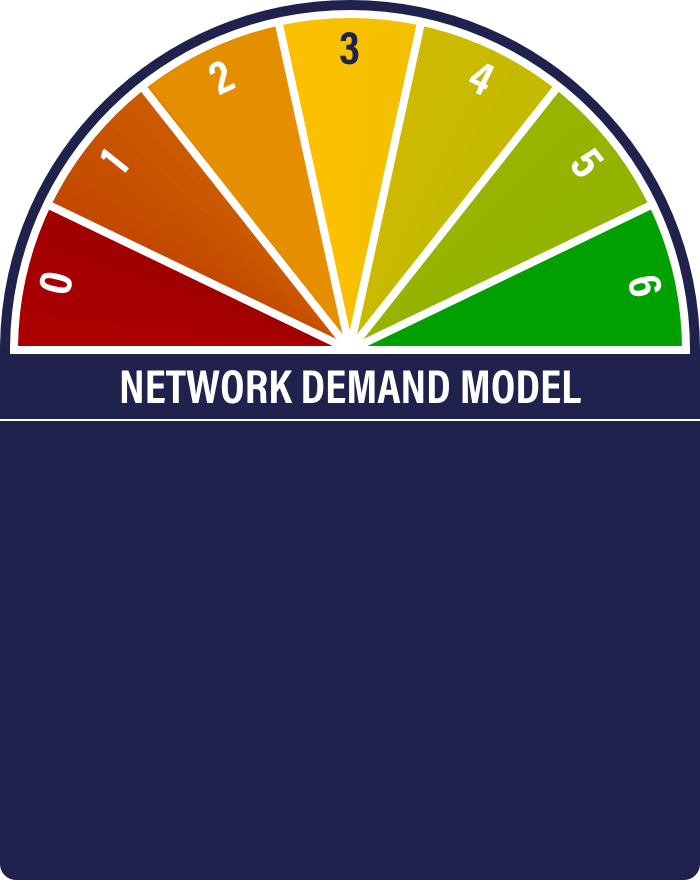

The Network Demand Model says that the bitcoin network is as strong as an ox. The score remains on a full 6/6.

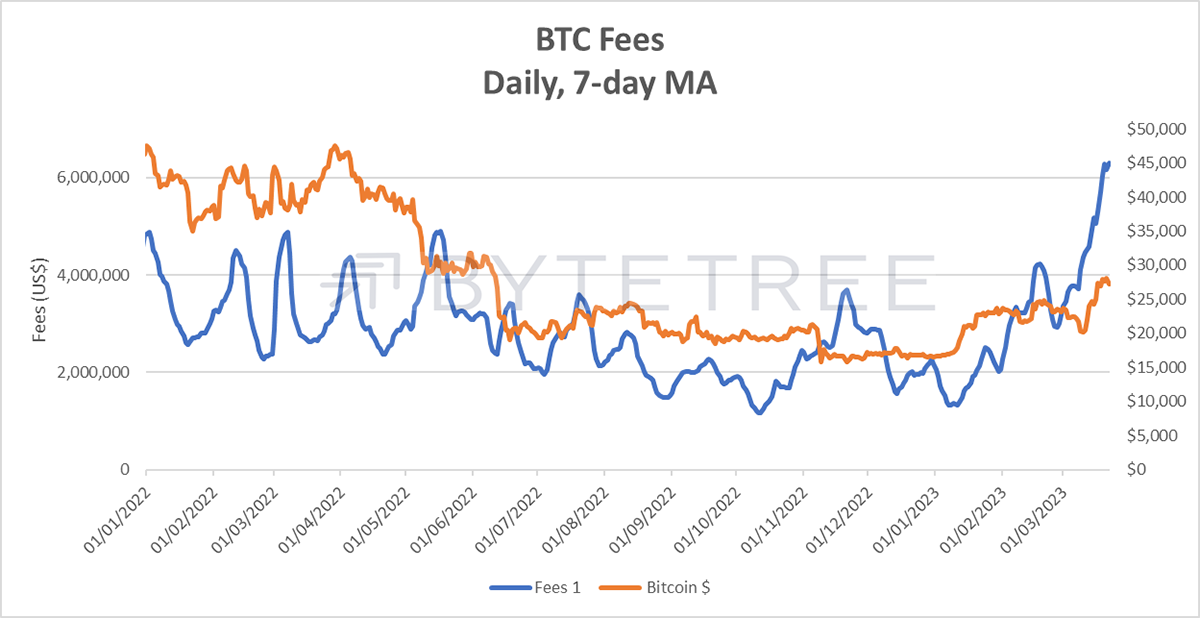

One particular feature is how robust the fees are. This is vitally important for the long-term sustainability and security of the network. It also shows the impact of the broader use cases being built on top of the network. It really is very encouraging.

You can see below that the average daily fees have risen substantially from a low of ~US$1.2m on 10 October 2022 to around US$6.3m now.

Source: ByteTree

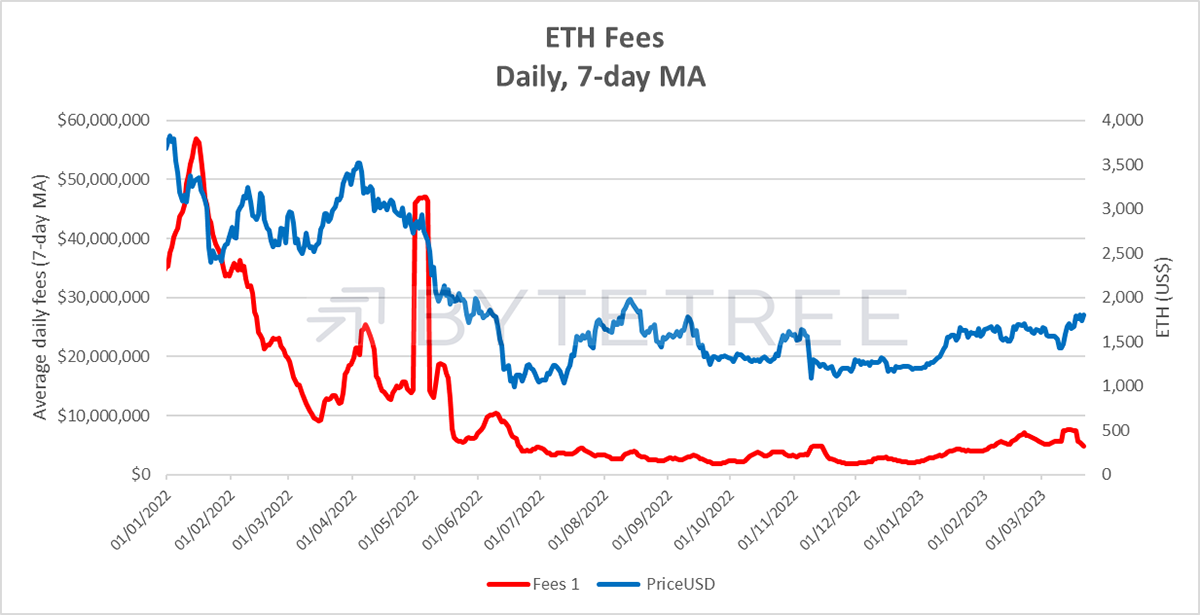

This contrasts with Ethereum, where we show the same data below.

Source: CoinMetrics, ByteTree Asset Management

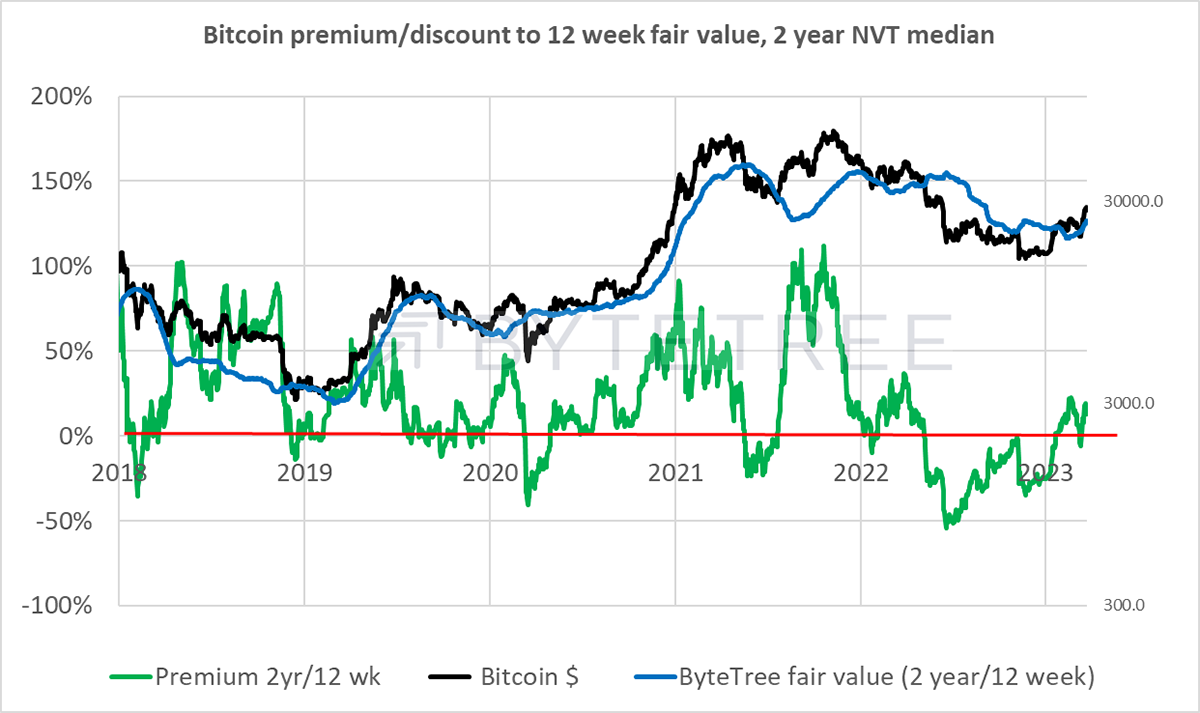

Our internal fair value sits at around US$24,100. We’re using the 2-year median multiple to reach the fair value, which puts BTC at a mild premium.

Source: ByteTree

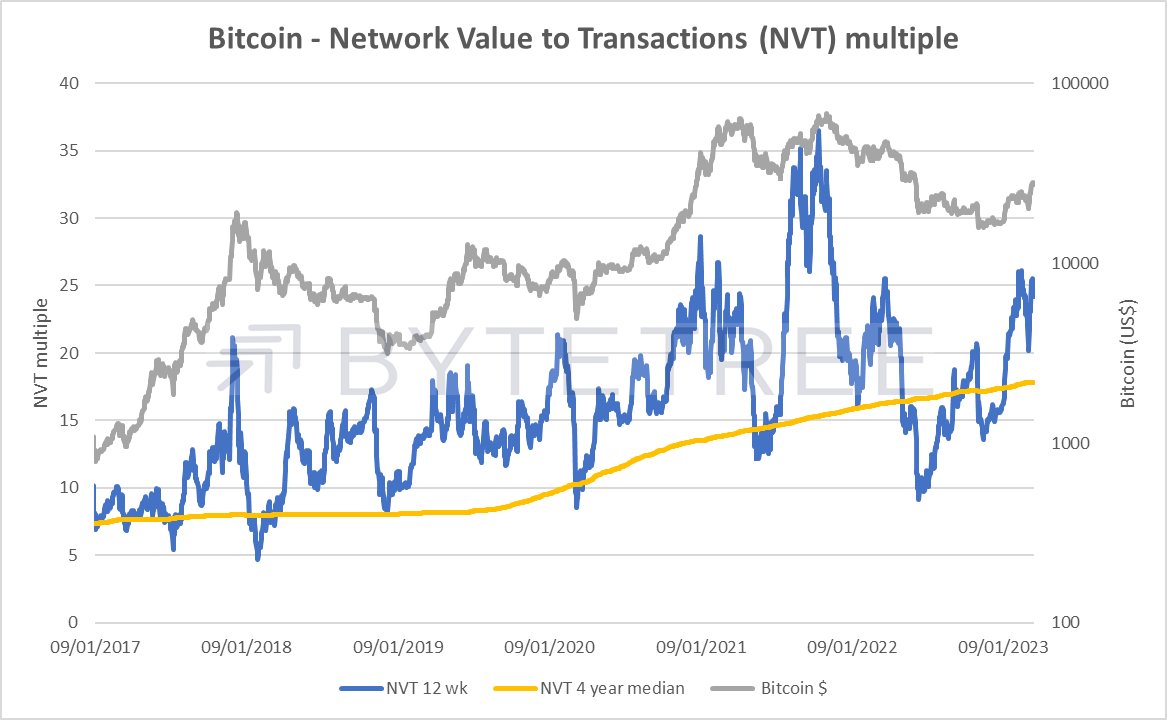

It’s interesting to see what’s happening to the multiple over a longer timeframe. Size and liquidity are value-enhancing for any tradable asset, and BTC is no different, especially in its growth stages. The chart below shows how that multiple has been trending higher. The yellow line is a smoother 4-year average, and the blue line is 3 months. Shorter term, you might justifiably argue that we’re nearing an area where some sort of consolidation is justified.

Source: ByteTree

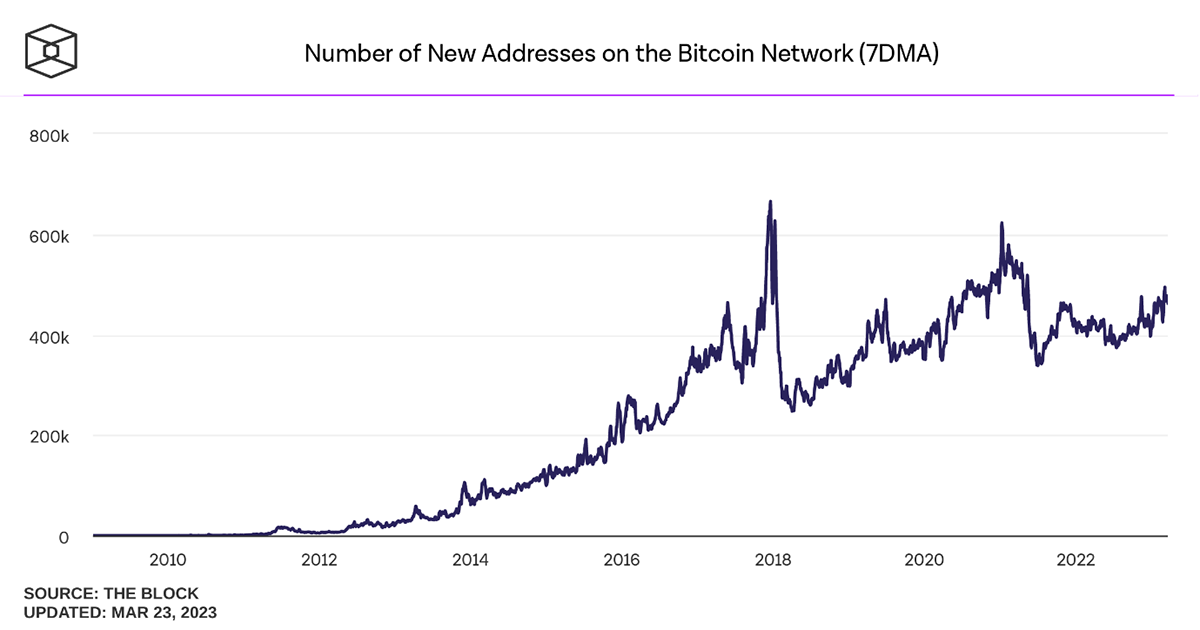

At this point, we want to see a continued pick-up in network activity and evidence of increasing adoption. The number of new addresses on the Bitcoin Network shows a steady, but far from spectacular, appreciation.

Source: The Block

Macro

To reinforce the “move along, nothing to see here” message, the Fed and the Bank of England have both raised interest rates by 0.25% this week, while the Swiss National Bank has raised by 50bps to 1.5%. Whether this breezy demeanour will fool anyone is a separate matter. The smouldering wreckage referred to above is, of course, the recent bank collapses. When the last issue of ATOMIC went to print, only Silvergate had hit the deck. Now it’s been joined by Silicon Valley Bank, Signature and Credit Suisse, while several others have had their share prices monkey-hammered.

ATOMIC views this as another watershed moment for bitcoin. In an ostensibly mega-hostile environment this year, BTC has risen sharply. In what was shaping up to be a financial crisis, investors went towards bitcoin, not away from it.

There are three things here: the first is that with every episode of this sort, everyone gets a lesson in how fractional reserve banking works. It’s often a shock to discover that once it’s deposited in a bank, their money isn’t theirs. Secondly, repeat rescue acts undermine the integrity of the financial universe. The more institutions that are too big to fail, and the more that losses from incompetence and greed are socialised, the less likely people and businesses are to give them custody of their assets. They will look elsewhere, and it has been a revelation to see how bitcoin has responded in a time of financial stress.

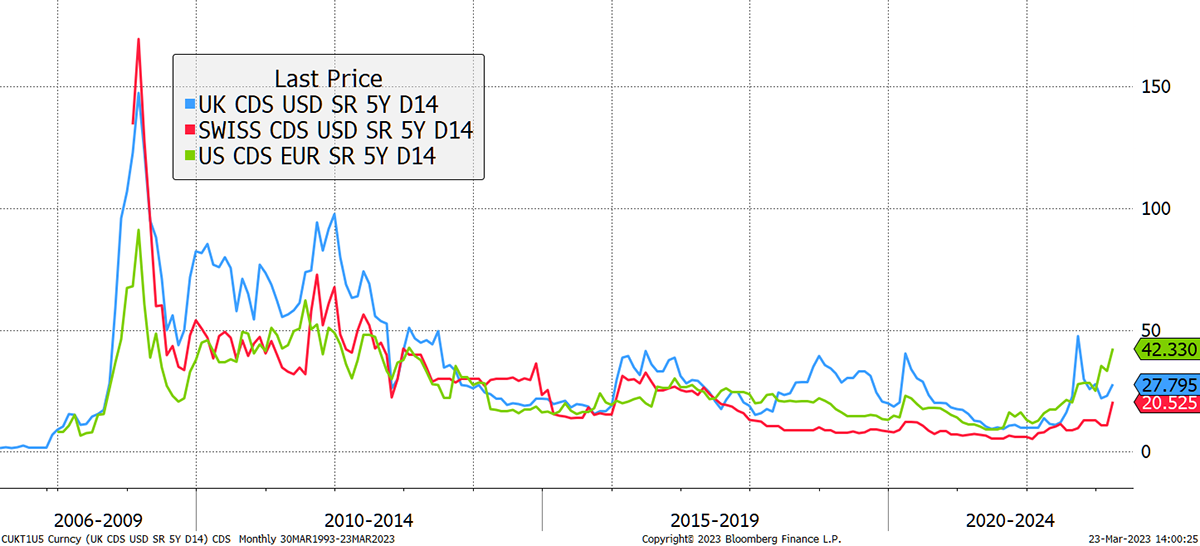

Markets have also responded, and in the chart below, the uptick in the cost of insuring against default is clear to see. What we’re seeing is a degradation of trust in traditional finance, as foreseen by bitcoin’s founders.

Source: Bloomberg

Central Banks, meanwhile, continue to tackle problems through the rear mirror. Sure, the February UK inflation print of 10.4% made for rough reading, but the largest upward pressure came from the cost of food and alcoholic beverages, which in large part have been driven higher by adverse weather conditions in Southern Europe and Africa (Trading Economics). Interest rates rises are even less likely to alter weather behaviour than Stop Oil protestors.

Meanwhile, energy prices continue to drift down, and activity in the property market continues to soften. Inflation doesn’t look too problematic from here, particularly as wages tend to be a lagging indicator. What will be problematic is if the extent and speed of this tightening cycle continue to break things.

Bitcoin is well-poised on most fronts. Bailouts and currency debasement are its friends. It seems unlikely that we’ve seen the last of either.

Meanwhile, all is not lost for Central America’s most bitcoin-friendly country. El Salvador’s debt situation seems to be moving in precisely the opposite direction of those mentioned earlier.

Source: Bloomberg

Investment Flows

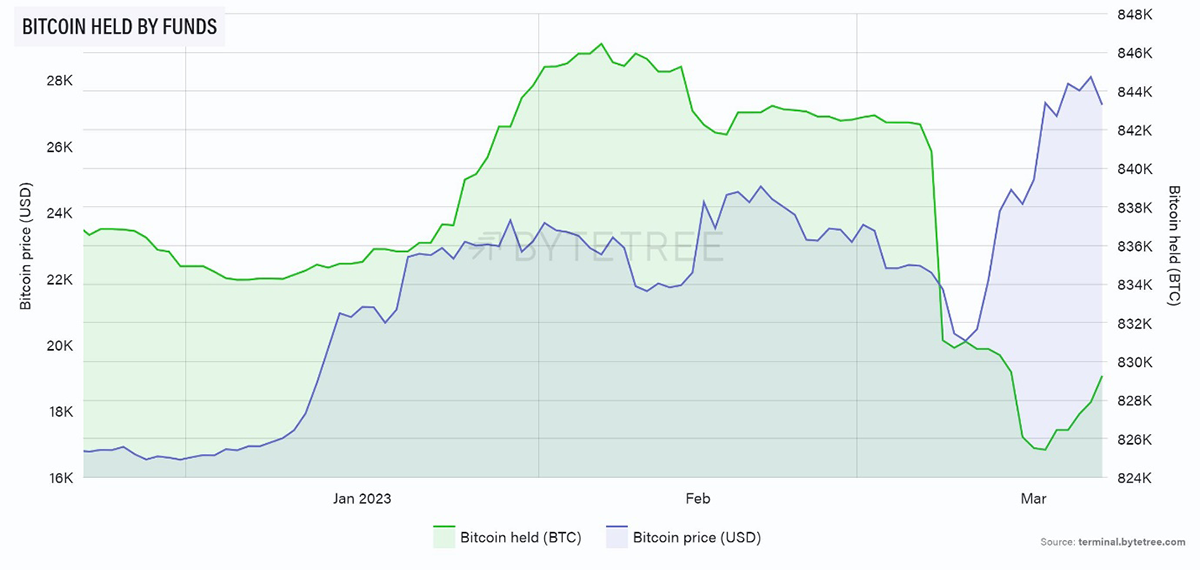

The tide has turned. Events of the last few weeks seem to have attracted some buyers, although it’s still very small.

Of note is that the BITO ETF (which is the only ETF accessible in the USA) has seen a net inflow this month of 1,075 BTC.

Source: ByteTree

Cryptonomy

Regulation in the USA dominates at the moment. The SEC seems hell-bent on destroying the crypto industry, with the latest being a Wells notice issued to industry behemoth Coinbase.

Before we get to that, it’s becoming increasingly clear that Signature Bank, which was generally regarded as the highest quality of all the crypto-friendly banks, was seized because of its exposure to crypto, not because it was insolvent. The source of this is Barney Frank, a director, in a New York Times article, and the fact that the buyer is divesting all of Signature’s crypto business seems to confirm the fact.

The tragic truth about this is that the SEC is simply feeding the beast. True bitcoiners simply don’t care what the SEC does to the industry. The reason many hold bitcoin is because of a fear of a rampant state, and this only strengthens their conviction.

Meanwhile, investment in decentralised finance, which seeks to create a stronger and more durable financial system, will be driven overseas, along with jobs and investment. It couldn’t be more stupid.

Back to Coinbase. The Wells notice is a way of informing a company that the SEC is being recommended to take enforcement actions for possible violations of securities laws. This would, of course, be the same SEC which approved Coinbase’s IPO in 2021 since when they’ve stayed in the same business.

This promises to be a great battle, and rather like the amicus brief we mentioned in ByteFolio this week, we look forward to seeing the arguments being put to the test in front of a Judge. Looking at Coinbase’s statement on the subject, it’s hard to see how the SEC come out looking good from this. Grab your popcorn.

Summary

Bitcoin was conceived as a way of holding, transferring and guarding wealth by a group of visionaries who foresaw the weaknesses of a political and financial system that was inherently unfair and incapable of making hard decisions. The last fortnight has proved them right.