Bitcoin's Golden Cross

Disclaimer: Your capital is at risk. This is not investment advice.

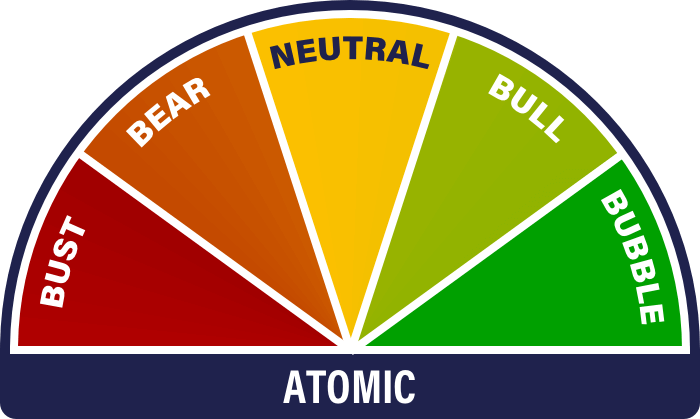

ATOMIC 78

Bitcoin has made a golden cross. It’s only the third time in three years. Meanwhile, we note that good regulators are not hostile regulators, which at least one member of the SEC agrees with.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | A 4-star trend and a golden cross |

| On-chain | Velocity is calm when there are no crises |

| Macro | Is the bitcoin and gold price divergence telling us something about inflation? |

| Investment Flows | US weak, but growth elsewhere |

| Cryptonomy | Dissent at the SEC and watch out for NOSTR |

Technical

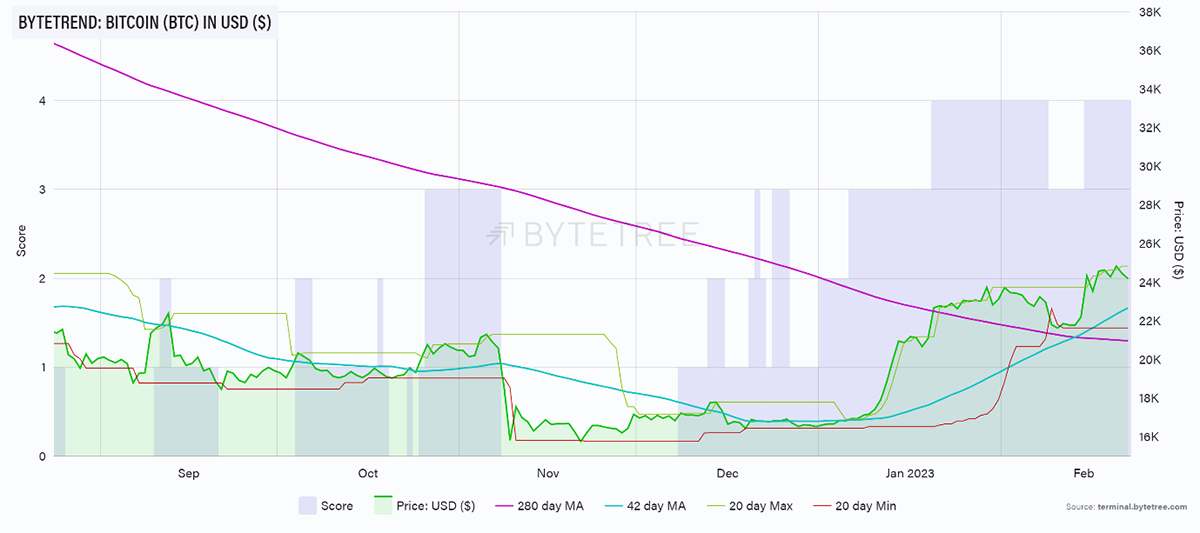

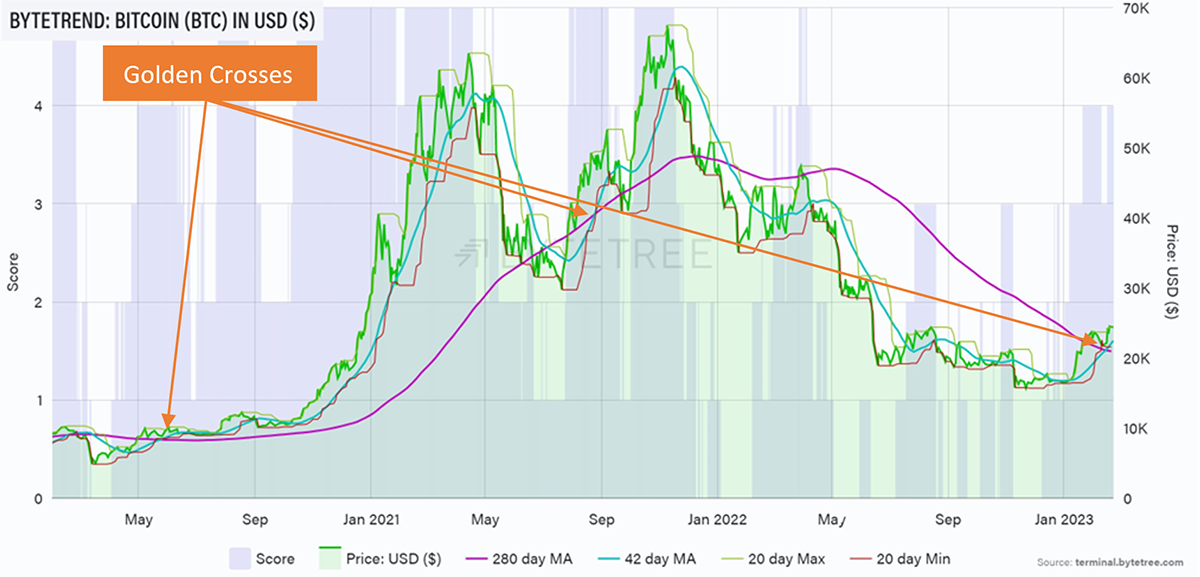

Bitcoin remains on a 4-star trend on ByteTrend, with the only star yet to be ignited being the 280-day moving average.

Also note that the 42-day moving average has crossed above the 280-day, sometimes referred to as a “golden cross”. This is a technically bullish signal and inclines us to believe that the US$21,000-22,000 level will act as strong support.

BTC on a 4-star ByteTrend in USD

If we zoom out, there have only been two golden crosses since the start of 2020, both of which preceded substantial price rises.

Bitcoin’s Golden Crosses

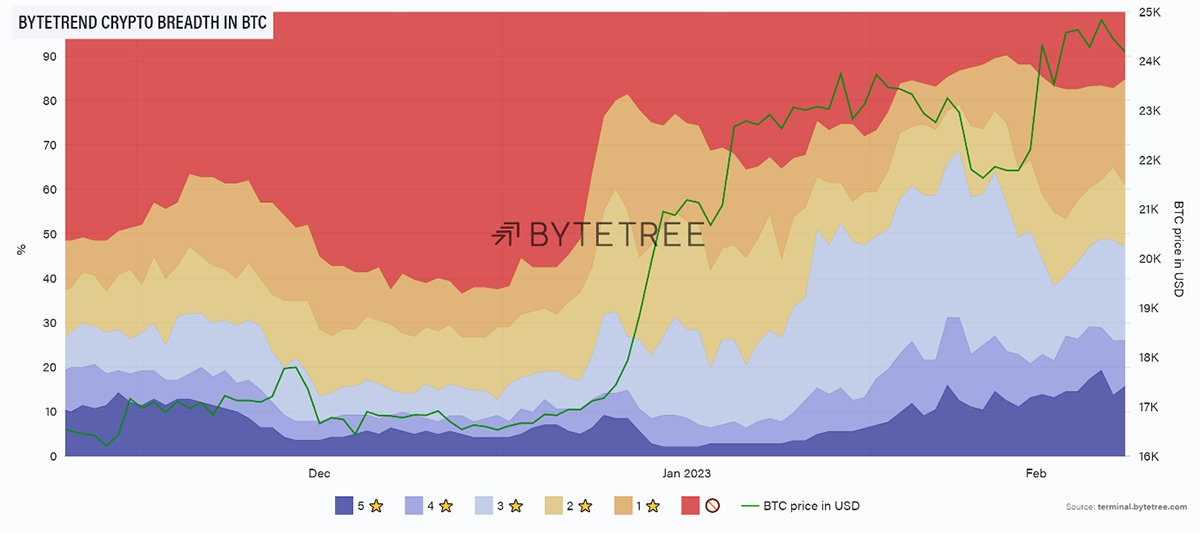

Sector strength has marginally tailed off since a fortnight ago, but that’s only because we’ve had a decent move higher in bitcoin, which at the moment, tends to lead the market higher before others catch up.

Follow the Leader

On-chain

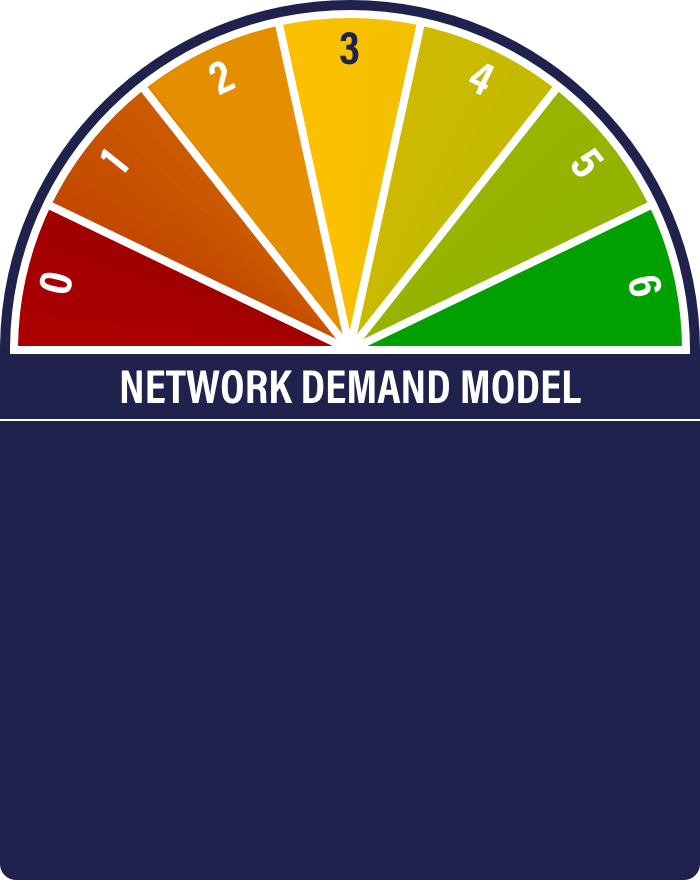

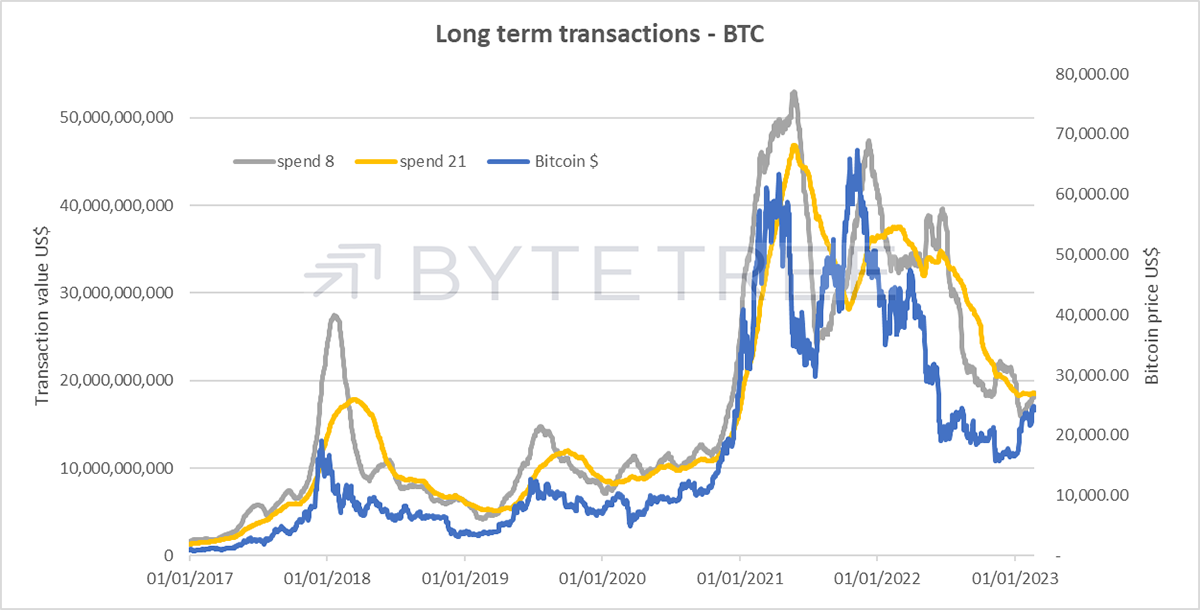

The Network Demand Model has moved to a bullish 5/6. The longer-term spend signal has turned on (see below, the grey line crossing above the yellow line), leaving only the short-term spend off.

The short-term spend is the most febrile of the six signals and frequently flickers on and off. A few strong days, and that will turn on as well. From a long-term cyclical basis, the model is unequivocally bullish.

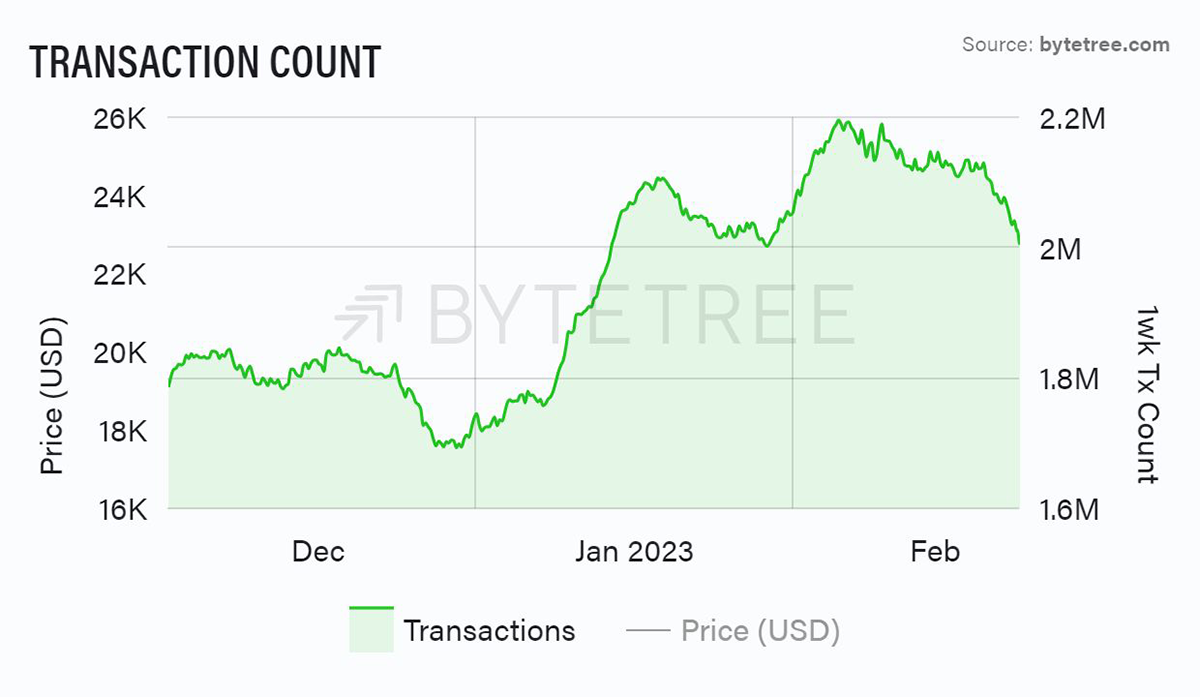

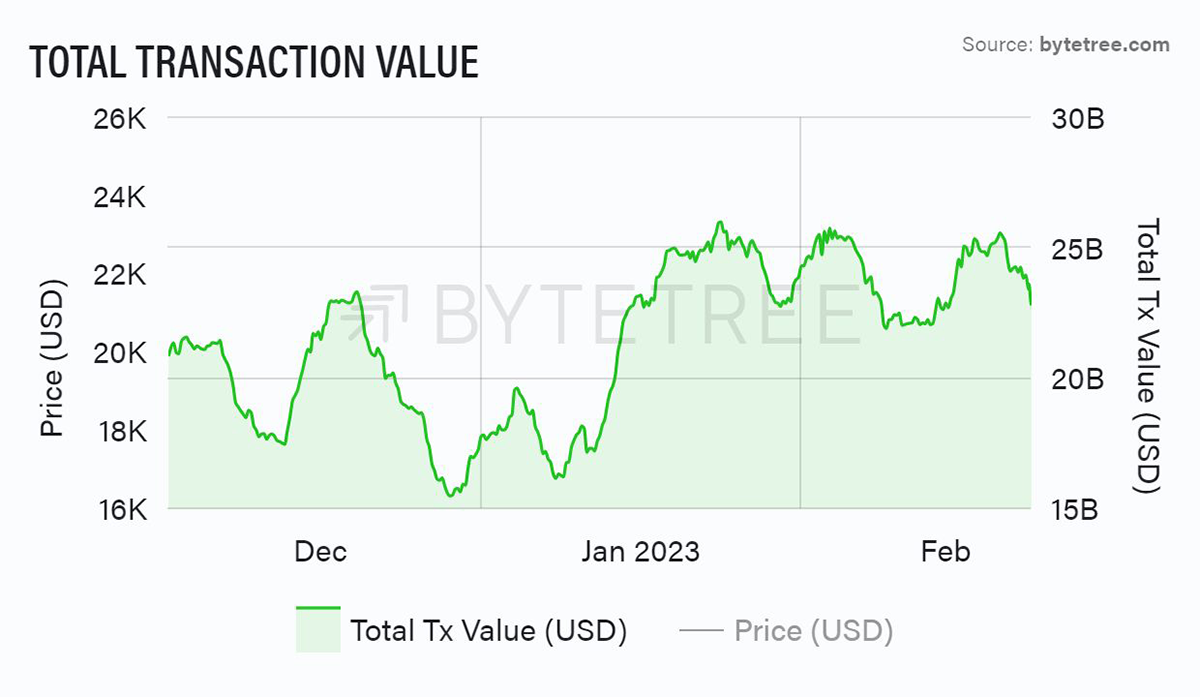

Short-term, there has been some softening in activity. Transaction count and transaction activity have both cooled from recent highs, although both remain considerably higher than at the start of the year.

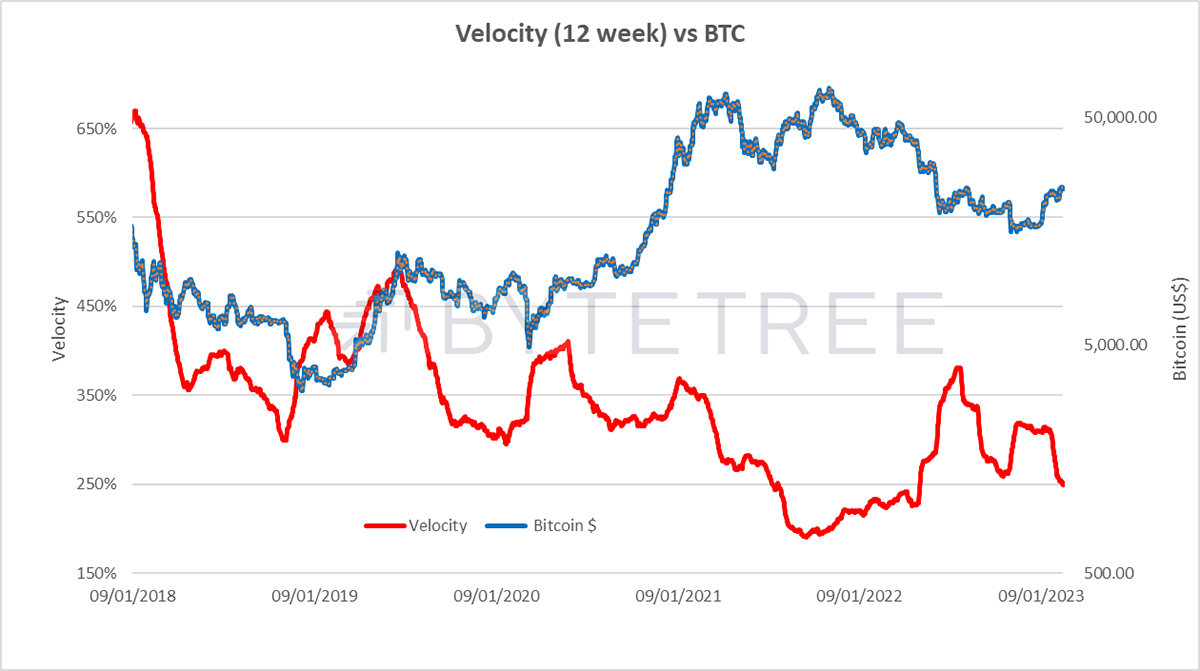

Velocity has also declined, but it’s difficult to read much into the price from this alone. As you can see below, spikes in velocity tend to accompany crises. This is because holders are forced to sell, and therefore BTC changes hands. Velocity essentially tells us the speed at which that is happening.

Although we have historically interpreted high velocity as a sign that the network is vibrant, an alternative explanation, particularly as the network matures, is that lower velocity is a sign of industry calmness. In many tax jurisdictions, it doesn’t make sense for investors to actively trade BTC, incurring a tax liability every time they do so.

Suppose an increasing cohort of investors own BTC as a long-term store of value and/or choose to use it as collateral in their trading strategies. In that case, we should expect velocity to structurally decline.

As can be seen by eyeballing the chart below, that appears to be exactly what is happening.

Macro

There’s been an interesting divergence in the prices of bitcoin and gold over the last couple of weeks. While bitcoin has bounced after its early month slump, gold has continued to flounder. It’s an interesting development. Bitcoin tends to perform well in growth environments, while gold is more of a stagflation beneficiary. Both like declining real interest rates, but bitcoin prefers such an environment because there is little inflationary pressure and central banks are stimulating. Gold, on the other hand, tends to run hard ahead of nominal inflation rises and lagging interest rate hikes.

So, maybe we’re being told something here. If we are – and it’s a big if - it’s hard to avoid the conclusion that the “transitory” camp is in the ascendant. In other words, we can stop fretting about inflation. If that’s the case, I will be writing less in this section of ATOMIC in the future, because the crypto story will rightly revert to being more about adoption than the Fed’s next meeting.

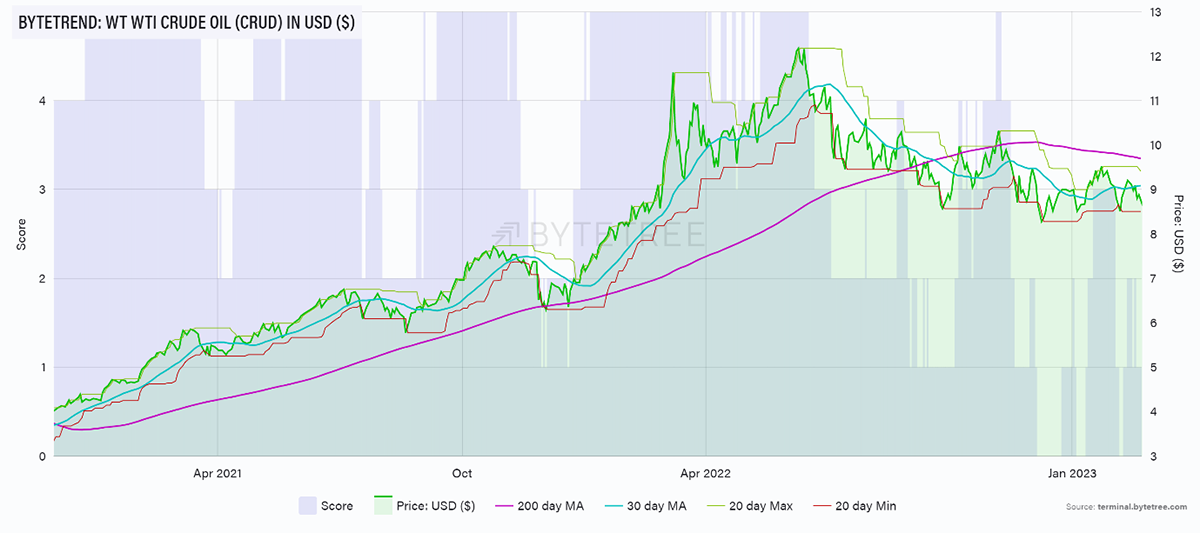

In this regard, it’s been interesting to see that some of the worst performing commodities on ByteTrend are in the energy sector. Crude Oil has just broken down to a 0-star (bearish) ByteTrend in US$, for example. A huge amount of inflationary pressure is driven from our energy diet. It’s one of the factors that prompted us to be worried about inflation a couple of years ago. There’s a strong case for arguing it should be a major reason to stop fretting so much now. And if that’s the case we can approach risk assets in general, and crypto in particular, with much greater confidence.

CRUD 0-star ByteTrend in USD

Investment Flows

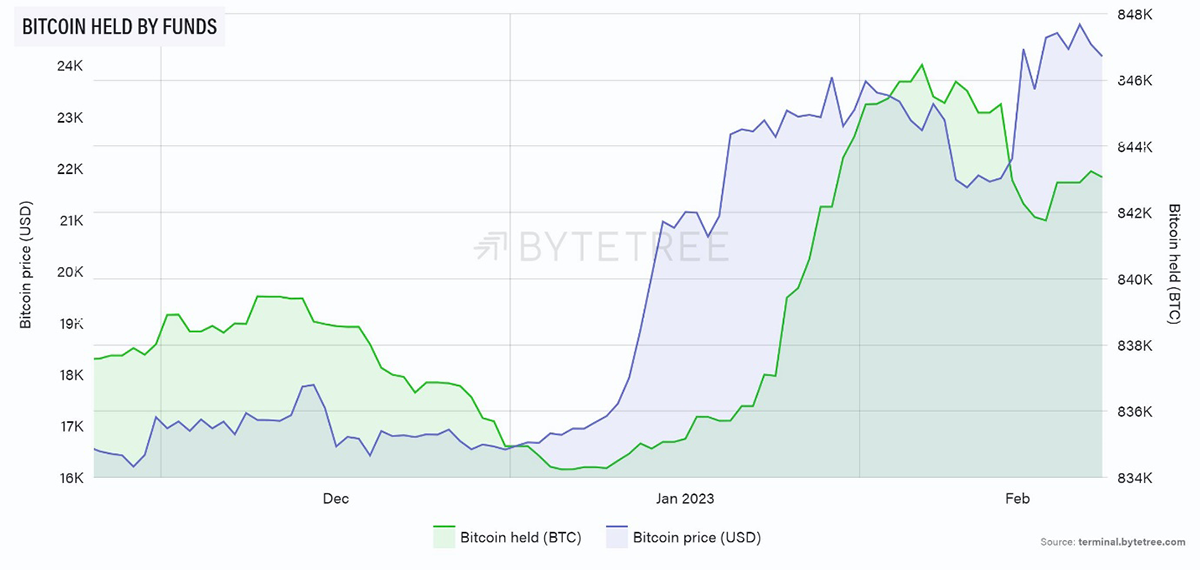

Fund flows indicate that there was a small amount of profit taking in the middle of February, but that has been easily absorbed. The price has rallied sharply from the mid-month dip to around US$21,600, and with it there has been a small recovery in fund ownership.

Looking through the flows on the ByteTree Terminal, it looks like the lion’s share of outflows have come from the only US bitcoin ETF, BITO. This actually invests in bitcoin futures rather than the underlying asset. US regulators, similar to the UK, have yet to approve a bitcoin ETF backed by the physical. These outflows could be in response to the US regulatory crackdown we have seen in recent weeks.

In Europe, meanwhile, inflows have remained healthy, with 21Shares (ABTC) and Coinshares (BITC) seeing increases of 112 and 297 BTC so far this month. The larger Canadian funds look similarly robust, with the exception of the US$ class in the Purpose Bitcoin ETF.

In conclusion, any fund flow weakness looks decidedly US-centric.

Cryptonomy

Regulation

While Gary Gensler at the SEC continues to make life difficult for the on/off ramps for crypto into the world of traditional finance (dubbed Operation Chokepoint 2), it is good to see that there are some dissenting voices in the SEC. Hester Peirce, a commissioner at the SEC, has described the agency’s actions as “paternalistic and lazy”. She also wrote, “Using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating”. She openly admits in her letter of dissent that the regulator is “hostile to crypto” and questions whether it is therefore fit to regulate it. Good regulation shows neither hostility nor favouritism. It should be neutral in protecting investors and nurturing the technology. The SEC’s current attitude is likely to fail in both.

NOSTR

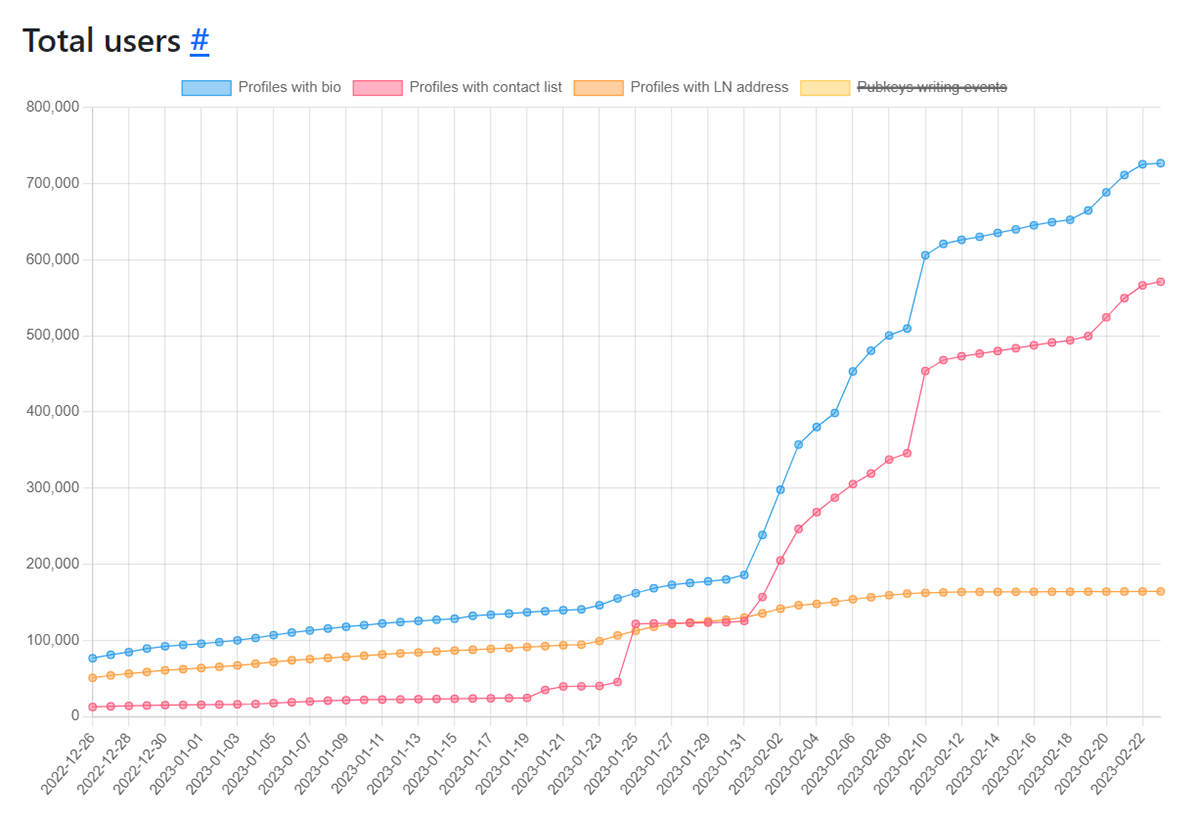

You might want to keep an eye on this abbreviation of a nasal cavity. Seriously, Nostr has lit up the crypto community, and while not growing at the same rate as ChatGPT, it isn’t doing too badly.

Nostr is a social media platform which, at its core, does away with centralised control. Twitter, Facebook and others can de-platform users at will, and Nostr solves that problem. What it doesn’t have is scale, with only just over 700,000 users so far (albeit it’s shot up in the last couple of months, see below), and getting started seems to be far from straightforward. Still, this might well be the way forward for social media and is worth keeping an eye on. Read the introduction.

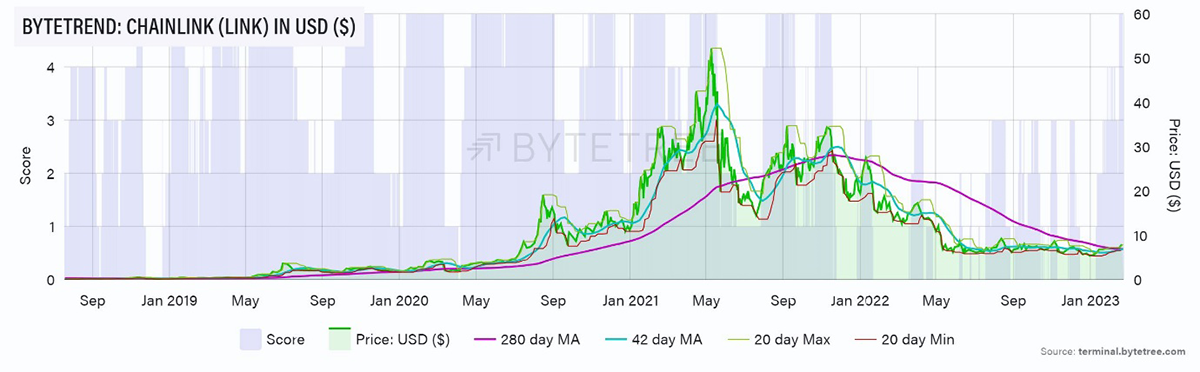

Chainlink (LINK)

Chainlink was added back into ByteFolio this week and today upgraded to a 5-star (bullish) trend in US$ on ByteTrend.

For the uninitiated, Chainlink is the leading Decentralised Oracle Network, or DON. DONs supply off-chain data to smart contracts in the blockchain world, which of course, has to be absolutely reliable and incorruptible. It’s a vital part of the crypto infrastructure and Chainlink is the dominant entity, with more going on for it besides. We see a constant feed of information on new partnerships and alliances interwoven across the crypto universe. And, I can’t lie, the long-term chart is pretty interesting too.

Summary

Markets have felt nervous over the last couple of weeks, but the way asset prices are behaving suggests we can remain optimistic about the year ahead. ATOMIC remains BULLISH.