Mind the Gap

Disclaimer: Your capital is at risk. This is not investment advice.

In this week’s Multi-Asset Investor, I recalled the two biggest problems facing the market in 2022, namely the collapsing bond market combined with an energy crisis. These pressures subsequently eased, and a new equity bull market has emerged. It has made us money, but the risk is that higher oil and rates return.

We can discuss oil another day, but those hoping for the price to crash back down to $40 per barrel, as we have seen in past slowdowns, will be disappointed. Consumption is back at all-time highs, in contrast to supply that faces resistance.

That leaves rates. With multiple interest rate rises around the world, even in Sweden, the hope is that the battle against inflation has been won. If so, it’s back to the pre-covid era, where growth is slow, but who cares? Rates will come back down, and tech stocks can go to the moon!

Mind the Gap

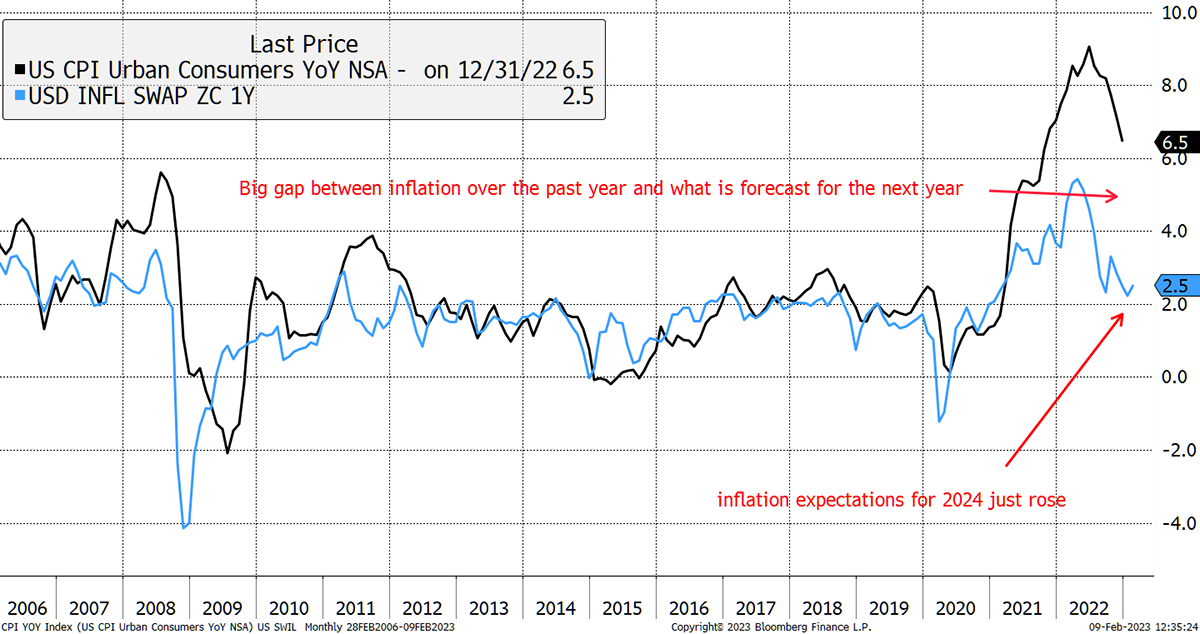

Normally we see inflation over the past year looking very similar to the forecast for next year. This has been true outside of periods of high macroeconomic uncertainty. For example, in 2008, inflation fell sharply, which was preceded by collapsing forecasts. They subsequently recovered in 2009, which not only preceded inflation but turned out to be a buy signal for the stockmarket.

Rising Inflation is Often a Buy Signal for the Stockmarket

But this time is different (or so they always say). At the end of bear markets, we normally interpret a rise in short-term inflation to be bullish because it comes off ultra-low levels. In addition, those ultra-low levels reflect actual inflation, which was also ultra-low at the time. However, this time, that has not been the case. Inflation expectations may have fallen from 5% to 2%, but actual inflation is still at 6.5%, having touched 9% last year. This is a very different scenario to what we have seen in past market recoveries.

It matters because we know that low rates mean “tech 2 da’ moon”, but they can only come about if inflation returns to where it came from. The confusion perhaps is that we are used to negatives turning into positives. In 2008, -4% inflation recovered to +2% and in 2015 0% recovered to +2%. This time, -1% recovered to +9%, and at the bottom of the bear (?) market was +6.5%.

This time, it is very different indeed.

We are used to recoveries seeing rising inflation expectations, and this recovery does indeed have rising inflation expectations, which is normally fine. Except that if inflation can’t return to 2%, rates will have to stay higher for longer. It is not just how high, but for how long.

Imagine you were offered a risk-free 10% IRR for a few days, weeks or even months. Big deal, you might say. Now imagine you were offered that risk-free 10% for five years or more. It would turn the entire financial system upside down as we dump assets and pile in.

High rates are very bad news for stocks. I show the US 10-year bond yield (inverted RHS) against the S&P 500. A rising yield (inverted, remember) has caused mayhem for the stockmarket.

Stocks Don’t Like Rising Bond Yields

Yet, in recent days, US tech has roared back to life, the inference being that inflation is under control and interest rates will come crashing down. My point is they need to or else the stockmarket will become a very dangerous place indeed.

For bond yields to come down, inflation must die.

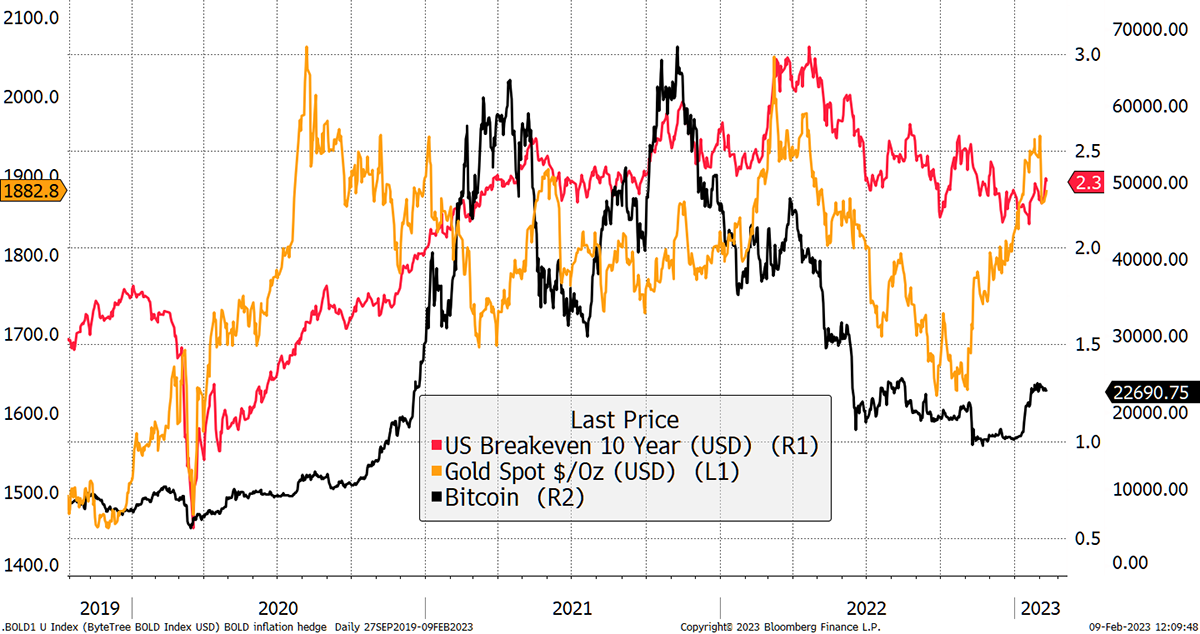

We are told that bitcoin and gold are inflation hedges, and I agree they are. That means their prices rise in response to, or anticipation of, inflation. The trouble is timing. Looking at gold (gold) and bitcoin (black) against inflation forecasts (red), and it’s a mess. Gold led inflation in 2020, which led bitcoin, yet both assets cooled in mid-2022. In any event, it’s hard to make sense of what’s what.

Bitcoin, Gold and Inflation

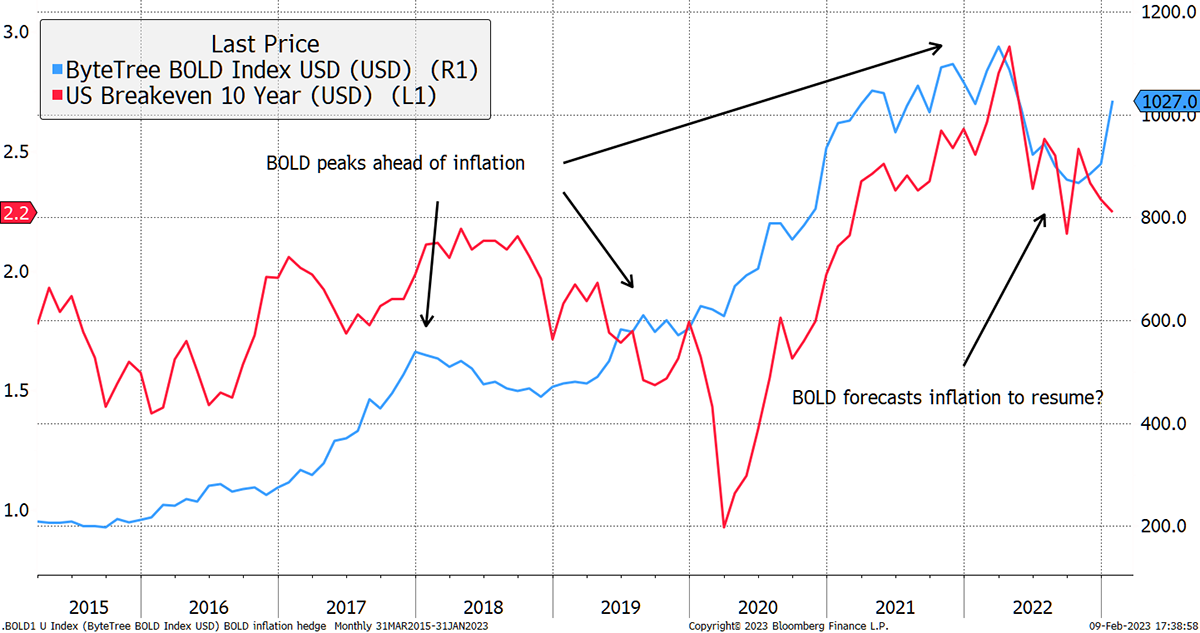

But when you then combine bitcoin and gold on a risk-adjusted basis, as we do in the ByteTree BOLD Index, you end up with a much calmer interpretation. BOLD may only have $20 invested in bitcoin for every $80 in gold, but in terms of risk, that is 50/50. To put it another way, having $80 in gold is about as risky as having $20 in bitcoin.

This equal-risk approach brings about financial magic. Gold is a risk-off asset in contrast to bitcoin, which is risk-on. In the BOLD blend, this interference disappears, and the result is something that is remarkably closely linked with changes in inflation. The trouble is that BOLD just had one hell of a month, surging 13.7% in dollars, while volatility remained just 15%. If BOLD is a leading indicator, that means inflation expectations are too low.

BOLD Predictions

Inflation expectations being too low doesn’t mean it is taking off again. Rather, closing that 4% gap between historical and forecast may take much longer than we expect. That would mean rates are higher for longer, which would cause the bond yield to rise, and the stockmarket to come under pressure and potentially crash. In my last piece, I highlighted that if the bond yield caught up with interest rates, which would mean a 1.1% jump, the stockmarket could drop by a third in short order.

To put it another way, this line showing equities relative to bonds is supposed to fall during stockmarket corrections. That recharges the batteries, paving the way for a new bull. How the hell is a new bull market supposed to start from the highest high we have ever seen?

The Everything Bubble is Back

There’s an answer to that question too. Equities beat bonds during times of inflation. And so it goes on. Is the equity outperformance confirming the message from BOLD that inflation isn’t going away? Or is this just another excitable equity bubble?

This Week at ByteTree

Charlie Erith made some excellent points in ATOMIC. The blockchain is firing on all cylinders, and transactions are back. He also made some arguments about prolonged financial repression. What does that mean? It means buy BOLD, but dividends and avoid bubbles. He also updated ByteFolio. No changes this week, but you just know a new beauty is coming along soon.

Have a great weekend,

Charlie Morris

Comments ()