Bitcoin Pauses for Thought

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 77

There’s a lot to digest after a 40% gain in a few weeks. Valuation seems about right, on-chain activity mildly positive, but question marks abound over the macro narrative. CBDCs are an obvious crypto use case, but is that a good thing for bitcoin?

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | No longer overbought, no golden cross yet |

| On-chain | Transactions strong, valuation fair |

| Macro | A return to financial repression? |

| Investment Flows | BTC strong, ETH flat |

| Cryptonomy | The Superbowl indicator and a digital pound |

Technical

In the last edition of ATOMIC, we wrote about the short-term “over-bought” situation for BTC. Pleasingly this has been resolved, and the price is almost exactly where it was. This is a classic set-up for a move higher in a bull market.

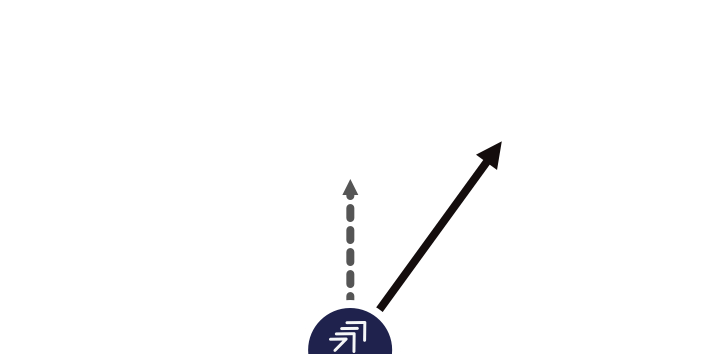

You can also see in the chart below that we are approaching a “golden cross”, where the 70-day moving average crosses above the 280-day (note we use these timeframes to equate to the 200- and 50-day moving averages used in equities and bonds because crypto trades 24/7). If it happens, it will further solidify the bull market case. Beware of people telling you it’s happened already (all of Twitter) because it hasn’t.

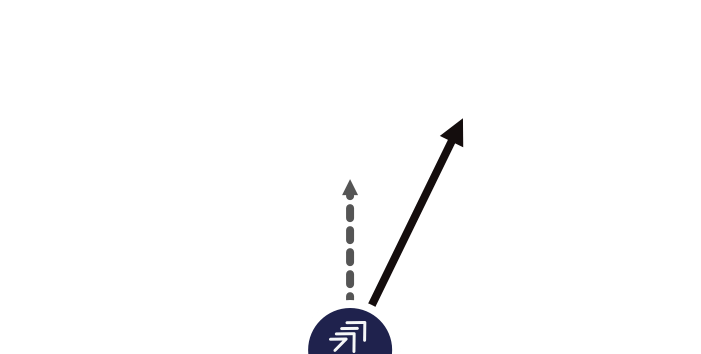

ByteTrend keeps BTC on a 4-star trend versus the USD. The missing star will be switched on when the 280-day MA slopes upwards.

On-Chain

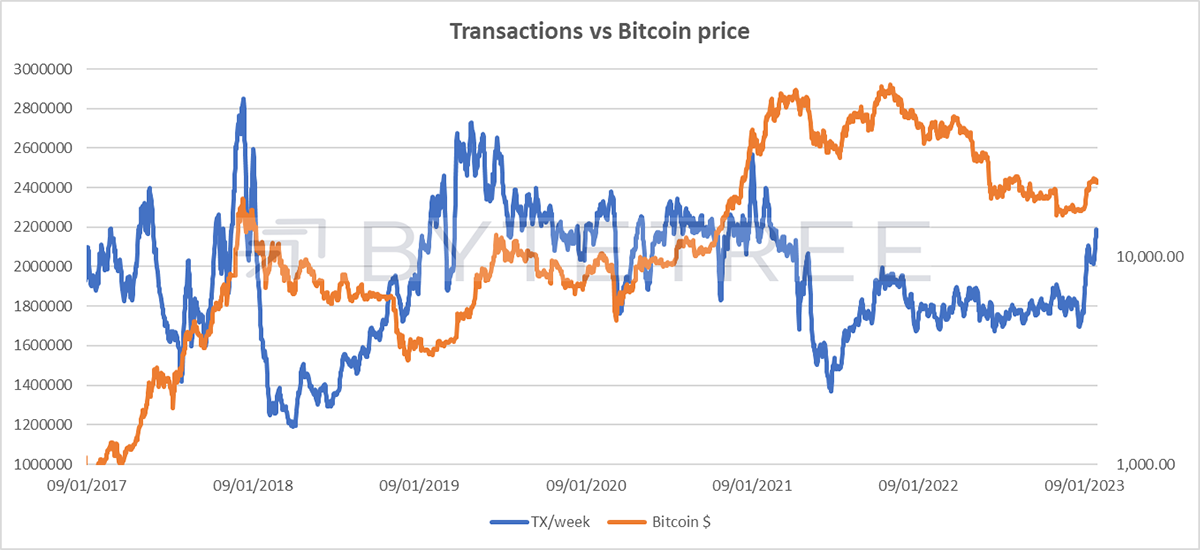

The transaction count has spiked higher again. What’s interesting here is it that acts as a decent sentiment indicator. A higher volume of transactions suggests higher engagement, and higher engagement suggests a growing network, and a growing network should make it more valuable. It will be interesting to see whether this higher level of activity is sustainable or just a reaction to the rally we’ve recently witnessed.

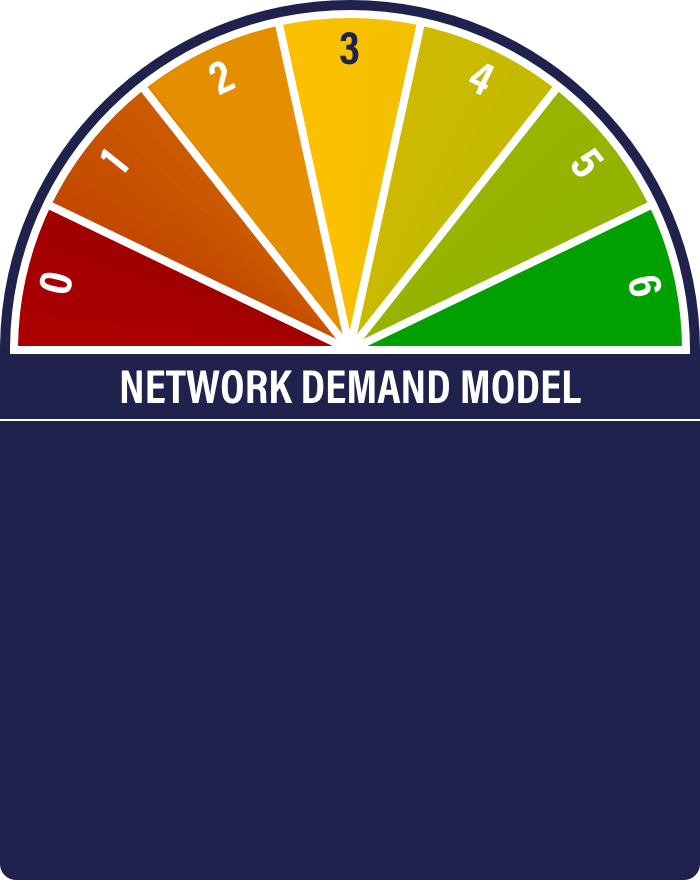

The ByteTree Network Demand model moves up to 4/6. The long-term fee indicator turns on again, joining short-term transactions, velocity, and MRI.

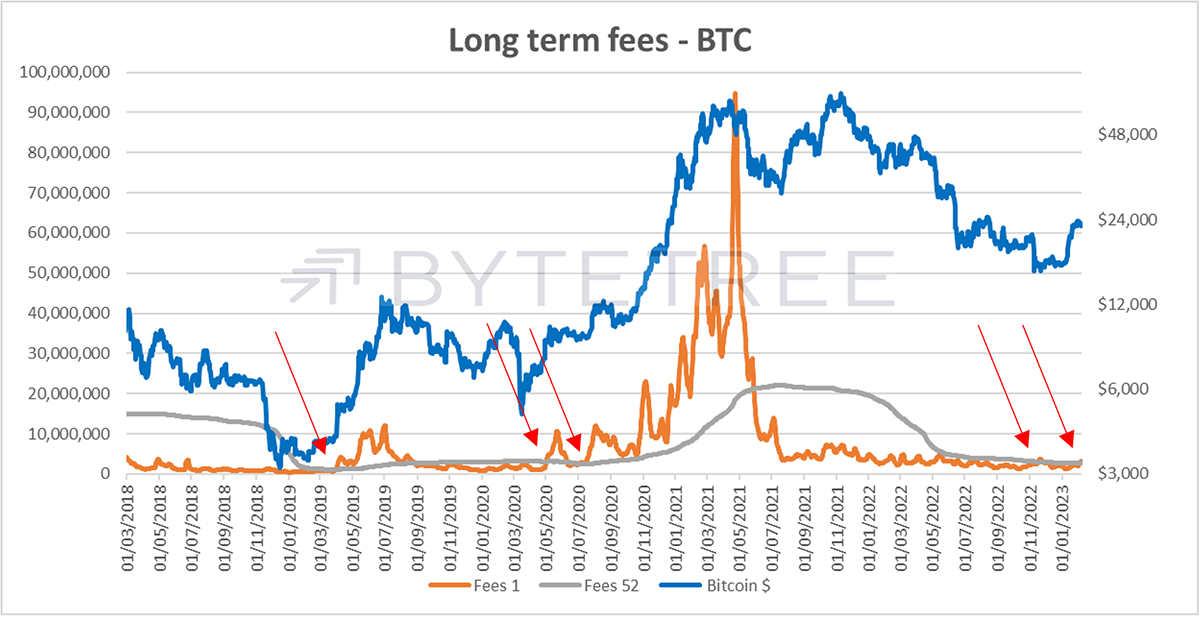

This was the signal that switched on in November last year when ATOMIC upgraded to bull. Of the six signals, it’s the least volatile and has historically been a fabulous buying indicator, as shown by the positioning of the red arrows below.

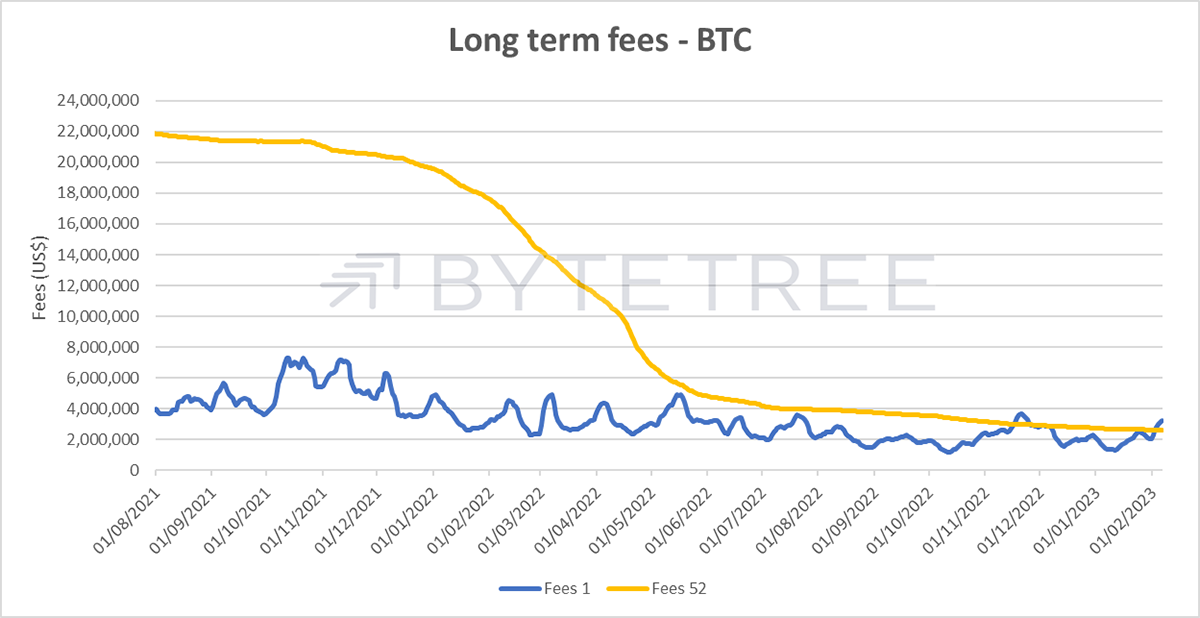

Zooming in, you can see that there’s been a sharp increase in fees in a short period, from a low of US$1.5m/week to closer to US$3.2m/week, more or less doubling over the past month. Still small beer, but better news for the miners and, by extension, the security and functioning of the network.

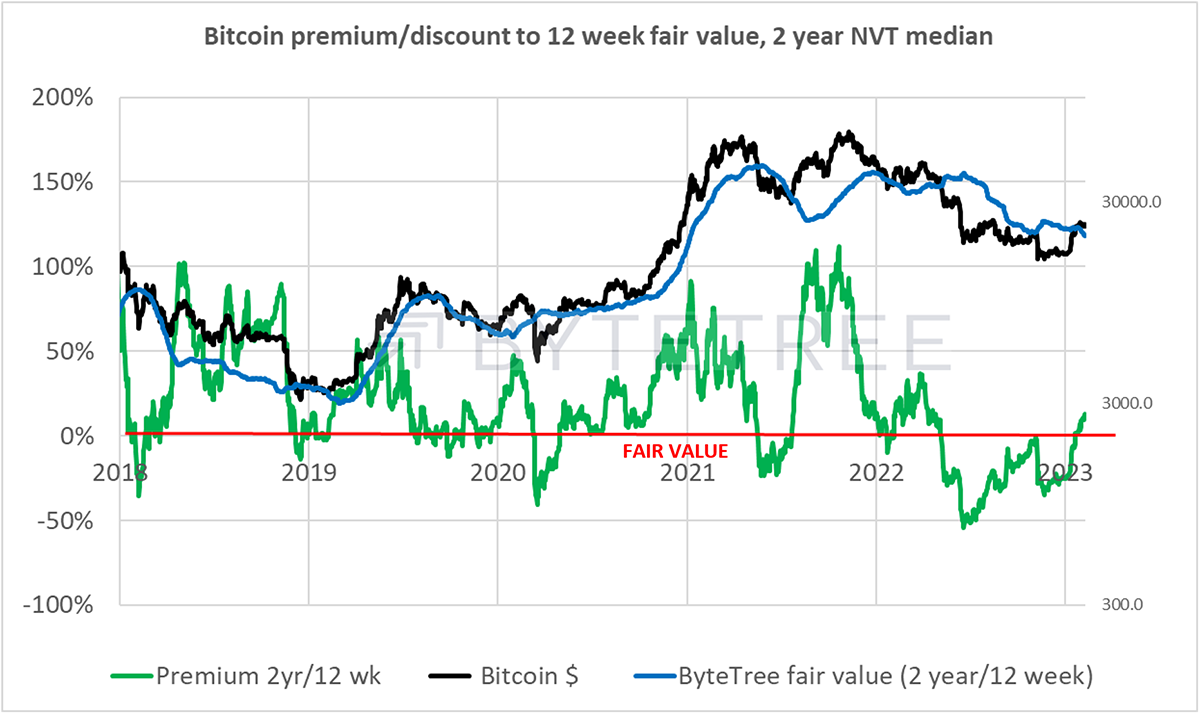

Just a quick word on valuation. When we look at where BTC is trading relative to its history, we see that the price has popped above the fair value line. This provides us with a sense check and tells us that we are no longer in overtly cheap territory. Neither is it expensive, but to justify a substantial move higher, it would be necessary to see a sustained pick-up in activity.

Macro

In this week’s Multi-Asset Investor, Charlie Morris warned that if inflation doesn’t cool, we should see a meaningful correction in equities. In other words, markets are pricing in Goldilocks already. The fact that bond markets shifted bond yields higher in the immediate aftermath of the most recent rate hike suggests that they’re worried they’ve been complacent.

Bitcoin is no less susceptible, short-term at least, to inflation data and interest rates than all other risk assets. So, if bonds start falling (yields rising), it’s a headwind for bitcoin.

With any number of public sector disputes about pay (note: public sector), there is a temptation to look at headlines and think that inflation is stickier than expected. But there are more compelling reasons to believe that’s not the case. We don’t want to be complacent, but on balance, the evidence suggests that we need not be worried. If anything, the worry is that central banks will continue to hammer away long after the problem has been solved.

I draw your attention to three recent podcasts by friends of ours, which are well worth a listen. James Fergusson and Russell Napier being interviewed by Merryn Somerset Webb on Merryn Talks Money, and Viktor Shvets on Odd Lots.

So why should we relax about inflation? Some of the key points are:

- The inflation we have witnessed has nothing to do with demand, which we know because demand is less than it would have been without Covid. This is all about disruption. There is no evidence that inflation expectations are embedded, which is critical. There is no evidence of consistent corporate or labour pricing power.

- Disinflationary offsets are strong, particularly in demographics and technology.

- De-globalisation is not inflationary. Re-shoring of manufacturing, which has been happening for a while, is not labour-intensive. Low-cost labour in Shenzhen will be replaced by robots in Telford.

- The US nominal money supply has been contracting since February last year. There is a lag in how this plays out. There has also been a boost from the release of pent-up covid savings, but this impact is coming to an end. If this is right, there will be a deflationary impulse from June/July.

- China won’t return to 5-6% growth rates. It is interesting already how little the post-zero Covid opening up has impacted commodity markets. Many thought China would play its usual card and stimulate via investments/infrastructure programmes etc. Still, it can’t because it’s in incredibly inefficient use of capital, and they already have US$63 trillion of debt. There might be a “savings release” bounce, but that’s it.

- Debt/GDP levels are now at the highest levels ever recorded. The US is now at 260%. Interest rates can only go so high before things break. In many countries, private debt/service ratios are higher than 20%, which is when warning lights start flashing. The only politically feasible solution, regardless of the externalities, is to keep interest rates low.

The broad line of thought is that a move back to a pre-Covid world of low inflation and financial repression is a more likely outcome than an embedded inflationary situation. We also know that Central Banks can turn a bear market into a bull market with the utterance of a sentence and the press of a button. As Russell Napier says, governments are “institutionalising negative real rates”.

This scenario is bitcoin friendly. Looser economic conditions and financial repression are problems which hard assets like bitcoin seek to solve. This is why Napier and Ferguson advocate for gold in a balanced portfolio. Any objection to bitcoin has nothing to do with macro but centres around whether the government will allow it, a separate argument.

Investment Flows

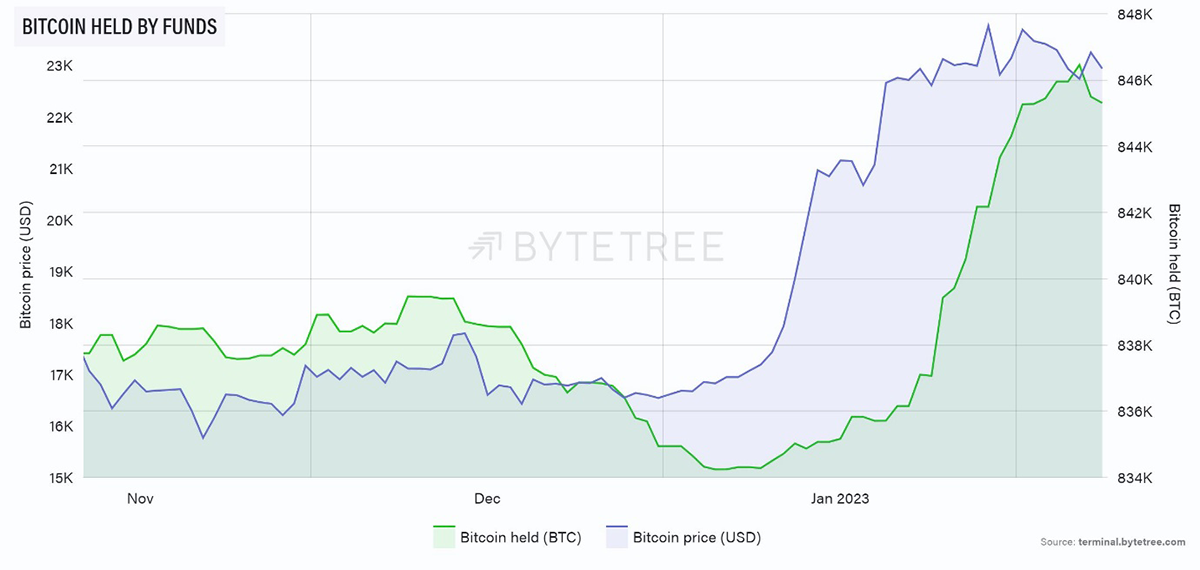

January saw strong flows into the bitcoin funds we track. Although, as is so often the case, the majority of net additions came after the price had moved sharply higher. The last week or so has seen a spot of profit-taking, of little surprise after a 40% gain in a month.

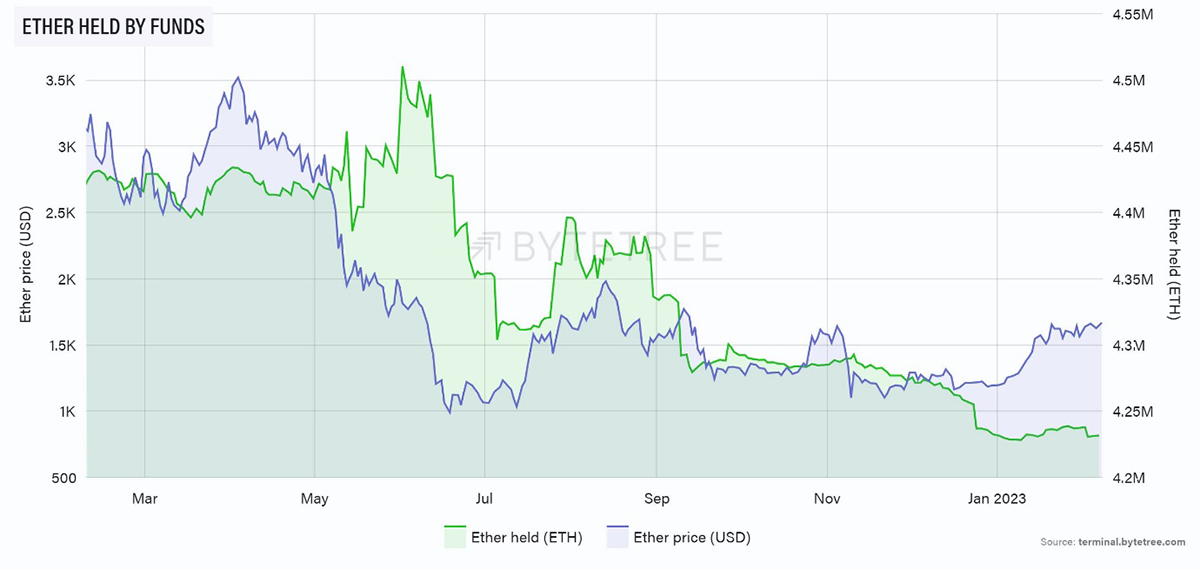

Ethereum, on the other hand, has seen hardly any activity at all. The best that can be said is that at least there aren’t further outflows following the calamities of last year when around 280,000 ETH came out of funds between 1 June and the year-end. That’s around US$448m at a price of US$1,600.

Cryptonomy

Digital Pound

We note that the Treasury and the Bank of England are consulting on the possibility of introducing a digital pound. It’s a thorny subject. On the one hand, payments are going digital and a digital pound will be easier to use (are you finding the existing one hard to use?). On the other hand, programmable money is an enabler for state surveillance and economic manipulation.

As far as crypto is concerned, there are a couple of observations: first, digitising existing fiat currencies corroborates the technology. There is an argument that the introduction of Central Bank Digital Currencies (CBDCs) will fast-track wider use of bitcoin by making the storage and user experience much easier. On the flip side, it might accelerate a more concerted attempt by central banks to – once again – try and ban crypto.

The good news is that the government is in charge. What could possibly go wrong?

The Superbowl Indicator

Hilariously, Fox News have announced that there will be no crypto advertising at this year’s Superbowl. If ever there was a sign of industry hubris, it was the sight of Matt Damon and others parading in front of the cameras at the event on 13 February last year, when the price was double where it is today.

Contrarian indicators come in many forms, and this could be one of them. Beware of the Coinbase splash at Superbowl 2025.

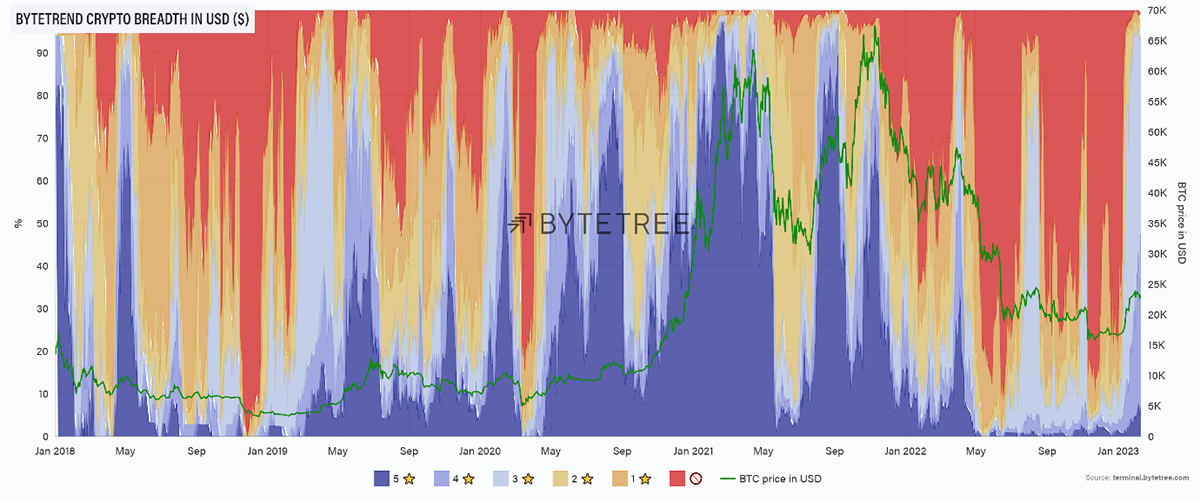

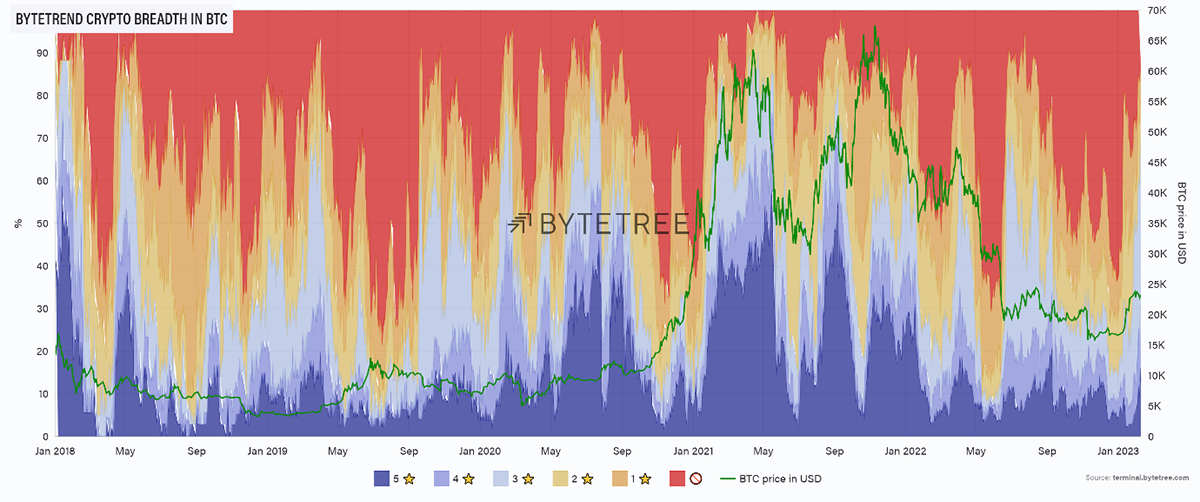

ByteTrend

Breadth remains pretty good across crypto. When we look at the number of coins and tokens sitting on 3-star trend scores and above, relative to the US$, it’s reminiscent of the sort of shape we saw in early to mid-2019.

The larger recent expanse of red sky, when we look at the universe relative to BTC, tells us that bitcoin has been dominant recently. It will be important to see whether this recent enthusiasm spreads to some of the smaller names in the sector.

Summary

After a huge relief rally in anticipation of peaking rates and declining inflation, markets are likely to pause to see whether the evidence fits the theory. Bitcoin is likely to trace sideways while that process unfolds, but the longer-term picture remains constructive.