The End of Rate Hikes Can't Be Far Away

Welcome new readers, and I thank you for joining ByteTree Premium and for the many kind messages.

It’s a big week for data. US consumer price inflation (CPI) was reported today at 7.1% against 7.3% last month. It was down from 7.7% last month. Markets seem to like it as the dollar fell on the news.

It’s important because tomorrow we have the Federal Reserve’s final rate decision for the year, which will be influenced by CPI. The market is looking for a 0.5% hike to 4.5%, which may or not turn out to be the peak for interest rates.

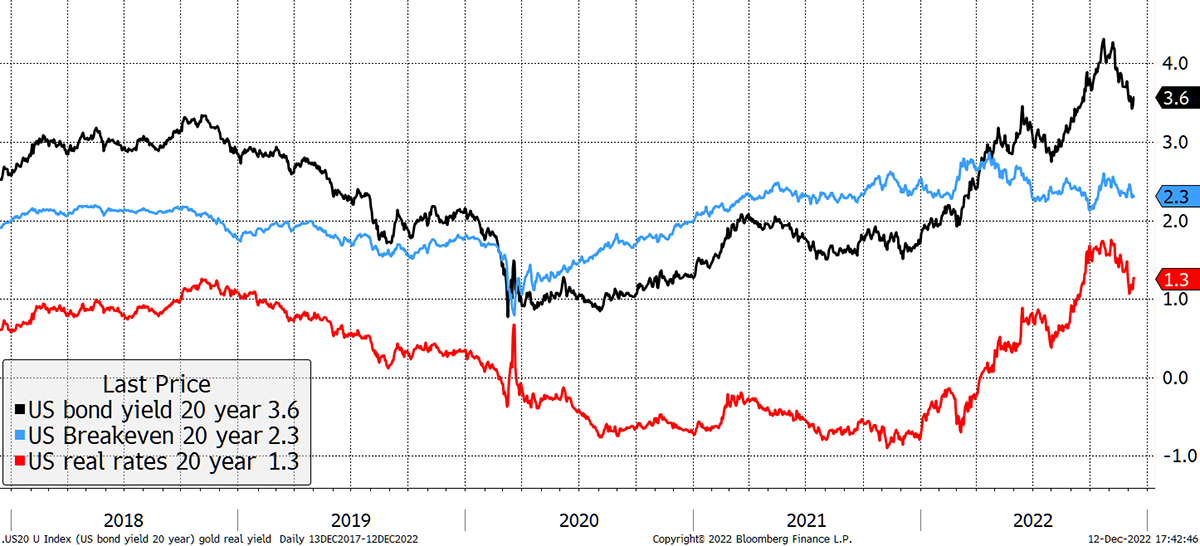

This is key for the Money Map, which determines much of what we do. In recent weeks, bond yields have been falling, which has relieved the upward pressure on real interest rates, as seen by the red line falling. That has been supportive for stockmarkets, but that could change, largely in anticipation of peak rates.

Relief

Source: Bloomberg

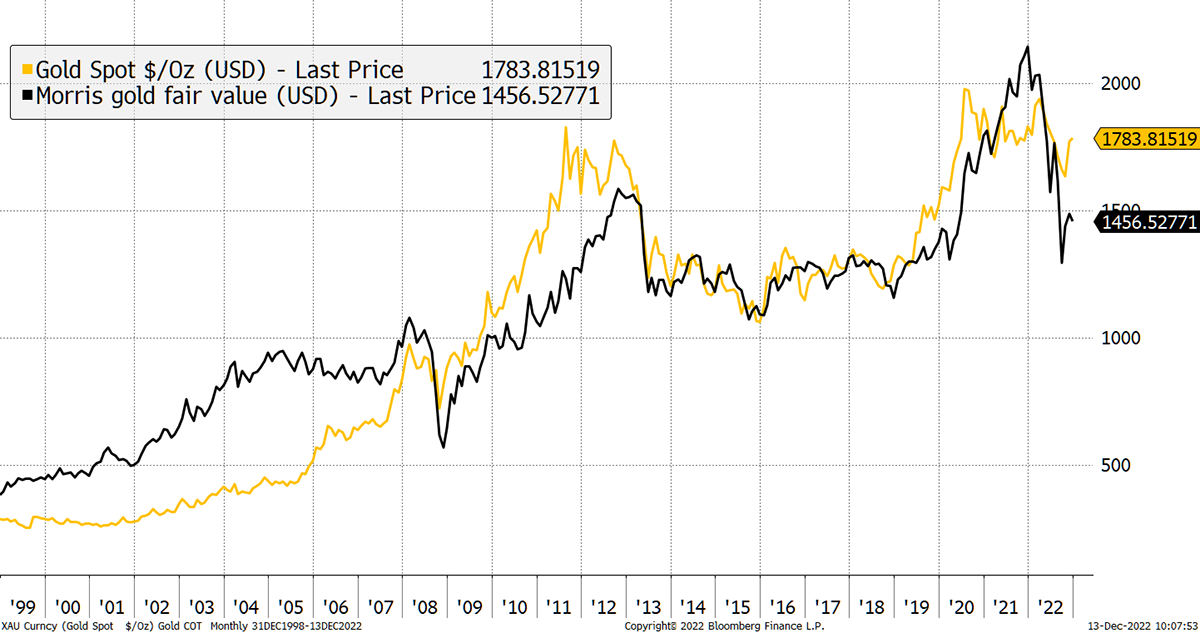

Gold has held up, in part due to its safe haven status, but also compounded by a new found rejection of US treasuries in parts of the world where they have been weaponised as a result of the war in Ukraine. Confiscating Russia’s reserves has consequences, and has made gold a more desirable alternative to treasuries. It has also made it more expensive.

If interest rates keep on rising too far, bond yields will follow and push real rates up again until the system chokes. High real rates make cash and bonds attractive choices, which is why I have embraced TIPS, which lock in higher real rates. On the flip side, gold is at risk because it prefers real interest rates to be falling, like they did between late 2018 to mid-2020.

That said, TIPS and gold are highly correlated. Over the medium-term, I expect real rates to ease back, but the scale of the pricing gap is alarming. I currently see TIPS as less risky with similar long-term inflation protection.

Mind the Gap

Source: Bloomberg

That is why I am happy to have a lower-than-normal position in gold and opt for TIPS instead. That said, I have kept a little gold and continue to hold silver and gold miners in Whisky for the time being. The miners are cheap, and silver remains historically undervalued vs gold.

Investing in TIPS

Some readers have struggled to buy the CG Real Return A Fund because their platforms won’t allow it. The best thing you can do is ask them to add it, and there is no reason why they shouldn’t. If you really can’t buy it, then I will reluctantly offer an alternative.

The iShares TIPS ETF (ITPS) trades in GBP, is unhedged and invests in medium-dated US TIPS. The CG Fund has 80% allocated to US TIPS at present because that is where they find the best value, but this will change over time. Index-linked bonds are a complex beast, and I believe the experts will do a better job than the trackers. I like the way CG scour the world for the best value they can find in index-linked bonds, and their long-term track record is excellent.

At some point, real rates will turn down again, presumably as the Fed “pivots” and starts looking at rate cuts. When that happens both TIPS and gold will enjoy capital gains once again. But if my calibration between these two assets is correct (it has been, but things can change), then I expect TIPS to do much better. Moreover, they offer good value in absolute terms, and if real rates keep on rising, they offer relative safety over gold. What I really hope to see is not gold fall, but real rates turn the corner so we can own both with confidence.

My final point here is that I have never seen the gold vs TIPS prices this far out of line in the absence of a disinflationary shock, such as in 2008. But even back then, had you bought the low in TIPS, you’d have beaten gold, only with less risk.

This conversation is important because now that real rates are back in positive territory, I want to periodically switch between gold and index-linked bonds (TIPS, gilts or other) on a tactical basis. Up until now, owning gold was the right choice. I believe that could change.

The Economy

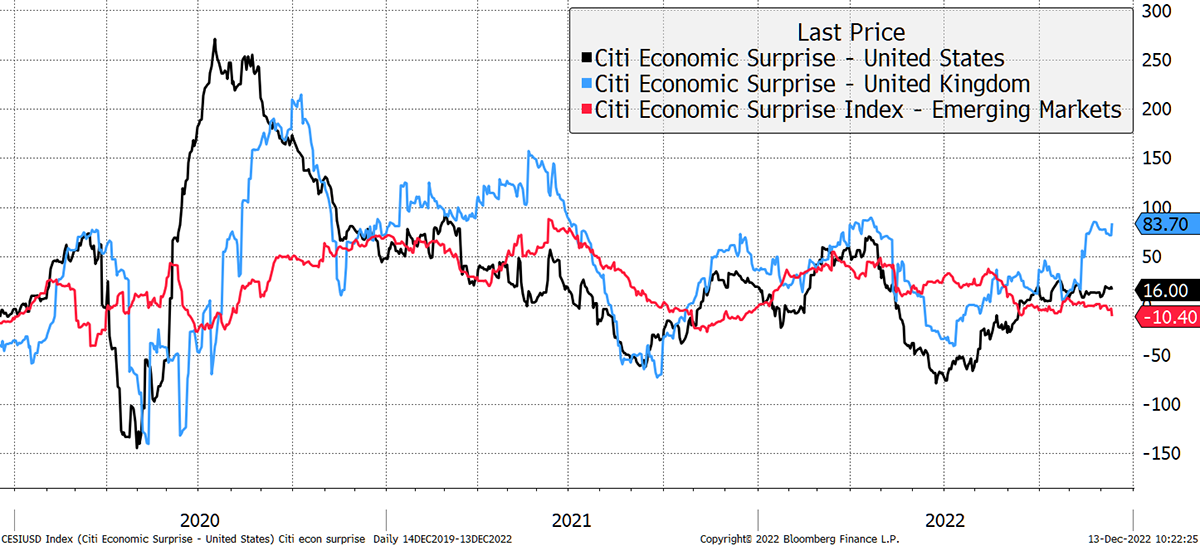

Currently, rates seem to be more important than the economy. If or when the US economy nosedives, that would change, and the stockmarket would focus on profits. Surprisingly, the current economic data is perkier than generally perceived. It may be bad, but it ought to be worse. The Citi Economic Surprise indices show this, where above zero shows improvement, and below zero, contraction.

Economic Surprises Can Be Surprising

Source: Bloomberg

In recent months, the US has been doing slightly better while the Emerging Markets are softening. The UK isn’t doing too badly, which you don’t read much about. Now there’s a surprise.

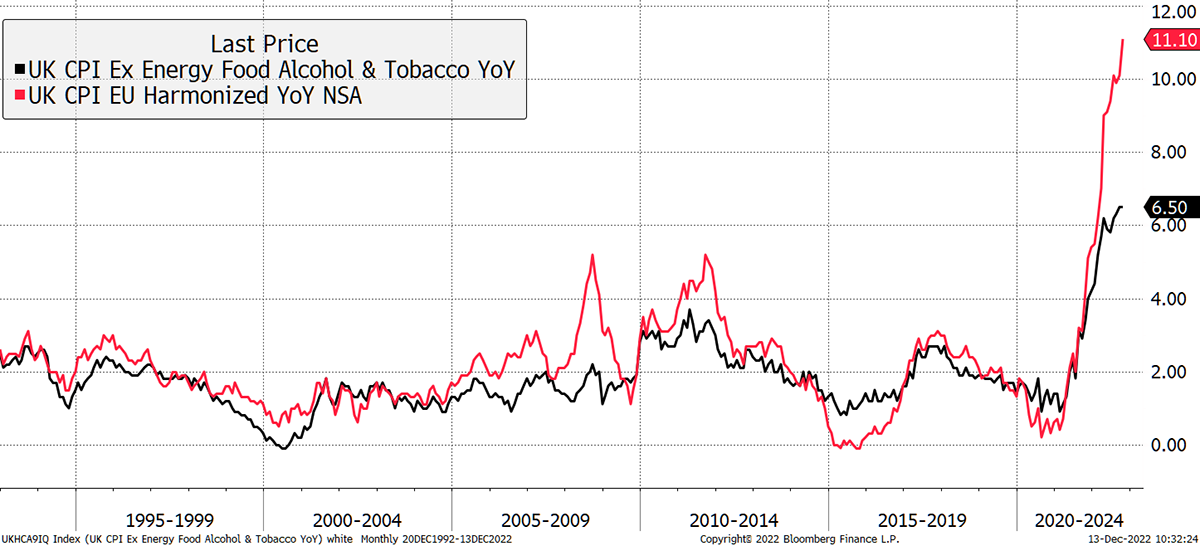

Have a look at UK inflation in red. In black, energy, food, alcohol, and tobacco are stripped out. Life without those bad things is surely less fun, but the culprit is not booze and fags; it’s energy. UK inflation, excluding the energy shock, is probably peaking.

UK Inflation Is an Energy Story

Source: Bloomberg

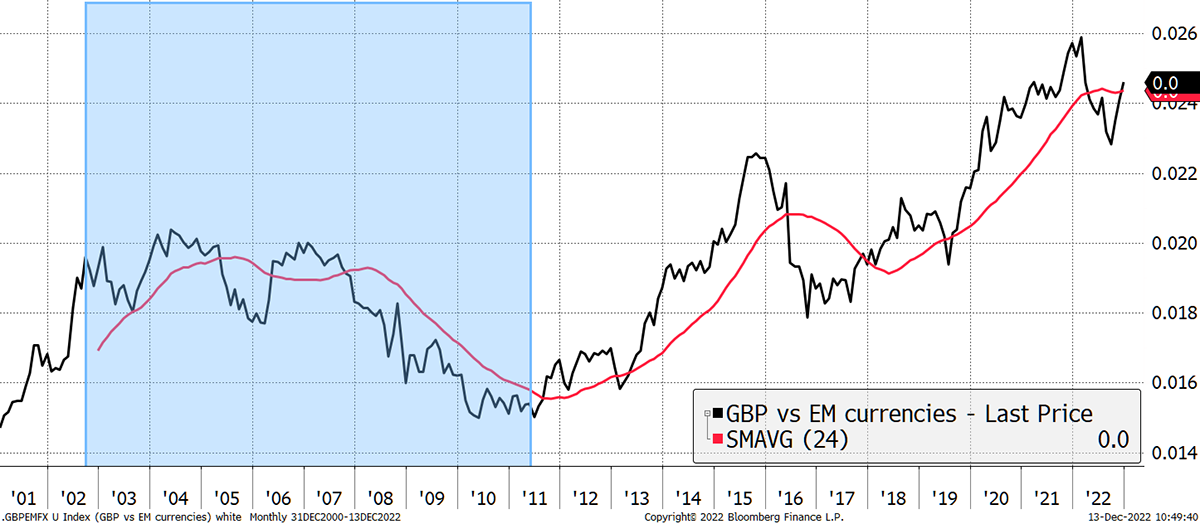

There’s one more point I would like to make on emerging markets. They probably aren’t enjoying the rate hikes much either. The dollar has eased off, but is a long way from being in a bear market like it was in the noughties. I show the pound, which was strong at the time vs emerging market currencies. In the blue box, the emerging markets were beating the pound. I feel we need this condition to once again be true before we fully embrace emerging markets again.

The Pound Is Beating Emerging Currencies

Source: Bloomberg

As I wrote last week, I am bullish on the long-term valuation case in emerging markets, but I think we have time on our side before we need to get more involved. On that note, thank you for your excellent comments, which are published in the postbox.

A Note on the Portfolios

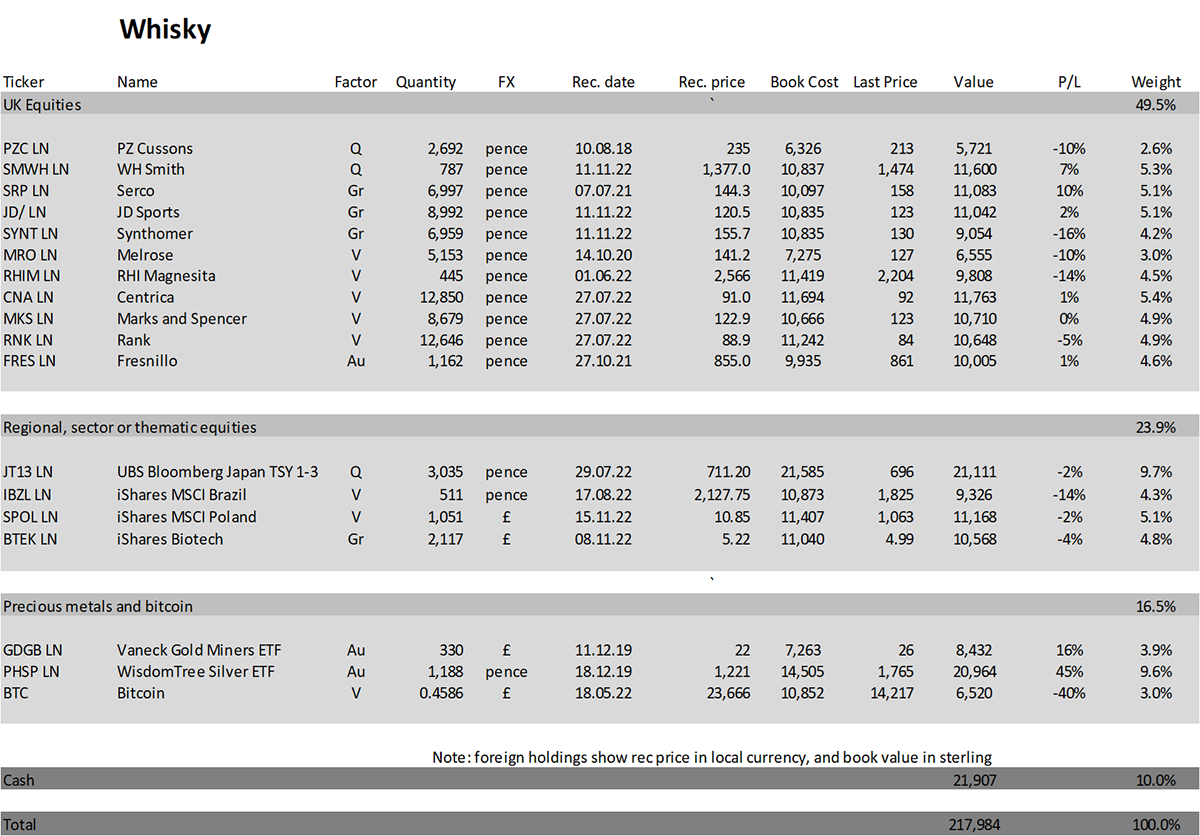

Both Whisky and Soda have eased back in recent weeks. The main problem has been sterling strength which has devalued global exposure, of which there is plenty.

Synthomer (SYNT) has got off to a poor start, but then again, my recommendation did push the price up, and I recorded the following day’s close. I see it as a classic deep-value situation, and today they announced the sale of a non-core division for $255m. This is in line with the CEO’s stated strategy to focus on areas of market leadership. Best of all, it boosts the balance sheet where there were some concerns. Hopefully, this announcement puts that to bed. Hold.

I am also underwhelmed by the recent purchase of Temple Bar (TMPL), a UK value investment trust. They buy undervalued companies, which haven’t been rewarded of late. I have no doubt it will work out well over time. That’s the thing with value; you get paid to wait. Hold.

Postbox

Thank you for the many good points made on emerging markets and on investing in China. I have posted some of your (edited) comments.

You asked whether we had strong views about investing in China. I don’t have strong views “against” across the board. There may be some investment opportunities that I might want to avoid from an ethical standpoint, and those would include ones such as where it was found that the company was exploiting or maltreating its employees. I also would not be keen on any venture that was unjustifiably detrimental to the global environment and global wellbeing, economically, climatically, politically or otherwise. I write “unjustifiably” because, for instance, I do believe we need to explore for enough new oil to tide us over until greener solutions can come online.

And…

When I started teaching (maths) in the mid-eighties independent schools were beginning to realise the considerable potential latent within the Hong Kong ‘market’. Hong Kong boys started to arrive and within a few years made up about 10% of the intake. Occasionally parents of UK boys would bemoan the fact their drilling in arithmetic and algebra gave them an unfair advantage, but in any case, this advantage would eventually dilute because they didn’t have the inbuilt advantage to exploit this early training. The first comment is true; the second isn’t. They arrived extraordinarily well prepared and when the time came for them to be creative, they had a powerful ready-made engine to switch on. They are, in general, industrious, polite and very good company. Several were outstanding musicians (often violinists) and made a huge difference to the school orchestra. Paradoxically perhaps they enabled the school to preserve its Englishness.

Following Hong Kong’s reorganisation in 1997 things began to change slowly but definitely. With spreading aspiration within China, I suppose, we began to admit boys from ‘mainland China’ (the Hong Kong boys’ descriptor). Some of these Chinese boys were among the best mathematicians I have ever taught. (China is surely highly efficient at elite education). They were less likely to be trained musicians but shared other great qualities - courteousness, industry and yes, creativity. They were at once sensitive to ‘English’ values, and also gently assertive of their own culture. Typically, they would go on to do Economics, Medicine, Science, Maths (including computer science) and Economics. Some stayed in the UK, some to USA, some to Europe, some back to their homeland. This first generation will now be in their mid-forties, give or take, and, presumably, there will be those among them who are substantially influencing the Chinese ‘transition’ - for want of a better word. I think many will be doing great work. So, as you say, there is the regime and there are the people. I would have great faith in the people and would strongly support the investment argument.

And…

On China, I was one of those investing prior to 2008. It was a strong story, and perhaps still is. I think it’s very easy to make a moral case against investing (the same having been true for Russia), but where do we draw the line? As with ESG investing, the nuances are many and we risk tying ourselves in knots. We risk limiting our investing universe to a very small number of countries with less scope for growth. Often principles fade into the background if the investment case is strong enough, so why not simply focus on the fundamentals to begin with?

And…

Whilst I don’t think much of the undemocratic Chinese political regime and its treatment of minority groups, it wouldn’t stop me investing in the country. However, when investing in Emerging Markets and/or the Far East, I would prefer to minimise the percentage of investment in China so, if possible, perhaps you could recommend a trust or ETF that does this. Obviously, any such trust/ETF would still have to have a good enough performance potential to be worth your recommendation and, if you can’t find one, so be it. I would still invest in whatever you did recommend.

And…

Most of world is, apparently, entering a recession although I see the US numbers are better than most. I think USD is more likely to rise in that scenario and therefore a wait until much later would seem prudent?

And…

Regarding China, may I repeat a short extract from Russell Napier? The escalating Cold War brings with it the risk of capital controls and de facto a complete loss of capital.

And…

As developed world capital goes increasingly in search of growth assets to defend wealth from financial repression, it will realise that Asia ex China assets offer the probability of high returns particularly in US dollar terms. I follow the Soda/Whisky portfolios exactly, but China makes me nervous.

And…

My concern is China. Firstly, I do not view it as an emerging market, it is far more comparable to a developed market. Positives, the country has no inflation, and can certainly stimulate more aggressively when it chooses to, and that should be good for growth. Negatives, it’s debt pile, property market and rule of law.

And…

Will the seemingly ongoing rhetoric over Taiwan and a real risk of escalation potentially cause any gains to be quickly wiped out as I don’t see this issue going away?

Thank you for the many excellent comments.

Emerging market is a technical investment term, I believe, created by the index companies (MSCI, FTSE etc.). It includes South Korea, Taiwan, Iceland, the Czech Republic, Saudi Arabia and Greece, which are far from poor. I am not certain of all the definitions, but an important one is capital controls and foreign ownership limits.

A developed market refers less to the country’s wealth, but to foreign shareholder rights and capital freedoms. On this basis, China is an emerging market, although still a powerful nation. The debt pile is certainly a concern, but that is an investment consideration as opposed to an “investable” consideration.

I sense readers are happy to embrace emerging markets but would prefer I skirt around China. It could be a part of a diversified Asia or emerging market allocation. But then, if the market goes bonkers, will we change our minds? A rising market is not only attractive, but seemingly more credible.

Howard Marks’ comments from last week’s issue are important. China may well play political games and attack their neighbours, but they haven’t broken capital rules when it comes to respecting financial markets. I agree that equity holders’ rights could be better, but bond holders seem to be respected. That means Chinese single stocks are riskier than diversified baskets. If they switched off their financial markets, they would be out in the cold. Xi does not want to end up like Putin.

The knowledgeable people I have spoken with say there is no chance of a Taiwanese invasion over the next ten years. Taiwan Semiconductor would not be investing in the high-end chips at home if that were the case. The new US plants are not getting the best technology which stays in Taiwan. But expect to keep on hearing plenty of sabre rattling. For China, fear and contradiction is an important part of their strategy.

As for timing, we will move slowly. While valuations are low, we need a catalyst. I have mentioned currencies, which will be important. Above all, we wait for the Fed to pivot.

Overall, very much looking forward to seeing how you propose gaining exposure to EM. Whether through an active manager via a trust or fund focussed on EM, or passive, through selecting a broad ETF for the sector as a whole (which no doubt includes China), or targeting pockets of emerging markets through an ETF or possibly a trust or fund e.g. Brazil, Mexico, India, Vietnam. The movement of manufacturing to Mexico and Vietnam from China could be very positive for these economies.

We will embrace multi-country ETFs and single-country ETFs, and perhaps an active fund or investment trust in Soda if I can find one worth buying. Most value managers disappeared as the surviving emerging market funds focused on the internet and China’s tech scene.

As always, Soda will keep it simple, while Whisky will embrace narrower opportunities. We will see how things evolve. My main aim has been to get people thinking about this and draw the battle lines. These excellent comments have helped.

I was already enjoying the free articles on ByteTree as a holder of both crypto and gold, and just upgraded to the Premium service having previously subscribed to the FLS via Southbank. It’s a huge loss for them, but a gain for readers in terms of value for money, with so much well researched and informative content. So congratulations to you and the team; I hope all continues to go well for you.

I am sorry you own crypto in 2022, as it hasn’t seen the best of years, but thankfully gold has done better. I remain committed to crypto and am convinced it is a new asset class that will sooner or later end up being legitimate and mainstream. Rather like the internet stocks, which were persona non grata in the late 90s, only to end up dominating the indices two decades later. That said, I fully understand why so many people view the space with caution.

After the recent dramas, where the blockchains have done no wrong, but various individuals have, I look forward to regulatory clarity and the entry of the big investment banks providing professional services within the space. Things can only get better and there’s been a nice jump in bitcoin today.

Might I suggest that you always include a paragraph beside the whisky and soda portfolios telling investors how the two portfolios are intended to be used together, e.g. in a 60/40 or 80/20 split. Those of us who have been following you for a while would, of course, already know this but it would be helpful for new investors.

Here goes… and it will remain a permanent fixture. Thank you. A very good idea and regular readers will know to skim over it.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC Plc in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 40% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

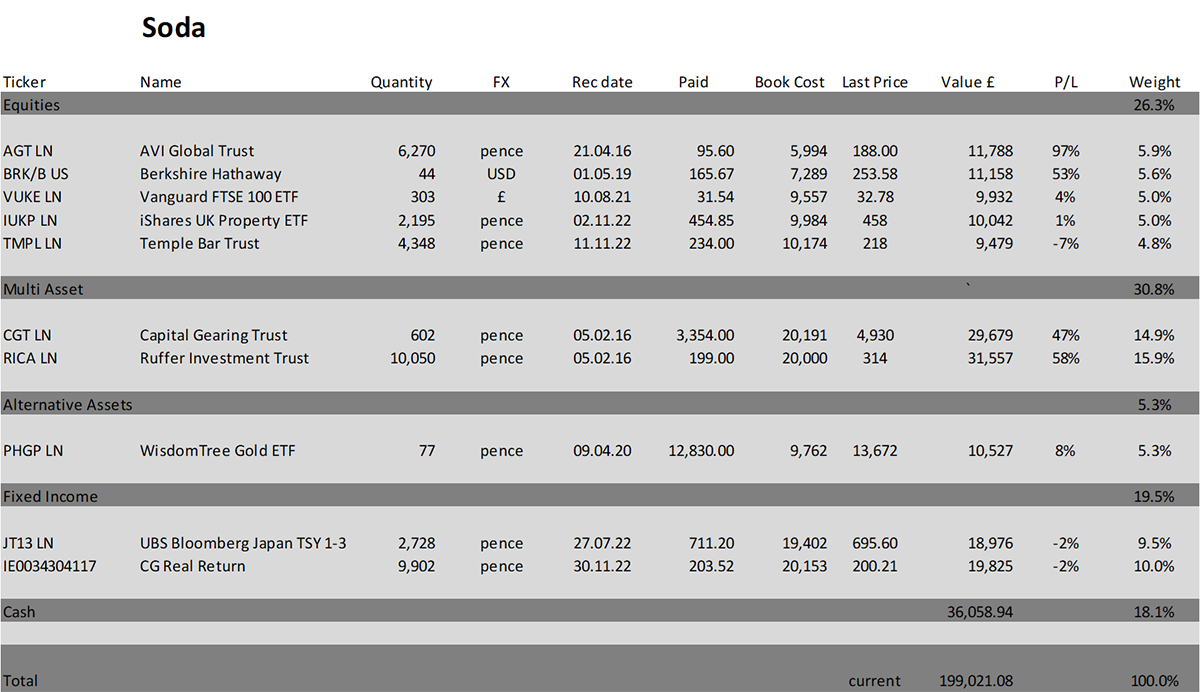

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.9% this year and up 99.0% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.3% this year and up 118.0% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

The message from the market is that rate hikes are working, and the battle against inflation is being won. That is, if you exclude energy. This has the potential to be a real boost for markets next year. Let’s hope it lasts.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()