Looking Ahead to 2023

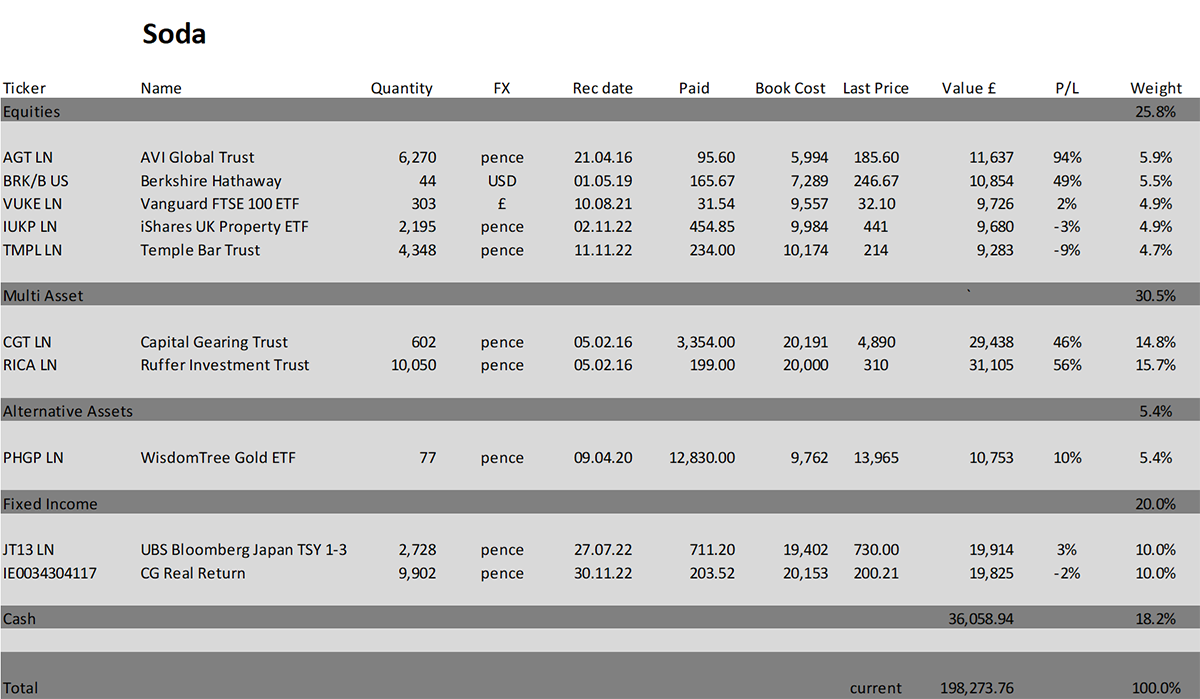

Trade in Soda

Welcome to ByteTree Premium, and thank you to the new readers for signing up. Please take a moment to familiarise yourself with ByteTree Premium. There’s lots happening on the site, and no doubt some of you will be perplexed by the amount of research available.

You may well ask, where’s Santa? There’s no December rally this year, and I will be reducing risk in areas where lower prices now seem inevitable. US equities jump off the page, and while Berkshire Hathaway is defensive, I am taking profits. Everything else is a hold.

2022 has been a tough year, but we got through it. I started the year relatively bearish, believing the surge in interest rates and inflation would be bad for stock and bond markets, especially bonds. I was also skeptical of the big tech companies and large US stocks in general, which traded on premium valuations. Big tech is under pressure again, and we mustn’t forget that Berkshire Hathaway has a large holding in Apple.

A year ago, I was somewhat contrarian with holdings in mining, energy, and defense, which raised eyebrows. Mainstream finance had rejected these areas, only to change their minds when Ukraine was invaded. These holdings have helped, but haven’t been enough to land a great year. Not everything has worked, but with both portfolios in positive territory, in a market full of casualties, I am pleased with the results.

Now that the full force of rate hikes is likely behind us, I have become more constructive. That is not yet outright bullish, but the good times will return. In 2023, we will continue to position for recovery, notwithstanding that we face, or are already in, a recession.

A Memorable Year

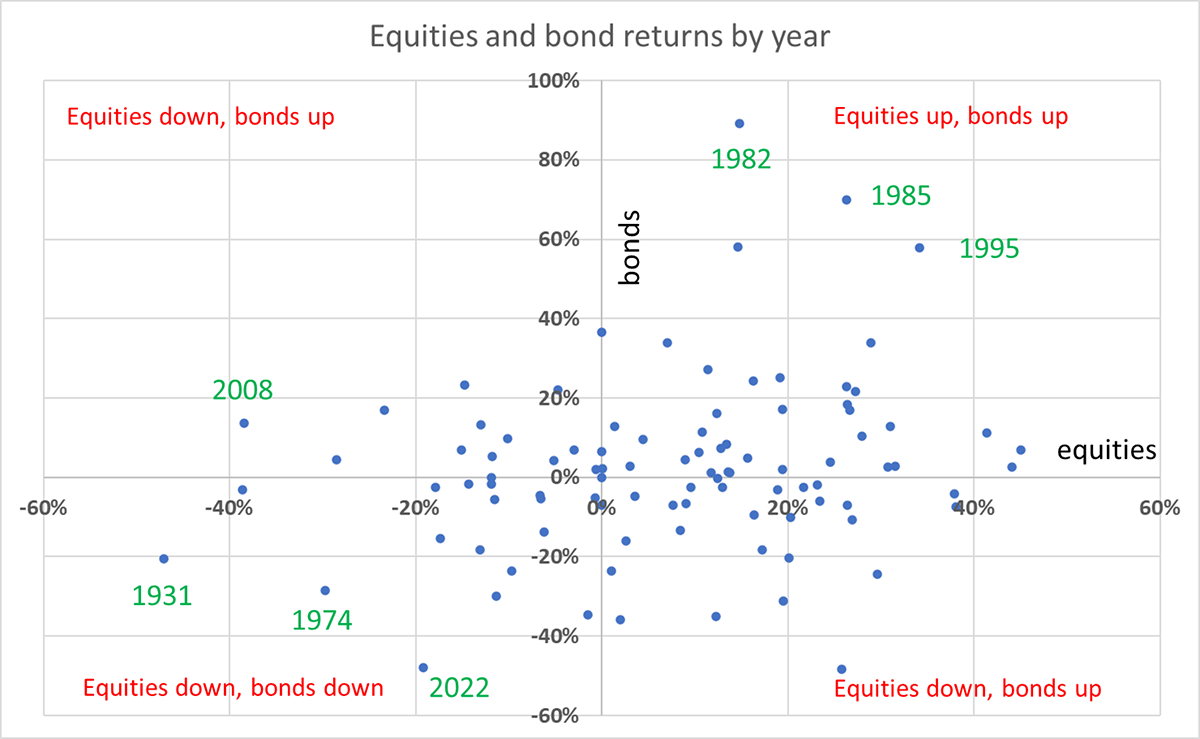

To recap on 2022, I show this chart of annual returns for US equities and bonds going back to 1920. The chart has been doing the rounds, and I have recreated it using Moodys and S&P 500 bond data from Bloomberg. Generally speaking, we see good years with equities and bonds up (top right), mixed years with one up and the other down, and relatively few bad years with both bonds and equities down. 2022 makes it onto the list of extreme years.

Source: Bloomberg

2022 was the worst year for the long bond on record. That shouldn’t be a surprise as it’s not often that interest rates move up from 0% to 4.5% in short order. It has never happened before, and I doubt it ever will again during our lifetimes. I am not saying rates can’t rise by 4.5% in a single year. They can, and will, but they won’t start from zero. My hunch is that future historians will snigger at the post-2008 zero interest rate policies, and as for negatively yielding bonds, they will be rolling around in hysterics.

I have marked a few interesting years in green:

- 1931 - Mid depression

- 1974 - Inflation fight

- 1982 - Aftermath of rate hikes

- 1985 - Aftermath of rate hikes

- 1995 - Aftermath of rate hikes

- 2008 - Financial crisis

- 2022 - Inflation fight

You can see where I am going with this. When the inflation fight is over, and therefore the rate hikes, we can look forward to better times ahead, just like we saw in 1982, 1985 and 1995. I can’t promise it will happen in 2023, but if it doesn’t, 2024 ought to be a shoe-in.

Bonds are now much better value than they were, although they’re not yet cheap. US inflation-linked bonds are cheap because they lock in positive real returns, regardless of what happens to bond yields. You end up with inflation+ returns, whether inflation is 1% or 10%.

In equities, most of the world offers good value, especially the emerging markets. Yet I’m perplexed how US equities still trade at a significant premium to the rest of the world. A safe haven for sure, but not at any price. They are under pressure again, and that is why I am reducing risk in Soda.

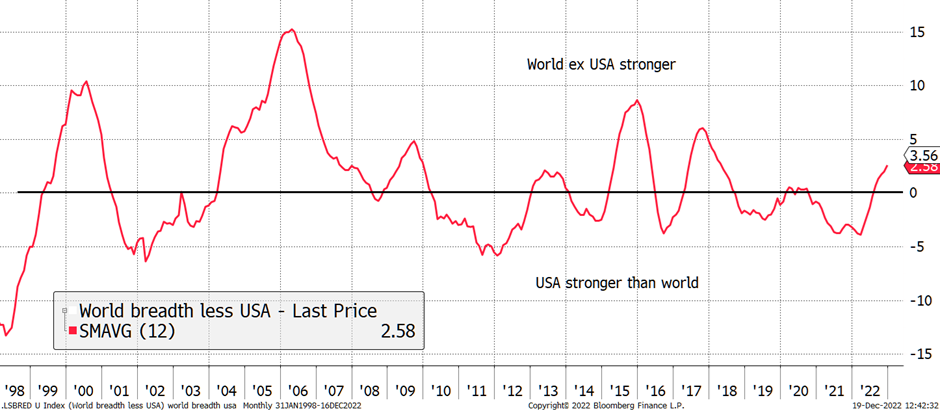

Going back 25 years, we can compare the market strength between the USA and the rest of the world by looking at “breadth”. That is, the percentage of stocks trending higher (above their 200-day moving average) around the world compared to in the USA. For the first time since 2018, the world leads the USA.

US Breadth Wanes

Source: Bloomberg

Outside of special situations such as biotech, I am in no hurry to add to US equities. Even Berkshire Hathaway (BRK), which has done so well, appears to be fully valued. You have to congratulate them for sitting on top of a $500 billion pile of short-dated bonds, which are presumably now paying over 4% interest. But that is reflected in the share price, and it is time to take profits.

Sell Berkshire Hathaway (BRK) in Soda

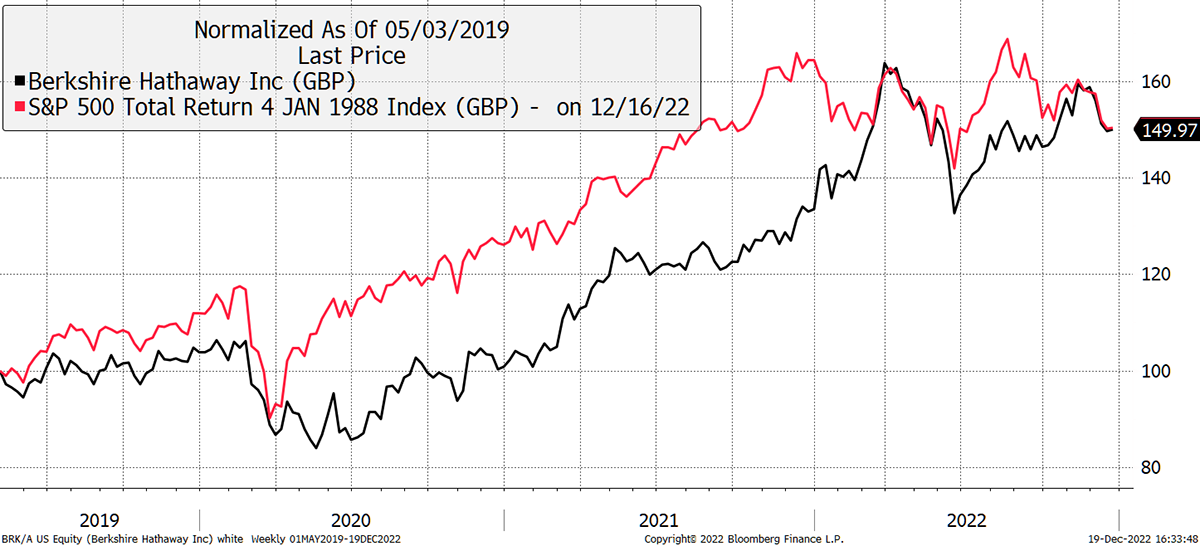

BRK was last recommended on 1 May 2019 on value grounds. Up until late last year, the S&P 500 would have been a better bet. But as things stand, the outcome has been approximately the same.

Berkshire Hathaway versus S&P 500

Source: Bloomberg

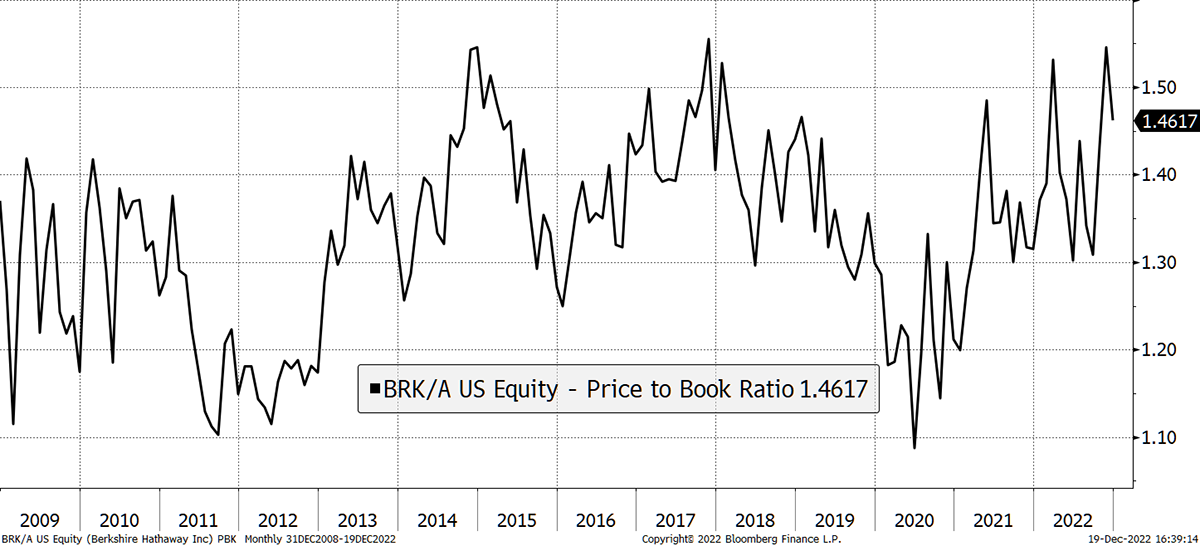

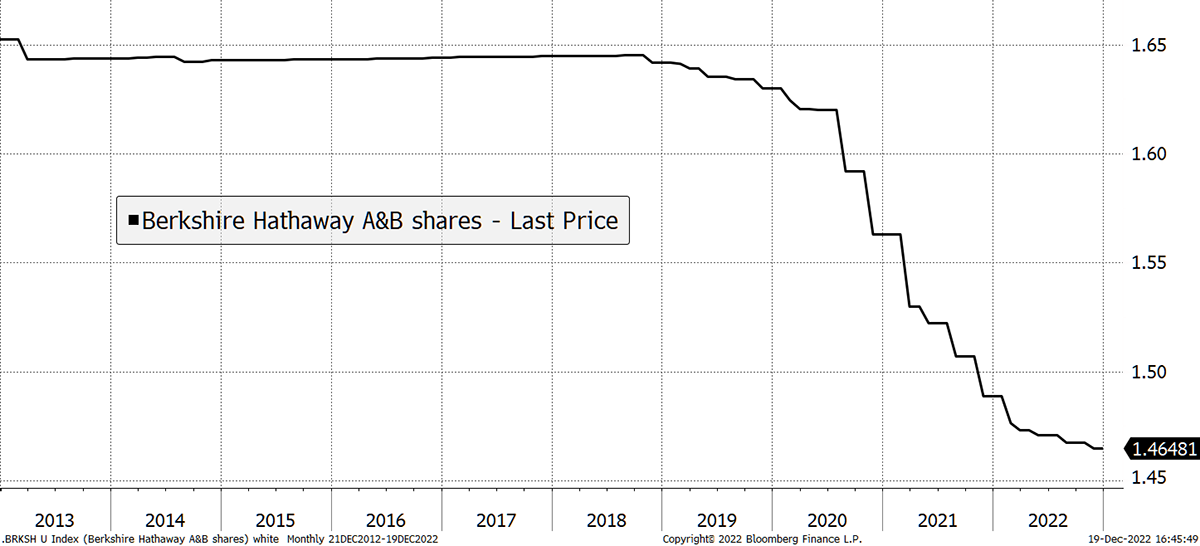

There are two things which make me believe this is a good time to take profits. Firstly, the valuation is at the top of the 10-year range. The Chairman, Warren Buffett, has previously insinuated that they would buy back stock at 1.2x book, a level where he deemed BRK to be undervalued.

Berkshire Hathaway Price to Book Ratio

Source: Bloomberg

In 2019, BRK had nearly 1.65 million shares (including equivalent B shares) in issue. As BRK was undervalued at the time, and even more so in 2020, BRK bought back 11% of the company’s shares. Now that BRK is trading close to 1.5x book, those repurchases have slowed. The message from Buffett is that he no longer sees value in his own company, despite sitting on a huge cash pile, and we should take notice.

Berkshire Buybacks Are Stalling

Source: Bloomberg

This is a good time to take profits because the good news is in the price, and US equities are not the place to be in 2023. No doubt we will revisit BRK in the future, and I will not hesitate to recommend BRK again when the valuation cools.

Action: Sell Berkshire Hathaway (BRK) in Soda

UK Property

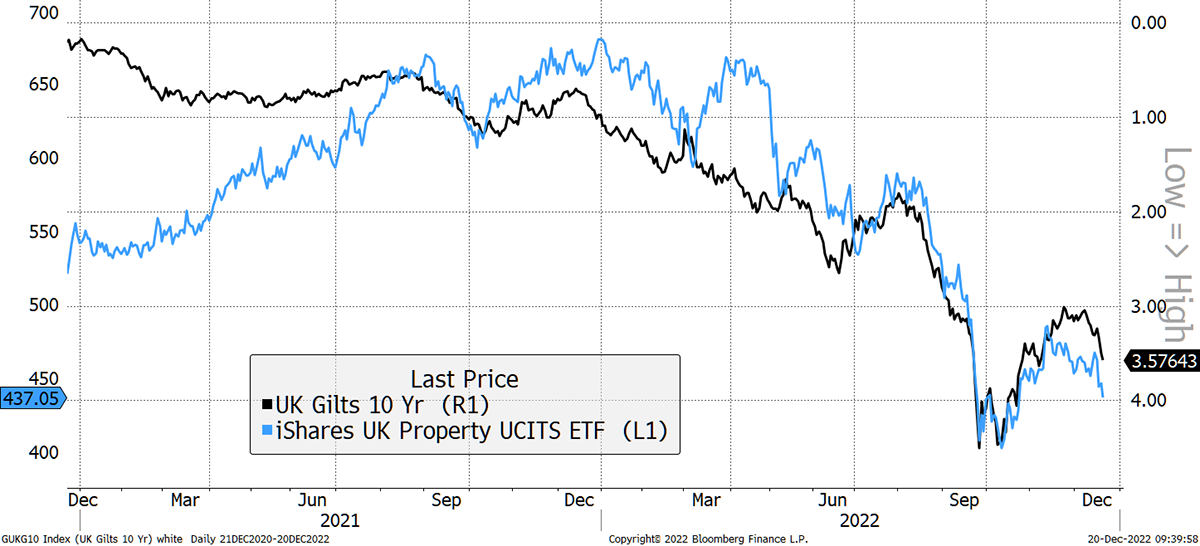

Bond yields have been cooling of late, and the chart shows how the iShares UK Property ETF (IUKP) has become highly correlated with UK bond yields (shown in black inverted, so down means up). Some of the smaller holdings in IUKP have sold off, but the higher-quality companies are proving resilient. In my note, I highlightedhow the price to book value of listed UK property has already priced in sharply lower prices for next year.

UK Property Is Following Bonds

That UK property is clearly negatively correlated with gilt yields is probably a good thing because it is rational and tells us that other factors have been eliminated. If gilts sell off next year (yields up) then IUKP will fall. But be sure that commercial property, unlike gilts, will be able to increase rents along with inflation over time. That is unlikely in 2023, if the recession bites, but it will prove true in the long run. I will hold.

Soda in 2023

The Soda Portfolio demands less risk and greater diversification. That means I need to find equity and bond funds alongside gold. I have cooled on gold in the short term in favour of TIPS, but the market is still rewarding gold. Maybe the 10% TIPS, 5% gold split should be 10%/10%. That is a decision for next year. It is easy to see how gold is underpinned in the medium and long term, but I see risks in the short term.

I remain convinced that TIPS currently offer a better risk versus reward trade-off, but the market is the ultimate judge, and be sure this is at the forefront of my mind.

The rest of the bond market doesn’t yet interest me very much, and I’m struggling to identify suitable diversified equity funds worthy of an allocation to Soda.

Most diversified index investments (regional) seemingly fail to stack up. The UK and Europe are outperforming, but I believe we own enough already, and Europe doesn’t offer us much diversification benefit. As you know, I’m gunning for emerging markets in 2023, but I believe time is still on our side. Japan too; a subject I haven’t visited for a while (third time lucky?).

The market is telling us to seek out first class active, value-orientated managers as opposed to index funds (ETFs). Let the search begin, but that won’t be easy as so many value funds have closed down. Such was the power of the growth era that fund management firms gave up and fired their best value managers. Who’s left? Ideas please! They must be UK retail investor friendly and readily available on platforms.

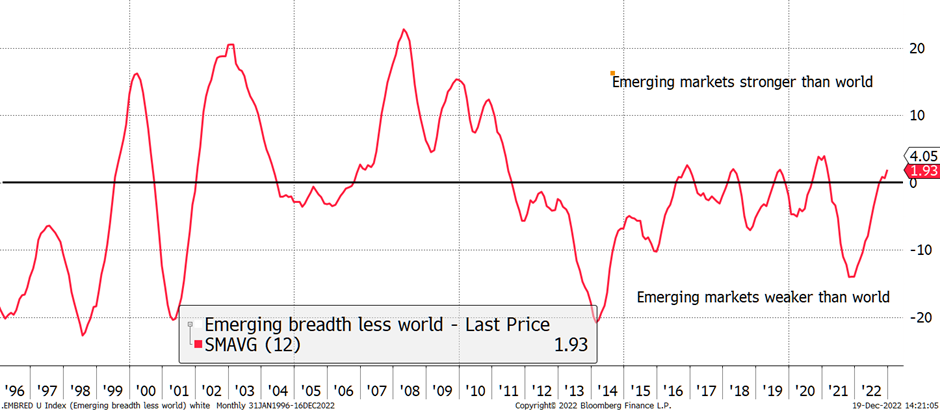

Looking at that same breadth comparison between the emerging markets and the world (including the USA), the signs are encouraging. From 2002 to 2011, the emerging markets spent most of the time stronger than the world (more stocks had positive trends), only for that to reverse in the following decade. Might this latest signal sustain? That seems likely.

Emerging Markets Are Warming up

Source: Bloomberg

I am already seeing bullish trends emerging in Vietnam, China, Thailand, and Malaysia. They are not strong in terms of price, but they are now beating the world. It begins.

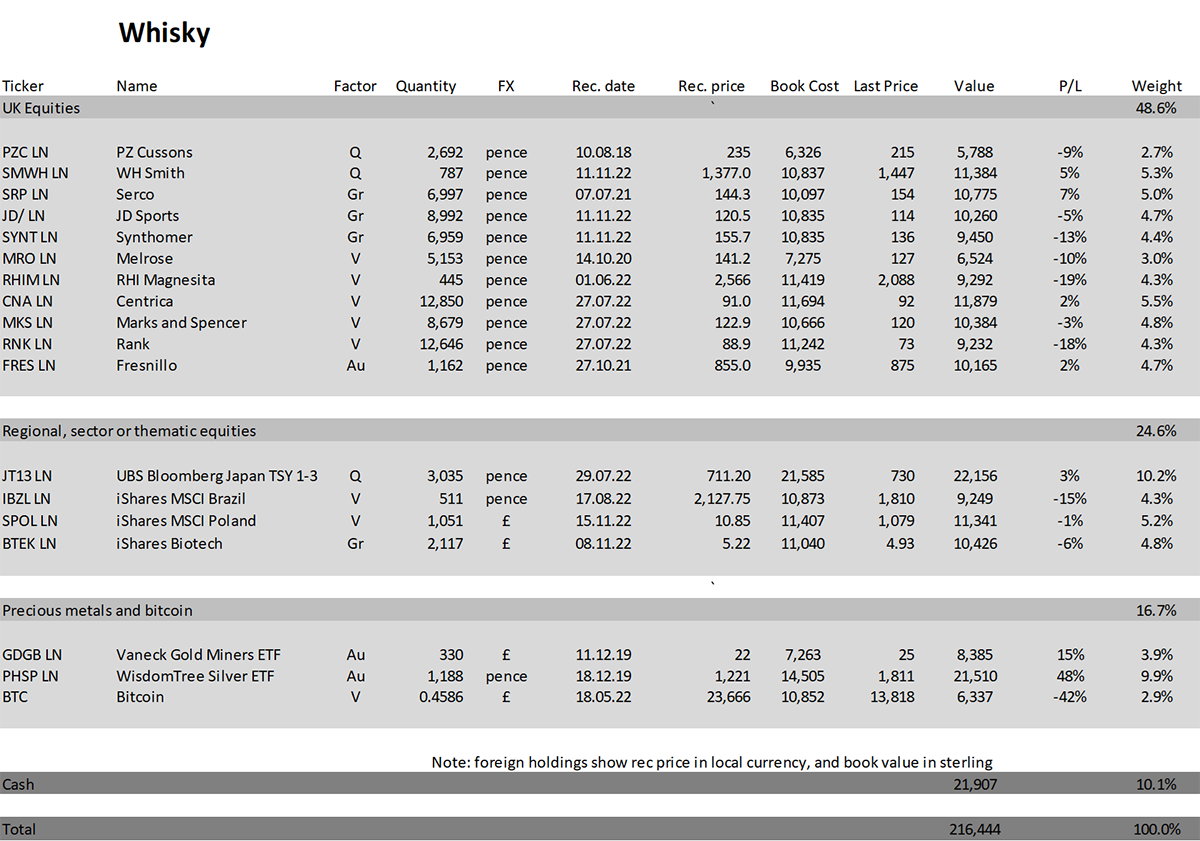

Whisky in 2023

In Whisky, I have found plenty of situations that I believe will work out next year, but we may face continued volatility. That contrasts with Soda, where good trades are hard to find. This is because there are plenty of good needles in the haystack but not enough compelling haystacks.

I am frustrated that the recent recommendations in Whisky haven’t collectively fared better. There was inevitably going to be a mixed outcome. But a couple of standout winners would have been nice. All of the stocks held in Whisky have low or ultra-low valuations, but we may have to be patient before being rewarded. I am confident we will get there next year.

The most important thing, as always, is not necessarily what we own but what we don’t own. It is statistically inevitable to stumble across winners if you aim in the right direction with value combined with improving fundamentals. We have the former; the latter will come.

I could make many more recommendations in Whisky, and there are some good ideas on the watch list, but I will not add more until things improve.

The Yen

It is always best to save the good news until last. The Bank of Japan announced that they will continue to control their bond market but have allowed the yield to rise to 0.5% compared to the previous cap of 0.25%. The bond market duly complied.

Japanese Bond Yield Rises

Source: Bloomberg

This caused the yen to surge, reminding us that holding short-dated Japanese Government Bonds is an efficient hedge. A deflation shock, or further tightening of their policy, will see the yen soar. This is the sort of thing that is most likely to work when all else fails. The yen is now 43% undervalued. Hold.

The Yen Is Still Cheap

Source: Bloomberg

Action: Sell Berkshire Hathaway (BRK) in Soda

Postbox

A bit of a blow regarding the profit warning from Rank (RNK) Group. Should we continue to hold?

The Chinese are yet to arrive sir, and the stock is dirt cheap. Be patient.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC Plc in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 40% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means that the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.5% this year and up 98.3% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 4.6% this year and up 116.4% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

My next issue of Atlas Pulse on gold should come next Tuesday, just as you are having a post-Christmas snooze. I’ll be questioning the gap between TIPS and gold in more detail. Do cheap TIPS understate inflation and forecast recession? Or has something fundamentally changed as US treasuries have risk that they previously didn’t? A bit heavy for the Christmas break, perhaps, but an important conversation.

If you do have some downtime over the holidays, then please spend a moment having a wander around ByteTree. Make sure you are receiving what you want to receive and are familiar with the site. The terminal is fun, and I particularly enjoy the ByteTrend ETF function.

In 2023, my main effort will be to identify value and protect capital until the situation improves. That is fully reflected in a cautious Soda portfolio.

I know some of you want to know who really writes The Multi-Asset Investor. Clemmie and I wish you a very Happy Christmas. See you on 3 January.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd