UK REITS Are Oversold. What to Buy?

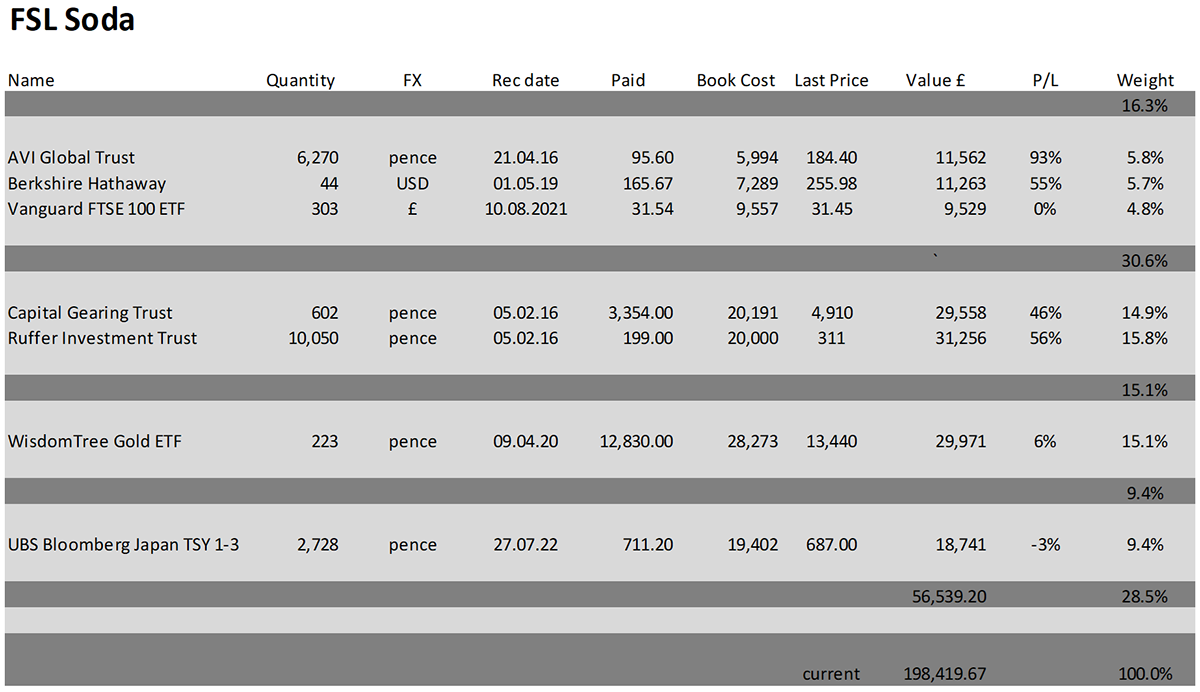

New Recommendation in the Soda Portfolio

The recent woes in the UK pensions industry, driven by rising interest rates, have caused UK assets to be dumped. They took on interest rate derivative bets that benefit from low rates. As interest rates have risen, the pension funds have become forced sellers of assets, including commercial property. For investors on the lookout for value, that now presents an opportunity.

I have been no fan of commercial property this cycle, for the same reason I have been avoiding bonds. Prices have been high because interest rates were low. That has now changed, as bonds have slumped, and property is undergoing a correction.

While that correction is still underway, the listed property shares have nosedived. They are pricing in a severe slump, and I believe there is a sufficient discount that provides investors with a margin of safety.

As a result, I am starting the process of adding property exposure using the iShares UK Property REIT ETF (IUKP) in Soda. It is simple and diversified.

Last year, we briefly held Derwent London (DLN) to take advantage of the post-pandemic office recovery. Sensing that rates would become more important than the question of working from home vs the office, I cut the position. Given recent events, that was the right decision, as prices have dropped considerably.

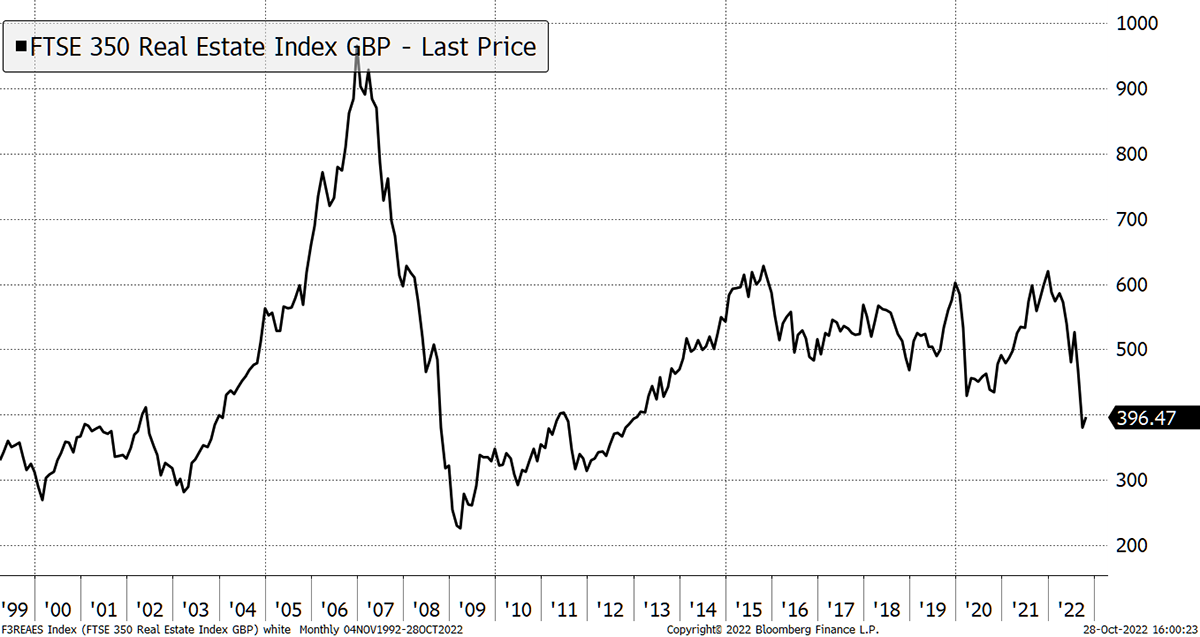

The FTSE 350 REIT Index is home to Segro (SGRO), Land Securities (LAND), British Land (BLND), Unite (UTG) and many others, thus capturing a material slice of the overall UK commercial property market. Who would have thought that UK listed property would collectively show zero growth over the past two decades?

A Surprisingly Lacklustre Journey for UK Commercial Property

Source: Bloomberg

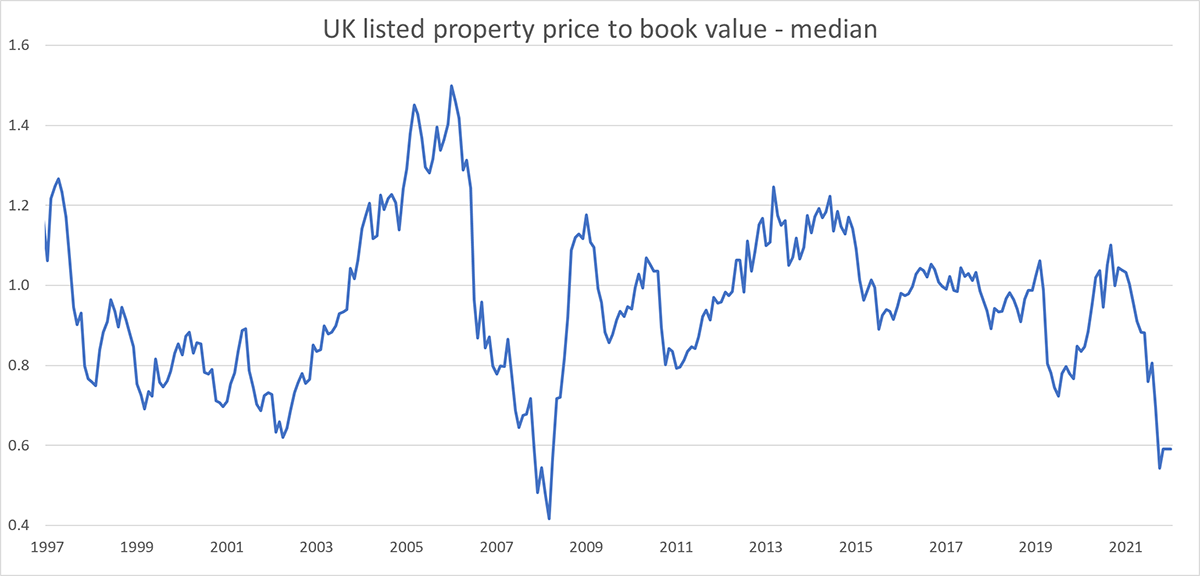

Underlying property prices have done better than REITS, because of an undesirable mix of overvaluation and leverage, at the wrong times. REITS slumped in 2008 because they became forced sellers in order to meet margin calls. That slump followed a bubble when they traded at a premium in 2005/6. The shift from a premium to a discount, with the underlying asset prices falling, is always painful.

Source: Bloomberg

The median price to book ratio across the REITS sector is 0.6x, which means it is cheaper to buy UK REITS than property directly. For those of you that can recall, this is a Daejan situation, where I recommended a prime property company with low debt that was stubbornly undervalued. Daejan was later bid for, which was fabulous. That said, it took a while.

A price to book value of 0.6x means that REITS would need to rise by 70% in order to return to book value. One day that is inevitable, but the risk is that book value itself falls. That is likely, but REITS have already priced that in, which means the risk of holding them is significantly reduced, and it is time to start accumulating UK listed property.

The Madness of Crowds

You have to wonder why investors sometimes pay above book value for REITS, but they do. In 2005/6, they willingly paid 50% more for listed property than physical property. Even in 2013, they paid 20% more. It escapes me why informed institutional investors willingly and repeatedly do this. Perhaps it’s because it is not their money, but other people’s.

I’ve seen it. A typical wealth manager will have 10% property (say) in their long-term asset allocation model. They will invest 10% in property, whatever the weather, because that’s what the model tells them to do! If they don’t, the risk department will call them out. If only they focused on portfolio risk as opposed to business or career risk, they’d do a better job for their clients.

I have no issue with a long-term 10% allocation, provided I can work around it. I want to own no property when things are going badly (or pricing is too high), and perhaps even more when all is well and prices are attractive.

This is the basics of active investment management over passive. But these opportunities don’t come around very often, and so you have to be patient. Patience is one of the most important skills in active investment.

The last time we saw price to book ratios down here was during the 2008 credit crisis and the 2002 recession. The outcome for REITS, after both occasions, was very satisfactory indeed.

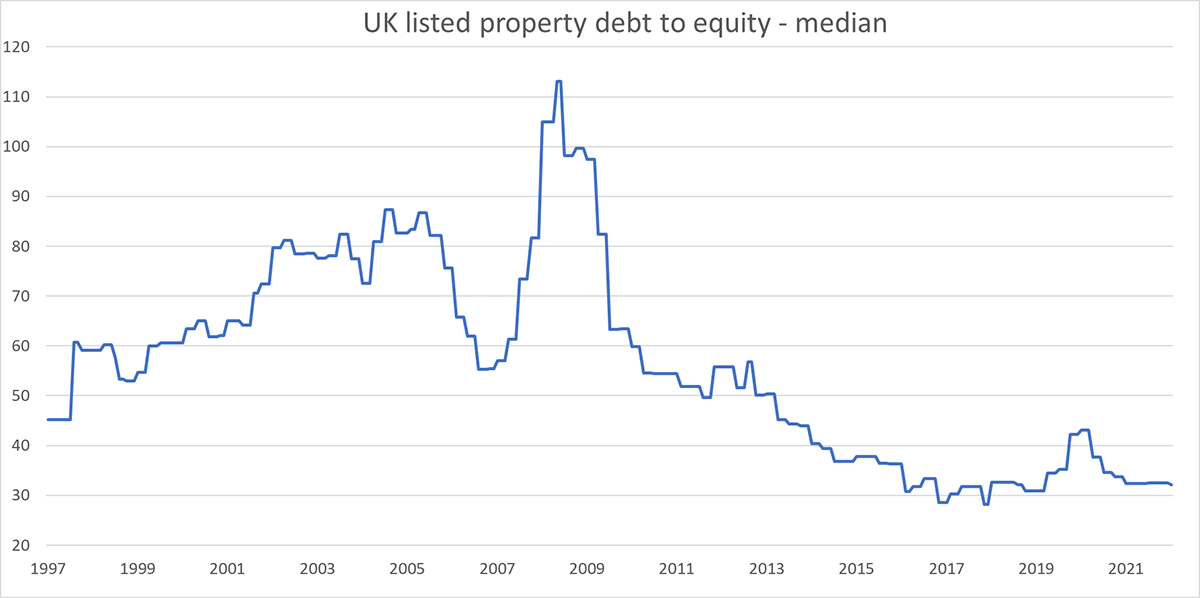

Yet there is a massive difference between buying REITS in 2002 or 2008 and today. Today, REITS are materially less risky than in the past as their balance sheets are collectively stronger. This can be seen via the debt to equity ratios which demonstrate how the sector is carrying lower leverage compared to the past.

Source: Bloomberg

In 2005, REITS carried 80% debt against their property values. That dropped in 2007, not because management caught a dose of financial prudence, but because property prices shot up in a bubble, temporarily reducing leverage ratios. When that bubble burst and property prices fell significantly, REITS were in trouble (property down, debt fixed) and have spent more than a decade deleveraging since.

With leverage ratios around 30%, it gets harder for the sector to get into trouble. Recall that REIT prices have fallen because the pension funds have been forced sellers. REITS are dirt cheap and carry less leverage than in previous cycles.

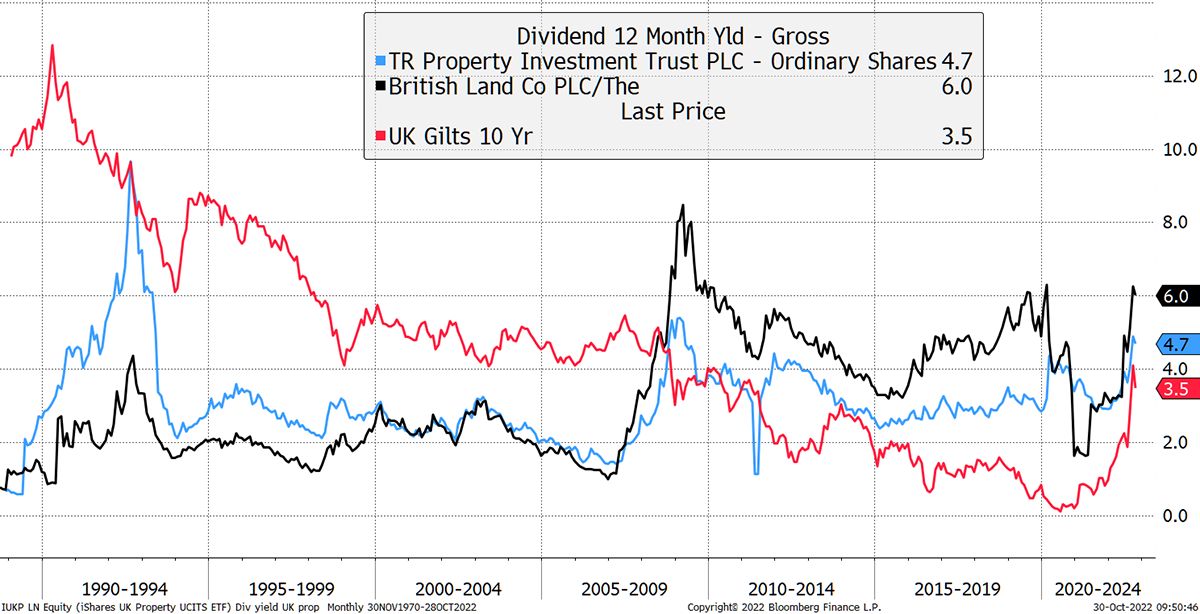

Another simple measure is the sector dividend yield, which is rarely this high. I have compared TR Property (TRY), an excellent pan-European investment trust that we have owned before, with British Land (BLND) and the 10-year gilt yield. There is a connection even if there is a lag.

UK Property Yields and Gilts

Source: Bloomberg

I used TRY and BLND because they have long histories and are large and diversified. They tell the story well.

In 1990, gilt yields touched 12%, and this was hugely problematic for the property sector. There were many bankruptcies at the time, as many readers will remember, with Canary Wharf being the poster child. Despite that, it later went on to great success following refinancing (and a tube line).

The resulting early 1990s property recession was one of the worst on record. BLND only saw their yield touch 4%, but TRY reached 10%, probably because the shares would have also traded on a significant discount to net asset value at the time. That would have been on top of the discounts of the underlying property companies held in the trust at the time. But what a recovery in 1993 (see the TRY price below).

Property and inflation

Good data on historical property prices is becoming increasingly hard to come by. The big commercial real estate companies, such as Savills and CBRE, no longer provide data to the public and the IPD series seems to have shut down. I’ve had to improvise.

We know that property is both pushed and pulled by inflation.

Higher rates put downward pressure on prices, as we have just seen, and refinancing becomes more difficult in a credit drought. Occupancy levels will also fall when economic activity declines.

On the other hand, land prices are a long-term real asset, and are an effective inflation hedge assuming reasonable valuations. Rents are often inflation-linked, which means the income growth should keep up with inflation.

My view is that when an asset is undervalued, it is much more likely to protect against inflation than when it is overvalued. Property may or may not be undervalued (depends on rates and the economy), but REITS definitely are.

Even if property falls from here, the low price of REITS has already factored that in. Once again, I turn to TRY for the long-term view. It crashed in the 1972 to 1974 bear market and thereafter, didn’t look back until the 1990s recession.

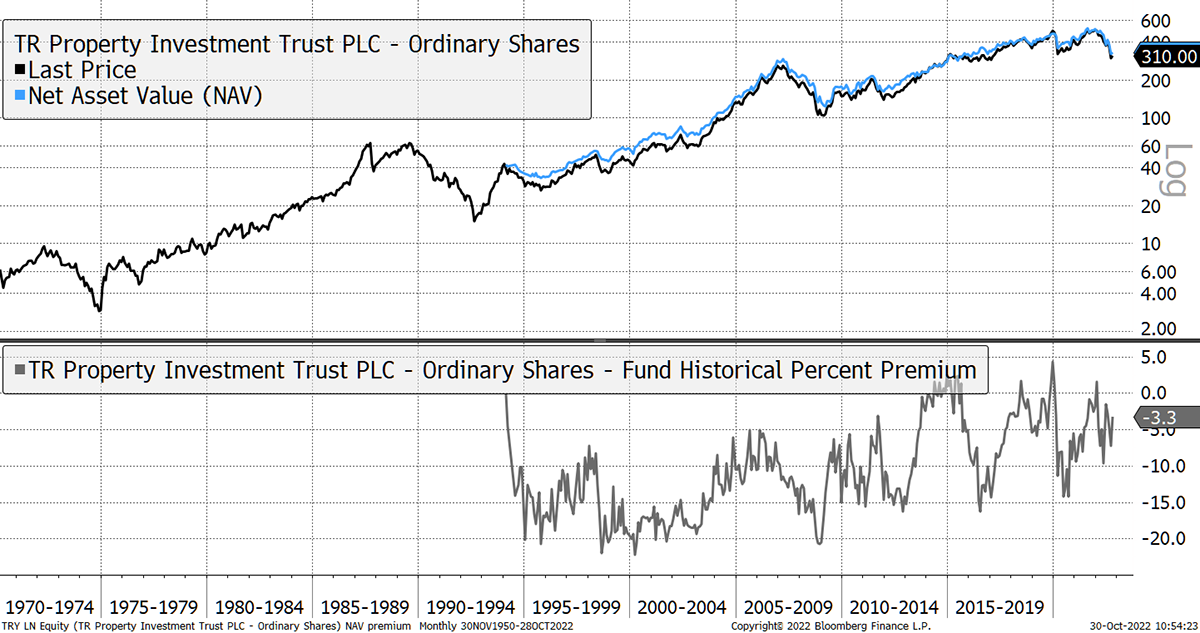

TRY Gives Us a Historical Perspective

Source: Bloomberg

Unfortunately, we only have net asset value (NAV) data for TRY since 1994. The best times to be invested were when the discount went to a premium and prices rose. The worst times were from premium to discount when prices fell.

I am very interested in buying TRY again, but there is currently only a 3% discount, and the portfolio is Pan-European. I have no issues with European property, but that doesn’t take advantage of the distressed prices caused by the pension funds selling UK property. Besides, EU rates remain lower, and that would be a good reason to wait.

Buying 5% iShares UK Property ETF in Soda (IUKP)

I have chosen an ETF as it does not face the risk of falling to a discount, which an investment trust does.

IUKP invests across 44 companies in the UK REITS sector. The trailing yield is 3.6%, and the fund charges 0.4% per year. It is a simple first choice to gain sector exposure with modest risk at current prices. Ideal for Soda at this stage of the cycle. It is a conservative start in UK property from which we can build a larger position over time.

The position size is 5% which is modest, and I am not calling the bottom for property. The largest holdings are shown in the list below.

Which REIT?

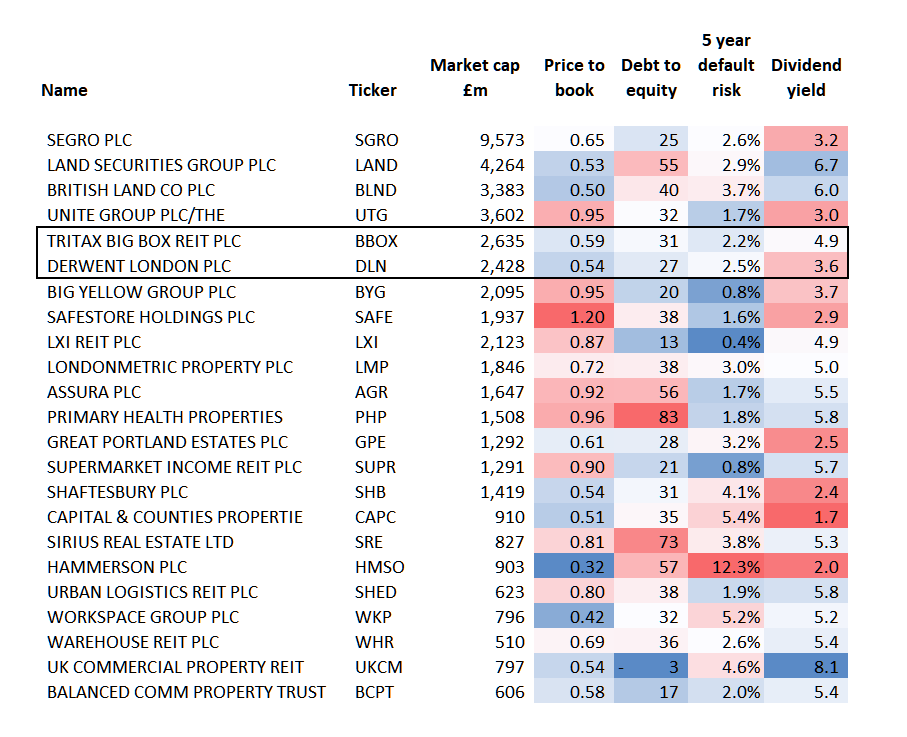

I have constructed a table showing the UK REITS with the important numbers. They are size, price to book, debt to equity, default risk and yield.

HMSO is the riskiest as there is a 12.3% chance of going bust over the next 5 years, according to Bloomberg bond data models. As a result, it is also the cheapest on a price to book value, yet the yield is low because the company is in poor health, and they have reduced the dividend to bolster their balance sheet. It is also smaller than most, and so the shares are less liquid.

Source: Bloomberg

LXI has the strongest balance sheet, as it has low debt, yet offers less value. It pays a good dividend yield because it simply owns buildings and does not engage in property development in search of growth. The rent it receives is paid out after costs and is inflation-linked. It is high quality and would be a good idea for Soda if it became meaningfully undervalued.

In search of large (keep it liquid in tough markets), safe, growth, value and yield, BBOX and DLN stand out. As I said last time I wrote about it, DLN is a class act, with a stunning central London portfolio.

BBOX is essentially the physical end of the internet. It owns and manages those massive warehouses that killed off the high street. I suspect it has a bright future, but I would think its growth will slow as online retail becomes a mature industry. Nevertheless, an interesting idea and good value at these prices.

On balance, the table is highly appealing. The safe assets trade close to book value, with everything else cheap. IUKP is unexciting but an efficient way to diversify across the sector at this stage of the cycle.

Risk

UK property will fall further should interest rates continue to rise sharply. This is becoming less likely, given the damage it is doing to the economy. REITS have already discounted a significant correction. IKUP is diversified and liquid and, unlike an investment trust, cannot trade at a discount to net asset value. In my opinion, it is medium risk.

Action: buy 5% iShares UK Property (IUKP) in Soda

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.6% this year and up 98.4% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

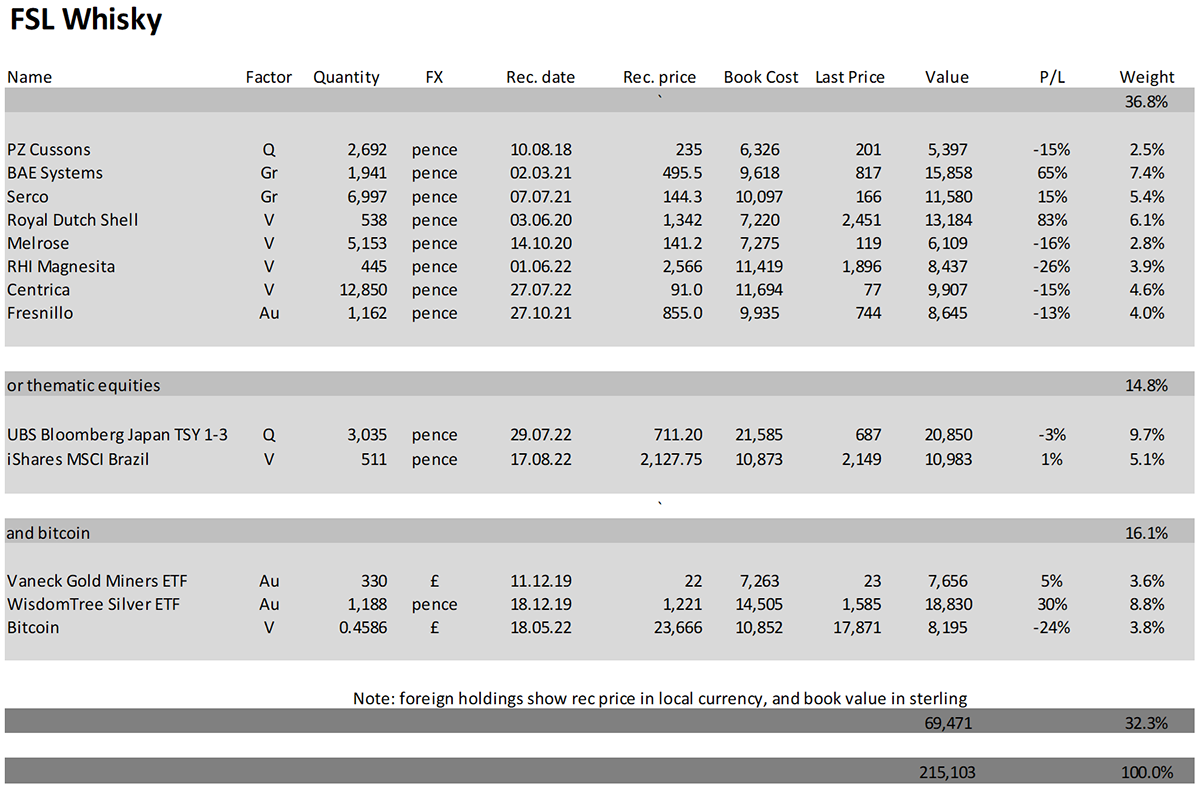

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 4.0% this year and up 115.1% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

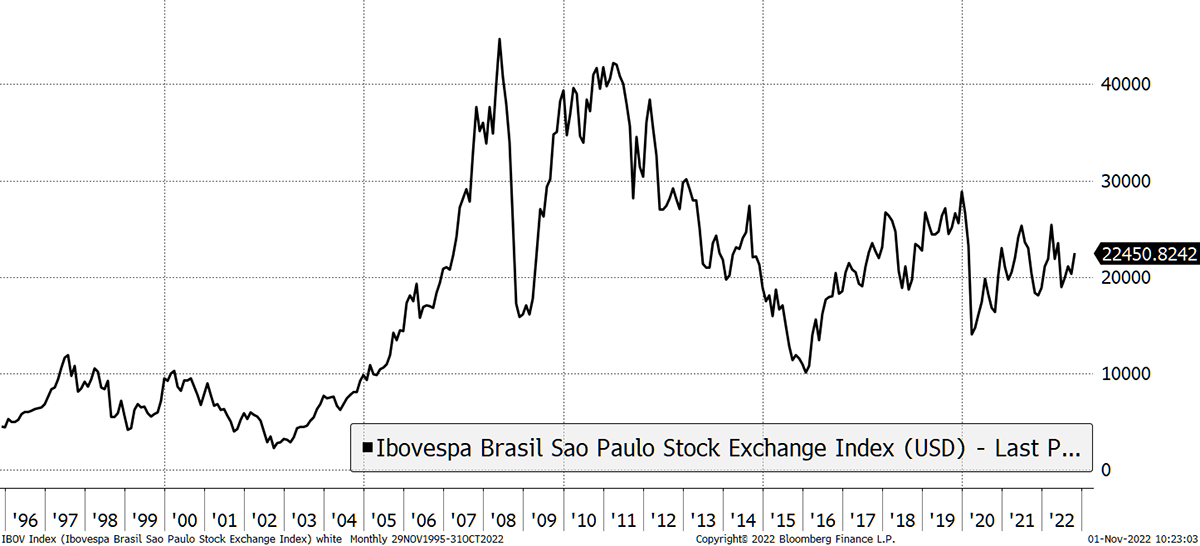

Since writing, Lula beat Bolsonaro in the Brazilian election. The market sank 5% only to reverse the fall overnight. Why would the market fear Lula? You should have seen what he did last time he took over the presidency in January 2003. Fasten your seatbelt.

Lula Was a Buy in 2003

Source: Bloomberg

Thank you for subscribing to ByteTree Premium.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd