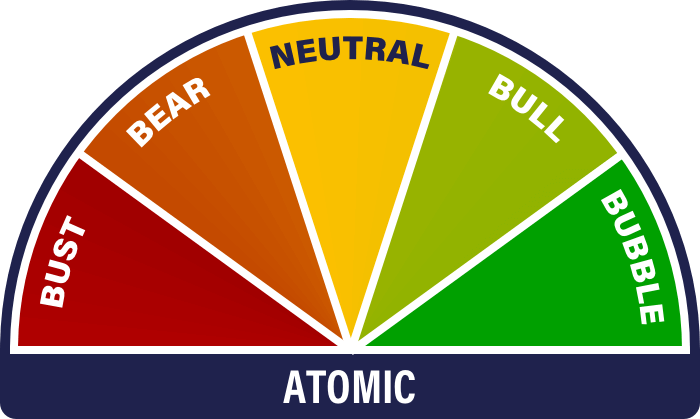

ATOMIC Upgrades to BULL

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 73

Our on-chain analysis tells us bitcoin is a buy, and the macro is improving. The technicals are ropy, but they always are at a turn. Crypto has absorbed a colossal amount of bad news over the last 6 months, but we’re now at a level where we can look at the horizon with great optimism.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Tradeable rally |

| On-chain | Hallelujah! |

| Macro | Changing course for the better |

| Investment Flows | Big players are back |

| Cryptonomy | Have your CAKE |

Technical

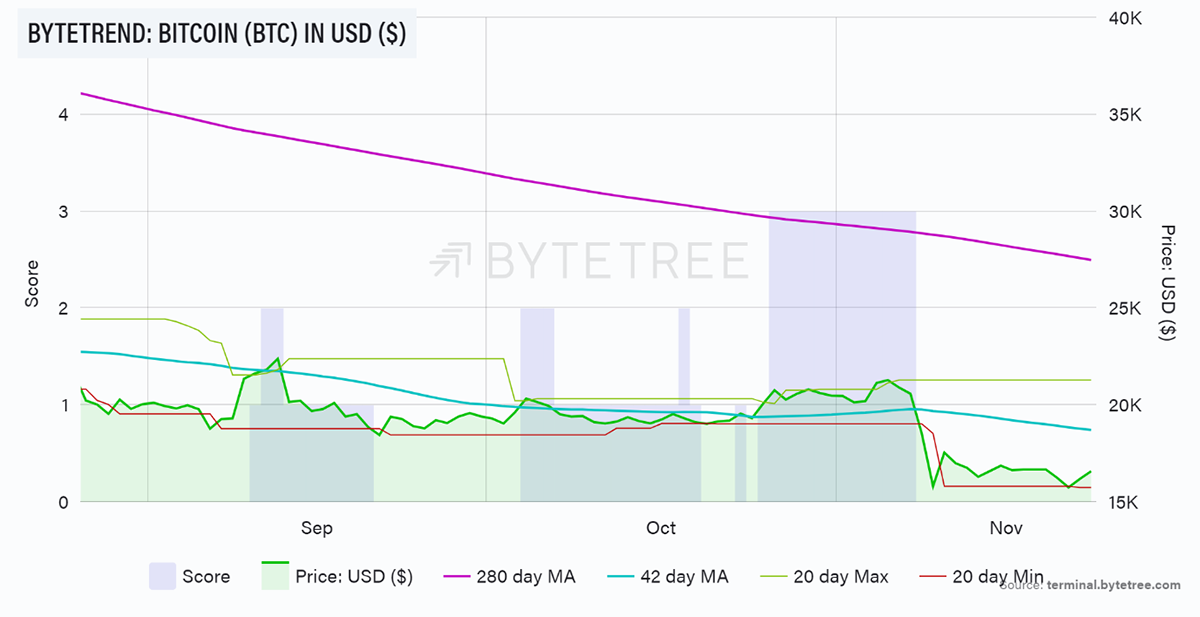

Unsurprisingly the recent drop in bitcoin’s price has left bitcoin on a zero ByteTrend score in US$. The 3-month chart below shows how much work is required to rebuild confidence from a trend perspective. Both moving averages continue to slope down, and the price is some way below both.

Source: ByteTree. ByteTrend for BTC, in USD, over the past three months.

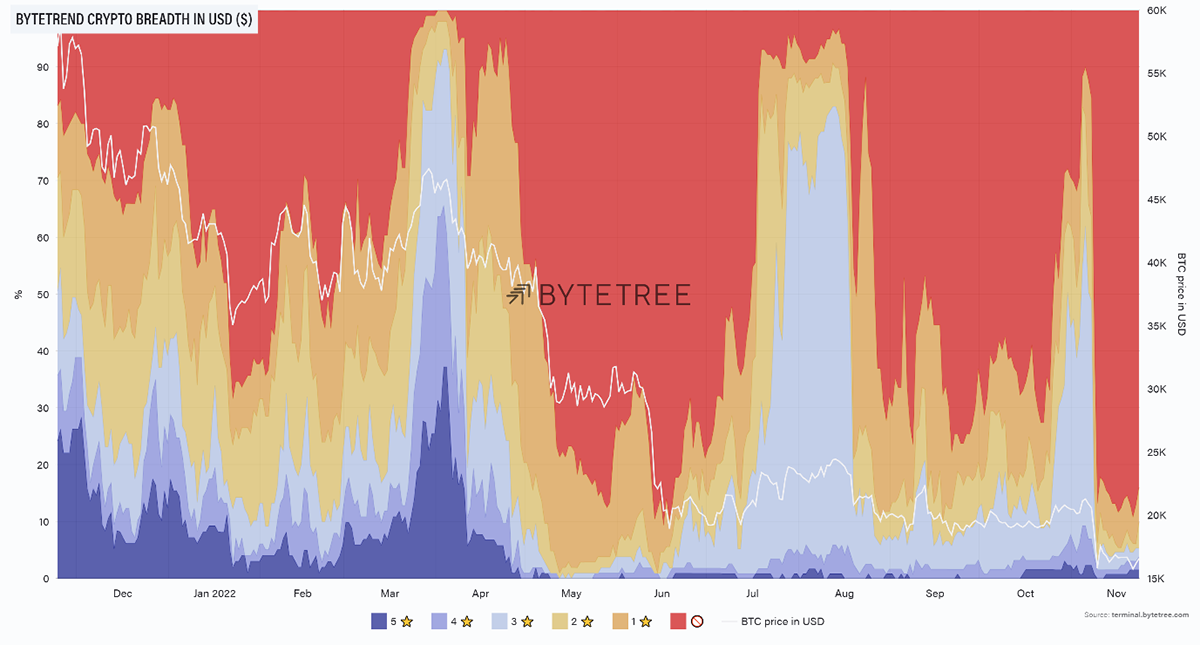

For those interested in the possibility of a tradeable rally, this year’s mid-summer analogue is promising. Note on the crypto breadth chart how the maximum “red sky” on 18 June marked a temporary low at around US$18,954, with the price rallying to US$24,449 on 14 August, a 29% increase.

Source: ByteTree. ByteTrend Crypto Breadth Chart in USD, with BTC price overlay, over the past year.

Ethereum is in a similar state to bitcoin in US$, but is notably stronger in BTC, where it retains 4 stars on ByteTrend. This is bullish for ETH fans but needs a careful eye kept on it as the longer-term moving average is precarious. For the moment, it gets the benefit of the doubt.

On-Chain

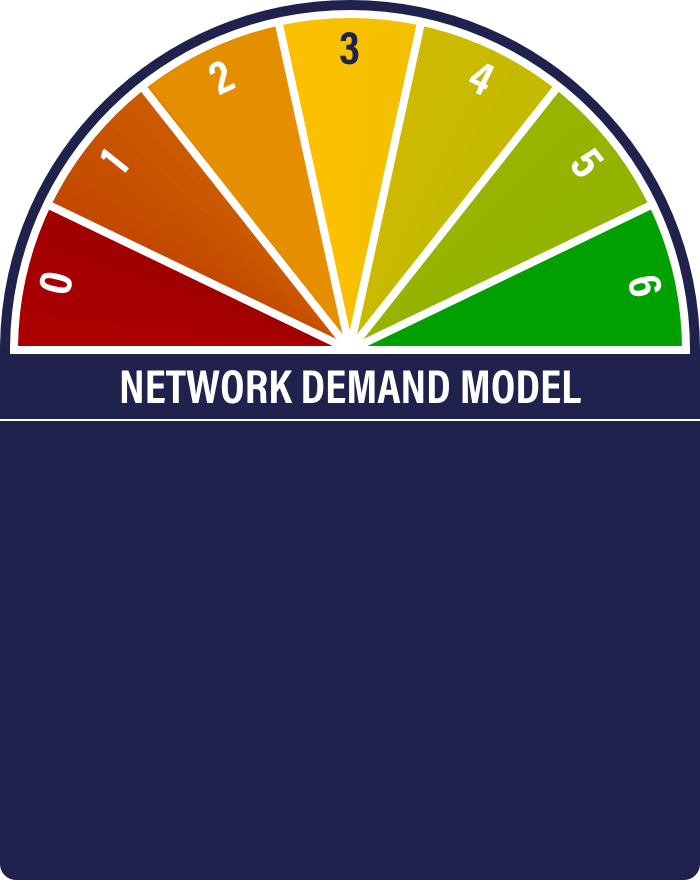

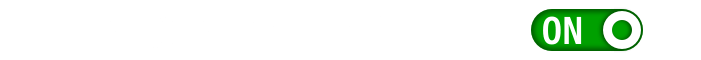

Hallelujah! Sound the bells! Light the fireworks! The klaxons have gone off, and the Network Demand Model, after nearly 18 months of bearishness, has turned bullish on bitcoin. With all signals being “on” except the long-term fee signal, the model is at 5/6.

We haven’t had such an abrupt shift since early 2019, as shown below.

Source: ByteTree

Make of it what you will. You can rightly argue that it failed us in the second rally of 2021, having indicated that the bull market was over in May. Yet subsequently, we have discovered that it was right after all, just that the market behaved irrationally through the NFT craze. All that time, network activity was weakening. Crazes are hard to measure.

The good thing about a model like this is that it doesn’t care about the news. It has no idea about Scam Bankrun-Fraud and FTX and will never read a tweet. It just tells you what it sees in terms of on-chain activity, and, according to historical patterns, bitcoin is in accumulation territory again.

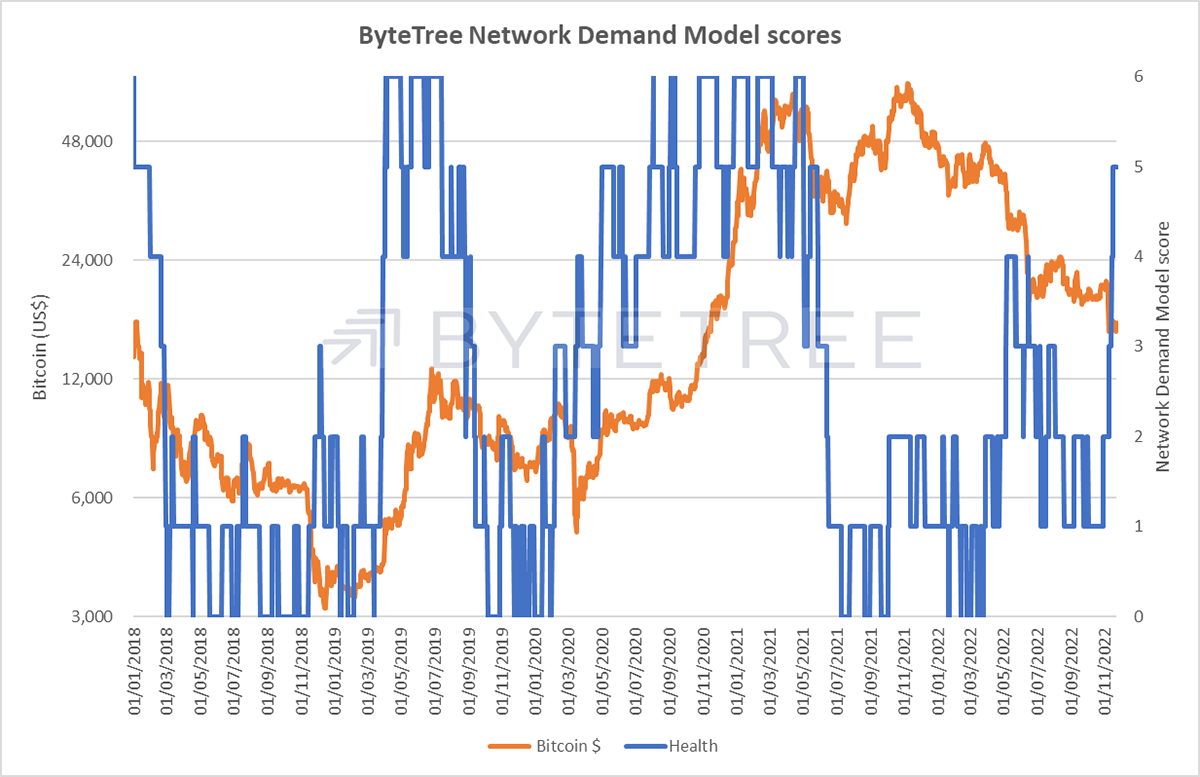

In other news, we see the block interval collapsing, presumably as miners leave the business. You can view that on ByteTree Terminal, where there was a spike in miner selling from 9-18 November, suggesting a bunch of miners could take no more and have packed their bags.

Source: ByteTree. Bitcoin block interval (secs) over the past five weeks.

If history is any guide, this capitulation is also consistent with the 2018 market bottom, as shown in the chart below (the 2021 MRI spike was more to do with miners gleefully unloading inventory to a new generation of buyers like Michael Saylor and Tesla).

Source: ByteTree

Macro

The headwinds from macro are surely abating. This is showing up in equity markets where a substantial momentum crash is unfurling. To get a better idea of what this means, I urge you to read The Multi-Asset Investor, which also had a couple of cracking stock ideas this week. If you haven’t the time, what we are seeing, in the simplest terms, is a massive leadership change.

Even the Fed are acknowledging it. As per the minutes of the November meeting, “A substantial number of participants judged that a slowing in the pace of increase would likely soon be appropriate”. The currency markets have certainly noticed, with the dollar index in rapid retreat.

Source: Bloomberg

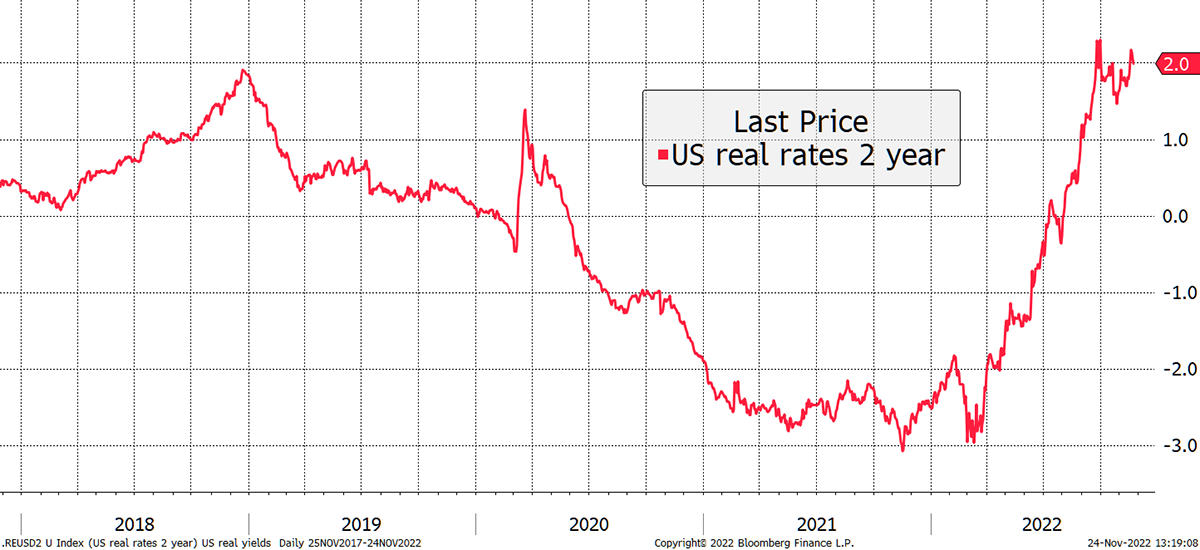

And real rates look extremely stretched, especially as we sense a change of course from the Central Bankers.

Source: Bloomberg

It begs the question of where the bitcoin price might be if it wasn’t for the FTX collapse. Recall that before the news emerged, the crypto market was starting to show signs of renewed life. If the macro is turning from headwind to tailwind, as soon as we have more clarity about any further contagion in the space, it is further grist to the mill that better days lie ahead.

Investment Flows

BTC and ETH held by funds have declined this week, but by hardly anything, which given the circumstances, is pretty remarkable.

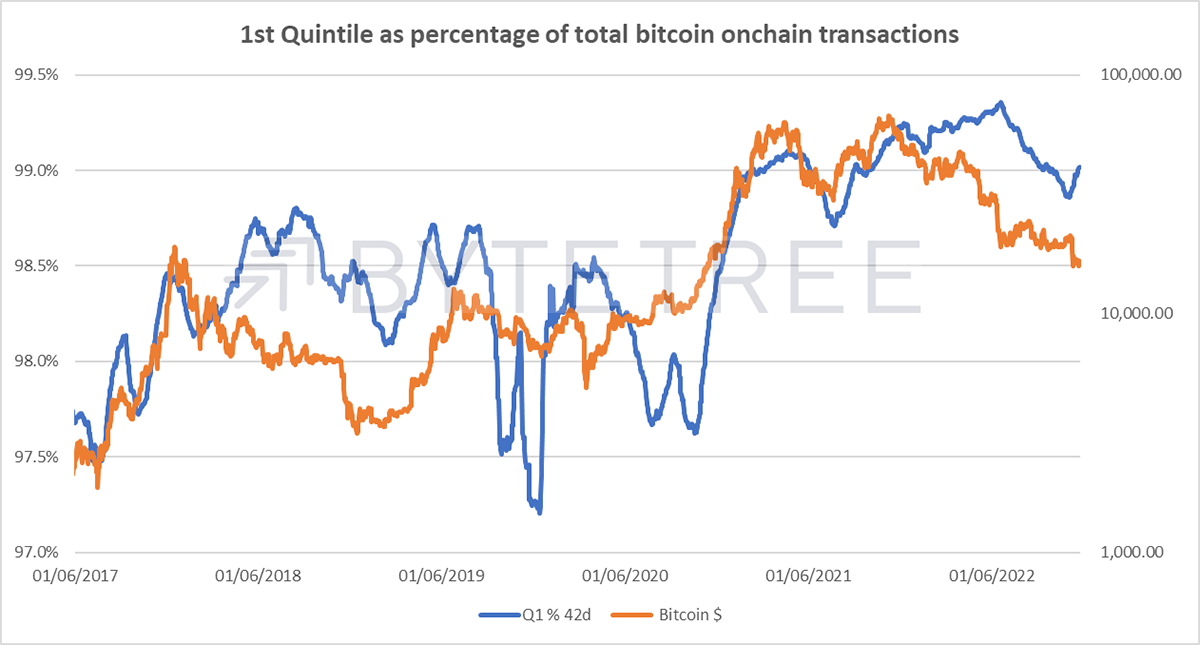

Because the data history is so short, the fund flow information on the ByteTree Terminal tells us nothing about the longer-term cycle. However, we can look at the behaviour of the largest investors at any point in bitcoin’s history. The chart below shows how much of bitcoin’s transacted value is accounted for by the largest 20%, or top quintile, of transactions. It appears that the bigger players step away in down cycles, while upward moves are characterised by big players coming back to the table. Identifying turning points is therefore key, and as you can see, we have once again jumped higher.

Source: ByteTree

Cryptonomy

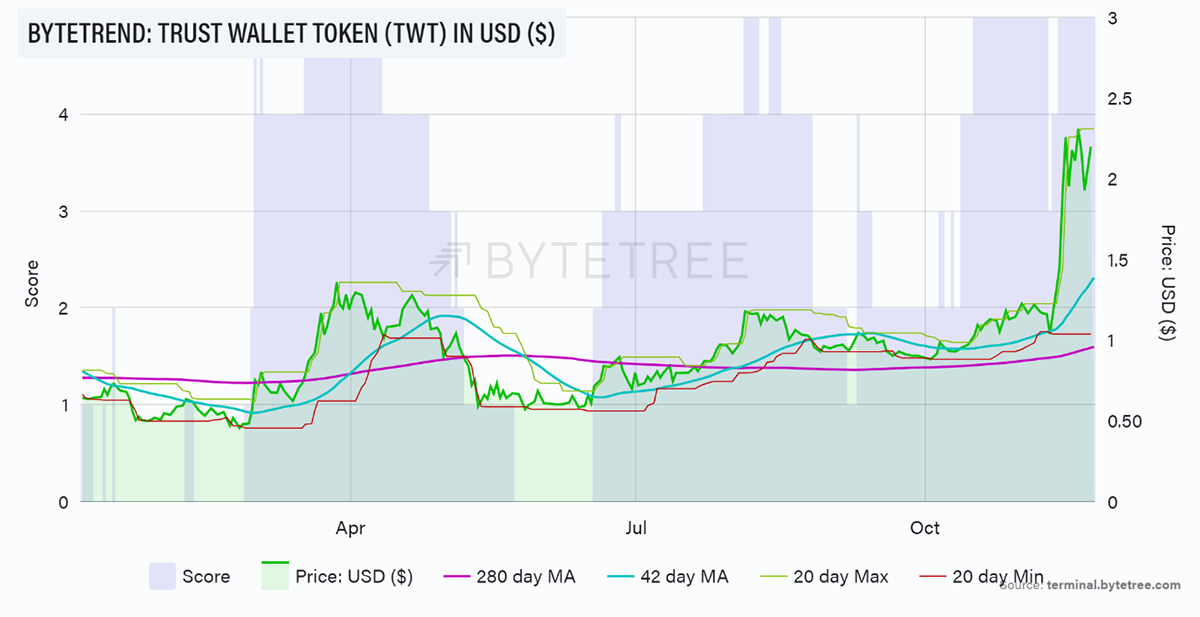

This week, there are only two coins scoring 5 stars on ByteTrend versus the US$: Trust Wallet Token (TWT) and SONM (SNM), the latter of which we haven’t looked at and has a short trading history.

TWT has been a superb performer as the custodial solution in the Binance ecosystem, and a huge beneficiary of the FTX fallout. In fact, it has been rallying since the Celsius/3AC-inspired crypto crash in June. We looked at it in Token Takeaway back in August but worried about the utility of the token, so it stayed out of ByteFolio, which has been painful in hindsight. Still, it shows the power of the ByteTrend process in that it kicks up winners like this good and early. It does look very overbought at the moment, however.

Source: ByteTree. ByteTrend for TWT, in USD, over the past year.

When we look at the strong performers against bitcoin, it remains encouraging to see existing ByteFolio constituents Polygon and Monero still on 5 stars, while new entrant PancakeSwap (CAKE) has just joined them. PancakeSwap is a decentralised exchange and should benefit if more traffic is driven towards the decentralised players as a result of FTX’s demise. Uniswap (UNI), another decentralised exchange, is just behind, showing a 4-star trend.

Keep an eye on Chainlink (LINK) as well. The much-anticipated introduction of stakinghas been announced for 6 December. Furthermore, the Chainlink Proof of Reserve has been heavily promoted so that exchanges and others can provide much greater transparency. Adopters include Huobiin another indication that crypto is rapidly adapting to mend the issues that have caused so much recent damage.

At the bottom of the pile, we continue to see ETH-killers like Cardano, Solana, Avalanche, and Near. However much we’re told how fabulous these all are, we’re staying away until the price behaviour tells us otherwise.

Summary

Our analysis of cycles suggests this is where the value buyer can step in. With the macro tailwinds starting to ease, things should start looking up after a torrid year.

Comments ()