Synthetix: Creating Carbon Copies of Assets

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: SNX;

Synthetix is a decentralised synthetic asset platform. It was built on top of Ethereum and Optimism to provide on-chain exposure to synthetic versions of fiat currencies, commodities, cryptocurrencies and indices. With their unique services and use cases, the Synthetix ecosystem is playing an important role in the DeFi space. In this article, we will examine the fundamentals of Synthetix and its native token, SNX.

Overview

The current traditional derivatives market is enormous, with estimations around 1.2 quadrillion dollars ($1,200tn) in notional value, which is 20x the world economy. Instruments like these opened a myriad of trading opportunities, from hedging to strategic investments. Investors and traders commonly use these to get exposure to securities they don’t own.

Blockchain introduced a similar product called synthetic asset or tokenised derivative, taking the whole process to the next level. Users can now get exposure to these assets independent of their geographical and political barriers. As is normally the case with blockchain technology, this process is more scalable, frictionless and decentralised compared to its traditional counterpart, while also immutably records the trading history of these assets on-chain.

Synthetix is a DeFi protocol built on the Ethereum blockchain and Optimism (a layer-2 scalability solution), building a much-needed bridge between TradFi and DeFi. Investors can now use the blockchain to buy traditional mainstream assets, while accessing DeFi services.

People from the most remote areas in the world now have the luxury of owning these assets through synthetic asset platforms like Synthetix, Mirror Protocol, Duet Protocol, and DeFiChain. Offering a synthetic version of ETH on-chain may not be that useful, but a synthetic version of Gold, Silver, EUR, or USD could be a real deal.

How Does Synthetix Work?

Synthetix enables the issuance of tokenised derivatives or synthetic crypto tokens, i.e. tokens imitating an underlying asset(s). In essence, these tokens are derivative products that are pegged to the underlying asset. Notably, these synthetic assets are not backed by the underlying asset but by the Synthetix Network Token (SNX) - the native token for the Synthetix protocol. More on that later.

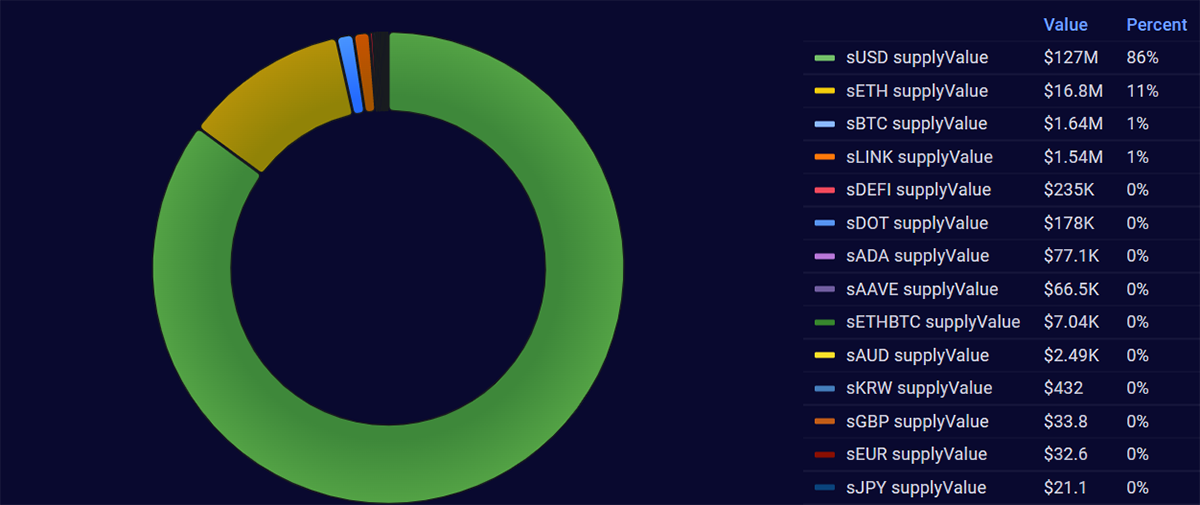

Synthetic assets are also called Synths. For example, a BTC Synth will appear as sBTC on the Synthetix protocol. Synths use decentralised oracles like Chainlink to track the price of the underlying asset, while a complex smart contract mechanism gives users exposure to the price of certain assets without having to own them.

Any user can lock up SNX or ETH in a smart contract and mint Synths. The amount of tokens locked up is decided by the collateralisation ratio (C-ratio), which is around 400% and 150% for SNX and ETH, respectively. Creating Synths incurs debt in the protocol, and to exit the system (free their SNX), users must burn their Synths using (a similar mechanism to MarkerDAO and DAI.

Since these Synths are basically ERC-20 tokens, they can be used to provide liquidity in DeFi protocols like Curve (Synthetix Integrator) and earn fees as rewards. To incentivise SNX stakers, a portion of the trading fees generated by all Synthetix Integrators is used as additional rewards.

Launch and Tokenomics

In February 2018, Synthetix was originally launched by Kian Warwick via an ICO as Havven, a stablecoin project. Later, to capture the DeFi trend, it was pivoted to synthetic assets.

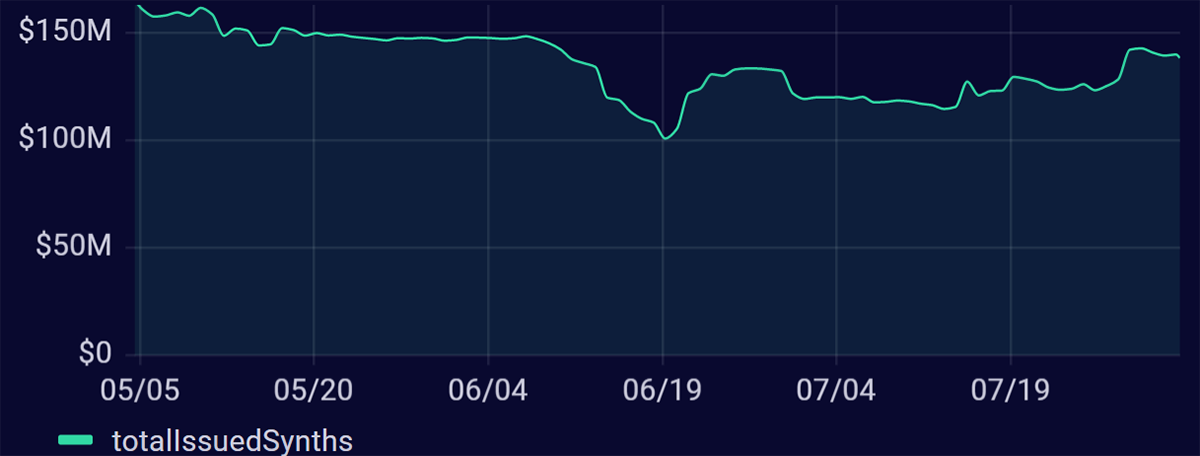

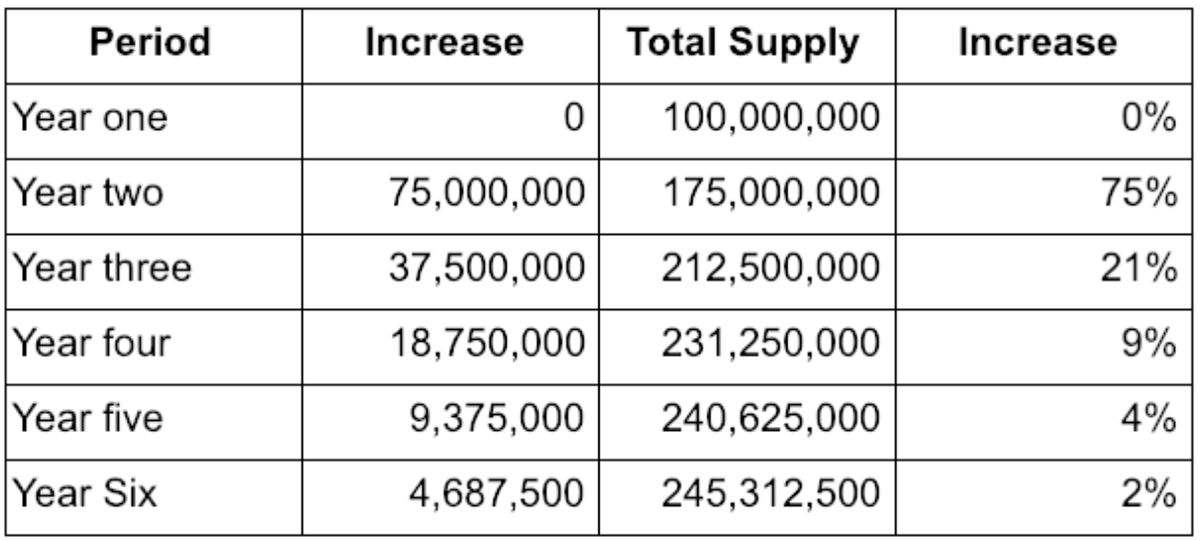

SNX was publicly distributed via two ICOs in 2018, raising a total of $29.26m. The initial supply was 100 million, but in March 2019, a new monetary policy was launched, inflating the SNX supply to reward active stakers. This issuance (rewards) will halve every year for five years until the network inflation is 2.5%.

Out of the current 231 million SNX tokens in circulation, 173 million are staked on the Synthetix network. Additionally, to the portion of trading fees as rewards, SNX stakers also get rewarded by the network inflation and can participate in the network governance.

Governance

The Synthetix Foundation originally governed Synthetix, but to reflect the community interest, they adopted a decentralised form of governance. Currently, Synthetix Improvement Proposals (SIPs) and four DAOs mainly contribute to the network governance, i.e., Spartan Council (SC), Protocol DAO (pDAO), Grants DAO (gDAO) and Synthetix DAO (sDAO). Anyone can submit a proposal via a SIP, which the SC will review, and the authors will be interviewed to debate the proposal's implications. pDAO helps implement the reviewed proposals, and gDAO is responsible for the issuance of grants to new projects. Finally, sDAO ensures that the governance bodies remain incentivised to work for the betterment of the network.

Stakers are assigned a weighted-vote in which they can delegate their SNX to the person they want to see in the DAO. This happens at the end of each epoch, where a favourable candidate for the DAO is chosen by election.

Risk

As mentioned in the Synthetix litepaper, Synthetix is an experimental and complex system with many risks in its mechanism. One of the risks is that users may have to burn (payback) more Synths (debt) than they originally minted (incurred) due to an increase in debt caused by the exchange rate fluctuations in the system. Additionally, when the collateral (SNX or ETH) price decreases significantly, users must keep adding collateral value to match the C-ratio to avoid possible liquidations.

As Gary Gensler, Chairman of the SEC, remarked on Synthetic assets:

“Make no mistake: It doesn’t matter whether it’s a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities. These platforms - whether in the decentralized or centralized finance space - are implicated by the securities laws and must work within our securities regime.”

Synthetic asset platforms have a history of attracting regulators. For example, if Synths have the same rules and regulations as traditional derivatives, the very utility of Synths will be compromised, crashing the whole ecosystem. As we have experienced through China banning crypto services, harsh regulations do have a bear effect on the entire market. Saying that, regulation is inevitable, and with proper collaboration and planning with the project teams, favourable rules can be drafted that will benefit everyone.

Competition is also a threat, as Synthetix is not the only player in this space. However, it is the largest crypto in the derivatives sector with $892m in market capitalisation and over $640m in TVL. Out of the other projects with similar services, like DeFiChain, Mirror Protocol, Duet Protocol, and Synthetify, only DeFiChain and Synthetix have displayed relatively good performance. Another competitive advantage for Synthetix is that the ecosystem offers not only Synth issuance, but also Synth trading, yield farming, options trading, asset swap, and wealth management through integrations with the likes of Kwenta, Lyra, dHedge and Curve.

Conclusion

Synthetix is leading the forefront of a tokenised derivatives space, giving users access to multiple assets on-chain without actually having to own them. Given that the traditional derivatives market is worth over a quadrillion dollars, Synthetix has real potential and opportunity to attract investors to the DeFi space. Additionally, over-collateralisation has also proven to be a secure mechanism given the life of this project and seems to be a good way to back debt, creating stability in the system.

With the current risks that surround the protocol, the journey ahead will be far from easy. Regulation is a primary unknown that could help shape the space in the future. However, with its ecosystem offering a basket of services and decentralised protocol governance mechanism, Synthetix is an appealing project for new users. Provided the project stays fundamentally and technically robust, continues to evolve, and acquires further market share, there is huge potential for growth.

Comments ()