The Rise of MakerDAO and DAI

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: MKR and DAI;

MakerDAO, a peer-to-peer Decentralised Autonomous Organisation (DAO), now hosts the largest collateral-backed decentralised stablecoin, DAI. Since its inception, MakerDAO has been dedicated to bringing financial stability and security to everyone worldwide using DeFi and blockchain technology. This article will examine the fundamentals of the MakerDAO ecosystem and its native tokens, MKR and DAI, and comment on its future outlook.

Overview

MakerDAO is an open source DeFi project operated by one of the largest Decentralised Autonomous Organisations (DAO) and was the first DeFi project to receive notable adoption on the Ethereum blockchain. One of the primary functions of the MakerDAO ecosystem is to provide a decentralised lending system, which is operated through smart contracts.

With $1.43bn in market cap, MKR, the native token of MakerDAO, is now the third largest crypto in the DeFi sector and within the top 50 largest cryptocurrencies. MakerDAO is also home to the largest decentralised stablecoin, DAI, which has a market cap of $6.5bn. DAI is also the fourth largest stablecoin after USDT, USDC and BUSD, but more on that later.

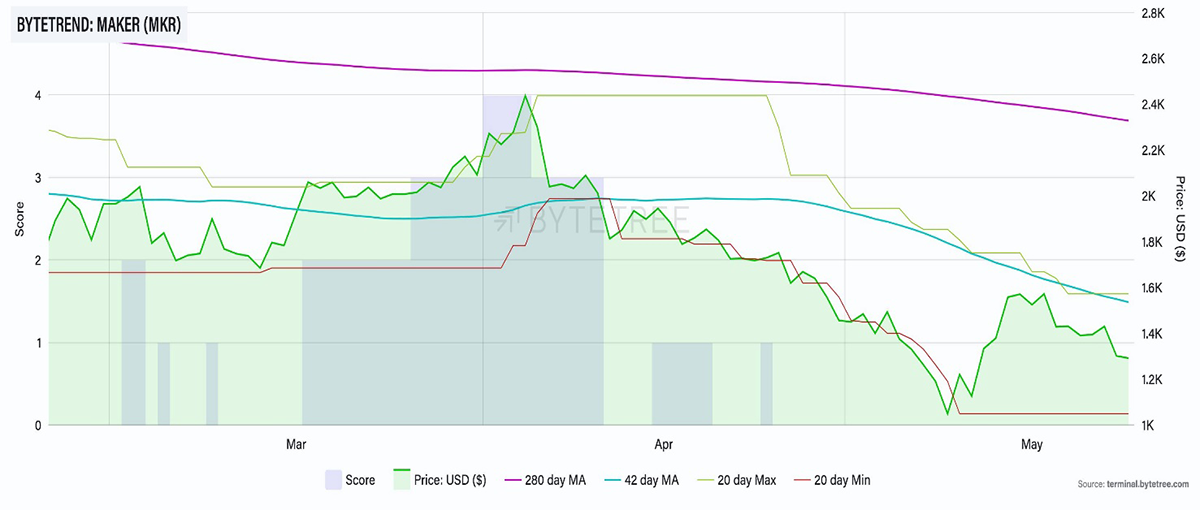

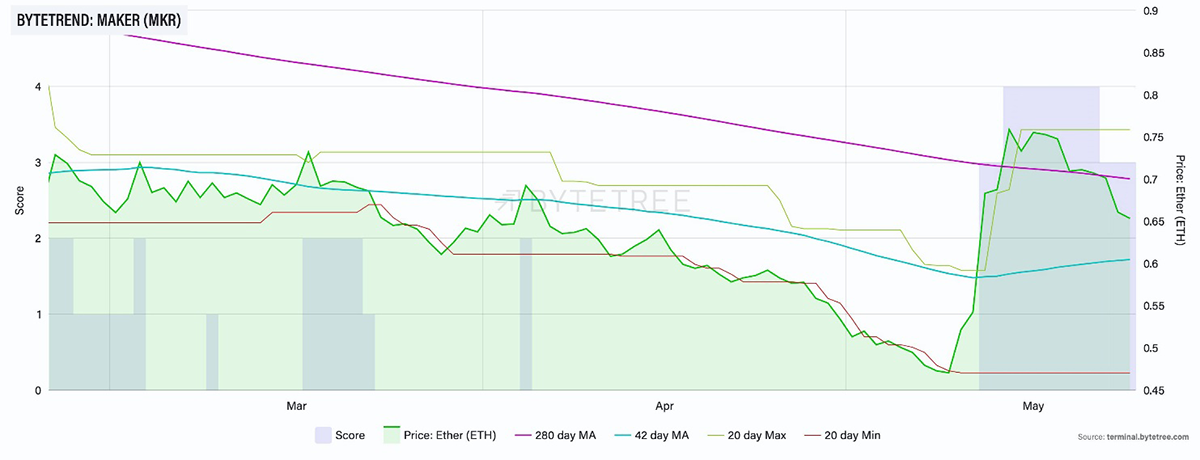

As illustrated in the first ByteTrend chart where MKR is measured in USD, the token price (green line) recently dipped to around $1,000, a level not seen since January 2021. This could be a result of the current market conditions, as the MKR price has since recovered back to over $1,400. Meanwhile, looking at the second chart where MKR is measured in ETH, the token recently held a 4-star trend for 7 days, indicating that MKR is outperforming Ether. Additionally, MKR also holds a 2-star rating against BTC.

Launch

MakerDAO, which is based in San Francisco, was founded by Rune Christensen in 2014, who is also the CEO of the project. MakerDAO initially launched 1 million MKR tokens, which were distributed in a centralised fashion in three private sales in 2017-2019. Around $54.5m was collectively raised from a16z crypto, FBG Capital, Wyre Capital, 1confirmation, Paradigm, and Dragonfly Capital, among others.

MKR Tokenomics and Governance

MKR is the governance token of the Maker Protocol, a project based on the Ethereum blockchain, where MKR holders can vote on any changes that will affect the ecosystem. Stability fees (interest rate) and DAI Savings Rate (DSR), set by Maker Governance, are used to maintain the DAI peg. In a situation where rate adjustments could not bring the peg to normal, Maker Governance incentivises a sufficient capital pool to Keepers, an external actor who acts to make the system stable.

In the case of a black swan event, e.g. the Maker Protocol is compromised, governance participants can trigger an Emergency Shutdown, which prevents the making of new vaults (loan smart contract) or manipulation of existing vaults and freezing of price feeds. The reason for freezing the price feed is to ensure that every user receives the collateral they are entitled to at a fixed price. However, there is some risk of devaluation, i.e. users may not get the full value of their collateral due to the risk of value decline of the collateral and other factors. If the Emergency Shutdown is triggered wrongfully, other governance participants can trigger the Governance Security Module (GSM) to delay any action for up to 24hrs.

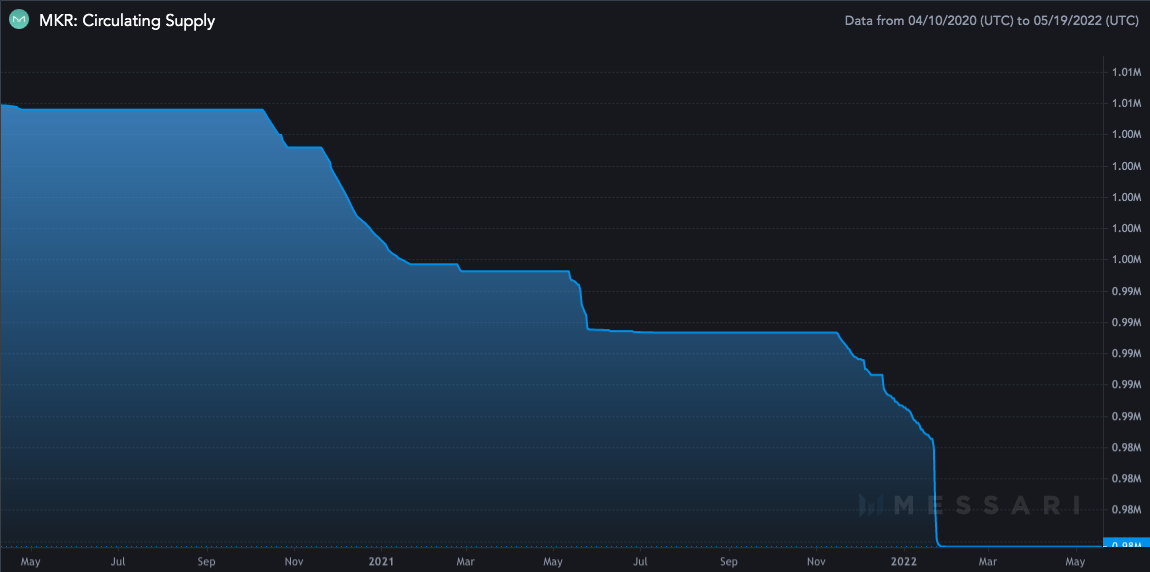

Since the initial launch of around 1 million MKR, over 200k tokens have been burnt, making it akin to a deflationary asset. However, there is no hard cap supply for MKR tokens. The supply will increase with a debt auction, where DAI is raised by selling the newly minted MKR tokens for repaying the deficit of liquidated/undercollateralised DAI loans.

DAI Tokenomics

DAI, a decentralised stablecoin that is soft pegged to the USD, was created by MakerDAO and first launched in 2017 as SAI. Anyone who locks ETH in a smart contract called Collateralized Debt Position (CDP) could create SAI, also known as Single Collateral DAI (SCD).

In 2019, the DAI Stablecoin System, now the Maker Protocol, launched the Multi Collateral DAI (MCD) system, allowing users to use any Ethereum-based token that MKR holders approve as collateral to generate DAI. Additionally, DAI can be generated using centralised tokens like USDC or USDT. However, these collateral assets do not make DAI any less decentralised. Equally, the ETH collateral does not make DAI any more decentralised than before; DAI is always equally decentralised.

A minimum of 150% collateral is required for borrowing/creating DAI, meaning $1.5m worth of ETH could be used to generate $1m worth of DAI or 1 million DAI. If the collateral goes below 150%, it is liquidated and sold in Collateral Auction to cover the outstanding obligation of the loan, including payment of a Liquidation Penalty fee. If the collateral value falls short, the deficit is converted into Protocol debt. Protocol debt is covered by DAI in the Maker Buffer, which is comprised of stability fees, liquidation penalty and collateral auction value.

To maintain the DAI peg, the governance participants fluctuate the Stability Fees (interest rates) and DAI Savings Rates (DSR). However, this mechanism doesn’t have an immediate impact but rather shows a slow adjustment. The price was a little unstable initially but has evolved a lot since then.

Unlike UST or USDD, DAI is a decentralised stablecoin that has real crypto assets as collateral. Instead of depending on a burn-and-mint mechanism to influence the supply and demand, DAI relies on smart contracts and the Maker Governance participants to maintain its soft peg. Therefore, it is best distinguished as a collateral-backed decentralised stablecoin.

Future Outlook

According to data on CoinMarketCap, on 11 May, when UST made a low of $0.29, MKR made a high of $1,976 - a 60%+ jump from the day’s opening price. The volume also increased by nearly 3x from the previous day, showing a drastic increase in the user interest in DAI and MKR. For context, the UST market cap was over $18.5bn at its height, which portrays a substantial opportunity for DAI if it continues to be stable. Moreover, the largest stablecoin, USDT, also fell to $0.97 on 12 May, causing widespread fear and panic among investors.

I don’t think this is a winner-takes-all space, but there will definitely be a first-mover advantage in terms of outreach and adoption. In layman’s terms, a stablecoin is basically a synthetic version of a fiat currency. Since there are multiple successful fiat currencies, there will also be multiple successful stablecoins, but not all. In the future, where numerous stablecoins and potential CBDCs exist, there will be many factors deciding their success, but it all comes down to them maintaining their peg.

Conclusion

MakerDAO is emerging as a prominent force in the DeFi space. Although DAI was a little unstable initially, it has evolved a lot since then. Given the popularity and necessity of stablecoins in the crypto market, there is a huge future opportunity for MakerDAO and DAI. However, since the mechanism to maintain the DAI peg is slow to react, this could be a huge threat to maintaining rationality in severe market turmoil where potential liquidations could be triggered across DAI and MKR and result in heavy damages. Nevertheless, up until this point, there are no signs of such instances. As this space matures with time, hopefully, there never will be.