Chainlink: Making Blockchains Relevant?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: LINK;

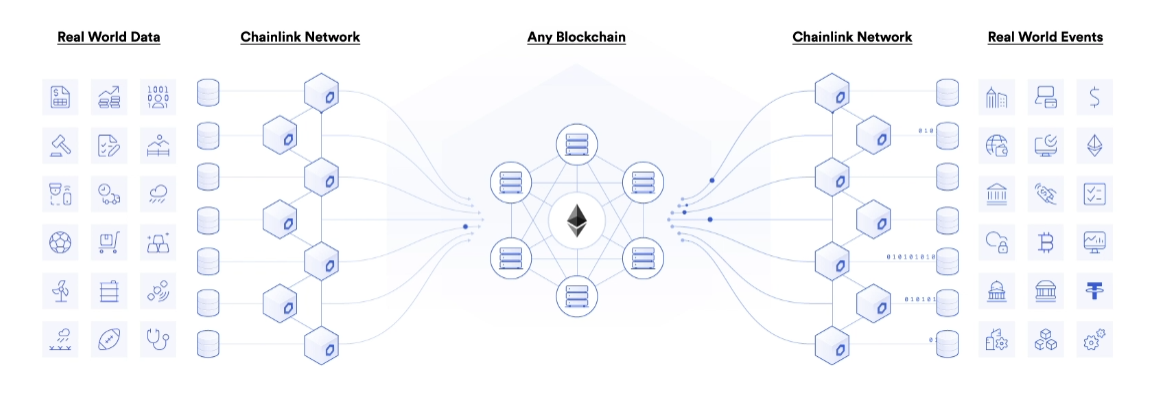

In this week's Token Takeaway, we revisit Chainlink. This blockchain-agnostic project greatly expands the capabilities of smart contracts by enabling access to real-world data and off-chain computation. We will also examine the many changes the Chainlink ecosystem has undergone since we last reviewed it earlier this year.

In 2021, we saw an increased demand for DeFi products and services. This was evident by the Total Value Locked (TVL) locked across all DeFi, which reached an all-time high of $253.91 billion in December 2021 - an increase of 1200% year on year. However, since then, the consumer interest in DeFi has significantly cooled. So instead, we focus on the progress of the underlying technology that makes DeFi possible - one of those elements being oracle networks.

To recap, oracle networks fetch real-world off-chain data for blockchains to use. A perfect example could be how oracles can provide price feeds that DeFi protocols like algorithmic stablecoins can use to recalibrate incentive mechanisms to help stablecoins maintain peg stability. With over 1390 projects and 1616 integrations, Chainlink is the largest Decentralised Oracle Network (DON) by market cap and the go-to oracle for securely and effectively incorporating real-world off-chain data into smart contracts.

Overview

Chainlink was co-founded by Sergey Nazarov and Steve Ellis, who co-authored the original Chainlink whitepaper in 2017. The oracle’s developments, integrations and growth are managed by Chainlink Labs, a for-profit organisation founded in 2014. Chainlink Labs employs over 360 employees, and its annual revenue is approximately $52.6 million. Chainlink’s initial development funding was raised via an initial coin offering (ICO), which took place in 2017. The ICO helped Chainlink Labs raise a total of $32 million in funding over four rounds.

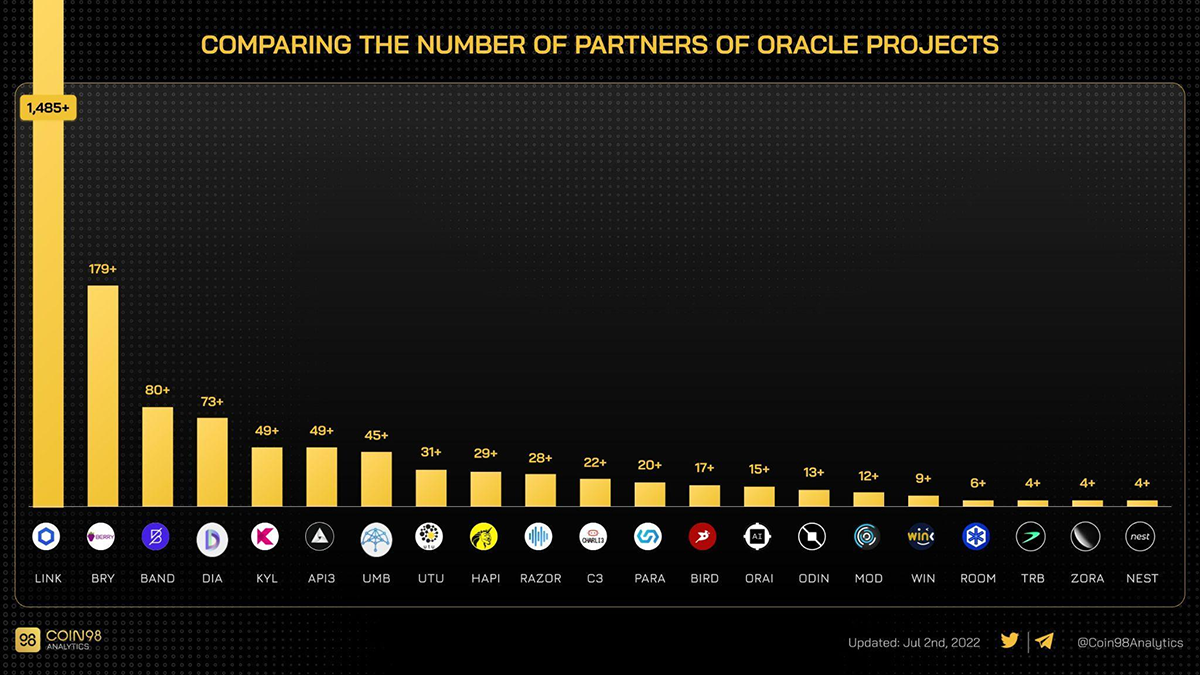

When we previously reviewed Chainlink in January 2022, Chainlink was by far the most dominant DON in the digital assets space, with over 1,091 partners. Fast forward seven months, and Chainlink is still the market leader with over 1,485 partners. This means Chainlink Labs has been able to onboard over 320 projects in 2022 alone.

To date, Chainlink is integrated with 16 different blockchains, from well-known layer-1 blockchains such as Ethereum, BNB and Cardano to lesser-known projects like Moonriver and Harmony One.

However, the immense growth of this ecosystem is also one of the main reasons why the price performance for LINK, the native token, has been mediocre over the past few months. To facilitate the growth of the ecosystem, Chainlink Labs have been selling its reserve LINK holdings, which offset the demand for the token.

A report published by Coinbase in March 2022 states that among all oracles, Chainlink represents 54% of all activity, a position held since late 2020. However, this growth and market dominance has been offset as LINK’s circulating supply grew at an average pace of around 1.4% per month. This might hint as to why the value of LINK hasn't increased proportionately, despite the demand for Chainlink's data feeds increasing more than eight-fold.

Tokenomics

The circulating supply of LINK is approximately 467.09 million tokens, with a max supply capped at 1 billion. The top 100 holders collectively own 76.97% of LINK, with Chainlink Labs holding 34.98% of the total supply making the token slightly more centralised.

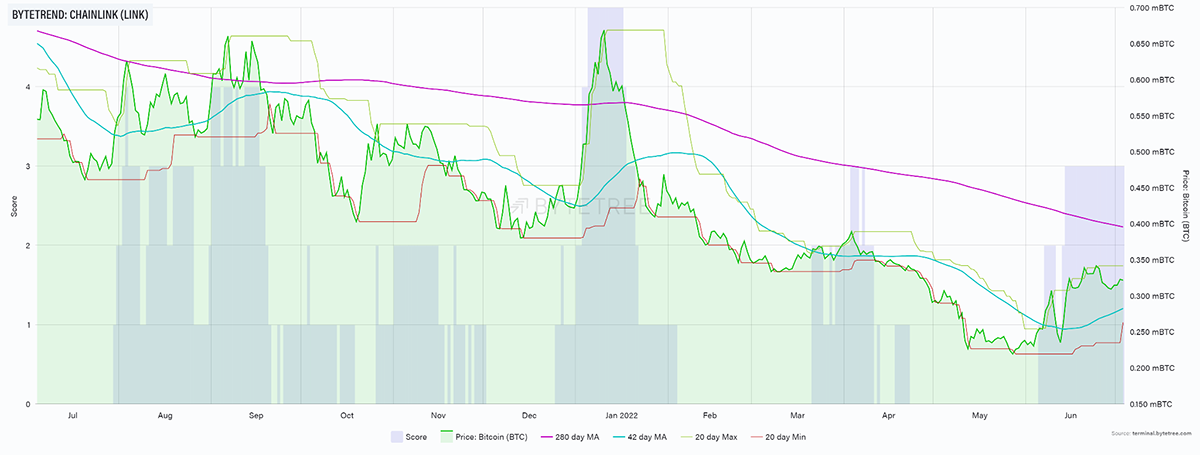

As seen from the ByteTrend graph above, the LINK price performance is in a downtrend. However, with the introduction of LINK staking in Q4 2022, we believe that this graph will look very different in a few months.

According to Chainlink Labs' blog post, the staking mechanism will evolve across multiple versions, with the initial v0.1 focusing on introducing a reputation framework and staking alerting system. After sufficient validation from in-production usage and community feedback, a v1 release will introduce additional functionality such as the slashing of stakes to deter malicious activities and the incorporation of user fees as rewards.

What particularly caught my eye in their blog post is that LINK holders who partake in the v0.1 release will have their staked LINK locked until the release of v1. There is no mention of a timeline or how long it will take for the staking mechanism to be upgraded to v1. This could be the catalyst that creates a supply shock for LINK. The expected annualised staking rewards for v0.1 will be up to 5%.

At the time of publication, LINK is trading at $6.33, with a market cap of approximately $2.95 billion.

The SWIFT Integration

The Society for Worldwide Interbank Financial (SWIFT) is the world’s leading provider of secure financial messaging services between banks and financial institutes and has recently been brought to the limelight due to the Russian trade restrictions.

SWIFT securely transfers messages between banks and is the current standard for international transfers, with over 11,000 financial institutionsusing the network daily. However, since cryptocurrencies became a medium to transfer funds, critics have called the SWIFT network slow and relatively expensive. To ensure SWIFT was not obsolete in the face of blockchain technology, they built a DLT-based payments system called SWIFT GPI (Global Payments Innovation), which requires decentralised oracles to function.

While the information between SWIFT and Chainlink is limited, their cooperation began as early as 2016, when Chainlink won a prize at the SWIFT Innotribe Industry Challenge. In a video posted in 2021 by Chainlink’s official Youtube channel, Sergey Nazarov and his colleagues at Chainlink Labs discussed that they were building a SWIFT Smart Oracle. This would allow smart contracts on various networks to make payments, send governance instructions, and release collateral with more than 11,000 banks. However, since then, no information has been provided by either party to confirm whether this oracle is currently operational or not.

The use cases for Chainlink on a global scale would be considerably expanded with a full SWIFT integration. Should this be confirmed, LINK would undoubtedly propel to new all-time highs.

Conclusion

While the recent poor price action from LINK might put many off, the ecosystem has grown faster than any other crypto project to date. The Chainlink Network has over 1,485 partners and onboarded 320 projects this year alone. The implementation of staking will also be a game-changer for the token as this will effectively reduce the overall circulating supply and incentivise holders to stake their LINK to earn some passive income, increasing the demand for the token.

The unloading of LINK by Chainlink Labs should be seen as an investment in the longevity of the project. As one of the fastest-growing crypto ecosystems, I truly believe Chainlink is here to stay for the long run, something that can’t be said for many crypto projects with larger market caps.