Ethereum: Goodbye Miners, Hello Stakers

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: ETH;

With the global crypto market cap rebounding to over $1 trillion, all eyes are on Ethereum and its long-awaited Proof of Stake (POS) Merge, which is expected to be implemented on September 19. In anticipation of the merge, the price of Ethereum has surged. In this Token Takeaway, we look at Ethereum’s native token, Ether, the second-largest crypto asset by market cap, and what we can expect from this thriving ecosystem after the POS merge.

Overview

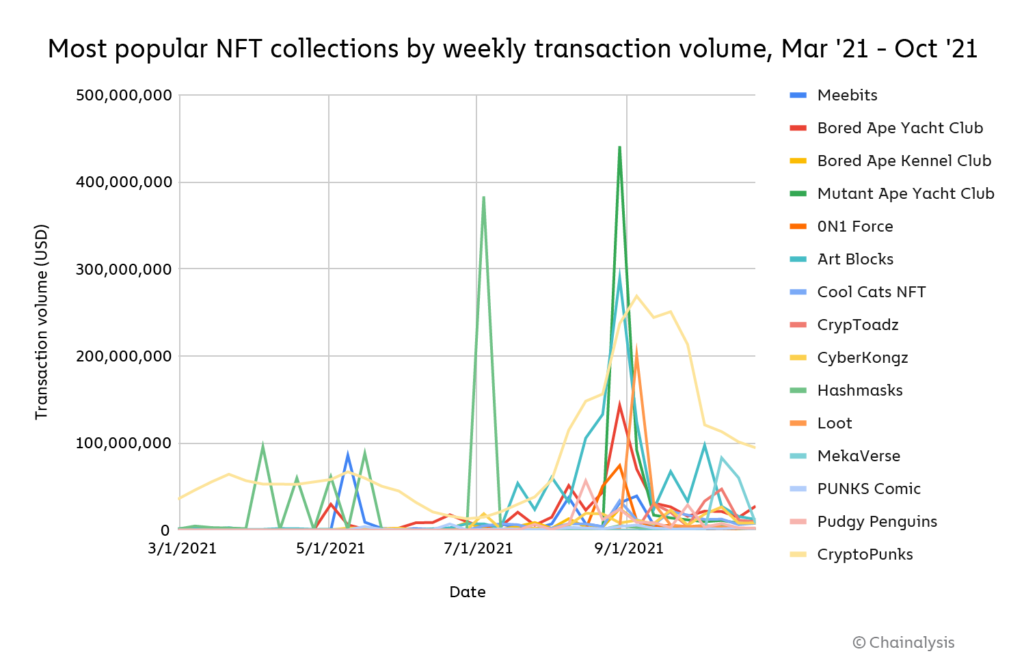

The demand for digital art, music and videos as non-fungible tokens (NFTs) facilitated via blockchains soared last year to $44 billion. The rise of NFTs was so prominent in 2021 that Collins Dictionary awarded “NFT” the word of the year.

The illustration above shows that the most sought-after NFT collections were traded on the Ethereum blockchain. While this was a bullish notion for Ethereum’s native token Ether, as it is used to process the transactions, it was not the case for the Ethereum Network as a whole. As the Ethereum blockchain can only process 15 transactions per second, it reached certain capacity limitations as the demand for these services grew drastically. This drove the cost of processing transactions on the blockchain to record highs, with the highest gas fees recorded at $196.68 in May last year. This effectively priced out many, and users flocked to other POS blockchains such as the Binance Smart Chain and Solana, where gas fees are usually less than a dollar. These alternative blockchains were subsequently dubbed as ‘ETH-killers’.

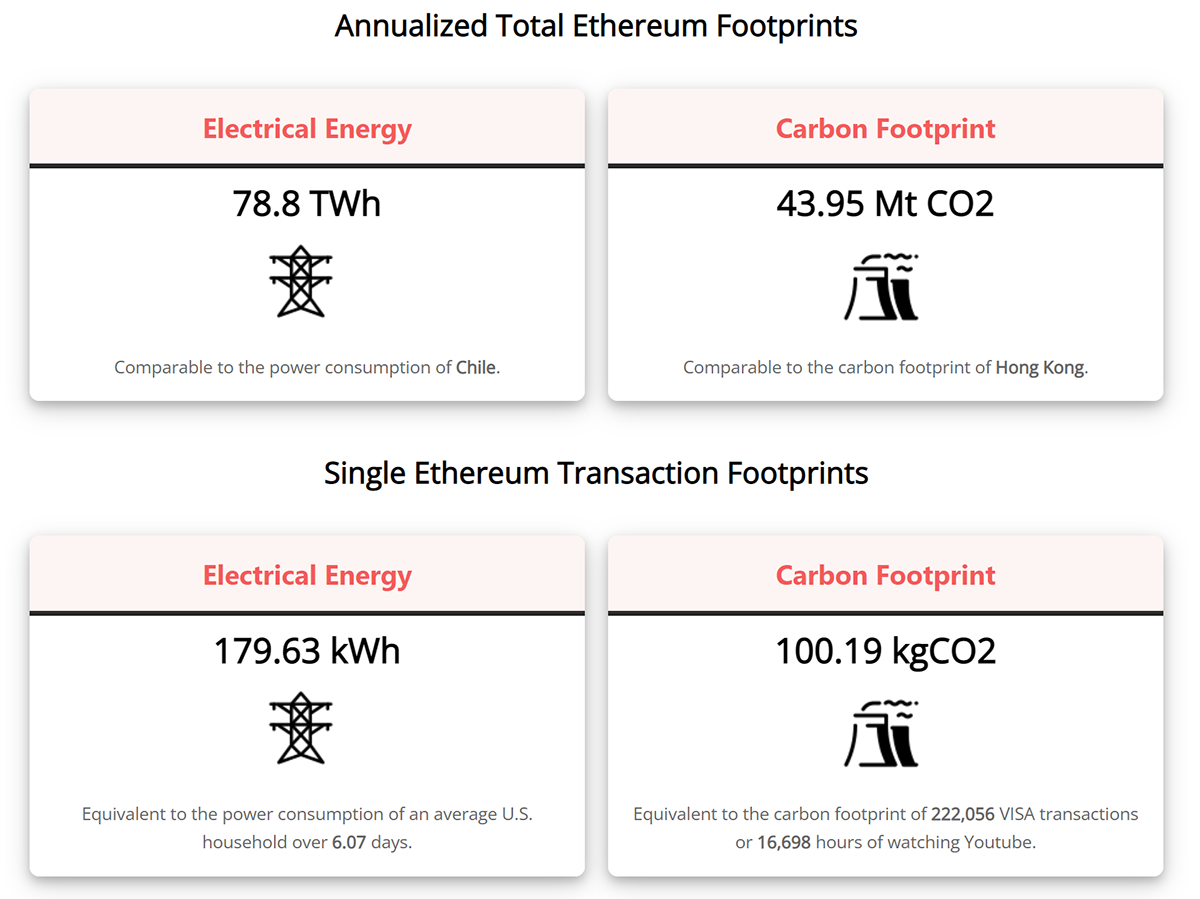

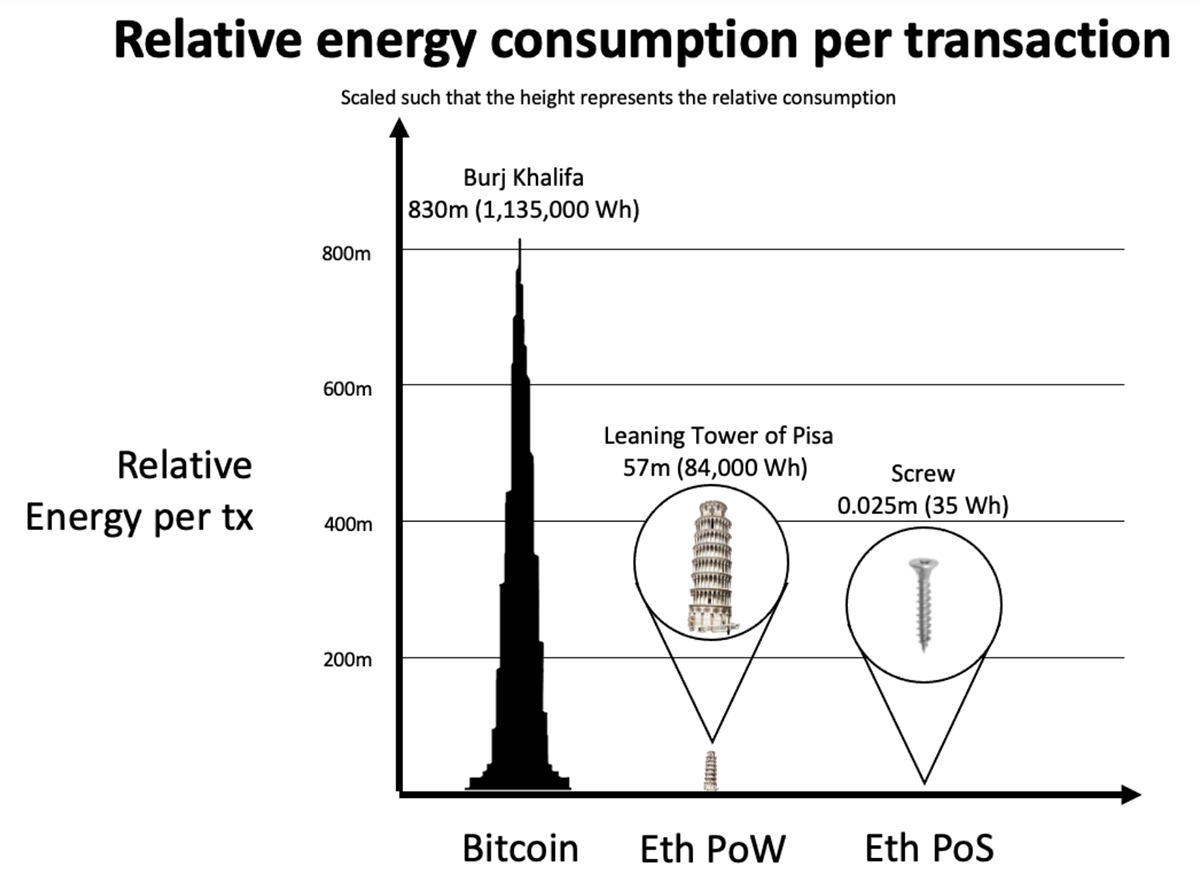

The limelight on Ethereum also brought attention to something else, namely the massive energy consumption required for cryptocurrency mining to secure the network. As Ethereum in its current state is a Proof of Work(POW) blockchain and requires crypto miners to secure the network, miners are incentivised with Ether as a form of payment. However, this specialised mining equipment consumes an excessive amount of energy, making the blockchain less 'green' in comparison to competitors. Currently, the blockchain’s energy consumption is comparable to the power consumption of Chile, which is not a small country, as it ranks as the 38th largest by landmass. To alleviate the blockchain from these issues, the Ethereum Foundation, with a community consensus, started its long and challenging journey of becoming a POS blockchain.

Enter Proof of Stake

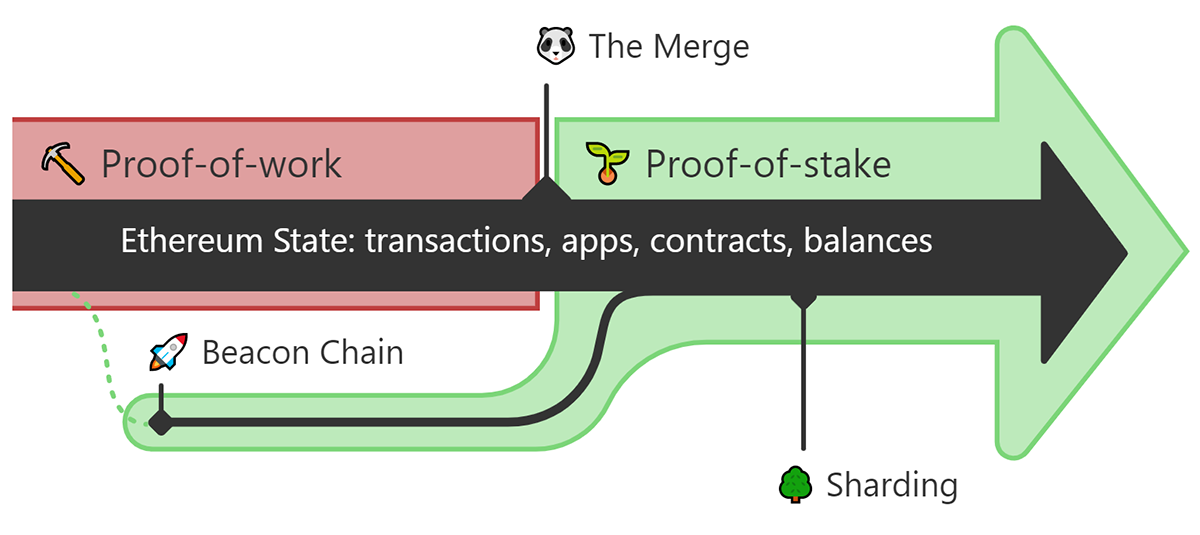

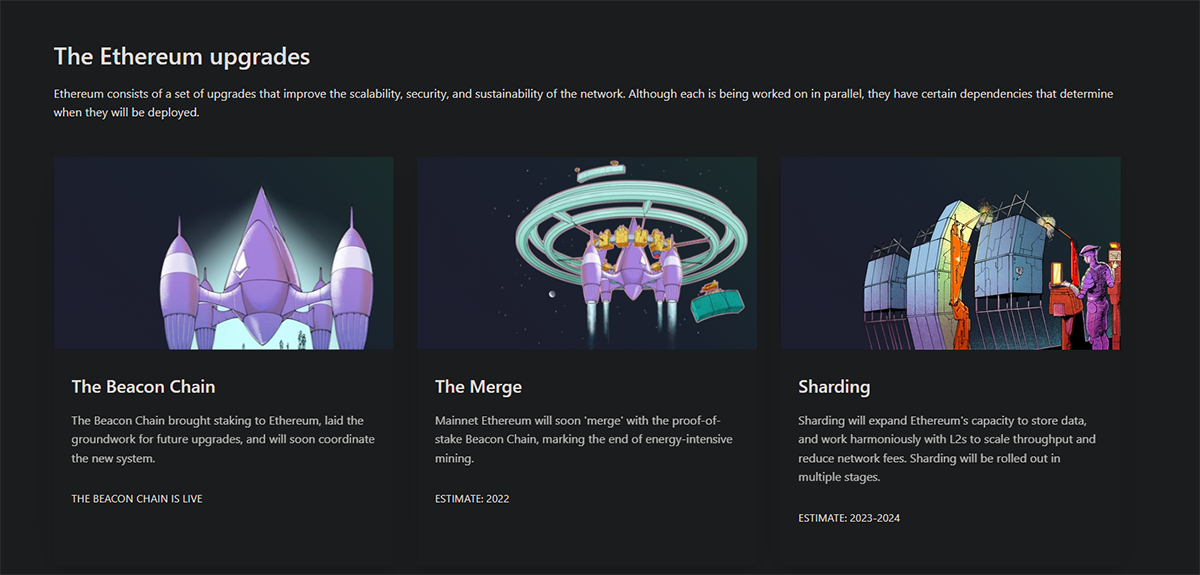

Since Ethereum’s genesis block in July 2015, Ethereum has been secured by miners, while the Mainnet holds records of every transaction, smart contract and account balance. In preparation for an eventual transition to POS, the Beacon Chain was launched in December 2020 and has been running parallel to the Mainnet since. When the planned merge goes ahead in September, the Beacon Chain will merge with the Mainnet and transition into a Proof of Stake blockchain, making mining obsolete.

POS is a consensus method for processing transactions and creating new blocks on a blockchain. With POS, the need for crypto miners is replaced with cryptocurrency owners who stake their assets to secure and validate blockchain transactions. Users who stake their assets are usually referred to as ‘stakers’ and are incentivised based on the amount they stake. This consensus method effectively reduces the computation power required to secure the blockchain and directly tackles the vast amount of energy currently required to operate the network.

The illustration above helps to visualise the substantial decrease in energy consumption once Ethereum goes POS. Not only will the POS merge reduce the energy consumption, but it will also reduce the amount of specialised mining equipment sent to landfills, as most equipment used for mining typically fail within four years. This will make Ether a more ESG-compliant asset and could appeal to institutional investors to hold Ether on their balance sheets.

Is ETH a Deflationary Asset?

As previously mentioned, Ethereum incentivises miners in Ether to secure the blockchain, which equates to approximately 5 million Ether each year. After the POS merger, the burden of securing the network will shift from miners to stakers.

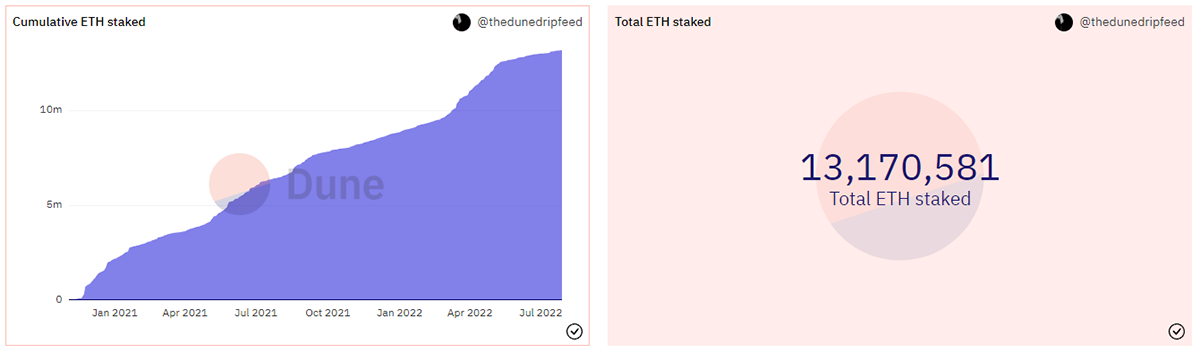

At the time of publication,13,153,029 Ether is staked, which is approximately 11% of the total supply. These stakers receive a return of roughly 5% per annum for locking their Ether. At the current staking rate, the network will be minting around 657,650 Ether per year, which is a far cry from the 5 million Ether to incentivise miners. This will effectively reduce the issuance rate of Ether by approximately 88%.

In August 2021, the Ethereum Improvement Proposal (EIP) 1559 was implemented alongside the London Hard Fork, which changed how Ethereum calculates and processes gas fees. One of the key features of this improvement plan was that a portion of the gas fees previously sent to miners would now be burned. Since the implementation of EIP-1559, a total of 2.6 million ETH has collectively been burned. This, combined with the POS merge, should see the total supply of Ether shrink by 1.7% annually, making Ether potentially a deflationary asset.

The POS Merger Alone Won't Save Ethereum

Given all the hope and optimism surrounding the POS merger, there is a lot of misconception that the merge will reduce Ethereum’s high gas fees. The truth is that the upcoming merge won’t do much in terms of the high gas fees, as the transaction output will not increase. Instead, users who expected Ethereum to have blazing transaction speeds, as seen with the likes of Solana and Avalanche, need to look forward to when Ethereum implements its own scalability solution in the form of sharding.

Sharding is the process of splitting a database horizontally to spread the load. This will reduce network congestion on Ethereum and effectively increase transactions per second. According to Vitalik Buterin, Ethereum’s co-founder, Ethereum will be able to process 100,000 transactions per second by the end of its roadmap. Sharding is estimated to be implemented in either 2023 or 2024.

This may be a sigh of relief for the aforementioned ‘ETH-killers’, allowing these blockchains to further develop their respective ecosystem for the next two years. I do believe that blockchains will be interoperable and work cohesively in the future. Until then, it is fair to assume that once Ethereum is fully fleshed out, it will carve out a good portion of traffic and liquidity from other rival layer-1 blockchains.

Conclusion

While it is clear the Ethereum Proof of Stake merge alone will not fix all of the problems on the network, it is a step (more of a leap) in the right direction. The Merge can be seen as a catalyst that will make Ethereum more scalable for mass adoption. However, this ultimately depends on how well the merge goes in September, or if it goes ahead at all. Fingers crossed because if this doesn't go as planned, we could have another market sell-off, effectively ending any chances of another bull run until the next Bitcoin halving in 2024.