Solana - Riskier Than the Price Action Suggests

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: SOL;

Solana is leading the “ETH Killers” narrative - more on this in part I. In this article, we will evaluate the numbers, competitors, and risks that an investor should understand if they are considering an investment in the SOL token.

Solana has two promising NFT platforms. First, Metaplex is an NFT infrastructure which is aiming to be the Shopify for digital art. Two days ago, they partnered with FTX exchange to help them launch an NFT marketplace. Currently, the cost to mint one NFT on FTX is $500; this has led to SOL and FTX’s token experiencing very positive price action in the last couple of days.

This is a very expensive minting cost, even when compared to Ethereum (typically $200). Considering Metaplex specifically mentions it costs around $0.34 to mint, this could prove very profitable for FTX.

The second platform, Audius, empowers content creators by providing them with a music streaming platform, which generates immutable and time-stamped records of their works. These “assets” are then registered on the Audius network. Audius states that 90% of all platform revenue goes directly to the artist, who is paid according to their stream amount. This has the potential to be hugely disruptive to the traditional music industry.

Audius started on Ethereum but migrated to Solana due to the lower cost. Since launching in July, they have quickly gained five million unique users.

Competitor Analysis

| Market Cap | TVL | TPS | Real Volume (24hr) | |

| Solana | $98bn | $8bn | 65,000 | $10bn |

| Ethereum | $408bn | $90bn | 30 | $7bn |

| Polkadot | $33bn | Unavailable | 166 | $1bn |

| Cosmos | $7bn | Unavailable | 40,000 | $790m |

| Binance Smart Chain | $45bn | $20bn | 132 | $1bn |

| Algorand | $10bn | Unavailable | 1,000 | $3bn |

| Cardano | $82bn | Unavailable | 1,000 | $3bn |

Source: Messari; CoinMarketCap. Competitor Comparison.

The smart contract sector is very competitive. Blockchains within this ecosystem tend to be either:

- Networks that wish to capitalise on Ethereum’s high-cost transactions

or

- Networks that have identified the potential value of hosting sectors like decentralised finance (DeFi) or non-fungible tokens (NFTs)

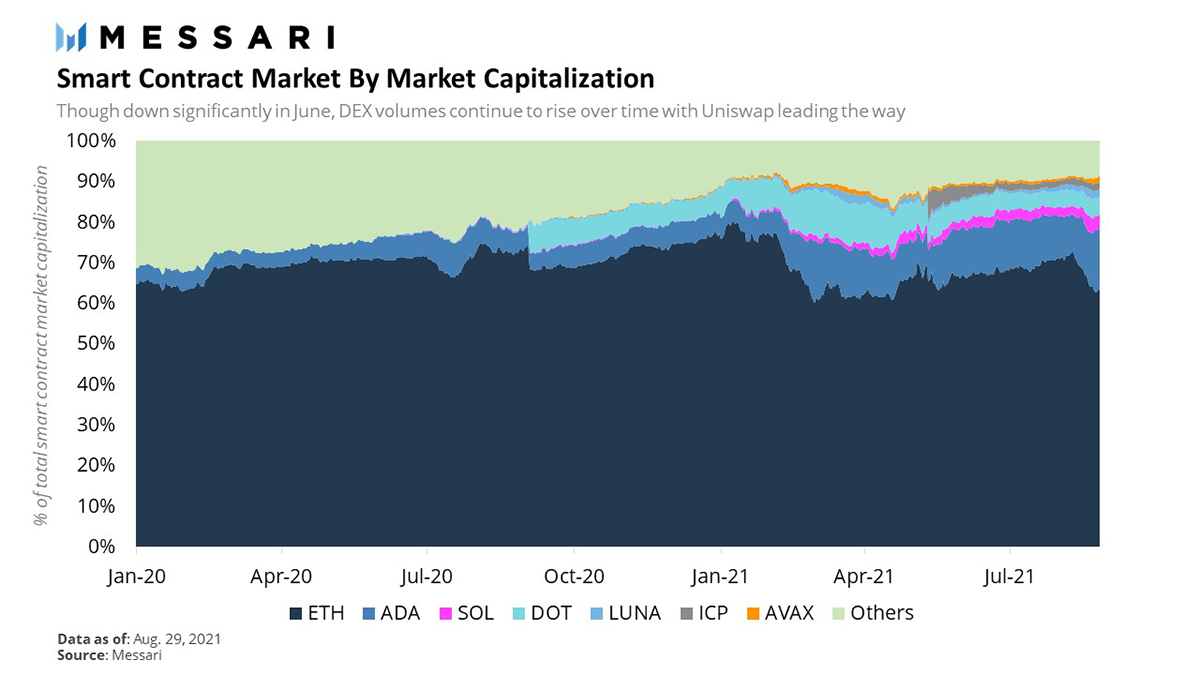

Let’s look at SOL’s returns relative to the smart contract sector.

Relative returns heavily favour SOL. The token has generated a 5,700% ROI (vs USD) over the past year. Binance’s BNB token is in second place with 1,606%, followed by Ethereum with 900%. For some, this cements Solana and Binance Smart Chain as the two main ETH Killers.

Despite the run-up in price, Solana’s market cap of US$60bn remains relatively small in the context of a sector valued at US$700bn.

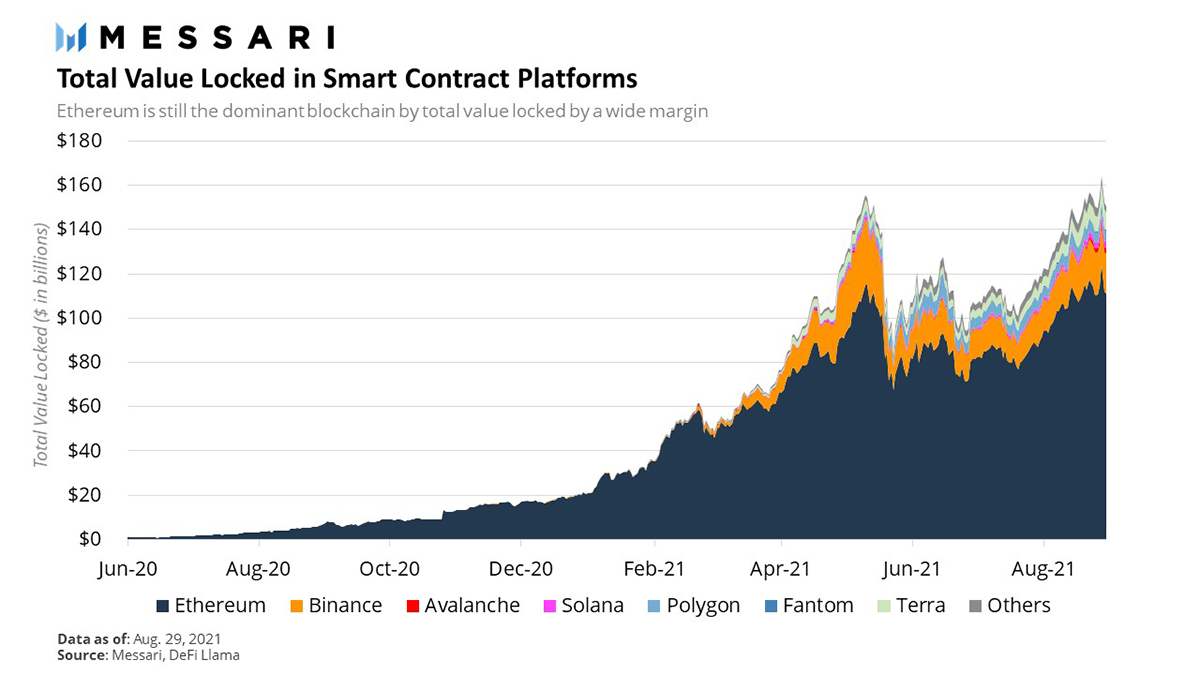

A similar story arises when considering the total value locked (TVL), which looks at the capital at risk within each blockchain’s smart contracts. Solana is a blip in the ocean, with just $6.5bn of TVL. While it has ambitions to lead the DeFi sector, this looks unlikely in the short-term. For the time being, Solana has focussed on a high-risk market: Non-Fungible Tokens, or NFTs.

NFTs are a hot topic due to the lucrative returns some market participants are generating. The opinion about the real value of NFTs is split. Many see a parallel between the 2017 initial coin offerings (ICO) wreck and the NFT fervour today. Others see a sustainable marketplace in its infancy. If we are in a bubble, Solana will be in the line of fire when it bursts.

General Statistics Table

| General | |

|---|---|

| Token Price | $207.32 |

| Reported Market Cap | $60.64bn |

| Real Volume (24hr) | $10.26bn |

| Return on Investment (1 month) | +423.34% |

| Network Analysis | |

|---|---|

| Total Supply | 488,630,611 SOL |

| Circulating Supply | 290,803,822 SOL |

| Inflation Rate | 10.59% |

| Current Transactions Per Second | 2,130 |

| Potential Transactions Per Second | 65,000 |

| Average transaction cost | $0.00025 |

| Applications | 302 |

| Money Market Analysis | |

|---|---|

| Total Value Locked (TVL) - DeFi | $8bn |

| Stablecoins Issued on Solana | $1.6bn |

Sources: Messari; DeFiLlama; @RareLiquid; CoinGecko; Audius; Solana. General Stats Table for Solana.

The growth of Solana is highlighted when analysing its reported market cap. On January 1st 2021, SOL had a market cap of just $70m; this grew to over $60bn in 9 months. In the last 30 days alone, it has returned investors over 400%.

Solana prides itself on its transaction capacity, i.e. the number of transactions it can process at any given time. Currently, the technical limit sits at 65,000 transactions per second (“tps”), but the network is nowhere near that number, operating at just over 2,100 tps now.

This brings us to the biggest paradox with “ETH Killers”. They are so focused on enticing users with promises of huge transaction capabilities that they neglect two main things.

First, a massive transaction capacity means next to nothing without high-quality development on a blockchain; Solana relative to Ethereum shows this perfectly. Solana’s cap is 65,000 tps while Ethereum’s is around 30 tps, yet when it comes to value generated or TVL, Ethereum leaves Solana in the dust. Each Ethereum block is full, which creates demand and attributes value to any block space available. High tps blockchains lack this.

Second, highly scalable blockchains like Solana typically compromise on two vital components of protocol architecture, security and decentralisation. To succeed in the long run, it is vital that a network provides a robust balance between these core features. It is not the case of finding a perfect network but one that strikes a balance well. Ethereum is the leader at this, while Solana is unproven.

| Exchange Coverage | |

|---|---|

| Centralised Exchanges | All major exchanges such as Coinbase, Binance, Huobi, FTX, Kraken, and Bitstamp |

| Decentralised Exchanges | All major exchanges such as Uniswap, Sushiswap, 1inch, and Quickswap |

SOL Conviction Score

- Digital Asset Market: The market is shaky after the El Salvador leverage flush out. Investors should be wary of short-term volatility.

- Hype Vs. Reality: Reality

- Trade or Trend: Currently, neither. Investors with exposure should look to take profit due to SOL’s parabolic price appreciation. Furthermore, the NFT craze looks poised to leave someone with a large bag.

- Market Outperformance: Outperformance across the board, very impressive for a top seven crypto. Over 5,000% ROI over the past year.

- Competitive Advantage: There are few more competitive sectors than smart contract blockchains. Solana has unproven technology, and due to the lack of TVL in its financial stack, it looks like Ethereum wins here.

Token Takeaway Score: 3/5

Comments ()