I Disagree with Goldman Sachs

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 5

“Of the three roles that Bitcoin was purported to play in the real world, we believe that none has materialized” - Goldman Sachs

Highlights

| Technicals | Narrowing range, trend weak |

| On-chain | Blockchain still slow following difficulty adjustment |

| Macro | A renewed inflation narrative would boost crypto |

| Investment Flows | Buoyed by the fall in miner selling |

| Crypto | Crypto computer games are catching on |

This report by the Goldman Sachs Investment Strategy Group came out today, saying:

“Of the three roles that Bitcoin was purported to play in the real world, we believe that none has materialized”

They go on to say that Bitcoin has failed as a:

Medium of exchange

“Bitcoin cannot fulfil that role since processing a transaction is too slow”

Volatility

“It is virtually impossible for producers and consumers to use a unit of measurement to value the price of a barrel of crude oil with something whose volatility has ranged from 43% to 178%.”

Store of value

“We also do not believe that Bitcoin is a long-term store of value or an investable asset class for diversified portfolios.”

Talk about the obvious. These are old criticisms, and the one thing that makes me structurally bullish on the crypto ecosystem is its ability to evolve. For speed, there are lightning layers and new faster protocols. For volatility, stablecoins have become a $120bn asset class, which the world’s central banks are mimicking crypto. As a store of value, I agree Bitcoin’s future is unknown, but the reasons stated by Goldman Sachs are naive.

They think gold is not an effective store of value either.

“Likewise, we do not believe that gold is an investable asset class as a store of value, so claims that Bitcoin is “digital gold” do not confer any value to Bitcoin.

Their reason?

“Since the inception of pricing data, gold has provided an annualized real return of 1%, barely outperforming inflation. Adjusting for storage and insurance costs, the estimated excess return drops to zero.”

Gold says that on the tin. It is a 0% real return asset over the very long-term, hence the expression “the golden constant.” It is so called because it is the constant through time. No one ever said it would make a real return. They then show their true colours:

“The only asset class that hedges inflation on a consistent and reliable basis is US equities. US equities have outperformed inflation 100% of the time.”

Quelle surprise. I know it was the American Day of Independence on Sunday, but this is ridiculous. Here’s the best bit.

“Gold outperforms inflation only about 50% of the time over a 19-year window. So owning US equities is a better long-term inflation hedge.”

19 years? Talk about data mining. Besides, how long is 19 years? It is the best part of half a career in finance. How unhappy would your clients be if it took 19 years to generate a real return? I suspect not many.

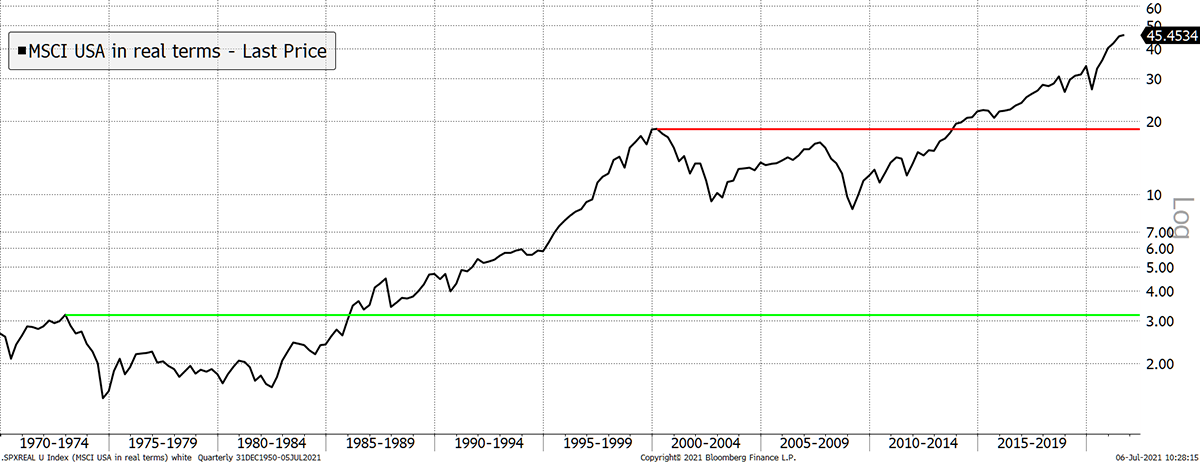

Here’s the S&P 500, including dividends, and in real terms since 1970. Of course, it has done well. Yet from 1972, a new real high didn’t materialise until 1986. And from March 2000, things weren’t perky until 2014.

US equities can stall for long periods

Source: Bloomberg. MSCI US TR real return (divided by CPI) since 1970.

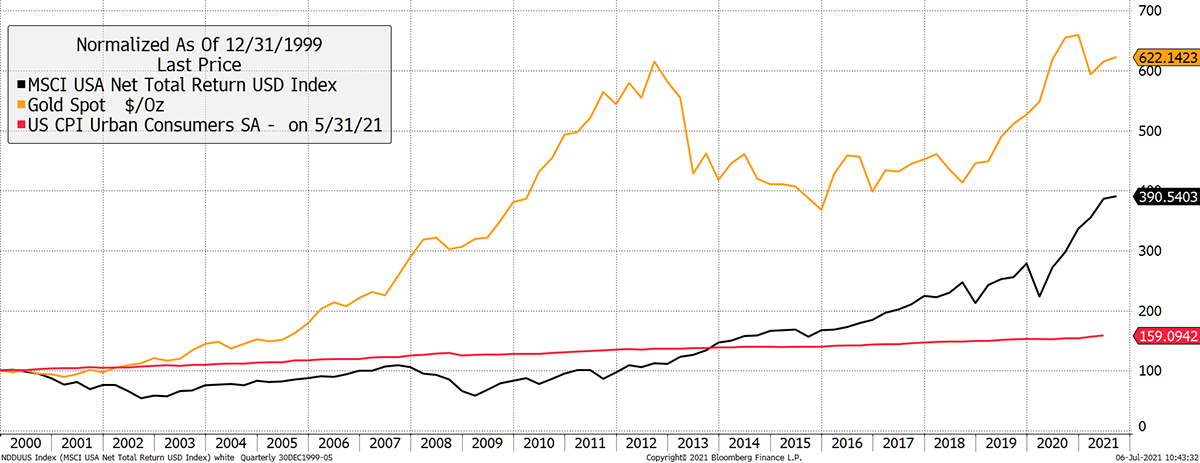

What did gold do in the 1970s while markets imploded? It rose 27-fold. And in the noughties? It’s still way ahead of the S&P 500 and inflation after including dividends.

Gold wins

Source: Bloomberg. Gold, S&P 500 and CPI since 2000.

I accept that US equities will beat gold over the long-term. That is the point of productive and risky assets. Gold’s job is to thrive when things go wrong.

To demonstrate a total lack of understanding (or more likely an agenda) doesn’t serve Goldman’s well. 19 years??? Well yes, any economy and financial market ought to be able to pull itself back together over such a long period of time. But then to extrapolate that, and dismiss the mad monetary times we live in, is deplorable.

Goldman don’t seem to acknowledge the basic role of gold, which is to return loads more than CPI when inflation spikes, and less (negative) when it comes back under control. Knowing this, I have confidence they are missing the point on Bitcoin too.

It’s not a currency. That’s been obvious for years, yet they still use that to critique it. It’s a digital asset and a great one, with huge potential. But I agree, that is far from assured. Value creation never is.

In summary, Goldman trot out the usual guff that blockchain is great, but Bitcoin isn’t.

ByteTree ATOMIC

Technical

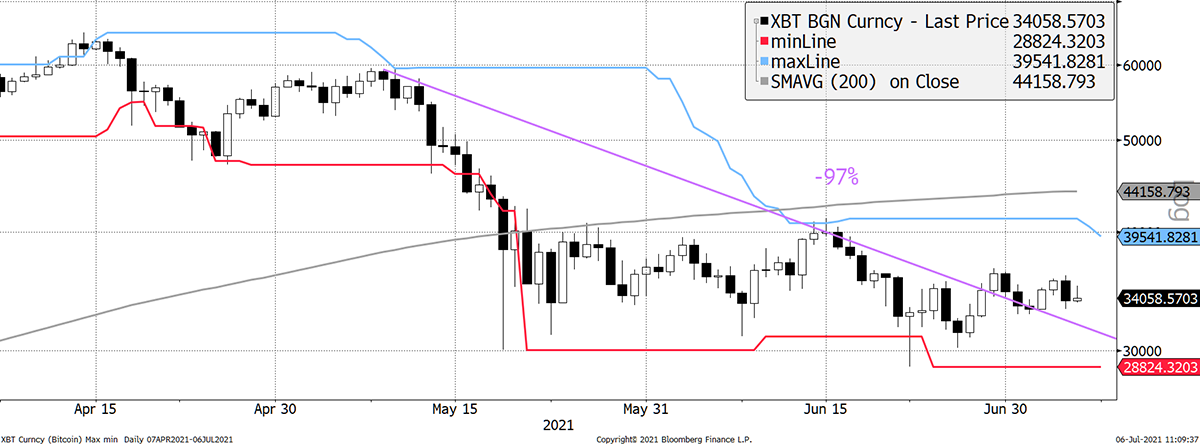

The market has been somewhat calm, but perhaps that doesn’t come across when you watch the ticks. BTC is still in the middle of the range. On the plus side, it has nudged through my purple trendline. On the minus, the 200-day moving average will soon point south (gradient), and the upper 20-day price band (MAX) has nudged lower.

Source: Bloomberg. Bitcoin with max/min over the past three months.

The upside of a falling MAX is that it’ll be easier to break. That now sits at $39k and, by next week, will be at $35k.

Still, big picture, the trend remains weak. I can’t dress it up.

On-chain

The downward difficulty adjustment passed on Saturday without a hitch. BTC rallied on the event, only to reverse gains on Monday morning.

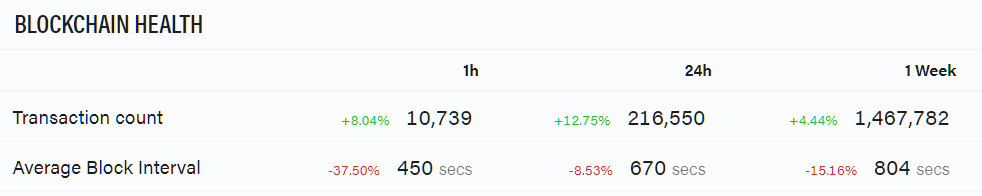

Average block intervals have eased back to 670 seconds (target 600 secs, was >1,000 secs last week) over the past 24 hours. You can view this on the “Raw” tab on our Terminal.

Source: ByteTree. Transaction count and the average block interval.

The surprise is fees. They have eased slightly but not by as much as I thought they would. Still, an average transaction cost $9.39 last week and $7.7 yesterday.

Source: ByteTree. Total and average Fees.

Recently, we have seen blocks coming through which are light on transactions yet heavy on data. We can’t be sure of the cause, but with a bit of luck, on-chain application is evolving.

I have always felt that a Bitcoin Network with genuine utility would be materially more valuable than one at the behest of mere speculation. I’ll be watching the block size and will report back.

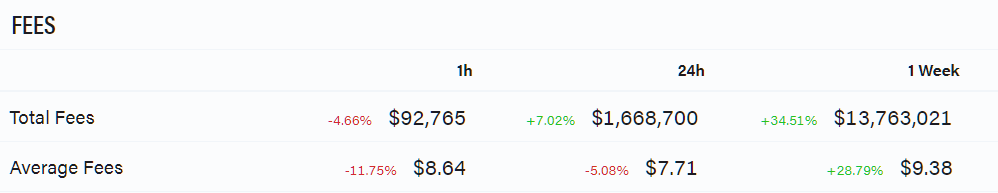

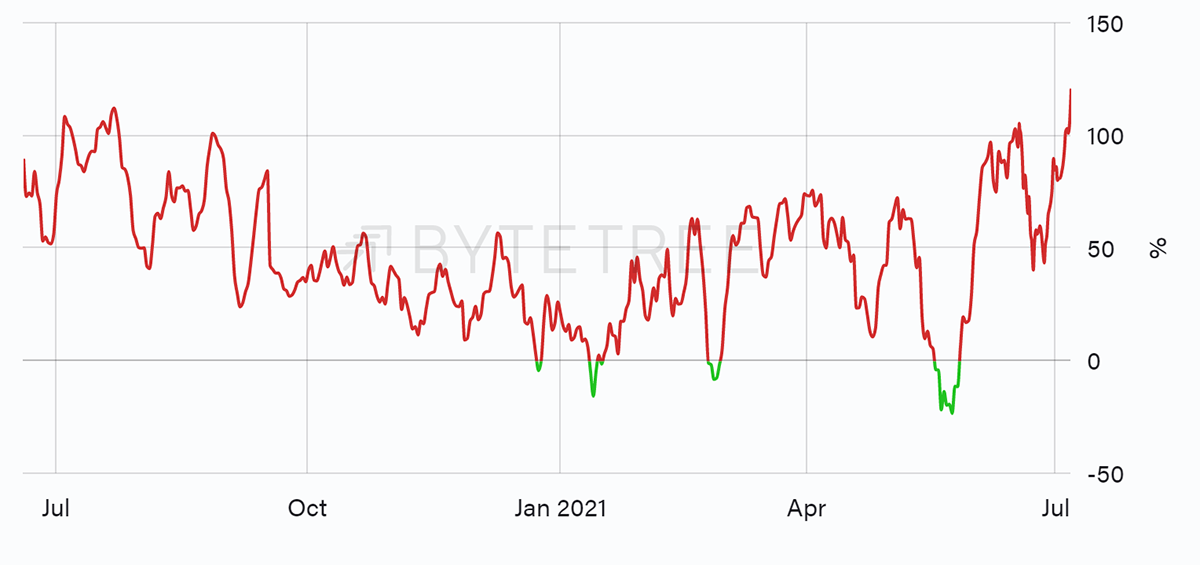

So light is network traffic today, compared to the spring, that the one-week Fair Value has dropped from $20k last week to $15.6k today. That puts the Premium to Fair Value at 120%. That’s the highest this year.

Premium is uncomfortably high

Source: ByteTree. ByteTree Premium (red) and Discount (green), over the past 12 months.

Macro

Last week, I highlighted the dollarwhich looks poised to move higher in the short-term. Longer-term, policy decisions will see this reverse, but we have to be patient.

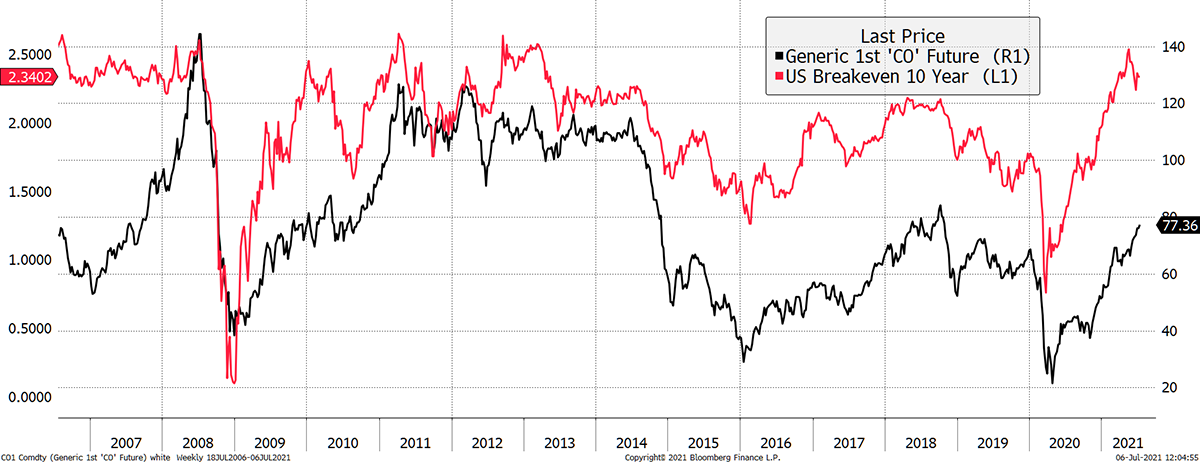

On the bright side is a thriving oil price that ought to feed through to higher inflation. I think this time, the market really means it.

Oil can drive inflation higher

Source: Bloomberg. Brent crude and 10 -year inflation expectations since 2006.

One of the reasons inflation has remained low is down to cheap energy. A tight oil market will put an end to this.

Higher inflation will reignite the crypto narrative. Ignore Goldman Sachs.

Investment flows

One positive of a slow blockchain is that it generates fewer new BTC. We’ve typically seen 27k to 30k BTC sold by miners from March to May. In April, it was 22,374 BTC. That has offset the –4.8k BTC outflows from the funds.

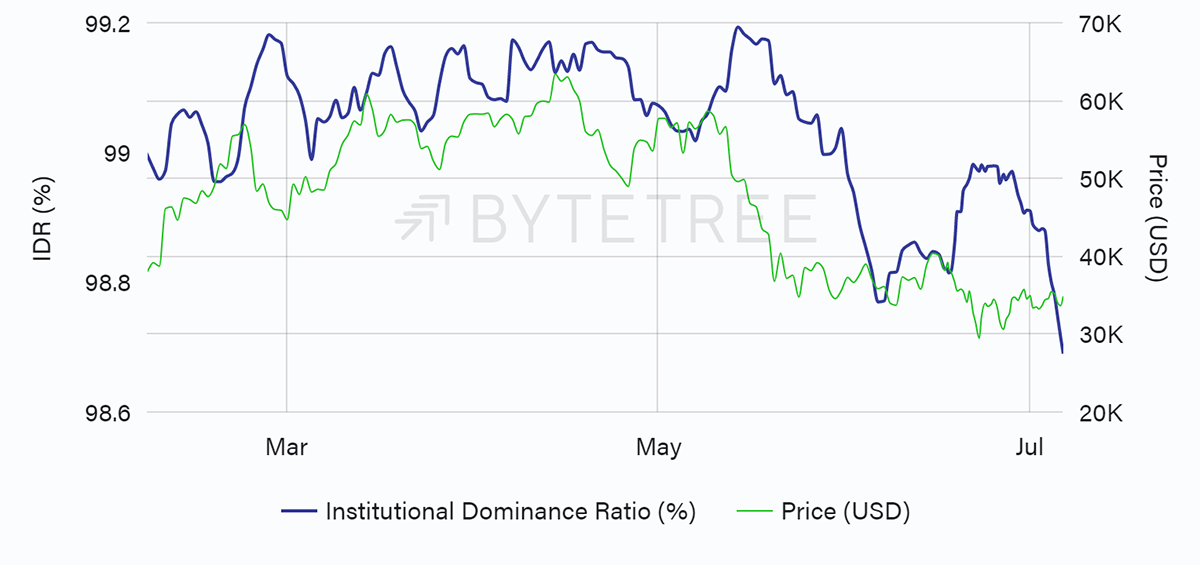

Yet, I point to the Institutional Dominance Ratio (IDR), which has fallen to a new low for this cycle. The high value transactions, driven by institutional trading activity, are slowing.

High value transactions are falling

Source: ByteTree. ByteTree’s Institutional Dominance Ratio (IDR) and the price of bitcoin over the past 12 weeks.

This simply means the whales are no longer feeding. If you want to learn more about IDR, please read this recent insight.

Crypto

A few tokens are breaking ranks and showing strength. Tom will cover Axie Infinity (AXS) this week, which is creating a pay-to-play gaming economy. I love this sort of thing because it’s easy to see how gaming could interact with the space and be enhanced by value sharing. By the way, it’s already doing it.

Summary

All in all, demand remains weak, and the risks high. It is unsurprising when you consider the savage attack on Binance in multiple jurisdictions. We need this to pass and for inflation to return.

Comments ()