What would make institutional investors increase their Bitcoin allocations?

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 82

After the roller coaster ride in Bitcoin in recent weeks, I asked three of the leading ETF providers what would make their institutional clients allocate more money to Bitcoin?

Daniel Masters, the Executive Chairman for CoinShares, said:

“To the many institutions around the Globe who have been studying crypto – this is the time to step in. Prices have dropped considerably in light of ESG concerns, Chinese crackdowns and wider Government and regulatory intervention. This news is now discounted in the market. What remains is the fact bitcoin is the North Star of the crypto movement and is the most basic element on the periodic table of decentralised finance (DeFi). DeFi is a faster, cheaper, more inclusive, smarter, more transparent instance of financial plumbing and is plainly a better product than what has existed until now.”

As Masters touched on, DeFi is quickly becoming a challenger to the archaic financial system. Global accessibility to financial products will continue to drive this demand as professional investors look for yield generating opportunities.

Hector McNeil, the CEO of HAN ETF, which oversees the BTCetc Bitcoin Fund (BTCE), told me:

“We are seeing more and more multi asset managers looking at the space. They like the correlation and diversification benefits but would be greatly encouraged by lower volatility.”

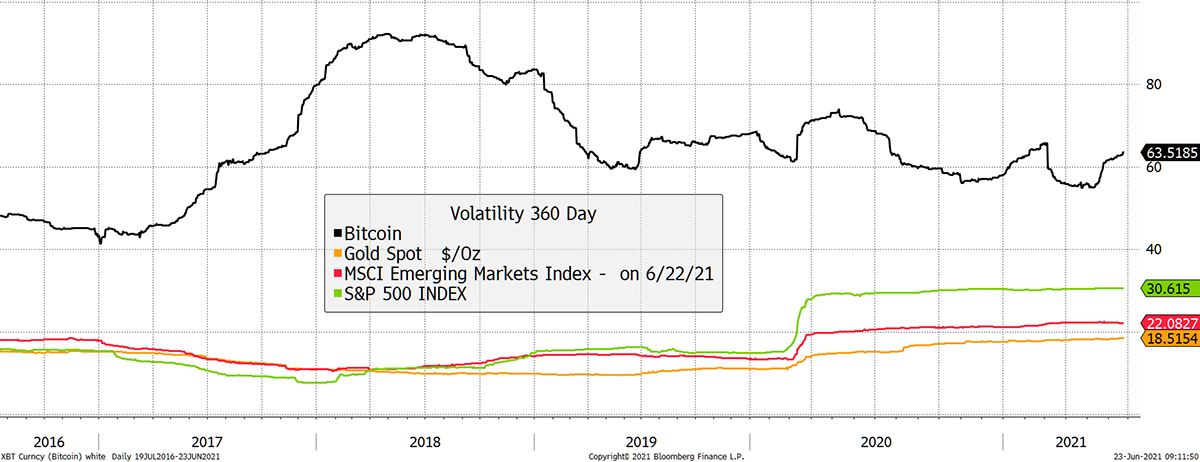

I’ll go through those points. 90-day volatility, a measure of the size of daily moves, is 76%, which is below the pre-2014, era as shown by the two-year trend in red. But it’s still high.

Bitcoin volatility remains elevated

The volatility stands out when comparing it with other asset classes that institutional investors deal in day-to-day. Remarkably, the S&P 500 has shown more volatility than emerging market equities in recent months, which is unusual. Gold continues to show stability, but Bitcoin is something entirely different from traditional assets. In this chart, I used the more stable measure of 360-day volatility for comparison.

Bitcoin volatility comparison

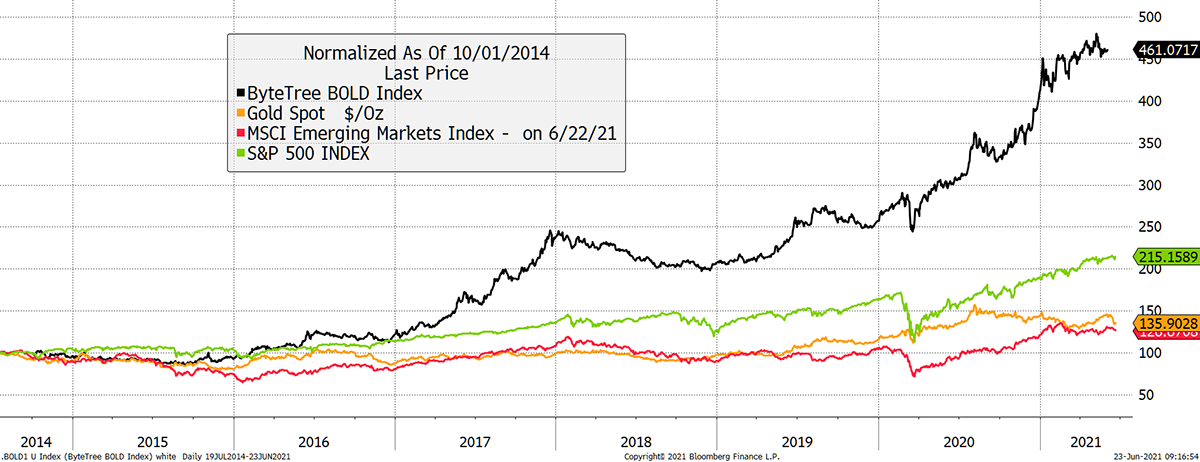

McNeil also mentioned the diversification benefits of Bitcoin. To understand this, look no further than ByteTree’s BOLD1 Index. By blending Bitcoin and gold together on a risk-adjusted basis , the results have been striking. Just a 20% weight in Bitcoin (approx. as it varies), with the rest in gold, delivers a powerful combination that can only be possible because of diversification benefits.

The power of diversification from Bitcoin

If gold and Bitcoin were correlated, there would be fewer diversification benefits, and this result would not be possible. These benefits would also be lesser if Bitcoin were blended with equities as they are risk-on assets and have a higher correlation. The Bitcoin and gold combo is for kings.

I asked the same question to Laurent Kssis, Managing Director at 21Shares, which manages a wide range of crypto ETPs. He told me,

“Before the institutions were sceptical because the price was too high. The price has now fallen by 40%. This is an opportunity for them to jump in.”

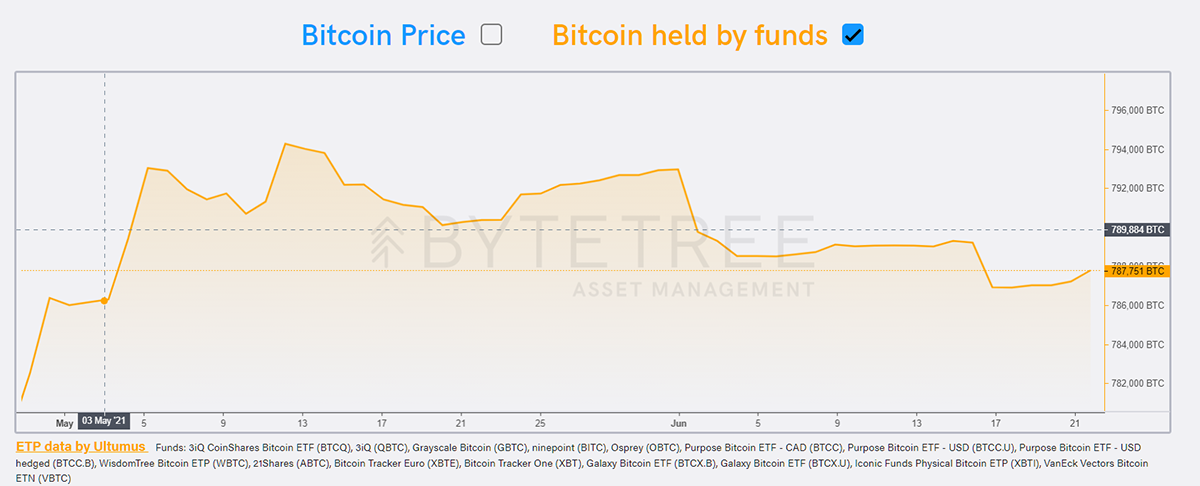

In which case, we ought to see more inflows, which ByteTree data tracks. By no means are the ETFs and funds the sole source of demand, but they are a consistent and significant sample with flows in both directions as institutions are free to buy or sell.

Despite funds holding fewer bitcoins than a month ago, they are not dumping. In fact, the past two trading days have seen modest inflows. Might this continue?

Supply versus demand

Tracking Bitcoin supply is easy as it has been pre-defined. There is some flexibility on future supply, such as block intervals, which influence the date of the future halving events. There is also the question of whether the miners HODL or sell, but basically, the next 100 years’ worth of Bitcoin supply is known to a high degree of accuracy.

That makes Bitcoin a demand story and tracking that is hard. The ByteTree ETF flows are probably the most important sampling exercise for the big money. Other methods look at exchange flows, address balances and web traffic trends. These are all interesting to watch but seriously flaky data points; I know that having tested them.

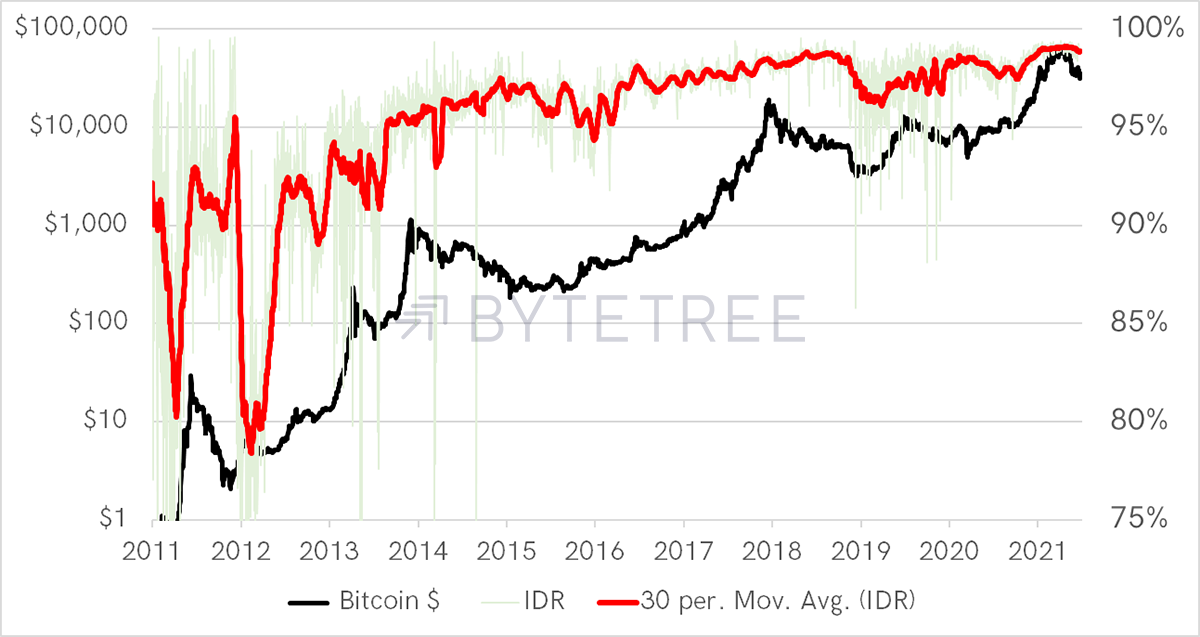

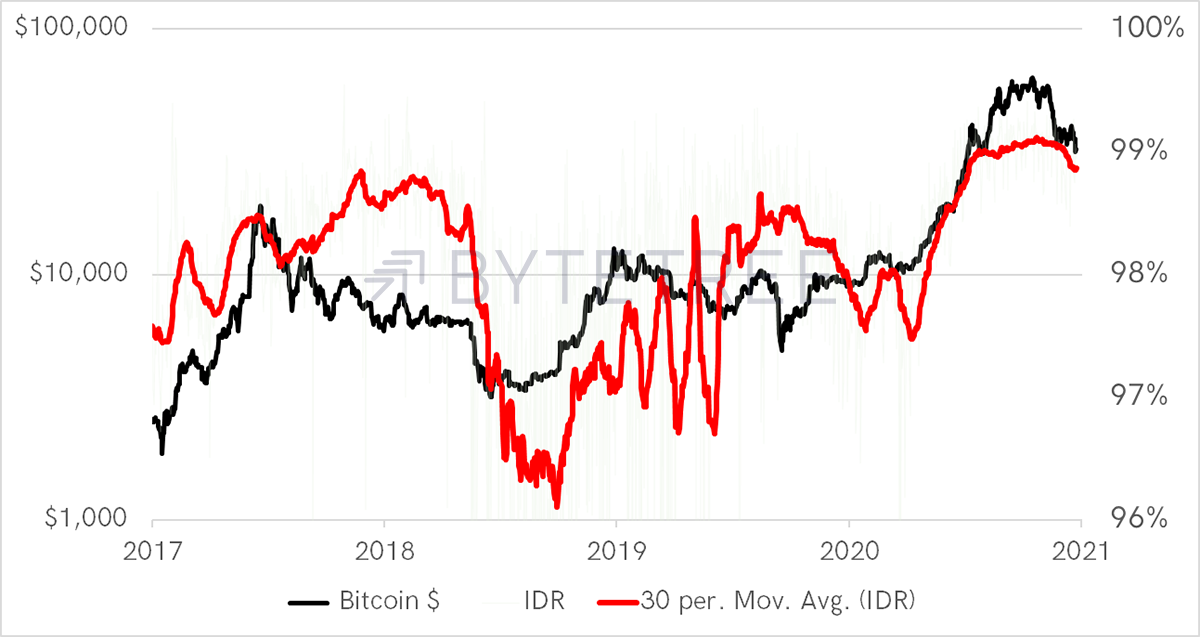

ByteTree has a second method that targets the big money and that is the Institutional Dominance Ratio (IDR). Quite simply, it looks at the size of transactions. If the large transactions overwhelm the network, IDR is high and institutional trades dominate the network. If a block has 1,000 transactions, we look at the top 200 transactions as a percentage of all transactions; this is how it has varied over time.

Institutional interest has increased over the past decade

I use a 30-day smoothing for clarity. In 2011 and 2012, the large traders left the market, causing mayhem. But over the years, the largest quintile of transactions has grown from 80% of the network to +96%.

Zooming in post-2017, you can see how interest dried up in mid-2018 and broadly followed the price trend thereafter. In mid-2020, it surged towards the year-end and hit a record 99%. We can conclude that institutions now dominate the Bitcoin Network. A high IDR reading confirms heavy institutional interest.

Big institutions drive the network

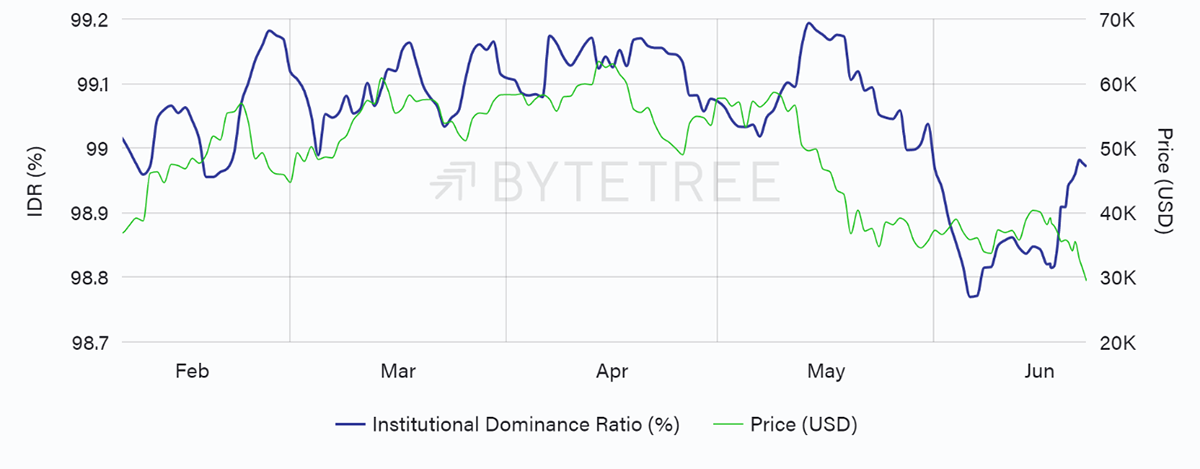

The 7-day smoothing is published block-by-block. It started to ebb in mid-May to 98.8%, but it has rebounded to 99% over the past week.

IDR rebounds

I feel this will be an important measure this year. It has recently broken below the 99% level. Provided it can hold up, the Bitcoin Network will continue to be supported by the big money, which means a network collapse is unlikely.

China again

Finally, what is behind the recent weakness? It’s China. They have banned Bitcoin mining and heavily restricted trading. The mining ban has reduced the hashrate and increased the average block intervals to over 800 seconds (should be 600). These will self-correct on 1 July (estimated), and the blockchain should speed up again.

It is a bit like China banning Coca-Cola. The company’s share price would take a knock, but the company would survive and remain profitable. It would take a while, but eventually, it would find new sales channels. Something along those lines anyway.

Bitcoin cannot die and will not die. It is just resting, and fortunately, the underlying network growth rate is many times higher than Coca-Cola. Keep the faith.

Comments ()