Compound Finance: Global Credit Markets Benefit All

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: COMP;

Axie Infinity and other NFT-based tokens have offered investors the best trades over the past week. That should not come as a surprise as Delphi Digital estimates that Axie Infinity will have an annualised revenue of $1bn. See my two-part analysis of AXS from last week, here. In this week’s Token Takeaway, we will be looking at Compound.Finance and their native governance token, COMP.

For investors looking to gain exposure to DeFi, there are few protocols more credible than Compound.Finance. I recommend using our actionable coverage to take a keen interest in one of the most promising applications out there.

Like always, this first article will look at COMP through a qualitative lens. Whereas next week, I will provide readers with the quantitative analysis.

Sector: DeFi, Lending and Borrowing

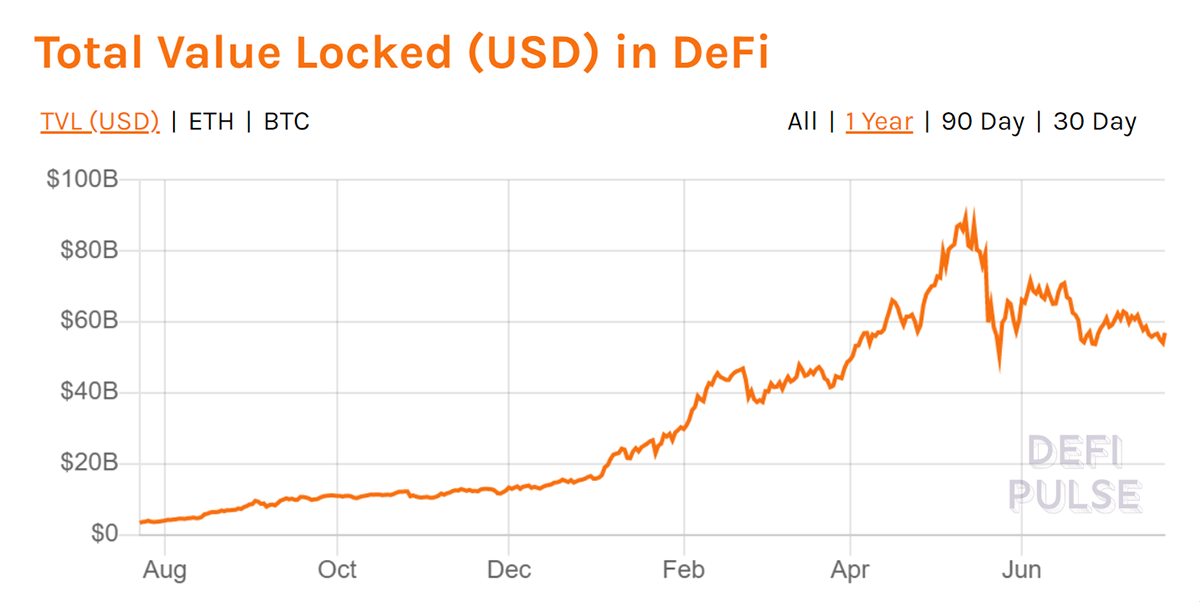

Decentralised Finance (DeFi) has grown to a current total value locked (TVL) of $55bn from a peak of $85bn in May 2021. This exponential growth has cemented DeFi as the certain next contender for traditional finance. For the less-versed, DeFi is the financial innovation layer of the digital asset space. It empowers users by providing unhindered accessibility to a decentralised and global financial market. Wow.

Market participants have not only experienced yields that are beyond imagination in the risk-free fallacy rates of the “old-world”, but tokens associated with DeFi protocols have generated parabolic returns for their holders. COMP is one of the best in both departments.

Company, Team, Partnerships and Funding

Compound Labs Inc., a Delaware-incorporated company since August 2017, are the creators of Compound.Finance. Additionally, they have several open patents surrounding key technological processes; these can be found here. Readers should be intrigued by these patents because if they are approved, Compound could cement a serious competitive moat within DeFi.

The Compound.Finance team contains an impressive concoction of experts in the traditional and digital asset world. This is great to see in the space because all too often, crypto maximalists cater only for their kin and lose the interest of the traditional world - a market that must be catered to.

Robert Leshner, CEO and Founder, is well revered in the digital world for his understanding of DeFi, and in the traditional world for his professionalism as a CFA holder and former economist. Geoffrey Hayes, CTO, has a much more digital asset facing CV. He helps to maintain Exthereum, an Ethereum client built with the supposedly more intuitive Elixir coding language. Readers should understand that this shows extreme competency in understanding how Ethereum works.

The team is good, but the backers are simply world-class. Support from the likes of BainCapital, a16z, Coinbase, PolyChain Capital, Paradigm and Dragonfly capital show the credibility of Compound, which should carry a lot of weight in a space where anyone can recreate a protocol’s code.

Compound has carried out two funding rounds since inception. Most recently, a $25m series A round was completed in November 2019, which was led by a16z. Secondly, in May 2018, Compound completed a seed round to the tune of $8.2m, which was led by ten investors, such as Bain Capital, Polychain Capital and a16z. Not too much to say here; well-funded by terrific investors.

The Ecosystem Surrounding COMP: Decentralised Lending and Borrowing

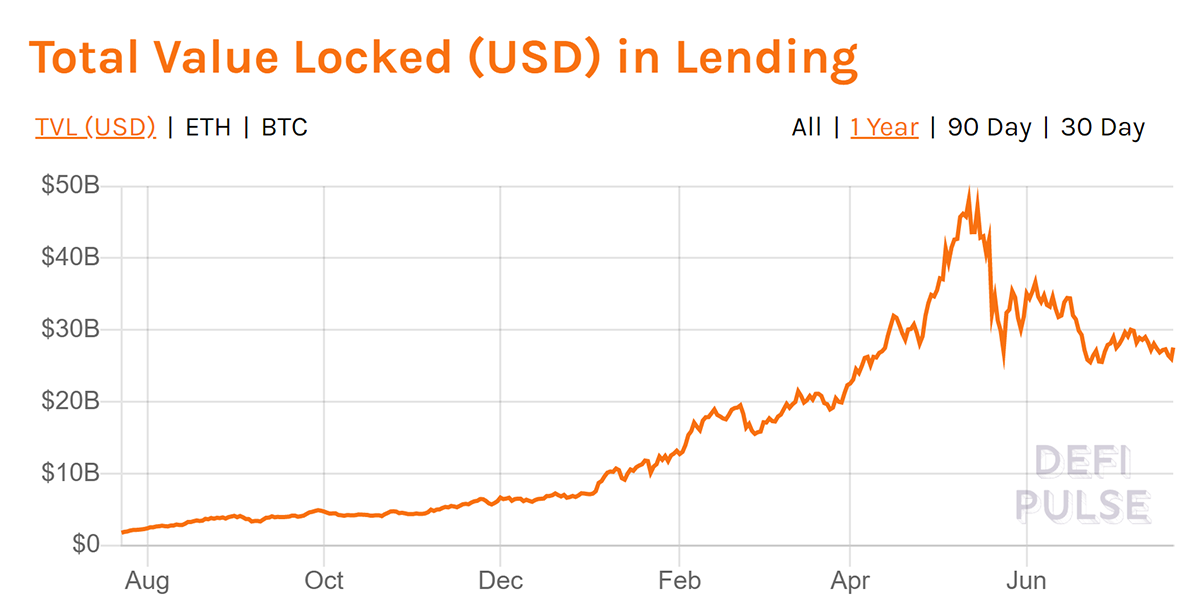

The Lending and Borrowing markets surround the COMP token, and these financial instruments are part of the wider DeFi sector. Readers should note that this sector is the largest within DeFi as it attributes to around half of the sector’s TVL.

The lending and borrowing sector often requires users to back their positions with collateral. This has enabled the digital markets to provide a solution to “bank-runs” and mitigate volatility risk (not entirely) by safeguarding most of the market from the mistakes of large players. Perhaps something traditional banks should have factored in with the 2008 Financial Crisis.

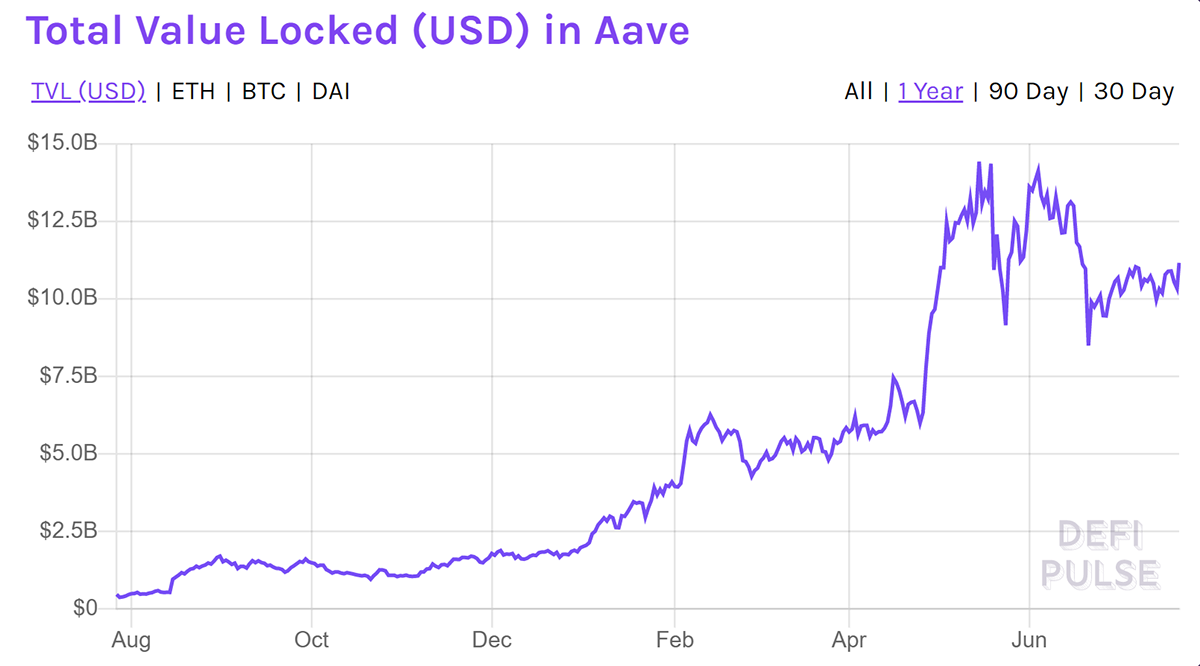

There is nearly $30bn TVL in just the lending and borrowing sub-sector. Compound is the second-largest attributer to this from an application perspective. Aave is the largest lending and borrowing protocol with a TVL of $11bn. However, this has only been the case since the new year. Compound was the catalyst for DeFi last summer, which arguably makes it the most trustworthy.

The Compound protocol generates an enormous amount of value for its users. Typically, their lending rates for stablecoins range between 2-5%, whereas borrowing ranges from 3-7%.

COMP is situated at the top of the most successful DeFi sector. Many believe, including myself, that digital finance has a massive role to play in the future of accessible financial instruments. Investors must evaluate the potential of COMP should it continue to be a winner within possibly the most disruptive sector in the digital asset ecosystem.

The COMP Token

The COMP token is an ERC-20 token, meaning it is based on the Ethereum blockchain. It also plays the role of a governance token, which typically split the opinions of fundamental and growth analysts because voting rights are certainly not a driving force for valuing equity.

Sure, being on the Ethereum blockchain can carry the bottleneck of high network fees, but Compound has “Gateway” coming out soon, which will enable Compound to run as a multi-chain platform. They really do have an answer for everything.

On the one hand, fundamentals suggest that the “primary market” utility of COMP on the Compound.finance platform does not warrant a $2bn market cap. However, this view typically disregards two key points. Firstly, COMP token holders have a direct yield generating opportunity by lending to the COMP lending market. Doing so will provide them with COMP interest and COMP token distribution. Secondly, due to the nature of decentralised governance, future value-generating opportunities are in the best interest of all tokenholders.

On the other hand, the right to govern a protocol has an inherent value in the crypto-sphere. Protocols that increase the value they generate for users typically experience significant demand for their native tokens.

A more nuance answer to why the market is attributing so much value to voting rates could pertain to the self-fulfilling prophecy that the COMP token is an accurate representation of the success of Compound.Finance. Perhaps this is not too dissimilar to the fact that a share on the IG broker platform is never really a claim on a company’s equity and barely comes with the opportunity to directly shape the company’s future.

A more speculative approach would be to look at the reserves of the Compound protocol. Every borrower pays something called a “reserve factor”, which means that a certain percentage of the fee they pay to the money market goes to the borrowed currency reserves. Currently, each reserve is owned entirely by COMP tokenholders, which some might speculate generates value through the potential to redirect those funds back to COMP holders.

As we discussed last week, an investor needs to evaluate the products of the protocol attached to a governance token. Firstly, being Ethereum-based is a positive because it provides protocols with access to the largest capital pool in the world of smart contract blockchains.

The Future of COMP

Furthermore, Compound offers a wide range of money markets for all the major digital assets, including stablecoins which make up around 90% of the total borrowing market on Compound and around 65% of the total lending market. This is due to the very respectable range of stablecoin lending and borrowing rates, which I mentioned earlier. However, in some cases, due to the COMP token rewards, many borrowers are subsidised and can even profit from borrowing digital assets. In the lending case, it provides a turbo boost to the already traditionally unattainable rate.

Compound has also recently released “treasuries”, an institution-facing product to which readers should attribute immense value. According to their Medium article, treasuries are:

“Designed for non-crypto native businesses and financial institutions to access the benefits of the Compound protocol”

This is exactly what the DeFi space needed. Traditional lending and borrowing markets are involved in most people’s daily lives. The Fintech lending industry alone was worth nearly $300bn last year, and through treasuries, Compound can tap into that market and provide rates that are unbeatable in the “old-world”. Bullish. They are offering non-crypto firms a fixed rate of 4% a year on the USDC stablecoin; tell me how this is not the future of Fintech financing.

Conclusion

Overall, COMP and Compound.Finance are positioned perfectly to capitalise on the demand from the digital asset space and the traditional world. Being on Ethereum and involved in DeFi has enabled the sector around COMP to experience eye-watering growth, which leaders such as Compound and Aave benefit from the most. Pick the winners and you will continue to have investment success.

I believe the COMP token has enough value drivers when factoring in its protocol and the potential of reserves being syphoned back to holders. However, from a fundamental perspective, I would like to see a more solid utility case for COMP.

Lastly, it is hard to find protocols that continue to innovate in the right direction and at a higher speed than other digital asset platforms. Treasuries and Gateway are key examples of why COMP and Compound have a great chance at generating long-term value. They get what the wider market needs; easy to use, readily available to traditional players and institutional facing financial instruments that are unbeatable.

See part II for a more quantitative look into COMP. If this part has not convinced you of the power of COMP perhaps next one will.