Bitcoin and Jackson Hole

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 40

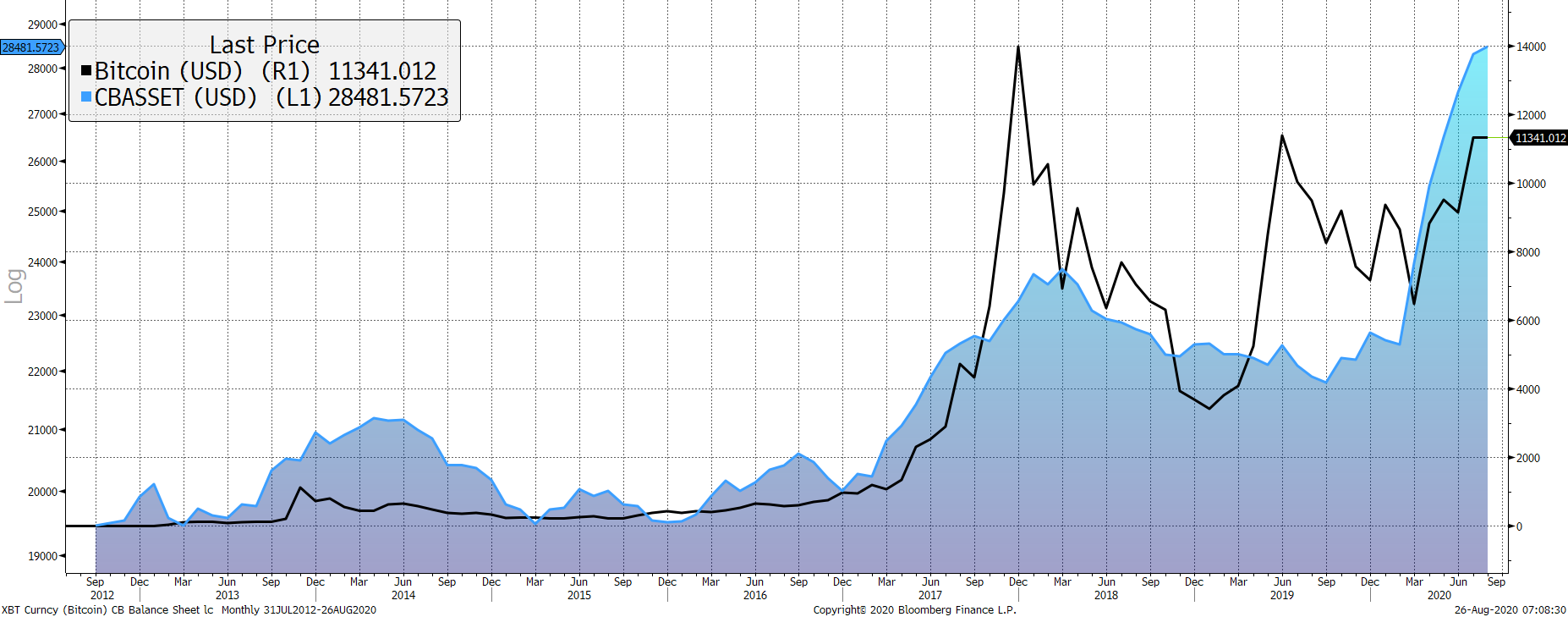

As the world’s central banks meet for their annual shindig at Jackson Hole, albeit virtually, they’ll surely be pondering the size of their collective balance sheets. I’m not sure if their objective is to boost the price of Bitcoin, but they seem to be doing a good job.

Bitcoin and the central banks

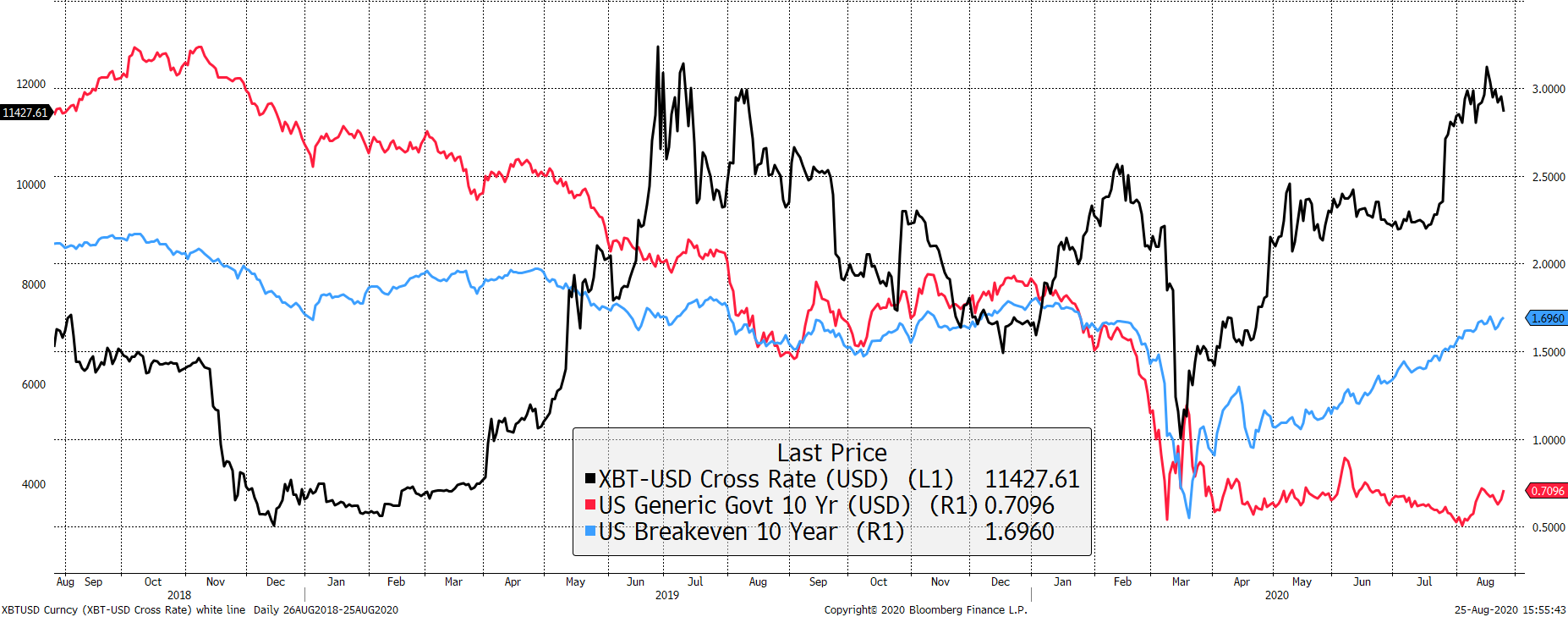

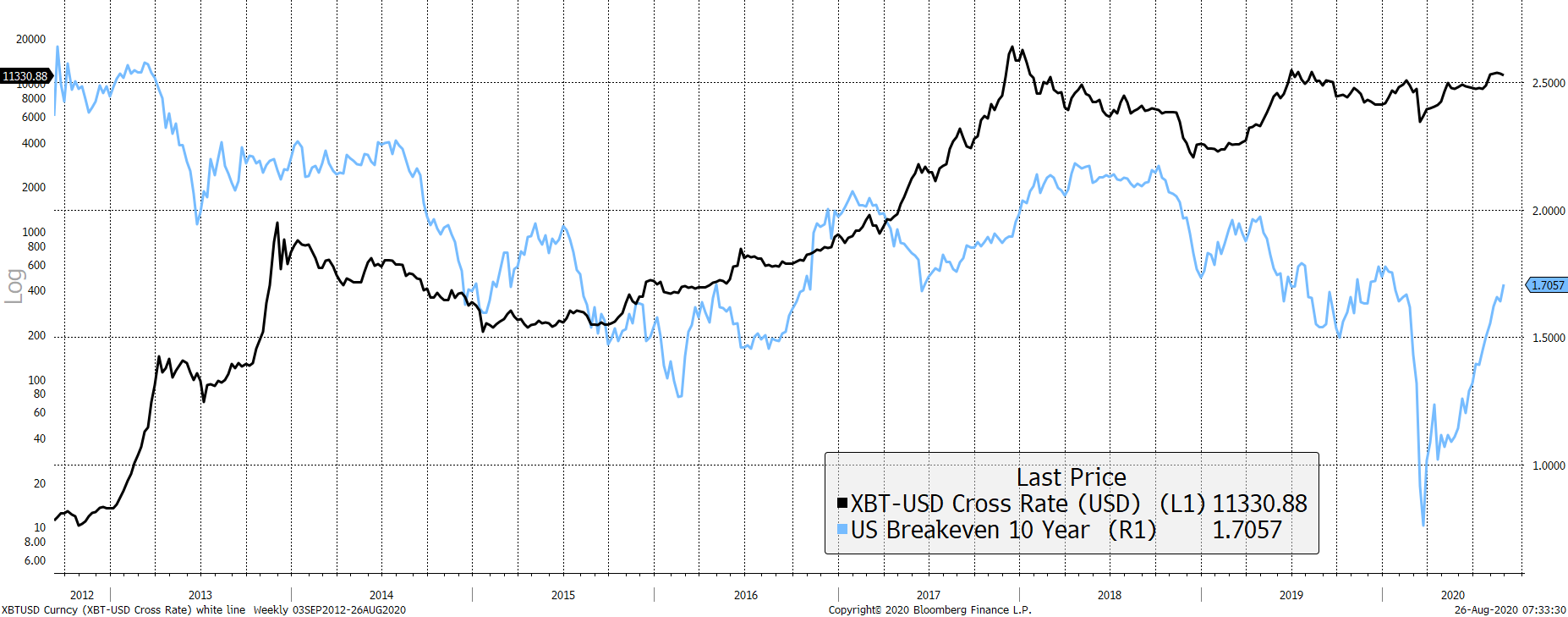

Focusing on the US over the past two years, monetary conditions have shifted from tight to easy. You can see that below as interest rates (red 10-year treasury yield) used to be 1% above inflation (blue 10-year breakeven or future inflation expectations), whereas today, they are 1% below. Gold watchers are well aware that falling real rates drove the recent surge in the gold price, but it is perhaps less clear for what it means for Bitcoin.

Bitcoin and the bond market

On the one hand, real rates peaked in November 2018, just as Bitcoin crashed from $6,000 to $3,000. Was the crash related to the Bitcoin Network or the macro environment? Perhaps we’ll never know, but at the time, ByteTree data had the Bitcoin fair value at $4.3k. Most likely, that was the final capitulation in a savage bear market.

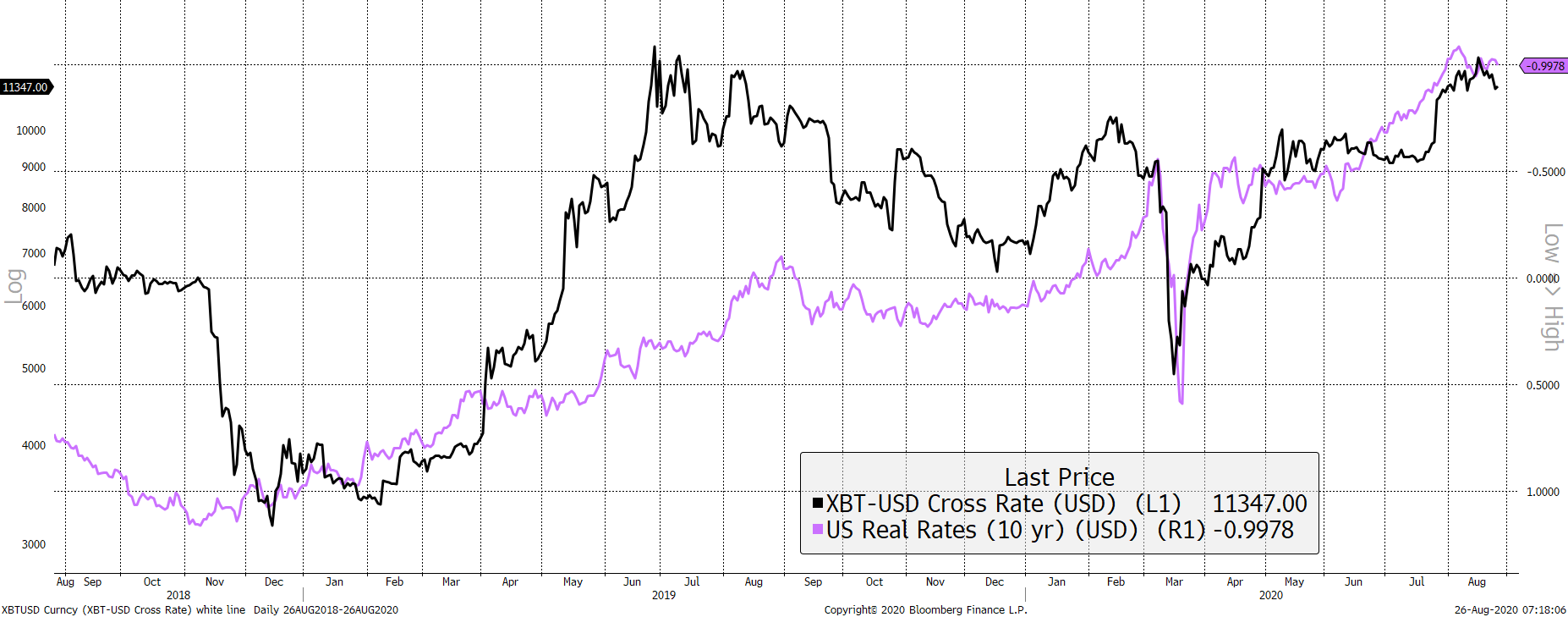

Just as things couldn’t get much worse, in early 2019, Bitcoin found its feet as real rates declined (purple 10-year yield less 10-year breakeven), which is shown on the chart inverted. Then Bitcoin stalled over the summer, just as real rates were about to trough (remember the purple line is inverted). And in 2020, Bitcoin and real rates seem to have been joined at the hip.

Bitcoin and real rates

It is inevitable that as the network matures, macro influences will become increasingly important, but we mustn’t forget that the huge move from 10 cents to $10k is largely down to Bitcoin’s own network growth. That said, there are traces and hints that spring up from time to time and some relationships seem beyond coincidence even if the quants can’t identify them.

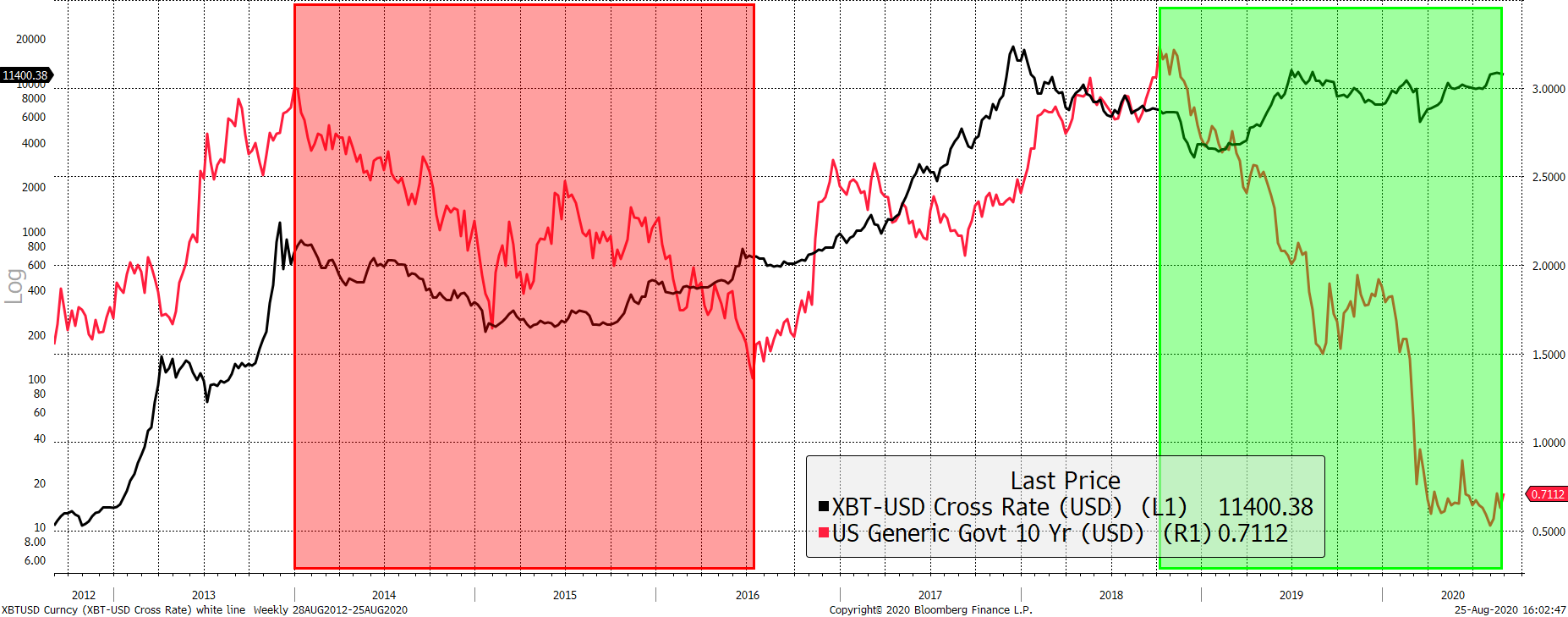

In particular, it is striking how Bitcoin has appreciated much more when bond yields have been rising than falling as shown in the white patches. Normally speaking, you would associate a rising yield with economic expansion, and a falling yield with contraction. In short, this is evidence that Bitcoin is a risk-on asset that prefers the good times.

Could Bitcoin surge on a rising yield?

In the red period, the bond yield fell over 2 ½ years as Bitcoin remained underwater. And in the green period, the bond yield collapsed during a time that Bitcoin had delivered sub-par returns while remaining below its all-time high. Contrast that to the white periods, where Bitcoin surged as bond yields rose. Could it be that the great breakout Bitcoiners are waiting for will be fuelled by rising yields? If so, it’s coming soon.

Or is it simply future inflation expectations that are important. I would be keen to agree with that, but if so, you might have expected the recent inflation pick up to have had a greater impact on price.

Bitcoin and inflation

I suspect it is a combination of all four charts shown. Money printing from the central banks clearly drives investors towards Bitcoin which, like gold, prefers easier monetary conditions. Unlike gold, Bitcoin prefers a risk on environment to a risk off, but they both benefit from inflation.

The bottom line is that the central bankers at Jackson Hole may be missing out on five-star luxury this year, but that won’t stop them from doing their job. They recognise the serious state of the world and will be in no mood to slam on the brakes. I suspect policy will remain easy for some time to come, and that will provide a tailwind for Bitcoin. And gold too.

The CoinJoin Privacy Pool

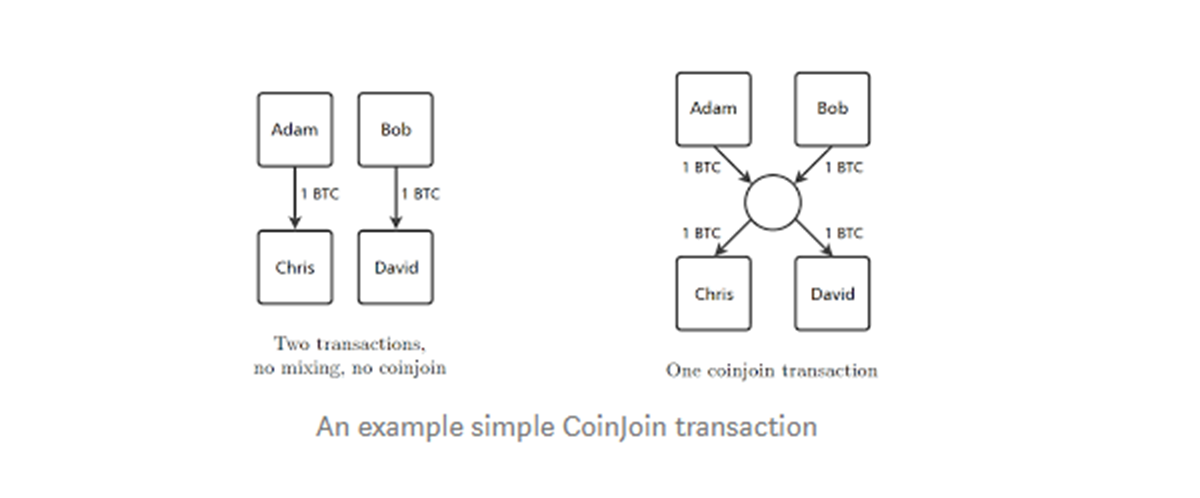

Last week, I discussed the surge in network traffic. It was suspicious because it was driven by $100 million transactions which kept on coming. Our eager analyst, Tom Salter, identified the source as CoinJoin, a system used to provide transaction privacy.

CoinJoin technology was initially proposed in 2013 by cryptographer Greg Maxwell, with the idea that the identity of the user would be better protected if a group of different transactions were pooled together and redistributed, making heuristic forensics difficult.

This is a contradiction of direct transactions, where Bitcoin would be sent directly to a separate wallet. Direct transactions typically have one input and one output, whereas a CoinJoin transaction will typically have three or more inputs and outputs.

A Direct Transaction and a Coinjoin transaction

The technology has been around for a while in the form of coin mixers, which promise users supposed anonymity. Traditional coin mixers do not affect the UTXO data that ByteTree collects. This is because the transactions are valid and will all be ‘spent’ in time. In advanced CoinJoin pools, the collective balance of users’ coins is transferred when a transaction is made. The complete balance doesn’t change hands when moved, but a mix of ‘fake’ and ‘real’ transactions will be recorded on the blockchain as a result. The introduction of CoinJoin techniques has inflated network transaction value, which quite clearly, has no economic value. That said, ByteTree will keep on tracking it as we strive to build a picture of the inner workings of the Bitcoin Network.

One of the biggest mainstream CoinJoin wallet providers is Wasabi, created in late 2018 by Nopara73, an experienced blockchain privacy figure. Wasabi is one of the first to implement Schnorr technology, created by Pieter Wuille who is the co-founder of Blockstream. Schnorr technology benefits CoinJoin transactions as it allows for lower fees, which given the number of transactions involved, is essential. Its implementation will make the high expenses of previous iterations of CoinJoin obsolete. In any event, it is clear that some Bitcoin users value their privacy highly and are prepared to pay for the privilege.

The right to privacy

Privacy is a good thing and not something to fear. Consider the alternative. If Bitcoin transactions were literally published with your name alongside, who would use it? Cash is private as are most transactions you carry out via banks. Your bank knows what you are up to but historically they are in the business of discretion. The police could know if they had the right permissions, but as far as your friends, family, employer, enemies and competitors are concerned, your banking is private and long may that last.

In my opinion, a ‘few bad actors’ is a weak argument for boosting Bitcoin hurdles and regulation, as the same logic applies to all forms of payment. If the cops want to find the bad guys, they should call Inspector Clouseau rather than ask the government for more rules.

We were suspicious of the recent traffic surge, because the onslaught of large transactions kept on coming, while the smaller on-chain traffic remained stagnant. It was also too good to be true. The larger transactions accounted for 99.7% of traffic and for that reason, we stripped out the large transactions and focused on the rest. It is easy to do in the ByteTree API by eliminating quintile 5 traffic. Easier still is to focus on the median transaction size. When there are over 300,000 daily transactions, large transactions can’t fool the median. In fact, not much can, unless you are prepared to pay hefty fees.

And it’s good for ByteTree’s analysis because now we know what it is, we can track it. In fact, we already are, and will publish new counts soon. (if you are in a hurry, switch the data over to raw mode and you can get it today). I have always wanted to build a picture of the segments that make up the total traffic. Inevitably, some are economically sensitive, and others are not. CoinJoin traffic is not.

Network Demand Health Model

The network health score stands at 5 out of 6, down one tick from last week as short-term transaction value fades. This is of course with CoinJoin stripped out. Other than that, the blockchain is well.

Summary

The price took a knock yesterday in a risk-on environment. This is perhaps disappointing but no cause for alarm. It is a reminder that Bitcoin has a mind of its own and doesn’t tag along with everything else. That’s a positive because it reaffirms its differences. When it comes to diversification, being different is attractive because that is what the best portfolio managers seek.