Bitcoin Whales Drive Network Traffic to an All-Time High

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 39

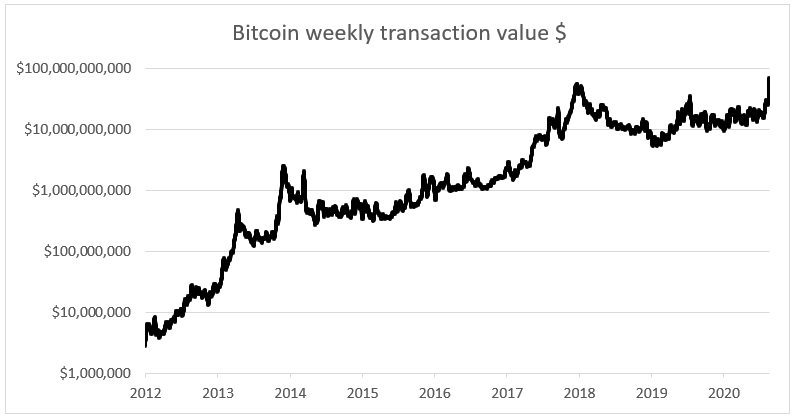

Over the past week, the Bitcoin network has seen $70 billion change hands; an all-time high. That smashes the previous record set back in December 2017 of $54 billion. Bitcoin’s fortunes have been aligned with network growth. On the face of it, this is excellent news.

But it has all come about very quickly. Two weeks ago, I reported a leap to a $30 billion week, and going back to mid-July, the network transaction value was a mere $15 billion. A move from $15 billion to $70 billion over the past month is potentially alarming.

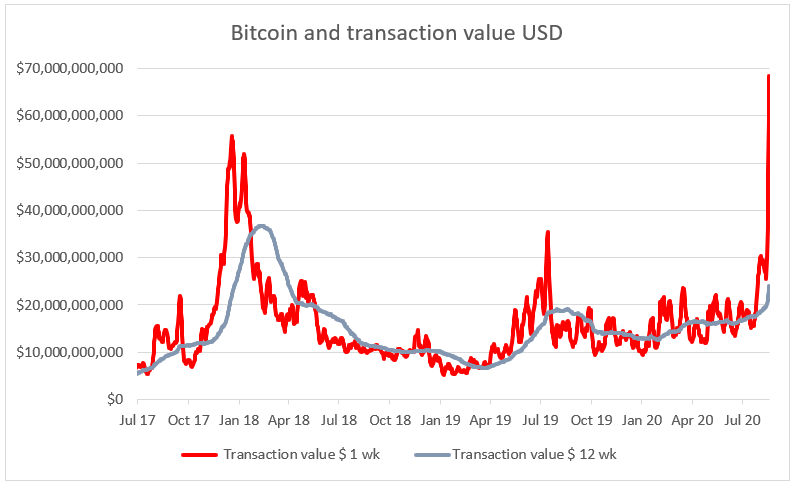

Looking back over the past three years, the 2017 network transaction value peak was a fast and furious affair, as it surged from $10 billion in October to $54 billion by December. It didn’t last long as the network soon retreated to where it came from by the summer of 2018. Since then, there has been a period of relative stability as the network settled within a $10 to $20 billion range.

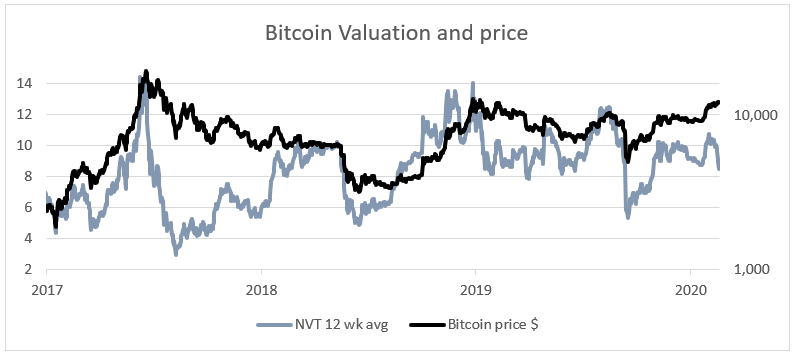

But as the saying goes, it’s different this time. Back in 2017, the ByteTree network value transaction ratio (NVT) rose to 14 weeks meaning that 14 weeks’ traffic equated to the total network value (market cap). This time, it is a little over 8 weeks.

That’s reassuring because the long-term average is approximately 7 weeks, and so the valuation is far from stretched. But you have to wonder why the price action has been on the calm side when on-chain activity has surged. That said, the price has risen from circa $9,000 in July to $12,000 today. Yet, the network growth has seen multiples of that rise.

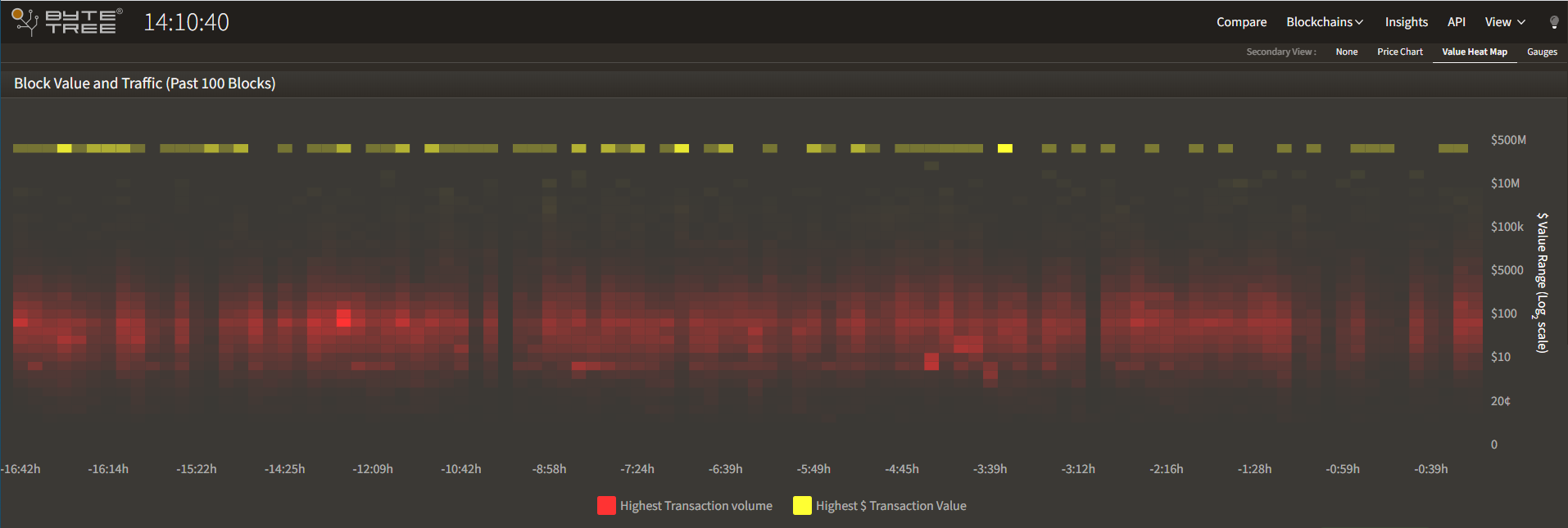

The ByteTree value heat maps breakdown the network traffic by transaction size each day. There is a consistent red zone from $10 to $5,000, which means most transactions sit within that value range. However, a yellow line has recently appeared with transactions all around $115 million. These transactions are remarkably consistent and appear in most blocks. They have been the driver behind the growth in transaction value.

ByteTree Value Heat Map

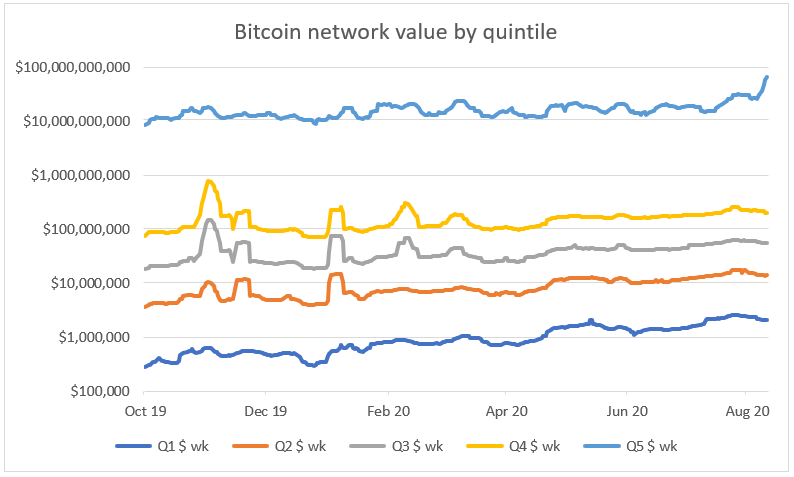

To better understand this, I have split the network traffic into transaction quintiles. Say there were 1,000 transactions in a block, the smallest 200 transactions would be combined to make up the lowest quintile, Q1, and the largest 200 transactions combined to make up Q5. As of 18 August 2020, Q1 was $1.95 million while Q5 was $68 billion. Notice how Quintiles 1 to 4 have eased in recent weeks, while Q1 has surged.

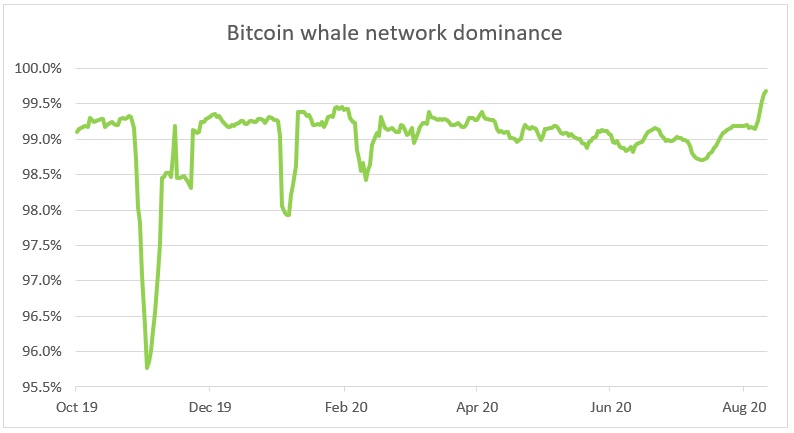

Taking Q5 traffic as a percentage of all traffic shows you whale dominance in the network. Q5 now accounts for 99.7% of total traffic. The median over the past year is 99.1%. This is a high reading, and something is up. I could just say put it down to institutional flows, which would be great. The trouble with that is that traffic was high over the weekend; a time when institutional investors play golf.

I can’t be sure why this pod of whales has turned up, and why they are repeatedly transacting $100 million on a near block by block basis. On the positive side, it could be a new use case for the Bitcoin blockchain. On the negative side, it could be fake traffic, to make the economy look larger than it is. If the latter, they will fail because the stats show that the Bitcoin price is more sensitive to the combined quintiles 1 to 4, and least sensitive to the whales shown in Q5.

The dollar

The US dollar Index (shown inverted) against Bitcoin does appear to have some influence on price. Clearly the rise in Bitcoin far exceeds the fall in the dollar, but the correlation seems to be strong. This is hardly a revelation but does help us to better understand Bitcoin’s macro credentials. It reaffirms my view that Bitcoin is a sort of risk-on gold that will protect you from debasement.

Network Demand Health Model

The network health score stands at 6 out of 6. Velocity has picked up as more coins are on the move. We’re bullish when 12-week velocity is above 600%, meaning a typical coin moves around the network six times each year. Obviously, some get around a lot, while others stand still, so it’s an average. This has now risen to 721% and last week managed to reach 1,839%. That’ll be the whales again.

Summary

I set up ByteTree so that blockchains could undergo rigourous financial analysis. Generally speaking, that means measuring for growth and stability, which are essential in understanding risk and reward. The record high in on-chain traffic is, on the one hand, something to celebrate, but on the other, it raises questions. What are the whales doing and why now? I very much hope some answers come to light. Until we know more, this remains a potential source of uncertainty.