A 22-Billion-Dollar Week

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 36

What a spectacular weekend. It reminded me of 2016, when Bitcoiners seemed to make more money at weekends than during the week. There is something deeply satisfying about profiting over the period that you are least productive.

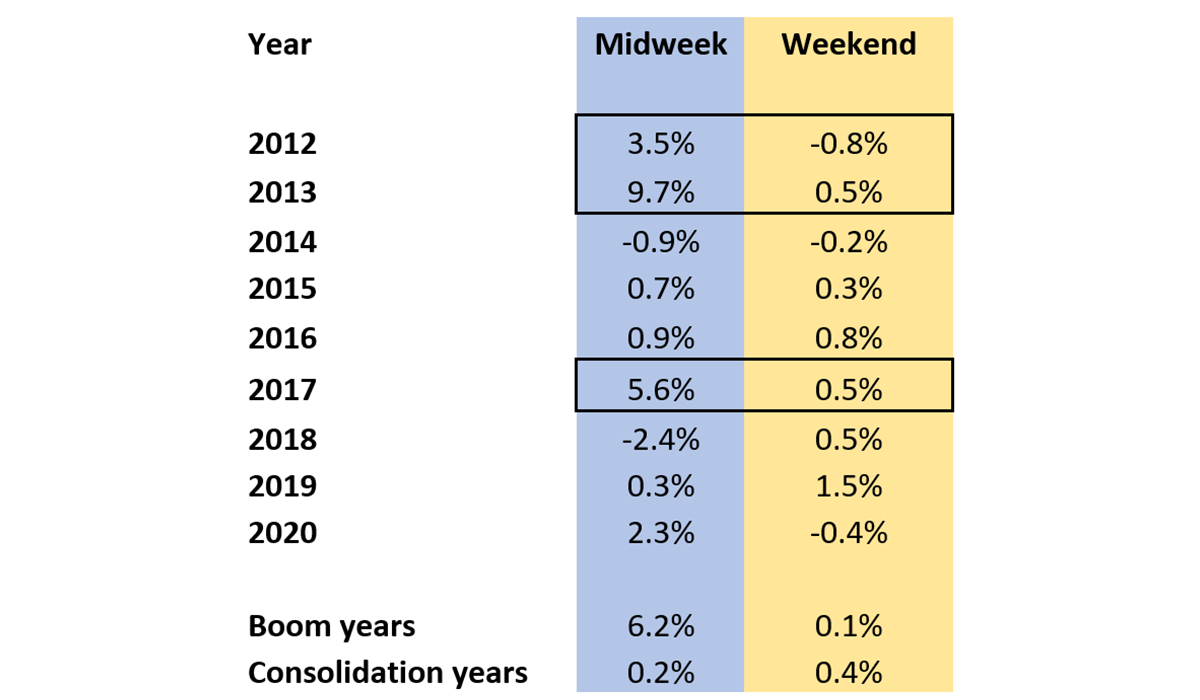

When you study the numbers it wasn’t true after all, but it certainly felt that way at the time. That said, it turns out that the weekends have tended to do well during the price consolidation years. In the years where Bitcoin traded at an all-time high, the midweek had the upper hand highlighted by the years in boxes.

Bitcoin average daily return

Useless information perhaps, but it is inescapable that the boom years saw huge gains during the working week and nothing spectacular at the weekends. So far in 2020, the mid-week period seems to be doing well, which we would historically link to a bull market. If true, you would want to see a breakout. That has just happened, accompanied by $22 billion of network transaction value. Things are perking up.

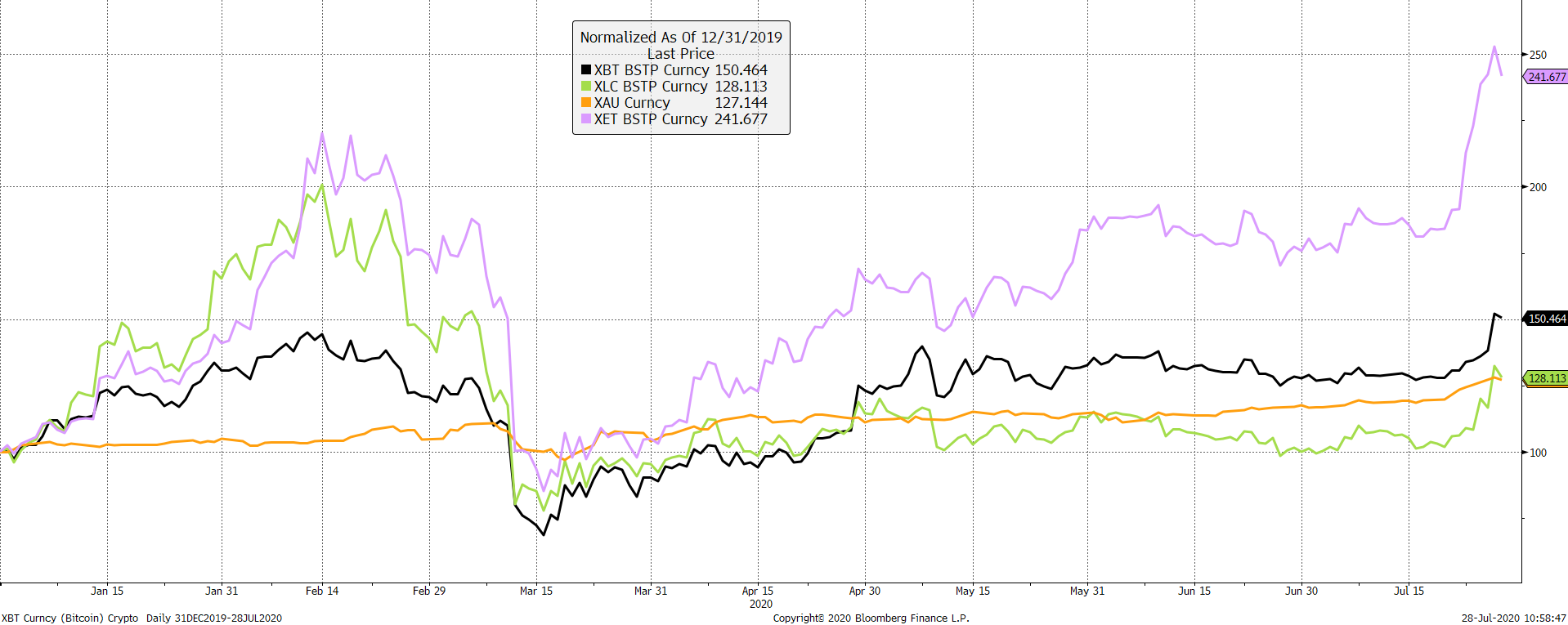

Bitcoin breakout

The price has moved above the psychologically important $10,000 mark. It has also taken out the February high. The next challenge is the peak from last summer at $13,000. If the network can keep $22 billion on the move each week, it shouldn’t be too difficult to achieve.

But this past week, gold has taken the limelight. It reached an all-time high for the first time since 2011. I sincerely hope Bitcoin doesn’t have to wait that long; most unlikely. But what’s interesting is how Bitcoin has lagged the tech hype since May, yet seemingly hung onto gold for this recent move. It does raise the prospect that Bitcoin wants to position itself as an inflation sensitive asset, as opposed to a tech stock. Smart choice.

The quiet rallies are the best rallies. While gold has risen by 28% this year, the same as Litecoin, Bitcoin is up 50% and Ethereum, an impressive 241%. Ethereum is booming and plays host to $168m of Bitcoin according to Defi Pulse. Wrapped Bitcoin (WBTC) trades like a gold token or Tether USD over the Ethereum network. This drives Token Sets among other things. It’s all go.

Alt rally

Network Demand Health Model

The latest score is 5 out of 6, which is an improvement over last week. Short-term network demand turned positive as you would expect when things are on the move. The network is back in growth mode and fair value has risen to $7,500. Don’t be scared by the premium, as it hangs off a 12-week moving average and so takes time to catch up. The short-term measure is closer to $10,000 but it is volatile and therefore indicative.

I would caution fees. While you would associate rising fees with a rising price, you can have too much of a good thing. The average fee is pushing $5 again. It’s too high and to add insult to injury, there was a recent drop in difficulty, which tends to put even more upward pressure on fees. The last time this happened after halving, there was a fall in demand. These are worth keeping an eye on. Last week, total fees reached $8m. The post halving peak was $10m and that didn’t work out too well.

A note from Henry Bezant, Crypto Analyst

Last Wednesday, the Office for Controller of the Currency (OCC) in the US circulated a letter to the National banks of America clarifying that they may now provide cryptocurrency custody services for customers, including the holding of private keys. The letter from the OCC, which governs 1,175 entities in the US, comes after other significant developments in the cryptocurrency markets with the SEC approving a bitcoin futures fund and the introduction of bitcoin options on futures by CME group.

The actions of the OCC are a big step for the industry in two key ways:

- National banks are able to enter the cryptocurrency custody market, which will drive down costs and increase access for millions of others wishing to purchase and hold digital assets. This will encourage greater investment in the industry and widen the network of active participants, adding value to the networks they operate on. Furthermore, this may also provide the necessary platform for more institutional investors to enter the market (a recent study by Fidelity found that 80% of institutional investors find cryptocurrency appealing).

- The authorization of National Banks to provide custodian services for digital assets acts as a stamp of approval for the industry, increasing the trust of both retail and institutional investors in digital asset security and may compel other regulators to follow suit.

Through this decisive move by the OCC, banking services can now be more readily provided to cryptocurrency firms, removing a significant barrier to growth within the industry.

The ByteTree fundraise is complete

This has recently closed and was 100% oversubscribed. Thank you to those who participated.