Bitcoin and Gold Correction

ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

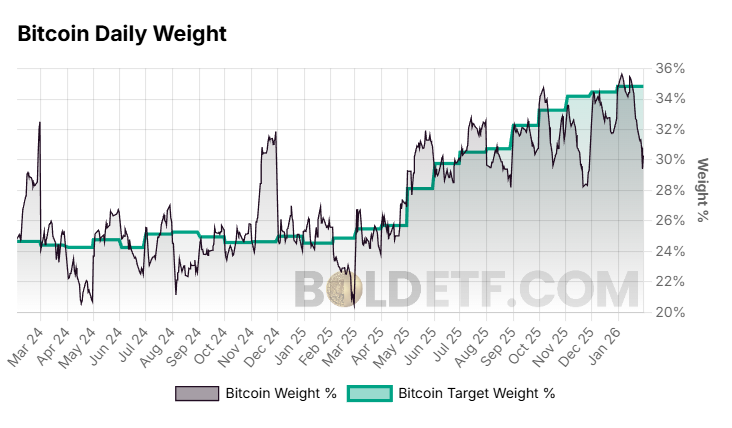

The target weights last month were 34.8% and 65.2% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 30.3% Bitcoin and 69.7% Gold. This means the latest rebalancing has seen 6.6% added to Bitcoin and reduced from Gold to meet the new target weights.

BOLD Performance

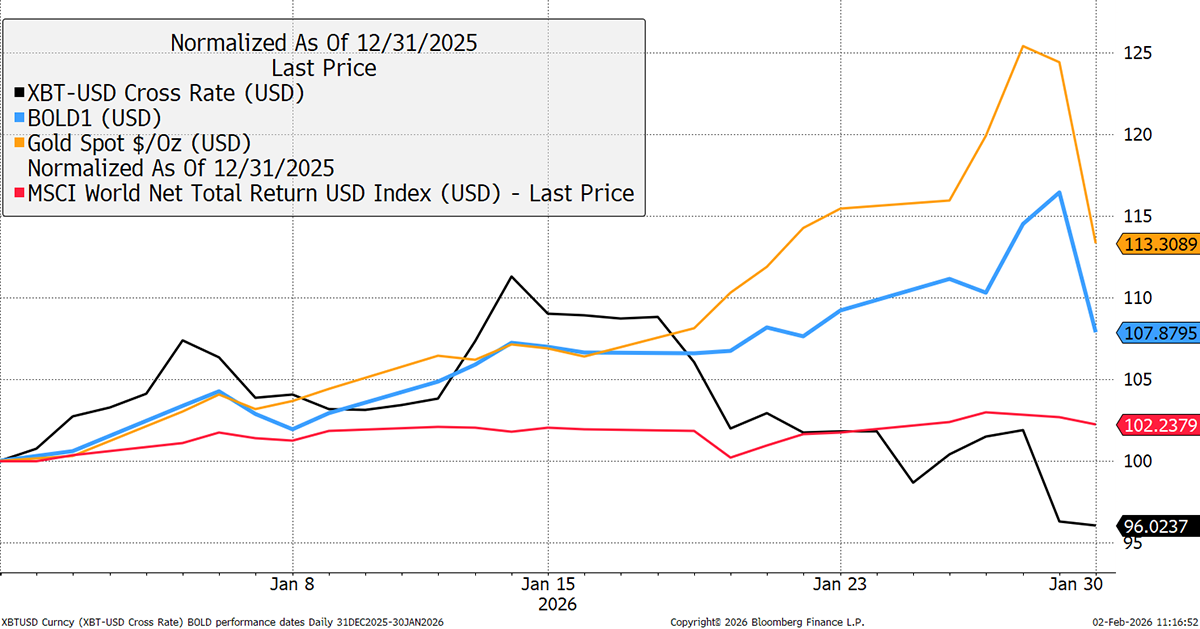

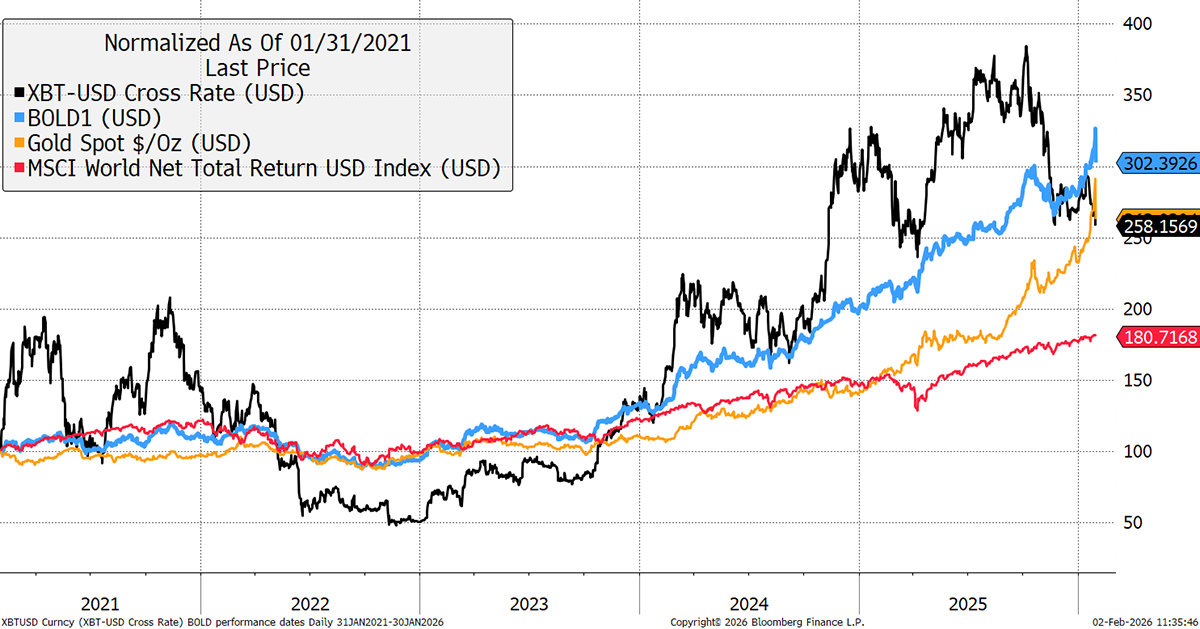

In January, BOLD rose by +7.8%, while Bitcoin returned -4.0%, Gold +13.3%, and global equities +2.2%, in USD terms. A major correction began at the end of January, which spread to Bitcoin over the weekend.

Bitcoin, Gold, BOLD, and Equities in USD – January 2026

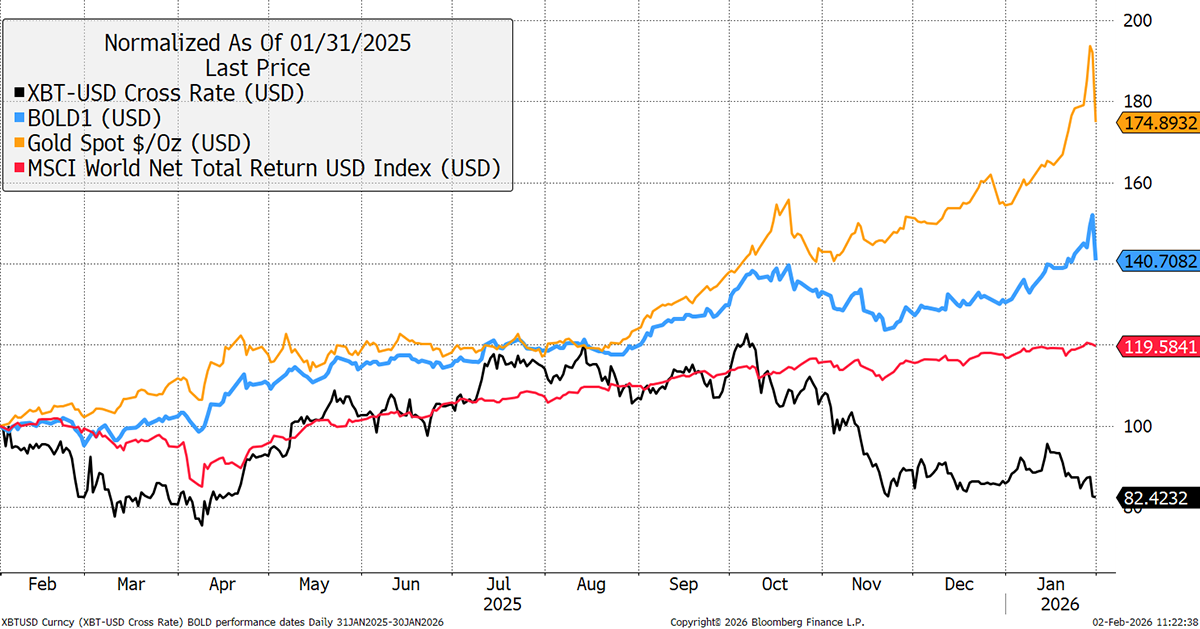

Over the past year, BOLD has returned 40.7%, Bitcoin has returned -17.6%, while Gold has returned +74.9%, and equities +19.6%. The Gold price has gotten ahead of itself in one of the strongest moves in history. The divergence between Bitcoin and Gold began last October, when BOLD captured some of the upside from Gold and shook off the weakness from Bitcoin.

Bitcoin, Gold, BOLD, and Global Equities in USD - Past Year

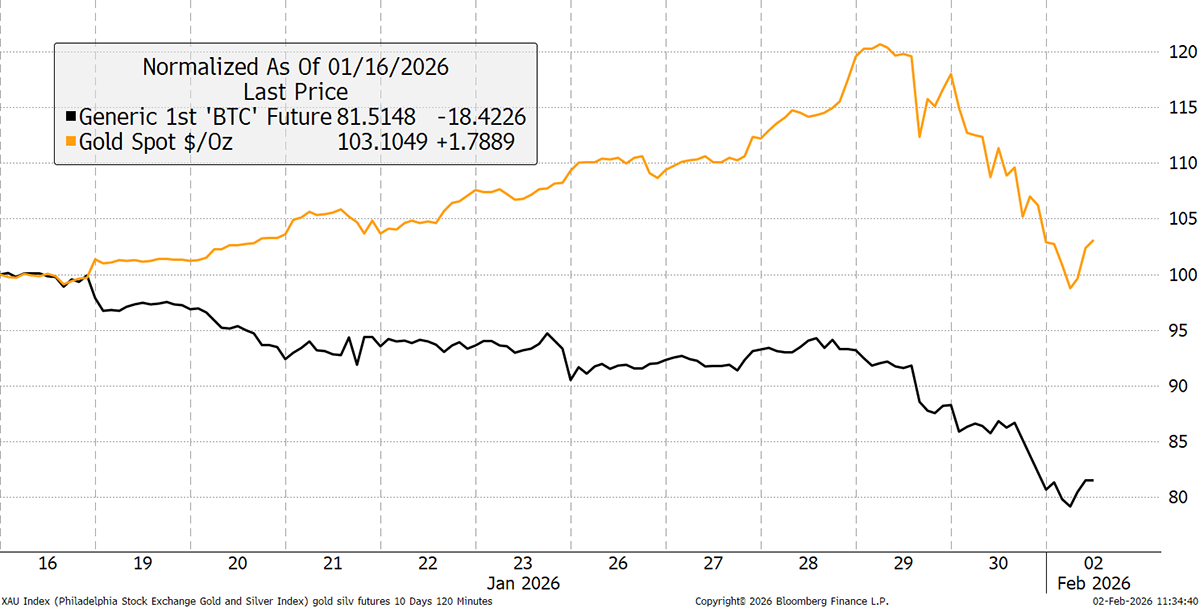

The Gold price had become exuberant, surpassing $5,000 for the first time in history in late January. The price peaked just four days later at over $5,500 and has since undergone a 21% peak-to-trough correction. Bitcoin also fell in late January. It is unusual but not unknown for both assets to fall simultaneously.

Bitcoin and Gold Recent Price Correction

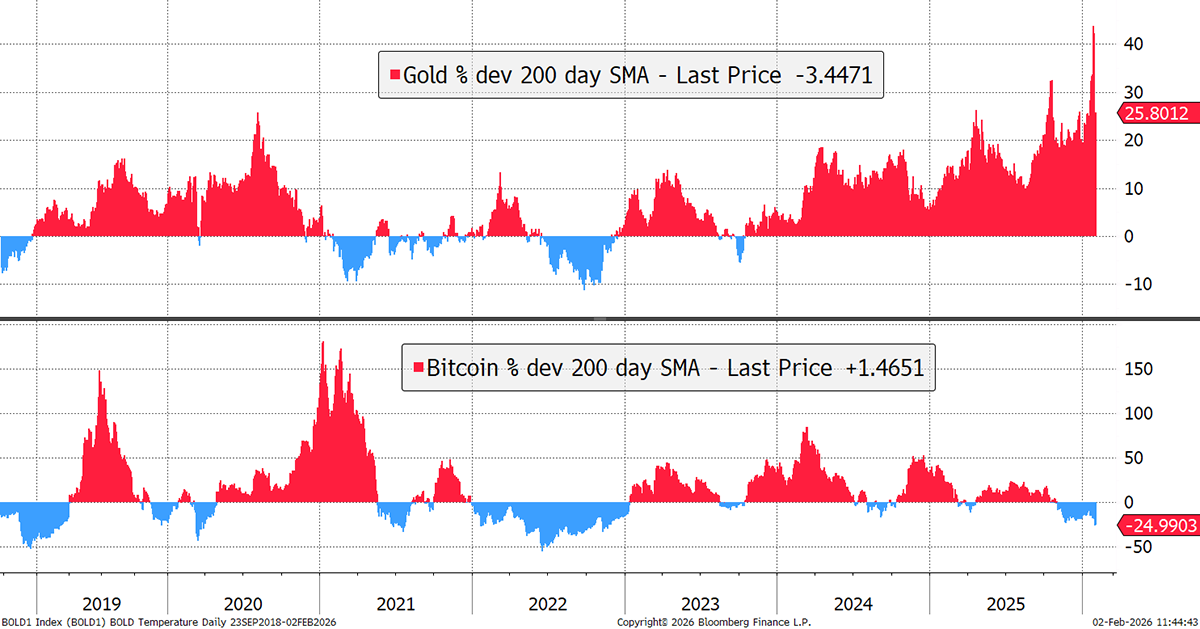

While both prices are down, these are completely different types of corrections. Gold has fallen from a position of trend strength, while Bitcoin has fallen from a position of trend weakness. The natural assumption is that, at some point, these positions reverse, as they have done many times in the past.

Bitcoin and Gold Deviation from Trend

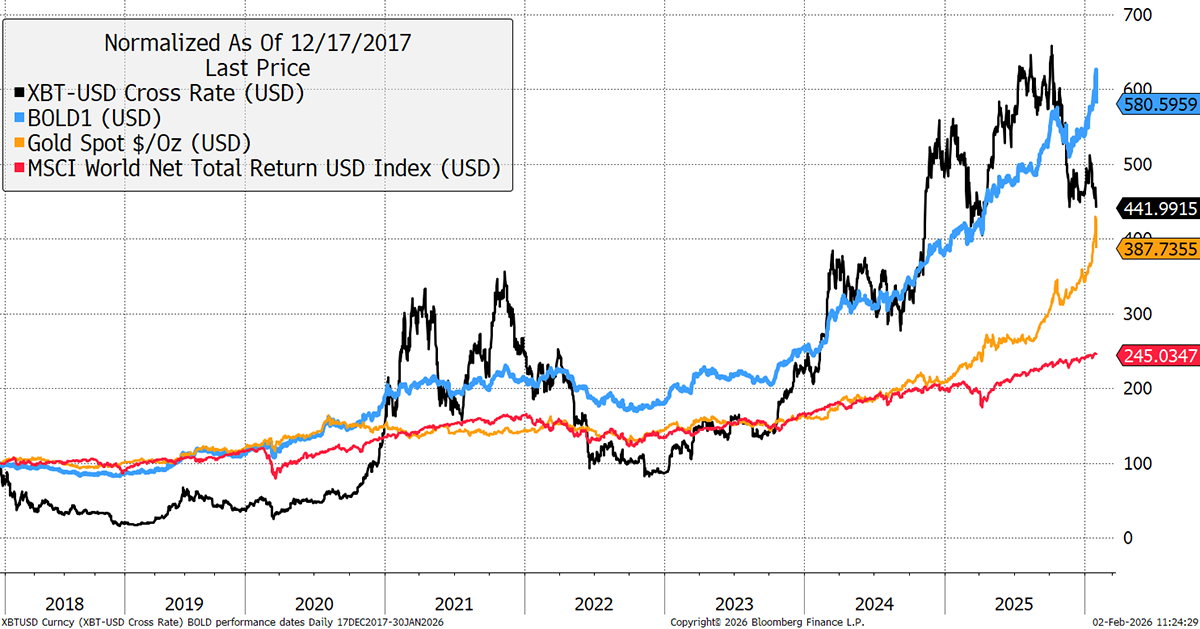

Over the past five years, BOLD has returned +202.4%, while Bitcoin has returned +158.2%, Gold +163.0%, and equities +80.7%. The average return of Bitcoin and Gold was 160.6%, yet BOLD was 41.8% ahead, demonstrating added value from rebalancing transactions. The more stable journey holding BOLD is driven by the asset allocation described below.

Bitcoin, Gold, BOLD, and Global Equities in USD - Past Five Years

This point is best demonstrated since the Bitcoin price high at $19,041 on 17 December 2017, which seemed extreme at the time. Since then, BOLD has returned +480.6%, while Bitcoin has returned +342.0%, Gold +287.8%, and equities +145.0%. The average return of Bitcoin and Gold was 214.9%, yet BOLD was +165.7% ahead, demonstrating added value from rebalancing transactions. The more stable journey of holding BOLD is driven by the asset allocation described in the next section.

Bitcoin, Gold, BOLD, and Global Equities in USD - Since the 2017 Bitcoin Price High

Monthly Rebalancing of the BOLD ETP

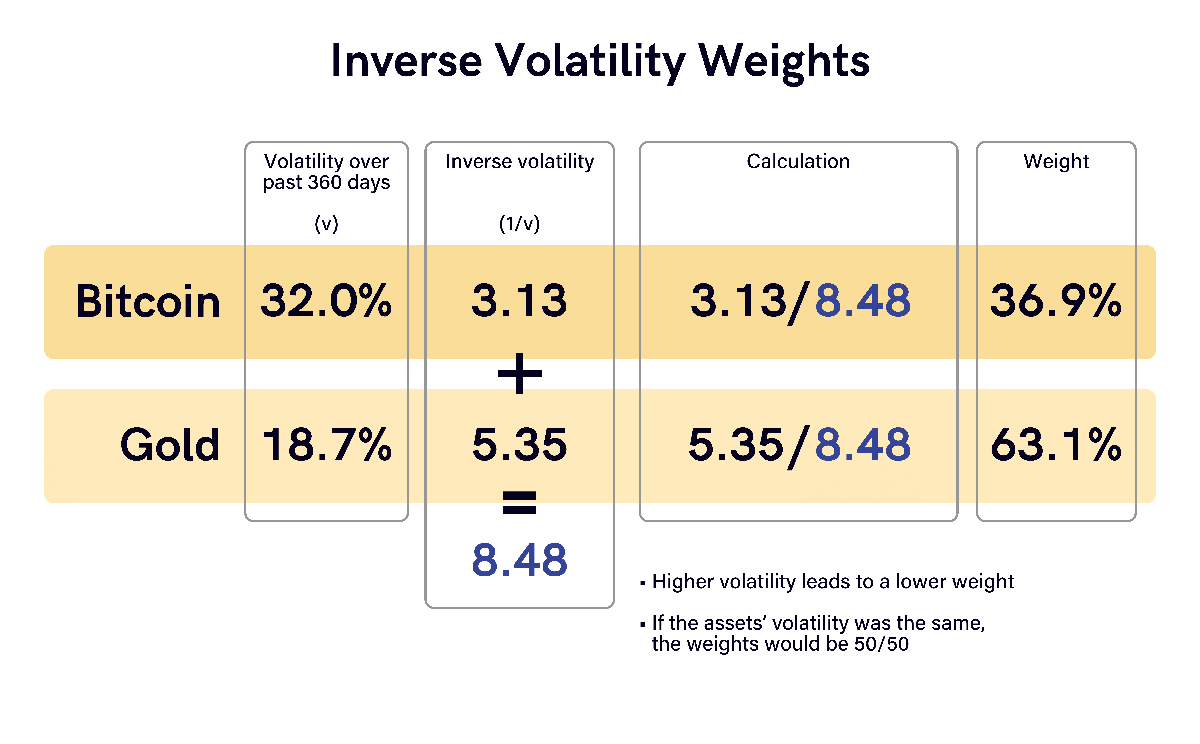

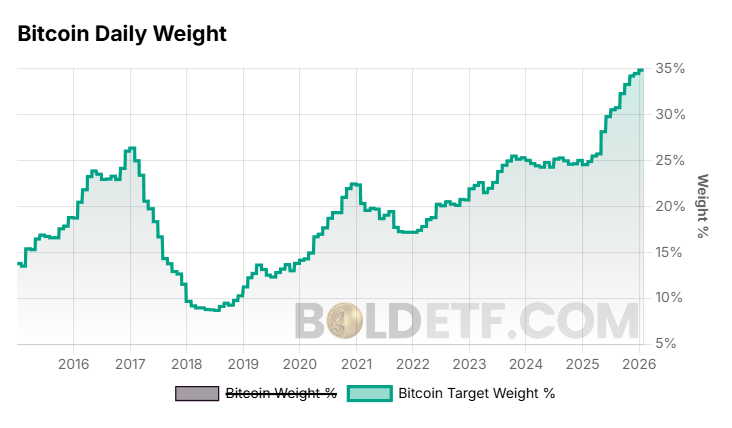

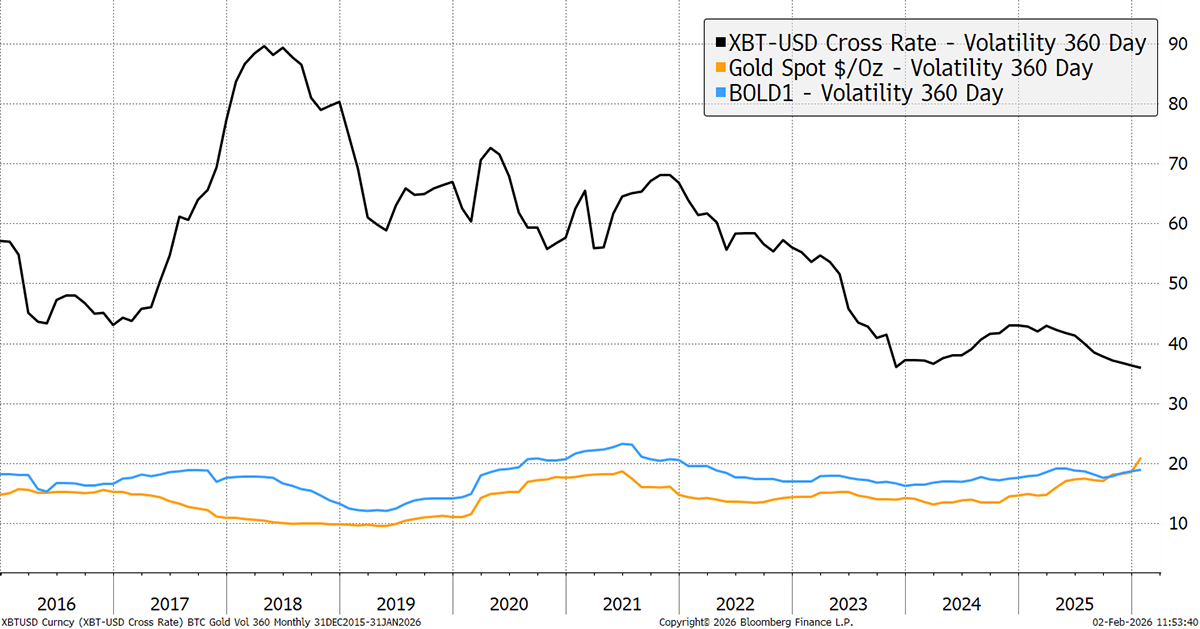

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

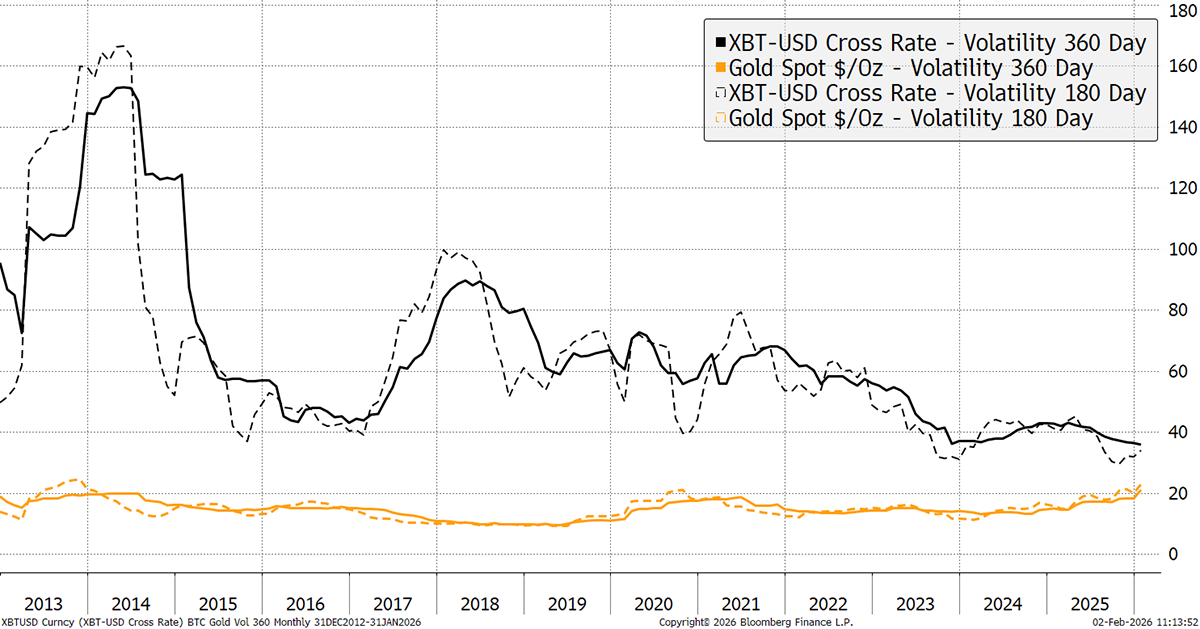

It is notable that Bitcoin’s 360-day volatility is falling, while Gold’s has been rising. Note how the short-term 180-day volatility for Bitcoin has risen, which will slow the decline in the 360-day volatility in the coming months. For Gold, the 180-day measure is leading Gold’s volatility higher. The gap between the asset volatilities has never been narrower than it is today.

Bitcoin and Gold: Past 360-day Volatility

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 32.0% and 18.7%, respectively.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 36.9% Bitcoin and 63.1% Gold using this formula.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold. The current Bitcoin weight is a record high.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to a buy-and-hold strategy. Using the weight in Gold, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Bitcoin: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, Bitcoin has lagged Gold in recent months, and so the Bitcoin exposure has been boosted back up to the target weight during the monthly rebalancing. This ensures the strategy maintains the optimised weights for Bitcoin and Gold.

If Bitcoin was particularly strong one month and Gold weak, the rebalancing process would reduce Bitcoin’s exposure back down to the target weight, and increase Gold’s, at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and a key advantage over holding Bitcoin and Gold independently.

BOLD’s Volatility Is Comparable with Gold

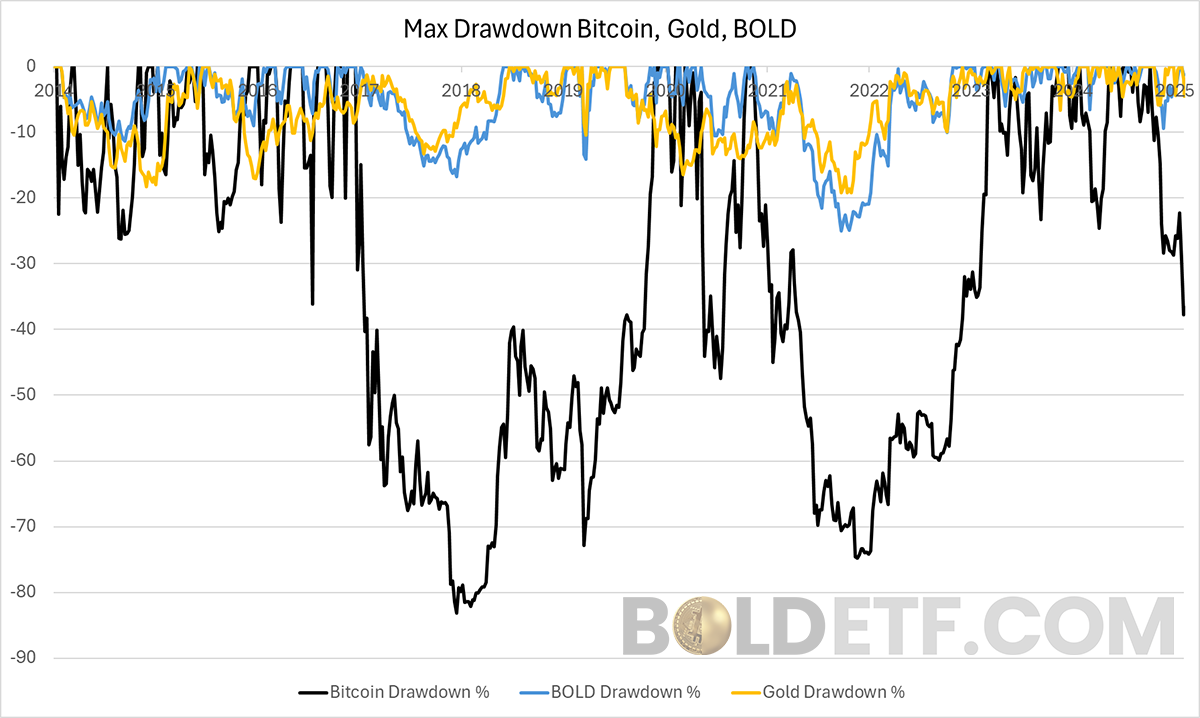

Risk is not just a matter of volatility but of maximum drawdowns. Historically, Bitcoin drawdowns have been severe, and Gold drawdowns less so. BOLD drawdowns have been closer to Gold than Bitcoin.

Bitcoin, Gold, BOLD Max Drawdown

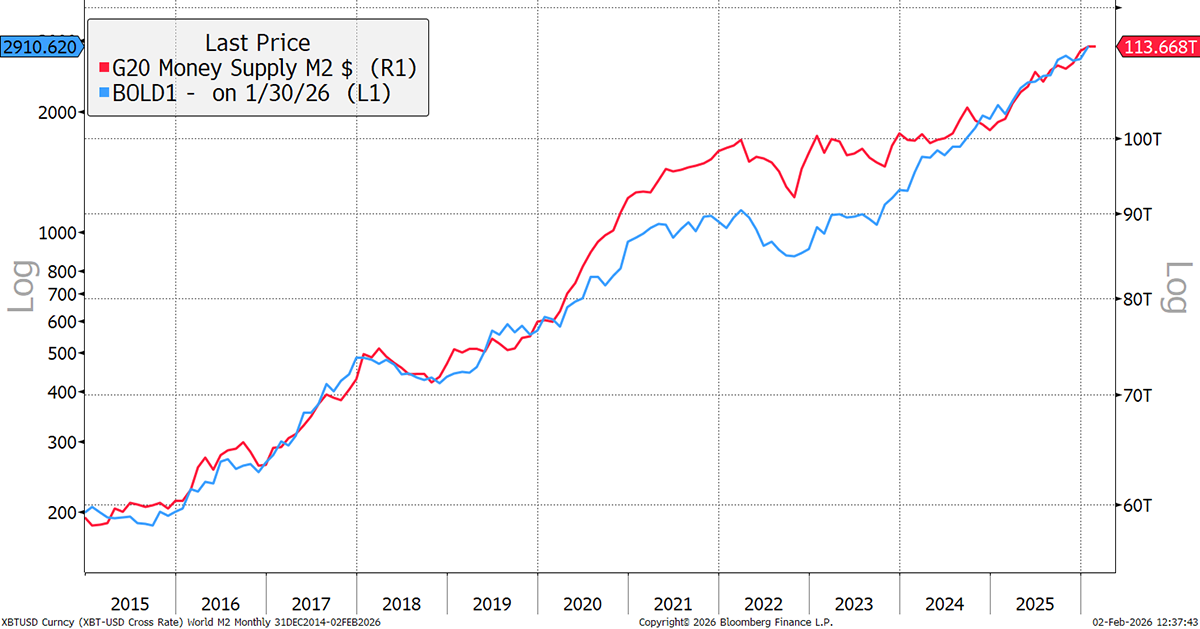

While Bitcoin and Gold travel along different paths, it is notable how BOLD has historically been highly correlated with the global money supply. BOLD has been an efficient way to express this macroeconomic view.

BOLD versus the Global Money Supply

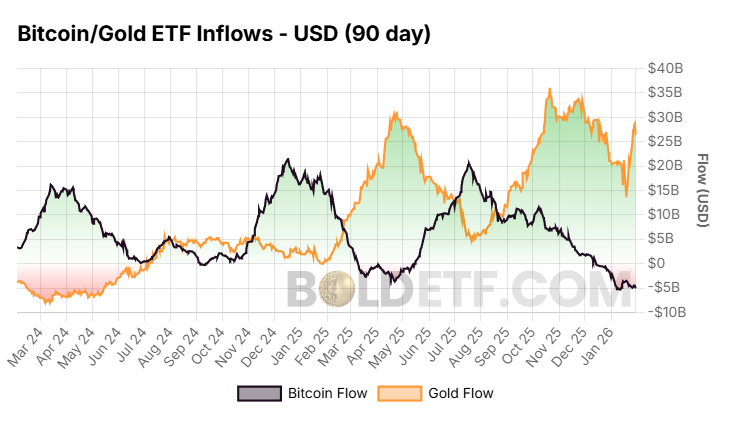

Bitcoin and Gold ETF Flows

Gold ETFs have seen $27bn inflows over the past 90 days, in contrast to Bitcoin ETFs, which have seen $5bn outflows. The correlation between the asset flows has generally been negatively correlated.

Bitcoin and Gold ETF Flows in USD

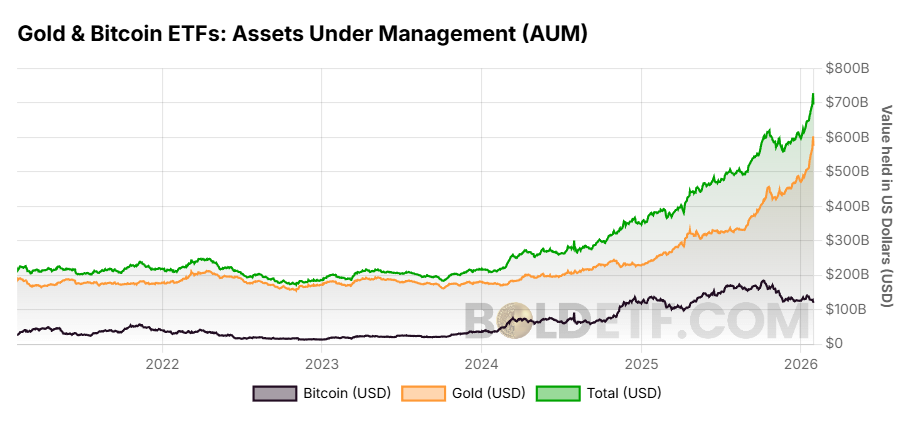

The total value of Bitcoin and Gold ETFs has exceeded $700 billion, underscoring their status as a major alternative asset allocation.

Bitcoin and Gold ETFs AUM

BOLD ETP London Listing

The 21Shares ByteTree BOLD ETP (BOLD) is now listed on the London Stock Exchange, alongside listings in Switzerland, Germany, the Netherlands, France, and Sweden.

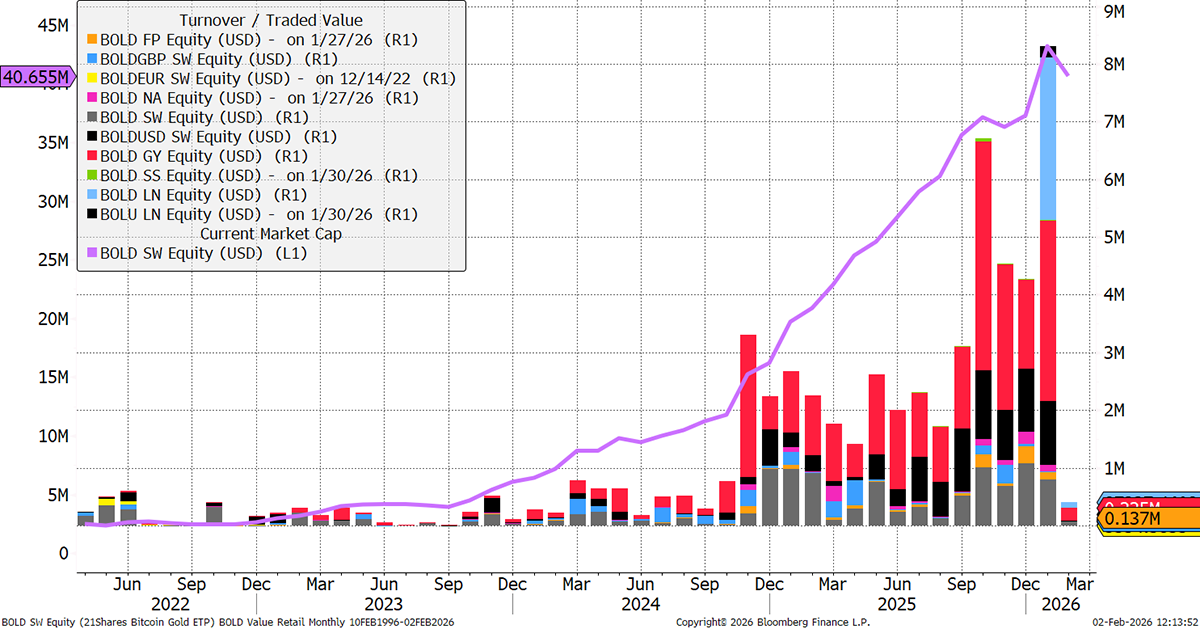

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) tracks the BOLD Index. The fund now holds $40.6 million in Bitcoin and Gold held in safe custody with Copper for Bitcoin and JP Morgan for Gold. January saw strong volume traded once again, exceeding $8 million; the GBP volume is shown in blue. BOLD trades actively in CHF, EUR, USD, SEK, and GBP. The ticker is BOLD. The 21Shares Bitcoin and Gold ETP (BOLD) trades in the primary market, meaning that purchases and sales lead to Bitcoin and Gold buy or sell transactions directly from the market.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

For further information, please visit BOLDETF.com, which offers extensive data and charts to help investors better understand the benefits of the strategy.

Recent Videos

Please watch our recent videos with:

- John Reade, Senior Market Strategist from the World Gold Council

- Izabella Kaminska, Founder of The Blind Spot

- Adrian Fritz, the Chief Investment Strategist at 21Shares

Product Details

| Issuer | 21Shares AG, Switzerland |

| Launch Date | 27 April 2022 |

| Fee | 0.65% Per Annum |

| Custody | Copper Technologies (Swiss) for Bitcoin, JP Morgan for Gold |

| Investment Objective | Risk-weighted Bitcoin and Gold Exposure |

| Benchmark | Kaiko ByteTree BOLD Index |

| Rebalancing Frequency | Monthly |

| ISIN | CH1146882308 |

| SEDOL | BK81V89 CH |

| WKN | A3GYXW |

| Ticker | BOLD SW (Switzerland), BOLD GY (Germany), BOLD FP (France), BOLD NA (the Netherlands), BOLD SS (Sweden), BOLD LN (United Kingdom) |

| Listings | Switzerland, Germany, France, the Netherlands, Sweden, United Kingdom |

| Currency | USD, EUR, CHF, GBP, SEK |

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.