State of Tokenized Real-World Asset Market

Token Takeaway;

While much of Web3 continues to struggle, the tokenized real-world asset (RWA) market is still expanding. Long regarded as a bridge between traditional finance and the digital asset world, tokenization is increasingly taking shape beyond theory. Momentum built throughout 2025, and, as the market enters 2026, RWAs are closer to mainstream adoption than ever before. This article examines the current state of the tokenized RWA market and explores its longer-term outlook.

Overview

What began as a niche experiment has evolved into one of the fastest-growing and most prominent segments of the crypto industry. Interest in tokenized real-world assets is now being driven by practical use cases, improved accessibility, capital preservation, and greater security, rather than speculative enthusiasm alone. Blockchains are well-suited to deliver this, offering transparent settlement, global reach, and significant scope to scale.

Unlike the early attempts at tokenization, which were often hampered by high fees, wide spreads and limited liquidity, many of these frictions are now being actively addressed. On-chain capital has matured to a point where tokenization protocols are increasingly able to offer services that rival traditional finance and, in some cases, improve it. As a result, demand continues to build for assets that provide predictable returns, lower volatility, and clearer links to real-world cash flows, alongside global access, 24/7 redeemability and low friction.

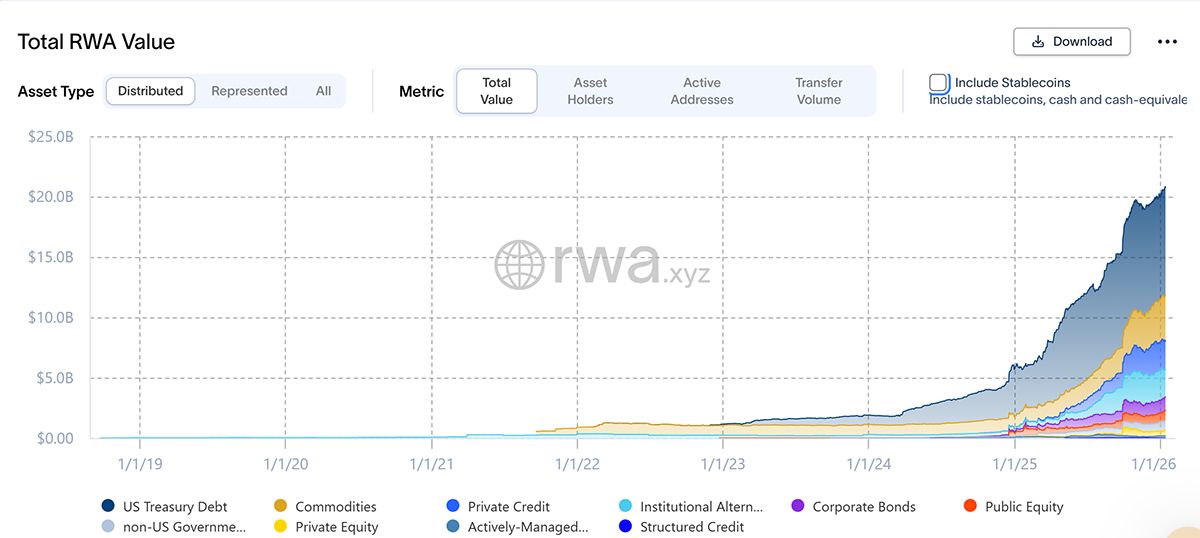

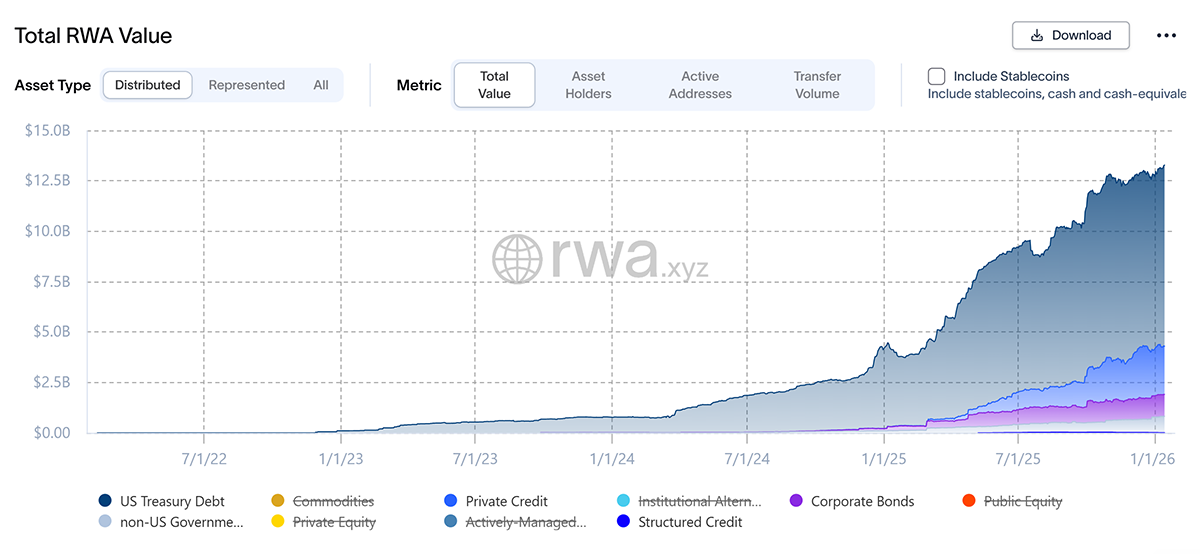

Total RWA Marketcap

Today, the total market capitalisation of tokenized RWAs has surpassed $21 billion. Tokenized US Treasuries represent the largest share of this market, accounting for nearly $9bn in value. Other segments, including commodities, private credit and on-chain funds, have also seen meaningful growth.

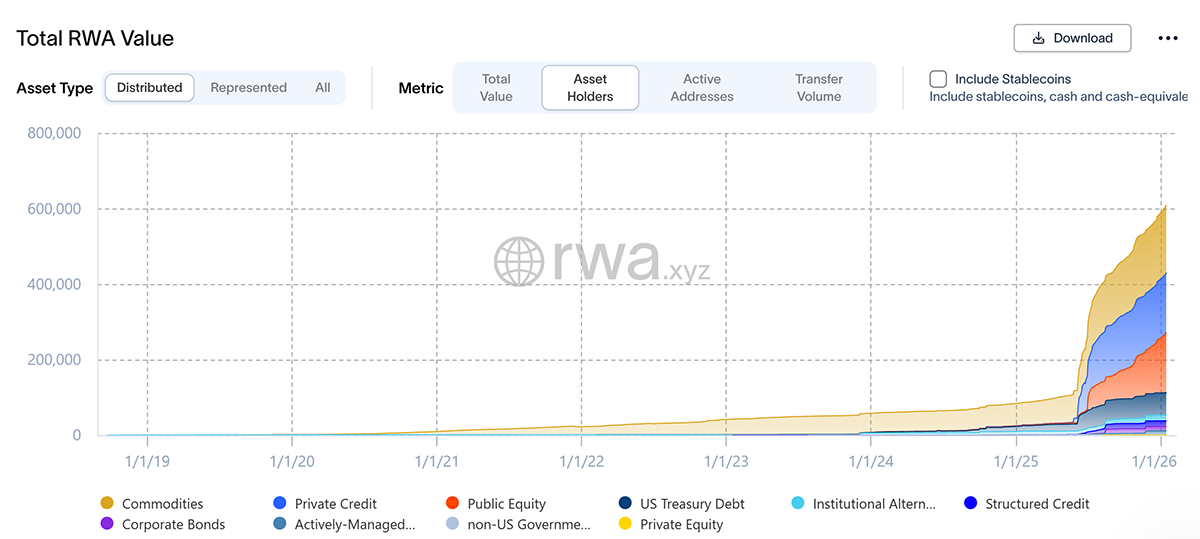

Notably, it’s not just assets that have seen a drastic increase, but the users/holders of these assets as well.

RWA Holders

The number of RWA holders has risen sharply, with user growth accelerating from mid-2025 onwards. There are now more than 630k tokenized RWA holders, with the figure increasing by roughly 10% over the past 30 days alone. Before examining the key drivers behind this growth and exploring RWAs by category, it is useful to first understand the basics.

What Are Real-World Assets?

Real-World Assets are tangible or financial assets that exist in the physical world (i.e., outside of the blockchain), such as real estate, government bonds, private credit, commodities (like gold), and art. The process of tokenizing RWAs allows investors to trade them digitally 24/7, just like cryptocurrencies, but with the added benefit of backing from physical or financial instruments.

What Is Tokenization and How Does It Work?

Tokenization is the process of converting real-world assets into digital tokens on a blockchain. These tokens represent ownership or a stake in the asset, allowing investors to buy, sell, or trade them more efficiently than in traditional markets. The process typically involves:

- Asset Identification and Legal Structuring: Determining the asset to be tokenized and ensuring compliance with regulations.

- Token Creation: Using blockchain technology to issue digital tokens that represent ownership or value. This breaks down large, illiquid assets (e.g. real estate) into smaller, tradable tokens.

- Smart Contracts and Automation: Enabling automated transactions, such as revenue distribution and ownership.

Key Drivers of Tokenization Growth

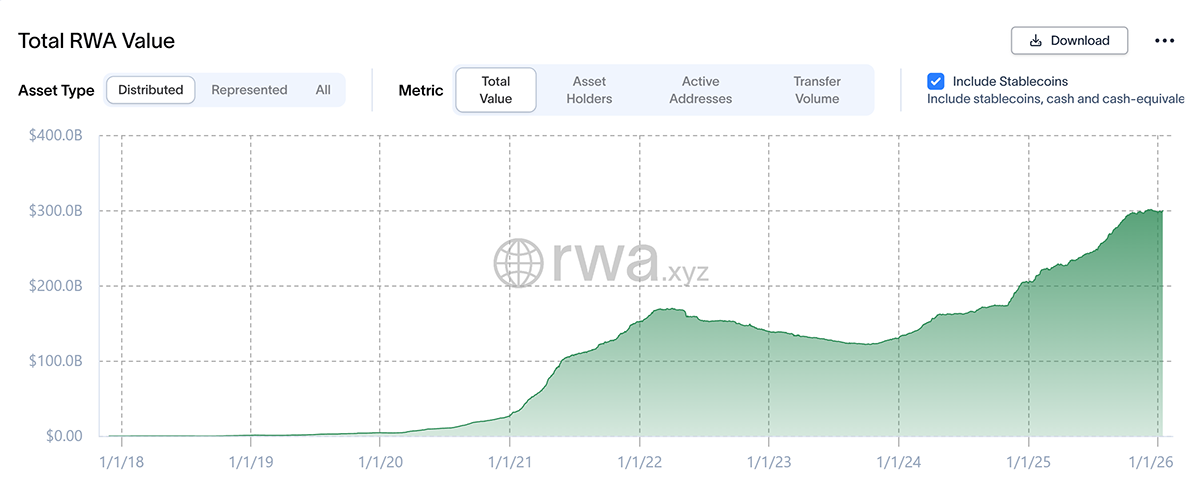

One of the primary drivers behind the expansion of the RWA market has been the continued growth of stablecoins, which aligned closely with increasingly favourable regulatory developments. Stablecoins have provided the foundational liquidity layer required for tokenization to scale, while also benefiting from clearer legal treatment in the US.

Total Stablecoin Market Cap

Today, more than $300bn worth of stablecoins are in circulation. While this is already an extraordinary figure, it still represents only the early stage of widespread adoption. Tether remains the largest issuer, with USDT’s market capitalisation of approximately $186bn, followed by Circle’s USDC at around $75bn. Circle’s public market debut further highlighted the depth of demand for stablecoins and tokenization more broadly. The company launched their IPO in June 2025 at $31 per share, which rallied sharply to nearly $300, an increase of roughly 860%. Although the share price has since settled to around $76, it continues to trade well above its listing price, underscoring sustained investor interest in the stablecoin and RWA narrative, even within traditional equity markets.

Stablecoins are effectively the lifeblood of the entire crypto economy, including the tokenization sector. In many ways, they represent the first successful and widely adopted proof of concept for tokenising real-world assets at scale.

A major positive catalyst for this growth was the outcome of the US presidential election in 2024. Donald Trump’s victory marked a decisive shift in regulatory posture, including the removal of then SEC Chair Gary Gensler, who was widely viewed as hostile to crypto innovation. He was replaced by Paul Atkins, who is seen as more constructive and open to digital asset development.

This regulatory shift was reinforced by the passage of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which introduced a comprehensive framework specifically governing stablecoin issuance and operations. Alongside this, the introduction of the CLARITY Act established a broader regulatory framework for the crypto market.

The GENIUS Act was signed into law in July 2025, representing the first major piece of digital asset legislation in the United States. Notably, this period coincided with a sharp increase in RWA user adoption. Since July 2025, stablecoin market capitalisation alone has expanded by approximately $55bn. This highlights the importance of regulatory clarity, particularly for capital entering from traditional finance, where legal certainty often outweighs technological novelty.

Geopolitical Tensions and Comfort in Safe Investments

The macro backdrop of 2025 also played a meaningful role. The year was marked by elevated geopolitical tension, including the Israel–Iran conflict, ongoing instability surrounding Palestine, the continued Russia–Ukraine war, and renewed tensions between India and Pakistan. These developments were further compounded by aggressive US trade policy and tariff measures, which heightened global uncertainty.

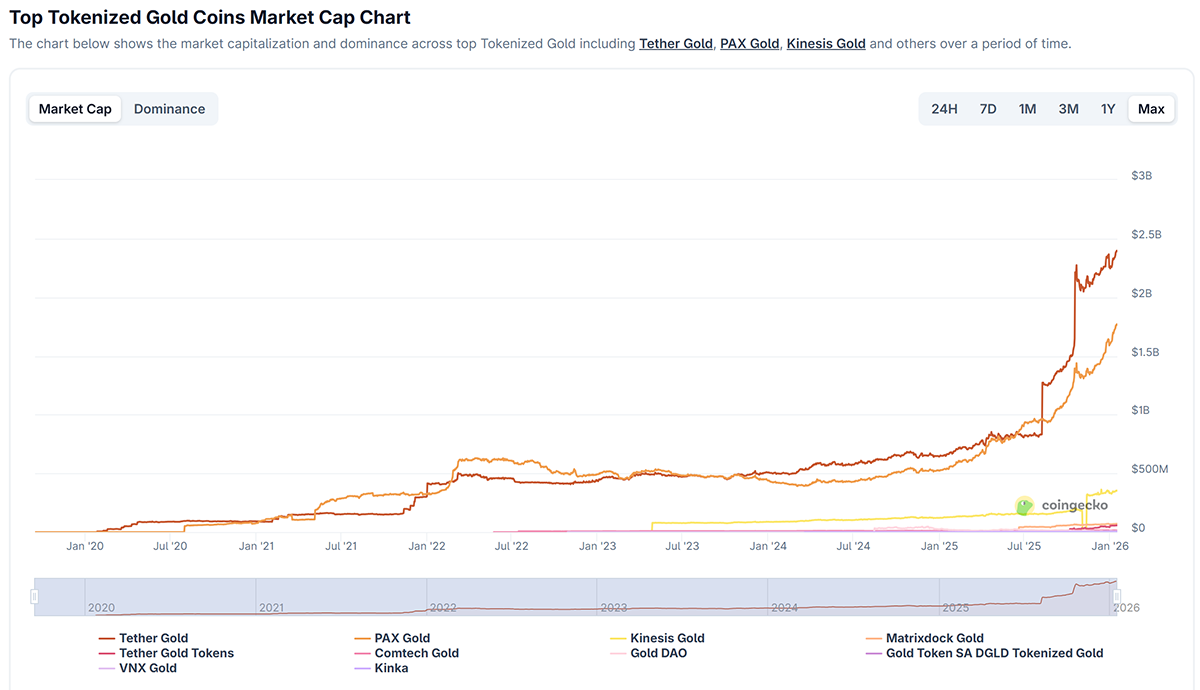

In response, investors reduced exposure to higher-risk assets and increased allocations to perceived safe havens. This shift was clearly reflected in the sharp rise in gold prices. As often noted, gold remains the world’s reserve asset, a role it continues to fulfil effectively during periods of stress. Unsurprisingly, gold is also the largest tokenized commodity.

Tokenized Gold Market Cap

The tokenized gold market has reached an all-time high of $4.6 billion. Tether’s XAUT is the dominant product, with a market capitalisation of approximately $2.3bn, followed by Paxos’s PAXG at around $1.7bn. You can read more about tokenized gold in our deep dive here.

Debt instruments, particularly US Treasuries, represent another category traditionally viewed as a safe investment and have also seen significant growth since 2025.

Tokenized RWAs by Yield-Based Products

Since 1 January 2025, tokenized US Treasury debt has expanded from $3.9bn to $8.9bn, representing a 127% increase. From its low in July 2025, around the same time the GENIUS Act was enacted, tokenized Treasury debt has grown from $6.6bn to nearly $9bn, a 36% increase in just six months. Other yield-based RWA categories, including private credit, non-US government debt, structured credit, and corporate bonds, have also experienced steady growth over this period, reinforcing the broader trend towards real-world yield on-chain.