Locked into Tech

Our first recommendation of 2026 fits the description of a market-leading quality compounder in transition. It fell by 60% in 2022/23 and, after returning to new highs in 2024, it pulled back 30% again in 2025. It has a proven ability to win, a legendary, pioneering founder who has more energy and optimism than ever, and an existing culture and set of relationships that offer train tracks into the next phase – advantages that few, if any, peers share. It was significantly overvalued, but following the price correction, it is back on track.

What can we say about AI?

In the three years since ChatGPT was released, we have largely grown accustomed to using a simple AI Chatbot, generating very good, sometimes extraordinary, and sometimes illusory responses.

When Marc Andreessen, legendary Silicon Valley founder and venture capitalist, wrote his 2011 piece arguing that software was eating the world, he was right. The decade that followed saw software companies disrupting industries and growing consistently with high profitability. The economics of their business models were powerful: Netflix in video, Spotify in music, Uber in taxis, Facebook in social media, Google in search, Amazon in cloud storage and ecommerce, and many more besides. Software has eaten the world.

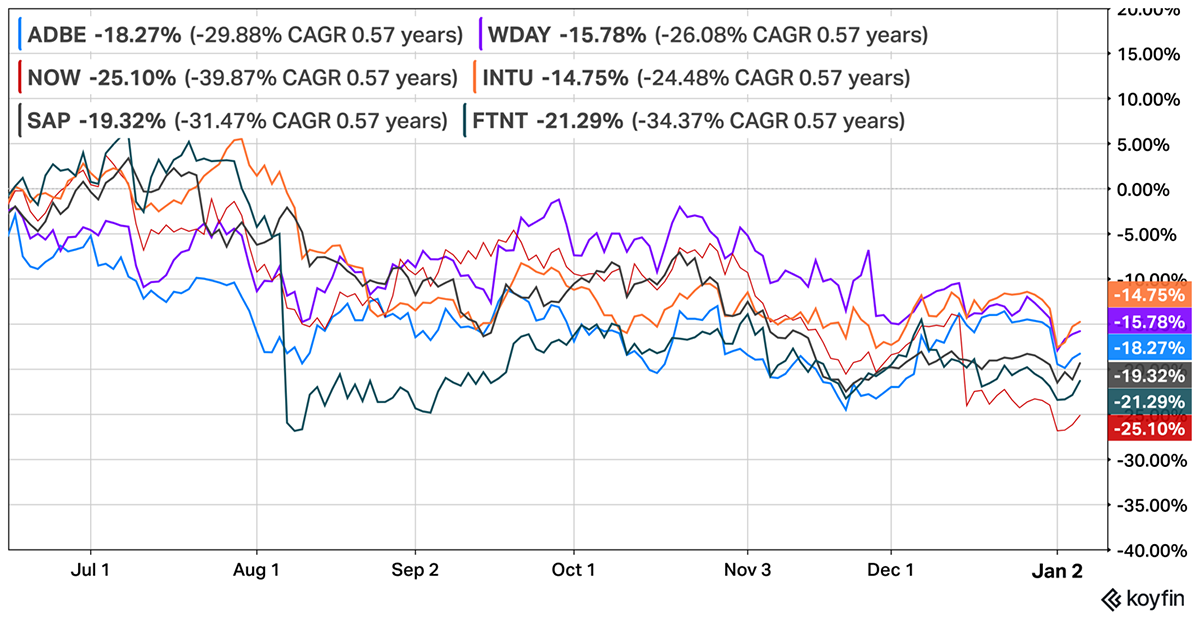

In recent years, some software companies have been seen as potential losers from the AI revolution, as we are already seeing rapid improvement in AI’s capabilities. The fear is that repeat buyers of expensive software will soon be able to replicate it cheaply and quickly themselves. As a result, software companies will have to adapt to survive, which has caused weakness in the sector.

Software Stumbles

We have identified a company that we believe is high quality, which now trades at a sufficient discount to merit inclusion in the ByteTree Quality portfolio. It is a leading player in what we see as a core market for artificial intelligence applications.

It has a founder-CEO, acknowledged by many to be a genius, a powerful culture, and a deep moat, with most of the world’s largest companies as clients. It has key advantages that will allow it to lead the new tech industries even as the old ones it used to dominate fade. At valuation multiples that match the lows of 2008, with a powerful new growth engine exploding from within the business, this company has the necessary tools and advantages to defy investor expectations and dominate a new and larger market for years to come.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd