Venture: Portfolio Update

Issue 99;

After 50 years, silver breaks to a new all-time high. The bubble of 1979 was one for the history books, with silver rising 12x from 1975. There was a failed attempt in 2011, boosted by the expectations of a solar boom, but it didn’t last. Fourteen years later, it’s finally here and seemingly unstoppable. Venture’s gold and silver stocks are doing very well.

Silver since 1970

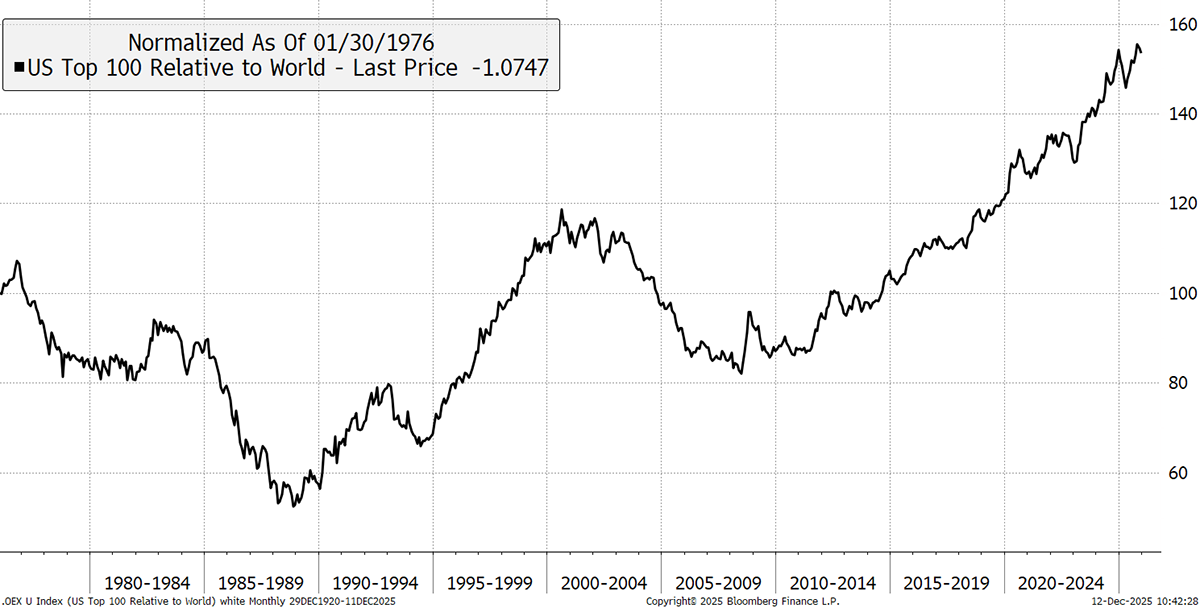

Another silver boom was always going to come, and it is telling us that a commodities bull market is building. You can certainly see it in metals, but less so in energy and agriculture; it will come. It is all part of the great Rotation, a move away from the world’s largest US stocks, and back to the rest of the world. These stocks lagged in the 1980s and again in the noughties but boomed in the 1990s and post the 2008 financial crisis. This latest burst of outperformance by the world’s largest companies, especially concentrated around US tech, has many factors behind it. But at its core, it is a generational bubble driven by indexation. The love of cheap tracker funds has completely distorted the world’s stockmarkets.

Mega-Caps versus the World

That chart doesn’t highlight the turn very clearly, but this one does. Last Christmas, these mega-caps peaked versus the world, and despite a strong recovery since the April Tariff Crash, they are retreating from the all-time high. If the downturn is sustained, it is fabulous news for active investors.

Mega-Caps versus the World – Stalling at the High

It means it won’t just be silver and commodities, but there will be opportunities in faraway countries, and better still, mid-caps in the USA and around the world. Our ByteTrend.io website picked up a new trend in the Russell 2000 US Small Cap Index, and it makes you think.

Money chases success, and as the $47 trillion in US large-caps starts to disappoint, the outflows will begin. It’s happening, and 2026 is going to be a great year for stockpickers.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd