It’s All About the Beer

“Beer is a proof that God loves people and wants them to be happy”

– Benjamin Franklin.

Beer drinking goes back thousands of years, and it has been connecting, gratifying, and embarrassing people ever since its creation. In moderation, it can be lovely; in extremity, it can be totally destructive. Perhaps that’s why beer volumes are dwindling today.

Research has found that 74% of Gen Z said they were reducing their alcohol intake in 2024. According to research firm Kantar, more than half (53%) of 18 to 34-year-olds, and 41% of Britain’s total adult population, are now trying to drink less alcohol. This has led to a new trend for beers that are lower in alcohol content, as well as zero percent options. The brand manager for Old Speckled Hen said,

“We see growing consumer appetite for low & no beer and also for lower ABV beer in general across the category. Drinkers are looking for beers that taste great at lower strengths, particularly around the 3% to 4% ABV mark, where they can enjoy one pint or more.”

Why is this happening? Inflation, shifting beverage preferences, and rising alcohol moderation are all factors. Many consumers feeling the pinch are either trading down to cheaper brands or cutting back entirely. When they do indulge, more are opting for ready-to-drink (RTD) cocktails or even cannabis-derived THC beverages. Some are walking away from alcohol altogether. Just 54% of US adults now drink alcohol, the lowest share since Gallup began tracking the data in 1939. Among adults ages 18 to 34, that figure drops to 50%.

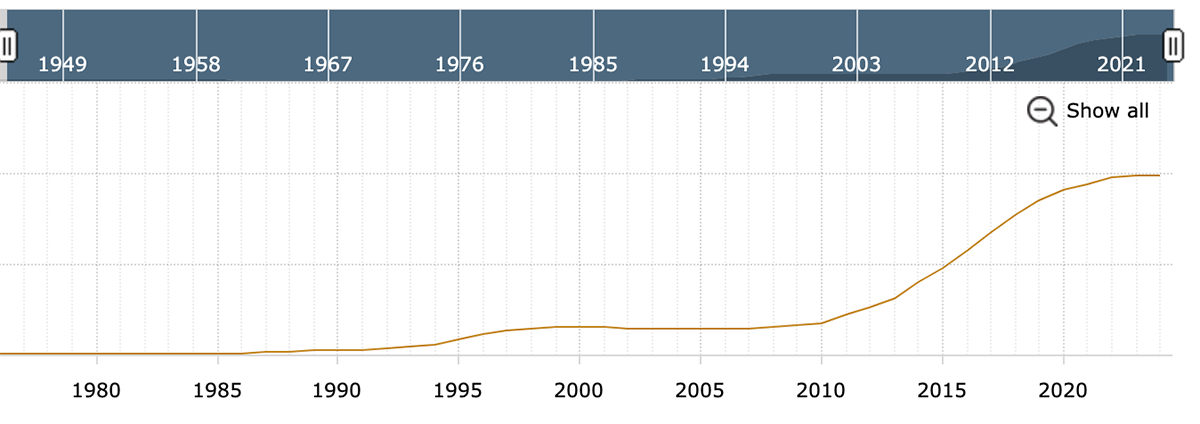

Since the pandemic, the beer industry has been hurt by this drop in consumption. The downturn is steepest in the once high-flying craft segment, where production dropped 3.9% last year. Having exploded from 1,500 to 9,500 independent breweries over the decade to 2020, the industry reached oversupply. The evolutionary crunch arrived, and many are now closing down. For the first time in two decades, more breweries have closed than opened over the past 18 months.

Historical US Brewery Count

The trend is more widespread than just in craft beer though. Large non-craft breweries also saw declines/consolidation last year, down 13% in 2024 (from 145 to 126), having grown steadily up to 2021. This is a potential cause for optimism for investors, as it reflects a reduction in competition, as less profitable players are removed from the market.

Nonetheless, beer remains the most popular alcoholic drink in America, with around 40% of drinkers choosing it. Something like one in every ten litres of liquid consumed in America is beer (another tenth is Coca-Cola products, as Warren Buffett likes to point out). The industry is broadening its range to target more customers, more situations, and more moments.

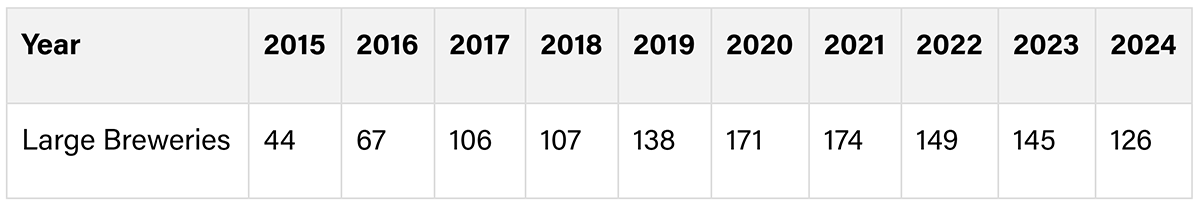

One argument for volume weakness is that people, the young especially, are turning away from drinking for health reasons. But this narrative has largely appeared in the last few years, as inflationary pressures have rapidly pushed prices higher. In fact, new research shows that pint prices in the UK have grown at more than double the rate of the average salary since 1990. It’s not just health choices: Beer, Wine, and Spirits prices are clearly a factor in falling volumes too.

Prices Paid by Producers

The theory that it’s driven by health preferences is certainly possible, but until we can see consumer behaviour in a more benign price environment, it’s too soon to fully adopt that thesis. It’s notable that even though broader headline inflation figures have come back down, the alcohol industry has seen even swifter input price rises in 2025. Barley prices have been especially volatile since the pandemic, nearly tripling before falling back down more recently.

Pearl Barley Prices in USD

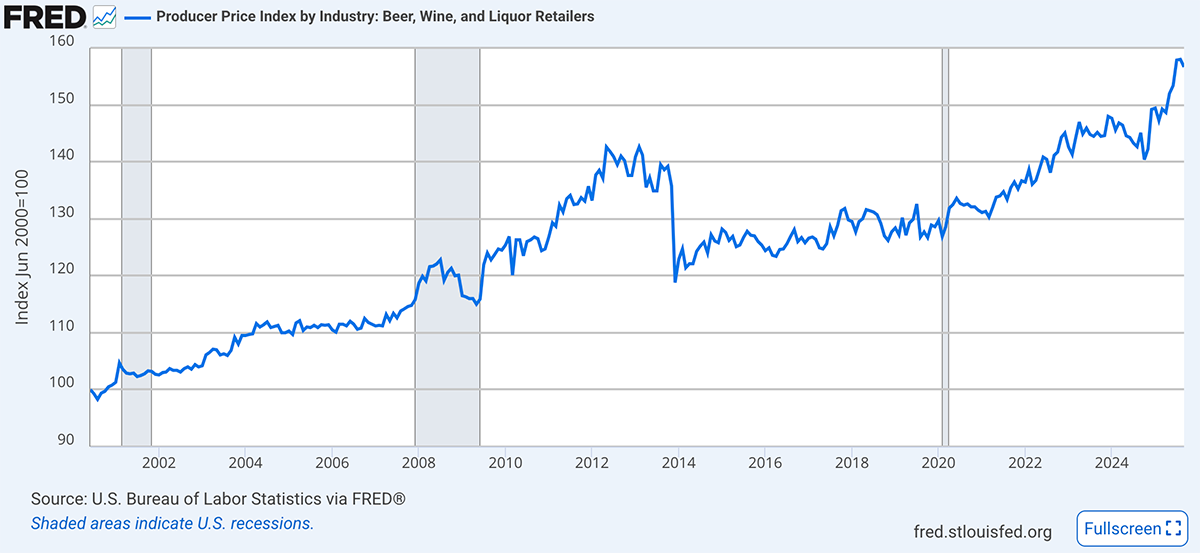

Meanwhile, looking at retail sales of beer, wine, and spirits in the USA (where we have good data), there is a visible jump caused by the pandemic, followed by normalisation as the trend drifts back towards the original growth trajectory.

Alcohol Sales in America

This is also visible in wholesale volumes: a spike, then normalisation, and now returning to trend.

Merchant Wholesalers: Beer, Wine, and Distilled Alcoholic Beverage Sales

These charts make it clear that both prices and the pandemic remain key factors in explaining the trajectory of alcohol sales in the last five years. Even health preferences could be a reaction to the nihilistic drinking rates that took hold during various global lockdowns. People over-indulged and are now pulling back. The data doesn’t yet support the conclusion that this trend will continue forever. Recent reports even suggest that younger drinkers are pulling back on their abstinence, showing a turning tide when it comes to adoption of Dry January, for example. So don’t count the beer industry out yet.

Pity the Brits

At £6.83, London has the second most expensive average pint price of any European country. Germany is cruising at £3.48, while Croatia and Portugal stand out as attractive destinations with average prices below £2.30. If ByteTree gave travel advice, we’d note that Norway and the US top £7, the only notable countries pricier than us, while Nigeria enjoys £0.74, 90% cheaper than the top two.

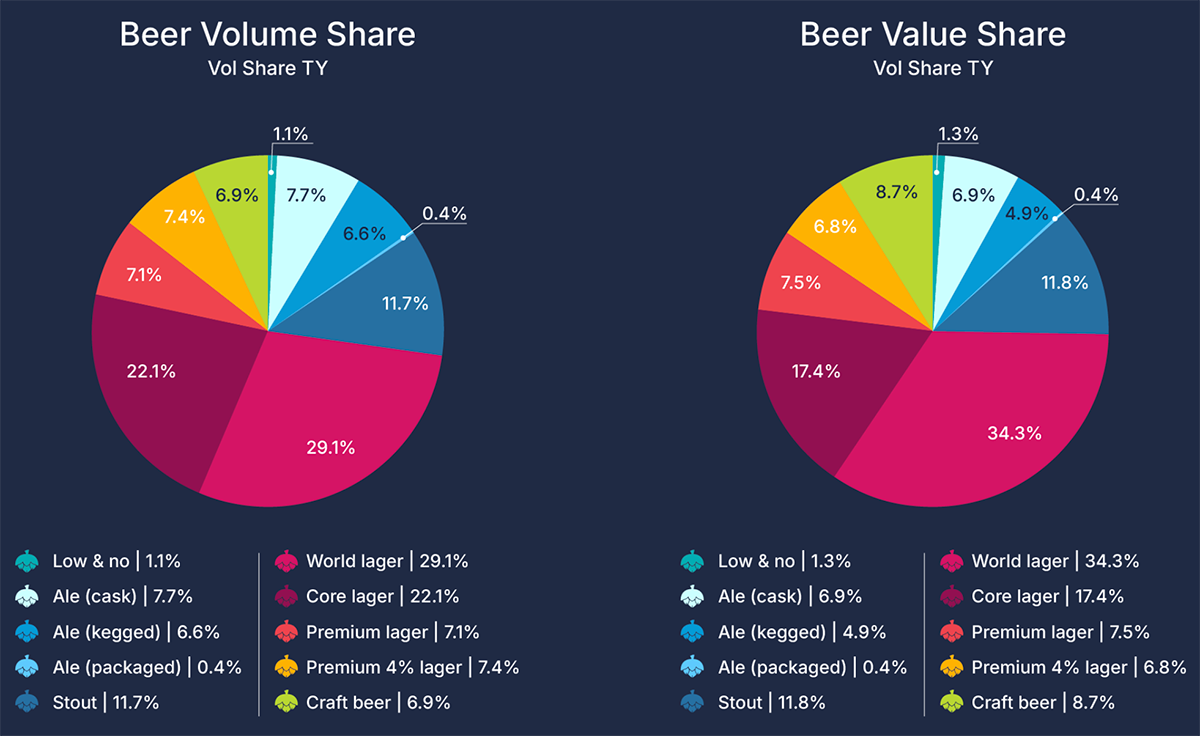

Recently, the UK budget shifted taxes more towards wine and spirits, based on ABV content rather than volume, meaning that beer has benefitted in relative terms. The UK industry is interesting to study, as it largely reflects global trends. In the year to February 2025:

- Total alcohol volumes fell about 3%, but beer did slightly better with only a 2.2% volume decline.

- Low & No Alcohol Beer is booming, with volumes up 51% YoY (the trend has doubled since 2023).

- Stout shows strong growth, with volumes up 18.6% and value up 23.5% year-on-year, and gains of nearly 38% in volume and 51% in value versus two years ago. This trend is led by Guinness, owned by Diageo.

- World Lager is growing steadily, with volume up 5.6% in 2024 and 15.3% vs 2023, and value up even more. It is now the largest beer segment, accounting for 29% of volume and 34% of value.

- Core Standard Lagers are the main losers, as drinkers shift to higher-priced options like World or Premium Lager and drink “less but better.”

Beer Categories’ Market Share – World Beers lead

As for pricing by brand, using the southeast England data, the spectrum looks like this:

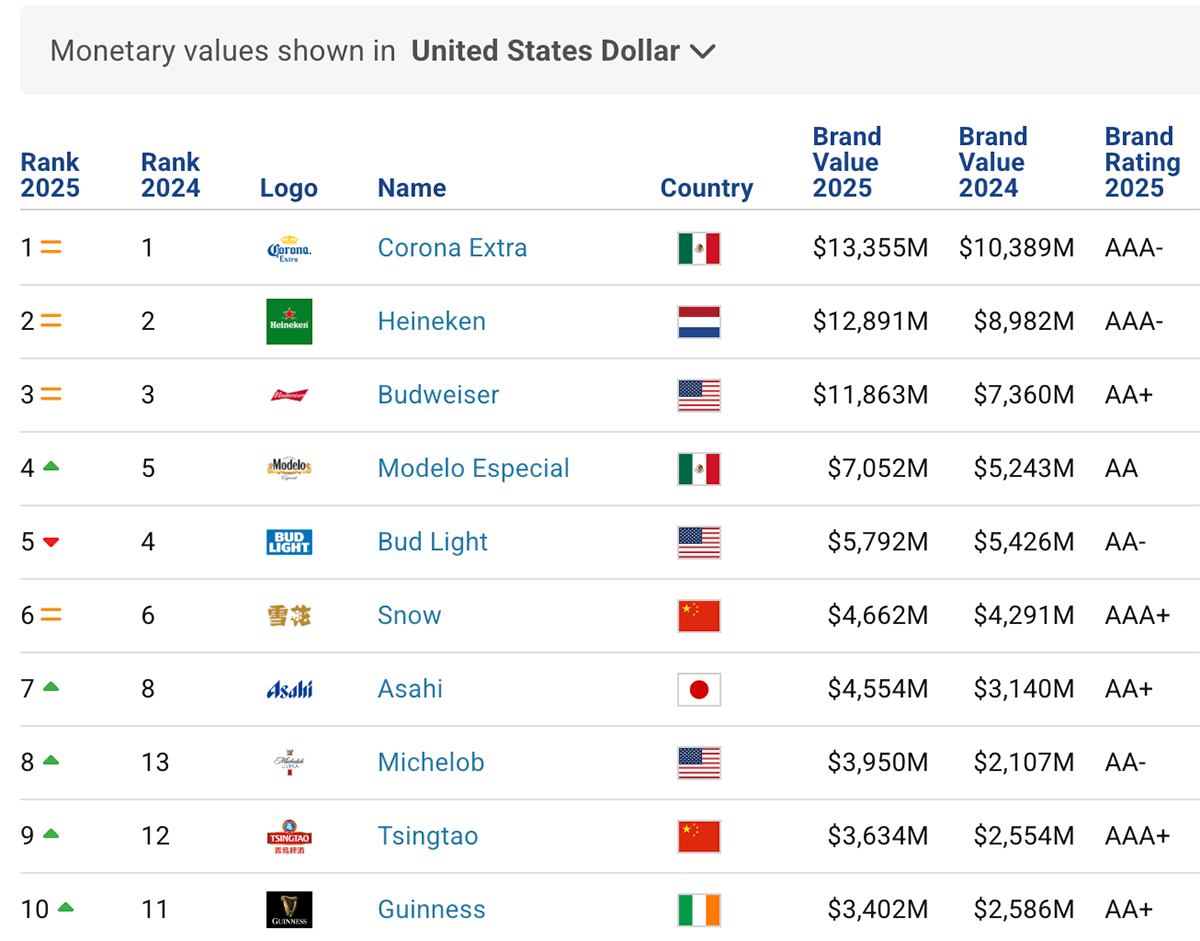

According to the Brand Directory, the worldwide picture looks like this:

“The total brand value of the world’s top 50 most valuable beer brands has reached USD117.6 billion in 2025. The top three, Corona Extra, Heineken, and Budweiser, remains unchanged from 2024 in terms of ranking. Mexico’s Modelo Especial has surpassed Bud Light to claim fourth place, pushing it to fifth. Michelob and Tsingtao have entered the top 10 for the first time, and Guinness has re-entered the top 10 for the first time since 2018, now ranking eighth to tenth, respectively. Notably, all brands in the 2025 top 10 recorded brand value growth.”

World Top 10 Beer Brands

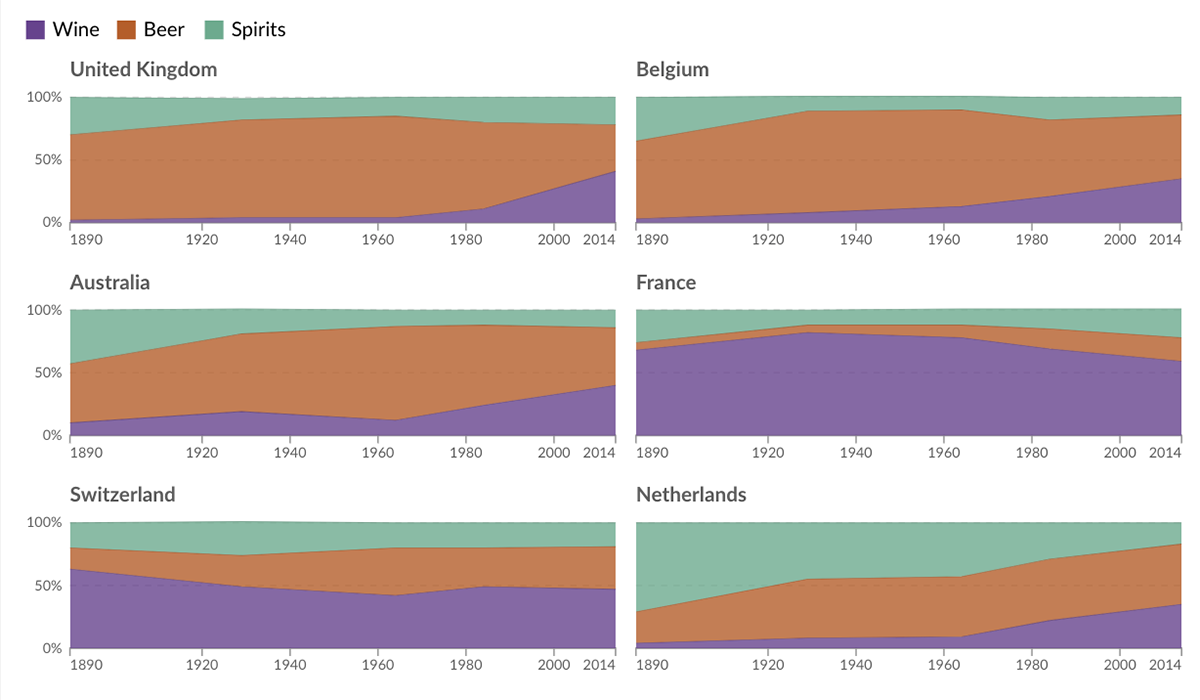

Competition for brewers isn’t just against rival beer brands; it’s also against other forms of alcohol. The global picture remains culturally dominated, but change is occurring as countries converge towards a more balanced split between the three. For example, the UK is drinking more wine, while the French are (slowly) drinking more beer and spirits. In the Nordics, the spirits’ share is falling.

Changing Cultural Habits

Our Next Quality Recommendation

There’s a saying that all great investments begin in great discomfort. If things were easy and obvious to buy, they wouldn’t be cheap enough to make their future returns compelling. Today, we are buying a company that is facing a narrative of stalling or falling volumes, of changing alcohol habits and new threats in the form of weight-loss drugs (GLP-1s).

Balancing the value against the reasons for the company is the challenge of investing and explains the desire for the deep research we do at ByteTree Quality and the long, detailed notes that result. Our next company justifies its selection in full awareness of the challenges and negative narrative/momentum around the industry. It may take patience, but its long-term prospects are excellent from this starting point.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd