BOLD Buys the Bitcoin Dip

ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

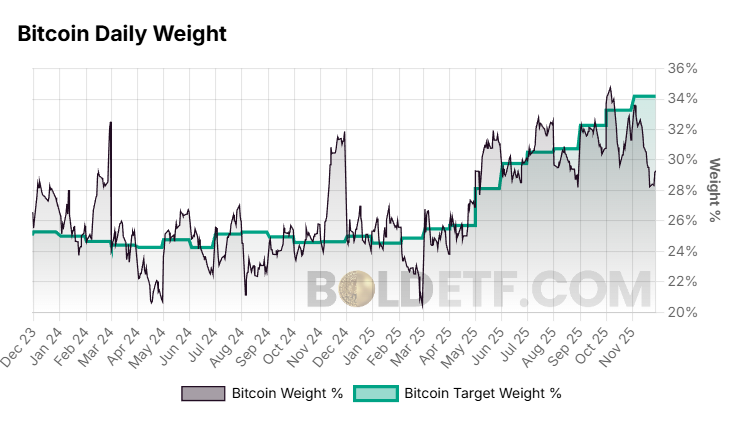

The target weights last month were 34.2% and 65.8% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 29.3% Bitcoin and 70.7% Gold. This means the latest rebalancing has seen 5.2% added to Bitcoin and reduced from Gold to meet the new target weights.

BOLD Performance

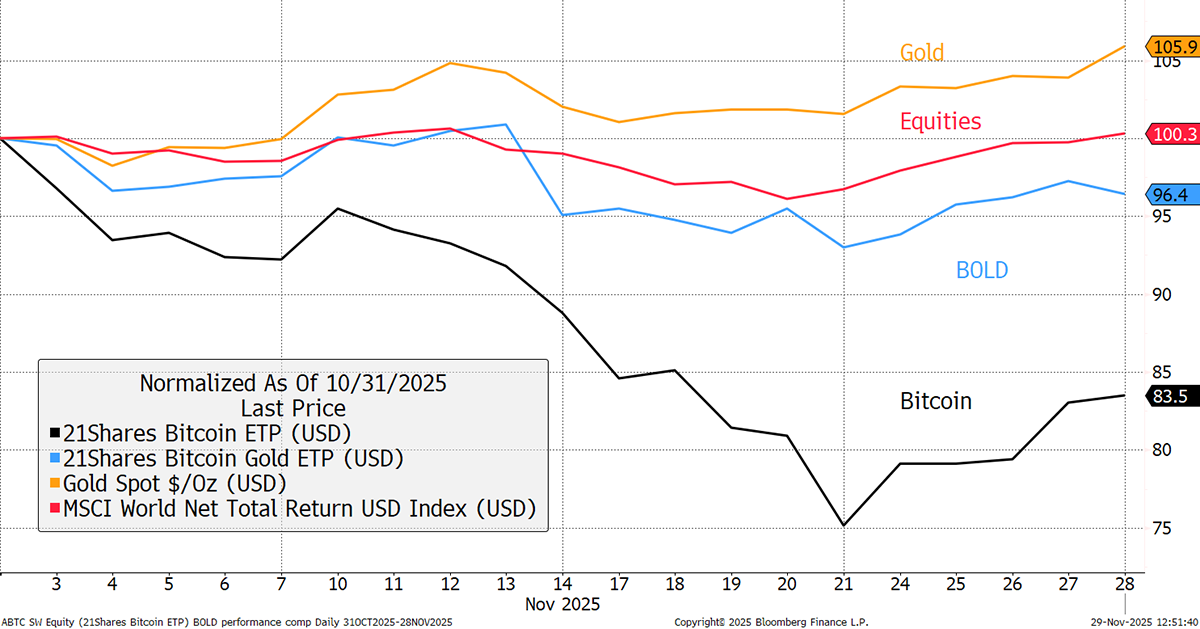

In November, BOLD fell by 3.6%, while Bitcoin returned -16.5%, Gold +5.9%, and global equities +0.3%, in USD terms. The month saw another significant loss for Bitcoin after losing 4.6% in October. This has been a severe correction, yet Gold’s gains have softened the fall for BOLD.

Bitcoin, Gold, BOLD, and Equities in USD – November 2025

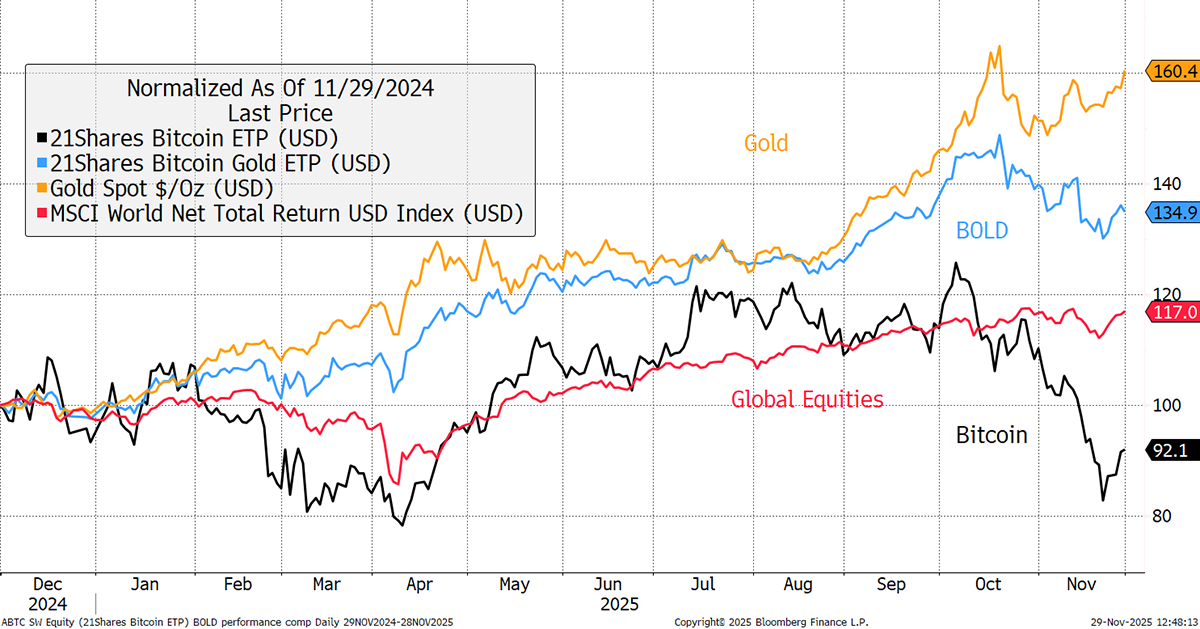

Over the past year, BOLD has returned 34.9%, Bitcoin has returned -7.9%, while Gold has returned +60.4%, and equities 17.0%.

Bitcoin, Gold, BOLD, and Global Equities in USD – Past Year

Bitcoin has fallen from grace and has lagged the stockmarket since early October. We have looked at that in more detail in our research, but the simple answer is that Bitcoin has been caught up in the technology crash, which has impacted AI-related stocks. For investors who believe that the price of Bitcoin will be much higher in the years ahead, the right thing to do is to buy the dip, and that is exactly what BOLD has done in the latest monthly rebalancing.

The BOLD Index has beaten Gold by 3.5x over the past decade, in part due to the superior performance of Bitcoin, which was commonplace pre-2017, but also due to the monthly rebalancing transactions. If Bitcoin falls, and an investor does not rebalance, they have reduced exposure for the rally that follows. The BOLD strategy ensures it is topped up, and so when Bitcoin’s fortunes return, there is sufficient exposure to capture the upside. Rebalancing not only boosts returns but maintains a constant level of risk.

BOLD in Gold

That process also works in reverse. When Bitcoin does well, profits are captured and reinvested into Gold, which is inherently more stable.

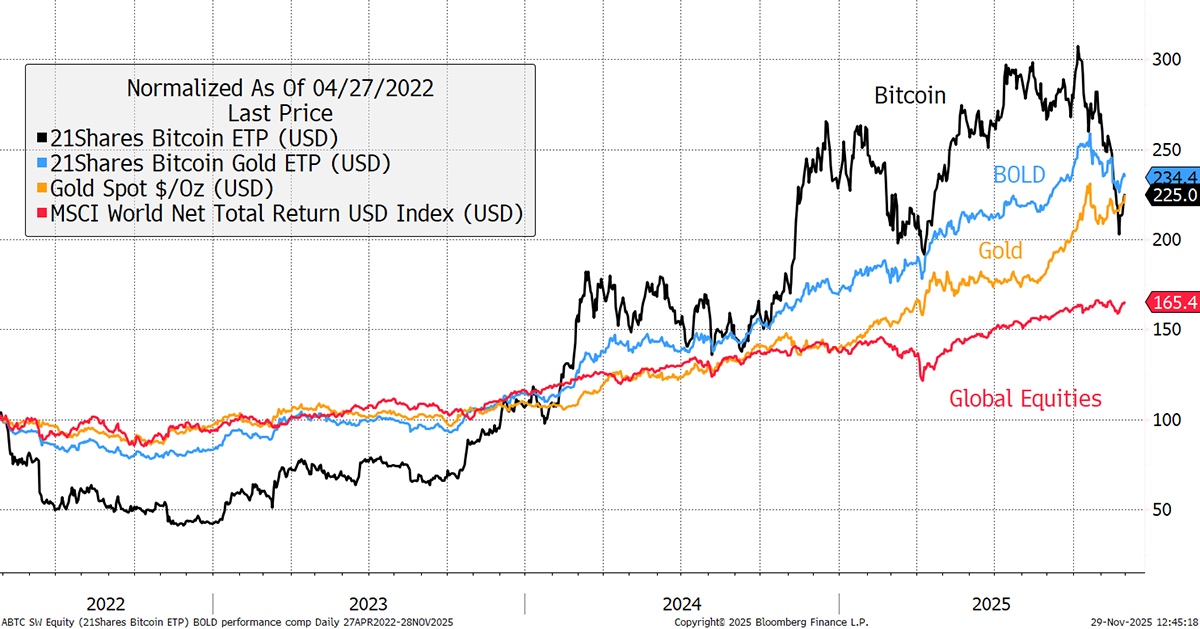

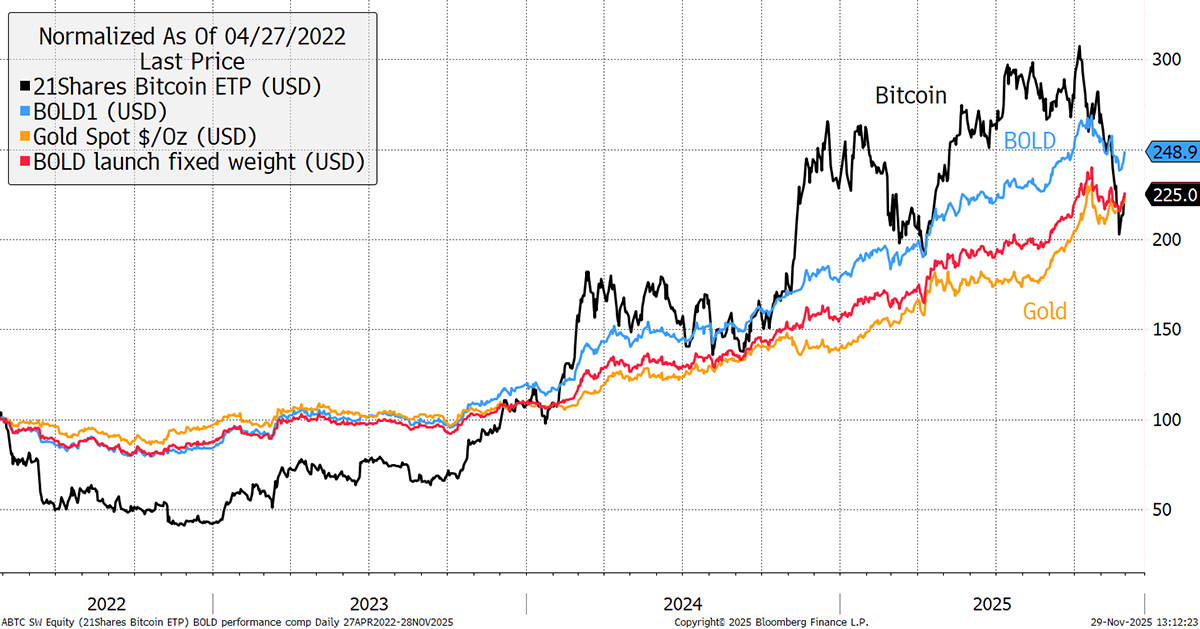

Since the inception of the 21Shares ByteTree BOLD ETP on 27th April 2022, BOLD has returned +134.4%, while Bitcoin has returned +125.0%, Gold +124.8%, and equities 65.4%. For BOLD to beat both assets demonstrates the power of rebalancing.

Bitcoin, Gold, BOLD, and Global Equities in USD – Since BOLD ETP Inception

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

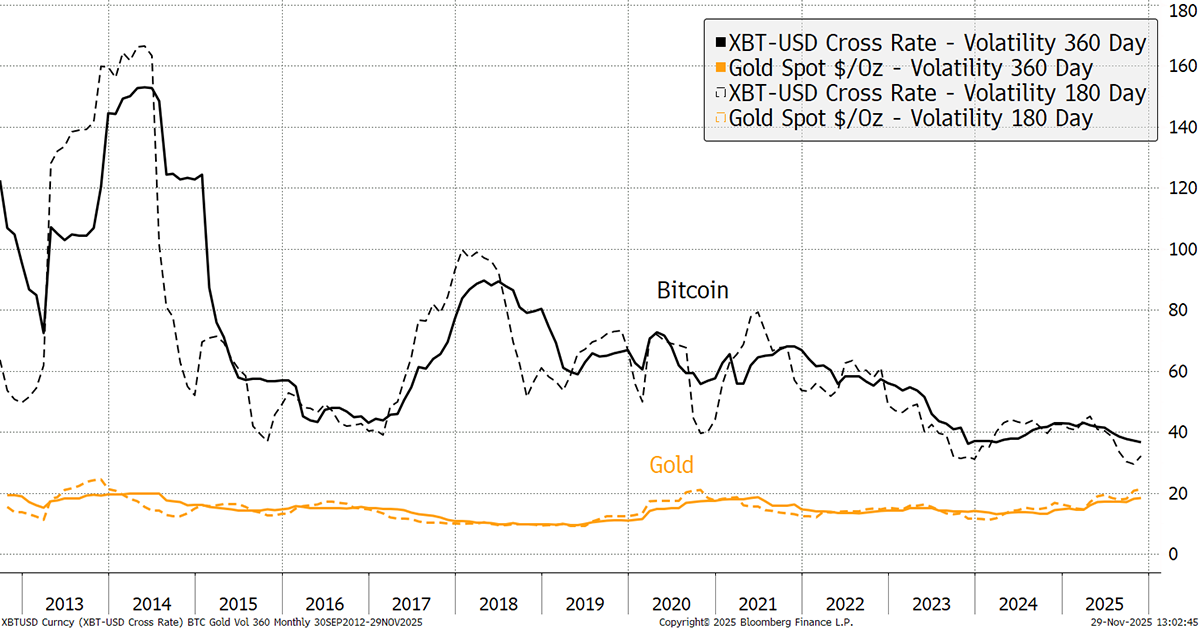

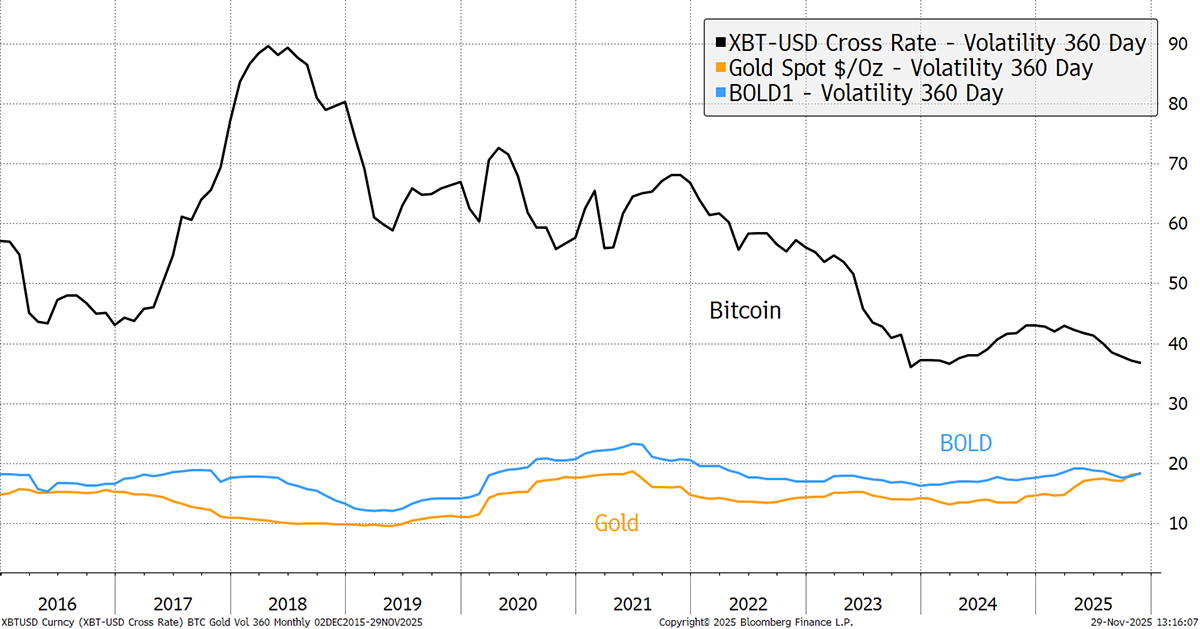

It is notable that Bitcoin’s 360-day volatility is falling, while Gold’s has been rising. Note how the short-term 180-day volatility for Bitcoin is leading the 360-day volatility lower. For Gold, it is leading Gold’s volatility higher. The gap between the asset volatilities has never been narrower than it is today. This indicates that Gold has become a more exciting asset in investors’ eyes, while Bitcoin has become increasingly stable. Investors will not have sensed Bitcoin’s fall in volatility in recent months, but the size of the average daily move, both up and down, is lower than in the past.

Bitcoin’s and Gold’s Past 360-day Volatility

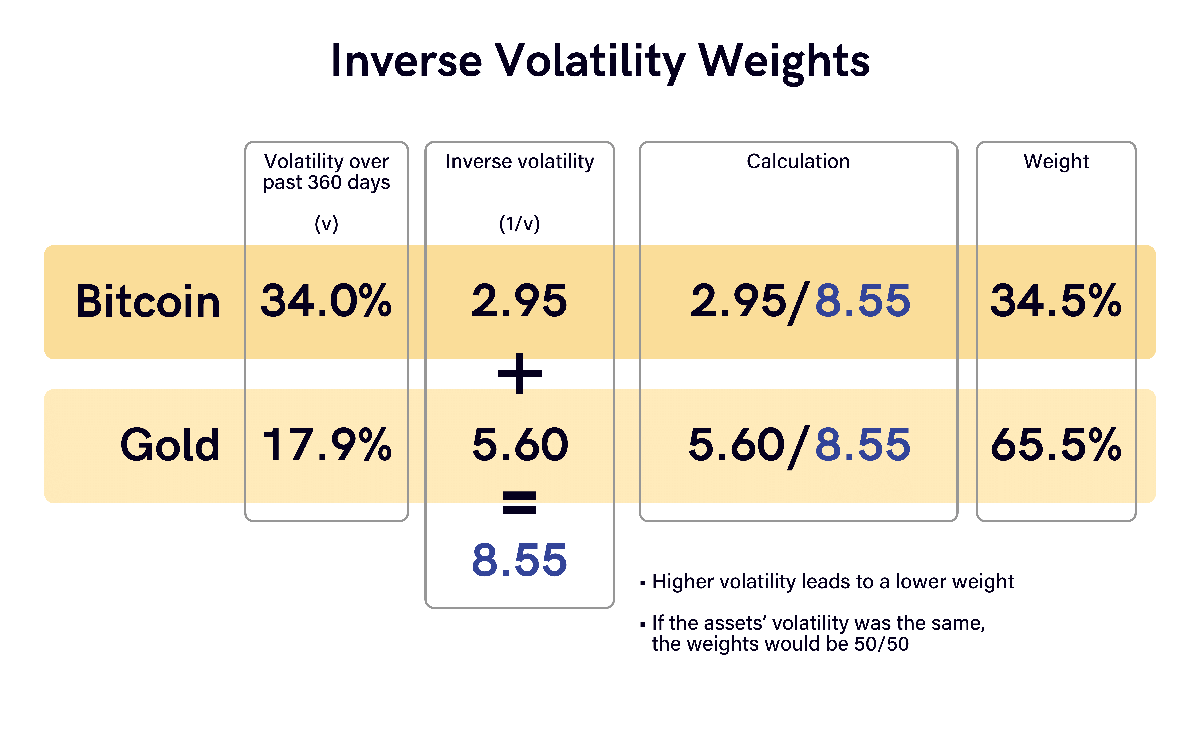

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 34.0% and 17.9%, respectively.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility were ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 34.5% Bitcoin and 65.5% Gold using this formula.

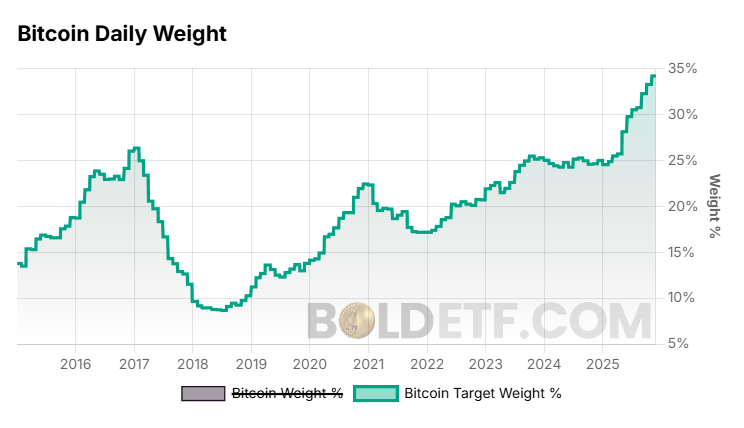

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold.

BOLD Rebalance Weights

The monthly rebalancing transactions, which repeatedly top up the weaker asset, have added significant value compared to buy-and-hold. Using the weight in Bitcoin, you can see how the monthly rebalancing brings the asset allocation back into line. Repeatedly doing this adds value while maintaining a constant level of risk.

Bitcoin: Daily Weight

The daily weights deviate much more than the monthly target weights due to the intra-month price movements between Bitcoin and Gold. For example, if Bitcoin were to have a material fall in price, as it did in November, it would be boosted back up to the target weight during rebalancing. This ensures the strategy maintains the optimised weights on a regular basis.

This rebalancing is also a source of excess return. The red line shows the Bitcoin and Gold performance at the weights in April 2022 to date, which were 18.6% Bitcoin and 81.2% Gold. The excess return of BOLD (after fees) has been 22.9% since the ETP was launched, compared to buy-and-hold. Rebalancing transactions, alongside a risk-weighted asset allocation, deliver excess returns. This dynamic is much more powerful in Bitcoin and Gold than in other asset combinations.

BOLD Rebalancing Has Added 22.9% Over Buy-and-Hold – Since BOLD ETP Inception

If Bitcoin were particularly strong one month or Gold were weak, the rebalancing process would reduce Bitcoin’s exposure back down to the target weight at the month's end. This process keeps the amount of risk, as defined by volatility, roughly the same in each asset. That means BOLD maintains its level of risk over time, not being overly exposed to either Bitcoin or Gold. This explains why BOLD’s volatility is so low and a key advantage over holding Bitcoin and Gold independently.

BOLD Volatility Is Comparable with Gold

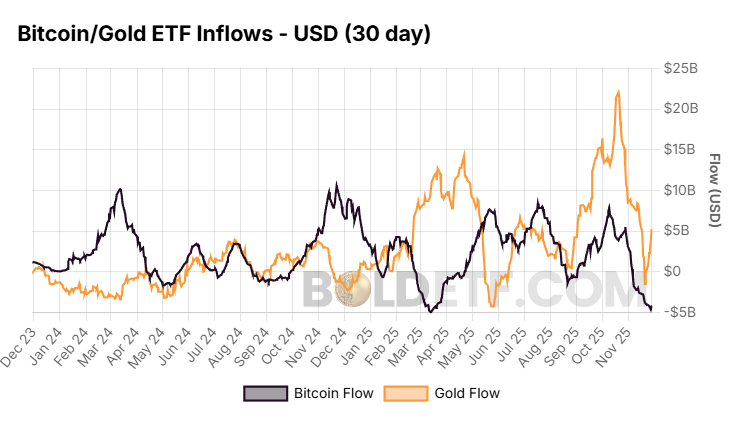

Bitcoin and Gold ETF Flows

Gold ETFs have seen $5bn inflows over the past 30 days, in contrast to Bitcoin ETFs, which have seen $5bn of outflows.

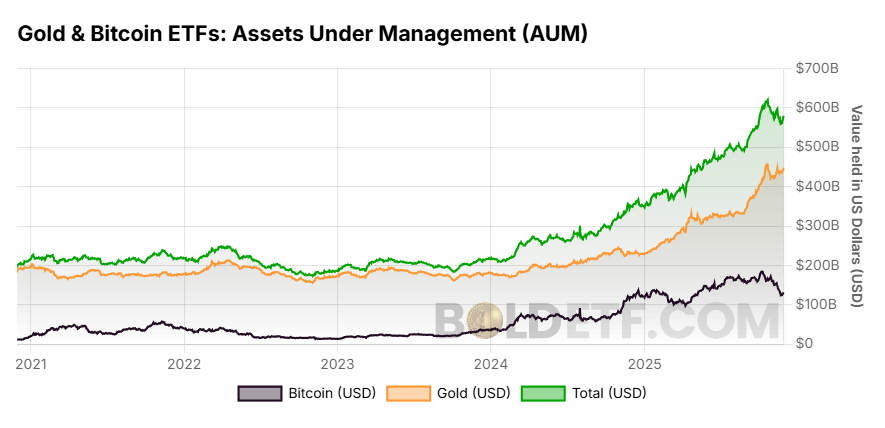

The total value of Bitcoin and Gold ETFs has touched $580 billion, demonstrating that this is a major alternative asset allocation.

BOLD ETP London Listing

The 21Shares ByteTree BOLD ETP (BOLD) will be listing in the UK. It has now been filed, and the date will be confirmed soon. We shall announce it as soon as we know more.

In the meantime, please visit BOLDETF.com, which is full of data and charts to help you better understand the benefits of the BOLD strategy.

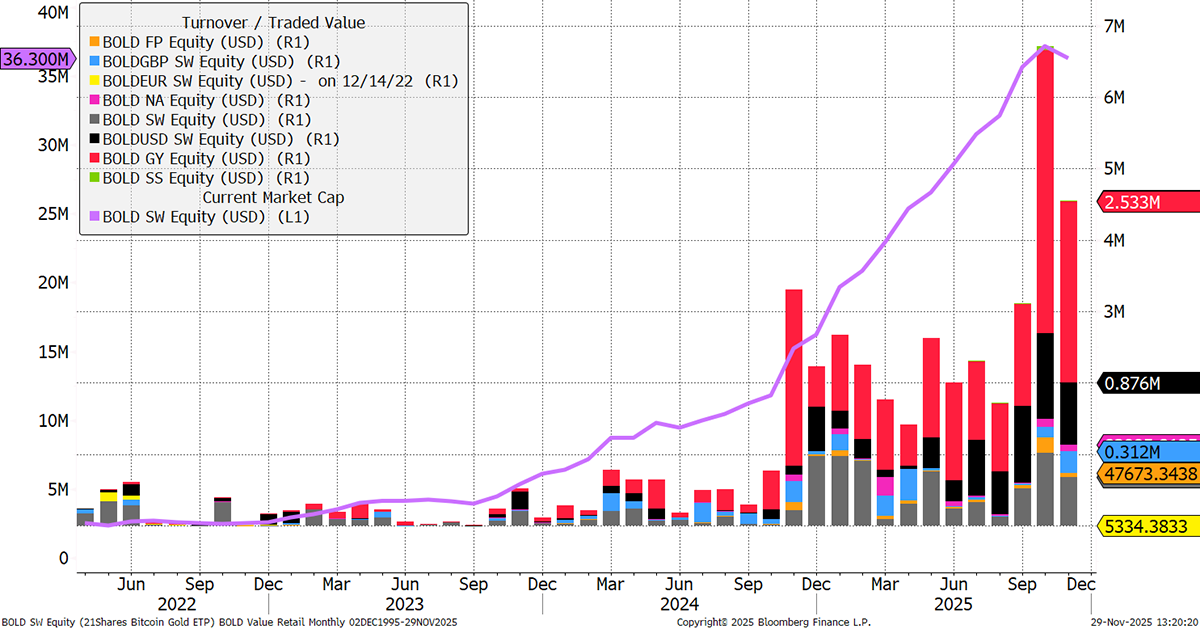

BOLD ETP

The 21Shares ByteTree BOLD ETP (BOLD) has continued to grow. The fund now holds $36.3 million of Bitcoin and Gold in safe custody with Copper for Bitcoin and JP Morgan for Gold. November saw strong volume traded once again, exceeding $4 million. It trades actively in CHF, EUR, USD, SEK, and GBP in Switzerland, Germany, the Netherlands, France, and Sweden. The ticker is BOLD.

21Shares ByteTree BOLD ETP Price and Volume by Share Class in US$

Product Details

| Issuer | 21Shares AG, Switzerland |

| Launch Date | 27 April 2022 |

| Fee | 0.65% Per Annum |

| Custody | Copper Technologies (Swiss) for Bitcoin, JP Morgan for Gold |

| Investment Objective | Risk-weighted Bitcoin and Gold Exposure |

| Benchmark | Kaiko ByteTree BOLD Index |

| Rebalancing Frequency | Monthly |

| ISIN | CH1146882308 |

| SEDOL | BK81V89 CH |

| WKN | A3GYXW |

| Ticker | BOLD SW |

| Listings | Switzerland, Germany, France, Netherlands |

| Currency | USD, EUR, CHF, GBP |

Contact

For information on investing in BOLD, contact bold@bytetree.com.

If your investment firm or media outlet would like a private briefing on BOLD, we will be happy to oblige. If a physical meeting is not possible, we can arrange a Zoom call.