Time for Quality Stocks

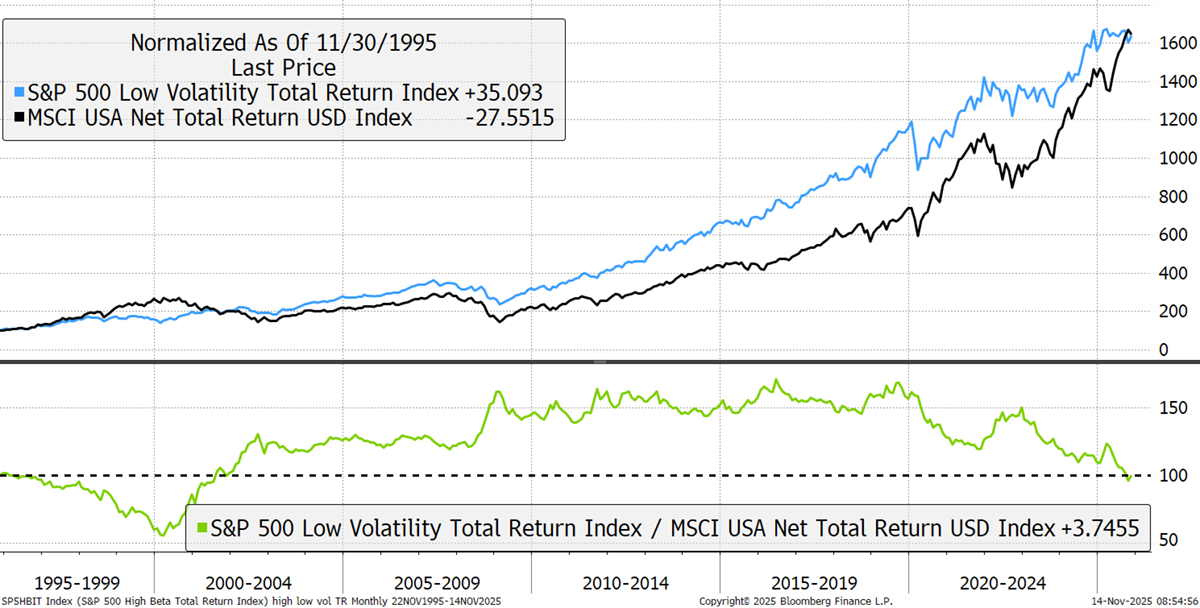

We launched the Quality portfolio when we did because the timing felt right. The market was being led to great heights by very large, volatile, and speculative technology stocks. On the other hand, low-volatility stocks tend to be more resilient when things go wrong. Their volatility is lower because their future is more predictable, and hence they are higher-quality businesses.

Our view has been that the next major market rotation would see this trend reverse. Quality stocks have lagged this bull market, and as a result, offer good value. Investors have been focusing on growth at seemingly any price, and that can never end well. In the long run, value is the only thing that rewards investors.

The big tech stocks recently reported strong earnings growth, but the market wanted more. Prices have been sliding since, and this may well mark the end of the great US technology bull market of the past decade. If not the end, it’s close to the end. As investors recognise that the best is behind us, they will reduce exposure to technology and hunt for quality and value. What will they find? The stocks we have already added to the Quality Portfolio.

High-Volatility and Momentum Winners vs Low-Volatility Stocks

The underperformance of many high-quality companies has started to turn. Given the circumstances, we see good reason to move faster in our recommendations. This will mean that we prioritise making the right decision and communicating it to you quickly. As such, we will be sending the actionable investment case in brief, with the full research note to follow at a later date.

Today, we are adding another company to the Quality Portfolio. It is a market leader in high-patient-necessity medical products, operating globally across multiple segments, with highly loyal customers and strong relationships with key industry partners. This is a well-regarded company, trading at the same share price as in 2015.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd