Bad Habits

Interesting History, Interesting Future;

As a child, we used to listen to the comedy stories of Bob Newhart. A particularly good one was about “Nutty Walt” Raleigh discovering tobacco, available here. The history of smoking is full of surprises…

Tobacco has been grown in the Americas since 6000 BCE. It was originally thought of as a medicine and was also used for religious and cultural ceremonies. In 1492, Columbus arrived and learned of the “miraculous painkiller” of the natives. Soon, the Europeans were using it as a medicine for pretty much anything. By Tudor times, tobacco houses were places of gathering and discussion.

In 1607, the King James Virginia Company formed a colony in America. As part of a broader search for profitable industries, Englishman John Rolfe brought tobacco to Virginia from central/south America in 1612. Spain had a monopoly at the time, but Rolfe planted the seeds and started to grow tobacco crops. Slaves were brought from Africa in 1619 to support this new enterprise, which grew rapidly from their labour. Tobacco soon became so significant that it was even used as a currency during a multi-decade shortage of gold and silver. Wealth was measured in units of tobacco.

As early as 1826, some scientists concluded that tobacco was poisonous in some way, but their findings had little impact. By the 1880s, most tobacco was produced for chewing, and cigarettes were made of the leftovers. Cigars and cigarettes, being pre-rolled, became a luxury. However, when James Bonsack invented a cigarette rolling machine in 1880, everything changed. At the time, manual production was slow, with skilled workmen rolling about four cigarettes per minute, not enough to meet the rising demand of the 1870s.

To incentivise innovation, a company called Allen and Ginter offered a $75,000 prize (about $2 million today) for anyone who invented a cigarette-rolling machine. Bonsack left college to focus on this challenge, and by 1880, he had developed a working prototype. It was destroyed by fire, but he built a new one and secured patents in 1881. However, Allen and Ginter rejected it, concerned over consumer acceptance of machine-rolled products and keen not to actually give the prize money. Instead, Bonsack partnered with tobacco magnate James Duke, who adopted the machine. Capable of rolling 200 per minute, it completely disrupted the cigarette industry, with Duke’s growing conglomerate ultimately taking over Allen and Ginter.

A Bonsack Replica

Cigarettes gained popularity during WW1, and by WW2, they were so important that they were included in ration packs. However, in the 1930s, German doctors had established the first link between smoking and lung cancer. In the 1950s, Anglo-American scientists confirmed it. In the 1960s, these were reported to the public but denied by the tobacco companies. Despite their efforts, the UK banned tobacco advertising on TV in 1965, and America followed suit in 1971.

Smoking is now provably dangerous to all parts of the body, but lung cancer is still the main risk, and is the top preventable cause of death worldwide, causing 5 million deaths per year. As a result, advertising cigarette brands is now banned almost everywhere, almost all the time. How things have changed.

Smoking itself is now banned in most indoor spaces in most countries, including on flights. Despite these and other initiatives, tobacco still hooks one in five adults worldwide.

Industry

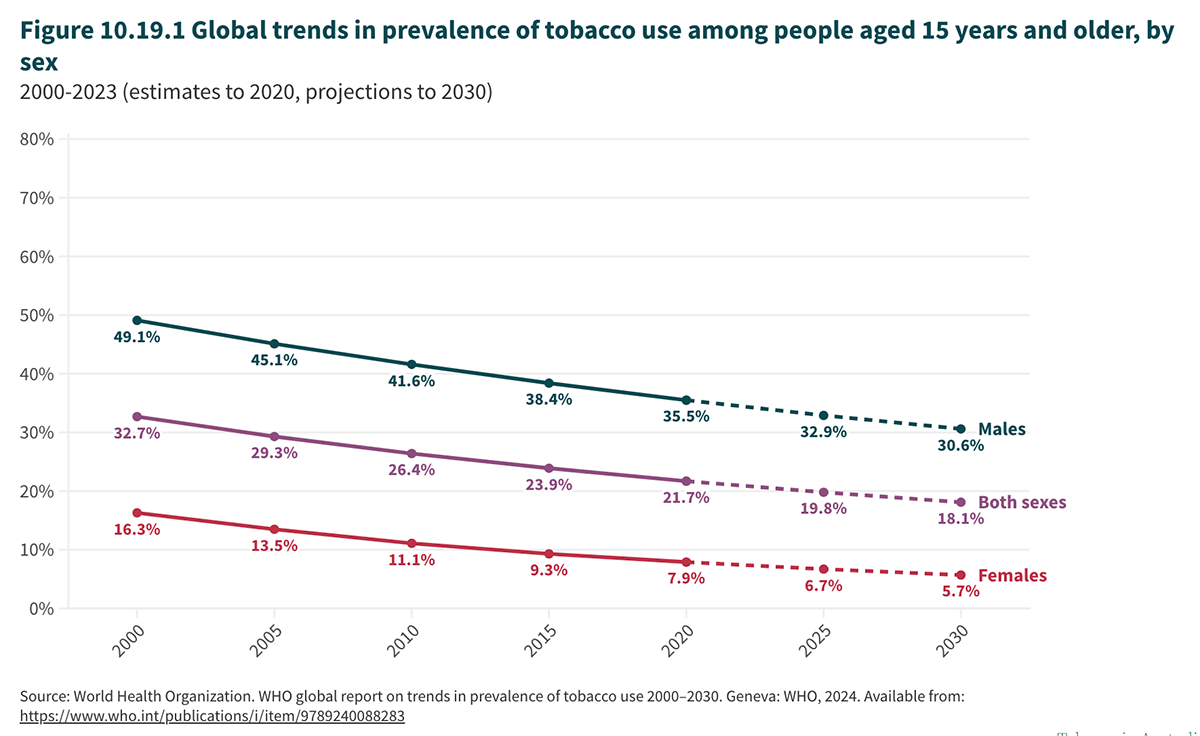

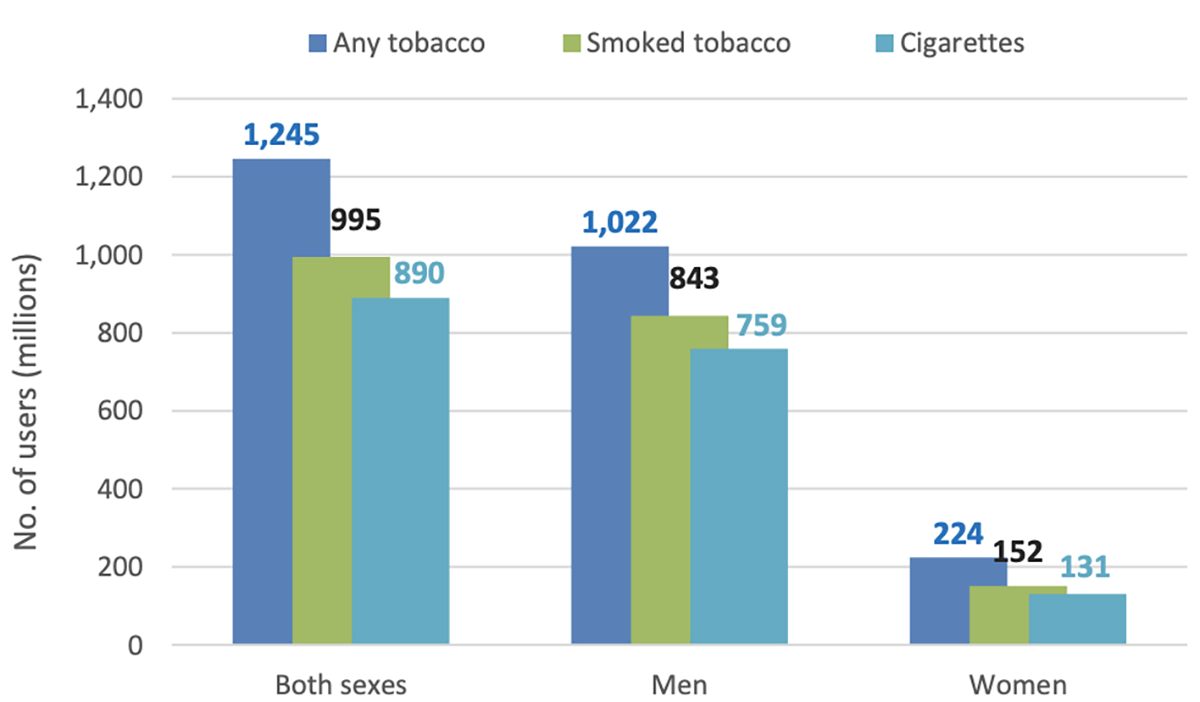

The WHO says the number of tobacco users has dropped from 1.38 billion in 2000 to 1.2 billion in 2024. Nonetheless, 350 young adults start smoking every day. Having taken up the habit, it takes an average of 30 attempts to stop, and many never succeed.

Tobacco Use

While tobacco companies remain reliant on revenue from traditional cigarettes, there has been increasing interest from governments in policy options that have the potential to largely eliminate tobacco use. Large tobacco companies have been consistently interfering with governments' efforts to enact such “endgame” policies. That battle is well known, and the industry is undergoing a slow, steady decline as shown above. Politicians are against it, and there is a steady increase in health awareness in the global population, with alcohol volumes and sugary products also coming under pressure.

Overall, more women are quitting tobacco than men, and they make up around 1/6th of the total (c. 200 million). Just under 1 billion men still use tobacco, as use has fallen from 41.4% in 2010 to 32.5% in 2024. South-East Asia was once the world’s hotspot, but prevalence among men has nearly halved, from 70% in 2000 to 37% in 2024. This region alone accounts for over half of the global decline. Prevalence is low and falling in Africa (9.5%), but total user numbers continue to rise because of population growth. Europe is now the highest-prevalence region globally, with 24.1% of adults using tobacco in 2024.

As for younger people, the global dataset indicates that 37 million adolescents aged 13–15 years currently use some form of tobacco, of which 12 million are smokeless tobacco users. It may seem like an industry of the past, or one in decline, but one in five is a huge proportion of people, and while more are quitting, many are still starting.

The leading brands are Marlboro, L&M, Pall Mall, Winston, and Camel. These are all noticeably old brands. One factor in favour of tobacco stock is an almost complete lack of threat from new entrants. They have enjoyed this psychological moat for decades because who would start a traditional cigarette company today? This is a large part of the industry’s continued success from an investment perspective. One way excess returns are competed away is through people entering the business, but for tobacco companies, that threat isn’t there.

Another factor is government regulation. The enforced lack of advertising by any player in the market may have helped the reduction in overall smoker numbers, but it’s also helped support the famously high profitability of tobacco companies, by removing a significant cost line. They now can’t spend anything on packaging either. Terry Smith, a fan of the industry from a quality investment perspective, makes the point that investors should be wary of industries where governments have a heavy hand. He says that the tobacco industry wasn’t a particularly strong performer until the government started trying to stop it. Smoking is an industry the government is actively trying to hold back, and yet they’ve played a large role in reducing costs and competition.

Thinking again about new entrants. Say you really did want to start a new cigarette brand and challenge the big guns – but how? Even if you made a product, you cannot advertise. They’re all nameless packs hidden behind closed doors behind the counter. How can you ask a cashier for something you’ve never heard of and can’t see? No wonder smokers stick to one brand. This is a classic cornered resource – powerful, limited in number, and unique to a handful of companies.

Terry Smith isn’t the only major investor keen on the sector. Warren Buffett and Charlie Munger have sung its praises in the past, as has Michael Burry of Big Short fame. Buffett’s famous line was,

“It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.”

He and Munger also discussed the ethical question about investing in it, but concluded that it was messy, complicated, and personal. They didn’t own a pure tobacco company at the time, but they did own the largest retailer of cigarettes in America – Walmart. For us, briefly, we have our own mixed feelings, but we are seeing this in pure investment terms, and letting you make the decision as you please.

In any case, change is coming for the industry. Since the 1970s, tobacco companies have been interested in cannabis as both a potential new product and a rival product. But the main story is tech, i.e., e-cigarettes in all their forms.

The Future

In 2022, the WHO estimated global e-cigarette use at over 100 million people worldwide. This included 86 million adults and 15 million children, who are (on average) nine times more likely to vape than adults.

Innovation in nicotine products is accelerating, with sector leaders pushing heat-not-burn technologies focused on heating precision and consistent aerosol delivery. Premium e-cigarettes now offer advanced features like temperature controls and smart connectivity. Genetic engineering is being used to deliver precise nicotine doses, while sustainability is a rising focus through biodegradable components. AI- and IoT-enabled personalised nicotine delivery is emerging.

The market is concentrated in heat-not-burn, highly competitive e-cigarette/vaping categories, and fast-growing oral formats like nicotine pouches. Product innovation is driven by better flavours, improved ergonomics and battery life. There’s a push to market next-generation formats as “lower-risk alternatives”, though the science is still unclear on that (too soon to tell).

The main categories are heated and liquid vapour products.

- “Vapour products contain an e-liquid, nicotine and flavours, and a battery-powered heating element. When activated, via puff or button, the heating element heats the liquid and forms an aerosol, commonly known as vapour.

- Heated Products (HPs) have two main functional parts: a battery-powered device and a consumable - which contains a plant-based (tobacco leaf or non-tobacco leaf) substance that is heated. Once the consumable has reached the necessary temperature, it forms an aerosol releasing nicotine and flavours.”

Vapour products, or vapes, are also known as e-cigarettes, while heated products are a separate category. There are also traditional and modern oral products, such as snus and snuff. Together, they make up the smokeless, alternative, or the “next-generation” category, in opposition to “traditional combustibles”.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd