Venture Gold Update

Issue 92;

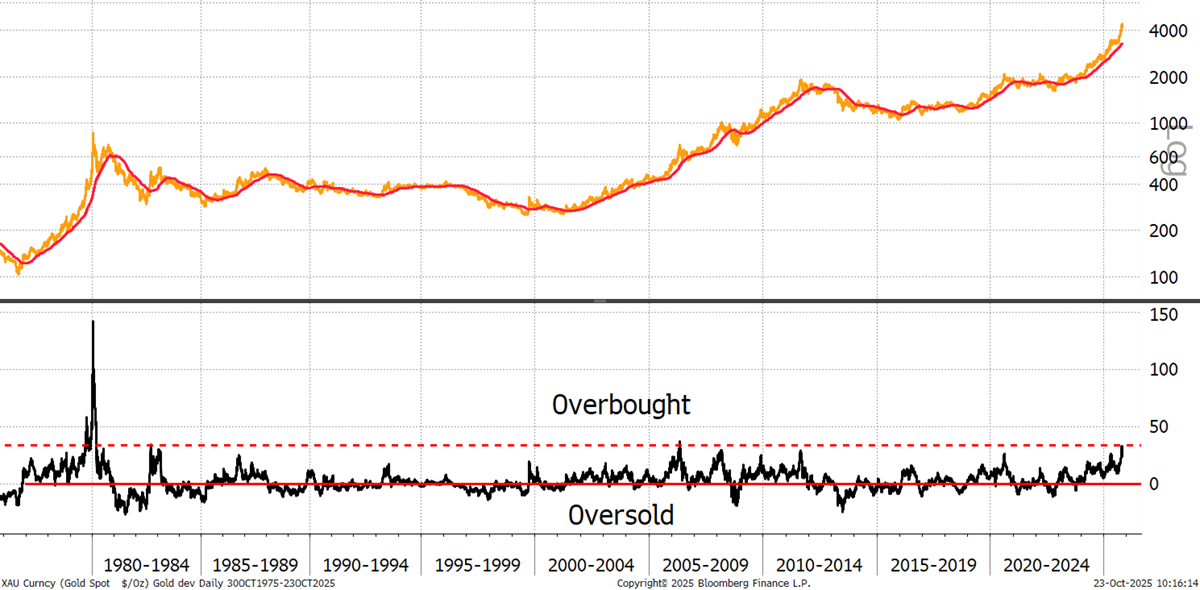

With the recent correction in the gold price, I am updating ByteTree Venture clients on the gold mining stocks. On the face of it, the gold price correction of 6% is modest, but what took investors by surprise was its speed. The price of gold had traded 33% above its 200-day moving average, which is not something we see very often.

Gold Deviation from Trend since 1975

Gold is still in a strong uptrend, but previous overbought situations have normally led to a period of consolidation. We have also seen a rise in implied volatility, which reflects greater uncertainty. A spike in volatility normally signals a trend reversal, in either direction, but it isn’t necessarily large.

The Gold VIX

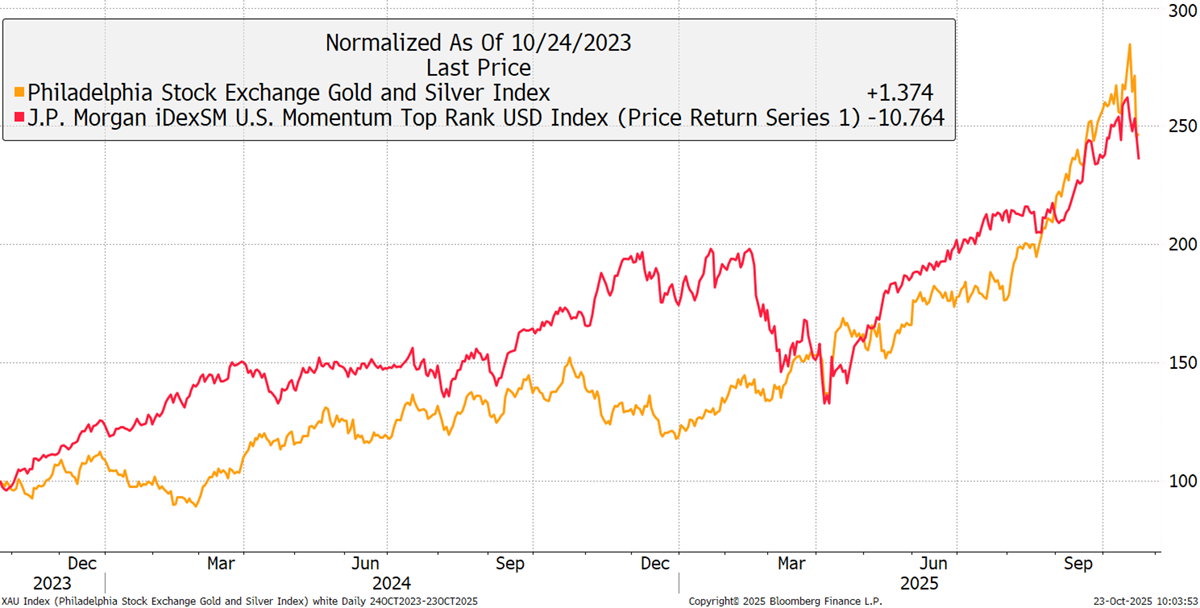

I would also highlight that the gold miners started to correlate with the equity momentum trade, having been a diversifier before the tariff crash in April. Recently, the gold miners have been moving alongside AI, robots, and blockchains. I had no idea that gold mining was such a high-tech sport.

Gold Miners and Momentum Stocks

Moving on to Venture’s gold-related stocks, the correction appears to have been savage, with the gold miners’ index falling by 16% by yesterday morning. But bear in mind, it had rallied by 141% this year, and 109% since the April low.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd