BOLD Holds One-Third in Bitcoin

ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

The target weights last month were 32.3% and 67.7% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 30.8% Bitcoin and 69.2% Gold. This means the latest rebalancing has seen 2.5% added to Bitcoin and reduced from Gold to meet the new target weights.

BOLD Performance

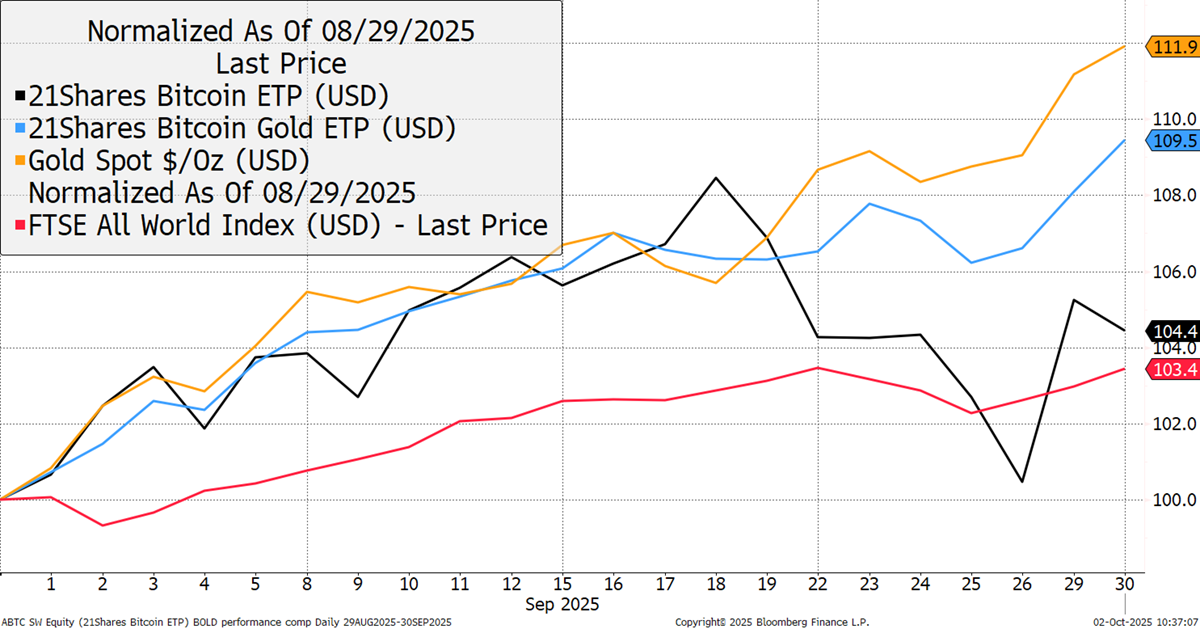

In September, BOLD rose by 9.5%, Bitcoin rose by 4.4%, and Gold rose by 11.9%, while global equities rose by 3.4% in USD terms.

Bitcoin, Gold, BOLD, and Equities in USD – September 2025

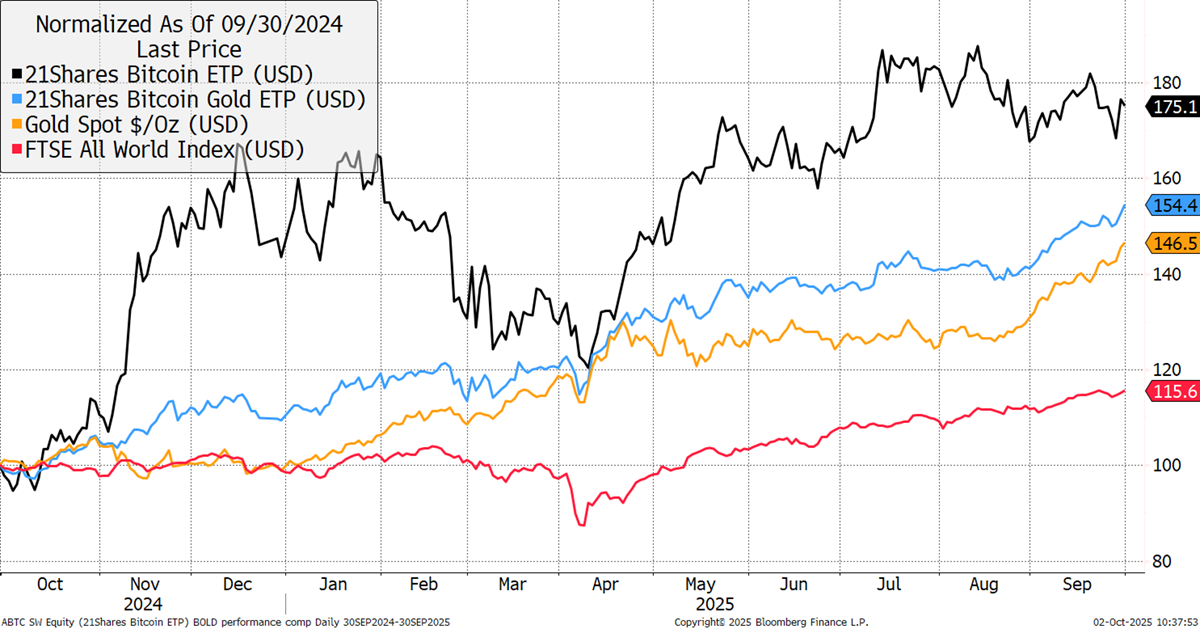

Over the past year, BOLD has returned 54.4%, Bitcoin has returned +75.1%, in contrast to Gold with a +46.5% gain, while equities have risen by +15.6%.

Bitcoin, Gold, BOLD, and Equities - Past Year

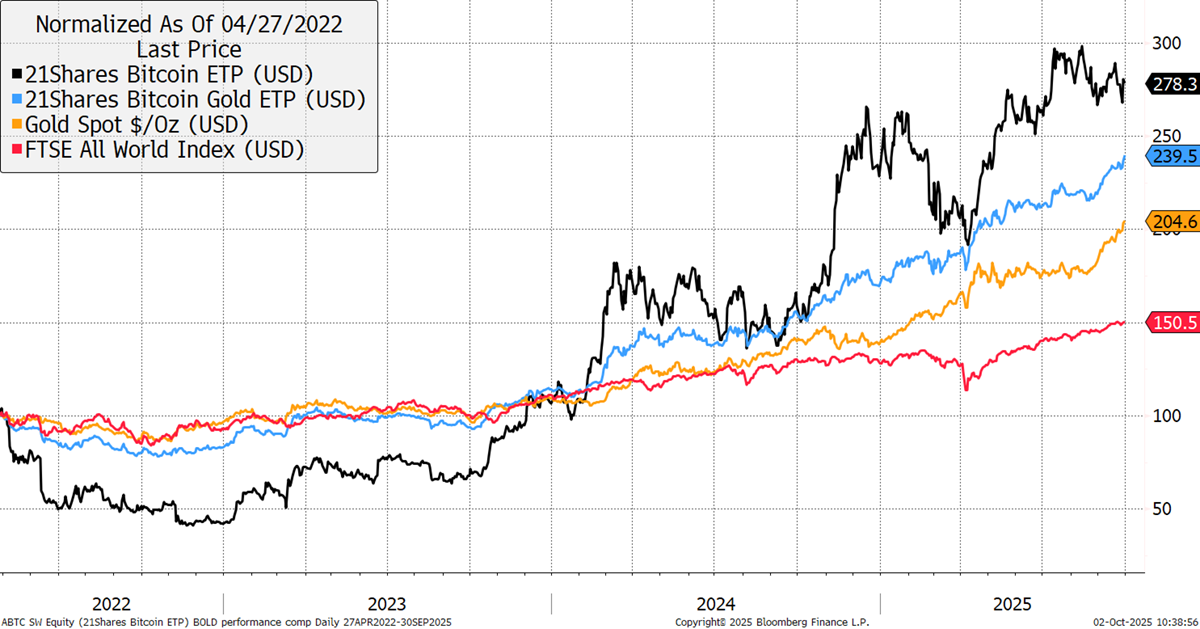

Since the 21Shares ByteTree BOLD ETP's inception on 27th April 2022, BOLD has returned +139.5%, Bitcoin has returned +178.3%, Gold is up +104.6%, while equities have risen by +50.5%.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

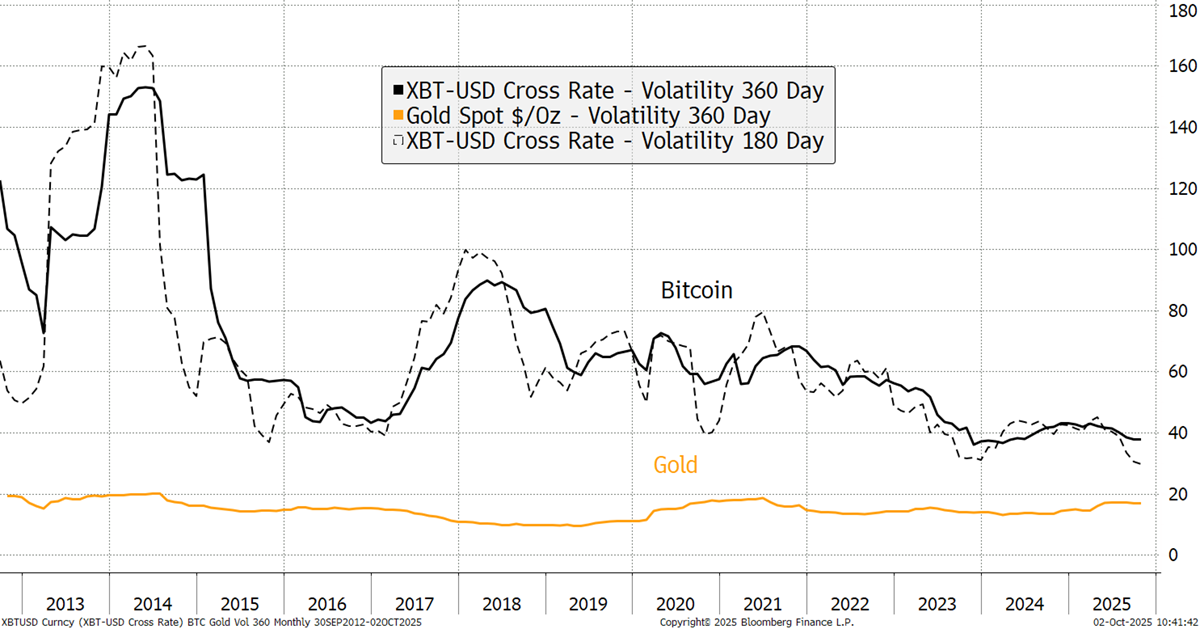

Bitcoin and Gold’s Past 360-day Volatility

It is notable that Bitcoin’s 360-day volatility is falling rapidly, while Gold’s has been rising. Note how the short-term 180-day volatility for Bitcoin is leading the 360-day volatility lower. This is the lowest level of volatility on record and demonstrates that Bitcoin is much more stable than it has been in the past. This makes the asset more credible for institutional investors.

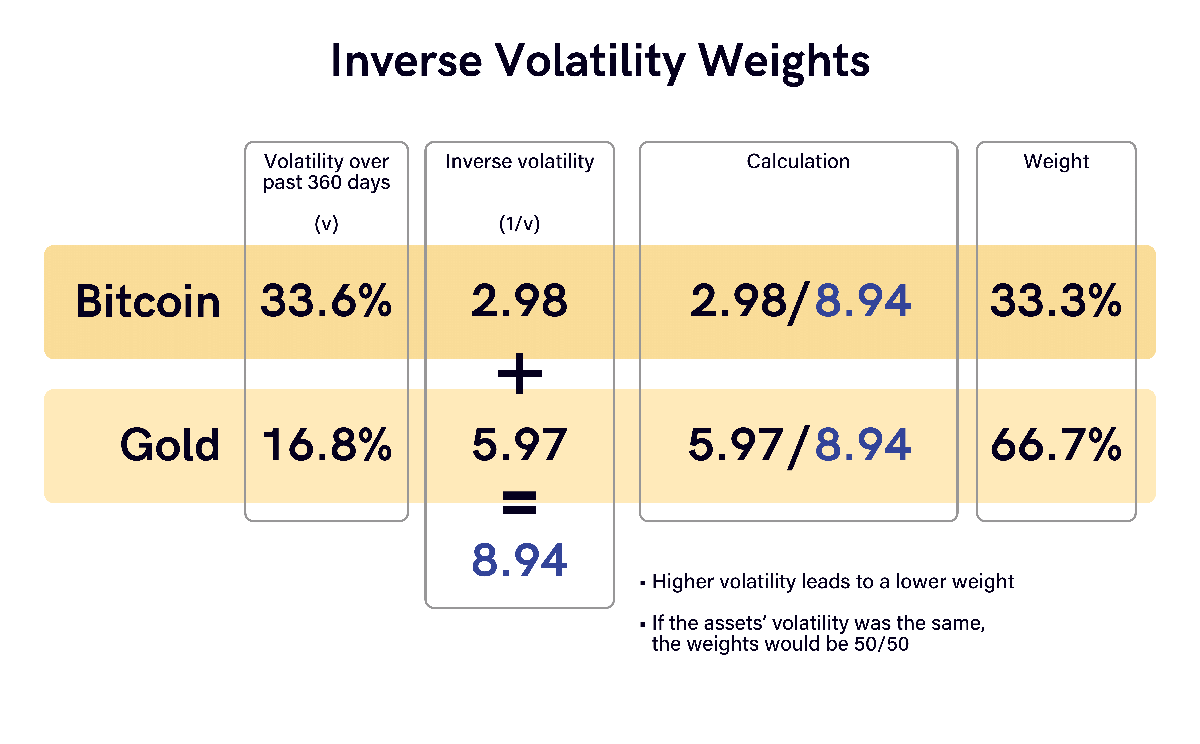

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 33.6% and 16.8%, respectively.

If Bitcoin and Gold had the same volatility, the weights would be 50/50. Indeed, if Gold’s volatility were ever higher than Bitcoin’s, then Bitcoin would have a larger allocation. The volatility measures have resulted in new target weights of 33.3% Bitcoin and 66.7% Gold using this formula. For the first time, BOLD holds one-third in Bitcoin.

Asset allocation is an important feature. Over the long term, the aim is to equalise the risk in each asset. In 2017 and 2018, BOLD had relatively low exposure to Bitcoin due to its high volatility at the time, which held it in good stead in the 2018 bear market. At other times, it has generally been in the 20% to 25% range, with the remaining balance in Gold.