Aster: The Fastest Growing Perp DEX

Token Takeaway: ASTER;

Aster has quickly climbed the ranks to become the largest decentralised platform for perpetual futures trading. Its native token now sits among the top 20 by fully diluted valuation (FDV). Built on a multichain infrastructure, Aster enables users to trade crypto futures and spot markets, while also offering tools to deploy yield extraction strategies. In this Token Takeaway, we’ll dive into the perpetual futures market, assess Aster’s fundamentals and sector positioning, and evaluate the value proposition of its native token, ASTER.

Overview

Aster is a high-performance, multichain Perpetual Futures (Perp) DEX operating across the BNB Chain, Ethereum, Arbitrum, and Solana. The platform was born from the merger of Astherus, a multi-asset liquidity hub, and APX Finance, a decentralised perpetual protocol, at the end of 2024. This merger created a new entity that, despite being less than a year old, has already reached a remarkable scale. Although the protocol has been functional for some time, activity surged following the launch of the ASTER token on 17 September.

Trading Volume on Aster

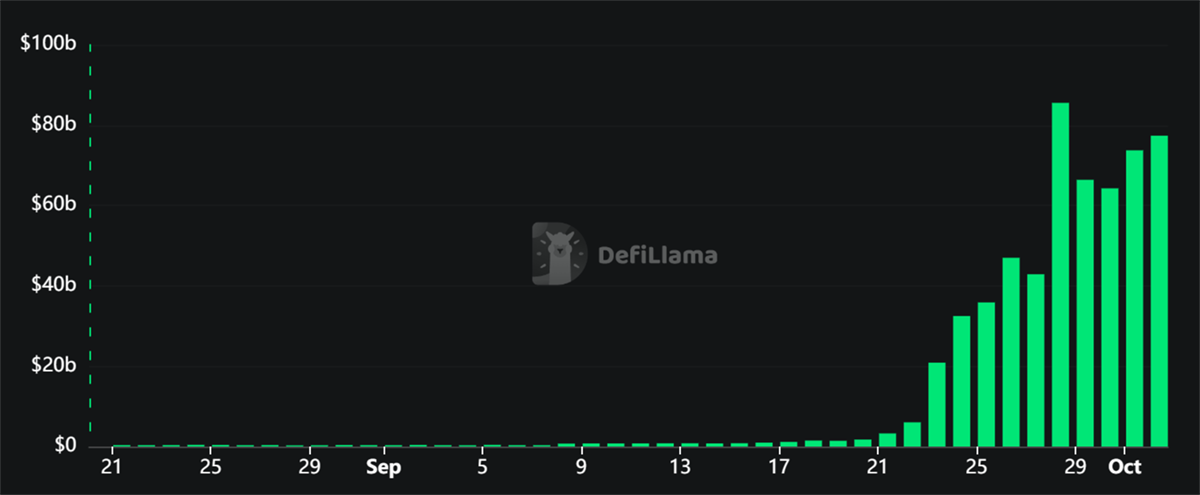

Aster has processed over $1 trillion in cumulative trading volume to date, with almost half of that, $493bn, in the last 30 days alone. Of this, $415bn was recorded in just the last 7 days, and an impressive $74bn was processed within the last 24 hours. These figures underscore the extraordinary pace at which Aster has established itself as a dominant player in the market.

The perpetual futures sector is widely recognised as one of the fastest-growing segments in crypto, and Aster’s rapid rise is a testament to that momentum. The scale of its volumes is unprecedented, surpassing even the benchmarks set by HyperLiquid, the previous market leader in the space.

To put this into perspective, HyperLiquid’s latest figures, $9.4bn in 24-hour volume and $70bn over 7 days, pale in comparison to the volumes Aster is now generating. Such numbers not only highlight Aster’s ability to attract and handle liquidity and traders at scale but also suggest a broader shift in market leadership within decentralised perpetual futures trading.

Before diving deeper into the intricacies of Aster, let's first explore the perpetual trading market to get a better understanding of Aster’s market positioning.

Perpetual Trading Market

Perpetual futures have emerged as the fastest-growing segment in crypto, with user activity and volumes expanding at a pace rarely seen in crypto markets. Even in traditional finance, derivatives have long overshadowed spot trading, as they provide traders with powerful tools to speculate, hedge, and leverage their positions. The same dynamic is now unfolding in the crypto market, and it is rewriting the market's structure.

The appeal of perps lies in their flexibility. Traders can take leveraged positions, amplify exposure, and engage in strategies that would be impossible in spot markets. For many, the allure is simple: the potential for outsized returns in a short timeframe, despite the high risks involved. This “get-rich-quick” element has always been a key driver of speculative interest, but beyond speculation, perps also serve more sophisticated functions such as hedging portfolios, providing liquidity, and managing risk. In other words, perpetuals are not just high-risk gambling products but are becoming the backbone of how crypto capital markets function.

To understand the scale of the opportunity, it is helpful to examine the traditional financial system. The notional value of the global derivatives market is estimated to exceed $1 quadrillion, a staggering figure compared to the world’s GDP of around $106 trillion. While the net exposure is far smaller due to offsetting positions and leverage, the sheer size highlights how deeply ingrained derivatives are in modern markets. If crypto follows even a fraction of this trajectory, the potential for growth in perpetual futures is enormous.

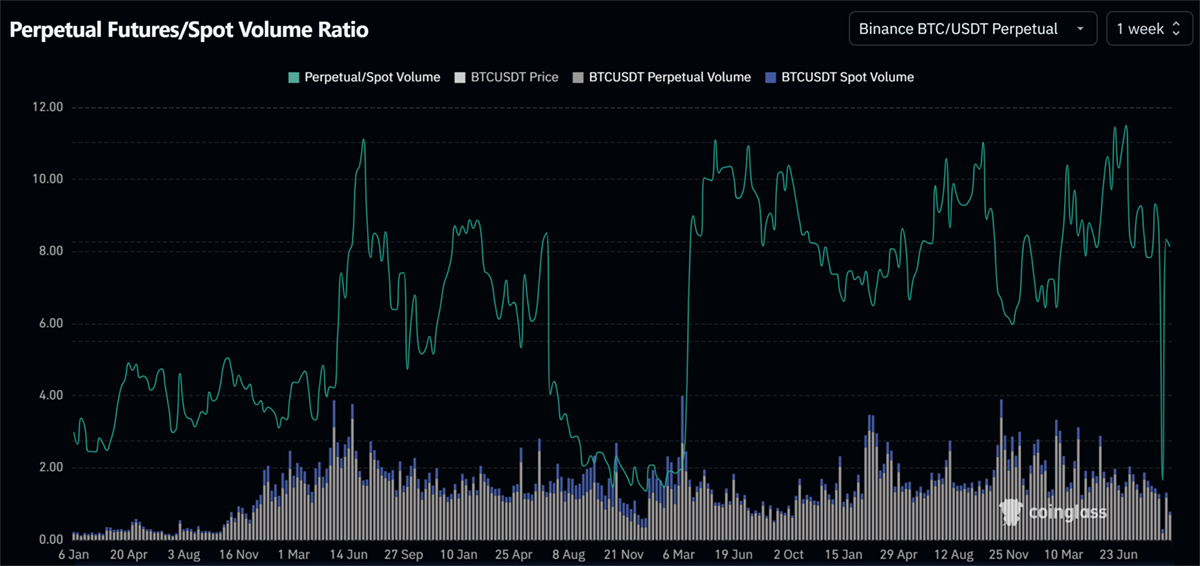

We are already seeing this trend play out. In the crypto market, perpetual futures significantly outpace spot volumes. Bitcoin, the most liquid and widely traded crypto asset, offers the clearest example. On Binance, Bitcoin’s perpetual futures trading volume consistently exceeds spot volume by more than 10x. This isn’t a temporary distortion but a structural trend that has shown over time. The perpetual-to-spot ratio illustrates the market’s preference for derivative trading as the primary venue for price discovery.

BTC Perpetual Futures vs Spot Volumes

Interestingly, the perp-to-spot ratio on Binance has recently declined from 11.5x in July to under 8x today. This drop doesn’t suggest an increase in spot volume, but rather a fall in Binance’s perp activity as traders migrated to decentralised platforms. The rise of Aster, in particular, has been the key driver behind this shift. The point, however, is that perp volumes have historically been orders of magnitude higher than spot volumes. With decentralised perp DEXs gaining momentum, this divergence is only set to widen.

CEXs like Binance and FTX popularised the perp model, but decentralised competitors are catching up quickly. Protocols such as HyperLiquid and Aster have replicated, and in some cases improved upon, the core features of CEXs. Traders can now access deep liquidity, fast execution, and competitive fees in a fully decentralised, non-custodial environment where they retain control of their assets. This combination of efficiency and trustlessness is a powerful value proposition that is fuelling the migration from CEX to DEX.

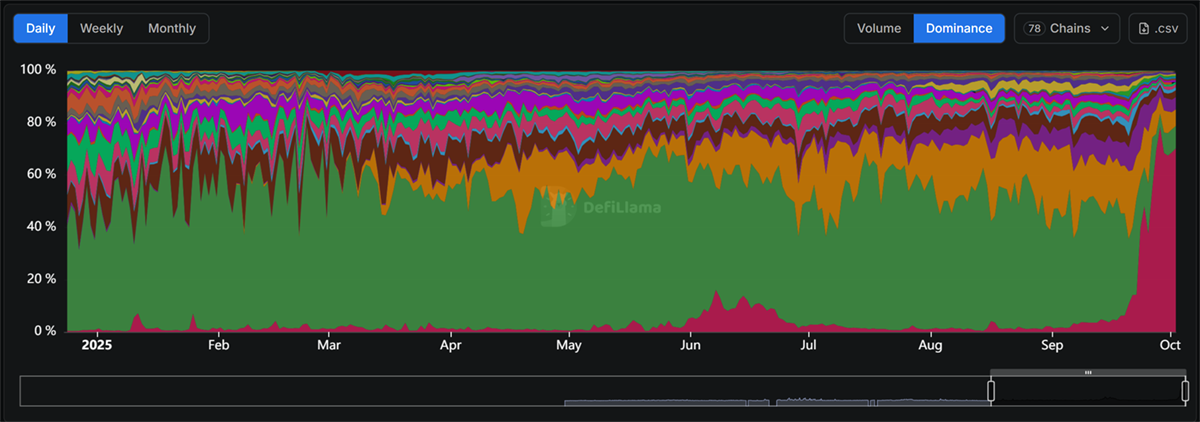

Aster’s Market Share

The data speaks for itself. As highlighted in red above, Aster has captured the majority of the market, commanding around 70% of decentralised perp trading activity. This dominance has effectively given Aster a monopoly in the space. The biggest casualty of this shift has been HyperLiquid. Once the undisputed leader with over 75% market share in February 2025, HyperLiquid has since collapsed to just 8.5% today, an 88% decline in dominance.

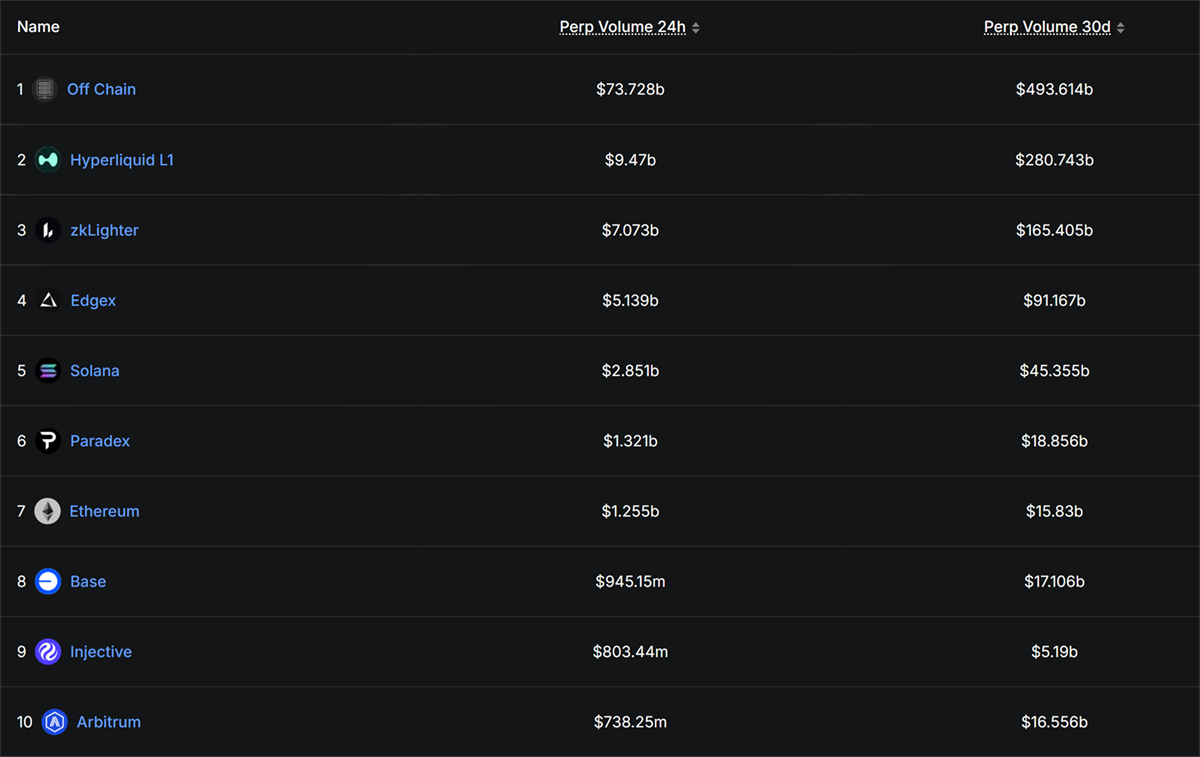

Top 10 Chains by Perp Volume

The table above shows the top 10 chains ranked by 30-day perp volume. The top spot is listed as “Off-Chain,” which in practice refers to Aster as its native chain is still under development. Another protocol, Aden, also operates in this category, but its numbers are negligible compared to Aster.

The second-largest chain is HyperLiquid L1, with $9.4bn in 24-hour volume, $70bn in 7-day volume, and $280bn across 30 days. This is followed by zkLighter, reporting $7bn over 7 days and $164bn across 30 days. While these numbers are impressive in their own right, they pale in comparison to Aster’s volumes, underscoring the extent to which it has consolidated market leadership in such a short span of time.

It’s worth noting this is far from the end for HyperLiquid. In fact, looking at Open Interest, which measures outstanding active positions, HyperLiquid sits at $12.8bn compared to Aster’s $1.6bn. To put this into perspective, I’ve compiled a list of key metrics for direct comparison between Aster and HyperLiquid.

Aster vs HyperLiquid

| Metric | Aster | HyperLiquid |

|---|---|---|

| Cumulative Volume | $1.3tn | $2.7tn |

| 30-Day Volume | $493bn | $280bn |

| 7-Day Volume | $415bn | $70bn |

| 24-Hour Volume | $74bn | $9.4bn |

| FDV | $13.3bn | $50bn |

| Multichain | Yes (BNB Chain, Ethereum, Solana, Arbitrum) | No |

| Gasless Trades | Yes | Yes |

| Perp Trading Fees | Maker: 0.01%, Taker: 0.035% | Maker: 0.015%, Taker: 0.045% |

| Spot Trading Fees | Maker: 0.04%, Taker: 0.1% | Maker: 0.04%, Taker: 0.07% |

| Native Blockchain | Aster Chain (in development) | HyperLiquid L1 |

Source: DeFiLlama, CoinGecko, Aster Docs, HyperLiquid

HyperLiquid has processed the most cumulative volume at $2.7tn, compared to Aster’s $1.3tn, but Aster is catching up fast, with much higher recent activity. HyperLiquid has the larger FDV at $50bn, while Aster sits at $13.3bn. Aster is multichain (BNB, Ethereum, Solana, and Arbitrum), whereas HyperLiquid has its own native chain called HyperLiquid L1. Both offer gasless trading.

On fees, Aster comes out cheaper across the board. For perp trading, Aster charges 0.01% maker and 0.035% taker, while HyperLiquid charges 0.015% maker and 0.045% taker. On spot trading, Aster’s fees are 0.04% maker and 0.1% taker, while HyperLiquid sets 0.04% maker and 0.07% taker. A “maker” is someone who adds liquidity to the order book, for example, by placing a limit order to sell Bitcoin at $115k that doesn’t instantly match with a buyer. That order sits on the book and provides liquidity for others. A “taker” is someone who removes liquidity, for instance, by placing a market order to buy Bitcoin immediately at the best available price, which matches the existing sell orders.