Alpine Advantage

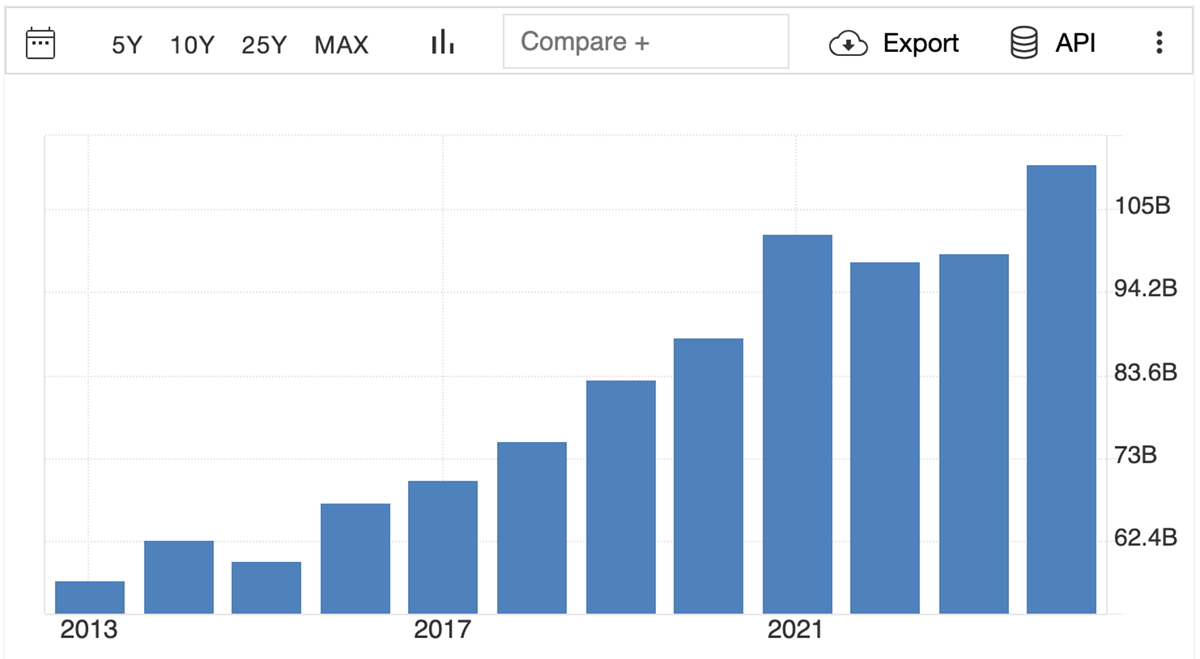

At $110bn, pharmaceutical products make up 25% of Swiss annual exports and around 6% of its GDP. In 2013, it was $57bn, so it has nearly doubled. Only Germany exports more, but for them, it's only 7.5% of the total. The US and Ireland (a tax wheeze) aren’t far behind, while the UK sits in 10th.

Swiss Pharma Exports

Why is Switzerland such a pharma powerhouse? Universities, regulations, talent, innovation, focus on high-value-added/tech research, manufacturing quality, and history… And above all, a strong currency in which only the best companies can survive. All these things tie together.

Switzerland has a long history of peace, trade, and innovation. The great rivers of western Europe (Rhine, Rhone, and Ticino/Po) flow from its glaciers, forming the basis for trade and the spread of ideas. The reformation began here, as did luxury watches and hotels (César Ritz was a Swiss hotelier around 1900). The pharma industry began with dyes used in the textiles industry in the 19th century, when Swiss scientists discovered that some chemicals in them also had medicinal properties.

As China has done in the last few decades, Switzerland kept IP laws deliberately lax in its early years, allowing domestic companies to learn from foreign medicines, helping the industry get up to speed. Then, in the 1970s, it flipped and introduced a robust patent protection framework, forcing companies to become leaders, not followers. Today, this has snowballed into a powerful ecosystem.

For starters, Switzerland now has so many drug, biotech, and device companies that the talent pool is enormous. Historic universities have been producing bright graduates for centuries. Switzerland has been top of the Global Talent Competitiveness Index (GTCI) for a decade, which ranks countries based on their ability to develop and retain talent (Britain has slipped from 7th to 10th, while Singapore is second). A cornerstone of this talent pipeline is the “dual” Vocational Education and Training (VET) system, which combines classroom-based learning with paid, practical, on-the-job training for 70% of the country’s young people.

It is central in Europe, and the quality of life there is high, both geographically and financially, making it easily accessible and a nice place to work. Its borderlands are filled with EU citizens who live in low-cost France or Germany, and commute into Switzerland for the pay package and low taxes. Not a bad bit of arbitrage.

The regulatory framework (Swissmedic) is also a powerful advantage. It has developed in tandem with the industry and has one of the fastest approval processes in the world - the result of working with companies from the earliest stages of innovation. It is constantly networking and engaging with the private sector to keep abreast of the latest tech and trends. It is not a bureaucratic blocker, but a strategic enabler that builds trust and collaboration. It deliberately aligns with major foreign health authorities, so that approved Swiss drugs have a smoother path to international approval. With 98% of the sector's revenues generated abroad, this is significant.

Switzerland’s patent protection is incredibly strong, with a powerful second line of defence through a system where the first to submit approved data has the exclusive right to use it for a defined period. This stops rivals from using its costly and hard-won data insights to quickly develop generic or branded alternatives.

Geographically, the industry is concentrated in a handful of world-leading clusters that create powerful network effects. The largest and most famous is the Basel region: often referred to as the “BioValley”. It hosts the global HQ of Roche and Novartis, as well as major operations for multinationals including Bayer, Johnson & Johnson, and Moderna.

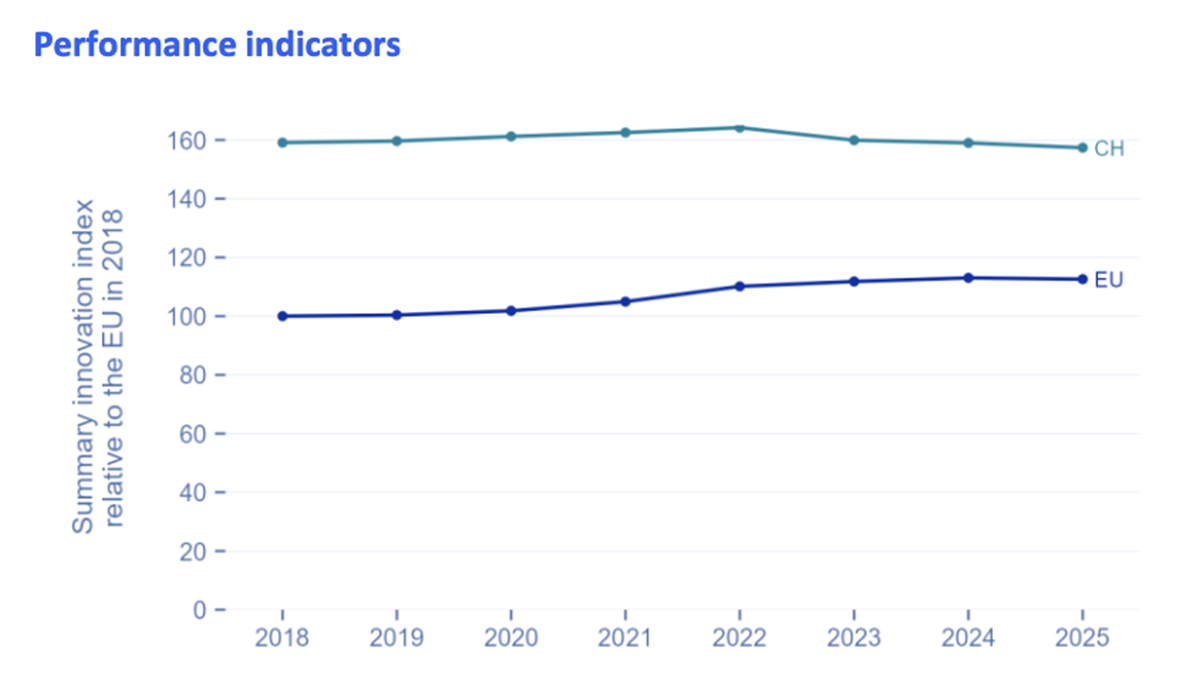

Switzerland also invests heavily, ranking first in the EU Innovation Scoreboard in 2024. Private companies are responsible for 2/3rds of this $25bn annual investment, with pharma companies being by far the biggest contributors. Capital looks to Switzerland for opportunities, giving the sector global access to cheap capital. Another benefit of a strong currency is cheap imports, which keep inflation and interest rates low. Favourable tax reductions for profits generated from R&D incentivise companies to focus their R&D efforts there.

Switzerland Ranking on the EU Innovation Scoreboard

Politically, it has a devolved government, with high power in local cantons, and the Prime Minister is not a celebrity like in so many places today. Can anyone name him without looking it up? They have run balanced budgets. Switzerland is the home of quality.

Overall, Switzerland’s pharmaceutical dominance is built on an ecosystem of self-reinforcing factors. These are its continuous innovations, respected regulatory body, IP regime, talent pipeline, access to capital, political/economic stability, and manufacturing quality. All were built up over centuries, and are not easily matched, as they work together to create a competitive advantage that is hard for other nations to replicate.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd