Innovative Immunology: Danish Healthcare Leader

There is a perception that pharmaceutical companies have lost their “safe growth” status. They have previously been seen as quality, given that people’s health needs are not affected by the economic cycle. Healthcare fits squarely in the “needs not wants” camp. However, medicine is changing.

We saw during the pandemic how new platforms for drug discovery enabled swifter discovery of vaccines. AI and existing technologies are driving rapid change and opening the door for new drug development models.

Today, there is an increasing focus on harnessing what we naturally have inside us. This is immunology: using carefully developed drugs to weaponise the immune system against disease, using antibodies for precision medicine.

The modern journey of antibody use in drug development began with the 1975 invention of the “hybridoma technique”, which enabled mass production of antibodies. The first antibody drug was approved in 1986 to prevent kidney transplant rejection. However, being mouse-derived, it caused immune reactions in humans.

Advances in the late 1980s and 1990s introduced fully human antibodies, which reduced side effects. Since then, antibody drugs have gained approval for treating cancers, autoimmune diseases, and more, and have become integral to precision medicine. Continuous innovations, including bispecific antibodies and antibody-drug conjugates, promise further advances.

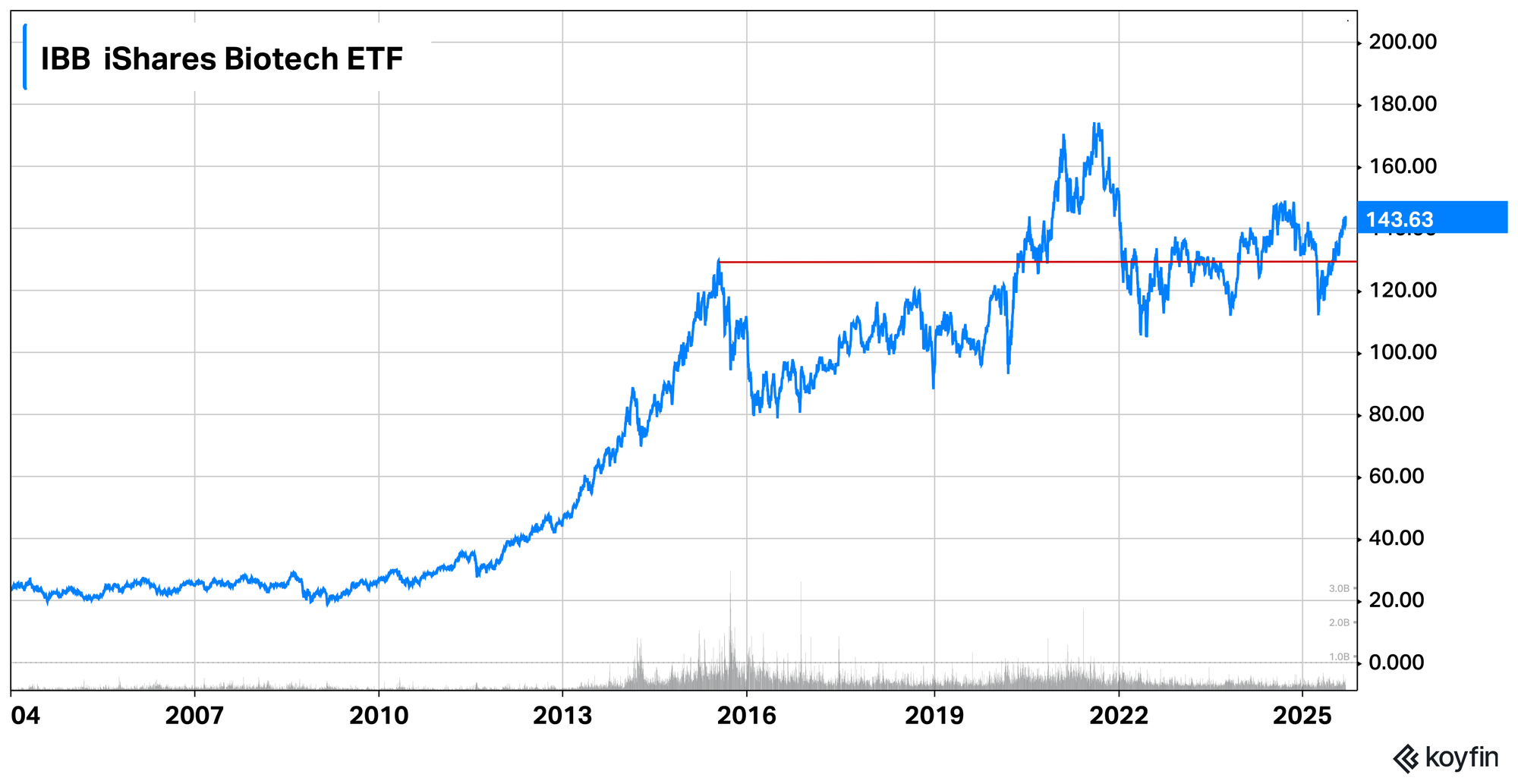

Our next recommendation in ByteTree Quality is field-leading in these emerging areas. It comes from the biotech space, which after a bull run to 2015, has gone nowhere in a decade.

Biotech Returns

Founder-led, it has developed a strong culture of technology, innovation, and excellence, which have driven high and consistent revenue growth, and a successful transition to strong profitability in the early 2010s.

A decade on, the platform is stronger than ever with a dual-revenue stream model delivering high cash generation, enabling greater investment in its own portfolio of drugs. A single disappointment in its clinical pipeline and the 2030 patent cliff for its current leading drug have led investors to sell it in recent years.

Nonetheless, we see a market leader of the future selling at a heavy short-term discount and consider it a fine early addition to the portfolio given promising recent price action.

This is a rare case of a wonderful company that is undervalued with a bright future.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd