Gold and Elton John

Atlas Pulse Gold Report Issue 106;

The idea of gold being an inflation hedge still holds true, but it isn’t the driver of this bull market. That’s been left to the central banks, who seem to be cooling. But don’t worry about that because the true source of gold demand comes from Elton John, who stars in a film made by the World Gold Council. I can’t wait to see it.

With the stockmarket roaring ahead, you might not think that it’s chasing gold, but it is. There was a moment when gold was in front of the stockmarket in 2020, but it hasn’t really happened since 2011. Earlier this century, gold beat the stockmarket for 10 years out of the first 12. Imagine if that happened again!

Gold versus the S&P 500

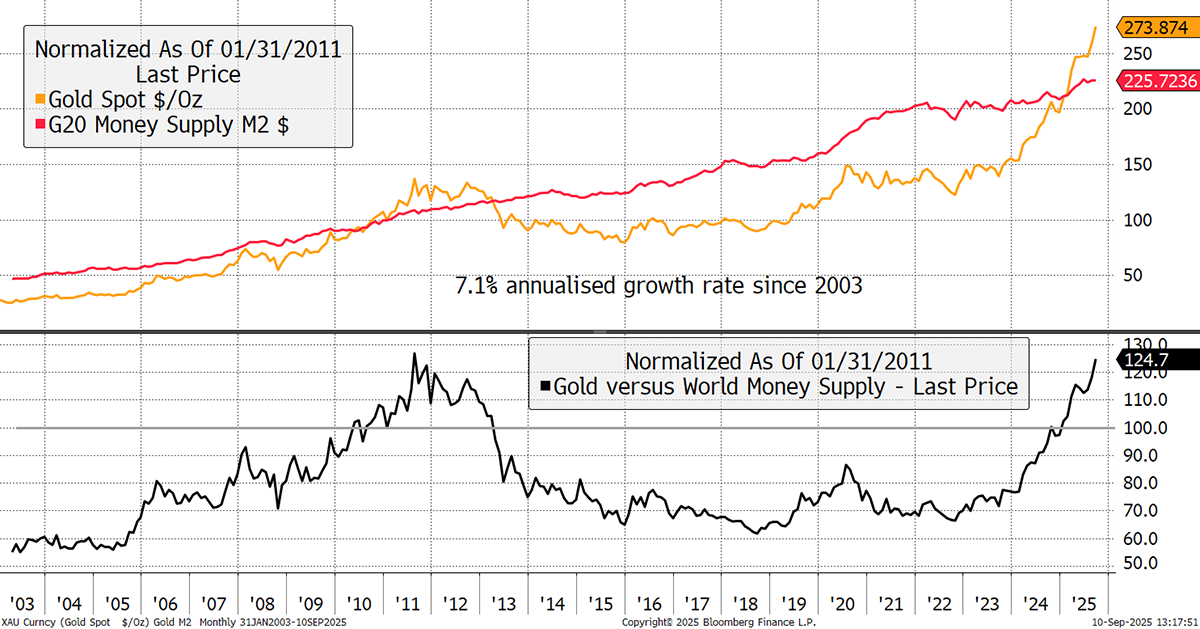

It could happen again, but it seems unlikely that both stocks and gold will continue to rise in tandem for another decade. A more likely gold market winning scenario is that gold holds up while stocks tumble. But that’s an old school view. These days, they keep on printing money with brutal efficiency, and a rising tide floats all boats. Yet the price of gold has risen so high that it is now ahead of the money supply, just like it was in 2011. That didn’t work out too well, but could this time be different?

Gold and the Global Money Supply

We’ve recently had a mini crisis in the bond market, one that may yet turn into a major crisis. Many countries in the Western world have large outstanding debts and perpetual deficits. If companies or households were run like that, they’d go bust. For countries, it’s a bit different because they can print money, but ultimately, that doesn’t work in the long run either.

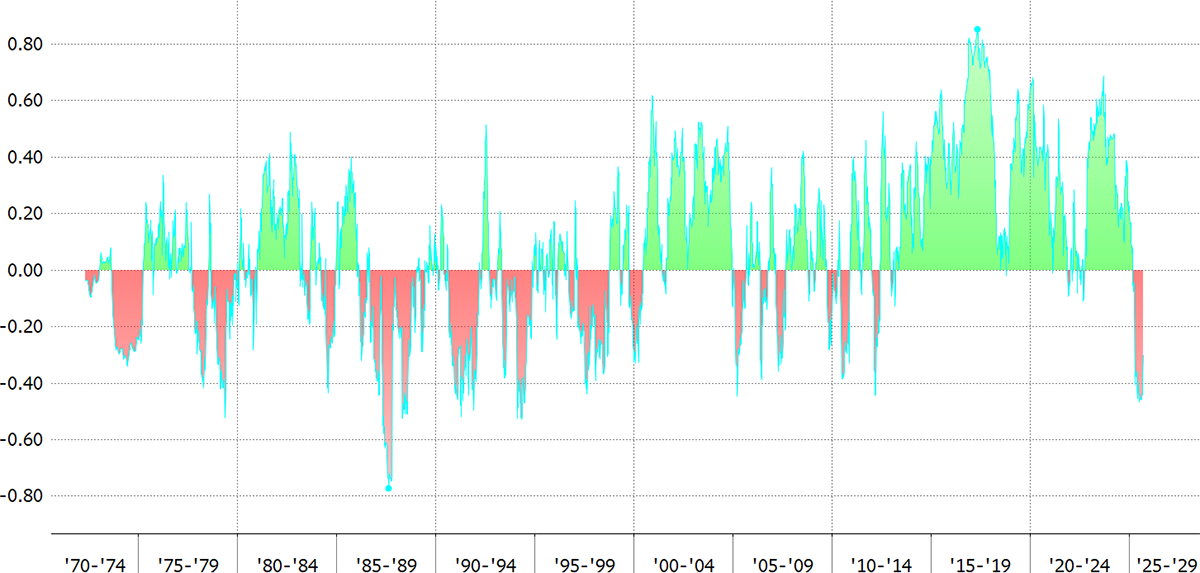

This year, long-dated government bonds have been selling off, and as that has happened, the price of gold has risen. Gold’s correlation with bonds (prices, not yields) has turned negative for the first time since 2011.

Gold Correlation with The US 10-Year Treasury Price

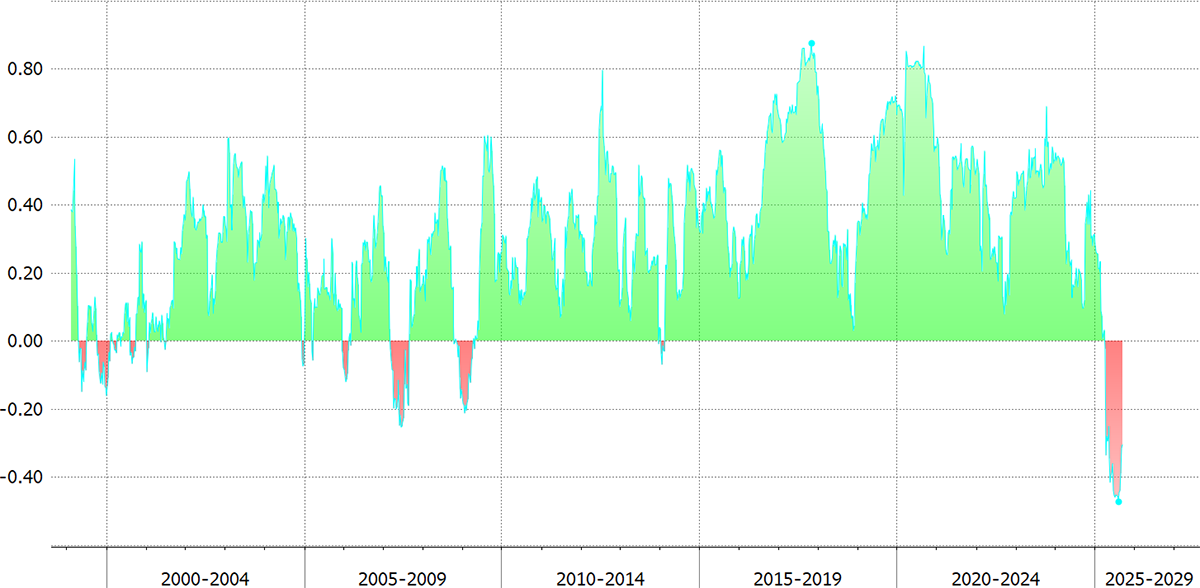

Pre-2011, it has bounced around, but when we bring in real yields, which sadly we only have data from 1998, it becomes much clearer. There were brief moments of modest negative correlation around 2008, when markets were overwhelmed by the credit crisis, but the recent reading stands out.

Gold Correlation with The US 10-Year Real Treasury Price

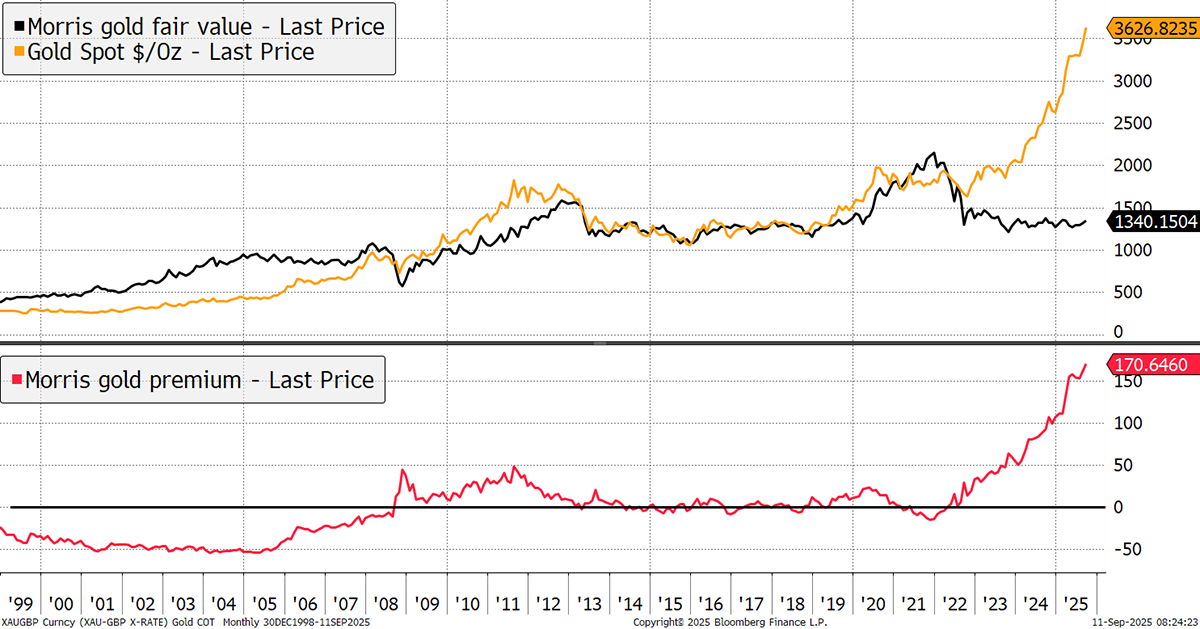

That’s another way of saying that my great old gold price model, created well over a decade ago, has broken. This idea was that gold mimicked the price of 20-year TIPS, which worked so well, until it didn’t. According to that, gold is 170% overvalued. It’s a good thing I was early to recognise that things had changed, and I will admit to buying TIPS in 2022, but that didn’t work out!

Gold and the TIPS Model

The TIPS model is (currently) broken because the price of TIPS is not forecasting inflation, and gold is rising regardless. More to the point, gold has been rising alongside rising real yields, which isn’t supposed to happen. Gold watchers take the view that gold likes easy money, hence low real yields, which ideally means low rates and lots of inflation.

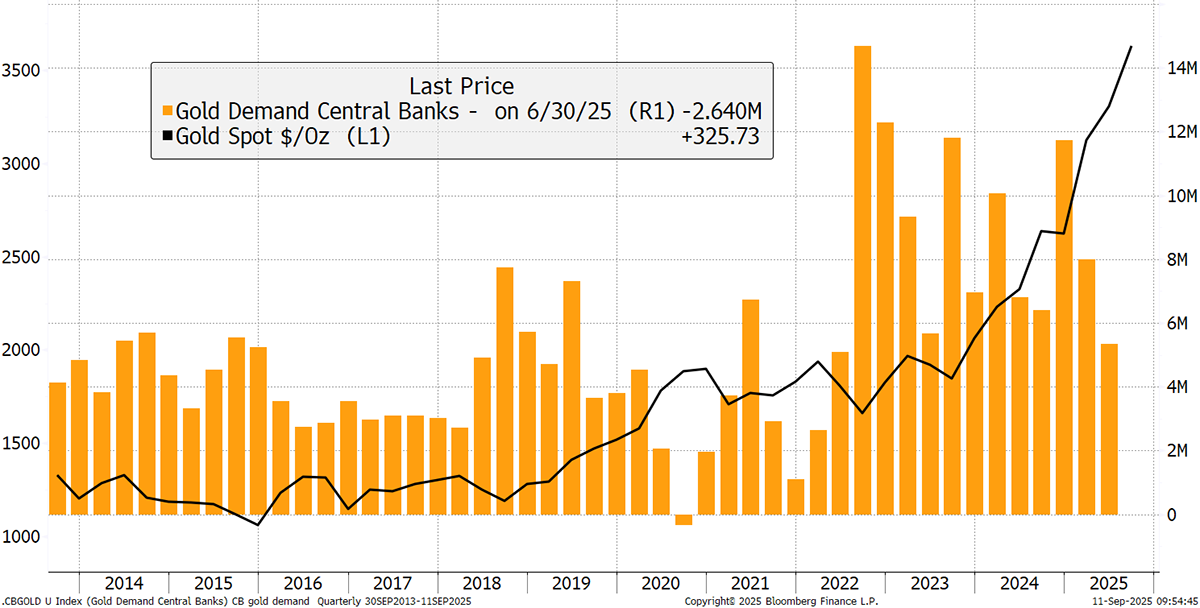

Yet this time, rates are higher than inflation, but no one would describe the current environment as being one of hard money. Obviously, many believe the CPI measures are false, but that’s another subject. I believe gold has latched onto the money supply and left CPI behind. Yet the idea of gold being an inflation hedge still holds true, but it isn’t the driver of this bull market. That’s been left to the central banks, who seem to be cooling.

Gold and Central Bank Demand

But don’t worry about that because the true source of gold demand comes from Elton John, who stars in a film made by the World Gold Council. I can’t wait to see it.

Watch the trailer for a sneak preview.

Back to the gold price, the last major breakout began in early 2024, so the trend is still less than two years old. Better still is that the market was hugely overbought in April, as highlighted in Atlas Pulse at the time. The message was: don’t panic, and now the market has consolidated and broken out. The price is a mere 17% above its 200-day moving average. That compares to nearly 30% in April, which in the past has always led to a consolidation period, and sometimes a reversal.