Cocoa and Cash Flow

Issue 2;

Our next recommendation in ByteTree Quality is a company with a world class portfolio of consumer goods brands.

Founded as the result of a 19th century scientific breakthrough, it has grown into one of the best-known companies in food. From babies to adults, and grandparents, it meets the nutritional needs and desires of consumers all over the world. After a tough few years impacted by short term issues, it has entered buy territory for long term investors.

It owns some of the most desirable brands and products on supermarket shelves, driving healthy returns on capital with a whole world to grow into. It has bought back a third of its shares over the last 15 years, while growing free cash flow per share by 19% per year since 2000. One of the key drivers of its recent weakness has begun to turn, which will take the brakes off the company’s financial performance.

Nestlé (NESN) Investment Case in Brief

“Our purpose is unlocking the power of food to enhance quality of life for everyone, today and for generations to come. With our global presence, in-market capabilities and diverse portfolio of iconic brands and innovative products, we can unlock growth through our Nutrition, Health and Wellness strategy and our Creating Shared Value approach. We strive to create efficiencies to fund investments in our brands that enable us to succeed in the marketplace and drive profitable growth. We call this continuous process the Nestlé Virtuous Circle.”

Nestlé is a Swiss consumer goods company focused on food, beverages, health, and nutrition. Its strategy is based on its wide portfolio of globally recognised brands, innovation, marketing, and operational efficiency. They target humans, and pets, from before birth into old age with a broad portfolio of products that touch people’s lives at every stage, backed by over 150 years of history, in 185 countries.

The beauty is in the flywheel that drives the business: innovation and advertising lead to market leadership and high levels of cash generation which, in turn, fund the first two again. The result is a long history of growth and profitability, leading it to become a CHF 200 billion (£176 billion) company today.

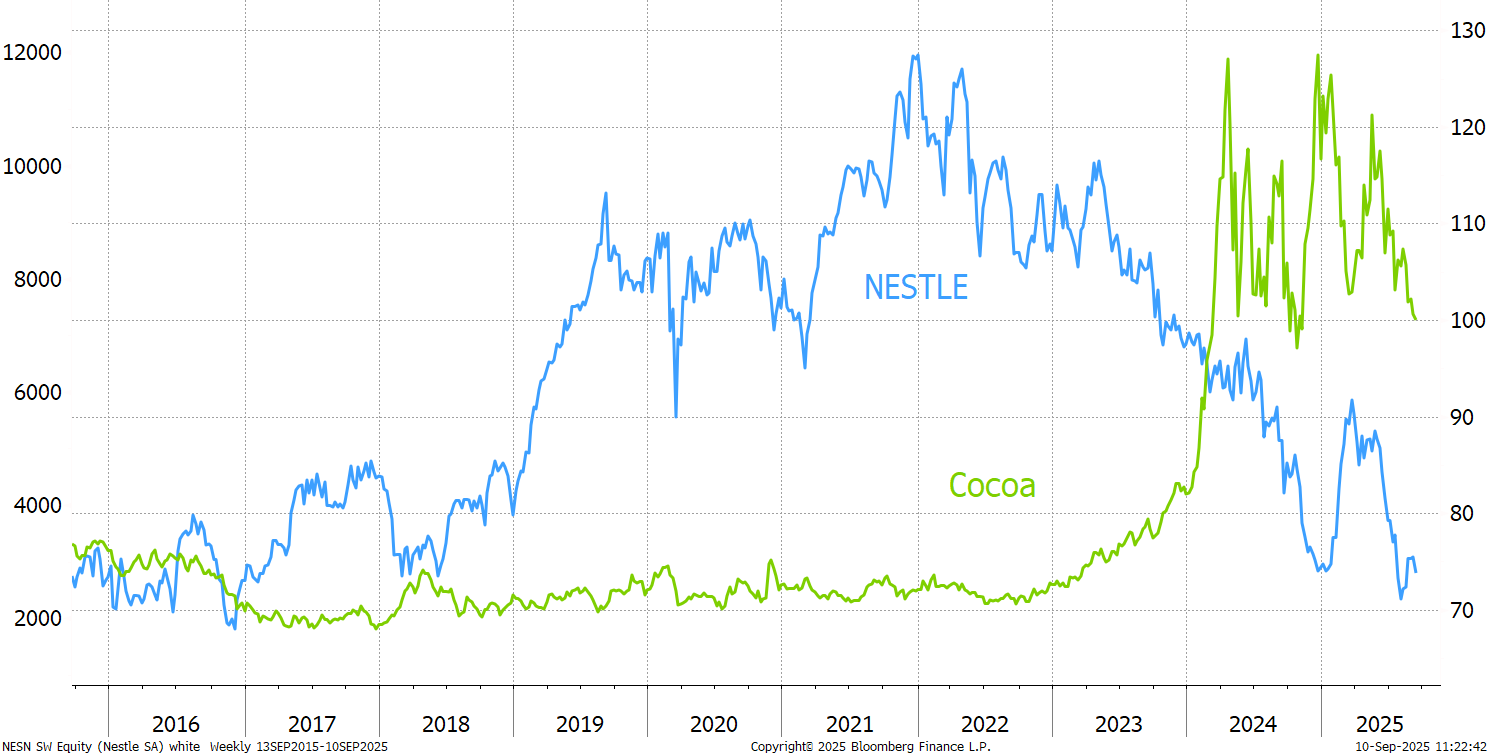

It hasn’t all been plain sailing, and recently, Nestle has had a water bottling scandal in France, and the CEO depart under a cloud of internal romance. All this came during a period of high cocoa prices, which have squeezed its profitability and pushed prices up for consumers. The result has been a 3.5 year fall in the share price amounting to 42%. More recently, cocoa prices have begun to fall again. As always with commodities, there’s no cure for high prices like high prices, and after a difficult few years for the chocolate industry, better times lie ahead.

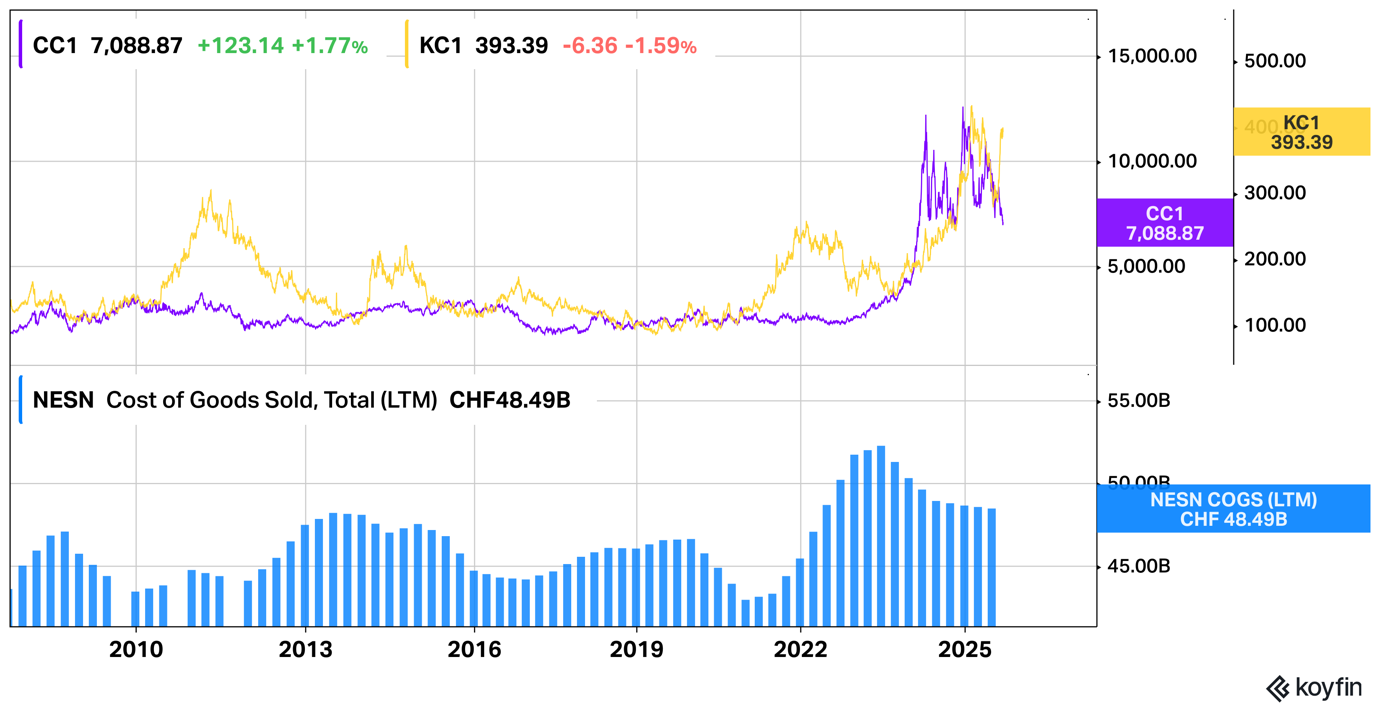

NESN vs Cocoa Price

Nestlé (NESN SW) is a high-quality business with over 150 years of history. It is widely diversified by product segment, brand, and geography, competitive on quality and pricing, and part of a global consumer brand oligopoly that has a powerful moat against competitive threats. It benefits from brand power, process power, and economies of scale. Recent issues are short-term in nature and do not impact the long-term viability of the brands or the overall business. We believe this is an attractive entry point and have added it to the ByteTree Quality Portfolio.

Investment Case in Full

“Good food, Good life”

“We want to create more enjoyment. To bring better health. To make good nutrition accessible and affordable.”

In 1867 a young Henri Nestlé made a breakthrough. He started as a pharmacist’s apprentice, but troubled by the high infant mortality rate, created a novel infant formula. By the time he was 60, the Nestlé company was an international success and his milk-based baby food, Farine Lactée, was being sold across five continents. His town, Vevey, is still the HQ of Nestlé today.

Vevey is a quiet place from which to run a global empire, but that is how they like it. One interesting piece of chocolate history is that Forrest Mars, son of Frank Mars, worked there as a spy in the 1930s, while he learned the trade secrets about chocolate making. After another stint at Tobler, Forrest went to Slough, UK, to set up his own chocolate factory, which would one day merge with his father’s US business.

We can learn a lot about Nestlé and how it sees itself from their group logo, where two birds are being fed by their mother in a nest.

It is rooted in a desire to connect the company's products, particularly infant formula, with the natural world and the nurturing aspect of motherhood. The imagery, trademarked in 1868, has remained a core element of the Nestlé brand, evolving over time but always retaining the central image of the nest.

We mostly know the company for its unhealthy snacks and drinks, so “health-focused” might be a surprising claim. But it’s important to grasp that there is more to Nestlé than chocolate.

Nestle Product Split Today

Between WW1, the Great Depression, and the Second World War, Nestlé faced unthinkable challenges, but by professionalising its management, taking some production outside Europe, and controversially supplying both allied and axis power militaries, it kept going. It developed new products like Nescafé thanks to a new method for drying coffee bean extract. It also introduced Milo hot chocolate, and Maggi soups (which it bought. Today, over 28 million cups of Milo are consumed every day. These additions helped it survive until the growth and prosperity after the wars. It learned resilience through experience and is now built to last.

As fridges and freezers become affordable after the war, it expanded into chilled goods like Waters and Ice Cream. In 1988, it bought UK confectionary company Rowntree Mackintosh, adding KitKat, After Eight and Smarties (copied by Forrest in the USA to become M&Ms). In the 1990s it formed partnerships with General Mills on cereals and Coca Cola on drinks like Nestea. From the mid-1990s, it increasingly targeted the Nutrition, Health and Wellness category, while Purina pet food was added in the early 2000s.

Alongside its portfolio of brands, it also has a large equity stake in L’Oréal, itself a high-quality consumer goods company. The original stake, bought in 1974, was a “white knight” investment by Nestlé and strategic for both parties, protecting the L’Oréal owners (the Bettencourt family) who feared hostile takeovers or nationalisation. Nestlé is the second largest shareholder with 20.1%.

L'Oréal Share Price

Nestlé's ownership has been beneficial to both parties. L'Oréal knows that it has the full support of its two biggest shareholders, while Nestlé has benefited from good long-term returns on its investment. They have collaborated on research, and had a successful joint venture, Galderma, now listed independently. Nestlé recently sold some shares and returned the cash to shareholders, reducing their number of seats on the board from 3 to 2.

Nestlé Today

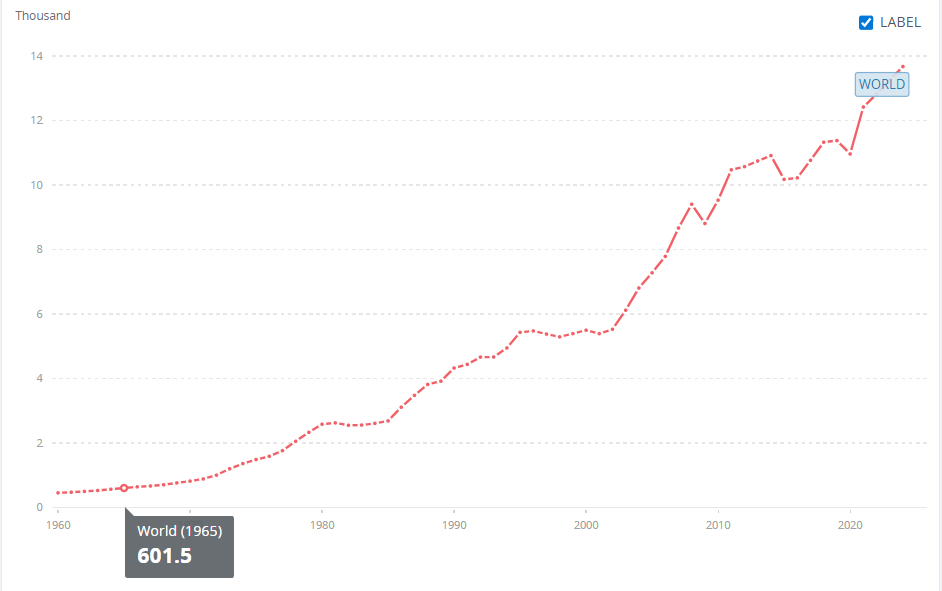

Nestlé is a nutrition, health, and wellness company, with a focus on enhancing the quality of all lives – everyone, everywhere, all through life. This makes their target market enormous. They have two problems to solve – malnutrition (one billion people), and obesity (two billion). Both need to be healthier – i.e. in the middle.

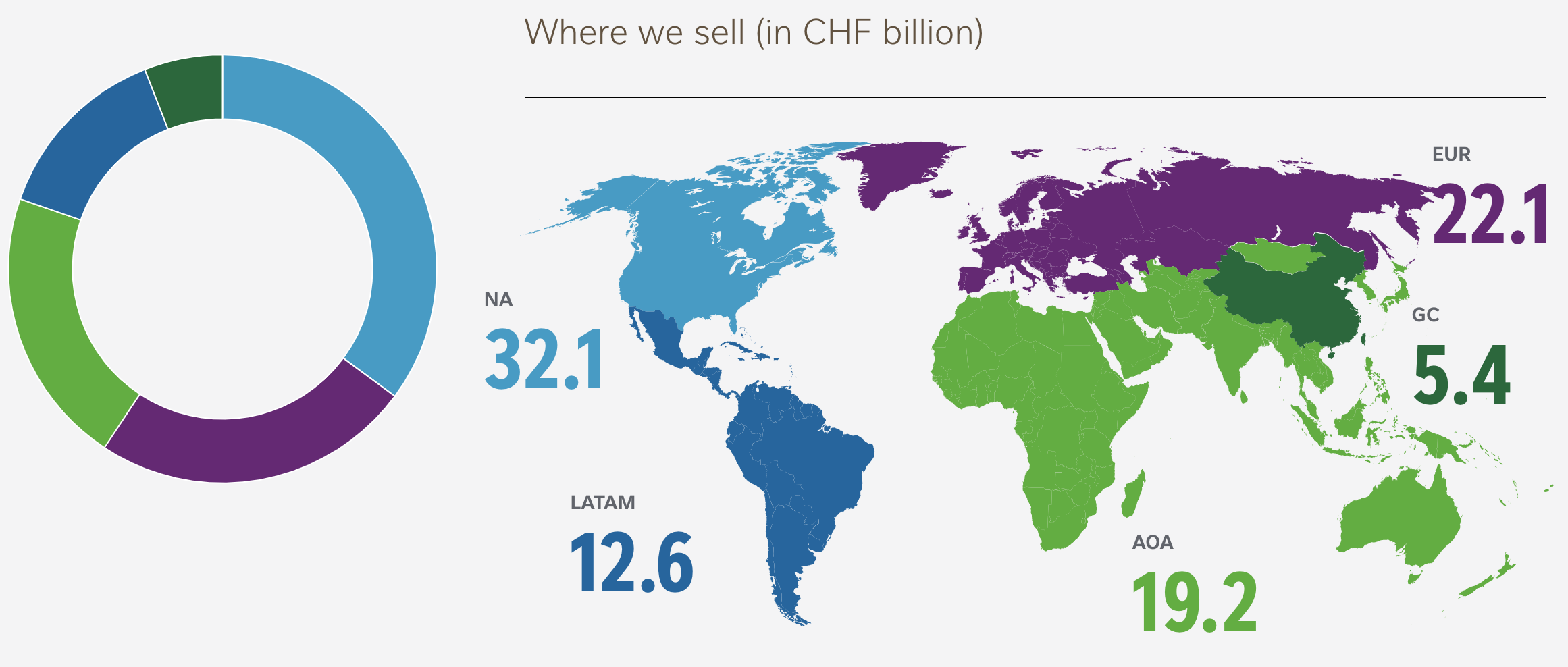

Like so many high-quality companies, Nestlé’s long history has led it to a position of real resilience, strongly diversified by product and geography.

Nestle Global Markets

Their key brands cover various segments, and include:

- Coffee: Nescafé and Nespresso.

- Confectionery: KitKat, Smarties, Quality Street.

- Beverages: Nestea, Vittel, Nesquik, Milo.

- Nutrition: NAN, S-26, Nestum, Lactogen

- Food: Maggi, Stouffer’s, Toll House.

- Pet: Purina Felix, and Purina One.

A selection of other notable names includes: Acqua Panna (waters), Aero (chocolate), Blue Bottle (coffee/cafes), Buxton (waters), Cheerios and Chocapic (cereal), Haagen-Dazs (ice cream), La Laitière (yoghurts and puddings), Milkybar (white chocolate), Perrier (waters), S. Pellegrino (fruit sodas), and Shreddies (cereal). Everyone could pick out a different list of favourites from their portfolio.

E-commerce accounts for 25% of total sales, alongside traditional retail stores run by their retail partners – mostly large supermarket chains. Marketing is primarily digital, with 70% of the media budget spent online. Of the 280,000 employees, they are evenly split between factory workers and those in administration/sales. Its business model is built on a combination of brand leadership and heritage, global scale and local adaptation, product innovation, and marketing, but a few external things stand out.

Key drivers include global demographics, the Swiss Franc, innovation, marketing, while key costs are the global cocoa and coffee prices.

Demographics

For Nestlé, falling birth rates across the world (that have tracked improvements in medicine, better life expectancy, and lower child mortality) are seen as a good thing. You might think an infant formula maker would want more babies, but in their view, parents with fewer children buy better formula, which benefits their premiumisation strategy.

They are also responding to demographic shifts by focusing on the opportunity of serving a growing 50+ category with specialised nutrition such as fortified drinks, protein powders, vitamins and supplements.

Currency

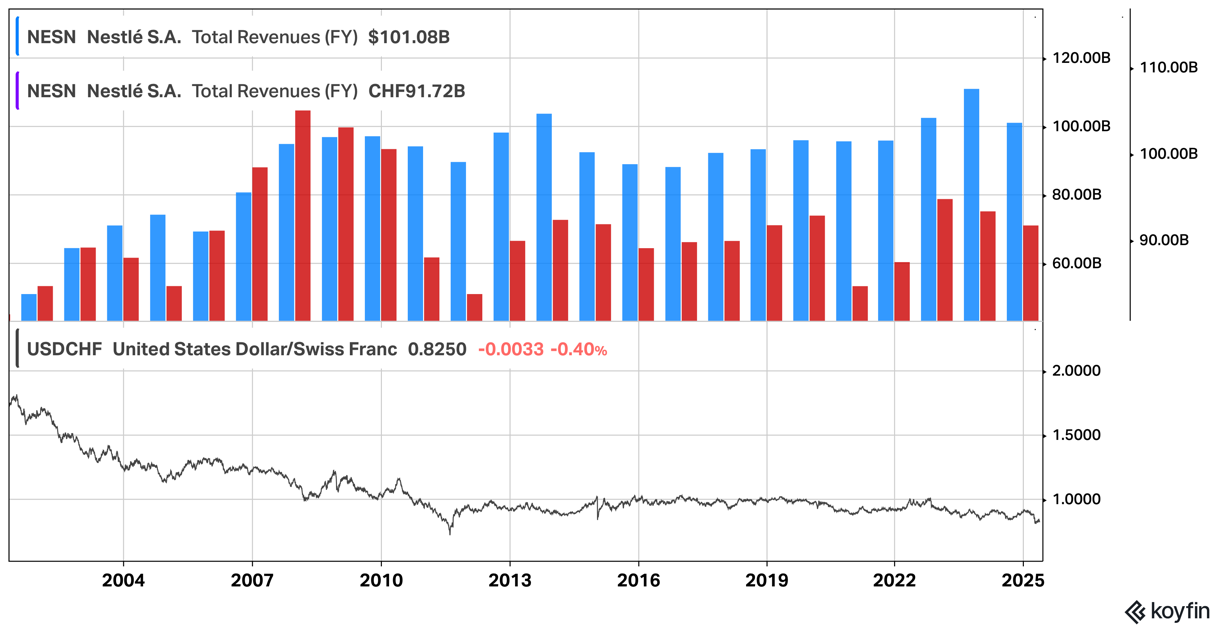

The Swiss Franc is such a strong currency that it distorts many of its domestic companies’ financials. When looked at in foreign currency like dollars, the growth is much clearer. In 2023, over a third of Nestlé’s profit (CHF 4.15bn) was given back in the form of currency retranslations – i.e. converting foreign profits back into Swiss francs. The impact isn’t so large every year, but it is a constant factor.

As a foreign investor, the actual investment return is determined by the change in Nestlé’s share price (in CHF), dividends received (in CHF), and the CHF/GBP exchange rate at the time you convert your proceeds back into pounds, so the FX effect is somewhat balanced out when you sell.

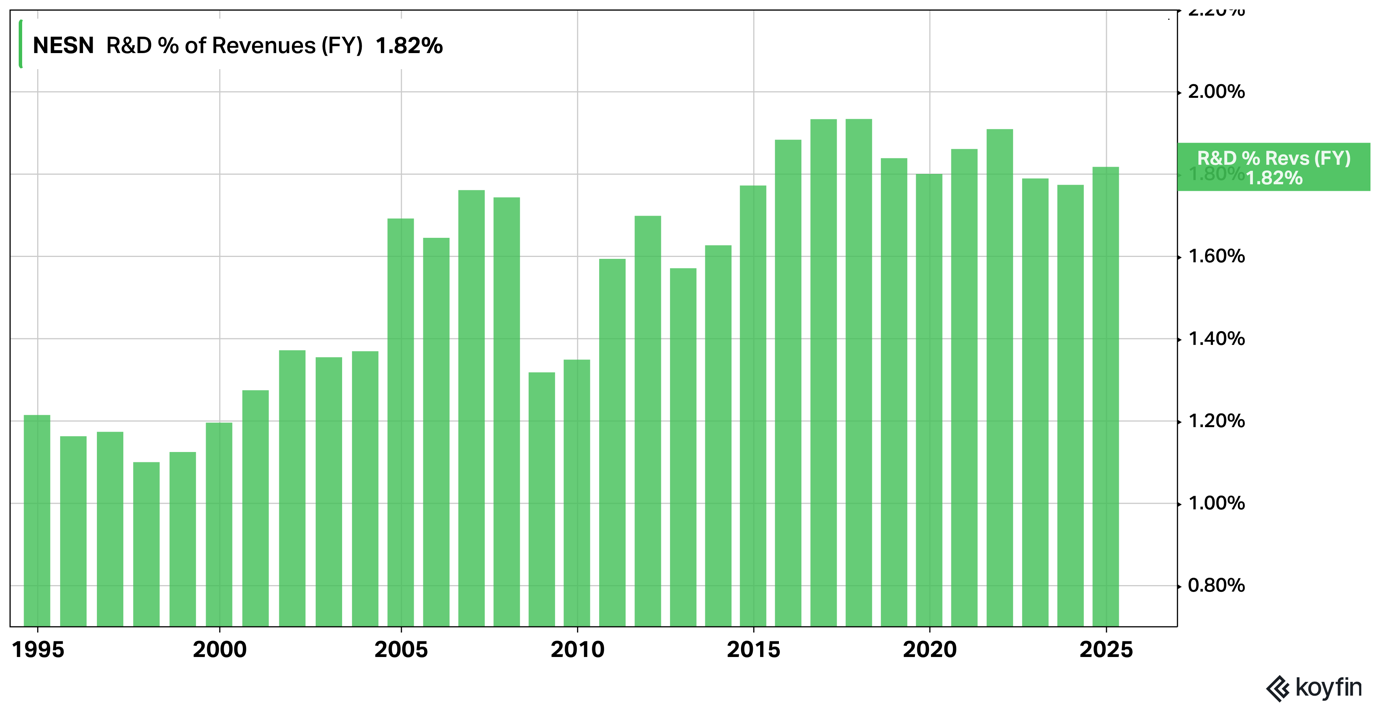

Innovation

As with so many consumer goods companies, Nestlé is innovating constantly to ensure its products fulfil their customers’ needs and desires. They are challenged by competitors in every segment and geography and have to adopt an approach of continuous improvement to stay ahead. They do this effectively, spending a steadily increasing portion of annual revenues on R&D each year.

Nestlé R&D as a % of Revenue

This leads to innovations such as a smart litter box system for cats, which can detect health conditions based on the animal’s behaviours and weight changes. Also. research has shown that people using GLP-1s (weight-loss drugs) struggle to maintain muscle, so Nestlé has responded by launching a line of ready meals, Vital Pursuit, which contain extra protein and fibre, and are portioned to suit a GLP-1 user’s lower appetite and higher protein needs.

In coffee, they have developed novel freeze-drying techniques, allowing solubility in cold liquids as well as the traditional hot ones. This means they can offer a premium coffee to the emerging group of cold coffee drinkers. This has led to a collaboration with Starbucks of the Crema Collection Premium Instant Coffee, which is a premium soluble coffee that can be prepared, foam and all, with both hot and cold liquids.

Two key areas of innovation are health, and sustainability. This is driven by what consumers want. The sustainability side has taken a slight backseat recently, but it remains in the background. As for health, this is both a key challenge and opportunity for Nestlé. With widespread obesity, weight-loss drugs (GLP-1s like Wegovy and Ozempic), and new health trends and products coming through every year, Nestlé has plenty of change to handle.

Whether increasing nutrient-content, or reducing sugar, salt, or saturated fats, it is constantly battling to balance flavour, health, and sales. Achieving this balance will determine the success, or otherwise, of the coming decades.

As for the short term, the main catalysts we can see are a return to growth, better consumer confidence, or the new CEO restoring investor confidence after a few things went awry in recent years (more on that below). In general, it is not an investment which has or needs many catalysts. The beauty is in the flywheel: innovation and advertising leading to market leadership and high levels of cash generation which, in turn, fund the first two again.

Industry & Market Opportunity

The potential addressable market for Nestlé amounts to trillions of dollars per year. Over the past 15 years, Nestlé has behaved like other food giants such as Danone and Mars who have diversified away from just groceries into higher-growth or higher-margin sectors like specialised nutrition, Petcare and coffee. The biggest drivers of its growth are GDP growth, and inflation. Population and economic growth are highest in emerging markets, but currencies there may be weaker.

As for competition, Nestlé sits alongside Unilever, P&G, and PepsiCo as the four dominant global consumer brand conglomerates. The likes of Mars, Coke, Kraft Heinz, Danone, Mondelez, Colgate, General Mills, and Associated British Foods are somewhat behind in terms of sales. These twelve companies together own over 500 consumer brands:

Competitive Advantage

Beyond food and beverage products, Nestlé has a dedicated nutrition division targeting specific health needs such as infant, healthcare (e.g., diabetes management), and performance nutrition, as well as weight management. This focus on specialised nutrition sets Nestlé apart from peers.

All are innovative, all have very broad portfolios of brands covering multiple segments in almost every country in the world, with local adaptation. There are enough consumers for all to succeed. It’s an oligopoly, and the competitive advantage is not so much over one another, but over potential new entrants. It’s notable how all the companies in their peer group have very long histories. It takes a lot of time, money, success, and luck to get to where they have. Now that they are there, upstart brands which could begin to form conglomerates of their own are much more likely to be bought than fight their way into this elevated tier.

For a new entrant to reach the same position as Nestlé, it would require overcoming a series of formidable barriers that have allowed these incumbents to maintain dominance for decades. For example:

- Massive Capital Investment: Entering at a global scale demands billions in capital for manufacturing, supply chains, R&D, and marketing. High startup costs alone deter most new entrants.

- Brand Loyalty and Recognition: Nestlé has built powerful brands over generations, resulting in strong customer loyalty. New entrants would need to invest heavily and over a long period to build comparable trust and recognition, with no guarantee of success.

- Economies of Scale: Incumbents produce at such scale that their unit costs are much lower, allowing them to price competitively and maintain higher margins. New entrants, starting small, face higher costs and struggle to match pricing without losing money.

- Distribution Networks: Nestlé and its peers have entrenched relationships with distributors and retailers worldwide. Securing shelf space and reliable distribution is a major challenge for newcomers, especially in the grocery and consumer goods sectors.

- Regulatory Compliance: Food, beverage, and pet care industries are highly regulated. Meeting safety, quality, and labelling requirements globally requires expertise and resources.

- Product Differentiation and Innovation: Incumbents invest heavily in R&D, constantly innovating and protecting their products with patents and trademarks. New entrants must find unique value propositions or risk being overshadowed by established offerings.

Overall, the positions of these historic consumer brand conglomerates look nearly unassailable. A single competitor might build out a new category, but all these companies will quickly circle and look to buy the most promising ones. Nestlé’s competitive advantage is shared with its peer group, but is very broad and deep nonetheless.

Strategy

Lasting 150 years through wars, pandemics, financial crises and everything besides is no easy feat. It is achieved through resilience, an operational margin of safety, on top of flexibility and long-term thinking. They value consistency and reliability. That’s what brands offer: when you buy a KitKat it should be identical to every extent with the last one you had.

Many of its peers are looking to divest weak performers, move to higher margin categories (“premiumisation”) and build out its best brands. While Nestlé does want to put more spending behind its 30+ “Billionaire Brands”, it is doing this with the mindset of reinvigorating its core business, rather than slimming down. The feeling was that it had been distracted, not that it has grown too much fat around the edges. Wewe are likely to see less portfolio management from Nestlé than some of the other large competitors.

However, it too is pursuing premiumisation. The fear is that growth of the consumer pool is slowing, and that most of the transition from poor to middle-class has occurred in the world. We disagree, as GDP per capita continues to be a growing force and Nestle is well placed to capture a slice of it.

Global GDP Per capita $

At their Capital Markets Day in late 2024 below, Nestle laid out their key beliefs that growth is crucial, and is the key driver of value. They also highlighted that Nestlé’s superpower is being simultaneously the most global and the most local company. It operates in 188 countries, with a 60/40 split between developed and developing. In most countries people think they are a local company, but global scale creates the efficiency that allows them to invest in growth. Over 70% of brands are number one or two market leaders. Finally, that they are science-led: filing 400 patents in 2023. When it comes to innovations, they want to pursue fewer, bigger initiatives.

They want to grow investment in the business to drive growth, but say that it cannot come at the expense of margins and cash generation. A high return on capital is a key metric. Nestlé has reduced marketing budgets in recent years, but that has come to an end. It is returning to pre-covid levels, and with a different approach that targets the biggest brands and opportunities.

One good example is making KitKat the snack partner of F1, which feels like the world’s fastest growing sport, in commercial terms. They are heavily featured in the pitlane: the goal is to “own the break”. While we can’t see Lando Norris cracking open a KitKat in the seconds-long tire-change, you get the point.

It is the number one coffee company globally, with 25% of at-home coffee market. They have the three best brands in the industry but still see an opportunity to grow in out of home (€2.5bn in sales already, growing double digit), and ready-to-drink (RTD) coffee (>1bn CHF in sales, double digit growth potential), and cold coffee too. In Petcare, the opportunities are in strengthening geographic footprint beyond US and EU, e.g in Asia/South America.

Ultimately, their strategy is geared around two main pillars: investment, and operational efficiency. In other words, spend and spend well.

Culture, Management, and Backers

The CEO until recently was Laurent Freixe. He had been appointed on 1 Sept, 2024, but left as the subject of a very recent scandal, involving an undisclosed internal relationship. We liked his business instincts, but at companies like Nestlé, the brands, market conditions, and culture tend to matter more than any individual leader. The strategy comes from the board and senior management, not just the CEO, and will be followed regardless.

The chairman Paul Bulcke stated: "This was a necessary decision. Nestlé's values and governance are strong foundations of our company.” This is an example of the benefits of investing in large, historic businesses. Incidents can happen, but are less likely to derail a company like Nestlé, with a strong board, and a clear strategy to follow.

Freixe has been replaced by Philipp Navratil, who is young but has been with the business since 2001, with experience in coffee and South America. The board have seemingly opted for speed and stability: Navratil has suggested that he will follow Nestlé’s strategy in its current form, which is to invest for growth, focus on big bets, and fix rather than sell most of its under-performing businesses.

In terms of culture, it seems quite unique, and insular, having built up over a very long period. Its HQ is in the small town of Vevey in Switzerland, due to the history of the business. Schneider, the CEO before Freixe, was only the second “outsider” appointed to the job. The recent scandals have shaken investor faith, and it will be a test for the culture.

In terms of major shareholders, Norway’s SWF is the largest shareholder with over 3%, while 66% is held by the general public. Shareholders will typically fall into the long-term quality or passive investor buckets. Third Point, the activist hedge fund, spent a few years in the late 2010s trying to shake things up, but is no longer involved.

In 2024, there was a shareholder proposal to reduce dependence on high-sugar-content products, led by five institutions including Legal & General. They fear that Nestlé risked “missing the opportunity to meet growing consumer demand for more healthy products and face increasing regulatory pressure from governments legislating to tackle the rising costs of poor health”. This is a valid concern, and a potential headwind.

Overall, management and culture have come into question lately, partly explaining the huge underperformance. This is both a concern, but presents an opportunity. With a strong culture and stable, long-term oriented shareholder base, we believe that stability will be restored, and previous performance with it.

Financials and Valuation

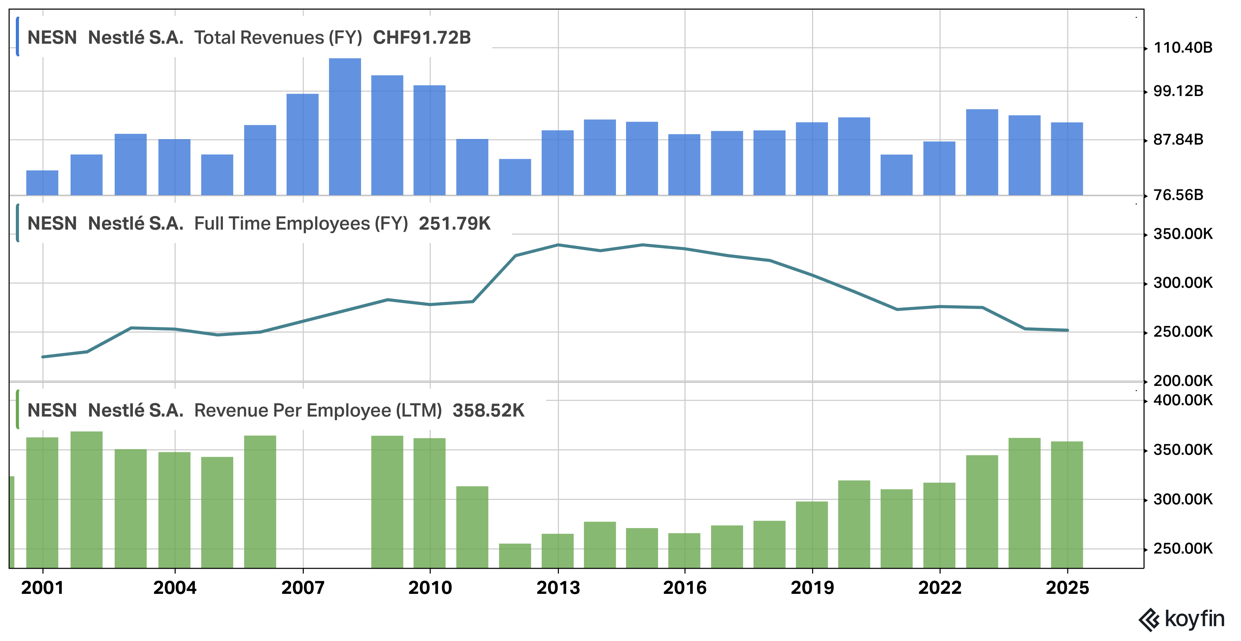

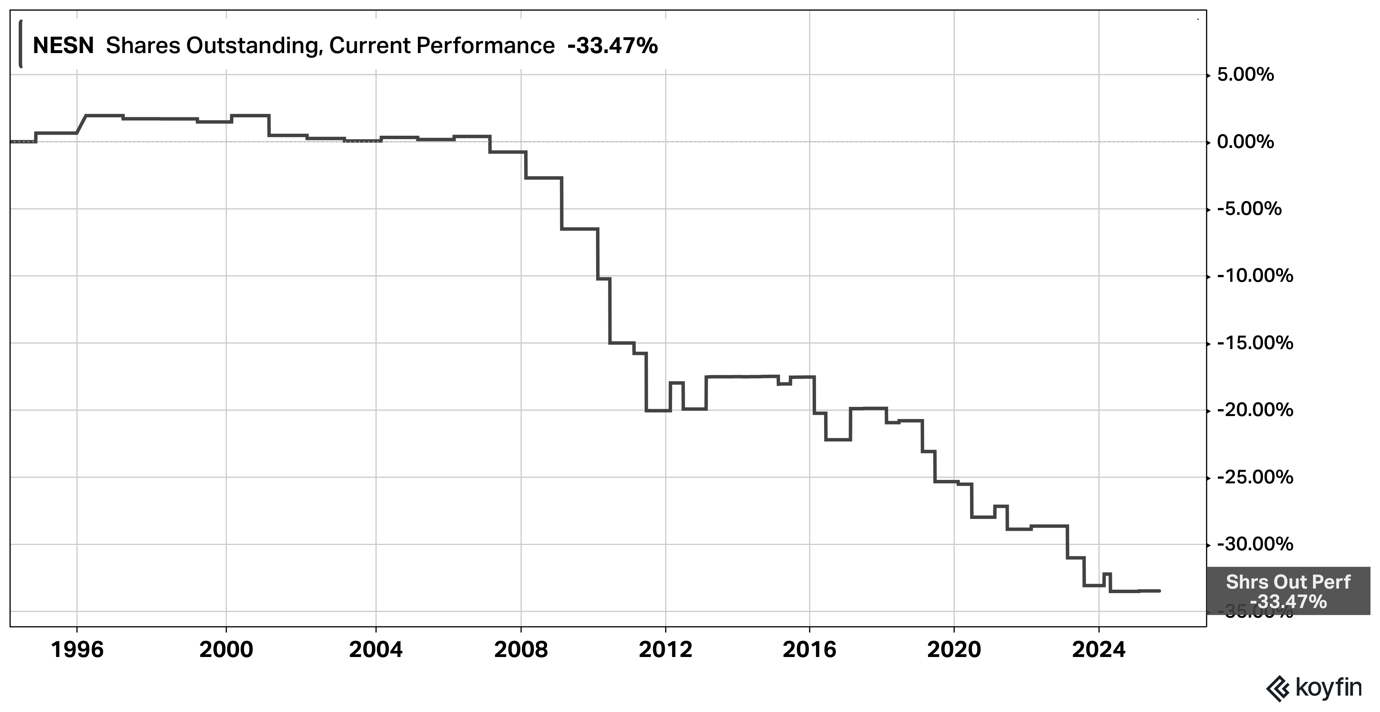

Nestlé has not grown revenues at an absolute level in the last two decades, in its home currency. Its 2024 revenues were at the same level they were in 2005, however, since 2011 It has been successfully driving efficiency internally and actively managing the portfolio, so revenue per employee is up from CHF 255k to 358k. It has also bought back a third of its shares since 2008, meaning per share stats are also much more favourable.

NESN Revenues, Employees, and Revenue/Employee

It is also important to recognise the impact that currency has had. The Swiss Franc’s strength against the dollar distorts the revenue picture. Here are its revenues in both currencies, side by side. In Francs (red bars), sales are up 8.3% over 22 years. In dollars (blue) they have doubled, because the greenback has halved in value (USD/CHF, grey line).

NESN revenues in CHF and USD

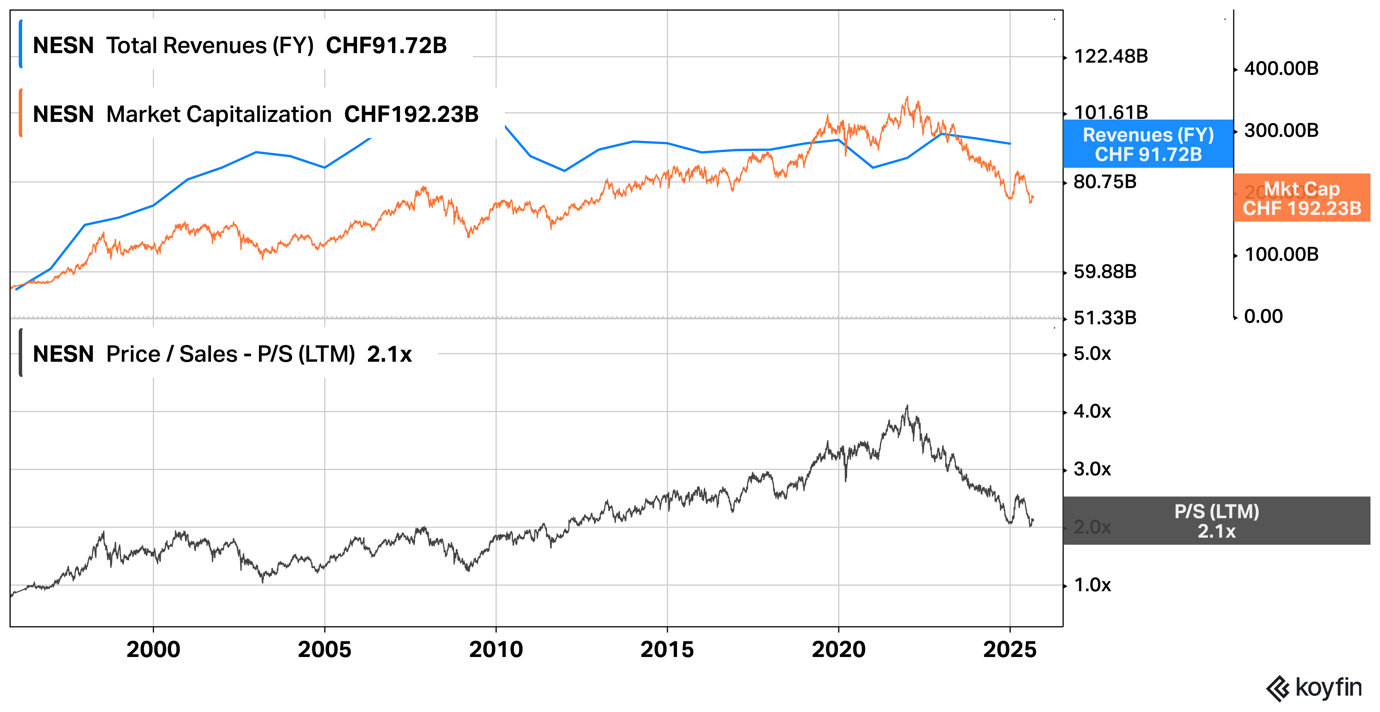

Its valuation got to quite extreme levels in the quality/bond-proxy excitement of the 2018-2022 period, when low bond yields made sustainably profitable compounder-style companies like Nestlé very popular. Now, with higher rates, the Price/Sales ratio is down by half, and back into fair-value territory.

NESN Price and Sales (in CHF)

It has grown free cash flow per share since the GFC in 2008, which is essential. It fell from CHF 2.2 to 1.7 during that crisis, and has now got it back up to CHF 4.3. That growth has just plateaued in the last two quarters, but we are more interested in longer term trends here.

As for debt, it is large at 0.7x sales (up from 0.4x in 2020), but the value of the stake in L’Oréal reduces the potential impact. In a difficult situation, it could monetise the stake and reduce the total debt pile significantly.

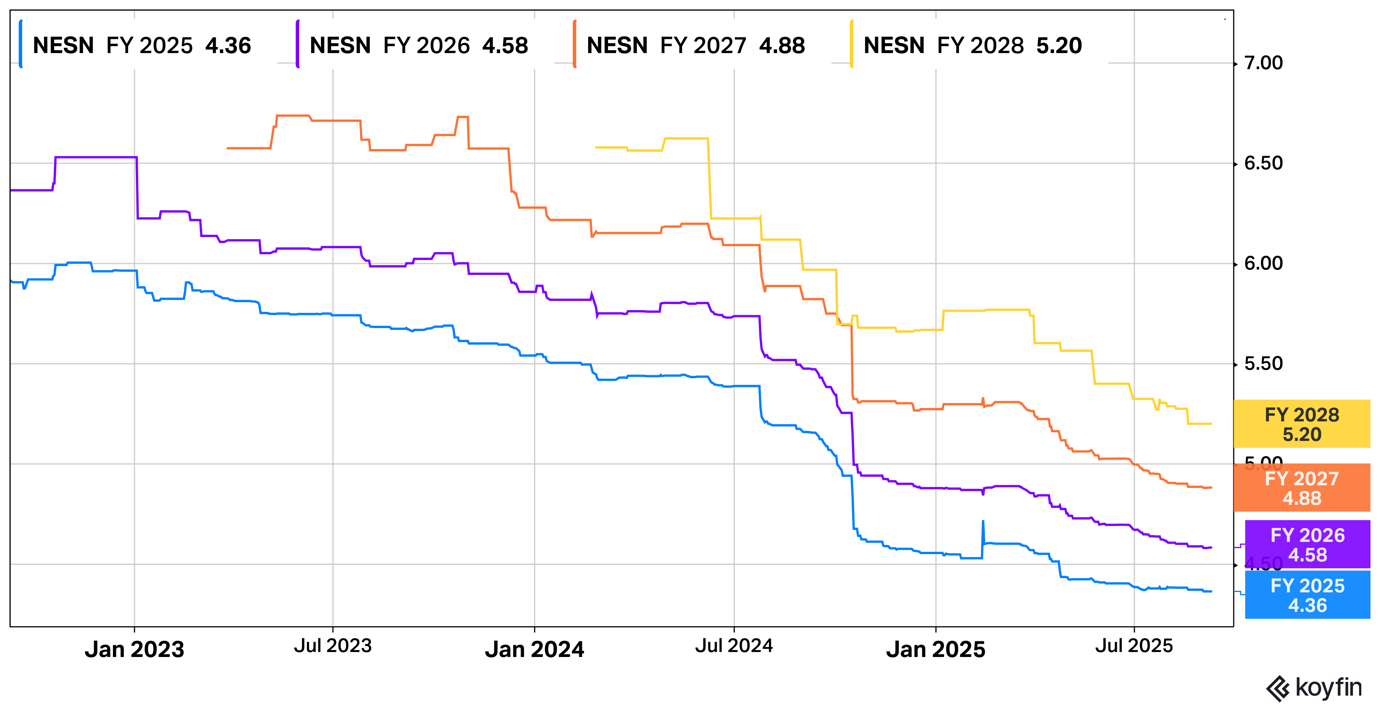

Analyst expectations are interesting. Revenue growth is expected to be around 3% for the next 7 years. EPS growth, however, which includes margin expansion and share buybacks, is expected to be 7-10% for at least the next 5 years, which is quite good for a company of its size. One of its problems, however, is that these projections have been steadily dragged lower since 2022. Hence, one catalyst for the shares would be turning these around.

Nestlé EPS projections for 2025 (blue) - 2028 (yellow)

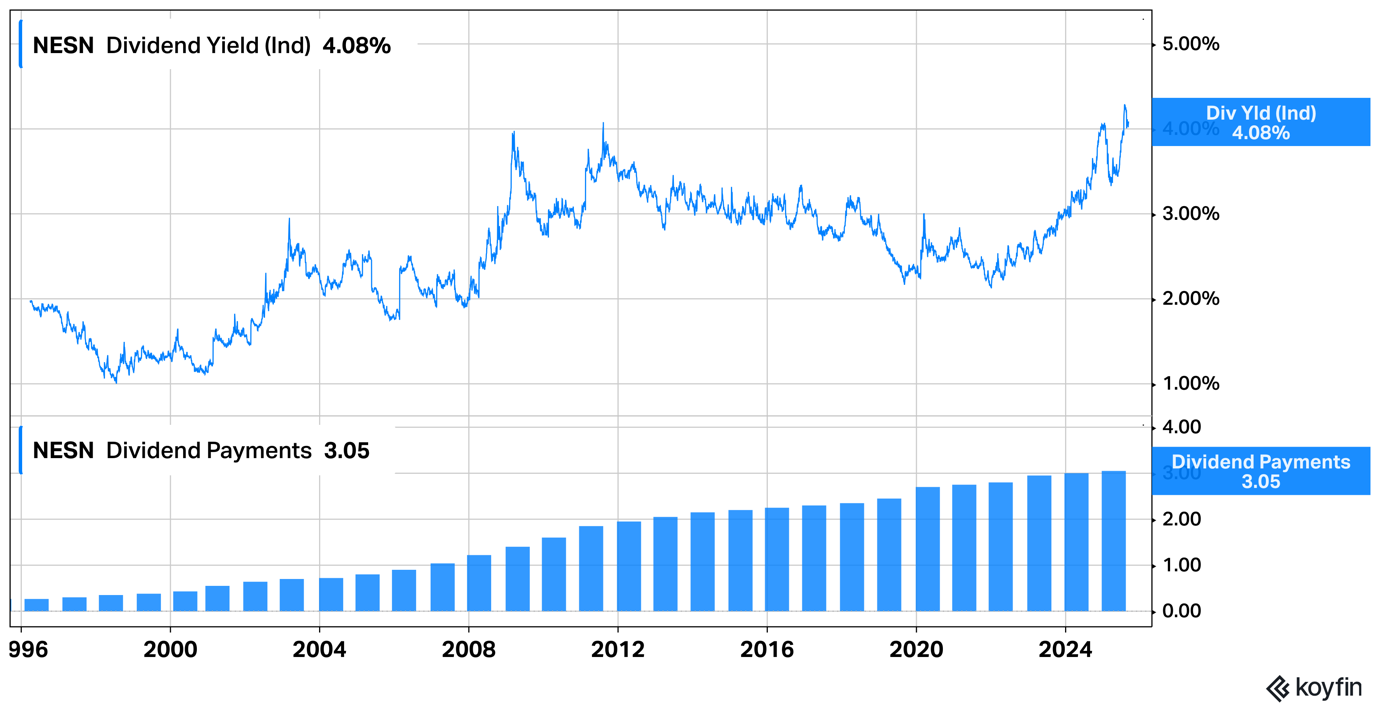

At just over 4%, its current dividend yield is near the top of its 30-year range. It has grown its dividend very consistently over a very long period of time, a classic hallmark of quality compounders.

NESN Dividend Yield and Payments

The dividend is an important part of their relationship with shareholders.

“Nestlé has maintained or increased the dividend in Swiss francs over the last 65 years. We remain committed to the long-held practice of increasing the dividend in Swiss francs every year.”

Looking at its valuation and profitability rankings against its peer group and its own history, it performs well compared to global consumer staples peers, being in the top quartile for profitability across all metrics. On gross profits and return on equity (ROE), it is underperforming relative to its own history. In terms of valuation multiples, it looks broadly fair value. Not especially cheap or expensive compared to its past or peers.

It has been buying back shares consistently over 15 years.

NESN Shares Outstanding, 30yr

Return on Invested Capital (ROIC) is a key metric, as always with quality companies. It is the product of NOPAT (Net Operating Profit After Tax) margins and Invested Capital turnover (sales/invested capital). You can see our full explanation of the metric here.

Nestlé has quite an even balance between capital efficiency (turning 91.5% of invested capital into sales each year) and operational efficiency (turning 13.4% of sales into profits). The result is a 12.2% ROIC in 2024, that while lower than the last few years, is in line with longer-term averages. Also, it has risen to 13.0% using the last four quarters from Q2, 2025. In short, returns on capital are healthy, suggesting Nestlé csn continue investing in growth profitably, the key driver of future compounding of business value.

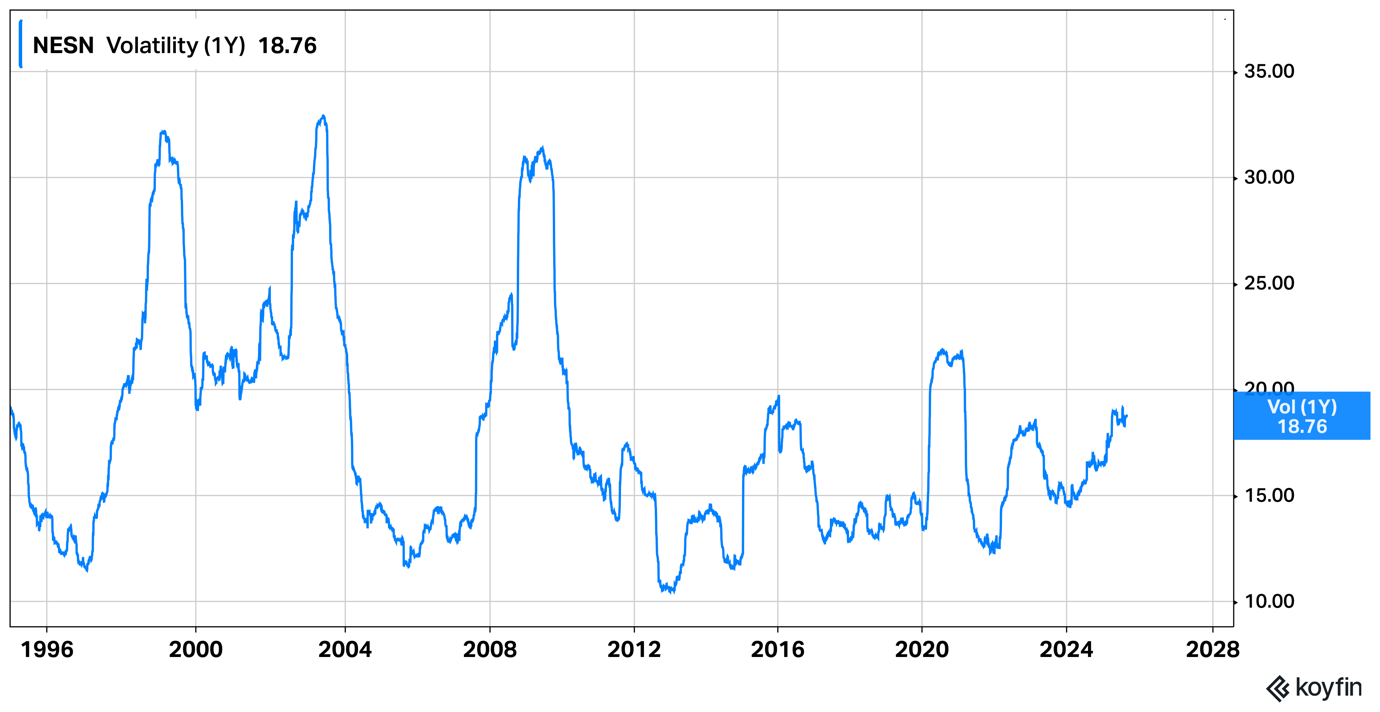

As for its volatility, it is very low at 19. This is despite a recent rise, from 15. This reflects its incredibly broad portfolio of brands and products across the world, giving it the same volatility as the S&P 500.

NESN Volatility 1Y

Commodity Prices

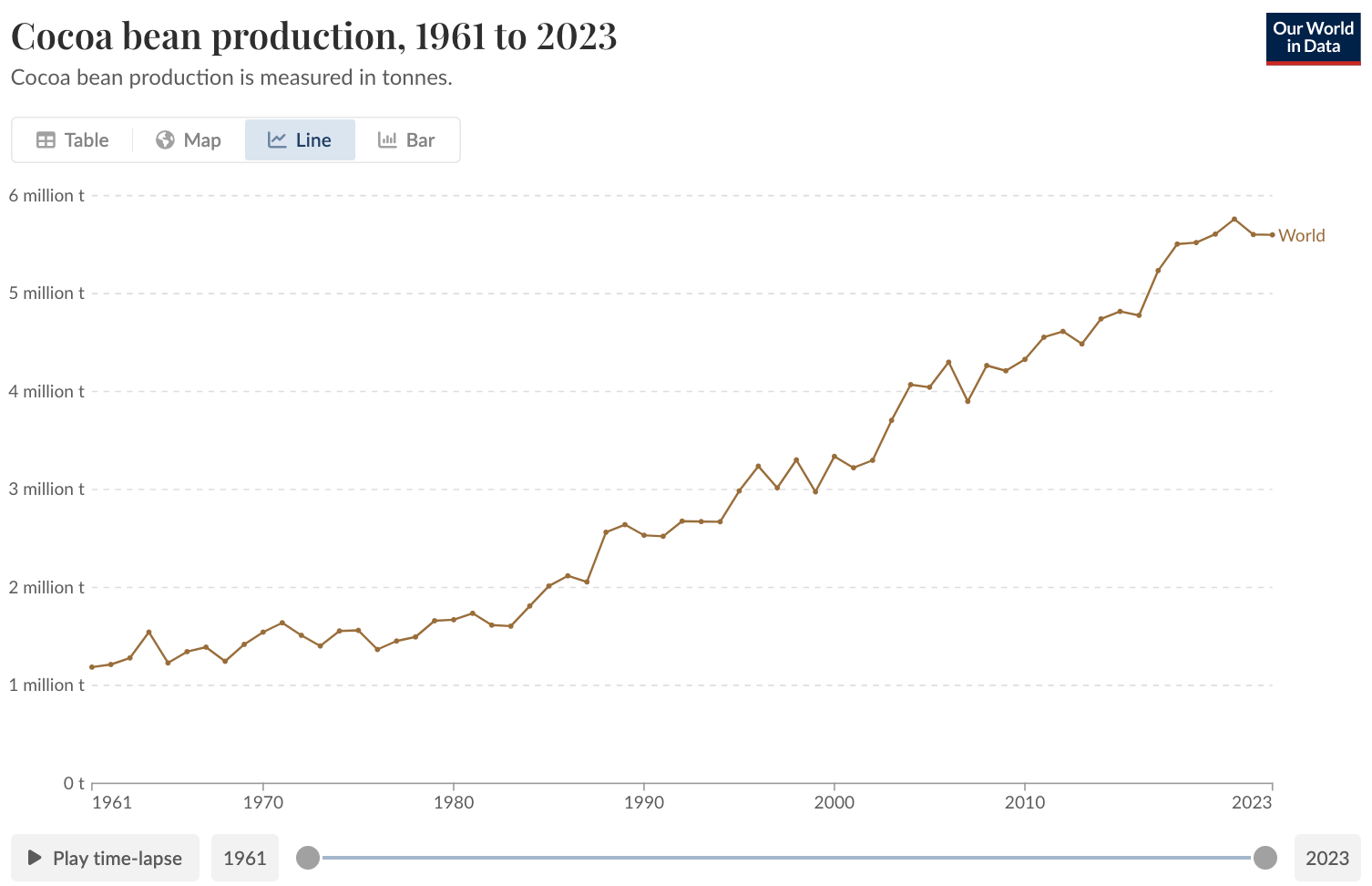

Rising cocoa (and coffee) prices are key input costs and have been rising aggressively in recent years. However, this is beginning to change.

According to the ICCO (Intl Cocoa Organisation), early July 2025 saw the lowest prices yet from the 2024/5 crop. This was driven by reports of improved yields for the 2025/26 season, and expectations of weakening demand driven by higher prices. Predictably, “Several seasons of elevated cocoa prices have spurred renewed interest in cultivation, leading to increased output”.

Price takers like Nestlé are also innovating their way around the problem, seeking to improve yields and efficiency. In August 2025, they announced a patented new cocoa bean production technique which utilises up to 30% more of cocoa fruit by extracting chocolate flavour from the fruit, husk, and placenta, rather than just thee beans inside. Demand is responding, and in a long term context, the recent supply issues look minor.

Cocoa bean production, World

Cocoa prices (purple) are now in a material downtrend as a result, coming off an incredibly high period following 2022. Coffee (yellow) rose first, causing the first spike in Nestlé's costs. As this continues to normalise, the narrative for Nestlé should improve, along with its cost of goods sold.

NESN Cost of Goods Sold (blue bars) vs Cocoa and Coffee

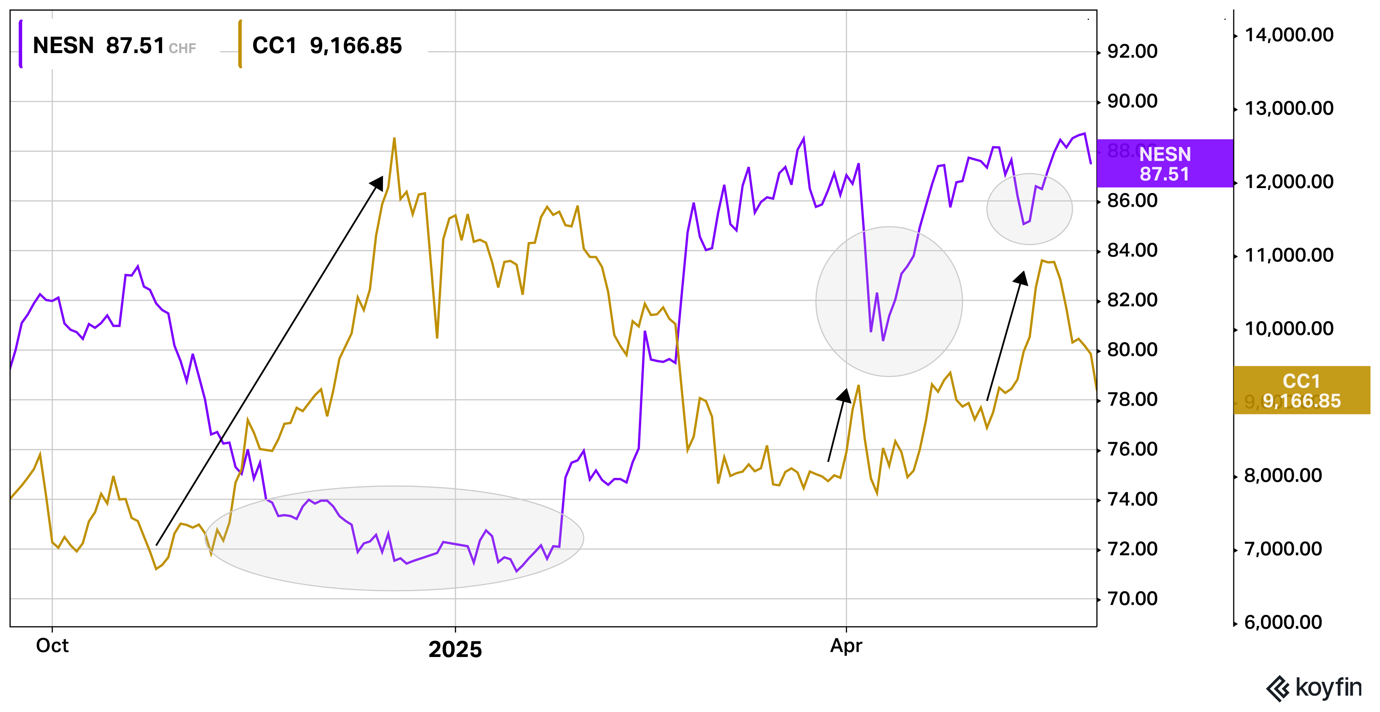

The result is a clear relationship between cocoa prices and the stock. Each spike in cocoa (gold line) in the last year has led to dips in the Nestlé share price, which recovers as the cocoa price fades.

NESN vs Cocoa Price, 1Y

The cocoa price downtrend signals easier times ahead for the confectionary giant. With three-years of underperformance behind it, more attractive valuation multiples, 150 years of history, and a globally diversified portfolio of strong brands backed by a powerful marketing and innovation machine, Nestlé is attractive. We investigate its sources of power, before addressing the risks.

Seven Powers

Scale Economies – Nestlé benefits from huge global scale as well as localisation. This allows it to cater for local tastes and interests, backed by their worldwide distribution and marketing capabilities. Its size helps it negotiate with bigger retailers at better prices, improves costs-per-unit, and its R&D can also be centrally driven with use cases in many end products.

Network Economies – Each brand benefits from being part of the portfolio, gaining access to the production, marketing, and innovation capabilities of the Nestlé group. However, there is no real network effect among consumers – the addition of new customers doesn’t benefit existing ones.

Process Power – Global scale with a local touch is something only immense scale and experience can bring. As a result, Nestlé does have some process power which would be hard for a newer company to achieve, although it is shared by many of its peers.

Branding – Branding is central to its power. Trust, loyalty, pricing power, these count for a lot. Many have over a century of heritage, are dominant in local markets, and together they receive billions in marketing support every year. For example, brands like Nespresso and Perrier command 20–30% price premiums over generic alternatives, and its brands maintain #1 market share in more than fifteen product categories globally.

Switching Costs – Low, as there are almost always substitutes available. However, it does have some institutional lock-in through partnerships, e.g. with Starbucks, which gives Nestlé exclusive rights to market and distribute Starbucks-branded packaged coffee, pods, and ready-to-drink (RTD) products outside of Starbucks' retail stores. Or, with McDonalds, where it’s mainly about pairing Nestlé brands with its McFlurry soft-serve ice creams.

Counter-Positioning – N/A – as the leader, it is subject to more challenges than it launches itself. It commonly neutralises threats by acquisition, e.g. Blue Bottle Coffee.

Cornered Resource – Nestlé has some proprietary formulations, e.g. within baby formula, and key water rights with over 50 mineral springs worldwide. Direct relationships with farmers also constitute a cornered resource. Its brands are a cornered resource too - no one else can use it, and it adds value to everything it sells.

Risks

Nestlé is not without flaws. It has had a few tough years in terms of its share price, revenue growth, corporate reputation, and management stability. Often, these are the best times to buy companies, if they really are resilient. We believe that is true in this case, but there are concerns which could affect its performance, especially in the short term.

Water Scandal

In 2024 and 2025, there have been investigations by the French Senate into a cover-up by the state of unauthorised practices at Nestlé. According to the NYT,

“At the heart of the issue is the marketing of Perrier as “natural mineral water,” a term whose use is strictly regulated by France and the EU. Regulators have accused Nestlé Waters of using filters and ultraviolet sterilisers to treat the water, which would make it ineligible to use the term “natural mineral” in its marketing.”

Nestlé was granted permission by the French state to use a banned microfiltration process to remedy that initial issue. Now, the Senate’s recent report is an attack on the state for agreeing to an illegal remediation that allowed Nestlé to continue marketing the water under the profitable label “natural mineral water”, even though the microfiltration changed the nature of the water. This has led to a strategic review and ultimately to the reorganisation of the unit into a standalone business, and is an ongoing issue.

The “Fat Shot Drug”

Donald Trump recently referred to the GLP-1 based weight loss/diabetes drugs as “the fat shot drug” when discussing high pharma prices in the US relative to the rest of the world. Who knows what will unfold with pricing, but they are a big threat even at current high prices. A Cornell University study found that GLP-1 users reduced grocery spending by 6% on average.

However, it is not visibly impacting sales figures at global multi-brand brand conglomerates yet, as its impacts are smaller scale. We are taking a wait and see approach to this issue. Terry Smith has expressed particular fears on this topic, although with the recent share price performance of his large holding, Novo Nordisk, perhaps he will reconsider.

Trump’s appointment of Robert F Kennedy as US health secretary poses another potential problem for Nestlé. Kennedy supposedly wants to curb ultra-processed foods and Americans’ sugar intake. That could impact Nestlé’s confectionery and prepared meals businesses, which make up 15% of global sales. How Nestlé lives up to its “healthy living” ambitions will be a focus in the years to come.

The end of globalisation

The key drivers of success at global consumer brand companies has been globalisation, falling inflation, and falling interest rates. All three tailwinds are fading. As global trade opened up in the last forty years, it allowed their dominant positions in developed western nations to spread into emerging economies too. But there is only one world, and it can only be conquered once. Charlie Munger warned of this very late in his life.

Secondly, steadily falling rates have led stocks like Nestlé’s consistent earnings and steadily rising dividends look more attractive relative to the yields on government bonds. With bond yields back up to the 4-5% range, Nestlé is less attractive in relative terms (although its yield has risen too).

Finally, low inflation has meant Nestlé has kept tight control of costs, and supply chains all operated with incredible precision and zero slack. Now, various factors are driving inflation higher again. We’ve already seen one big burst, pushing input costs higher across the business, pressuring margins and volumes. The quest for resilience over precision could also introduce more redundancy into the system, impacting margins even in the absence of shocks. We see sufficient growth in emerging markets and in new categories, as well as market share to be gained, but remain vigilant to slowing growth.

Supply Chain

Allegations of child labour in cocoa supply chain are longstanding, with the spotlight shining brighter thanks the rise of the Tony’s Chocolonely brand’s efforts. Nestlé’s history isn’t blemish-free, however, its 2022 initiative to tackle this won plaudits, with Tony’s writing:

“We’re super pumped about Nestlé’s recent announcement to introduce a new program tackling child labour, aiming for full traceability and addressing poverty as the root cause of the problems in cocoa. This program really teaches other Big Choco a thing or two about stepping up their game.”

High praise from a competitor with lofty ideals. You can read Nestlé’s announcement here. It’s based on the Nestlé Cocoa Plan which was launched in 2009 to support “better farming, better lives, and better cocoa”. It started small, but now reaches almost 180,000 cocoa farmers, providing training and resources to help improve yields and livelihoods. It also supports female empowerment in the communities it operates in, and builds more transparency into the supply chain, making it traceable and verifiable.

In 2023, 85.5% of all Nestlé cocoa used was sourced through the plan – 288k tonnes – up from just 50% in 2021. Over half its cocoa is sourced from one country – the Cote D’Ivoire, with another 15% from elsewhere in Africa and the rest mostly from Ecuador and Brazil. A hallmark of quality companies is a broad stakeholder approach. There is no point flying first class if there’s no one else on the plane. Treating relationships as symbiotic makes everyone richer, and Nestlé is getting better at this.

Other controversies

In 2025, A fifty-year relationship with its Thai distributor, the Mahagitsiri family, has ended in acrimony and legal challenge. Nestlé now faces a court-ordered halt to Nescafé production and sales in Thailand, and a legal battle. This came after Nestlé ended it distribution agreement with their local JV in 2021, which remains majority controlled by the Mahagitsiri family.

It has also variously suffered bad press for: union-busting behaviour in Colombia, aggressive marketing of their baby formula which discouraged breastfeeding, food safety, price fixing, deforestation, and animal welfare. It was also notably slow to pull out of Russia following their invasion of Ukraine. Additionally, the changing tariff picture naturally impacts it, as a global consumer goods company. It is materially impacting its bottom line already, as well as consumer confidence.

These risks are not to be ignored. However, they must be set against the strength of the arguments in Nestlé’s favour: history, brand strength, portfolio breadth, and valuation.

Summary

Nestlé (NESN SW) is a high-quality business with over 150 years of history. It is widely diversified by product segment, brand, and geography, competitive on quality and pricing, and part of a global consumer brand oligopoly that has a powerful moat against competitive threats. It benefits from brand power, process power, and economies of scale. Recent issues are short-term in nature and do not impact the long-term viability of the brands or the overall business.

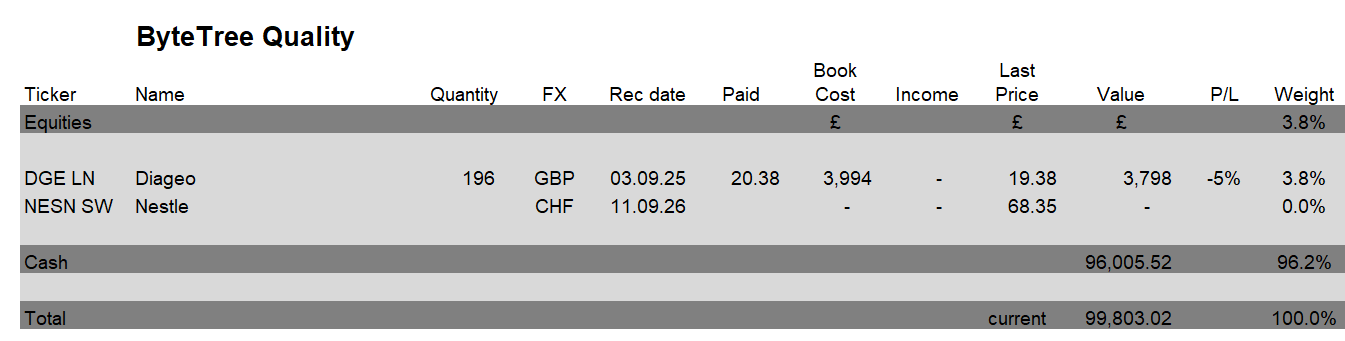

Nestle will be added to the portfolio at the end of day price after publication.

Portfolio

Please let us know your thoughts by emailing us at quality@bytetree.com or tweeting us @ByteTree.

Many thanks,

Charlie Morris & Kit Winder

Editors, ByteTree Quality

If you enjoyed this write up of Nestlé, consider joining the ByteTree Quality service. For just £19/month you get access to every research note, update, and the portfolio in real time.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd