ByteTree Launches The Quality Portfolio

First Recommendation Coming Soon;

Quality companies have staying power. They are the types of companies whereby future profits have a high degree of certainty. They make your toothpaste, detergents, lifesaving drugs, snacks, and even your favourite tipple. The amount of money that people spend on products made by quality companies does not materially rise when the economy is expanding, nor decline when it is contracting. Some people define quality stocks as needs rather than wants.

In terms of needs, why not add utilities? The answer is simple. Utilities may have stable revenue, but have high capital costs, and regulatory uncertainties, with low returns on capital. They also embrace leverage which can cause problems when the debt markets turn down. Despite stable revenues, utilities face uncertain profits.

Then take a company that produces steel, or an airline, a recruitment agency, or somea clothes retailers. These companies are cyclical, and their strength or weakness lies at the mercy of the economy. They make high profits in the good times while struggling to survive in the bad. These companies may do well over time, but their future profits are filled with uncertainty.

When we think of share prices moving around minute by minute, it becomes clear that quality companies swing around by much less. Their future profits are more certain and dependable, and so their share price volatility is lower as a result. For utilities, share prices are more volatile to reflect greater uncertainty, and for cyclical companies, price volatility can be high.

The MSCI World Quality Index aims to capture the performance of quality growth stocks by identifying companies with high quality scores based on three main fundamental variables:

- High return on equity (ROE),

- Stable year-over-year earnings growth,

- Low financial leverage.

This is a simple but useful definition. By screening for high return on equity, you eliminate companies with high capital requirements, such as heavy industry, airlines or utilities. You could even add real estate to that list because while your own home is normally the best investment you’ll ever make, most of the returns are non-financial. Real estate is capital intensive, and many companies carry large amounts of debt.

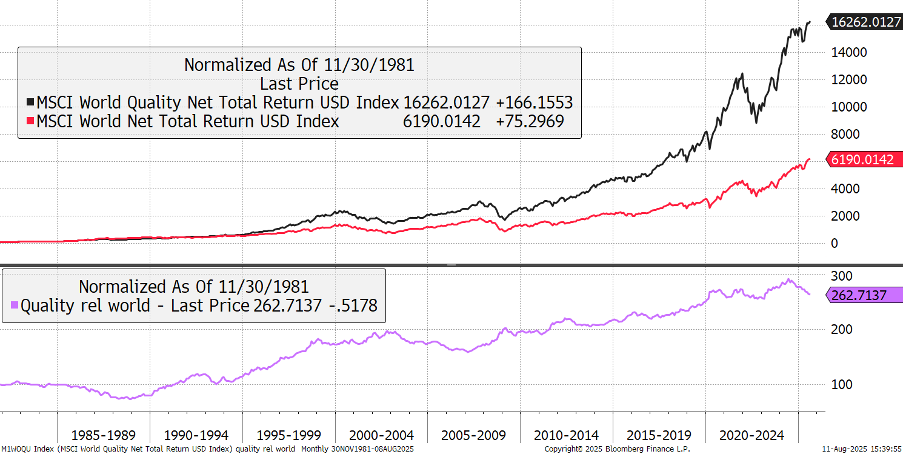

$100 invested into quality stocks, as defined by MSCI’s World Quality Index, turned into $16,262 (11.5% p.a.) from November 1981, which is three times that of the MSCI World Index (8.5% p.a.).

Quality versus the World

But that doesn’t tell the whole story because spare a thought for those who followed the opposite idea.

- Low return on equity (ROE)

- Unstable year-over-year earnings growth

- And high financial leverage.

Presumably their returns were far below the World Index. Then when you consider that according to MSCI, the world index houses stocks worth a combined $77 trillion and their quality index, $32 trillion, the index itself is comprised of 42% quality. That implies the world index would have done very poorly indeed, had it not contained quality stocks. It turns out that quality stocks drove most of the returns for the entire world index.

Charlie Munger

These days, investing in quality stocks has become a popular pastime, but back in the 1970s or 1980s, it wasn’t. Charlie Munger, the late vice chairman of Berkshire Hathaway was one in the know. He emphasised the importance of investing in high-quality companies with a durable competitive advantage (or "moats"), strong management, predictable earnings, and the ability to compound value over time.

He argued that while traditional value investing focused on buying mediocre businesses at bargain prices, true long-term success came from acquiring exceptional businesses at fair prices and holding them patiently. This approach, which influenced Warren Buffett, shifted their strategy away from cheap stocks, toward quality-focused compounding. He said:

“A great business at a fair price is superior to a fair business at a great price… The investment game always involves considering both quality and price, and the trick is to get more quality than you pay for in price. It’s just that simple."

He’s right, and this change in strategy was essential for Berkshire Hathway as the company grew. As Berkshire Hathaway’s assets grew into hundreds of billions, that reduced their ability to trade (buy low, sell high). By holding the best companies they could find, that were available at attractive prices, they would sit on their hands in the knowledge that these quality companies would drive returns for them. Munger’s key point:

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it. If the business earns 6% on capital over 40 years and you hold it for 40 years, you're not going to make much different than a 6% return even if you buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result. So the trick is getting into better businesses."

He made good points, which when you think about it, soon become obvious. But quality investing requires patience, and it is therefore best suited for patient investors who have a long-term , horizons and prefer to trade infrequently.

There are many funds focused on quality stocks such as the Morgan Stanley Global Brands Fund, Fundsmith, and Lindsell Train Global Equity. They have all done well over the long term, but have suffered in recent years, particularly in the aftermath of the pandemic. As a result, many traditional high-quality companies today trade at bargain basement prices.

One reason perhaps is that the large technology stocks are often described as quality and are included in the MSCI Quality Index. Of the Magnificent 7, NVIDIA, Microsoft, Apple, Meta, and Alphabet, are included, with just Amazon and Tesla excluded. That exclusion is presumably due to less stable earnings.

The quality index includes all high return companies, regardless of valuation. Even Munger talked about a great business at a fair price. The active managers mentioned earlier tend to hold Microsoft and Alphabet. Fundsmith also holds Meta, while Lindsell Train only holds Alphabet. They are significantly underrepresented in today’s large fashionable technology stocks and have lagged the market as a result. I don’t blame them for avoiding these stocks, because it is hard to imagine any scenario where these companies will deliver satisfactory returns to investors, given the exorbitant share prices.

Back to Reality

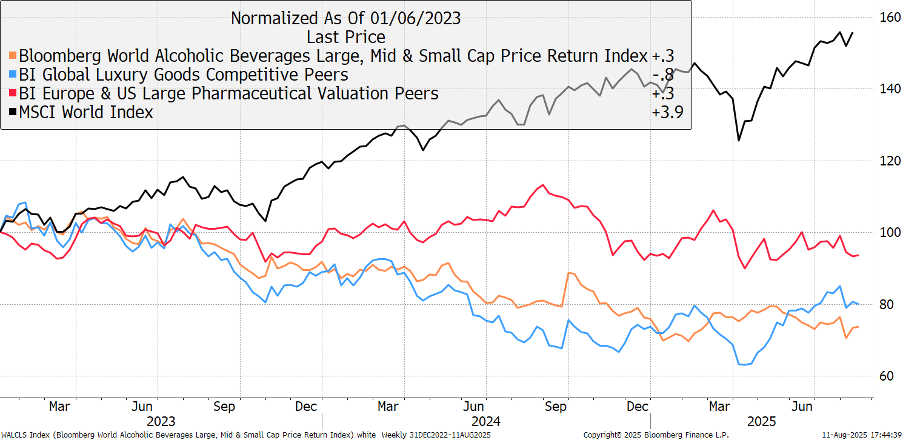

Instead, these successful investors embrace popular consumer brands such as Pepsico, L’Oreal, and Visa. While there has been a generational surge in what might be described as quality growth, based around technology, quality defensives are on sale. That can be shown since the interest rate hikes in 2022 whereby the world index has recovered strongly, while these key brands have slumped. The companies haven’t changed, but in several cases, their share prices are back into attractive territory.

Alcohol, Luxury, and Pharmaceuticals versus the World

The term quality has no formal definition but tends to include the simple MSCI definitions with a little extra. Some believe that profit margins should be high, but that would exclude great companies such as Costco. Others emphasise cash flow, return on invested capital, sustainability, a dominant market position, or quite simply low-price volatility.

ByteTree Definition of Quality

The ByteTree Quality Portfolio will have a flexible approach because we will embrace different types of quality.

- Quality Defensive - consumer staples and pharmaceuticals, with a strong market position such as Unilever, Procter and Gamble, and Roche.

- Quality Growth – higher sustainable growth companies with a moat, such as internet and software. This includes Microsoft and Alphabet.

- Quality Value (fallen angels) - formerly highly rated companies that have undergone restructuring such as Estee Lauder.

- Quality Conglomerates – diversified businesses with strong capital discipline such as Berkshire Hathaway.

All the ideas mentioned in identifying quality companies will be important considerations, but ByteTree’s key differentiator will be value. We will seek out great companies at attractive prices and apply our risk management techniques to the overall portfolio. That means we will diversify by company, by country, by sector, and by type of quality company. The aim is to have a robust portfolio, with low turnover, that can deliver market beating returns over the long-term.

The ByteTree Quality Portfolio will be opportunistic in embracing new ideas, with geographical constraints. The time to begin this journey is now, because so many quality companies are being derated as they have been crowded out by the big technology companies. We saw what happened the last time this happened in 1999. Technology stocks fell back to earth, while quality stocks, which were trading at bargain prices, and went on to beat the market for years to come. Our timing feels right.

Luckily for me, I have Kit Winder to help me with this exciting new venture. He joined ByteTree earlier this year, and recently passed his CFA exams, which is no mean feat. He’s a natural quality investor, has read all the books, studied the companies, and is fascinated by the concept. I will be picking the stocks, while Kit will be heavily involved in the research, and the updates.

The ByteTree Quality Portfolio launches next week. It will take some months to build the initial portfolio, but we should be over halfway by the new year. Why rush when the priority is to get it right?

We will get straight into it with our first note next week. That will give you the opportunity to see what it’s like. If a robust portfolio, with low turnover, that can deliver market beating returns over the long-term is for you, then join us on this exciting new journey.

Details to follow.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd