Token Takeaway: TRX;

With hundreds of millions of accounts and billions in transactions, Tron is one of the largest public blockchains in the world. It facilitates trillions in annual payment volume, supports a thriving DeFi ecosystem, and is arguably one of the most efficient Layer-1 networks in operation today. While on-chain activity remains robust, token burning has begun to slow, and inflation is making a return, something the TRX token hasn’t seen in years. This Token Takeaway dives into the broader payments landscape, unpacks Tron’s architecture and on-chain metrics, and examines the fundamentals of TRX.

Introduction

Launched in July 2017 by Justin Sun, Tron is an open-source, EVM-compatible Layer-1 blockchain designed for scalable smart contracts and decentralised applications (dApps). Its mainnet went live in May 2018, and despite navigating years of controversy, particularly around its founder, it has quietly matured into one of the most important infrastructure layers in crypto. We covered many of the early controversies in our previous Token Takeaway on Tron.

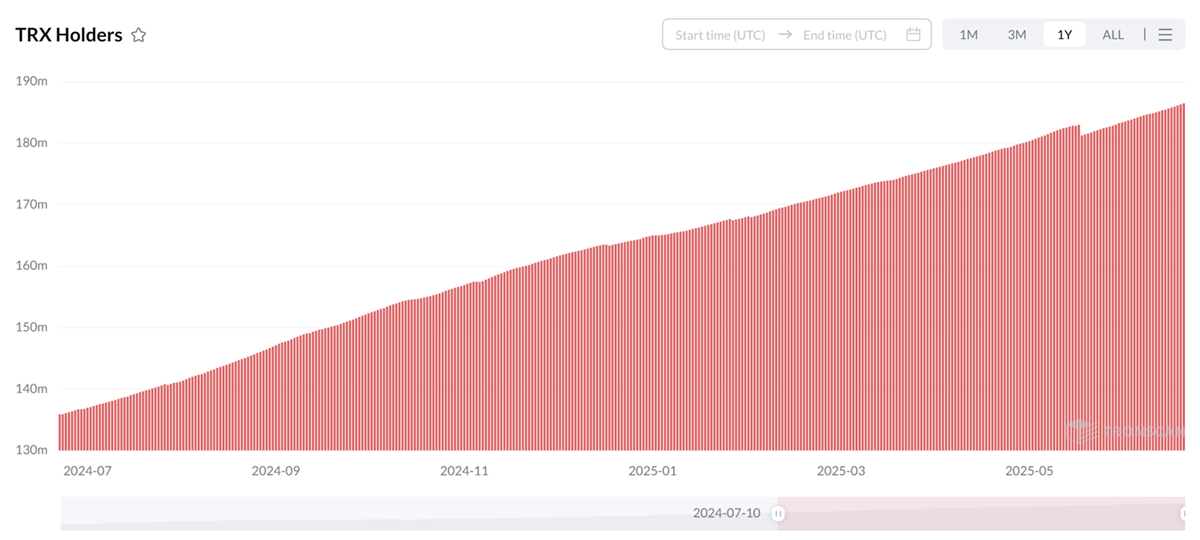

Today, Tron supports over 318 million accounts, with 186 million holding TRX, the native asset. It has processed more than 10.8 billion transactions, with $19.6tn in cumulative on-chain volume, which is largely driven by over 1 million daily active accounts moving USDT across the network.

Total TRX Holders

While Tron’s DeFi ecosystem is sizable, its most headline-grabbing stat is over $22bn in daily average USDT transfer volume, settled seamlessly, without the congestion or cost typical of other blockchains.

Before we explore how Tron came to dominate the stablecoin settlement space, let’s first zoom out and examine the broader stablecoin landscape.

Stablecoin/Payments Market

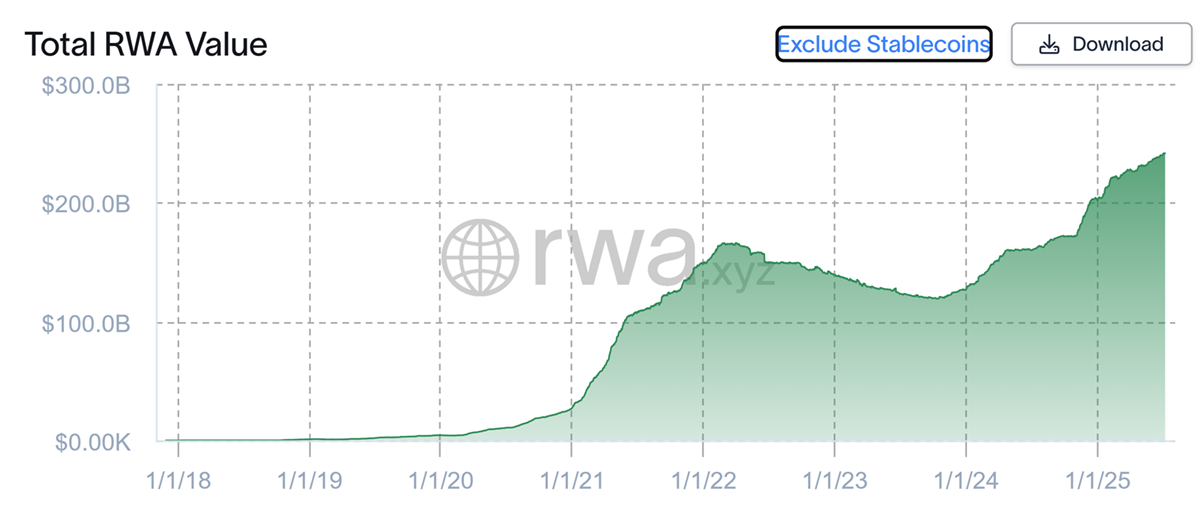

Since the start of the year, stablecoins and crypto payments have emerged as the hottest themes in the digital asset space. The total stablecoin market cap has grown astronomically since 2024, surpassing $241bn, which not only reflects growing adoption but also increased acceptance and institutional interest.

Stablecoin Market Capitalisation

Stablecoins are quickly becoming one of the most transformative innovations in global finance. Stripe recently identified stablecoins, alongside AI, as one of the two primary forces shaping the future of the internet economy. Following its acquisition of Bridge, Stripe launched stablecoin-powered business accounts.

Meanwhile, PayPal has rolled out its stablecoin, PYUSD, across both PayPal and Venmo wallets. With nearly $1bn in market cap, PYUSD is now usable for retail transfers and payments and benefits from PayPal’s massive distribution.

On the regulatory front, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) recently passed the U.S. Senate with a 67–27 majority, laying the groundwork for clearer compliance and issuance standards. At the same time, Circle, issuer of USDC, launched its IPO on the NYSE at $31 per share and opened at $69 before rapidly soaring to $300 and now stabilising near $200, a sign of market-wide conviction in the stablecoin sector.

Even President Trump has joined the wave, backing a new stablecoin called USD1 under the World Liberty Financial initiative, which has already struck deals in the Middle East and launched on Tron.

USDT Still Dominates

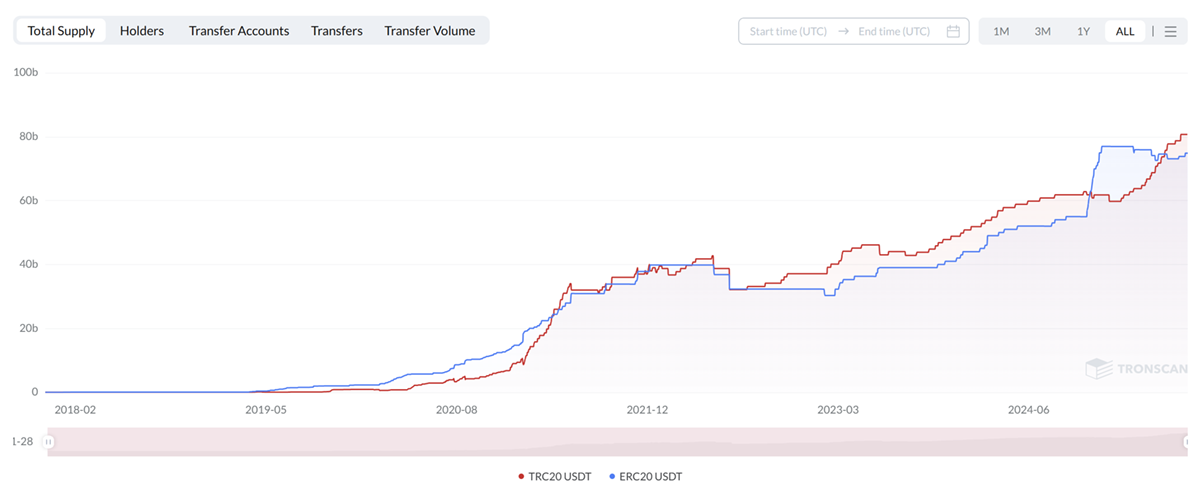

While the overall stablecoin market is flourishing, Tether’s USDT remains the undisputed leader, with a market cap exceeding $160bn, commanding 66.4% of the sector. Of the total, more than $80.7bn resides on Tron, surpassing Ethereum’s $74.8bn.

USDT Supply: Tron vs Ethereum

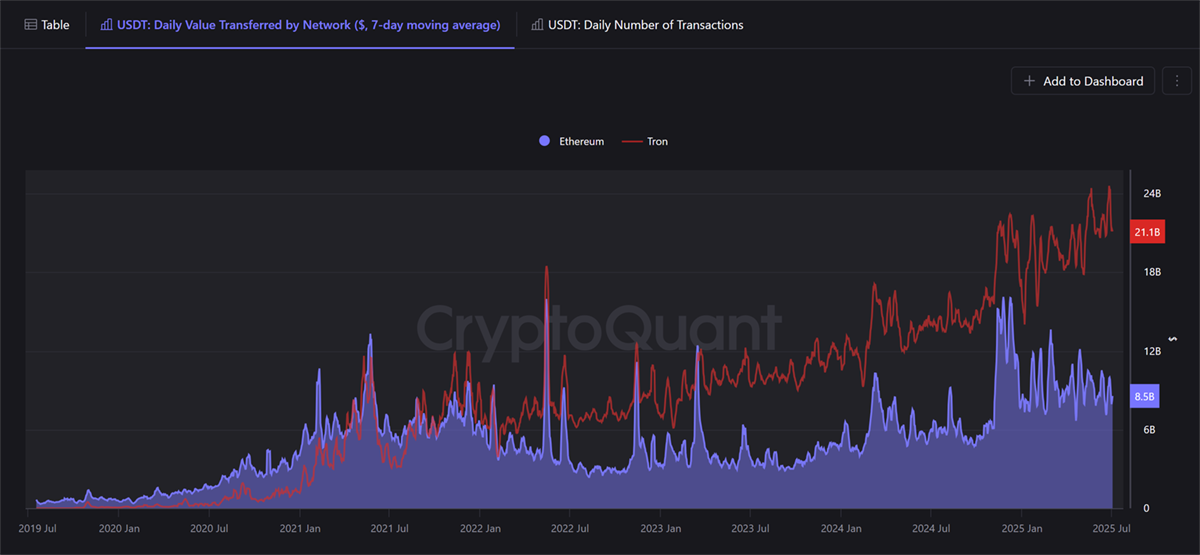

But it's not just supply; USDT volume tells an even more powerful story.

USDT Volume on Tron and Ethereum

Tron handles over $21bn in daily USDT volume, compared to Ethereum’s $8.5bn, almost 150% more transactional activity. This is real monetary value moving through the network every day.

Tron vs PayPal and Stripe

To put things into perspective, traditional fintech giants like Stripe and PayPal, valued at $91.5bn and $72.7bn, respectively, handled massive payment volumes in 2024. Stripe processed around $1.4tn for the year (roughly $3.8bn per day), while PayPal’s volume reached $1.68tn, averaging $4.6bn daily.

Now compare that to a decentralised blockchain network with a fully diluted valuation (FDV) of just $27.6bn. Tron regularly settles over $21bn in value every single day, more than five times Stripe’s daily throughput and four times PayPal’s.

Unlike traditional platforms, Tron operates with no central authority, open access, and no gatekeepers. It’s a striking example of how on-chain infrastructure is not just scaling but outpacing some of the largest centralised payment rails in the world, quietly proving that blockchain isn’t future infrastructure; it’s already here.

These figures are nothing short of remarkable, especially as countless Layer-1s launched around the same time as Tron, many with similar claims of low fees and high throughput. Yet none of them have captured the stablecoin payments market like Tron has.

That raises the question: Why Tron?