The Controversial Mega-TRON Blockchain

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: TRX;

After many controversies and accusations, TRON, a network with a long-time focus to decentralise the web by using blockchain technology, is trying to build back the community’s trust. Since it became decentralised in 2021, the TRON ecosystem has gradually grown by focusing on speed, security, scalability and innovation. In this article, we will examine the fundamentals of the TRON blockchain and its native token, Tronix (TRX).

Overview

TRON, an open-source, decentralised, multipurpose smart contracts platform, is now the 14th largest crypto with $7.2bn in market cap. It empowers the creation and deployment of decentralised applications (dApps) and complex protocols on its blockchain by offering security and high throughput with no transaction fees. According to their website, the blockchain can process up to 10,000 TPS, whereas its whitepaper suggests that TRON’s delegated proof of stake (DPoS) consensus mechanism can process around 2000 TPS. In comparison, blockchains like Solana and DeFiChain process well over 2000 TPS. Nevertheless, it is far better than the TPS of Bitcoin and Ethereum, which sits around 4 and 15, respectively.

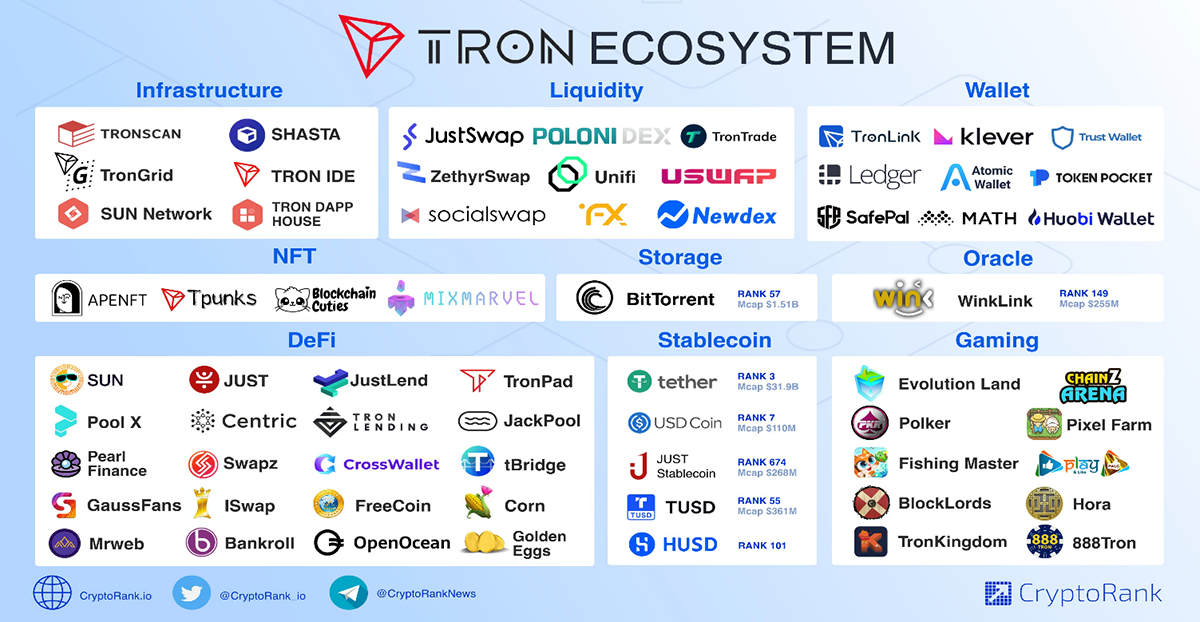

According to DappRadar, the TRON ecosystem has just under 1400 dApps, serving various sectors on its blockchain, which makes TRON one of the largest ecosystems in the crypto space.

History and Launch

The TRON Foundation initially launched TRX with a supply of 100 billion tokens. The tokens were distributed to the market by a private sale (25.7%) and an ICO (40%). The remaining 34.3% was distributed between the TRON Foundation and the founder, Justin Sun.

After the TRON white paper was released, it was accused of plagiarising the content from other projects like Ethereum, Filecoin, IPFS, etc. However, Justin Sun claimed that the whitepaper was not copied but instead reflected a translation error since it was originally in Chinese. In addition to that, it was also accused of copying the code from Ethereum, among other projects. Fast forward to today, the new USDD stablecoin concept and mechanism is also a direct copy of Terra’s UST, but more on that later.

TRON’s founder and ex-CEO Justin Sun is a well-accomplished entrepreneur and a protege of Alibaba founder Jack Ma. He is also an ambassador and permanent representative of Grenada (an island country in the Caribbean Sea) to the WTO. However, he is also a very controversial figure in the crypto space. He has been accused of false advertisement by claiming un-official partnerships and giving away $20m and a Tesla to celebrate the acquisition of BitTorrent, a decentralised file-sharing blockchain. Additionally, he was also accused of market manipulation and insider trading, basically directing the “Market Making” of TRX.

Tokenomics and Burning

TRX was initially launched on the Ethereum Network as an ERC-20 standard but migrated to the TRON Network as a TRC-20 token standard in 2018. Similar to the smallest unit of Bitcoin, called Satoshi, the smallest unit of TRX is called SUN (1 TRX = 1,000,000 SUN). TRX doesn’t have a hard cap on supply, but they do have a maximum amount of TRX issuance rewards to Super Representatives (Validators) and Voters, 336,384,000 TRX and 168,192,000 TRX, respectively. To become one of the 27 validators, an election is held among the candidates, and users who wish to be nominated in the elections, will have 9999 TRX burnt from their account.

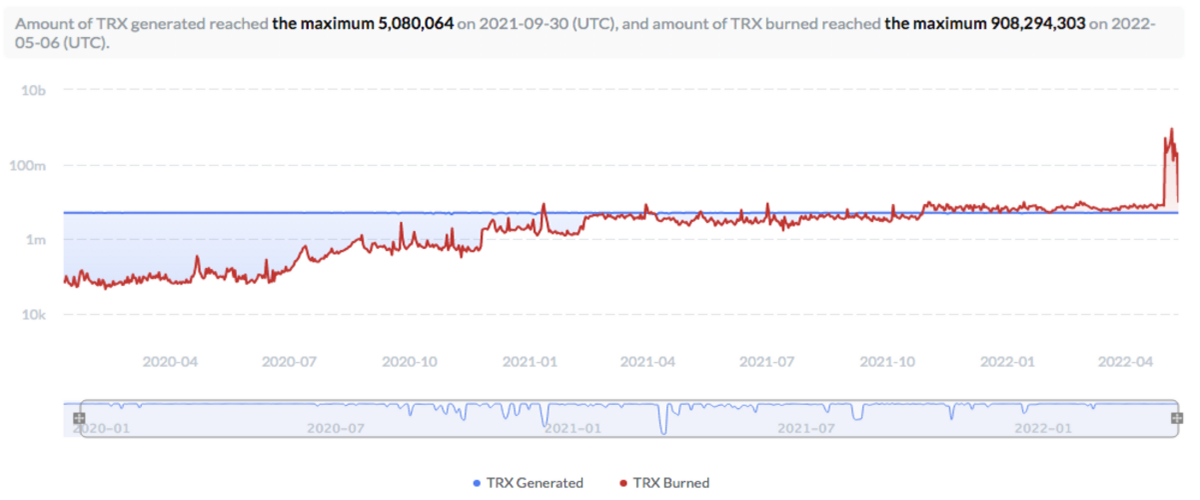

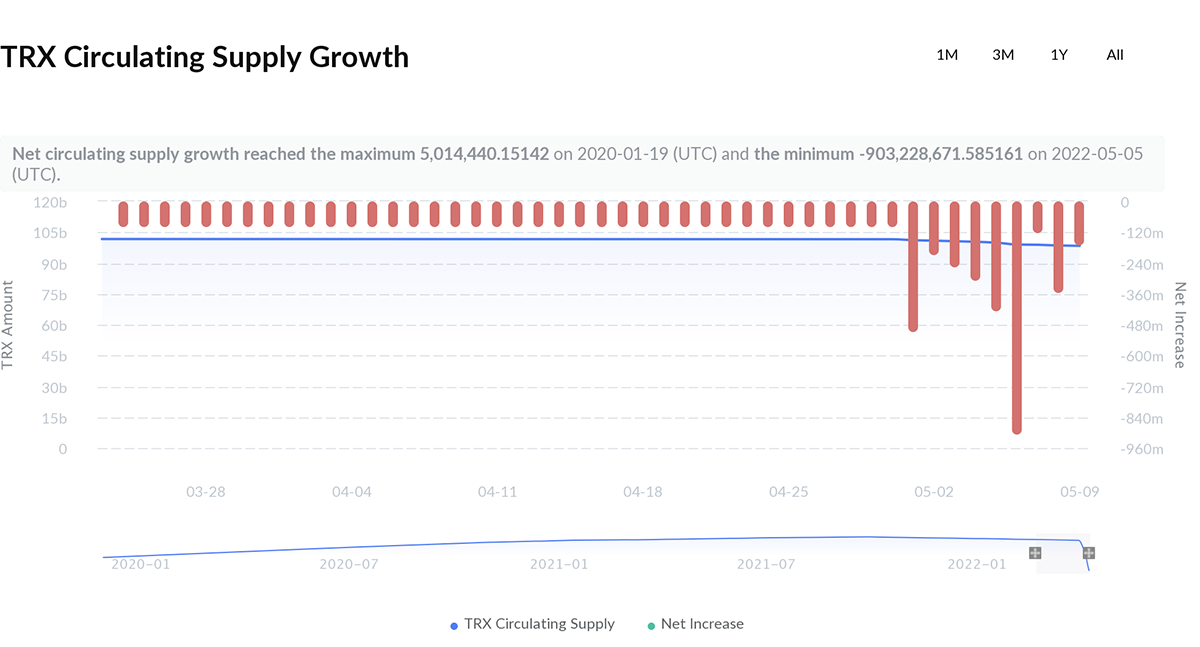

Since October 2021, there has been a constant daily burning of TRX. Furthermore, the launch of USDD recently accelerated the burning process. On 5 May 2022, over 900 million TRX tokens were burnt. In the past few days, around 3 billion TRX, or over 3.1% of the total supply was burnt. More on USDD below.

BitTorrent Chain

In 2018, Justin Sun and TRON acquired BitTorrent, a decentralised peer-to-peer file-sharing platform, for $140m. Following this, the BitTorrent Chain (BTTC), a heterogeneous cross-chain interoperability protocol, was launched on the TRON blockchain in 2021. It enables easy transfer of assets across established and mainstream public chains such as TRON, Ethereum, and BNB Chain. Due to the exponential increase in the development of smart contracts and dApps on these mainstream blockchains, it's hard to keep up with the pace, which indirectly results in network congestion, slower block validation, limiting scalability, high fees etc. In comparison, BTTC leverages PoS consensus for higher throughput, with block confirmations within 3s and up to 7,000 TPS. Other attractive features of BTTC include an average transaction fee of under $0.01 and one-click migration of smart contracts from Ethereum, BNB Chain and TRON networks, to mention a few.

Future Outlook and Technicals

On 22 April, Justin Sun announced the launch of a decentralised algorithmic stablecoin, USDD, which will be pegged as 1:1 with the US dollar. TRON plans to raise $10bn for TronDAO, a reserve, which will theoretically help USDD maintain its peg in a high volatility scenario. To maintain its peg, USDD will use a burn and mint mechanism with an arbitrage swap.

If USDD falls off its peg, users can buy 1 USDD in the external market and then swap it for a guaranteed 1 USD worth of TRX in the system. As a result, 1 USDD will be burned, and 1 USD worth of TRX will be minted. Theoretically, as the supply of USDD decreases, the price will increase to the point where there is no room for arbitrage. Similarly, if the price of USDD is above its peg, users can swap 1 USD worth of TRX with 1 USDD in the protocol. This way, 1 USDD will be minted, and 1 USD worth of TRX will be burned, decreasing the TRX supply and increasing the supply of USDD until its price is equal to the peg (i.e. a basic supply and demand model).

For context, algorithmic stablecoins are very reflexive in nature. These coins are prone to be unstable in market turmoil. For instance, TerraUSD (UST) was the largest algorithmic stablecoin, which lost its peg and made a low of 22 cents on 11 May 2022. Due to a similar burning and minting mechanism, LUNA (the Terra token) lost 99% of its value in the same period. This illustrates how algorithmic stablecoins are a risky project and have the capacity to make or break the network.

Recently, TRON announced an allocation of $1.1bn to the ecosystem fund they revealed in November 2021. The fund was introduced to help develop the TRON ecosystem. Sun V2.0 and JustLend were the first projects to receive $24.899 million as liquidity mining rewards, while $150m will be distributed as mining and staking rewards to other ecosystem projects. Additionally, $600m will be committed to expanding the DeFi environment by investing in innovative DeFi projects on the TRON network.

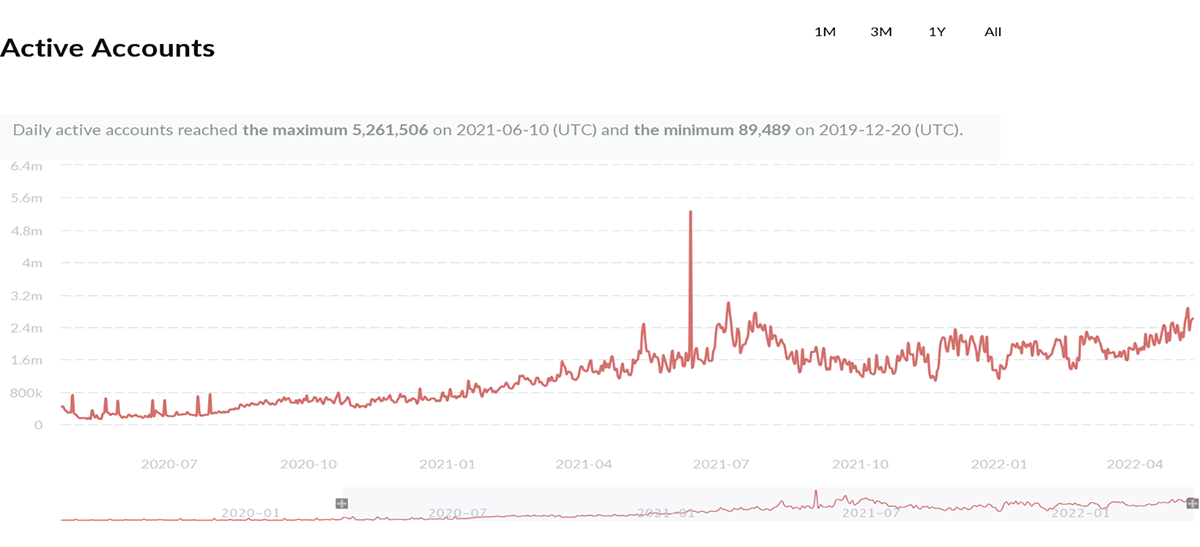

According to TRONSCAN, on-chain transactions on the TRON network have reached over 3.1bn, with the total active user accounts exceeding 91 million.

Conclusion

Like many crypto projects, TRON has had its fair share of ups and downs. Despite all the controversies and overhyped backlash, the TRON ecosystem has not only survived but managed to grow. Moving forward, TRON appears to have learned from its mistakes and is building back trust by launching large-scale innovative projects that benefit the TRON community. However, the success of USDD will be very crucial for TRX’s growth. If USDD ends up like UST, it’ll be next to impossible for TRON to bounce back again.

Comments ()