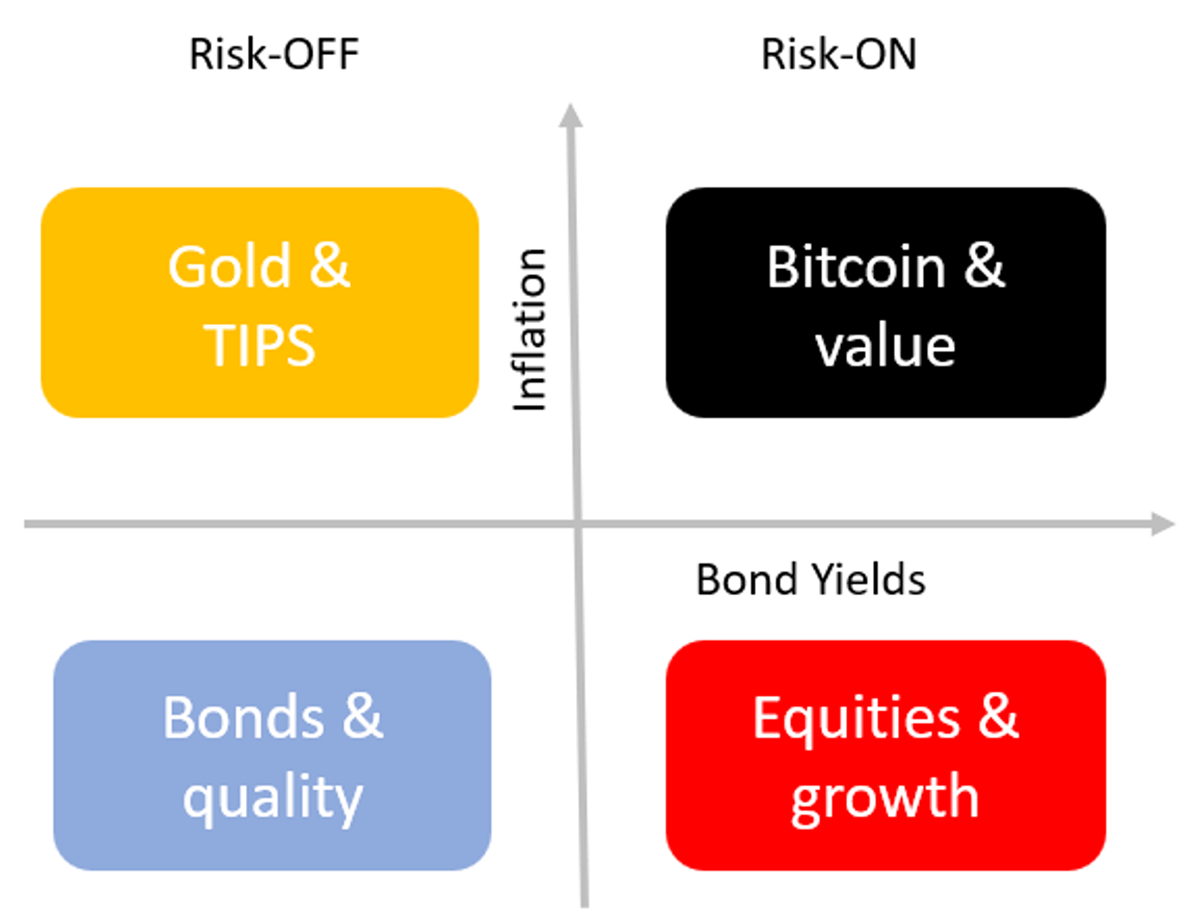

The Money Map is a simple idea that I have embraced for years. It outlines the investment strategy most suited to different macroeconomic environments. When times are good, stay on the right, and when bad, stay on the left. When inflation is rising, stay high; when it is low and stable, duck.

The ByteTree Money Map

The optimal quadrant isn’t always easy to follow, as macro forces can change suddenly, but the worst quadrant generally is. The current sweet spots are anything but bonds. I show the three different equity groups - Quality, Growth and Value - relative to the world index, including dividends.

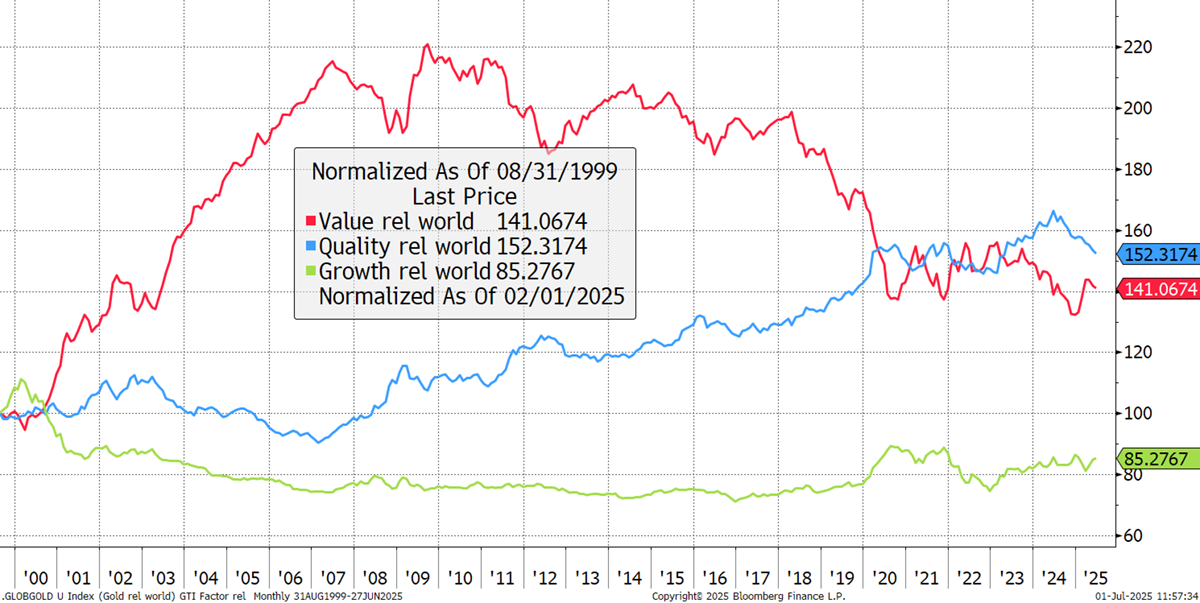

Quality, Growth, and Value Relative to the World – Total Return since 1999

Value enjoyed the surge in global growth pre-2008 as China’s expansion drove the world economy. Growth was suffering after the dotcom implosion in 2000, and started to recover a decade ago, and has been boosted by the internet and, more recently, AI. Quality lagged the bull market between 2002 and 2007, only to surge into 2024 thereafter. It should be noted that some of the big tech companies, such as Microsoft, are considered quality rather than growth these days. That will explain why growth hasn’t been as strong as it might appear, as it lost its best companies to quality.

When I focus on the more classical definition of quality, pre-big tech companies, that could be loosely defined as the consumer staples companies such as Costco, Walmart, Procter and Gamble, Coca Cola, Philip Morris, Nestle, PepsiCo, Unilever, L’Oreal, and Altria, to cite the top 10. On this basis, classic quality did well until 2016 and has been lagging the market since. Notice how quality is stall ahead of the world since 1995, despite lagging since 2016. That’s why it’s called quality.

Consumer Staples versus the World

When the quality lags the market, the wise old hands see an opportunity. This happened in 2000 and 2007, just before major bear markets. Quality doesn’t necessarily rise during bear markets, but it certainly falls a lot less. The advantage for an investor is that the drawdowns are not material, and time is on their side. That is, if you buy when quality is fairly valued, as overpaying for anything is generally a bad idea when investing money.

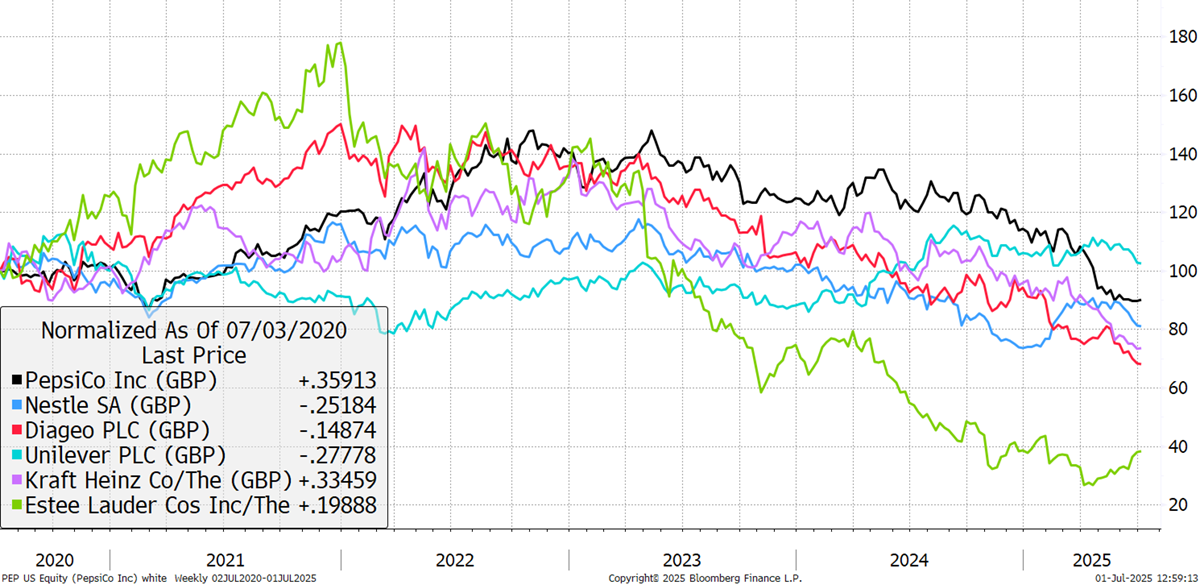

I have highlighted the luxury goods companies in the past, and how in recent years, they have hit a wall. That has broadened into defensive stocks in general, including consumer staples and pharmaceuticals. I could have added pharmaceuticals, which tell a similar story, if not worse. The point is that quality companies sell things we need, not just what we want, making them resilient when the economy turns down. I show a few well-known companies that have suffered in recent years.

Selection of Quality Companies

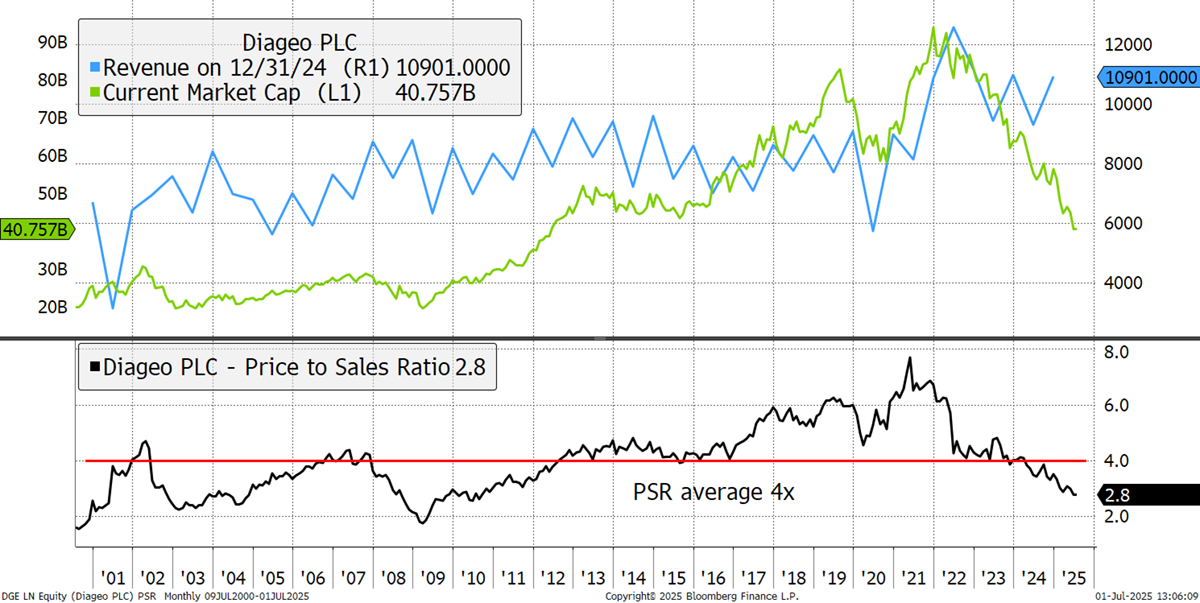

I highlight the great British company, Diageo, which will likely find its way into the Whisky portfolio at some point in the not-too-distant future. The share price is down 55% since the high in 2022, and the valuation is now agreeable on a price-to-sales (PSR) basis. The PSR is now 2.8x, meaning the market cap is 2.8x the annual sales. This is below the 4x average since 2000, and the 8x at the peak. Yet at the quality troughs in 2000 and 2007, it managed to trade at 2x sales. Diageo is in the valuation buy zone for the long-term investor, but there may be some more downside. The company has also increased its levels of debt in recent years, which should also be considered.

Diageo Price-to-Sales Ratio

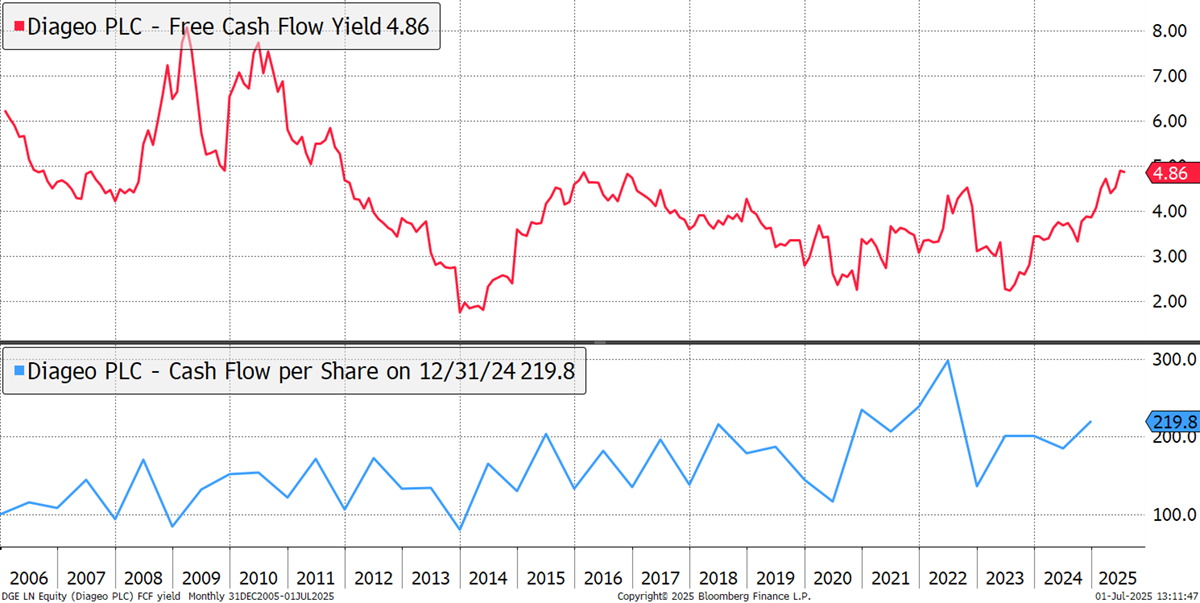

The PSR gives the big picture, but quality stocks are generally best valued using free cash flow yield. That is because they are non-cyclical, and so cash generation tends to be steady year on year. The free cash flow yield is 4.9%, which is the highest since 2012. Investors in quality stocks will deem the yield to be high on the grounds that cash flow will grow long into the future, just as it has in the past.

Diageo Free Cash Flow and Yield

The naysayers will say that the drinks business is highly competitive these days, but Diageo have great brands. They will also point to the health benefits of reducing alcohol consumption and how today’s youth shun it. My problem with that argument, is that my elder daughters’ friends, aged 23 to 25, seem to contradict that.

There are always positives and negatives in assessing a company, but in the case of Diageo and many other quality stocks, high valuations are no longer the problem. The current top 10, mentioned earlier, tend to trade at a premium (tobacco excluded) to the wider group, but there are now plenty of cheap stocks to be found in quality, and that has caught my attention.

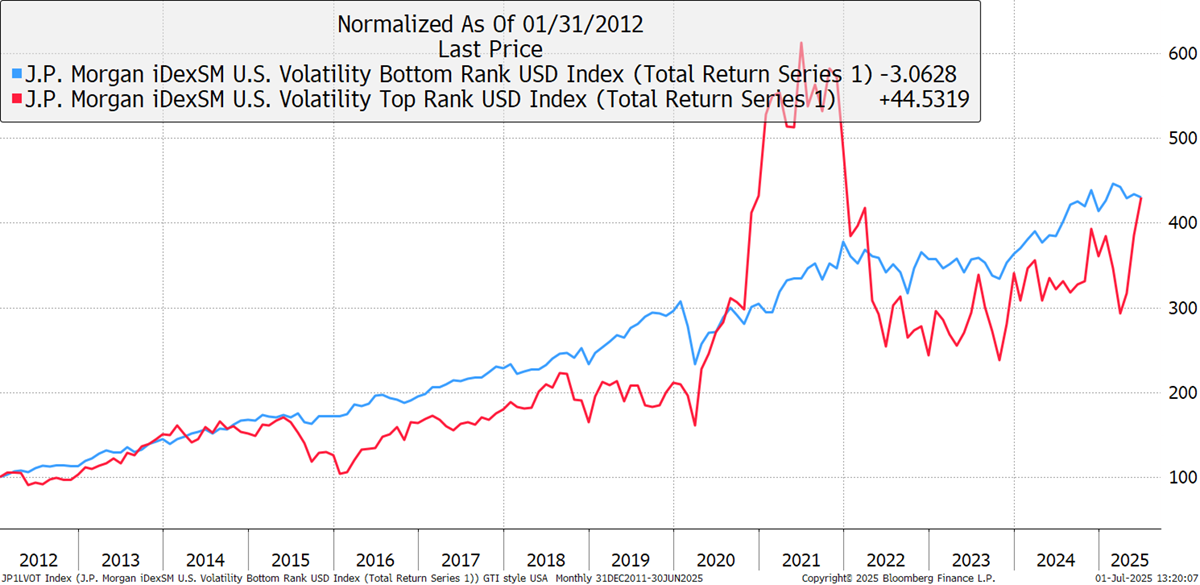

The trouble with these stocks is that they are not yet in demand. Readers of the Global Trends Investor, our free weekly piece on global relative strength, will be familiar with this chart. Safe stocks, which have low volatility, are lagging the market, where the gains are being made in more volatile stocks. The leaderboard since the tariff crash in April is dominated by microchips, whereas the laggards are overwhelmingly quality.

High versus Low Volatility Stocks

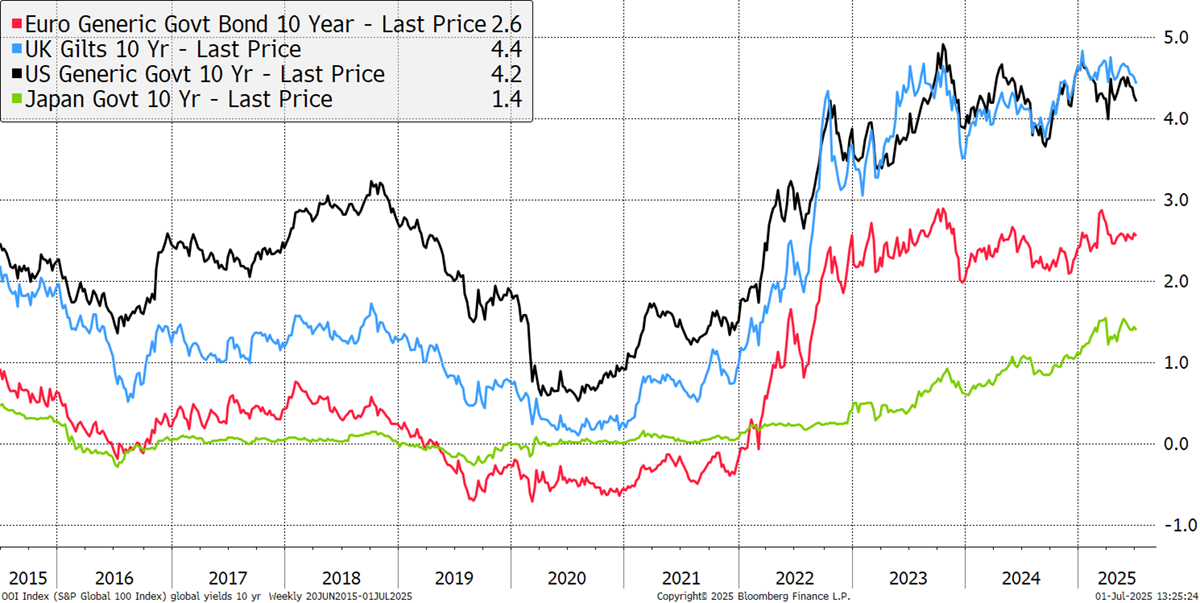

Going back to the Money Map, for quality to turn up again, we need confidence that bond yields are falling. While the last few weeks have seen off new highs in bond yields, it is far from clear that lower yields lie ahead (see question in the Postbox). Valuation is one thing, but macro conditions are another.

Global Bond Yields – Major Markets

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd